Global Edge AI in Smart Devices Market Size, Share, Statistics Analysis Report By Device (Smartphones & Tablets, Surveillance Cameras, Robots, Wearable, Edge Servers, Smart Speakers, Others), By Power Consumption (Less than 1W, 1-3W, 3-5W, 5-10W, More Than 10W), By Technology (Machine Learning (ML), Deep Learning (DL), Natural Language Processing (NLP), Computer Vision, Others (Federated Learning, etc.)), By Connectivity Type (5G & Edge AI, Wi-Fi & Local Network AI Processing, Offline Edge AI (No Internet Required)), By End-Use Industry (Consumer Electronics, Automotive & Transportation, Healthcare & Life Sciences, Manufacturing, Retail & E-commerce, Government, Aerospace & Defense, Others),Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: February 2025

- Report ID: 140042

- Number of Pages: 236

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- China Market Size and Growth

- Analysts’ Viewpoint

- Device Analysis

- Power Consumption Analysis

- Technology: Machine Learning (ML) Analysis

- Connectivity Type Analysis

- End-Use Industry Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Emerging Trends

- Business Benefits

- Key Regions and Countries

- Key Player Analysis

- Top Opportunities Awaiting for Players

- Recent Developments

- Report Scope

Report Overview

The Global Edge AI in Smart Devices Market size is expected to be worth around USD 385 Billion By 2034, from USD 27.5 Billion in 2024, growing at a CAGR of 30.20% during the forecast period from 2025 to 2034. In 2024, the Asia-Pacific region led the global market with over 34.8% market share and revenues of USD 9.5 billion. China’s Edge AI in Smart Devices market was valued at USD 3.63 billion, growing at a strong CAGR of 28.2%.

The market for Edge AI in smart devices has shown remarkable growth, with significant expansion driven by the increasing adoption of IoT devices and the need for real-time, efficient data processing. This growth is attributed to the rising integration of AI capabilities in edge devices which cater to industries like healthcare, manufacturing, and retail, where immediate data analysis is crucial for operational efficiency.

The primary factors driving the adoption of Edge AI include the need for reduced latency in data processing, heightened data security, and lower bandwidth requirements. These factors are crucial in scenarios where real-time analytics and immediate decision-making are essential, such as in autonomous driving and smart healthcare devices.

Based on data from Symmetry Electronics, Edge AI-enabled devices are revolutionizing processing efficiency. Handling up to 200 images per second and boasting accuracy improvements from 50% to over 99%, these devices are transforming tasks such as object recognition.

MediaTek is at the forefront, powering Edge AI applications in both the smart home and automotive sectors. Their latest innovation, the MediaTek MT8175 AI vision platform, enhances a variety of smart-screen devices, including smart TVs, cameras, and in-vehicle entertainment systems.

Key Takeaways

- The Global Edge AI in Smart Devices Market is expected to grow significantly, reaching USD 385 Billion by 2034, up from USD 27.5 Billion in 2024, with a CAGR of 30.20% during the forecast period from 2025 to 2034.

- In 2024, the Smartphones & Tablets segment led the market, holding a dominant share of more than 26.5% in the Edge AI smart devices market.

- The 3-5W segment held a prominent position in 2024, with more than 24.8% of the market share in Edge AI smart devices.

