Global Refurbished Computer And Laptops Market By Product (Computers, PCs, Workstations, Laptops, Notebooks, Ultrabooks), By Operating System (Windows OS, Mac OS, Linux OS), By Sales Channel (Online and eCommerce, Offline and Brick & Mortar Stores), By Grade, By Screen Size, By End User, By Distribution Channel, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 29869

- Number of Pages: 225

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Product Analysis

- Operating System Analysis

- Sales Channel Analysis

- Grade Analysis

- Screen Size Analysis

- End User Analysis

- Distribution Channel Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunity

- Challenges

- Growth Factors

- Emerging Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

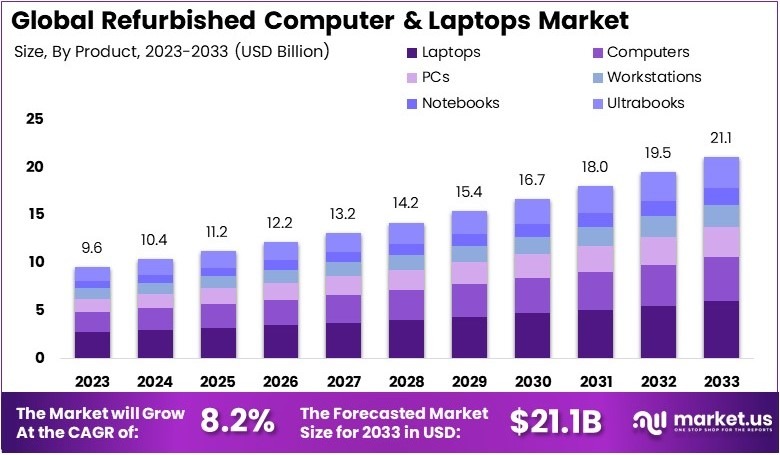

The Global Refurbished Computer And Laptops Market size is expected to be worth around USD 21.1 Billion by 2033, from USD 9.6 Billion in 2023, growing at a CAGR of 8.2% during the forecast period from 2024 to 2033.

Refurbished computers and laptops are pre-owned devices restored to full working condition. These products undergo repairs, testing, and quality checks to ensure functionality. They are an affordable option for individuals and businesses seeking reliable technology at a reduced cost.

The refurbished computer and laptops market involves the supply and sale of refurbished devices. It serves cost-conscious buyers, including students, professionals, and businesses. The market focuses on quality assurance and sustainable practices, offering certified refurbished products with warranties and after-sales support.

In 2022, global e-waste production reached 62 million tonnes, an 82% increase since 2010 as per UNITAR. By 2030, this figure is projected to rise by another 32% to 82 million tonnes. The low recycling rate of less than 25% results in resource loss and environmental concerns, fueling demand for refurbished computers.

The Refurbished Computer and Laptop Market benefits from growing consumer awareness of sustainability. In March 2023, ASUS launched its first refurbished PC store in India, offering affordable, high-quality products. Such initiatives highlight opportunities for brands to cater to cost-conscious and environmentally-conscious buyers, driving market growth.

Market competitiveness remains strong, with brands innovating to meet demand. However, saturation in developed markets challenges growth. Emerging markets, like India, offer untapped opportunities for expansion. Strategic initiatives, including dedicated refurbished PC stores, help players establish dominance in regions with rising demand for budget-friendly tech.

Government regulations and incentives support market expansion. Policies encouraging e-waste recycling promote refurbished computer adoption. However, only 1% of rare earth demand is met through e-waste recycling, revealing a critical gap. Addressing this issue could enhance resource availability, reduce waste, and support broader market sustainability goals.

Key Takeaways

- The Refurbished Computer and Laptops Market was valued at USD 9.6 billion in 2023 and is projected to reach USD 21.1 billion by 2033, with a CAGR of 8.2%.

- In 2023, Laptops dominated the product segment with 28.4%, reflecting widespread consumer preference for portability.

- In 2023, Windows OS led the operating system segment with 65.6%, valued for compatibility across devices.

