Global Renewable Naphtha Market By Product Type (Light Naphtha, Heavy Naphtha), By Feedstock (Used Cooking Oil, Wood Pulp Residue, Vegetable Oil Waste, Animal Fat, Others), By Application (Fuel Blending, Feed for H2 Production, Feed for Plastic Production, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151151

- Number of Pages: 383

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

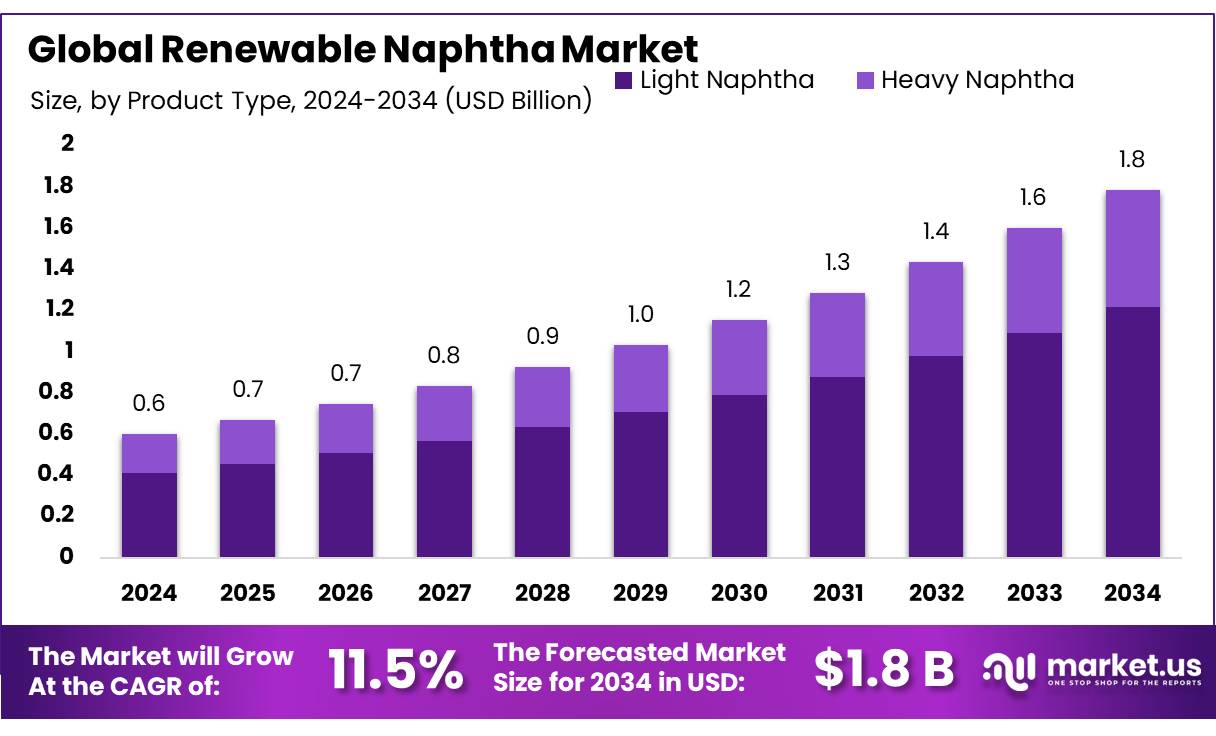

The Global Renewable Naphtha Market size is expected to be worth around USD 1.8 Billion by 2034, from USD 0.6 Billion in 2024, growing at a CAGR of 11.5% during the forecast period from 2025 to 2034.

Renewable naphtha, a bio-based hydrocarbon derived from renewable feedstocks such as biomass, algae, or organic waste, is gaining prominence as a sustainable alternative to traditional petroleum-based naphtha. It serves as a crucial component in the production of biofuels, green plastics, and hydrogen, aligning with global efforts to reduce carbon emissions and transition towards a circular economy.

