Global Real-time Fraud Monitoring Market Size, Share, Industry Analysis Report By Offering (Solution (Payment Fraud, Synthetic IDs, Account Takeover (ATO), Phishing and Social Engineering, Credit and Debit Card Fraud, Others (ACH Fraud, Money Laundering, etc.)), Services (Professional Services, Managed Services)), By Deployment (Cloud-Based, On-Premises), By Enterprise Size (Small & Medium Enterprise Size (SMEs), Large Enterprises), By Industry (Banking, Financial Services and Insurance (BFSI), Government and Public Sector, Aerospace & Defense, Healthcare, IT and Telecom, Automotive, Retail and E-commerce, Others (Gaming and Entertainment, Education, etc.)), By Region, Global Opportunity Analysis, Future Outlook and Industry Trends Forecast 2025-2034

- Published date: Sept. 2025

- Report ID: 158838

- Number of Pages: 393

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Insight Summary

- Role of Generative AI

- Analysts’ Viewpoint

- Regional Insights

- By Offering: Solution

- By Deployment: On-Premises

- By Enterprise Size: Large Enterprises

- By Industry: IT and Telecom

- Emerging Trends

- Growth Factors

- Key Market Segments

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

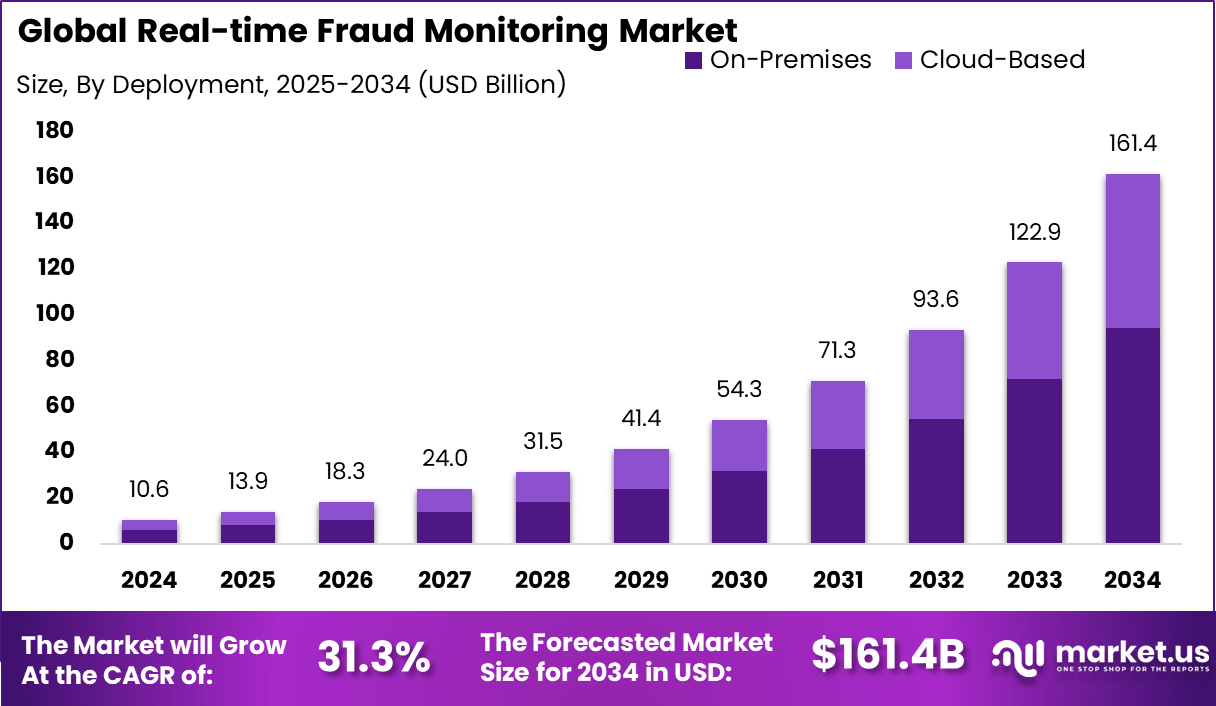

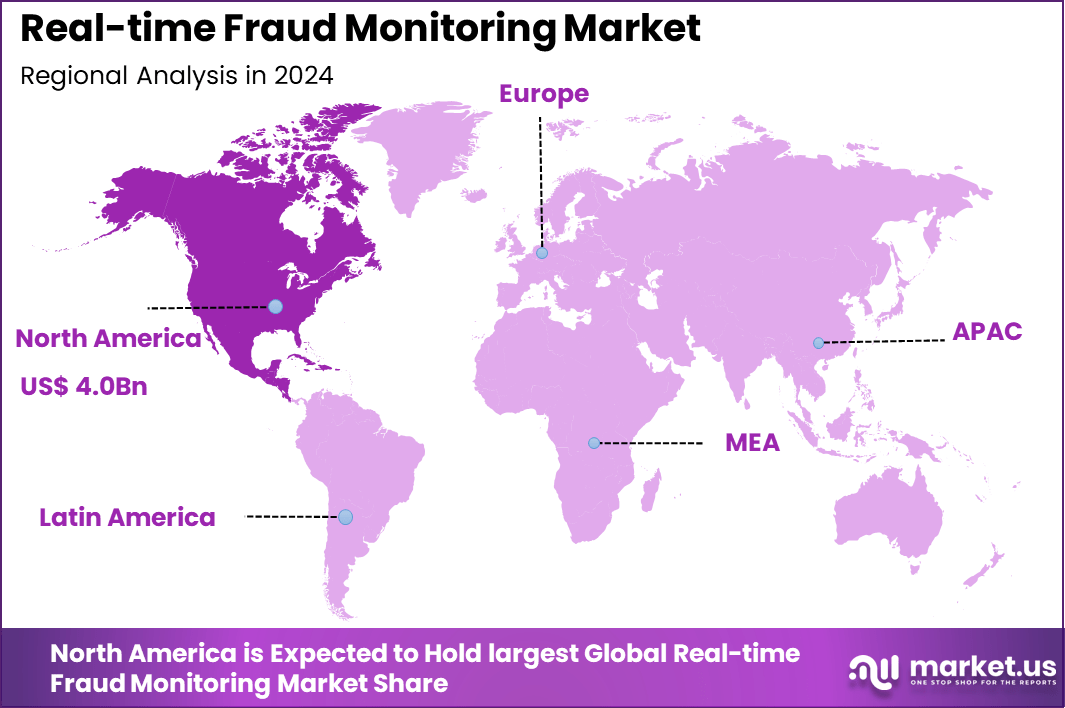

The Global Real-time Fraud Monitoring Market size is expected to be worth around USD 161.4 Billion By 2034, from USD 10.6 billion in 2024, growing at a CAGR of 31.3% during the forecast period from 2025 to 2034. In 2024, North America held a dominan market position, capturing more than a 38.3% share, holding USD 4.0 Billion revenue.

The Real-time Fraud Monitoring Market refers to technologies and solutions designed to detect and prevent fraudulent activities as they occur across digital platforms. These systems analyze transactions, user behavior, and network activity in real time using advanced algorithms, artificial intelligence, and machine learning models. They are widely adopted in banking, e-commerce, insurance, telecommunications, and government sectors to protect against financial fraud, identity theft, cybercrime, and regulatory violations.

The market is driven by the rapid increase in digital transactions, rising incidents of cyber fraud, and the global shift toward online banking and e-commerce. The growing complexity of fraud tactics, including account takeovers, synthetic identities, and phishing attacks, is compelling organizations to adopt real-time monitoring solutions. Regulatory pressure to ensure compliance with anti-money laundering (AML) and know-your-customer (KYC) requirements is another strong driver.