- In 2023, Online/eCommerce channels dominated with 58.5%, driven by convenience and availability.

- In 2023, Grade A products accounted for 45.5%, offering high-quality refurbished devices.

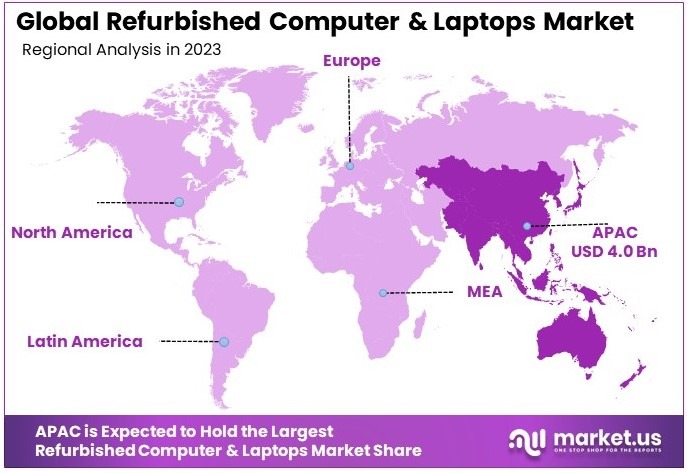

- In 2023, APAC led the market with 41.7%, benefiting from growing adoption in cost-sensitive regions.

Product Analysis

Laptops dominate with 28.4% due to their portability and versatility.

In the Refurbished Computer and Laptops Market, laptops hold the largest market share at 28.4%. Their dominance is driven by the growing demand for portable computing solutions that offer both performance and convenience. Laptops provide a versatile option for both personal and professional use, accommodating the needs of mobile professionals, students, and home users who seek flexibility in their computing devices.

Other sub-segments such as PCs, workstations, notebooks, and ultrabooks also contribute to the market. PCs are favored for their robust performance in office and gaming environments. Workstations offer specialized high-performance capabilities for professional software applications. Notebooks and ultrabooks are popular for their lighter weight and sleek designs, catering to users looking for portability along with substantial computing power.

Operating System Analysis

Windows OS dominates with 65.6% due to its wide compatibility and user-friendly interface.

Windows OS leads the operating system segment in the Refurbished Computer and Laptops Market with a 65.6% share. Its widespread use is attributed to its compatibility with a broad range of software applications and hardware components, making it a versatile choice for both general and specialized computing tasks. The user-friendly interface of Windows also contributes to its popularity, offering intuitive navigation and robust support for all types of users.

Mac OS and Linux OS serve niche segments within the market. Mac OS is preferred by users looking for advanced graphics and audio capabilities, typically used in creative professions. Linux OS is favored by developers and tech-savvy users who appreciate its open-source nature and customization possibilities, although it represents a smaller portion of the market.

Sales Channel Analysis

Online/eCommerce dominates with 58.5% due to the convenience and wide selection of products.

The Online/eCommerce sales channel leads with a 58.5% share in the Refurbished Computer and Laptops Market. The dominance of online sales channels is largely due to the convenience they offer, allowing customers to browse extensive inventories, compare prices, and read reviews at their leisure. The ability to shop from anywhere at any time, coupled with often competitive pricing and direct delivery options, makes online purchasing particularly attractive.

Offline/Brick & Mortar Stores remain important for customers who prefer a hands-on buying experience, where they can physically inspect products and interact with sales staff. These stores are crucial for providing personal service and immediate product availability, which are significant factors for many buyers.

Grade Analysis

Grade A dominates with 45.5% due to high quality and reliability.

Grade A refurbished computers and laptops lead the market segment with a 45.5% share. These products are preferred due to their high quality and reliability, which are close to new devices. Grade A items typically have minimal cosmetic defects and have been thoroughly tested and certified, ensuring that they meet all functional standards expected of new devices.

