Global Retail Clinics Market By Ownership Type (Retail owned and Hospital owned), By Location (Stores, Malls and Others), By Application (Point of care diagnostics, Clinical chemistry, Immunoassay, Vaccination and Other), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2026

- Report ID: 177173

- Number of Pages: 331

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

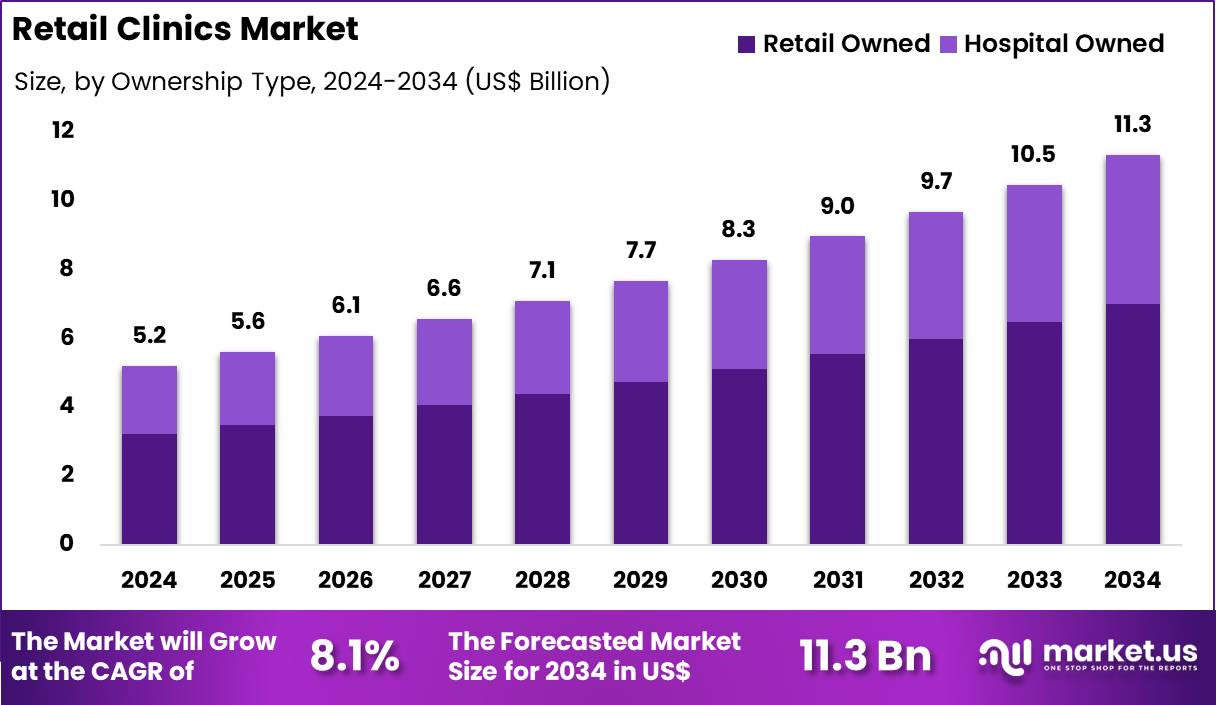

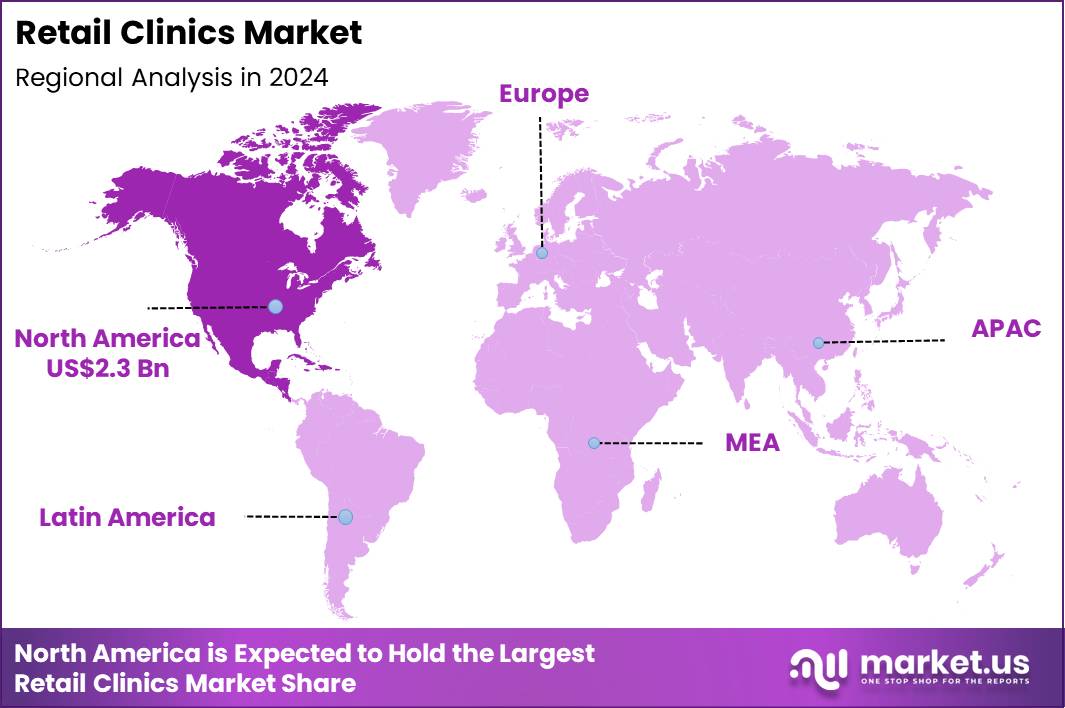

Global Retail Clinics Market size is expected to be worth around US$ 11.3 Billion by 2034 from US$ 5.2 Billion in 2024, growing at a CAGR of 8.1% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 43.6% share with a revenue of US$ 2.3 Billion.

Increasing consumer demand for convenient, accessible healthcare propels the retail clinics market as patients seek timely treatment for common ailments without scheduling traditional appointments. Retail clinics increasingly provide acute care services such as treatment for sinus infections, strep throat, and urinary tract infections, delivering rapid diagnostics and prescriptions during extended hours that accommodate busy lifestyles.

These facilities support preventive health applications by administering vaccinations for influenza, shingles, and travel-related diseases, enabling convenient immunization updates for families and working adults. Clinicians at retail clinics perform routine physical examinations for school, sports, and employment requirements, offering efficient health screenings that include blood pressure checks and basic lab testing.

Patients utilize these locations for minor injury management, including wound care, splinting, and treatment of sprains or minor burns, receiving immediate attention and follow-up guidance. Retail clinics also address skin conditions through evaluation and treatment of rashes, acne, and minor dermatologic issues, providing topical prescriptions and referrals when necessary.

Healthcare organizations pursue opportunities to expand retail clinic services into chronic disease monitoring, integrating point-of-care testing for diabetes management and hypertension follow-up to bridge gaps in primary care access.

Developers advance telehealth-enabled kiosks within retail settings, broadening applications for virtual consultations on minor illnesses and medication refills. These innovations facilitate partnerships with pharmacies for seamless prescription fulfillment and adherence support.

Opportunities emerge in wellness-focused offerings such as health coaching for weight management and smoking cessation, appealing to proactive consumers. Companies invest in digital platforms that track patient visits and outcomes, enhancing continuity of care across episodic and preventive encounters.

Recent trends emphasize expanded scope of practice for nurse practitioners, enabling retail clinics to manage more complex conditions like ear infections, conjunctivitis, and basic respiratory illnesses while maintaining high patient satisfaction through quick service and affordability.

