Hospital Supplies Market By Product Type (Sterilization & Disinfectant Equipments, Patient Examination Devices, Mobility Aids & Transportation Equipments, Operating Room Equipments, and Others), By End-user (Hospitals & Clinics, Diagnostic Centres, Ambulatory Surgical Centres, Long Term Care Centres, and Nursing Facilities), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 144351

- Number of Pages: 248

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

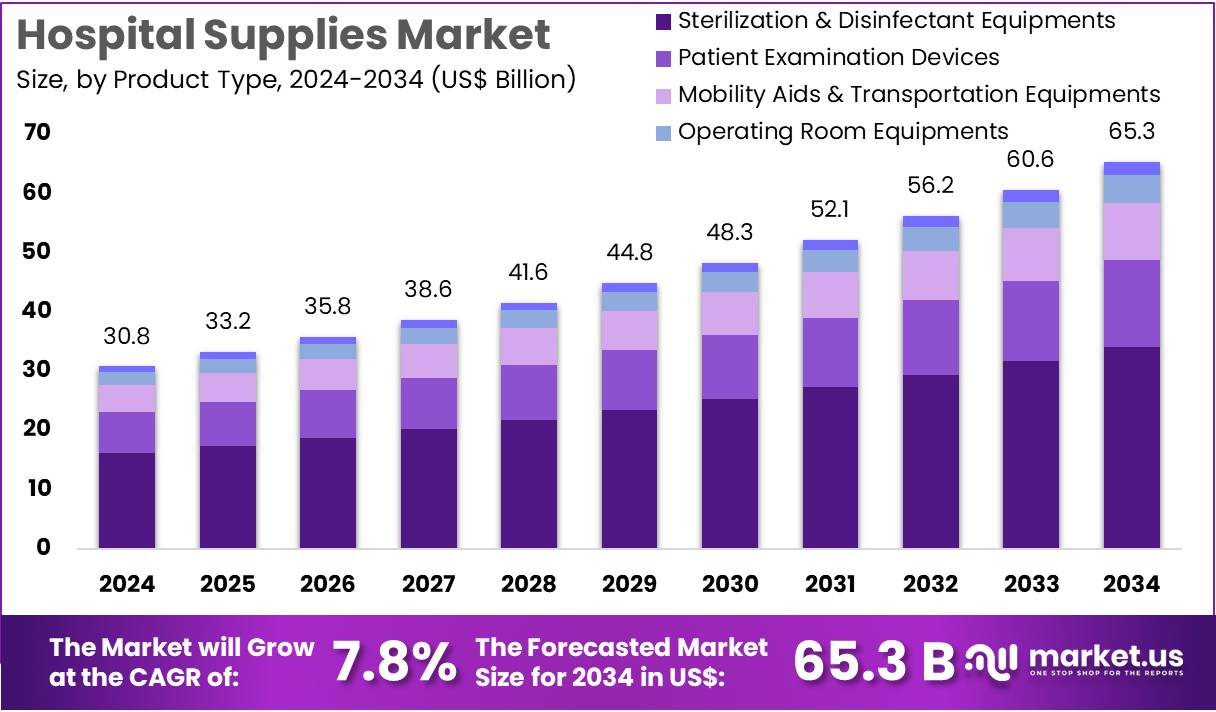

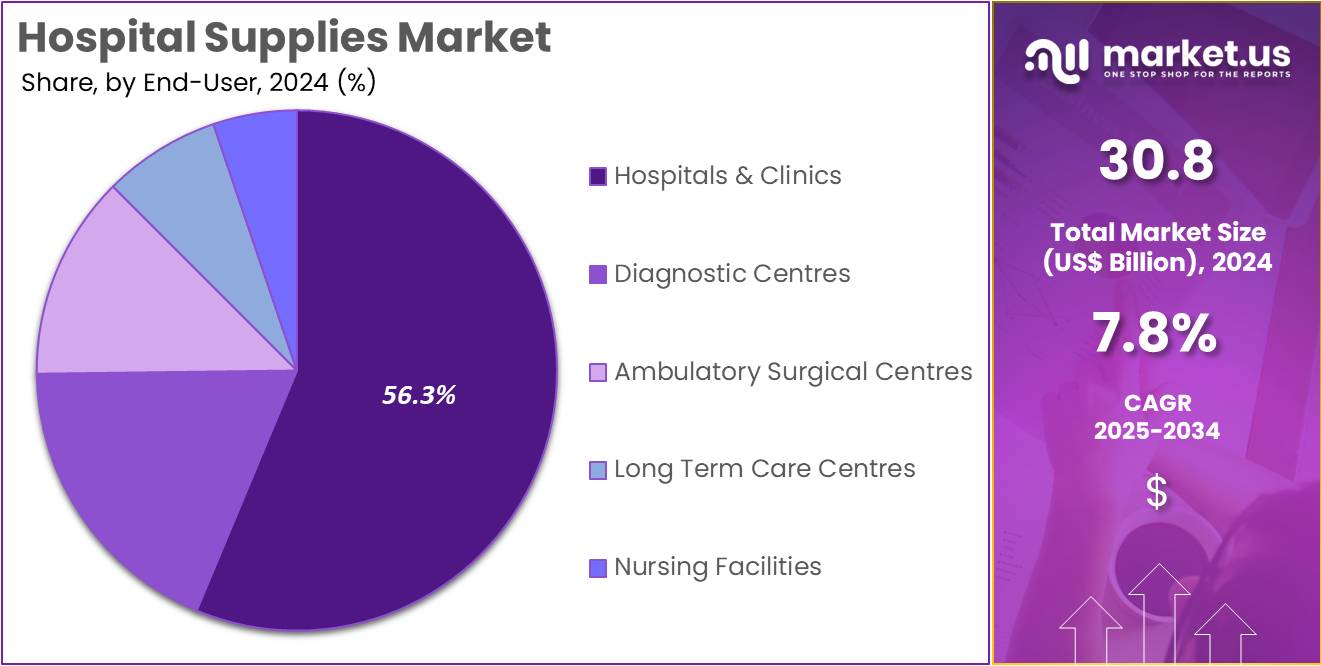

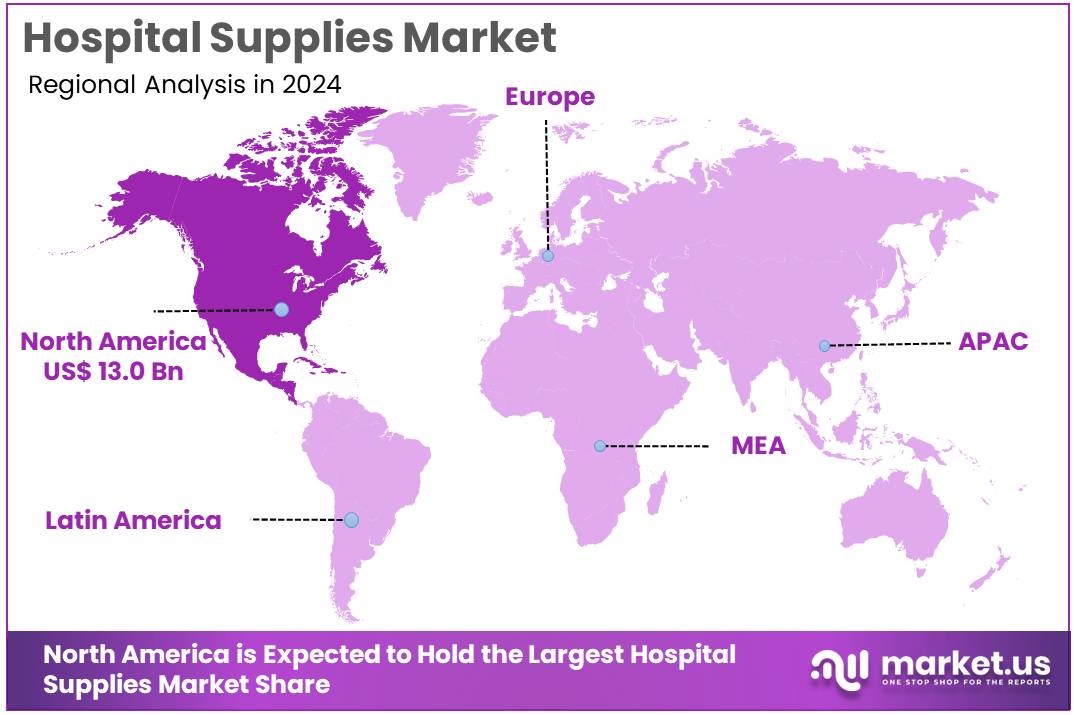

The Hospital Supplies Market Size is expected to be worth around US$ 65.3 billion by 2034 from US$ 30.8 billion in 2024, growing at a CAGR of 7.8% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 42.3% share and holds US$ 13 Billion market value for the year.