Grade B, Grade C, and Grade D products offer lower-priced alternatives with varying levels of cosmetic wear and technical performance. Grade B items may have moderate wear but maintain good functionality, while Grade C and D products might have significant wear or minor functional issues, catering to budget-conscious consumers who prioritize price over aesthetics or minor features.

Screen Size Analysis

14-16 inches dominates with 56.4% due to the optimal balance of usability and portability.

The 14-16 inch screen size segment leads the market with a 56.4% share in refurbished laptops and computers. This screen size range is most popular because it provides an optimal balance between usability and portability, making these devices ideal for both productivity and entertainment purposes. Screens within this range are large enough to comfortably work on documents or enjoy media, yet still compact enough to carry around easily.

The segments for 11-13 inches and 17 inches and above also play significant roles. Smaller screens are favored for their extreme portability, ideal for travelers and students, while larger screens are preferred by professionals and gamers who need expansive displays for detailed work or immersive gaming experiences.

End User Analysis

Enterprises dominate with 36.5% due to the high volume of deployments and cost-efficiency.

Enterprises are the leading end-user segment in the Refurbished Computer and Laptops Market, accounting for 36.5%. This dominance is due to the high volume of device deployments in corporate environments where cost efficiency is crucial. Refurbished computers provide an economical solution for businesses looking to equip their workforce without compromising on performance and reliability.

Educational institutes and government sectors also significantly invest in refurbished devices to stretch tight budgets further. Personal users represent a growing market segment, driven by consumers seeking affordable computing options for home use, showcasing the broad appeal of refurbished products across various consumer bases.

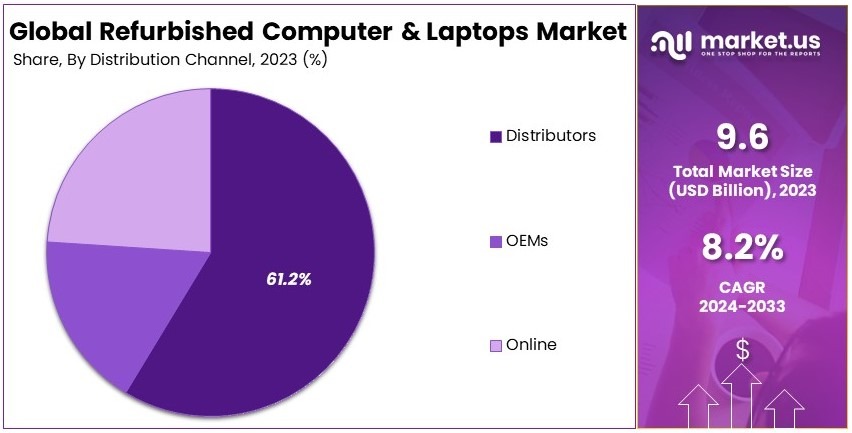

Distribution Channel Analysis

Distributors dominate with 61.2% due to their extensive networks and value-added services.

Distributors hold the largest share in the distribution channel segment of the Refurbished Computer and Laptops Market, with a 61.2% share. Their dominance can be attributed to their extensive distribution networks and value-added services such as warranty provisions, after-sales support, and flexible return policies. Distributors play a key role in bridging the gap between refurbishers and end-users, providing a crucial link that supports the flow of refurbished products to the market.

OEMs (Original Equipment Manufacturers) and online platforms also contribute to the distribution landscape. OEMs sometimes offer refurbished products directly to consumers, providing a trustworthy source for buyers. Online platforms cater to a wide audience by offering convenient access to various brands and product types, further enriching the market ecosystem.

Key Market Segments

By Product

- Computers

- PCs

- Workstations

- Laptops

- Notebooks

- Ultrabooks

By Operating System

- Windows OS

- Mac OS

- Linux OS

By Sales Channel

- Online/eCommerce

- Offline/Brick & Mortar Stores

By Grade

- Grade A

- Grade B

- Grade C

- Grade D

By Screen Size

- 11-13 inches

- 14-16 inches

- 17 inches and above

By End User

- Enterprises

- Small and Medium

- Large

- Educational Institutes

- Government

- Personal

By Distribution Channel

- OEMs

- Distributors

- Online

Drivers

Affordable Pricing and Environmental Sustainability Drive Market Growth

The Refurbished Computer and Laptops Market is experiencing significant growth driven by several key factors. One of the primary drivers is the increasing demand for affordable computing solutions. As consumers seek cost-effective alternatives to brand-new devices, refurbished computers and laptops offer a budget-friendly option without compromising on performance.