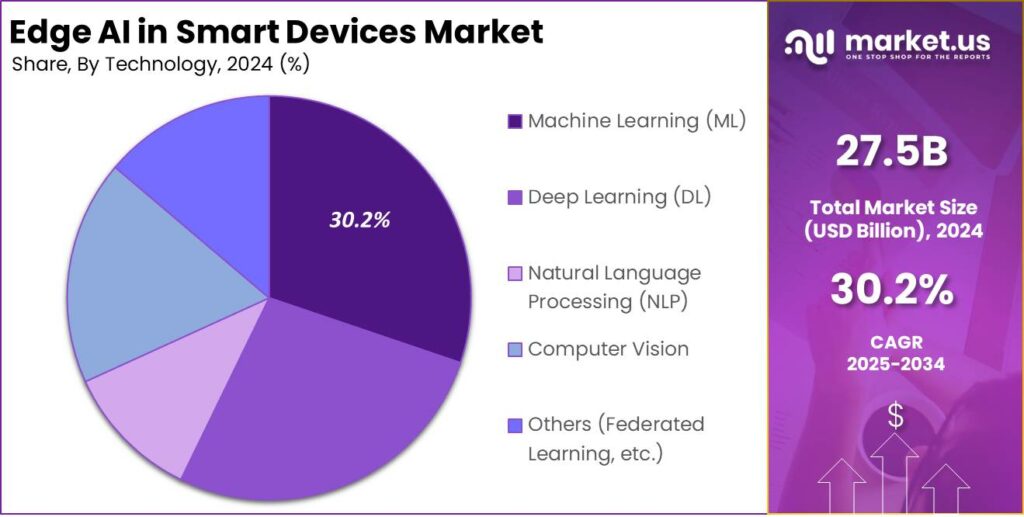

- The Machine Learning (ML) segment was the leader in the market, capturing more than 30.2% of the share in Edge AI for Smart Devices in 2024.

- The 5G & Edge AI segment was dominant in 2024, with a significant share of more than 42.7% in the Edge AI in smart devices market.

- In 2024, the Consumer Electronics segment led the market, accounting for more than 28.4% of the market share in Edge AI in Smart Devices.

- The Asia-Pacific region held a leading position in the global market in 2024, with more than 34.8% of the market share and revenues reaching USD 9.5 billion.

- The Edge AI in Smart Devices market in China was valued at USD 3.63 billion in 2024, experiencing a strong CAGR of 28.2%.

China Market Size and Growth

In 2024, the market for Edge AI in smart devices within China was valued at 3.63 billion USD. It has been experiencing a robust compound annual growth rate (CAGR) of 28.2%. This growth is fueled by the rising use of AI in consumer electronics and industrial devices, boosting efficiency and functionality.

The burgeoning demand for smart devices that are capable of processing and analyzing data locally, without relying on cloud computing, fuels this market’s expansion. Edge AI applications in sectors like healthcare, automotive, and consumer electronics are particularly noteworthy.

Moreover, government initiatives aimed at boosting the AI industry and substantial investments in AI technologies and IoT are propelling market growth. As China continues to advance in technological innovation, the market for Edge AI in smart devices is expected to maintain its upward trajectory, reflecting broader trends in AI adoption across various industries.

In 2024, Asia-Pacific held a dominant market position in the Edge AI in Smart Devices market, capturing more than a 34.8% share with revenues reaching USD 9.5 billion. The region leads the market due to rapid tech advancements, high smart device adoption, and heavy investments in AI and IoT infrastructure.

The Asia-Pacific region, particularly countries like China, South Korea, and Japan, is at the forefront of manufacturing and deploying cutting-edge technology in consumer electronics. These countries are home to some of the world’s largest technology companies, which are pivotal in integrating AI capabilities into everyday devices.

The growing internet connectivity and tech-savvy consumers are fueling demand for smart devices in this region. Urbanization and smart city initiatives in countries like India and China further accelerate the adoption of Edge AI systems, allowing for faster, more efficient data processing without cloud latency.

The Asia-Pacific market is strengthened by a vibrant startup ecosystem focused on AI-driven solutions in healthcare, automotive, and consumer electronics. Supported by venture capital and government grants, this entrepreneurial environment accelerates innovation and reduces time-to-market, reinforcing the region’s leadership in the global Edge AI smart devices market.

Analysts’ Viewpoint

The demand for Edge AI is largely influenced by its ability to provide real-time insights and its efficiency in processing data locally without relying on cloud connectivity. Industries such as manufacturing, healthcare, and automotive are increasingly implementing Edge AI to improve operational efficiency, automate processes, and reduce operational costs.