Increasing demand for healthcare services is driving the growth of the hospital supplies market. The need for advanced medical equipment and quality supplies is rising as healthcare facilities strive to improve patient outcomes, enhance operational efficiency, and meet regulatory standards. Hospitals increasingly require diagnostic tools, surgical instruments, and critical care supplies to support a wide range of medical procedures and treatments.

In August 2023, MeddeyGo.com expanded its medical equipment offerings by introducing high-quality diagnostic tools such as ECG machines, fetal monitors, and automated defibrillators, in addition to upgrading its hospital furniture selection. These additions aim to enhance hospital operations and provide healthcare professionals with the latest tools to perform their duties effectively. The rising prevalence of chronic diseases, the aging population, and the growing focus on preventive healthcare are also contributing to the market’s expansion.

Hospitals are increasingly prioritizing the integration of technology in their operations, and hospital supplies play a crucial role in ensuring accurate diagnosis, effective treatment, and improved patient care. As healthcare institutions adopt more advanced technologies, the demand for state-of-the-art supplies continues to grow, presenting substantial opportunities for market players to innovate and expand their product offerings.

Key Takeaways

- In 2024, the market for hospital supplies generated a revenue of US$ 30.8 billion, with a CAGR of 7.8%, and is expected to reach US$ 65.3 billion by the year 2034.

- The product type segment is divided into sterilization & disinfectant equipment’s, patient examination devices, mobility aids & transportation equipment’s, operating room equipment’s, and others, with sterilization & disinfectant equipment’s taking the lead in 2024 with a market share of 52.3%.

- Considering end-user, the market is divided into hospitals & clinics, diagnostic centers, ambulatory surgical center’s, long term care center’s, and nursing facilities. Among these, hospitals & clinics held a significant share of 56.3%.

- North America led the market by securing a market share of 42.3% in 2024.

Product Type Analysis

The sterilization & disinfectant equipment’s segment led in 2024, claiming a market share of 52.3% as healthcare institutions continue to prioritize infection control. The rising incidence of hospital-acquired infections (HAIs) and the growing emphasis on patient safety and hygiene are anticipated to drive the demand for sterilization and disinfectant equipment. As healthcare facilities adopt stricter cleanliness and sanitation protocols, the need for efficient sterilization systems, such as autoclaves and surface disinfectants, is likely to increase.

Additionally, advancements in sterilization technologies, along with the ongoing global health concerns such as pandemics, are projected to further propel the growth of this segment. Increased healthcare awareness and regulatory compliance regarding infection prevention are expected to make sterilization and disinfectant equipment a critical component of hospital supplies.

End-User Analysis

The hospitals & clinics held a significant share of 56.3% due to the expanding healthcare infrastructure and the increasing number of healthcare facilities worldwide. Hospitals and clinics remain the largest consumers of hospital supplies, driven by the continuous demand for high-quality patient care, medical procedures, and diagnostic services. The growing prevalence of chronic diseases, an aging population, and the rising need for emergency care services are expected to contribute to the expansion of healthcare facilities.

Furthermore, the trend toward outpatient care, coupled with technological advancements in medical treatments, is likely to increase the demand for hospital supplies in hospitals and clinics. As healthcare providers focus on improving patient outcomes and operational efficiency, the hospitals & clinics segment is expected to maintain strong growth within the market.

Key Market Segments

By Product Type

- Sterilization & Disinfectant Equipments

- Patient Examination Devices

- Mobility Aids & Transportation Equipments

- Operating Room Equipments

- Others

By End-user

- Hospitals & Clinics

- Diagnostic Centres

- Ambulatory Surgical Centres

- Long Term Care Centres

- Nursing Facilities

Drivers

Increasing Prevalence of Chronic Diseases is Driving the Market

The rising prevalence of chronic diseases is a major driver for the hospital supplies market. According to the World Health Organization (WHO), chronic diseases such as cardiovascular conditions, diabetes, and cancer account for 74% of global deaths as of 2022. This has led to a surge in hospital admissions and the need for medical supplies like syringes, catheters, and surgical instruments.