Additionally, the growing awareness of environmental sustainability is propelling the market forward. Consumers are becoming more conscious of electronic waste and the environmental impact of disposing of old devices.

Refurbishing extends the lifecycle of computers and laptops, reducing the need for new manufacturing and minimizing environmental harm. Moreover, advancements in refurbishment processes have enhanced the quality and reliability of refurbished devices, making them more appealing to a broader audience.

Improved warranties and certifications provided by reputable refurbishers also boost consumer confidence, encouraging more purchases. Furthermore, the rise of e-commerce platforms has made it easier for consumers to access a wide range of refurbished products, increasing market accessibility and driving sales.

Restraints

Limited Consumer Trust and Perceived Quality Issues Restrain Market Growth

Despite the positive growth trajectory, the Refurbished Computer and Laptops Market faces several restraining factors that hinder its expansion. One of the main challenges is the limited consumer trust in the quality and reliability of refurbished devices. Many potential buyers are concerned about the longevity and performance of refurbished products, fearing that they may encounter defects or reduced functionality compared to new devices.

Additionally, the lack of standardized refurbishment processes across different sellers exacerbates these trust issues. Without consistent quality assurance, consumers may find it difficult to differentiate between high-quality refurbishments and subpar offerings, further restricting market growth.

High initial costs associated with implementing rigorous testing and refurbishment protocols also pose a barrier for smaller refurbishers, limiting the overall supply of quality refurbished devices in the market. Moreover, stringent regulations and compliance requirements in various regions can complicate the refurbishment and resale process, increasing operational costs and delaying market entry for new players.

Furthermore, the rapid pace of technological advancements means that refurbished devices can quickly become outdated, reducing their attractiveness to consumers seeking the latest features and performance.

Opportunity

Expansion into Emerging Markets and Technological Advancements Provide Opportunities

The Refurbished Computer and Laptops Market is poised to capitalize on several growth opportunities that can drive its expansion in the coming years. One significant opportunity lies in the expansion into emerging markets, where increasing internet penetration and rising disposable incomes are fueling demand for affordable computing solutions.

Additionally, technological advancements in refurbishment processes offer opportunities to enhance product quality and extend the lifespan of devices. Innovations such as improved diagnostic tools, advanced repair techniques, and the integration of smart technologies can elevate the standard of refurbished products, making them more competitive with new devices.

Another promising avenue is the collaboration with educational institutions and non-profit organizations, which can drive bulk sales of refurbished computers and laptops for use in schools, community centers, and low-income households. This not only boosts sales but also promotes digital inclusion and educational development.

Furthermore, the increasing trend of remote work and online education has heightened the demand for affordable and reliable computing devices, presenting a timely opportunity for refurbished product providers to meet this surge in demand.

Challenges

Supply Chain Disruptions and Intense Competition Challenge Market Growth

The Refurbished Computer and Laptops Market encounters several challenging factors that could impede its growth trajectory. Supply chain disruptions, such as shortages of key components and delays in shipping, pose significant challenges for refurbishers striving to maintain inventory levels and meet consumer demand.

Additionally, the market is characterized by intense competition, with numerous players ranging from large-scale refurbishers to small independent sellers vying for market share. This competitive landscape forces companies to continuously innovate and differentiate their offerings, often leading to price wars and reduced profit margins.

Furthermore, the lack of standardized certification and quality assurance across the industry exacerbates competition, as consumers may favor well-known brands with established reputations over lesser-known refurbishers.