Investing in Edge AI presents significant opportunities due to its expansive growth potential and transformative impact across various industries. However, the technology also comes with risks related to the management of large data volumes and the need for high initial investments in specialized hardware and development. Businesses must consider these aspects when strategizing their investments in Edge AI technologies.

Recent advancements in Edge AI include improvements in AI algorithms that enable more sophisticated data processing capabilities directly on edge devices. These advancements are supported by the development of more powerful and energy-efficient microprocessors and neural network architectures designed for edge deployment. Such technological enhancements are crucial for enabling more complex applications in fields such as autonomous vehicles and smart city infrastructure.

Device Analysis

In 2024, the Smartphones & Tablets segment held a dominant market position in the Edge AI smart devices market, capturing more than a 26.5% share. This leading status can be attributed primarily to the ubiquitous nature of these devices in daily life.

Smartphones and tablets are integral to modern communication, entertainment, and personal management, making them ideal platforms for Edge AI integration. The widespread adoption of these devices ensures a broad, continually expanding user base eager for enhancements in processing speed, data privacy, and user experience all benefits afforded by Edge AI technologies.

The dominance of the Smartphones & Tablets segment is driven by advanced mobile technology and powerful processors that handle AI tasks locally. Manufacturers are integrating AI chips for real-time functions like voice recognition, image processing, and predictive text.

Another factor contributing to the leading position of Smartphones & Tablets in the Edge AI market is the continuous innovation in mobile software ecosystems. Operating system developers and application creators are relentlessly pushing updates that leverage Edge AI capabilities, providing users with increasingly intelligent and responsive tools.

Power Consumption Analysis

In 2024, the 3-5W segment held a dominant position in the Edge AI in Smart Devices market, capturing more than a 24.8% share. This segment’s leadership can be attributed to its optimal balance of power and performance, which suits a wide range of consumer electronics and industrial applications.

The 3-5W segment is highly versatile, powering devices like advanced security cameras and interactive home assistants. These devices need continuous, intensive processing for tasks such as real-time image recognition and natural language processing, boosting user experience and automation.

Additionally, the 3-5W power range supports the increasing demand for mobile and portable devices that incorporate AI. These devices, including sophisticated drones and portable health monitors, benefit from the power-efficient yet robust performance that 3-5W Edge AI solutions can provide.

Advancements in semiconductor technology have made it easier for manufacturers to produce efficient, cost-effective chips for the 3-5W power range. Improved chip design, including reduced leakage and better thermal management, supports the growth of this segment by making high-performance Edge AI more accessible.

Technology: Machine Learning (ML) Analysis

In 2024, the Machine Learning (ML) segment held a dominant market position in the Edge AI in Smart Devices market, capturing more than a 30.2% share. ML’s prominence comes from its versatility, enhancing device performance and user experience, from predictive maintenance to personalized recommendations.

Machine Learning algorithms are particularly adept at pattern recognition, which enables smart devices to learn from data in real-time without needing explicit programming. This capability is essential for applications requiring immediate decision-making, such as in autonomous vehicles and real-time health monitoring systems.

Furthermore, advancements in ML frameworks and APIs that simplify integration into consumer and industrial products have lowered barriers to entry for manufacturers. This democratization of technology allows even smaller players to incorporate sophisticated ML features into their devices, thereby expanding the technology’s reach and influence in the market.

The growth of the ML segment is fueled by significant investments from top tech companies in R&D, advancing ML capabilities in edge computing. These investments enhance both algorithm performance and hardware efficiency, making ML an increasingly attractive option for smart device manufacturers seeking to offer innovative features.

Connectivity Type Analysis

In 2024, the 5G & Edge AI segment held a dominant market position, capturing more than a 42.7% share in the edge AI in smart devices market. This segment leads due to the global rollout of 5G networks, which boost edge device capabilities by reducing latency and increasing data processing speed and volume.

The integration of 5G with edge AI allows for real-time data processing directly on the device, bypassing the need for constant cloud connectivity. This capability is critical in applications requiring instant decision-making, such as autonomous vehicles and real-time remote surveillance, driving the segment’s substantial market share.

