Global Residential Furniture Market Size, Share, Growth Analysis By Product Type (Living Room Furniture, Bedroom Furniture, Dining Room Furniture, Storage Furniture, Office Furniture, Outdoor Furniture, Others), By End-User (Individual Consumers, Retailers, Interior Designers, Hospitality Industry, Others), By Distribution Channel (Online Retail, Offline Retail, Direct Sales, Wholesale), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 139360

- Number of Pages: 274

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

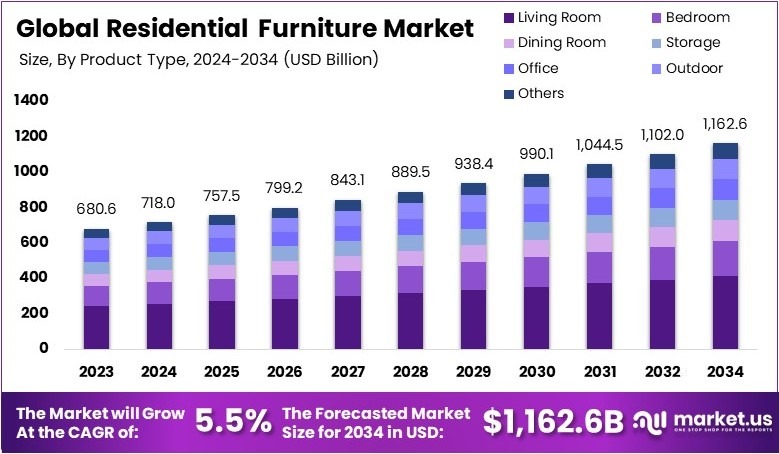

The Global Residential Furniture Market size is expected to be worth around USD 1,162.6 Billion by 2034, from USD 680.6 Billion in 2024, growing at a CAGR of 5.5% during the forecast period from 2025 to 2034.

Residential furniture is designed for home use and offers comfort and style. It includes items such as sofas, chairs, beds, tables, and cabinets. This furniture is created to enhance living spaces and provide practicality. Its design emphasizes durability, aesthetics, and functionality while meeting the everyday needs of household occupants effectively.

The residential furniture market comprises businesses that manufacture, distribute, and sell home furniture. It covers a wide range of products, from sofas and dining sets to beds and storage units. The market focuses on meeting consumer demand for quality, stylish, and affordable furnishings for personal living environments across diverse channels.

Residential furniture trends show a clear shift toward affordable, stylish upgrades. According to a survey by Opendoor, 66% of homeowners choose fresh paint while 49% opt to move furniture. Additionally, 41% prefer open layouts in key spaces. Social media and home improvement services shows further fuel this growing interest across markets.

The residential furniture market benefits from robust economic signals. The U.S. Bureau of Economic Analysis noted personal income increased by $50.5 billion and disposable income grew by $34.2 billion. Meanwhile, personal consumption rose by $47.2 billion. These figures create a globally significant foundation for market expansion and new opportunities indeed.

Growth factors in the market are strong. A study by the National Association of Home Builders revealed home buyers spend $12,000 on renovations, $5,000 on furnishings, and $4,000 on electrical appliances. Moreover, interior design jobs are projected to grow by 4%, while restaurant sales may reach $1 trillion in coming years.

Market saturation remains moderate despite high competition. Urban areas witness many brands fighting for attention. Retailers innovate with cost-effective designs to attract customers. New entrants leverage digital channels and social media. This competitive environment forces companies to adapt quickly to shifting consumer preferences and evolving market conditions across all sectors.

Key Takeaways

- The Residential Furniture Market was valued at USD 680.6 billion in 2024 and is expected to reach USD 1,162.6 billion by 2034, with a CAGR of 5.5%.

- In 2024, Living Room Furniture dominated the product type segment with 35.5% due to its essential role in home aesthetics and functionality.