As of January 1, 2024, the U.S. renewable fuels plant production capacity—including renewable diesel, jet, heating oil, naphtha, and gasoline—stands at approximately 4,328 million gallons per year (282thousand barrels per day), across 22 facilities. Canada has also initiated investments in clean fuels technologies, including bio-naphtha, under Natural Resources Canada’s clean fuels mandate. Globally, industry integration efforts are underway; for instance, refiners are increasingly blending biomass-derived components (e.g., used cooking oil) into conventional naphtha streams to meet sustainability targets.

Key drivers include stringent environmental policies, including the U.S. Renewable Fuel Standard (supporting bio-based blendstocks for 2026–2027), and Europe’s Green Deal, which incentivizes low-carbon chemical feedstocks. India’s NEP targets increasing renewable generation to 55% of capacity by FY 2026 and 66% by FY 2031, fostering a enabling energy environment for bio-refineries.

For example, World Energy plans to increase throughput at its California facility from 2 million gallons currently to 6 million gallons per year by 2026, with a target of 17 million gallons by 2030. Additionally, a California Energy Commission-supported project achieved 40 million gallons per year of renewable diesel, co-producing renewable jet and naphtha.

Government initiatives play a central role. In Canada, Natural Resources Canada has invested in clean fuel technologies including bio naphtha developments . The U.S. National Renewable Energy Laboratory reports increased contributions from advanced biofuels—including naphtha—to U.S. bioenergy consumption, rising from 1,551 TBtu in 2013 to 1,852 TBtu in 2022. The U.S. SAF Grand Challenge further signals policy commitment to renewable hydrocarbon streams.

Key Takeaways

- Renewable Naphtha Market size is expected to be worth around USD 1.8 Billion by 2034, from USD 0.6 Billion in 2024, growing at a CAGR of 11.5%.

- Light Naphtha held a dominant market position, capturing more than a 68.3% share of the global renewable naphtha market.

- Used Cooking Oil held a dominant market position, capturing more than a 43.9% share of the global renewable naphtha market.