Wi-Fi & Local Network AI Processing is another significant segment, which facilitates the operation of edge AI technologies in environments with limited or intermittent internet connectivity. Devices in this segment leverage existing Wi-Fi networks to process data locally, ensuring faster response times and reduced bandwidth costs.

The Offline Edge AI segment, which does not require internet connectivity, is particularly suited for scenarios where security and data privacy are paramount. This segment uses pre-trained algorithms that operate independently on the device, making it ideal for sensitive environments like healthcare and governmental facilities where data cannot leave the premises.

End-Use Industry Analysis

In 2024, the Consumer Electronics segment held a dominant market position in the Edge AI in Smart Devices market, capturing more than a 28.4% share. This leadership stems from the widespread adoption of smart devices like smartphones, smart speakers, and home automation systems, which increasingly leverage edge AI for improved user experiences.

The proliferation of IoT devices in households has also significantly contributed to the growth of this segment. As consumers continue to seek convenience and enhanced connectivity, the integration of edge AI into these products allows for more personalized and responsive interactions with technology.

The dominance of the Consumer Electronics segment is also driven by the competitive tech industry, where companies race to create innovative devices. This competition fuels increased R&D investments in edge AI, improving processing speed, decision-making, and autonomous functions without relying on constant cloud connectivity.

Regulatory and privacy concerns significantly impact the adoption of edge AI in consumer electronics. By processing data locally on the device, edge AI reduces the risk of data breaches and unauthorized access, making it an appealing option for privacy-conscious consumers and driving growth in the smart device market.

Key Market Segments

By Device

- Smartphones & Tablets

- Surveillance Cameras

- Robots

- Wearable

- Edge Servers

- Smart Speakers

- Others

By Power Consumption

- Less than 1W

- 1-3W

- 3-5W

- 5-10W

- More Than 10W

By Technology

- Machine Learning (ML)

- Deep Learning (DL)

- Natural Language Processing (NLP)

- Computer Vision

- Others (Federated Learning, etc.)

By Connectivity Type

- 5G & Edge AI

- Wi-Fi & Local Network AI Processing

- Offline Edge AI (No Internet Required)

By End-Use Industry

- Consumer Electronics

- Automotive & Transportation

- Healthcare & Life Sciences

- Manufacturing

- Retail & E-commerce

- Government

- Aerospace & Defense

- Others

Driver

Real-Time Data Processing

Edge AI enables smart devices to process data directly on-site, facilitating immediate analysis and response. This capability is crucial in applications where latency can impact performance or safety. For instance, autonomous vehicles rely on real-time data from sensors to navigate safely. Processing this information locally allows for split-second decisions without the delays associated with cloud computing.

Similarly, in industrial automation, machinery equipped with edge AI can monitor operational parameters and make instant adjustments to maintain efficiency and prevent malfunctions. This immediacy not only enhances performance but also reduces the bandwidth required for transmitting large volumes of data to centralized servers. As industries increasingly demand swift, reliable data handling, the adoption of edge AI in smart devices is poised to grow.

Restraint

Integration Complexities

Incorporating edge AI into existing systems presents significant challenges. Many organizations operate with legacy infrastructure not designed to support advanced AI functionalities. Integrating new edge AI technologies often requires substantial modifications, including hardware upgrades and software overhauls. This process can be both time-consuming and costly.

Additionally, the lack of standardized protocols and interfaces complicates interoperability between diverse systems and devices. Without universal standards, ensuring seamless communication and data exchange becomes difficult, potentially leading to operational inefficiencies. These integration hurdles can deter organizations from adopting edge AI solutions, despite their potential benefits.

Opportunity

TinyML Implementation

The emergence of Tiny Machine Learning (TinyML) offers promising avenues for edge AI development. TinyML focuses on implementing machine learning algorithms on resource-constrained devices, enabling advanced data processing capabilities in environments where traditional AI models are impractical. This advancement allows for the proliferation of intelligent applications across various sectors, including healthcare, agriculture, and consumer electronics.