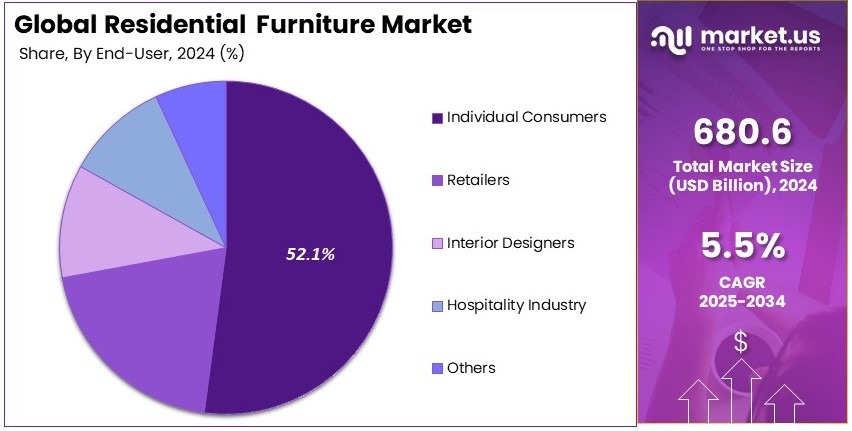

- In 2024, Individual Consumers led the end-user segment with 52.1%, driven by rising home ownership and interior personalization trends.

- In 2024, Offline Retail dominated the distribution channel with 31.2%, as customers prefer in-store furniture trials before purchase.

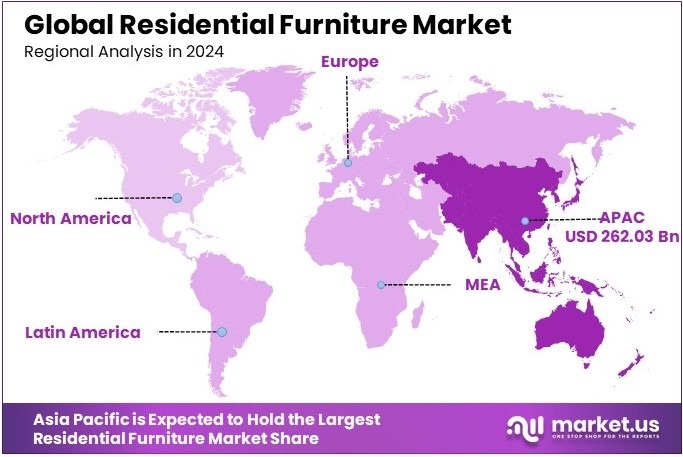

- In 2024, Asia Pacific led the market with 38.5% and a valuation of USD 262.03 billion, driven by urbanization and increasing disposable income.

Product Type Analysis

Living Room Furniture dominates with 35.5% due to its high demand and role in home décor.

Living Room Furniture holds the largest share in the Residential Furniture Market at 35.5%. This segment is central to the overall market due to the role living rooms play in the daily lives of consumers. People spend considerable time in their living rooms, making them a primary area for furniture purchases.

Sofa sets, coffee tables, TV units, and recliners are some of the most in-demand products in this category. As more people focus on home décor and comfort, the demand for stylish, functional living room furniture continues to grow. Living room furniture has also seen significant demand as the trend for home offices and multi-functional spaces has increased, especially during and after the COVID-19 pandemic.

Bedroom Furniture is essential, especially in the wake of increasing focus on personal well-being and comfort. With more people spending time at home, the demand for beds, wardrobes, and nightstands has surged. Storage Furniture includes bookshelves, cabinets, and other storage solutions, which are highly sought after due to the need for organization in modern homes.

Dining Room Furniture and Office Furniture each contribute to the market. The growth of dining room furniture is linked to a surge in family gatherings and social meals. Office furniture, on the other hand, is driven by the work-from-home trend, leading to higher sales of ergonomic chairs and desks. Finally, Outdoor Furniture holds a smaller share but is steadily growing due to an increasing interest in outdoor living spaces and home gardens.

End-User Analysis

Individual Consumers dominate with 52.1% due to growing home ownership and interest in home improvements.

