Global Rubber Gloves Market Report By Material (Natural Rubber/Latex, Nitrile, Neoprene, Other Material Types), By Product (Disposable, Durable), By Type (Powdered, Powder-Free), By Distribution Channel (Online, Physical), By End-Use (Medical & Healthcare, Automotive, Oil & Gas, Food & Beverages, Other End-Uses), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: October 2024

- Report ID: 12907

- Number of Pages: 351

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

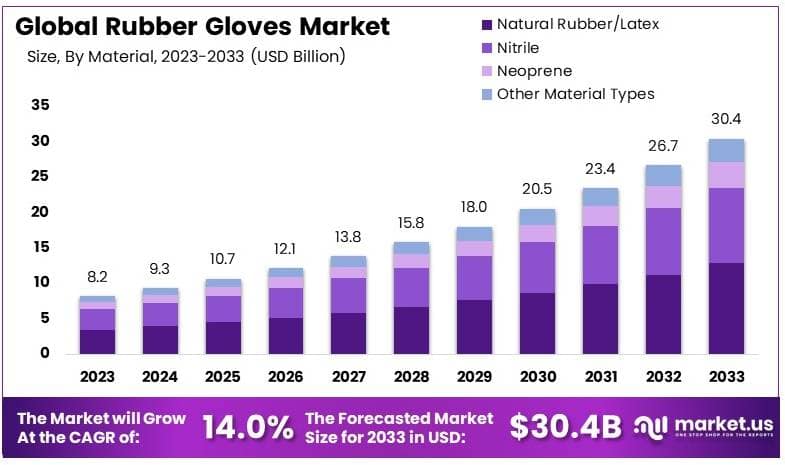

The Global Rubber Gloves Market size is expected to be worth around USD 30.4 Billion by 2033, from USD 8.2 Billion in 2023, growing at a CAGR of 14.0% during the forecast period from 2024 to 2033.

Rubber gloves are protective hand coverings made from natural or synthetic rubber. They are used in various settings, including medical, industrial, and household environments, to protect hands from contaminants, chemicals, or infections. Rubber gloves can be disposable or reusable, depending on their purpose.

The rubber gloves market includes the production, distribution, and sales of these protective gloves. It covers a range of gloves designed for different industries such as healthcare, food processing, and manufacturing. The market has expanded significantly due to the global demand for hygiene and safety, especially in medical and industrial sectors.

Advances in glove materials, like powder-free and latex-free options, are expanding product offerings, meeting specific industry needs and reducing allergic reactions. The focus on hygiene and workplace safety continues to support market demand.

The growth of the rubber gloves market is primarily supported by increasing regulations and workplace safety standards. The U.S. Occupational Safety and Health Administration (OSHA) has expanded its enforcement, especially in high-risk sectors like construction and healthcare, to reduce workplace accidents.

In 2022, OSHA recorded nearly 5,500 workplace fatalities, a 5.7% increase compared to the previous year. Stricter regulations and higher penalties, ranging from $1,190 for minor violations to $161,323 for repeated or willful violations, are pushing employers to invest more in safety equipment, including rubber gloves.

Opportunities also exist in developing markets where healthcare infrastructure is improving. As more hospitals and clinics are built, demand for surgical gloves increases. Additionally, the food processing industry continues to grow, creating further demand for gloves that meet hygiene standards.

In mature markets like North America and Europe, the rubber gloves market is reaching saturation. These regions have established healthcare and industrial sectors where glove usage is already standard.

Companies in these regions face high competition and must innovate to differentiate their products. New product development, such as biodegradable and eco-friendly gloves, is becoming a key trend as businesses look to meet consumer and regulatory demands for sustainability.

In contrast, emerging markets present strong growth opportunities. As safety standards increase in regions like Asia-Pacific and Latin America, glove manufacturers can capitalize on rising demand. The presence of local manufacturers and their ability to produce cost-effective products add to the competitive landscape.

Key Takeaways

- The Rubber Gloves Market was valued at USD 8.2 Billion in 2023 and is expected to reach USD 30.4 Billion by 2033, with a CAGR of 14.0%.

- In 2023, Natural Rubber/Latex dominated with 42.1%, owing to its flexibility and cost-effectiveness.

- In 2023, Disposable Rubber Gloves led the product segment with 70.2%, reflecting high demand in healthcare settings.

- In 2023, Powder-Free Gloves held the largest share at 72.1%, driven by safety and allergy concerns.