For example, wearable health monitors can analyze vital signs in real-time, providing users with immediate feedback without relying on cloud connectivity. Similarly, agricultural sensors equipped with TinyML can assess soil conditions on-site, aiding in precise farming practices. The ability to deploy efficient, low-power AI models on edge devices opens new markets and applications, driving innovation and growth in the edge AI landscape.

Challenge

Standardization Gap

The rapid development of edge AI technologies has outpaced the establishment of universal standards. This absence of standardization manifests in varied hardware architectures, software frameworks, and communication protocols across devices and platforms. Such diversity poses significant challenges for developers and organizations aiming to implement cohesive edge AI solutions.

Without common standards, ensuring compatibility and interoperability between different components becomes a complex task. This fragmentation can lead to increased development costs, extended time-to-market, and potential vendor lock-in scenarios. Addressing this challenge requires collaborative efforts among industry stakeholders to develop and adopt standardized practices, facilitating smoother integration and broader adoption of edge AI technologies.

Emerging Trends

One major trend is the development of smaller, more efficient AI models. These compact models can run directly on devices like smartphones and wearables, making them smarter without relying on constant internet connections.

Another trend is the collaboration between tech companies to create AI-powered hardware. Raspberry Pi and Sony have teamed up to produce an AI-enabled camera module. This device allows developers to build smart cameras that process images on the spot, opening doors for innovative applications in various fields.

Additionally, chipmakers are introducing specialized processors designed for edge AI tasks. STMicroelectronics, for instance, has launched microcontrollers tailored for machine learning applications. These chips enable devices to handle complex tasks like image and audio processing without needing powerful computers or data centers.

Business Benefits

Processing data directly on devices reduces the need for constant communication with cloud servers. This local processing cuts down on latency, leading to quicker responses and a smoother user experience. For instance, in industrial settings, edge AI can monitor equipment in real-time, promptly detecting issues and minimizing downtime.

Edge AI enhances data privacy and security. By keeping sensitive information on the device, businesses can better protect user data from potential breaches associated with data transmission and storage in the cloud. This approach is particularly beneficial in sectors like healthcare, where patient confidentiality is paramount.

Moreover, adopting edge AI can lead to cost savings. Processing data on-site reduces the expenses related to bandwidth and cloud storage. Companies can save money by decreasing the amount of data sent to and from the cloud, which is especially advantageous for applications generating large volumes of data.

Additionally, edge AI enables devices to function reliably even in areas with limited or intermittent internet connectivity. This reliability ensures continuous operation, which is crucial for applications in remote locations or critical systems where consistent performance is essential.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

NVIDIA is a key player in the Edge AI market, primarily known for its high-performance graphics processing units (GPUs). The company has expanded its product offerings to include hardware and software solutions tailored for AI processing at the edge. NVIDIA’s Jetson platform, for instance, allows developers to create intelligent applications in robotics, drones, and other IoT devices.

Intel has long been a leader in the semiconductor industry, and its focus on Edge AI is helping drive the next phase of innovation. Through its diverse range of processors, including the Intel Movidius and Intel Atom chips, the company provides solutions that are designed to accelerate AI workloads at the edge. Intel’s Edge AI technologies empower smart devices to make decisions on-site, reducing latency and improving performance.

Qualcomm Technologies, Inc., stands out with its mobile-centric approach to Edge AI. Known for its Snapdragon platform, Qualcomm is enabling smarter mobile devices with AI processing capabilities. The company’s AI Engine integrated within its Snapdragon chips allows for real-time AI processing on mobile phones, wearables, and automotive applications.

Top Key Players in the Market

- NVIDIA Corporation

- Intel Corporation

- Qualcomm Technologies, Inc.

- Google (Alphabet Inc.)

- Apple Inc.

- Huawei Technologies Co., Ltd.