According to Growth-onomics, global fraud losses exceed $5 trillion annually, and traditional batch-based methods lag behind. Companies like Visa and PayPal improved fraud detection by up to 10% with AI, cutting ATO detection time from an hour to 1–3 seconds, which reduced attacks by 60% and flagged 50% of hacked accounts without added costs. With 65% of organizations facing fraud attempts, access to detailed transaction data, user behavior, and context is now critical for smarter decisions.

Demand is strongest in the financial services sector, where banks and payment providers use these systems to analyze millions of transactions instantly and identify suspicious activities. E-commerce platforms are adopting real-time monitoring to protect customers from payment fraud and chargebacks. The insurance sector is using these solutions to detect false claims, while telecommunications providers rely on them to prevent subscription and SIM fraud.

Key Insight Summary

- By offering, Solutions dominated with a 75.3% share, reflecting strong demand for advanced fraud detection platforms.

- By deployment, the On-Premises segment led with a 58.5% share, driven by enterprises prioritizing security and compliance.

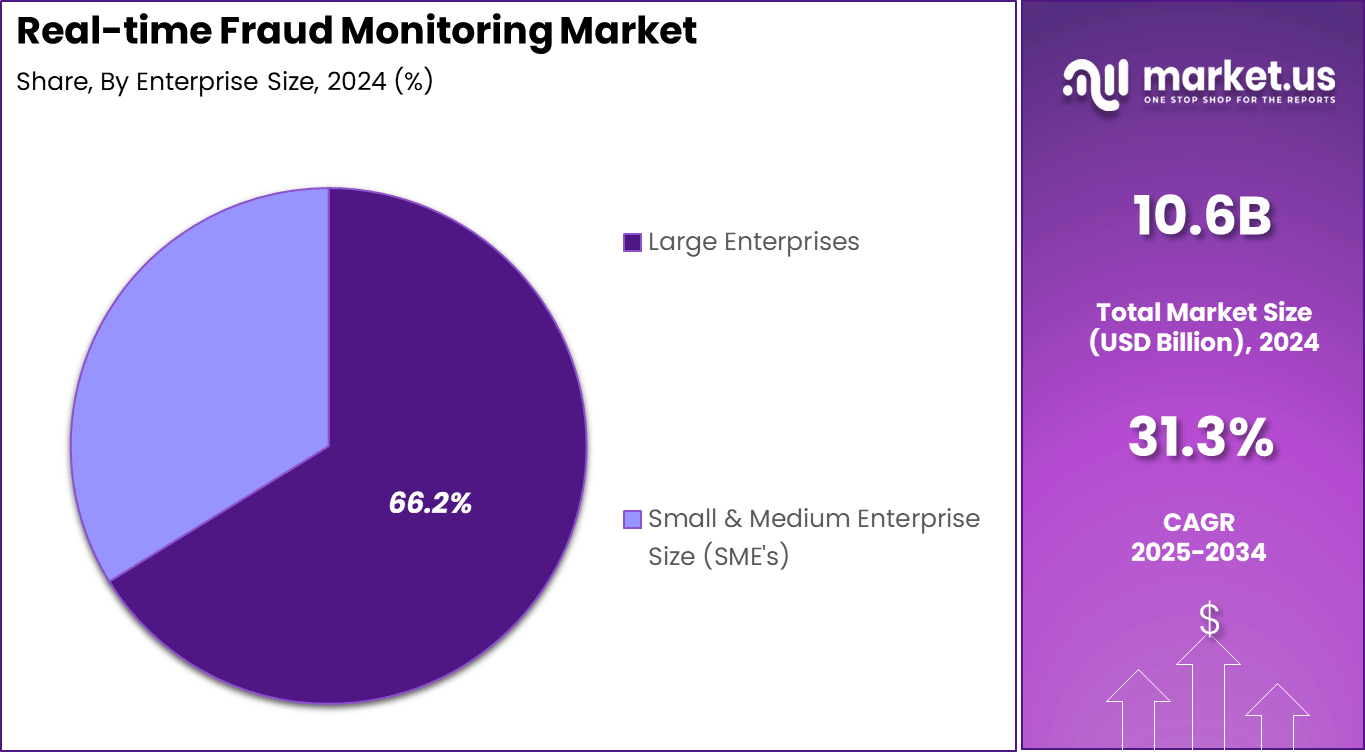

- By enterprise size, Large Enterprises captured 66.2% share, highlighting their extensive adoption of fraud monitoring systems.