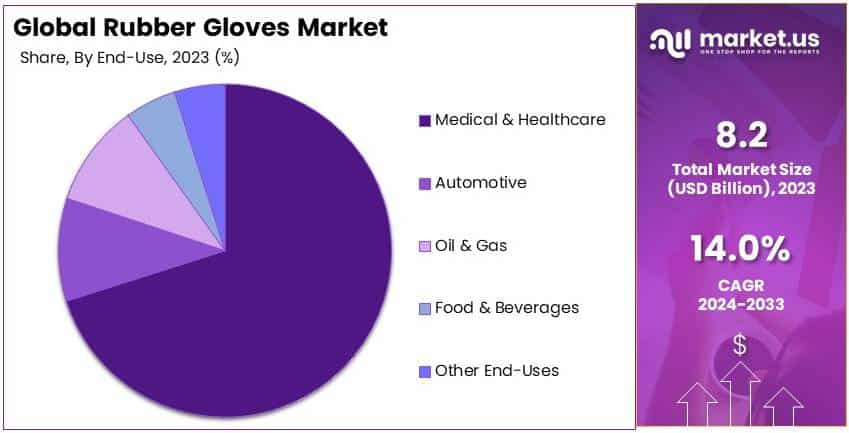

- In 2023, Medical & Healthcare dominated the end-use segment with 70.1%, indicating high usage in medical environments.

- In 2023, Europe accounted for 34.5% of the market, valued at USD 2.83 Billion, due to strong healthcare infrastructure.

Material Analysis

Natural Rubber/Latex dominates with 42.1% due to its superior elasticity and comfort.

In the rubber gloves market, the Material segment is essential for understanding the different types of gloves available based on the raw materials used. Natural Rubber, or Latex, is the leading material, holding a 42.1% market share.

This dominance is primarily due to the superior elasticity, comfort, and tactile sensitivity provided by latex gloves, making them highly favored in applications that require precision, such as in medical procedures and laboratory work.

Other materials in this segment include Nitrile, Neoprene, and other synthetic materials. Nitrile gloves are popular due to their puncture resistance and hypoallergenic properties, making them a preferred alternative for individuals allergic to latex. Neoprene gloves offer chemical resistance and are used in environments where gloves are exposed to harmful substances.

The role of latex gloves in the market is significant, as they continue to be preferred for their high level of sensitivity, which is crucial in many medical and research applications.

However, the rise in latex allergies has prompted increased use of alternative materials like nitrile, which are seeing growth due to their durability and resistance to a wide range of chemicals. This shift is influencing market dynamics, pushing manufacturers to innovate and improve synthetic gloves to match the comfort and elasticity of latex, potentially reshaping future market shares.

Product Analysis

Disposable Rubber Gloves dominate with 70.2% due to their convenience and hygiene factors.

The Product segment of the rubber gloves market distinguishes between Disposable and Durable gloves, with Disposable gloves being the more dominant, capturing a 70.2% market share. The overwhelming preference for disposable gloves can be attributed to their convenience, cost-effectiveness, and hygiene, which are essential in preventing cross-contamination in medical settings, food services, and cleanrooms.

Durable gloves, while less common, are used in applications that require gloves to withstand repeated use. These gloves are typically thicker and more robust, designed for industries such as automotive, oil and gas, where they provide protection against abrasions, cuts, and chemicals.

Disposable gloves are pivotal in sectors with high standards for cleanliness and contamination control, such as healthcare and food processing. The ongoing global health challenges have further propelled the demand for disposable gloves, underscoring their critical role in infection control.

The market for disposable gloves is expected to continue growing, driven by heightened awareness of hygiene practices across various sectors and the ongoing development of gloves that combine durability with disposability.

Type Analysis

Powder-Free Gloves dominate with 72.1% due to their reduced contamination risk.

In the Type segment of the rubber gloves market, Powder-Free gloves lead significantly, holding a 72.1% share. This dominance is largely because powder-free gloves reduce the risk of contamination, which is crucial in environments like surgical rooms and high-tech manufacturing facilities, where powder particles can compromise sterility and cleanliness.

Powdered gloves, which have historically been used to make gloves easier to put on, are seeing decreased usage due to the potential health risks associated with powder. They can cause allergic reactions and complications in patients during medical procedures.