In the US, the Centers for Disease Control and Prevention (CDC) reported that 60% of adults have at least one chronic disease, driving demand for healthcare services and related supplies. Key players like Cardinal Health and Medtronic have reported increased sales, with Cardinal Health’s medical segment revenue reaching US$ 16.5 billion in 2022. The growing burden of chronic diseases, coupled with an aging population, is expected to sustain demand for hospital supplies in the coming years.

Restraints

Supply Chain Disruptions and Rising Costs are Restraining the Market

Supply chain disruptions and rising production costs are significant restraints for the hospital supplies market. The COVID-19 pandemic exposed vulnerabilities in global supply chains, leading to shortages of critical materials like plastics and metals. In 2023, the US Food and Drug Administration (FDA) reported ongoing shortages of essential medical devices, including infusion pumps and ventilators, due to supply chain challenges.

Additionally, rising inflation has increased the cost of raw materials, impacting manufacturers’ profit margins. For instance, 3M, a major supplier of medical products, reported a 5% increase in production costs in 2022. These factors have forced hospitals to delay purchases or seek alternative suppliers, creating uncertainty in the market. Addressing these challenges remains a priority for stakeholders to ensure a stable supply of essential medical products.

Opportunities

Expansion of Healthcare Infrastructure in Emerging Markets is Creating Growth Opportunities

The expansion of healthcare infrastructure in emerging markets presents significant growth opportunities for the hospital supplies industry. Countries like India and China are investing heavily in healthcare modernization to meet the needs of their growing populations. In 2023, the Indian government allocated US$ 10 billion to upgrade healthcare facilities under the National Health Mission.

Similarly, China’s “Healthy China 2030” initiative aims to improve access to quality healthcare, driving demand for medical equipment and supplies. Companies like Becton, Dickinson and Company (BD) and Johnson & Johnson are expanding their presence in these regions to capitalize on the growing demand. The increasing focus on improving healthcare access in emerging economies offers a lucrative opportunity for market players to expand their operations and increase revenue.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors are significantly influencing the hospital supplies market. Rising healthcare expenditure and government initiatives to improve healthcare access are driving demand for medical equipment and consumables. For example, the US government allocated US$ 180 billion in 2023 to upgrade healthcare infrastructure, boosting market growth.

However, geopolitical tensions, such as the Russia-Ukraine conflict, have disrupted supply chains, leading to shortages of critical materials and increased costs. Inflation in key markets has also impacted hospital budgets, forcing them to prioritize essential purchases.

Despite these challenges, the growing focus on healthcare modernization and the adoption of advanced technologies are creating a positive outlook. Companies are leveraging these opportunities by investing in innovation and expanding into emerging markets, ensuring sustained growth in the hospital supplies industry.

Trends

Adoption of Smart and Connected Medical Devices is a Recent Trend

The adoption of smart and connected medical devices is a recent trend transforming the hospital supplies market. Hospitals are increasingly integrating IoT-enabled devices, such as smart infusion pumps and connected monitoring systems, to improve patient care and operational efficiency. In 2022, Philips reported a 20% increase in sales of connected care solutions, highlighting the growing demand for smart medical devices.

These technologies enable real-time data sharing, remote monitoring, and predictive maintenance, reducing errors and enhancing patient outcomes. The trend is further supported by government initiatives promoting digital health, such as the US Department of Health and Human Services’ investment of US$ 80 million in telehealth and connected health technologies in 2023. The shift towards smart and connected devices is expected to drive innovation and growth in the hospital supplies market.

Regional Analysis

North America is leading the Hospital Supplies Market

North America dominated the market with the highest revenue share of 42.3% owing to several critical factors. The rising prevalence of chronic diseases, such as diabetes and cardiovascular conditions, has increased the demand for medical equipment and consumables. According to the Centers for Disease Control and Prevention (CDC), chronic diseases account for 90% of the US’s annual healthcare expenditure, creating a sustained need for hospital resources.

The COVID-19 pandemic has also played a pivotal role, with hospitals expanding their inventories of essential supplies like personal protective equipment (PPE), ventilators, and diagnostic tools. The US Department of Health and Human Services reported a 25% increase in federal spending on hospital supplies between 2022 and 2024 to address pandemic-related shortages.

Technological advancements, such as the adoption of smart medical devices and automated systems, have further fueled market growth. Major manufacturers like Medtronic and Cardinal Health have reported a 15% year-on-year increase in sales of hospital equipment during this period. The aging population in the US and Canada has also contributed to higher demand, with the National Institute on Aging projecting that over 20% of the US population will be aged 65 or older by 2024.