- By industry, IT and Telecom held the top position with 26.7% share, owing to high transaction volumes and vulnerability to cyber risks.

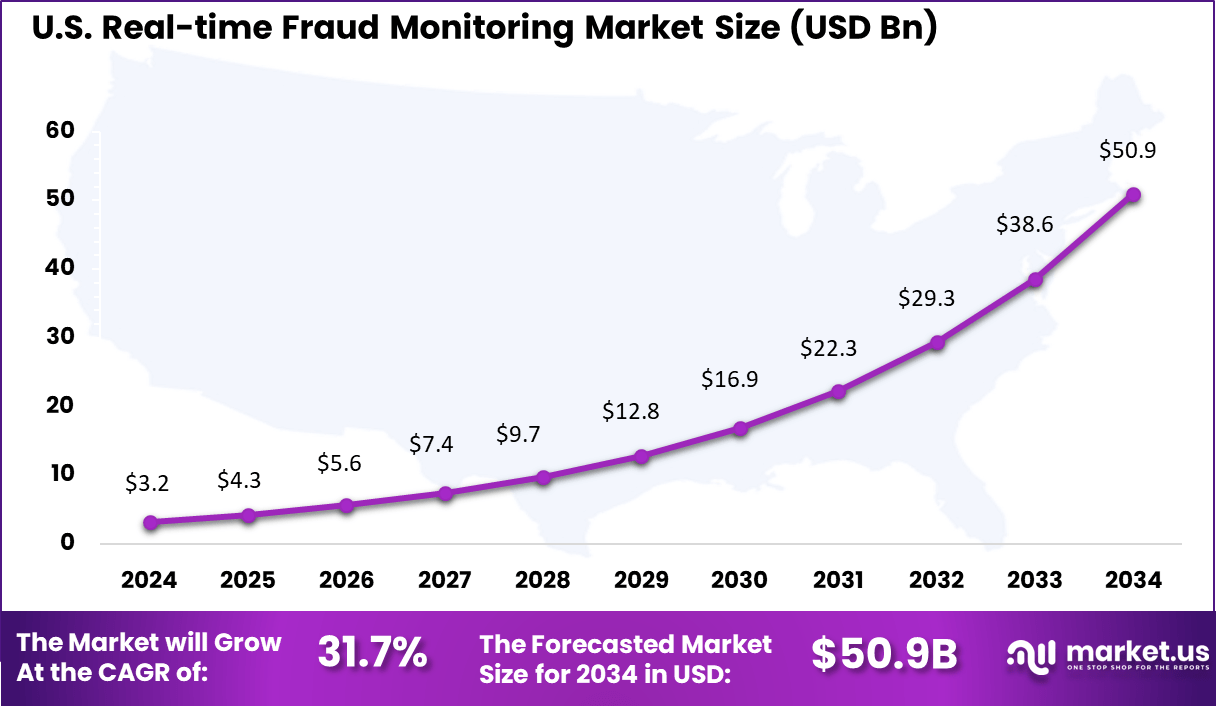

- Regionally, North America accounted for 38.3% share, with the U.S. market valued at USD 3.24 Billion in 2024, growing at a robust CAGR of 31.7%.

Role of Generative AI

Generative AI plays a critical role in real-time fraud monitoring by significantly improving the detection of fraudulent activities as they occur. It helps establish patterns of normal behavior to spot anomalies quickly, reducing false alarms and enabling early responses.