Another challenge is the rapid pace of technological advancements, which can render refurbished devices obsolete quickly, diminishing their appeal and reducing their resale value. Moreover, navigating varying regional regulations and compliance standards adds another layer of complexity for global market players, complicating the expansion efforts and increasing operational costs.

Growth Factors

Increasing Demand for Cost-Effective Solutions and Environmental Concerns Are Growth Factors

The Refurbished Computer and Laptops Market is set to experience robust growth driven by several key factors that enhance its applicability and appeal across various consumer segments. The increasing demand for cost-effective computing solutions is a primary growth factor, as both individual consumers and businesses seek to optimize their technology budgets without sacrificing performance.

Additionally, growing environmental concerns and the push for sustainable practices are driving consumers towards refurbished products as a means to reduce electronic waste and minimize their ecological footprint. This shift towards eco-conscious purchasing decisions aligns with global sustainability goals and enhances the market’s appeal to environmentally aware consumers.

The proliferation of e-commerce platforms and the expansion of online retail channels further support market growth by making refurbished computers and laptops more accessible to a broader audience. Online marketplaces offer convenience, competitive pricing, and a wide selection of products, attracting more buyers and increasing sales volumes.

Moreover, advancements in refurbishment technologies have improved the quality and reliability of refurbished devices, boosting consumer confidence and driving repeat purchases. The rise of remote work and online education has also heightened the need for affordable and dependable computing solutions, providing a timely boost to the market.

Emerging Trends

Sustainability Initiatives and Digital Transformation Are Latest Trending Factors

The Refurbished Computer and Laptops Market is experiencing dynamic shifts driven by several trending factors that are shaping its current landscape. Sustainability initiatives are at the forefront, with consumers increasingly prioritizing eco-friendly products and practices.

Additionally, digital transformation trends are revolutionizing the refurbishment process, with advancements in automation and data analytics enhancing efficiency and accuracy in device testing and repair. The integration of blockchain technology for tracking device history and authenticity is also emerging as a key trend, providing greater transparency and building consumer trust in refurbished products.

Moreover, the rise of online marketplaces and direct-to-consumer sales channels is facilitating easier access to refurbished computers and laptops, broadening the market reach and enhancing consumer convenience. Social media and digital marketing strategies are further amplifying brand visibility and consumer engagement, driving higher sales and market penetration.

Furthermore, the adoption of virtual and augmented reality tools for virtual inspections and demonstrations is enhancing the customer experience, making it easier for consumers to assess the quality and functionality of refurbished devices remotely.

Regional Analysis

Asia Pacific Dominates with 41.7% Market Share

Asia Pacific leads the Refurbished Computer and Laptops Market with a commanding 41.7% share, valued at USD 4.00 billion. This dominance is driven by the rising demand for affordable technology solutions, expanding e-learning adoption, and increasing small and medium-sized enterprises (SMEs) in the region.

Key factors include a price-sensitive consumer base seeking cost-effective computing options. The strong presence of refurbished product suppliers and the region’s growing acceptance of sustainable practices also play a significant role. Initiatives promoting technology access in developing countries such as India and Indonesia further enhance demand.

Regional dynamics are shaped by the large population and rapid digitalization, which increase the need for affordable laptops and computers. High internet penetration and expanding IT infrastructure also support the growth of refurbished devices. Additionally, government initiatives to bridge the digital divide contribute to the steady adoption of these products.

Asia Pacific is expected to strengthen its market position in the future. The growing awareness of e-waste reduction and sustainability will continue to boost demand. Increased investments in refurbishing facilities and better logistics networks are likely to enhance the region’s role in the global market.

Regional Mentions:

- North America: North America is a mature market, driven by strong demand for high-quality refurbished devices. Consumer awareness of sustainable technology solutions supports steady growth.

- Europe: Europe emphasizes sustainability, with increasing adoption of refurbished devices in both business and education sectors. Strict e-waste regulations drive market expansion.

- Middle East & Africa: The Middle East & Africa market is growing, driven by rising technology penetration and government efforts to improve digital infrastructure.

- Latin America: Latin America is an emerging market, supported by cost-conscious consumers and a push for affordable computing solutions in education and business.