Key Takeaways

- In 2024, the market generated a revenue of US$ 5.2 Billion, with a CAGR of 8.1%, and is expected to reach US$ 11.3 Billion by the year 2034.

- The ownership type segment is divided into retail owned and hospital owned, with retail owned taking the lead with a market share of 61.8%.

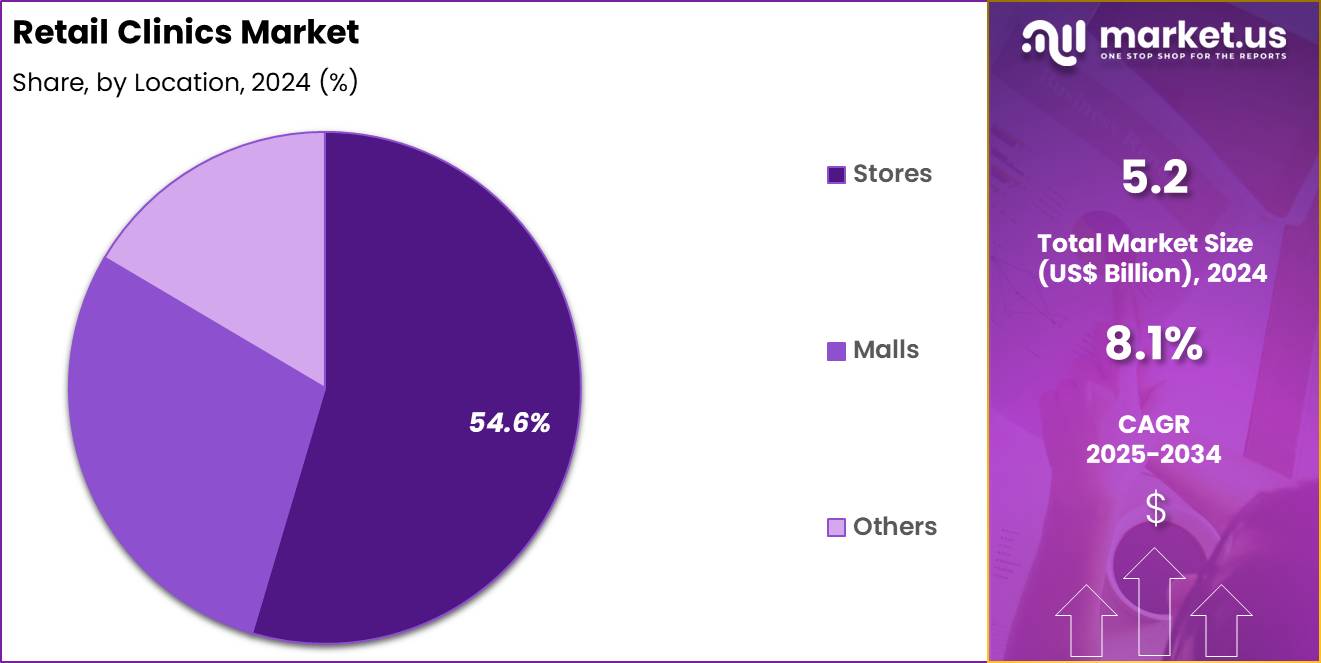

- Considering location, the market is divided into stores, malls and others. Among these, stores held a significant share of 54.6%.

- Furthermore, concerning the application segment, the market is segregated into point of care diagnostics, clinical chemistry, immunoassay, vaccination and other. The point of care diagnostics sector stands out as the dominant player, holding the largest revenue share of 39.7% in the market.

- North America led the market by securing a market share of 43.6%.

Ownership Type Analysis

Retail owned clinics contributed 61.8% of growth within ownership type and led the retail clinics market due to their operational independence, faster expansion models, and consumer-centric service design. Large retail chains leverage existing foot traffic, extended operating hours, and standardized workflows to scale clinic networks rapidly.

Patients prefer retail owned clinics for transparent pricing and minimal wait times, which increases visit frequency for minor illnesses and preventive care. These clinics focus on high-volume, low-complexity services that align well with walk-in demand patterns.