In 2025, over 90% of financial institutions employ AI-powered tools, including generative AI, to fight evolving fraud threats. These AI models generate synthetic data to better train detection systems and assist fraud analysts by swiftly highlighting suspicious behaviors from vast data sets.

Despite risks that fraudsters use generative AI for sophisticated scams like deepfakes and realistic phishing, security teams are using the same technology to stay ahead, creating adaptive defenses that continuously learn from emerging attack methods.

Analysts’ Viewpoint

The market is witnessing growing adoption of artificial intelligence, deep learning, and behavioral analytics to improve fraud detection accuracy and reduce false positives. Cloud-based platforms are becoming more common, offering scalability and flexibility for organizations of all sizes. Real-time data streaming technologies are enabling continuous monitoring across diverse systems.

Investment opportunities exist in AI-powered fraud detection platforms, cloud-native monitoring systems, and solutions designed for specific industries such as healthcare, insurance, and telecommunications. Startups focusing on behavioral biometrics, predictive fraud analytics, and decentralized verification systems are attracting strong interest.

The adoption of real-time fraud monitoring solutions delivers clear benefits, including reduced financial losses, improved compliance, and stronger customer confidence. Organizations gain the ability to stop fraudulent transactions before they are completed, reducing chargebacks and reputational risks. Improved detection accuracy lowers the rate of false positives, enhancing customer experience.

Regional Insights

North America Trends

In 2024, North America holds the largest regional share at 38.3% of the market. The US leads this segment, driven by advanced financial services ecosystems, high adoption of digital payment channels, and stringent regulatory frameworks that require real-time fraud controls. The market is particularly dynamic with a strong emphasis on AI-powered fraud monitoring technologies.

The US real-time fraud monitoring market is valued at USD 3.24 billion and grows at a strong CAGR of 31.7%. This rapid growth reflects the increasing sophistication and volume of fraud attempts in digital transactions and the urgent need for solutions that can address threats instantaneously.

Europe Market Trends

The European real-time fraud monitoring market is growing steadily, with increasing adoption in sectors such as BFSI, retail, and telecommunications. Europe’s regulatory environment, including GDPR and anti-money laundering mandates, drives demand for compliant fraud detection solutions capable of real-time transaction analysis.

Germany leads in adoption due to its mature financial sector and focus on digital infrastructure. The UK is emerging as a fast-growing market with expanding use of AI and machine learning in fraud monitoring. Organizations across Europe seek systems that integrate predictive analytics to prevent fraud proactively.

Asia Pacific Market Trends

Asia Pacific is experiencing rapid growth in real-time fraud monitoring due to the region’s expanding digital economy and rising volume of electronic transactions. Countries like China, India, and Japan are investing heavily in advanced fraud detection technologies to enhance security across banking, telecom, and e-commerce sectors.

Emerging technologies, including behavioral biometrics and AI-based monitoring, are being adopted widely to combat sophisticated fraud methods. The region faces high fraud losses, which fuels demand for real-time intervention tools that balance security with seamless user experience.

Latin America Market Trends

Latin America’s real-time fraud monitoring market is growing steadily, propelled by increasing digitization of financial services and the rise of e-commerce platforms. Brazil and Mexico are key contributors, with growing adoption of AI-driven detection and biometric authentication to improve fraud prevention efficiency.

Regulatory changes focused on data privacy and cybersecurity strengthen the need for robust real-time fraud monitoring. However, challenges like the high cost of advanced solutions and shortage of skilled professionals slow the market pace. Firms in Latin America are progressively integrating machine learning models to stay ahead of evolving threats.

By Offering: Solution

In 2024, the solution segment dominates the real-time fraud monitoring market with a 75.3% share. Solutions provide organizations with the essential tools to detect, analyze, and respond to fraudulent activity as it happens. They incorporate advanced technologies like artificial intelligence and machine learning to quickly identify suspicious transactions and patterns, minimizing financial losses and reputational damage.

These solutions are favored because they offer scalability and adaptability for various business needs, such as transaction monitoring, risk scoring, and compliance reporting. Organizations benefit from integrating these platforms directly into their existing systems, enabling proactive fraud prevention while maintaining operational efficiency.