The increasing preference for powder-free gloves reflects the market’s response to safety concerns associated with powdered gloves. This shift is also driven by stricter regulations and guidelines from healthcare authorities worldwide, which recommend powder-free gloves to enhance safety and reduce the incidence of allergies.

The focus on reducing allergenic and respiratory issues associated with glove powder is likely to continue influencing market trends and consumer preferences, favoring the growth of the powder-free glove segment.

End-Use Analysis

Medical & Healthcare dominates with 70.1% due to stringent health and safety standards.

In the End-Use segment of the rubber gloves market, Medical & Healthcare is the most dominant, with a substantial 70.1% market share. This segment’s dominance is driven by the stringent health and safety standards in medical environments, which necessitate the use of gloves to protect both healthcare providers and patients from infections and contamination.

Other end-uses include Automotive, Oil & Gas, Food & Beverages, and other sectors. Each of these industries has specific requirements for glove properties such as chemical resistance, durability, and sensitivity, reflecting the diverse applications of rubber gloves.

The Medical & Healthcare sector’s overwhelming share is sustained by continuous advancements in health services and an increasing focus on hygiene and safety practices. The demand for medical-grade gloves is expected to remain robust, driven by global health dynamics and an increasing number of medical procedures.

The expansion of healthcare services worldwide, coupled with rising health awareness and regulatory mandates, will continue to propel the demand for rubber gloves in this sector, reinforcing its status as the leading end-use category in the market.

Key Market Segments

By Material

- Natural Rubber/Latex

- Nitrile

- Neoprene

- Other Material Types

By Product

- Disposable

- Durable

By Type

- Powdered

- Powder-Free

By Distribution Channel

- Online

- Physical

By End-Use

- Medical & Healthcare

- Automotive

- Oil & Gas

- Food & Beverages

- Other End-Uses

Drivers

Rising Demand in Healthcare and Industrial Sectors Drives Market Growth

The rubber gloves market is experiencing growth due to rising demand in healthcare and hygiene sectors. Healthcare facilities, including hospitals and clinics, require large quantities of gloves for medical and diagnostic procedures, making this sector a significant contributor.

Growth in industrial applications is also driving the market. Various industries, including automotive, manufacturing, and chemical sectors, need rubber gloves to ensure worker safety and comply with occupational health standards.

Furthermore, the increase in safety regulations and standards across industries supports market expansion. Governments and regulatory bodies worldwide are implementing stricter safety norms, mandating the use of protective equipment like rubber gloves.

The expansion of disposable gloves in food services has positively impacted the market. Food hygiene regulations require workers to use gloves while handling food products, ensuring safety and compliance. This trend has led to higher demand for disposable gloves, driving the overall growth of the rubber gloves market.

Restraints

Volatile Raw Material Prices Restraints Market Growth

The rubber gloves market faces several restraints, with volatile raw material prices being a primary challenge. The prices of natural rubber compound and synthetic materials like nitrile fluctuate due to changes in supply and demand dynamics.

Environmental concerns over non-biodegradable waste also restrain the market. Traditional rubber gloves, especially those made from latex and nitrile, contribute to environmental pollution when not disposed of properly. With increasing focus on sustainability, companies face pressure to innovate, which can be costly and time-consuming, limiting market growth.

The availability of low-cost alternatives is another restraint. While premium gloves offer better quality, cheaper variants, often from unregulated markets, compete heavily, particularly in price-sensitive regions. These alternatives challenge established brands, reducing market share and impacting sales volumes.

Latex allergies pose a further restraint, as a considerable portion of the population is sensitive to latex products. This limits the use of latex gloves in many settings, reducing market potential and pushing consumers towards alternatives, which may not be as cost-effective for some manufacturers.

Opportunity

Development of Sustainable Gloves Provides Opportunities

The development of biodegradable and sustainable gloves presents significant growth opportunities in the rubber gloves market. With rising environmental concerns, there is a strong demand for eco-friendly products that reduce the impact of waste.

Expanding markets in developing regions offer another opportunity. As healthcare systems in these regions improve and industrialization progresses, the demand for rubber gloves increases.

The increasing adoption of nitrile gloves for allergy-sensitive users further supports market growth. Nitrile gloves are gaining popularity as they are hypoallergenic, durable, and offer strong chemical resistance. Companies developing innovative nitrile glove solutions can attract healthcare and industrial sectors looking for safer alternatives to latex gloves, expanding their customer base.