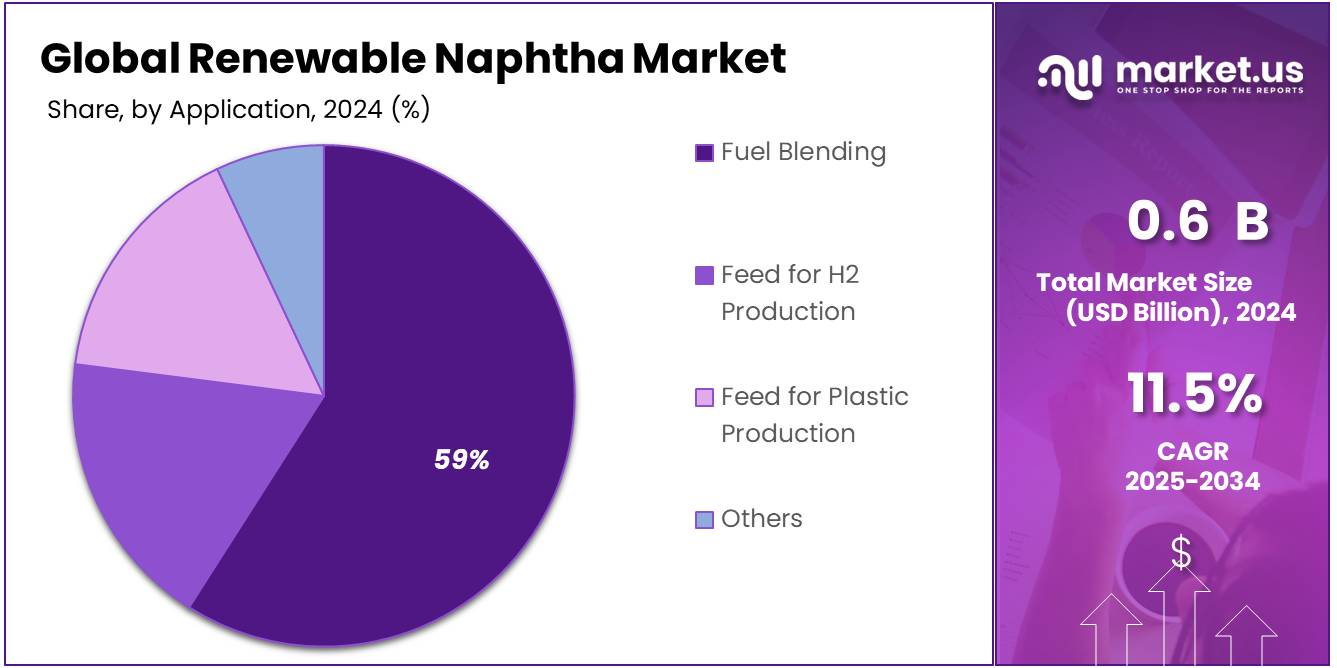

- Fuel Blending held a dominant market position, capturing more than a 59.1% share in the global renewable naphtha market.

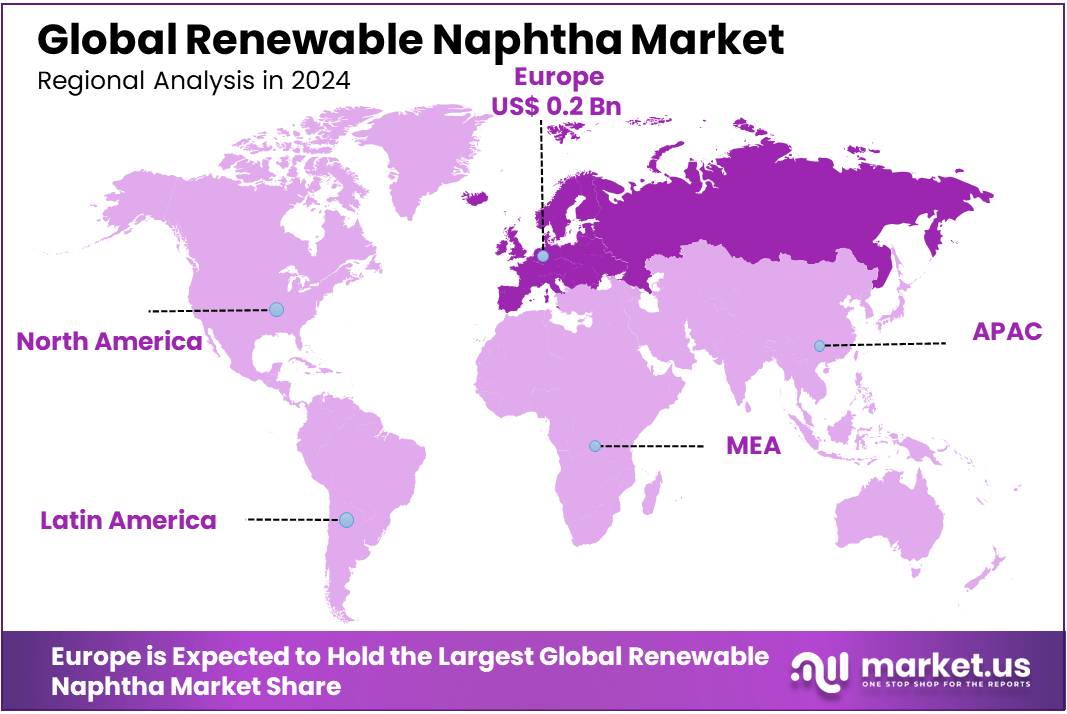

- Europe stood as the dominant regional market for renewable naphtha, capturing a commanding 43.2% share—equivalent to USD 0.2 billion.

By Product Type

Light Naphtha dominates with 68.3% share due to its broad usage in petrochemical feedstocks and cleaner fuel blending.

In 2024, Light Naphtha held a dominant market position, capturing more than a 68.3% share of the global renewable naphtha market. This segment maintained its lead primarily because of its wide applicability across petrochemical production, especially in the manufacturing of ethylene and propylene through steam cracking. The product’s low boiling point and high volatility make it an ideal feedstock for these processes.