Key Regions and Countries covered in the report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The refurbished computer and laptops market is led by established companies offering high-quality, affordable devices. These players ensure product reliability through certified refurbishment processes and strong customer support.

Amazon Renewed dominates with its vast selection and strong brand trust. Its easy-to-use platform and customer-friendly policies attract a wide audience, making it a major player in the market.

Apple Certified Refurbished Inc. focuses on premium quality and brand loyalty. Its rigorous refurbishment standards and warranty offerings provide assurance to customers, securing a significant share in the high-end segment.

Dell Refurbished stands out for its focus on corporate and individual customers. It offers certified refurbished laptops with strong after-sales service, ensuring customer satisfaction and retention.

HP Renew combines affordability with quality. Its extensive product range and environmental sustainability efforts position it as a leader in this market.

These companies focus on quality assurance, warranties, and strong customer support to remain competitive in the refurbished devices market.

Top Key Players in the Market

- Amazon Renewed

- Apple Certified Refurbished Inc.

- Arrow Direct

- Asustek Computer Inc.

- Dell Refurbished

- Fujitsu Limited

- HP Renew

- International Business Machines (IBM)

- Lenovo Group Limited

- LG Electronics Inc.

- Microsoft Corporation

- Micro-Star International (MSI) Co., Ltd.

- Panasonic Corporation

- Samsung Electronics Co.Ltd.

- Sony Corporation

- Toshiba Corporation

Recent Developments

- Lenovo: In June 2024, Lenovo implemented an AI-powered refurbishment process that increased the average output of refurbished units per hour from 30 to over 65, achieving a 116% improvement in efficiency. This advancement resulted in annual cost savings of $100,000 and ensured the timely fulfillment of refurbished orders.

- ASUS India: In October 2024, ASUS India expanded its retail presence by inaugurating its sixth Select Store in Chennai. This 300 sq. ft. outlet offers residents access to refurbished ASUS products, which undergo rigorous testing and are backed by a one-year warranty.

- Office of Broadband Access and Expansion (OBAE), New Mexico: In September 2024, OBAE launched a statewide campaign to distribute refurbished computers to community members and organizations in need. In collaboration with Digitunity, a national nonprofit focused on digital equity, the campaign connects donors with regional nonprofits to refurbish and distribute computers.

Report Scope

Report Features Description Market Value (2023) USD 9.6 Billion Forecast Revenue (2033) USD 21.1 Billion CAGR (2024-2033) 8.2% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Computers, PCs, Workstations, Laptops, Notebooks, Ultrabooks), By Operating System (Windows OS, Mac OS, Linux OS), By Sales Channel (Online/eCommerce, Offline/Brick & Mortar Stores), By Grade (Grade A, Grade B, Grade C, Grade D), By Screen Size (11-13 inches, 14-16 inches, 17 inches and above), By End User (Enterprises (Small and Medium, Large), Educational Institutes, Government, Personal), By Distribution Channel (OEMs, Distributors, Online) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Amazon Renewed, Apple Certified Refurbished Inc., Arrow Direct, Asustek Computer Inc., Dell Refurbished, Fujitsu Limited, HP Renew, International Business Machines (IBM), Lenovo Group Limited, LG Electronics Inc., Microsoft Corporation, Micro-Star International (MSI) Co., Ltd., Panasonic Corporation, Samsung Electronics Co., Ltd., Sony Corporation, Toshiba Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Refurbished Computer And Laptops MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample

Refurbished Computer And Laptops MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Amazon Renewed

- Apple Certified Refurbished Inc.

- Arrow Direct

- Asustek Computer Inc.

- Dell Refurbished

- Fujitsu Limited

- HP Renew

- International Business Machines (IBM)

- Lenovo Group Limited

- LG Electronics Inc.

- Microsoft Corporation

- Micro-Star International (MSI) Co., Ltd.

- Panasonic Corporation

- Samsung Electronics Co.Ltd.

- Sony Corporation

- Toshiba Corporation