Technological innovations in glove manufacturing also provide opportunities for growth. Automation and advanced production techniques can lower manufacturing costs, increase efficiency, and improve product quality. Companies that invest in such technologies can enhance their competitive edge, delivering better products at a reduced cost, thus driving market growth.

Challenges

Regulatory Compliance and Competition Challenges Market Growth

The rubber gloves market faces challenges due to regulatory compliance and certification costs. Different regions have distinct regulations for manufacturing and safety standards, making it complex for companies to ensure compliance across global markets.

Supply chain disruptions also pose a significant challenge. The rubber gloves market relies on a consistent supply of raw materials like latex and nitrile. Any disruption in these supply chains—whether due to geopolitical tensions, natural disasters, or pandemics—can lead to shortages and production delays. Such disruptions increase costs and affect the timely availability of products, impacting market stability.

Intense competition among established brands adds to the market’s challenges. With several key players offering similar products, maintaining market share requires continuous innovation and marketing efforts. Companies must differentiate their products through quality, pricing, or sustainability features to stand out, which can be resource-intensive.

Fluctuating demand in different industries also complicates market growth. Demand for rubber gloves can vary based on factors like healthcare needs, industrial activity, or changes in regulations. Companies must adapt quickly to these fluctuations to maintain consistent production levels and profitability, which can be challenging without flexible manufacturing capabilities.

Growth Factors

Increasing Focus on Workplace Safety Is Growth Factor

The increasing focus on workplace safety is a major growth factor for the rubber gloves market. With industries emphasizing the need for protective equipment, there is a consistent demand for gloves that ensure worker safety in various environments.

The expansion of healthcare facilities globally further drives market growth. With the ongoing development of healthcare infrastructure, especially in emerging regions, the demand for rubber gloves in medical and diagnostic settings is rising.

Rising awareness of hygiene practices, particularly in food services and healthcare, also boosts the market. As businesses and consumers become more conscious of hygiene standards, the use of gloves becomes a norm, increasing demand across multiple sectors.

Government initiatives promoting health and safety compliance also support the market. Governments worldwide are launching campaigns and regulations to enhance workplace safety and hygiene standards.

Emerging Trends

Shift Towards Nitrile Gloves Is Latest Trending Factor

The shift towards nitrile gloves is a significant trend in the rubber gloves market. Nitrile gloves are gaining traction due to their hypoallergenic properties, making them suitable for users who experience latex allergies.

The rise in e-commerce sales channels is also influencing the market. With increasing digitalization, many consumers and businesses prefer online purchasing for convenience. Rubber glove manufacturers are leveraging this trend by expanding their online presence and partnering with e-commerce platforms to reach a broader audience.

The introduction of powder-free and hypoallergenic glove variants is another key trend. Powder-free gloves are increasingly preferred due to their reduced risk of contamination and irritation. This shift aligns with the growing demand for safer and more hygienic products in medical and industrial applications, driving market growth.

The demand for reusable gloves is also growing. As environmental concerns rise, there is a push for products that reduce waste. Reusable gloves offer durability and cost-efficiency, appealing to industries where glove usage is frequent but sustainability is a priority. Manufacturers responding to this trend by producing high-quality reusable gloves are likely to capture a significant market share.

Regional Analysis

Europe Dominates with 34.5% Market Share

Europe leads the Rubber Gloves Market with a 34.5% share, amounting to USD 2.83 billion. This strong market presence is due to high hygiene standards, strict safety regulations, and a well-developed healthcare sector. The demand for rubber gloves is fueled by increasing awareness of workplace safety and the widespread use of gloves in various industries.

Europe’s regulatory environment emphasizes stringent health and safety protocols, which boost the demand for high-quality gloves. The region’s advanced manufacturing capabilities and the presence of major healthcare and food processing industries also support market growth. The high focus on hygiene in healthcare facilities and food services drives consistent consumption of rubber gloves.

Europe’s influence in the Rubber Gloves Market is expected to remain strong as regulations become more rigorous and hygiene awareness grows. The trend toward sustainable and eco-friendly glove options will likely create new market opportunities. As industries prioritize safety and compliance, Europe will continue to hold a major share in the market.

Regional Mentions:

- North America: North America’s rubber gloves market is growing, driven by high demand in healthcare and food processing sectors. The region benefits from advanced safety regulations and a strong focus on workplace protection.

- Asia Pacific: Asia Pacific is rapidly expanding its rubber gloves market due to booming healthcare services and industrial growth. Countries like Malaysia and Thailand dominate as major glove producers and exporters.

