Global Rose Water Market Size, Share, Growth Analysis By Product (Rosa Gallica, Rosa Damascene, Rosa Centifolia), By Application (Personal Care & Cosmetics, Medicinal Use, Food & Personal Care & Cosmetics, Others), By Distribution (Indirect Sales, Direct Sales), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 147857

- Number of Pages: 313

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

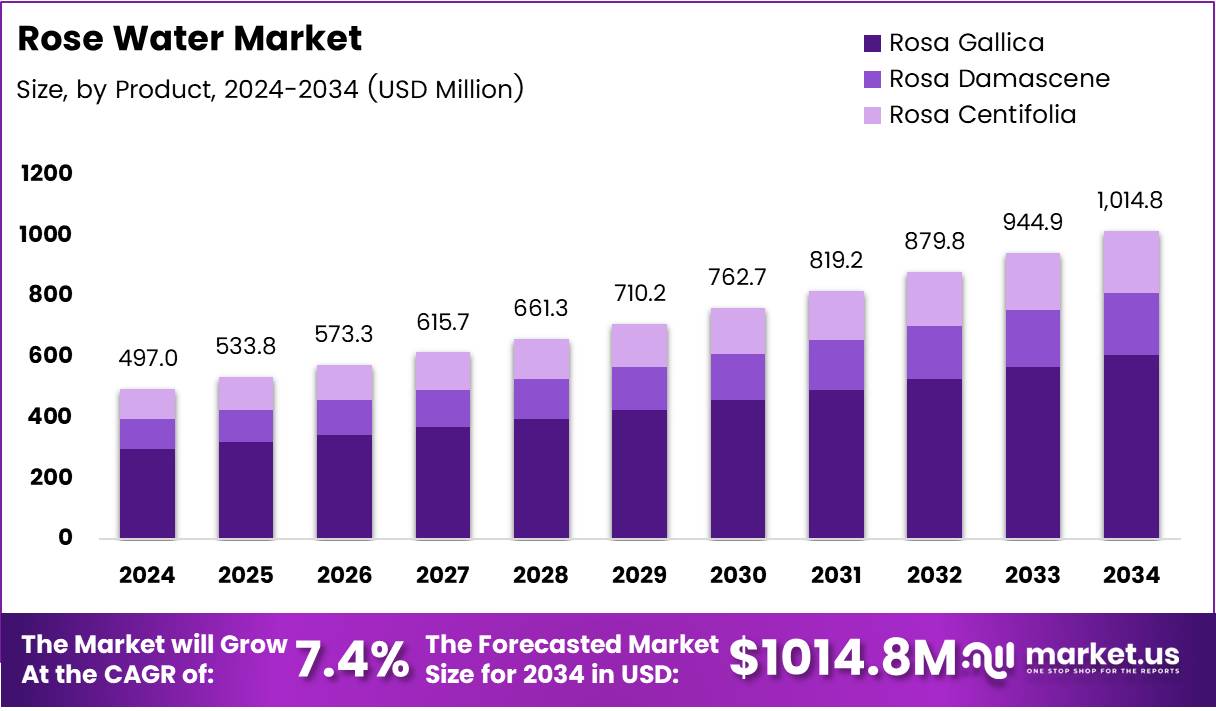

The Global Rose Water Market size is expected to be worth around USD 1014.8 Million by 2034, from USD 497.0 Million in 2024, growing at a CAGR of 7.4% during the forecast period from 2025 to 2034.

The global rose water market is witnessing significant growth driven by rising consumer preference for natural and organic ingredients in beauty and personal care products. According to CAS, over 40% of shoppers prioritize natural components when selecting beauty and personal care items. This shift towards natural products is creating lucrative opportunities for rose water, a popular ingredient known for its skin care and therapeutic benefits.

The market for rose water is expected to expand further due to the growing awareness of its versatile applications. From skincare to aromatherapy, rose water’s multifaceted uses are drawing increased attention, especially in the context of holistic wellness trends. As consumers seek products with minimal chemical additives, the demand for rose water is projected to rise, supporting market growth in the coming years.

Government investment and regulatory support play a crucial role in the growth of the rose water market. Many countries are increasing their investments in the natural cosmetics industry, offering grants and subsidies to companies promoting organic and eco-friendly products. This regulatory environment is fostering innovation and encouraging businesses to develop high-quality rose water products that meet international standards, particularly in the EU and North America.

According to Volza’s India Export data, India exported 2,341 shipments of rose water from March 2023 to February 2024. This growing export trend reflects the global appeal of rose water, especially in markets where demand for natural and organic beauty solutions is high. India’s role as a major supplier contributes to the overall market’s expansion, creating avenues for international trade and business partnerships.