Growth strengthens as retailers integrate healthcare offerings into broader convenience ecosystems that include pharmacies and wellness products. Investment in digital scheduling and electronic records improves service efficiency.

Retail brands also benefit from strong consumer trust and marketing reach. Expansion into underserved urban and suburban areas accelerates adoption. The segment is expected to remain dominant as convenience-driven healthcare access continues to reshape outpatient care delivery.

Location Analysis

Stores generated 54.6% of growth within location and emerged as the leading segment due to their accessibility and proximity to daily consumer activity. Clinics located inside or adjacent to retail stores attract patients during routine shopping visits, which lowers barriers to care. High visibility and predictable footfall increase patient awareness and utilization. Store-based clinics support quick consultations and diagnostics without the need for prior appointments.

Growth accelerates as retailers prioritize healthcare integration within core store layouts. Extended operating hours align with consumer schedules and improve visit convenience. Urbanization and busy lifestyles further strengthen preference for store-based healthcare access points.

Store locations also support efficient staffing and inventory management. The segment is projected to maintain leadership as healthcare delivery continues to shift toward convenient, near-home settings.

Application Analysis

Point of care diagnostics accounted for 39.7% of growth within application and dominated the retail clinics market due to rising demand for rapid testing and immediate clinical decision-making. Retail clinics use point of care tools to deliver fast results for infections, glucose levels, cholesterol, and basic health screenings. Patients value same-visit diagnosis and treatment, which improves satisfaction and follow-up compliance. These services align with retail clinics’ focus on efficiency and quick turnaround care.

Growth strengthens as preventive health awareness increases and consumers seek frequent health monitoring. Technological advances improve test accuracy and expand diagnostic menus suitable for retail settings.

Employers and insurers also encourage point of care testing to reduce healthcare costs. Integration with digital health records supports continuity of care. The segment is anticipated to remain dominant as rapid diagnostics become central to convenient outpatient healthcare models.

Key Market Segments

By Ownership Type

- Retail owned

- Hospital owned

By Location

- Stores

- Malls

- Others

By Application

- Point of care diagnostics

- Clinical chemistry

- Immunoassay

- Vaccination

- Othe

Drivers

Increasing demand for convenient healthcare is driving the market.

The escalating need for accessible medical services has propelled the establishment of retail clinics as a viable alternative to traditional healthcare settings. Patients seek prompt care for minor ailments, contributing to the expansion of these facilities within retail environments. Healthcare providers recognize the value of reduced wait times offered by retail clinics, enhancing patient satisfaction.

Government organizations have noted a rise in utilization rates among younger demographics, reflecting broader acceptance. According to the Centers for Disease Control and Prevention, the percentage of children and adolescents aged 17 years and under who visited an urgent care center or retail health clinic increased from 21.6% in 2021 to 28.4% in 2022. This upward trend indicates a shift toward convenient options for routine health needs.

Retail clinics facilitate vaccinations and screenings, addressing public health priorities efficiently. The integration of pharmacy services within these clinics supports comprehensive care delivery. Key players continue to invest in locations that align with consumer lifestyles. This driver fosters innovation in service models to meet evolving patient expectations.

Restraints

Limited reimbursement policies are restraining the market.

Reimbursement challenges from insurance providers restrict the financial viability of retail clinics for certain services. Many payers maintain stringent criteria for covering visits at these facilities, limiting patient access. Healthcare administrators must navigate complex billing processes, which can deter operational expansion.

Government regulations require compliance with specific standards to qualify for reimbursements, adding administrative burdens. In some instances, retail clinics receive lower payment rates compared to hospital-based services, impacting profitability. Providers may hesitate to offer advanced care due to uncertain financial returns. This restraint affects the ability to attract a diverse patient base in competitive markets.

Efforts to advocate for policy changes aim to address these limitations gradually. Despite the convenience offered, economic constraints hinder sustained growth. Resolving reimbursement disparities is essential for overcoming this market obstacle.