- Middle East & Africa: The Middle East & Africa are emerging markets for rubber gloves, supported by growing healthcare infrastructure and increasing hygiene awareness. Investments in healthcare facilities drive demand for medical gloves.

- Latin America: Latin America’s market is developing as healthcare standards improve and safety regulations strengthen. The growing food processing industry and healthcare expansion contribute to the rising demand for rubber gloves in the region.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The rubber gloves market is led by major players such as Top Glove Corporation Bhd, Hartalega Holdings Berhad, Supermax Corporation Berhad, and Ansell Limited. These companies are pivotal in addressing the growing global demand for both medical and industrial protective gloves.

Top Glove and Hartalega specialize in a broad array of latex and nitrile gloves, catering to healthcare and industrial sectors with an emphasis on strength, comfort, and hypoallergenic properties. Supermax and Ansell diversify their offerings by including specialized gloves that provide enhanced chemical and puncture resistance, designed for more rigorous industrial applications.

These companies position themselves as leaders by leveraging cutting-edge production technologies and expansive production capacities to meet global demands efficiently. Their strategic focus includes maintaining high standards of product quality and safety to uphold their brand reputations.

Top Glove and Supermax typically utilize competitive pricing strategies to penetrate diverse markets, whereas Hartalega and Ansell may command premium prices due to their specialized products and established brand reputation in high-stakes environments like healthcare.

All four companies boast a strong international presence, with significant market shares in North America, Europe, and Asia-Pacific. Their global reach is supported by extensive distribution networks and regional compliance with international standards.

Innovation in the rubber gloves market centers on improving glove durability, user comfort, and protection against a broader range of chemicals and pathogens. Environmental sustainability also plays a role, with initiatives to reduce resource use and waste in glove production.

Top Key Players in the Market

- Top Glove Corporation Bhd

- Hartalega Holdings Berhad

- Supermax Corporation Berhad

- Ansell Limited

- Kossan Rubber Industries Bhd

- Semperit AG Holding

- Medline Industries, Inc.

- Cardinal Health, Inc.

- The Glove Company

- Rubberex Corporation (M) Berhad

- Ammex Corporation

- Dynarex Corporation

- Shamrock Manufacturing Company, Inc.

- Kimberly-Clark Corporation

- MCR Safety

- Other Key Players

Recent Developments

- United Global Trading Corp.: On June 2024, United Global Trading Corp. introduced the ShieldON® EcoSeries biodegradable nitrile gloves, which decompose 67% faster than standard gloves in landfills, achieving significant biodegradability within 23 months. The gloves are FDA-approved and suitable for use with chemotherapy and fentanyl, demonstrating compliance with ASTM standards.

- Kimberly-Clark Professional: On January 2024, Kimberly-Clark unveiled the Kimtech Polaris Nitrile Gloves, designed to enhance safety in laboratory environments. These gloves provide superior chemical and chemotherapy protection while minimizing hand strain, as validated by ergonomic certification.

- Armbrust Inc.: On April 2023, Armbrust Inc. launched 100% American-made nitrile gloves, produced in Louisiana, to address quality control concerns in the glove manufacturing sector. These FDA-cleared, chemo-rated gloves aim to ensure high standards in PPE availability for U.S. healthcare providers, mitigating supply chain disruptions.

Report Scope

Report Features Description Market Value (2023) USD 8.2 Billion Forecast Revenue (2033) USD 30.4 Billion CAGR (2024-2033) 14.0% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Natural Rubber/Latex, Nitrile, Neoprene, Other Material Types), By Product (Disposable, Durable), By Type (Powdered, Powder-Free), By Distribution Channel (Online, Physical), By End-Use (Medical & Healthcare, Automotive, Oil & Gas, Food & Beverages, Other End-Uses) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Top Glove Corporation Bhd, Hartalega Holdings Berhad, Supermax Corporation Berhad, Ansell Limited, Kossan Rubber Industries Bhd, Semperit AG Holding, Medline Industries, Inc., Cardinal Health, Inc., The Glove Company, Rubberex Corporation (M) Berhad, Ammex Corporation, Dynarex Corporation, Shamrock Manufacturing Company, Inc., Kimberly-Clark Corporation, MCR Safety Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Ansell Ltd.

- Top Glove Corporation Bhd

- Hartalega Holdings Berhad

- Unigloves (UK) Limited

- The Glove Company

- MAPA Professional

- Other Key Players