The increased consumer shift towards organic and natural personal care products, along with favorable governmental policies, is providing robust opportunities for brands to tap into the growing rose water market. Moreover, innovations in packaging and distribution are expected to drive further market penetration, especially in emerging regions. As these trends unfold, the market is poised for steady growth, with significant opportunities for stakeholders at every level.

Key Takeaways

- Global Rose Water Market is expected to reach USD 1014.8 Million by 2034, growing at a CAGR of 7.4% from USD 497.0 Million in 2024.

- Rosa Gallica dominated the By Product Analysis segment with a 48.1% market share in 2024, known for its rich fragrance and therapeutic properties.

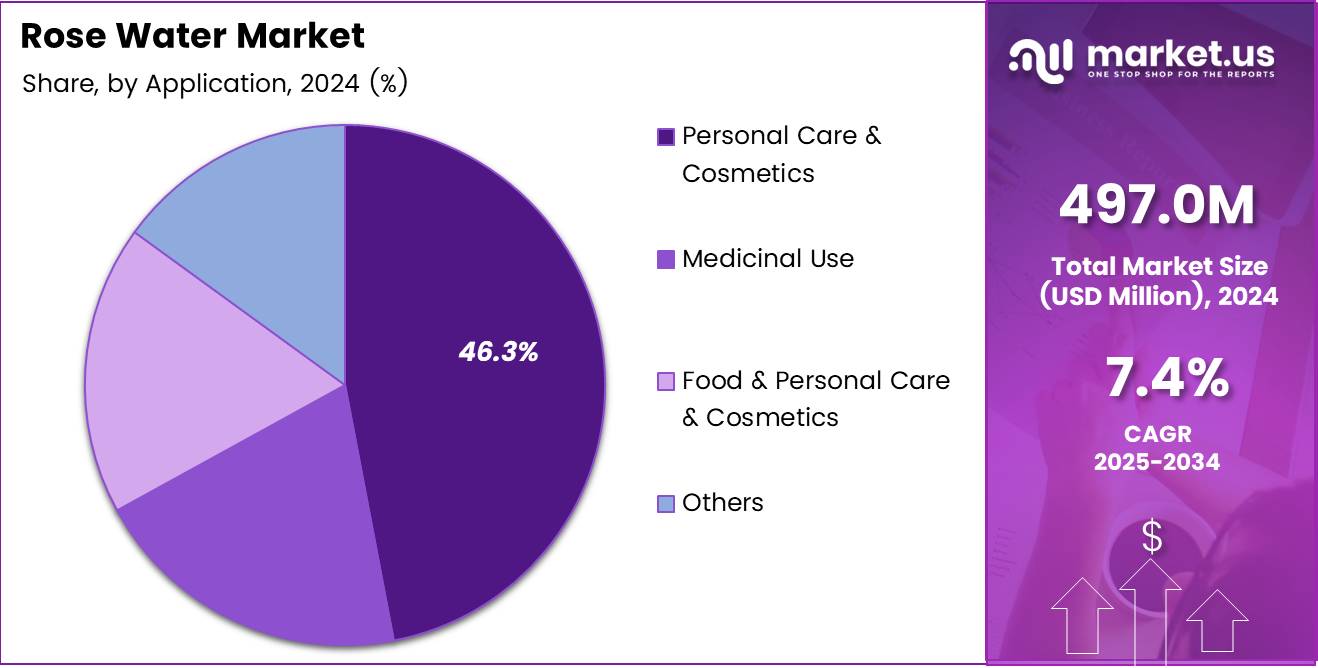

- Personal Care & Cosmetics led the By Application Analysis segment, holding a 46.3% share in 2024, driven by the demand for natural and organic beauty products.

- Indirect Sales dominated the By Distribution Analysis segment in 2024, driven by e-commerce platforms, retail stores, and wholesalers.