Additionally, Light Naphtha is increasingly being used as a blending component in cleaner-burning gasoline, especially in markets where governments are enforcing tighter emission standards. In 2025, the segment is expected to continue its upward momentum, supported by rising investments in green refineries and growing demand from bio-based plastic manufacturers. Its compatibility with existing infrastructure and refining processes makes Light Naphtha a cost-effective and scalable solution, further strengthening its market position in the renewable fuel and chemical value chain.

By Feedstock

Used Cooking Oil leads with 43.9% share as a preferred low-cost and sustainable feedstock option.

In 2024, Used Cooking Oil held a dominant market position, capturing more than a 43.9% share of the global renewable naphtha market by feedstock. This strong position was driven by its widespread availability, low acquisition cost, and minimal land-use impact compared to virgin oil crops. Used cooking oil is considered a waste-derived feedstock, which qualifies it for favorable treatment under various renewable fuel standards and carbon credit programs in both the EU and North America.

Moreover, it does not compete with food supply chains, making it a socially and environmentally preferred option. In 2025, the segment is expected to retain its leading position as governments continue to encourage waste-to-fuel programs and bio-refiners scale up capacity to process high volumes of used oils. The increasing adoption of circular economy models across industrial sectors further supports the long-term outlook for used cooking oil in renewable naphtha production.

By Application

Fuel Blending dominates with 59.1% share driven by rising demand for cleaner-burning transportation fuels.

In 2024, Fuel Blending held a dominant market position, capturing more than a 59.1% share in the global renewable naphtha market by application. This leadership was mainly due to growing global efforts to lower carbon emissions from conventional gasoline by incorporating renewable content. Renewable naphtha, when blended with fossil-based fuels, reduces the overall carbon intensity without requiring changes to engine technology or fueling infrastructure.

Countries in Europe, North America, and parts of Asia have introduced blending mandates and low-carbon fuel standards that directly support this segment. In 2025, the demand is expected to increase further as more refineries adapt their operations to include bio-based feedstocks and governments tighten emission norms for road transportation. The compatibility of renewable naphtha with standard fuel specifications makes it a highly scalable and practical solution for achieving cleaner mobility goals.

Key Market Segments

By Product Type

- Light Naphtha

- Heavy Naphtha

By Feedstock

- Used Cooking Oil

- Wood Pulp Residue

- Vegetable Oil Waste

- Animal Fat

- Others

By Application

- Fuel Blending

- Feed for H2 Production

- Feed for Plastic Production

- Ethylene

- Propylene

- Butadiene

- Others

- Others

Drivers

Growing Demand for Sustainable Fuels Drives Renewable Naphtha Market

The increasing global push towards sustainability is a significant driver for the growth of the renewable naphtha market. Renewable naphtha, produced from renewable feedstocks like biomass, serves as an alternative to traditional fossil fuel-derived naphtha. This transition is being accelerated by the need for cleaner energy solutions and regulatory mandates that promote the reduction of greenhouse gas emissions.

Governments worldwide are making strong efforts to reduce carbon emissions and transition to renewable energy. For instance, the European Union’s Renewable Energy Directive (RED II) mandates that by 2030, 14% of the EU’s energy consumption must come from renewable sources, including biofuels like renewable naphtha. This regulatory push is encouraging industries to adopt sustainable fuel options to meet their carbon reduction goals. In 2023, renewable naphtha was expected to play a pivotal role in decarbonizing industries such as aviation, shipping, and heavy transportation.

A major factor in the renewable naphtha market’s growth is the increasing demand for low-carbon alternatives in sectors traditionally dependent on fossil fuels. The food industry, for example, has seen a rise in demand for sustainable packaging solutions. Companies like Nestlé and Coca-Cola are integrating bio-based plastics derived from renewable naphtha into their product packaging, reducing reliance on petroleum-based plastics. Nestlé, in particular, has committed to making 100% of its packaging recyclable or reusable by 2025, with a significant portion coming from renewable resources.