Opportunities

Expansion into underserved rural areas is creating growth opportunities.

The development of retail clinics in rural communities addresses gaps in primary care access, presenting avenues for enhanced healthcare delivery. Governmental health initiatives support the placement of these facilities to improve service availability in remote locations. Rural residents often face longer travel distances to hospitals, making retail clinics a practical solution for routine needs.

Partnerships with local retailers facilitate the establishment of clinics in convenient settings. The potential for increased patient volumes in these areas amplifies revenue prospects for operators. According to Pew Research Center, rural residents live an average of 10.5 miles from the nearest hospital, highlighting the need for closer options. This opportunity aligns with efforts to reduce healthcare disparities across geographic regions.

Key organizations are exploring telehealth integrations to complement physical sites in rural expansions. Overall, rural growth strategies can strengthen market positions in untapped demographics. Focused investments may yield long-term benefits in community health outcomes.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic conditions influence the retail clinics market through consumer spending power, labor costs, and payer reimbursement dynamics. Inflation and higher interest rates raise wages, rent, and supply expenses, which compress margins and slow site expansion plans. Geopolitical tensions disrupt supplies of medical consumables, diagnostics, and IT hardware, increasing procurement risk and operating complexity.

Current US tariffs on imported equipment and supplies add to setup and maintenance costs, which pressures pricing for self pay and insured visits. These factors challenge smaller operators and limit growth in cost sensitive neighborhoods. On the positive side, trade pressure encourages standardized clinic formats, local sourcing, and tighter cost controls.

Demand for convenient, low cost care and vaccination services continues to rise across urban and suburban markets. With efficient staffing models and strong retail partnerships, the market remains positioned for steady and confident expansion.

Latest Trends

Shift toward virtual and hybrid care models is a recent trend in the market.

In 2024, retail clinics increasingly adopted virtual consultations to complement in-person services, enhancing flexibility for patients. These models incorporate telehealth platforms to manage follow-up care and initial assessments remotely. Manufacturers and providers focused on seamless digital integrations to support hybrid workflows.

Clinical applications expanded to include chronic condition monitoring through virtual visits. CVS Health reported maintaining more than 1,000 walk-in and primary care medical clinics as of December 31, 2024, while advancing virtual offerings. This trend responds to demands for contactless options amid ongoing health concerns.

Regulatory frameworks adapted to facilitate reimbursements for hybrid services. Industry collaborations refined technologies for secure data exchange in mixed models. These developments aim to optimize resource utilization in high-demand environments. This evolution positions hybrid approaches as integral to future clinic operations.

Regional Analysis

North America is leading the Retail Clinics Market

North America holds a 43.6% share of the global Retail Clinics market, showcasing remarkable expansion in 2024 fueled by surging demand for cost-effective, immediate care solutions that alleviate pressure on traditional healthcare systems during ongoing labor shortages in primary care.

Leading operators including CVS Health and Walgreens Boots Alliance have augmented their clinic footprints with enhanced diagnostic capabilities and partnerships for chronic condition monitoring, appealing to underserved populations in rural and metropolitan areas alike. The area’s progressive telehealth regulations have enabled seamless virtual consultations from retail settings, attracting tech-savvy consumers seeking flexibility in managing routine health issues.

Federal efforts via the Health Resources and Services Administration have subsidized training for nurse practitioners staffing these venues, elevating service quality and capacity. Heightened focus on preventive wellness post-pandemic has spurred offerings like biometric screenings and nutrition counseling, drawing in employer-sponsored health plans.

Interorganizational alliances have optimized supply chains for vaccines and testing kits, ensuring rapid response to seasonal illnesses. Additionally, consumer-driven insurance models have incentivized low-cost visits, fostering loyalty through loyalty programs tied to pharmacy services.