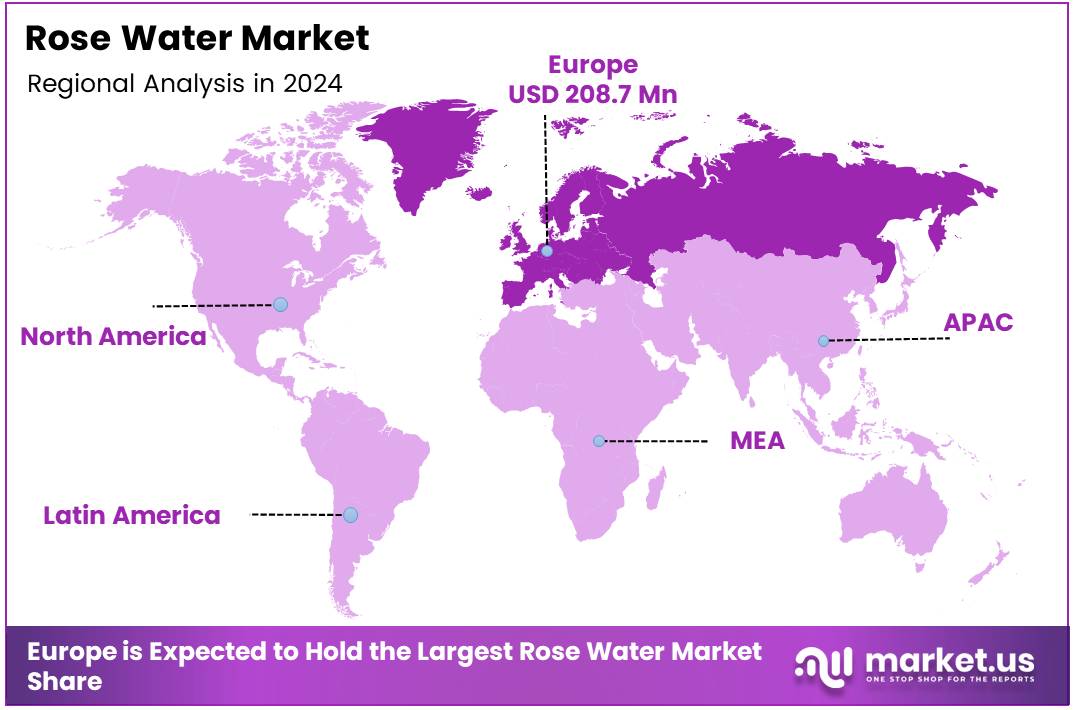

- Europe held the dominant market share in 2024 with 42.5%, valued at USD 208.74 Million, due to rising demand for natural beauty and skincare products.

Product Analysis

Rosa Gallica dominates the market with 48.1% share due to its historical use and versatile applications in rose water production.

In 2024, Rosa Gallica held a dominant market position in the By Product Analysis segment of the Rose Water Market, with a 48.1% share. Known for its rich fragrance and therapeutic properties, Rosa Gallica is widely used in the production of rose water, particularly in cosmetics and skincare products. Its high demand stems from its ability to provide a soothing effect on the skin while also promoting hydration.

Rosa Damascena, another key player, has also gained popularity due to its superior fragrance and extraction efficiency. It is widely used in perfumery and aromatherapy, where its floral notes are highly valued. Rosa Centifolia, though not as prevalent as Rosa Gallica and Rosa Damascena, is still a significant contributor due to its adaptability in various climates and the quality of its essential oil.

In conclusion, Rosa Gallica’s dominance can be attributed to its high-quality essence, ease of extraction, and broad application in skincare, making it the preferred choice for rose water production.

Application Analysis

Personal Care & Cosmetics leads with 46.3% share in the Rose Water Market due to increasing consumer preference for natural skincare solutions.

In 2024, Personal Care & Cosmetics held a dominant market position in the By Application Analysis segment of the Rose Water Market, with a 46.3% share. The surge in demand for natural and organic beauty products has made rose water a key ingredient in many skincare formulations. Its anti-inflammatory, hydrating, and antioxidant properties are highly sought after by consumers looking for gentle, chemical-free options for their daily skincare routines.

Medicinal Use, while still a valuable segment, holds a smaller share due to the relatively niche applications of rose water in medicinal remedies. It is used for its calming and healing properties, especially in traditional medicine practices.

Food & Beverages is another emerging segment, where rose water is increasingly used in culinary applications for its unique flavor. The Others category encompasses niche uses of rose water in perfumes, aromatherapy, and as a natural air freshener, though these remain secondary to the personal care and cosmetics industry.

Overall, the increasing demand for organic personal care products ensures that Personal Care & Cosmetics will continue to dominate the market in the coming years.

Distribution Analysis

Indirect Sales dominates with a significant share in the Rose Water Market due to the wide reach of online and retail distribution channels.

In 2024, Indirect Sales held a dominant market position in the By Distribution Analysis segment of the Rose Water Market. Indirect sales are primarily driven by e-commerce platforms, retail stores, and wholesalers, which contribute significantly to the market’s reach. These distribution channels allow rose water to be available to a global customer base, catering to both small-scale buyers and large retailers.

Direct Sales, on the other hand, tend to be more niche, with companies focusing on direct-to-consumer models, particularly in high-end or specialized markets. While direct sales provide better margins and customer relationships, they do not match the widespread reach of indirect sales.