The Individual Consumers segment leads with 52.1% of the Residential Furniture Market. This dominance is due to the increasing trend of homeownership, particularly among millennials and young families. Consumers are increasingly investing in furniture that enhances the comfort and aesthetics of their homes.

With the rise in disposable incomes and a greater focus on home décor, individual consumers prioritize furniture purchases. Additionally, people are more inclined to customize their living spaces, further driving the demand for various types of furniture.

Retailers play a critical role in distributing large volumes of furniture to end-users. They bring together a wide range of furniture brands and make them accessible to the public. Similarly, Interior Designers drive the high-end segment of the market, creating bespoke furniture pieces for upscale homes and luxury clients.

The Hospitality Industry, with its need for durable, stylish, and functional furniture in hotels, resorts, and other establishments, represents a smaller portion of the market. Lastly, the “Others” category represents the small percentage of market share taken by contractors, businesses, and other niche users.

Distribution Channel Analysis

Offline Retail dominates with 31.2% due to the continued preference for in-store shopping and product experience.

Offline Retail holds the largest share in the Residential Furniture Market at 31.2%. Despite the rise of e-commerce, many consumers still prefer to shop for furniture in physical stores. The ability to touch and feel the products, along with seeing their size and design in person, remains a significant factor in the purchasing decision for many.

Offline retail also allows consumers to access immediate delivery options and personalized assistance from sales staff. While online shopping is convenient, the tactile experience of furniture shopping in person continues to hold substantial appeal.

Online Retail is growing rapidly and holds a significant share of the market. The ease of shopping from home, the variety of options, and the convenience of home delivery have made it a popular choice for many consumers.

Direct Sales, where manufacturers sell directly to customers, offer exclusive deals and discounts, making it a competitive part of the market. Wholesale, which involves suppliers selling large quantities of furniture to small retailers or businesses, remains a smaller segment, serving niche customers and distributors.

Key Market Segments

By Product Type

- Living Room Furniture

- Bedroom Furniture

- Dining Room Furniture

- Storage Furniture

- Office Furniture

- Outdoor Furniture

- Others

By End-User

- Individual Consumers

- Retailers

- Interior Designers

- Hospitality Industry

- Others

By Distribution Channel

- Online Retail

- Offline Retail

- Direct Sales

- Wholesale

Driving Factors

Increasing Disposable Income Drives Market Growth

The rise in disposable income is a significant factor fueling the residential furniture market. As more individuals and families experience an increase in their earnings, they tend to spend more on enhancing their living spaces. With greater financial flexibility, consumers are opting for higher-quality furniture and more stylish designs to reflect their improved standard of living.

This is particularly evident in urban areas, where smaller living spaces are often complemented by multi-functional furniture, making them both stylish and space-efficient. The growing demand for well-designed, durable, and premium furniture products is evident across various price points, as consumers seek to invest in pieces that offer long-term value.

Retailers are expanding their offerings to include a wider range of furniture types, from traditional wooden pieces to contemporary and modern designs. Furthermore, as disposable income rises, more consumers are able to purchase large-ticket items such as sofas, dining tables, and bedroom sets, which were once considered a luxury.

This growing middle class also drives the expansion of new furniture retailers and stores targeting different market segments, contributing to overall market growth. With a continued trend of rising incomes and improved purchasing power, the residential furniture market is poised to benefit in the coming years, further increasing consumer spending in this sector.

Restraining Factors

Supply Chain Issues Restrain Market Growth

The residential furniture market faces several challenges that hinder its growth. One of the key restraints is the volatility in raw material prices, which affects the overall production cost of furniture. Prices of materials like wood, metals, and fabrics can fluctuate due to supply chain disruptions or changes in global demand, making it difficult for manufacturers to maintain consistent pricing.

This unpredictability often leads to higher production costs, which are then passed on to consumers, potentially reducing demand for certain products. Another issue is the limited availability of skilled labor, which impacts the ability to produce high-quality furniture, especially for handcrafted or premium items.

Additionally, transportation and logistics costs have been rising, driven by increasing fuel prices and supply chain disruptions. These higher costs not only make furniture more expensive but also limit the ability of companies to offer competitive pricing.