Governments are also investing in green technologies, such as bio-refineries, which convert organic materials into renewable naphtha. The U.S. Department of Energy, for instance, allocated over US$70 million to support the development of advanced biofuels, including renewable naphtha, in 2023. These initiatives not only boost the supply of renewable naphtha but also stimulate innovation and investment in the sector.

Restraints

High Production Costs Limit Renewable Naphtha Market Growth

One of the major restraining factors for the renewable naphtha market is the high production costs associated with its manufacturing process. While renewable naphtha presents a more sustainable alternative to conventional naphtha, its production is significantly more expensive, primarily due to the cost of raw materials and advanced technology required in bio-refineries. As a result, the market faces challenges in achieving widespread adoption, especially in industries where cost efficiency is a critical factor.

The cost of feedstocks, such as biomass, is another obstacle. According to the U.S. Department of Agriculture, biomass feedstock costs in the U.S. can vary widely, often exceeding $60 per dry ton, making renewable naphtha more expensive compared to fossil fuel-based alternatives. This price difference makes it challenging for many industries to justify switching to renewable naphtha, particularly in sectors like food packaging, where cost sensitivity is high.

Despite the efforts of major companies like Nestlé and Unilever to incorporate sustainable packaging materials, they continue to face difficulties in scaling the use of renewable naphtha due to its high costs. Nestlé, for example, committed to using 100% recyclable or reusable packaging by 2025, but the company has also noted that sourcing bio-based materials is often more expensive than traditional petroleum-based plastics. The food giant has had to balance sustainability goals with economic realities, making the transition slower than anticipated.

Opportunity

Government Mandates and Industry Shifts Fuel Renewable Naphtha Opportunities

The renewable naphtha market is experiencing significant growth, driven by government mandates and a shift towards sustainable practices in various industries. Governments worldwide are implementing policies that promote the use of renewable energy sources, including renewable naphtha, to reduce carbon emissions and dependence on fossil fuels.

In India, the government’s Ethanol Blended Petrol (EBP) program mandates blending 20% ethanol with petrol by 2025, creating a substantial demand for renewable naphtha. This initiative has led to investments from companies like Amul, which is setting up a bioethanol plant with a capacity of 50,000 liters per day, and Grainspan Nutrients, which has invested ₹500 crore in an ethanol plant with a capacity of 340 kiloliters per day.

The food industry is also contributing to the growth of renewable naphtha. Companies are increasingly adopting sustainable packaging solutions made from renewable naphtha to meet consumer demand for eco-friendly products. For instance, Nestlé has committed to making 100% of its packaging recyclable or reusable by 2025, with a significant portion coming from renewable resources.

Trends

Surge in Renewable Naphtha Demand for Sustainable Food Packaging

A notable trend in the renewable naphtha market is its increasing application in the food packaging industry, driven by consumer demand for sustainable products and regulatory support. Renewable naphtha, derived from renewable feedstocks like biomass, serves as a key component in producing bio-based plastics used for packaging food items.

In India, the government’s Ethanol Blended Petrol (EBP) program mandates blending up to 20% ethanol in petrol by 2025. This initiative has led to significant investments in bioethanol production, which is a precursor to renewable naphtha. For instance, Amul has invested ₹70 crore in a bioethanol plant capable of producing 50,000 liters per day, potentially generating ₹700 crore in additional income for dairy farmers.

The food industry is responding to this trend by adopting sustainable packaging solutions. Companies are increasingly incorporating bio-based plastics made from renewable naphtha to meet consumer expectations for eco-friendly products. This shift not only helps reduce the environmental impact of packaging but also aligns with global sustainability goals.

Regional Analysis

Europe leads with 43.2% share, contributing USD 0.2 billion to the renewable naphtha market.