The expansion of online retail and increasing awareness about the benefits of rose water have led to a significant shift towards indirect sales channels. Consequently, this segment is expected to continue driving market growth, capitalizing on the global trend toward online shopping and accessible wellness products.

Key Market Segments

By Product

- Rosa Gallica

- Rosa Damascene

- Rosa Centifolia

By Application

- Personal Care & Cosmetics

- Medicinal Use

- Food & Personal Care & Cosmetics

- Others

By Distribution

- Indirect Sales

- Direct Sales

Drivers

Rising Demand for Natural Beauty Products Drives Rose Water Market Growth

The growing preference for natural and organic skincare products is one of the primary drivers for the rose water market. Consumers are increasingly looking for beauty and personal care products that are free from synthetic chemicals, which has created a significant shift toward organic and plant-based ingredients. Rose water, known for its gentle and natural formulation, aligns with this consumer demand, making it a popular choice in skincare routines.

As people become more conscious of the ingredients in their skincare products, the demand for natural alternatives continues to rise. This shift is especially evident among health-conscious millennials and Gen Z consumers, who are more likely to prioritize eco-friendly and organic options.

Moreover, rose water is perceived as a multipurpose product with various skincare benefits, which further fuels its growing popularity in beauty treatments. As the beauty industry embraces clean beauty trends, rose water is expected to maintain its position as a key ingredient in the market.

Restraints

High Cost and Competition from Alternatives Limit Rose Water Market Growth

Despite its rising demand, the rose water market faces certain restraints that could hinder its growth. One significant challenge is the high cost of organic and premium-quality rose water, which can be prohibitive for budget-conscious consumers.

Organic rose water is typically produced through labor-intensive processes, resulting in higher prices. As a result, many customers may opt for more affordable alternatives that lack the premium quality of organic rose water.

Furthermore, the competition from substitutes such as lavender water, chamomile water, and other floral waters poses a threat to rose water’s market share. These alternatives often offer similar benefits and are available at lower prices, making them attractive options for price-sensitive consumers. As a result, rose water faces competition from these other floral waters, limiting its growth potential in certain segments of the market.

Growth Factors

Growth Opportunities for Rose Water Market Through Innovation and Expanding Reach

The rose water market has several promising growth opportunities that could drive its expansion. One of the most significant opportunities lies in product innovation, particularly in developing rose water-based skincare products with added benefits.

For example, the inclusion of anti-aging, brightening, or moisturizing properties in rose water formulations could open new avenues for market growth. Consumers are constantly seeking products that address multiple skin concerns, and innovative rose water-based products could cater to this demand.

Additionally, emerging markets, particularly in Asia Pacific and Latin America, present a considerable growth opportunity for the rose water market. As these regions experience rising disposable incomes and an increasing interest in natural beauty products, the demand for rose water is expected to grow. Brands that focus on expanding their presence in these regions can capitalize on the growing trend toward natural and organic skincare products.

Collaborations with spas and wellness centers also present another opportunity for rose water market growth. Spas and wellness centers are increasingly incorporating natural ingredients like rose water into their treatments, allowing brands to reach a broader audience and boost their visibility in the wellness sector.

Emerging Trends

Trending Factors Shaping the Rose Water Market

Several trends are currently shaping the rose water market, contributing to its growing popularity among consumers. One key trend is the rise of DIY skincare, where consumers are creating homemade skincare treatments such as facial masks and toners using natural ingredients like rose water. This trend has increased the demand for rose water as an essential component in at-home beauty routines.

Celebrity endorsements have also played a significant role in driving interest in rose water products. Influencers and celebrities who promote natural skincare lines or share their beauty routines have introduced rose water to a broader audience, further fueling its market growth. As these endorsements continue, more consumers are likely to explore the benefits of rose water in their skincare regimens.

Another important trend is the increasing focus on clean beauty. Consumers are now more aware of the harmful effects of harsh chemicals in their skincare products, leading to a shift toward products with natural, cruelty-free ingredients. Rose water, known for its natural, soothing properties, aligns perfectly with the clean beauty movement and is expected to see continued demand in the coming years.

Regional Analysis

Europe Dominates the Rose Water Market with a Market Share of 42.5%, Valued at USD 208.74 Million

In 2024, Europe held the dominant position in the Rose Water market, accounting for 42.5% of the global share, valued at approximately USD 208.74 million. This dominance is primarily driven by the increasing demand for natural beauty and skincare products in the region. Growing consumer awareness about the benefits of rose water, including its soothing, anti-inflammatory, and hydrating properties, is boosting its adoption in cosmetics and personal care applications.