Lastly, during periods of economic downturn, consumer confidence tends to decline, leading to reduced spending on discretionary items like home furnishings. This decline in consumer confidence, coupled with external economic challenges, slows down market growth and reduces overall demand for residential furniture.

Growth Opportunities

Luxury Furniture and Online Shopping Provides Opportunities

The residential furniture market is seeing significant opportunities for growth, especially in the luxury and online retail sectors. The demand for luxury and designer furniture is increasing as consumers look to enhance their living spaces with unique, high-quality pieces. The rise of affluent consumers, particularly in emerging markets, is driving demand for premium, bespoke furniture that reflects personal style and luxury living.

This creates an opportunity for furniture brands to diversify their offerings by adding high-end products and catering to the growing trend of luxury interior design. Another area of opportunity is the expansion of online furniture marketplaces. E-commerce platforms provide consumers with a convenient way to shop for furniture, compare prices, and access a wide range of styles and designs from the comfort of their homes.

The online furniture market is growing rapidly, with virtual showrooms and augmented reality tools allowing customers to visualize furniture in their homes before making a purchase. This technology-driven approach enhances the customer experience and increases the likelihood of making a purchase.

Additionally, the demand for custom-made furniture is on the rise, with consumers seeking personalized products that fit their specific needs and preferences. The growth of modular and easy-to-assemble furniture is another promising opportunity, as it caters to the fast-paced, space-conscious lifestyle of urban dwellers.

Emerging Trends

Social Media and Minimalism Are Latest Trending Factors

The residential furniture market is significantly influenced by current trends such as the growing impact of social media and the rise of minimalistic design preferences. Social media platforms, especially Instagram and Pinterest, have become key sources of inspiration for consumers looking to improve their home décor.

This digital shift in consumer behavior has made furniture shopping more visually driven, with online platforms capitalizing on this trend to showcase their products through carefully curated content. Additionally, minimalism and Scandinavian design are gaining traction among consumers who value simplicity, functionality, and clean aesthetics in their homes.

This trend focuses on decluttered, open spaces that prioritize practicality and timeless style, appealing to a broad audience seeking a balance between form and function. As a result, furniture brands are responding with sleek, streamlined designs that cater to these preferences.

Smart furniture is another important trend, with the integration of technology into home furnishings. From adjustable desks to beds with built-in charging stations, consumers are increasingly interested in multifunctional pieces that improve convenience and enhance their living experience. Furthermore, augmented reality (AR) is playing a significant role in furniture shopping, allowing consumers to virtually place furniture in their homes, enhancing the buying process and boosting sales.

Regional Analysis

Asia Pacific Dominates with 38.5% Market Share

Asia Pacific holds a commanding 38.5% market share in the Residential Furniture Market, valued at USD 262.03 billion. This dominance is fueled by rapid urbanization, a growing middle class, and a high demand for home furnishings due to increasing disposable income. The region’s diverse consumer base and extensive manufacturing capabilities also contribute to its leadership in the market.

The region’s extensive manufacturing base in countries like China, India, and Vietnam plays a pivotal role in keeping furniture production costs low. The growing urban population, especially in countries such as India and China, leads to higher demand for residential furniture.

Moreover, the evolving consumer preferences for modern, multifunctional furniture in compact living spaces further support market growth. The rise of e-commerce platforms has made it easier for consumers to access a variety of home furniture, boosting market penetration in both urban and rural areas.

Regional Mentions:

- North America: North America holds a strong position with a 30% share, led by the U.S. market, which is driven by high demand for premium, customized furniture. The region is focusing on eco-friendly materials and technological innovations in furniture design.

- Europe: Europe captures a significant share, driven by a preference for sustainable and high-quality designs. The demand for luxury and designer furniture is high, particularly in Western European countries, where a strong heritage of craftsmanship influences consumer preferences.