The Centers for Disease Control and Prevention’s 2024 National Health Interview Survey now distinguishes retail health clinics from urgent care centers in its questionnaire, reflecting their distinct role in healthcare delivery amid evolving utilization patterns.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Experts foresee considerable escalation in the convenient care landscape across Asia Pacific over the forecast period, since policymakers bolster incentives for public-private collaborations to decentralize medical access in densely populated nations.

Entities in Japan and Taiwan innovate compact diagnostic stations within convenience stores that cater to elderly demographics with rapid check-ups, while practitioners in Bangladesh refine protocols for over-the-counter treatments of endemic infections. Medical consortia in Pakistan deploy modular units in shopping districts that prioritize maternal health services, bridging gaps for working mothers in emerging economies.

Supporters in Nepal underwrite community-based hubs equipped with basic lab tools, countering geographic barriers for high-altitude residents. Officials in Sri Lanka enforce quality benchmarks that expedite licensing for chain-operated facilities, drawing foreign expertise in operational efficiency. Doctors in Myanmar harness solar-powered tech to sustain off-grid sites, optimizing interventions for nutritional deficiencies.

Producers in New Zealand adapt antimicrobial protocols for export to Pacific islands, fortifying resilience against tropical outbreaks. The World Health Organization allocated US$ 1.2 billion to health system strengthening in the Western Pacific region in 2023, emphasizing primary care enhancements to support anticipated expansions.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key competitors in the retail clinics market grow by expanding service offerings beyond basic urgent care to include chronic condition management, preventive screenings, and virtual care options that attract broader patient segments. They also strengthen accessibility by increasing clinic footprints within pharmacies, supermarkets, and other high-traffic retail environments where consumers value convenience and transparent pricing.

Firms integrate digital scheduling, telehealth follow-ups, and interoperable health records to streamline care continuity with primary providers and bolster patient loyalty. Strategic alliances with insurers and employers help secure value-based contracts that drive utilization while reinforcing cost-effective care delivery.

CVS Health exemplifies a diversified healthcare company operating a large network of in-store clinics that combine clinical services with pharmacy fulfillment, wellness programs, and digital care platforms. The company advances performance through disciplined expansion planning, coordinated technology investment, and a customer-centric approach that aligns clinical access with evolving consumer expectations.

Top Key Players

- CVS Health

- Walgreens Boots Alliance

- Walmart Health

- Kroger Health

- Rite Aid

- Concentra

- MedExpress

- NextCare Urgent Care

- The Little Clinic

- CityMD

Recent Developments

- In April 2025, Walmart Canada announced the launch of its first pharmacy clinic in St. Catharines, Ontario, marking the company’s entry into clinic-based care delivery in the country. The in-store clinic is designed to extend the role of licensed pharmacists by enabling private consultations and expanded healthcare services beyond traditional medication dispensing areas. Walmart Canada also confirmed plans to roll out additional pharmacy clinics nationwide later in the year.

- In April 2025, Carlyle Group supported VLCC in accelerating the expansion of its retail clinic network, targeting a total of 175 clinics by year-end. VLCC currently operates around 300 outlets, including franchise locations, and maintains an international footprint across the Middle East, with operations in the UAE, Qatar, Oman, and Kuwait.

Report Scope

Report Features Description Market Value (2024) US$ 5.2 Billion Forecast Revenue (2034) US$ 11.3 Billion CAGR (2025-2034) 8.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Ownership Type (Retail owned and Hospital owned), By Location (Stores, Malls and Others), By Application (Point of care diagnostics, Clinical chemistry, Immunoassay, Vaccination and Other) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape CVS Health, Walgreens Boots Alliance, Walmart Health, Kroger Health, Rite Aid, Concentra, MedExpress, NextCare Urgent Care, The Little Clinic, CityMD Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- CVS Health

- Walgreens Boots Alliance

- Walmart Health

- Kroger Health

- Rite Aid

- Concentra

- MedExpress

- NextCare Urgent Care

- The Little Clinic

- CityMD