Regional Mentions:

North America is witnessing steady growth in the Rose Water market, driven by rising consumer demand for organic and natural products in skincare routines. The U.S. market, in particular, has seen increased sales of rose water-infused beauty products due to a shift towards clean beauty trends and rising disposable income.

The Asia Pacific region is emerging as a key market for rose water, particularly in countries like India and China, where traditional beauty and skincare practices are being integrated with modern cosmetic trends. With the increasing popularity of organic beauty products, rose water is finding widespread application in personal care products.

The Middle East & Africa market is seeing steady growth in demand, primarily driven by the region’s long-standing use of rose water in traditional skincare and medicinal applications. In addition, growing consumer interest in premium natural cosmetics is expected to fuel market expansion in this region.

In Latin America, while the Rose Water market remains relatively small compared to other regions, it is anticipated to experience growth as the demand for organic and natural personal care products increases. As awareness about rose water’s benefits grows, the region is expected to show promising growth trends in the coming years.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2024, the global rose water market continues to experience robust growth, driven by increasing demand for natural skincare and wellness products. Among the key players, SVA Naturals has gained traction due to its strong online presence and commitment to organic sourcing, making it a favorite among health-conscious consumers seeking high-purity rose water.

Taj Pharma Group (Taj Agro International) plays a critical role with its pharmaceutical-grade formulations and diversified global distribution, catering to both cosmetic and medicinal segments of the market. Its reputation for quality control and scalability boosts its competitive position.

Bioprocess LLC focuses heavily on sustainability and bio-based extraction methods, appealing to eco-conscious brands and customers. Their innovation in processing technology helps enhance the shelf life and efficacy of rose water, giving them an edge in premium markets.

Eve Hansen, a U.S.-based natural skincare brand, leverages e-commerce and clean beauty trends. Their rose water is positioned as a multipurpose toner and facial mist, helping them tap into the growing demand for minimalist and chemical-free skincare routines.

These leading companies shape market dynamics through product innovation, brand positioning, and expanding global outreach. Their strategic emphasis on purity, sustainability, and functional skincare will be instrumental in setting the pace for the rose water industry in the near future.

Top Key Players in the Market

- SVA Naturals

- Taj Pharma Group (Taj Agro International)

- Bioprocess LLC

- Eve Hansen

- L’Oréal S.A.

- Azelis Group (Vigon Int.)

- Vesselino Ltd.

- RGB Paris – Rose of Bulgaria

- Alteya Inc.

- SINGHAI FRAGRANCES

- Poppy Austin Limited

- S.A.S. Jean GAZIGNAIRE

- Biosash Business Pvt. Ltd.

Recent Developments

- In Jan 2025, Ras Luxury Skincare raised US$5 million in a Series A funding round led by Unilever Ventures. The investment aims to support the brand’s growth, product innovation, and global expansion.

- In Jun 2024, skincare startup CHOSEN secured $1.2 million in seed funding. The funds will be used to expand product offerings and enhance their dermatology-backed formulations.

- In Oct 2024, six-month-old skincare startup ClayCo Cosmetics raised ₹16 crore from Unilever Ventures. The capital will help scale operations and bolster its direct-to-consumer presence.

- In Jun 2024, D2C skincare brand Foxtale raised $18 million in a Series B round. The funding is targeted at boosting brand visibility, R&D, and market reach.

Report Scope

Report Features Description Market Value (2024) USD 497.0 Million Forecast Revenue (2034) USD 1014.8 Million CAGR (2025-2034) 7.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Rosa Gallica, Rosa Damascene, Rosa Centifolia), By Application (Personal Care & Cosmetics, Medicinal Use, Food & Personal Care & Cosmetics, Others), By Distribution (Indirect Sales, Direct Sales) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape SVA Naturals, Taj Pharma Group (Taj Agro International), Bioprocess LLC, Eve Hansen, L’Oréal S.A., Azelis Group (Vigon Int.), Albert Vieille SAS, Dabur India Limited, Vesselino Ltd., RGB Paris – Rose of Bulgaria, Alteya Inc., SINGHAI FRAGRANCES, Poppy Austin Limited, S.A.S. Jean GAZIGNAIRE, Biosash Business Pvt. Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- SVA Naturals

- Taj Pharma Group (Taj Agro International)

- Bioprocess LLC

- Eve Hansen

- L'Oréal S.A.

- Azelis Group (Vigon Int.)

- Vesselino Ltd.

- RGB Paris - Rose of Bulgaria

- Alteya Inc.

- SINGHAI FRAGRANCES

- Poppy Austin Limited

- S.A.S. Jean GAZIGNAIRE

- Biosash Business Pvt. Ltd.