- Samsung Electronics Co., Ltd.

- Microsoft Corporation

- IBM Corporation

- Amazon Web Services (AWS)

- Others

Top Opportunities Awaiting for Players

- AI-Powered Solutions: The integration of AI directly into edge devices such as smartphones, home appliances, and automotive systems is becoming increasingly feasible. This allows for real-time decision-making without the latency associated with cloud computing. For example, AI can be used in autonomous vehicles for immediate response to driving conditions or in smart home devices for personalized user experiences.

- Expansion of 5G Networks: With the continued rollout of 5G technology, edge AI will benefit from faster communication speeds and reduced latency, enhancing the performance of AI algorithms in real-time applications. This synergy between 5G and edge AI is crucial for applications such as augmented reality, smart factories, and connected healthcare systems.

- Enhanced Edge Analytics: The local processing of data on edge devices enables quicker insights and action without the need to transmit data back to a central server. This capability is particularly valuable in sectors like retail and healthcare, where immediate data processing can significantly enhance operational efficiency and customer experience.

- Improved Energy Efficiency and Sustainability: As sustainability becomes a more pressing concern, edge AI applications that optimize energy use in smart devices will be crucial. Innovations in energy-efficient processing and AI algorithms that reduce power consumption without compromising performance will be particularly valuable.

- Tailored Industry-Specific Applications: Edge AI is set to customize technology solutions across diverse sectors. For instance, in healthcare, edge AI can support remote diagnostics and patient monitoring systems. In retail, it can enable smart inventory management and personalized customer experiences. Each industry has unique needs that edge AI can address, making its applications highly valuable for specific market demands.

Recent Developments

- In January 2025, NVIDIA unveiled its latest Jetson Orin Nano modules, designed to bring high-performance AI capabilities to edge devices, enabling real-time processing for applications such as robotics and autonomous systems

- In July 2024, Edgescale AI partnered with Palantir to launch Live Edge, a cloud-native solution that automates the creation of Virtual Connected Edges (VCEs). These are distributed cloud environments that allow AI to directly interact with physical devices, enhancing data flow and decision-making across connected systems.

- Product Launch In December 2024, Qualcomm introduced the Snapdragon X Elite platform, optimized for edge AI use cases like smart home devices and industrial IoT, with improved energy efficiency and processing power.

Report Scope

Report Features Description Market Value (2024) USD 27.5 Bn Forecast Revenue (2034) USD 385 Bn CAGR (2025-2034) 30.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Device (Smartphones & Tablets, Surveillance Cameras, Robots, Wearable, Edge Servers, Smart Speakers, Others), By Power Consumption (Less than 1W, 1-3W, 3-5W, 5-10W, More Than 10W), By Technology (Machine Learning (ML), Deep Learning (DL), Natural Language Processing (NLP), Computer Vision, Others (Federated Learning, etc.)), By Connectivity Type (5G & Edge AI, Wi-Fi & Local Network AI Processing, Offline Edge AI (No Internet Required)), By End-Use Industry (Consumer Electronics, Automotive & Transportation, Healthcare & Life Sciences, Manufacturing, Retail & E-commerce, Government, Aerospace & Defense, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape NVIDIA Corporation, Intel Corporation, Qualcomm Technologies, Inc., Google (Alphabet Inc.), Apple Inc., Huawei Technologies Co., Ltd., Samsung Electronics Co., Ltd., Microsoft Corporation, IBM Corporation, Amazon Web Services (AWS), Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Edge AI in Smart Devices MarketPublished date: February 2025add_shopping_cartBuy Now get_appDownload Sample

Edge AI in Smart Devices MarketPublished date: February 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- NVIDIA Corporation

- Intel Corporation

- Qualcomm Technologies, Inc.

- Google (Alphabet Inc.)

- Apple Inc.

- Huawei Technologies Co., Ltd.

- Samsung Electronics Co., Ltd.

- Microsoft Corporation

- IBM Corporation

- Amazon Web Services (AWS)

- Others