In 2024, Europe stood as the dominant regional market for renewable naphtha, capturing a commanding 43.2% share—equivalent to USD 0.2 billion in market value. The region’s leadership can be attributed to stringent environmental mandates such as the European Green Deal and RED II, which collectively aim for a 14% renewable energy uptake in transport by 2030. In 2023, renewables already represented 24.5% of the European Union’s final energy consumption, underscoring a policy context actively aligned with renewable fuel adoption.

Key European players—including Finland’s Neste, Germany’s UPM Biofuels, and various EU-based refineries—have invested in upgrading bio-refinery infrastructure to produce renewable hydrocarbon streams compatible with existing petrochemical systems. These investments are supporting increased integration of waste-based and advanced feedstocks into the supply chain while assuring compliance with life-cycle greenhouse gas reduction targets under EU regulation.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Braskem, a Brazilian petrochemical leader, has secured substantial naphtha supply agreements, including a minimum of 650kt annually (potentially scaling to 2.8Mt/year) with Petrobras, reinforcing its position in feedstock sourcing for its Bahia and Rio Grande do Sul units. The company is also modernizing its infrastructure—investing USD 332 million in a fleet of six vessels dedicated to transporting naphtha and ethane—demonstrating a strategic approach to securing stable logistics and supply chain integration.

Chevron’s subsidiary, Renewable Energy Group, produced 408 million gallons of biofuels in 2023, cutting approximately 3.8 million metric tonnes of CO2 emissions. CREG delivers a diverse fuel portfolio—including renewable diesel, biodiesel, renewable naphtha, propane, glycerin, methyl esters, and ethanol blends—under its EnDura and UltraClean product lines. Its global operations span nine biorefineries in the U.S. and Europe, supporting Chevron’s broader push toward lower-carbon fuel solutions.

Clean Planet Energy develops “ecoPlants” that convert hard-to-recycle plastics into circular naphtha and ultra-low sulfur fuels, supporting a circular plastic economy. Its first Teesside facility, backed by a long-term BP offtake agreement, will divert 250,000 tonnes of difficult plastic waste annually and generate over 700 green jobs. Expansion plans include twelve global ecoPlants aimed at large-scale sustainable feedstock recovery

Top Key Players in the Market

- Braskem

- Chevron Renewable Energy Group

- Clean Planet Energy

- Eni SpA

- EXXONMOBIL

- Galp Energia

- Honeywell UOP

- Indian Oil Corporation Ltd

- Neste Oyj

- PAO NOVATEK

- Preem AB

- SABIC

- Shell Plc

- SolvChem

- TotalEnergies SE

Recent Developments

In 2024, Braskem secured contracts with Petrobras to guarantee at least 650,000 tonnes per year, with options to increase supply up to 2.8 million tonnes, reinforcing stable feedstock access for its Bahia and Rio Grande do Sul plants.

In 2024, Chevron allocated USD 8 billion toward lower‑carbon energy investments by 2028, with a substantial portion earmarked for renewable fuel technologies including naphtha.

Report Scope

Report Features Description Market Value (2024) USD 0.6 Bn Forecast Revenue (2034) USD 1.8 Bn CAGR (2025-2034) 11.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Light Naphtha, Heavy Naphtha), By Feedstock (Used Cooking Oil, Wood Pulp Residue, Vegetable Oil Waste, Animal Fat, Others), By Application (Fuel Blending, Feed for H2 Production, Feed for Plastic Production, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Braskem, Chevron Renewable Energy Group, Clean Planet Energy, Eni SpA, EXXONMOBIL, Galp Energia, Honeywell UOP, Indian Oil Corporation Ltd, Neste Oyj, PAO NOVATEK, Preem AB, SABIC, Shell Plc, SolvChem, TotalEnergies SE Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Braskem

- Chevron Renewable Energy Group

- Clean Planet Energy

- Eni SpA

- EXXONMOBIL

- Galp Energia

- Honeywell UOP

- Indian Oil Corporation Ltd

- Neste Oyj

- PAO NOVATEK

- Preem AB

- SABIC

- Shell Plc

- SolvChem

- TotalEnergies SE