- Middle East & Africa: The Middle East & Africa region is gradually increasing its market share with a focus on luxury home furnishings, fueled by growing construction projects, particularly in the UAE and Saudi Arabia. Affluent consumers are driving demand for high-end, customizable furniture.

- Latin America: Latin America has a smaller yet growing market share, with Brazil and Mexico leading the charge. Rising urbanization and a shift towards modern home designs are spurring demand for residential furniture across the region.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

In the Residential Furniture Market, four key players dominate the industry due to their broad product ranges, innovative designs, and substantial market penetration. These companies are IKEA, Ashley Furniture Industries, Wayfair, and Steelcase. Each has carved out significant niches by catering to diverse consumer needs and preferences.

IKEA leads with a globally recognized brand known for its affordable, stylish, and functional furniture. It capitalizes on its strong presence in over 50 countries, offering unique designs that appeal to a wide demographic. IKEA’s success is bolstered by a highly efficient supply chain and a strong emphasis on cost control, sustainability, and innovation.

Ashley Furniture Industries follows closely, standing as one of the largest manufacturers and retailers in the industry. Its broad product range, coupled with a focus on craftsmanship and quality, ensures strong customer loyalty and market reach. Ashley Furniture is particularly noted for its traditional and transitional furniture, providing extensive collections that enhance home aesthetics and comfort.

Wayfair has quickly risen through the ranks to become a leading e-commerce giant in home furnishings. It distinguishes itself with an almost unlimited range of products online, competitive pricing, and excellent customer service. Wayfair’s use of advanced technology to enhance the shopping experience, like augmented reality apps that help consumers visualize furniture in their homes, has significantly boosted its market share.

Steelcase, traditionally known for office furniture, has made significant inroads into the residential market with its innovative and ergonomic designs. The company’s commitment to research and development in workspace solutions has been adapted to home environments, catering to the growing trend of home offices.

Major Companies in the Market

- IKEA

- Ashley Furniture Industries

- Wayfair

- Steelcase

- La-Z-Boy

- Herman Miller

- Rooms To Go

- Restoration Hardware

- West Elm

- Crate & Barrel

- Ethan Allen

- Bernhardt Furniture Company

Recent Developments

- Ashley Home, Inc. and Resident Home Inc.: On March 2024, Ashley Home, Inc. announced its plan to acquire Resident Home Inc. to expand its product assortment and global footprint by leveraging extensive sourcing and operational efficiencies as part of its broader strategy to bolster growth in the residential furnishings market.

- Rize Home and Floyd: On January 2025, Cleveland-based Rize Home acquired Detroit-based Floyd, a direct-to-consumer furniture brand known for its innovative adjustable leg product and evolution into a full-home furnishings label, aiming to overcome supply chain challenges and enhance operational efficiencies amid industry consolidation.

- Havenly and Burrow: On October 2024, Havenly announced its acquisition of Burrow, a digital-first furniture startup specializing in modular, quick-ship sofas and home furnishings, leveraging Burrow’s innovative design approach and fast delivery model that has driven its revenue into the nine figures.

Report Scope

Report Features Description Market Value (2024) USD 680.6 Billion Forecast Revenue (2034) USD 1,162.6 Billion CAGR (2025-2034) 5.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Living Room Furniture, Bedroom Furniture, Dining Room Furniture, Storage Furniture, Office Furniture, Outdoor Furniture, Others), By End-User (Individual Consumers, Retailers, Interior Designers, Hospitality Industry, Others), By Distribution Channel (Online Retail, Offline Retail, Direct Sales, Wholesale) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape IKEA, Ashley Furniture Industries, Wayfair, Steelcase, La-Z-Boy, Herman Miller, Rooms To Go, Restoration Hardware, West Elm, Crate & Barrel, Ethan Allen, Bernhardt Furniture Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Residential Furniture MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample

Residential Furniture MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- IKEA

- Ashley Furniture Industries

- Wayfair

- Steelcase

- La-Z-Boy

- Herman Miller

- Rooms To Go

- Restoration Hardware

- West Elm

- Crate & Barrel

- Ethan Allen

- Bernhardt Furniture Company