Government initiatives, such as the US FDA’s streamlined approval process for medical devices, have facilitated faster market entry for innovative products. Additionally, the rise in surgical procedures, as reported by the American Hospital Association, has driven demand for surgical supplies, with a 10% increase in hospital-based surgeries since 2022. These factors collectively highlight the robust growth of the hospital supplies market in North America.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to numerous factors. The World Health Organization (WHO) estimates that healthcare expenditure in the region will increase by 8% annually, driven by rising incomes and expanding healthcare infrastructure. Countries like China and India are anticipated to lead this growth, with the Chinese government investing US$ 150 billion in healthcare infrastructure development between 2022 and 2024.

India’s Ministry of Health and Family Welfare has allocated US$ 150 billion for healthcare infrastructure development during the same period, with a focus on upgrading hospital facilities, including the procurement of essential medical equipment. The growing burden of infectious and chronic diseases is likely to fuel demand, with the WHO reporting a 12% increase in hospital admissions for such conditions in the region since 2022.

Japan’s aging population is projected to further drive the need for advanced medical devices, as the Ministry of Health, Labour, and Welfare emphasizes improving healthcare access for the elderly. Manufacturers like Siemens Healthineers and Becton Dickinson are expected to expand their presence in the region, with sales growing by 20% in Southeast Asia during 2023-2024.

The Australian government’s investment in telehealth and hospital modernization is also anticipated to boost demand for medical supplies, with over 30% of hospitals upgrading their equipment by 2024, according to the Australian Institute of Health and Welfare. Rising awareness of healthcare quality and increasing government support are likely to sustain this growth trajectory across the region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the hospital supplies market focus on product innovation, strategic partnerships, and expanding their geographical reach to drive growth. They invest in developing high-quality, cost-effective supplies, including medical equipment, consumables, and sterile products, to meet the growing demands of healthcare facilities.

Companies also leverage technological advancements, such as automation and smart devices, to enhance operational efficiency and improve patient care. Collaborations with healthcare providers, hospitals, and research institutions help increase product adoption. Additionally, targeting emerging markets with expanding healthcare infrastructure offers new growth opportunities.

Johnson & Johnson, headquartered in New Brunswick, New Jersey, is a leading global provider of medical devices, pharmaceuticals, and consumer health products. The company offers a wide range of hospital supplies, including surgical instruments, wound care products, and diagnostic equipment. Johnson & Johnson focuses on innovation and quality, ensuring its products meet the highest standards of safety and effectiveness. With a strong global presence and a commitment to improving healthcare, the company continues to expand its offerings and strengthen its position in the hospital supplies market.

Top Key Players in the Hospital Supplies Market

- Teleflex Incorporated

- Smith & Nephew

- PENTAX Medical

- Cook Medical

- Coloplast Group

- CMR Surgical

- Abbott

- 3M

Recent Developments

- In February 2024, CMR Surgical introduced the vLimeLite fluorescence imaging system, a cutting-edge technology designed to assist surgeons in evaluating blood vessels and circulation during surgical procedures. This system aims to improve surgical precision and patient outcomes by providing real-time visual insights into vascular health.

- In February 2024, PENTAX Medical received CE marking for its latest i20c video endoscope series, which includes advanced colonoscopy and gastrointestinal scopes. These tools, designed for enhanced visualization, are expected to boost early detection and improve the treatment of various gastrointestinal conditions, significantly benefiting healthcare providers and patients alike.

Report Scope

Report Features Description Market Value (2024) US$ 30.8 billion Forecast Revenue (2034) US$ 65.3 billion CAGR (2025-2034) 7.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Sterilization & Disinfectant Equipments, Patient Examination Devices, Mobility Aids & Transportation Equipments, Operating Room Equipments, and Others), By End-user (Hospitals & Clinics, Diagnostic Centres, Ambulatory Surgical Centres, Long Term Care Centres, and Nursing Facilities) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Teleflex Incorporated, Smith & Nephew, PENTAX Medical, Cook Medical, Coloplast Group, CMR Surgical, Abbott, and 3M Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Teleflex Incorporated

- Smith & Nephew

- PENTAX Medical

- Cook Medical

- Coloplast Group

- CMR Surgical

- Abbott

- 3M