By Deployment: On-Premises

In 2024, On-premises deployment holds a significant 58.5% share in this market. Enterprises choose on-premises systems for the control and security they provide, particularly where sensitive financial and customer data must be closely guarded. This deployment option aligns well with industries and regions where regulations require strict data residency and compliance measures.

Moreover, on-premises setups allow for customization tailored specifically to an organization’s infrastructure and security protocols. While cloud-based services are growing, many large organizations and those dealing with highly sensitive data still prefer on-premises deployment for real-time fraud monitoring due to these advantages.

By Enterprise Size: Large Enterprises

In 2024, Large enterprises dominate the market with a 66.2% share. Their extensive transaction volumes and complex operational structures create significant demand for robust real-time fraud monitoring solutions. Large organizations can justify higher investments in advanced fraud detection technologies, which help protect them from substantial financial and reputational risks.

These enterprises often need to meet stringent regulatory compliance requirements and manage diverse fraud threats across multiple channels. Real-time monitoring systems help such organizations maintain integrity and customer trust by quickly detecting and addressing fraud attempts in complex business environments.

By Industry: IT and Telecom

In 2024, the IT and telecommunications industry accounts for 26.7% of the market. This sector faces frequent fraud risks due to the high volume of digital transactions and data exchanges occurring daily. Real-time fraud monitoring is critical here to prevent losses from activities such as identity theft, subscription fraud, and cyberattacks targeting network access.

With the surge in mobile connectivity, cloud services, and online platforms, telecom and IT companies increasingly rely on fraud monitoring solutions to safeguard their infrastructures. These solutions also support compliance with sector-specific regulations and help maintain service quality by quickly responding to fraudulent incidents.

Emerging Trends

The 2025 landscape reveals a shift towards real-time systems that leverage machine learning with generative AI to detect fraud instantly, minimizing financial and reputational damage. An important trend is integration of behavioral biometrics – tracking user patterns like typing and device use for continuous verification.

Additionally, governments and financial sectors increasingly focus on AI-driven orchestration layers that correlate data across channels, spotting both external fraud and insider threats. Adaptive learning algorithms update fraud detection rules dynamically, improving accuracy as new tactics appear. Fraud related to account takeovers and AI-generated synthetic identities has risen, pushing firms to blend traditional monitoring with AI to maintain vigilance.

Growth Factors

The growth of real-time fraud monitoring is driven by the rising volume and sophistication of fraud attacks and the expanding use of digital payment methods worldwide. Account takeover fraud increased by 13% in 2024, with losses hitting billions, emphasizing the critical need for faster, smarter detection systems. Businesses benefit from reduced operational disruption and cost savings by catching fraud immediately.

The increasing availability of high-quality data, advances in AI processing power, and regulatory encouragement for tighter fraud controls also fuel adoption. Real-time monitoring systems that adapt and scale across varying organization sizes are gaining traction as essential tools to protect customer trust and minimize financial loss.

Key Market Segments

By Offering

- Solution

- Payment fraud

- Synthetic IDs

- Account takeover (ATO)

- Phishing and social engineering

- Credit and debit card fraud

- Others (ACH fraud, Money laundering, etc.)

- Services

- Professional Services

- Managed Services

By Deployment

- Cloud-Based

- On-Premises

By Enterprise Size

- Small & Medium Enterprise Size (SME’s)

- Large Enterprises

By Industry

- Banking, Financial Services and Insurance (BFSI)

- Government and Public Sector

- Aerospace & defense

- Healthcare

- IT and Telecom

- Automotive

- Retail and E-commerce

- Others (Gaming and Entertainment, Education, etc.)

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Instant Fraud Detection and Prevention

Real-time fraud monitoring’s key driver is its ability to detect and prevent fraud instantly as transactions occur. Traditional fraud systems often catch fraud after it happens, leading to financial losses and reputational risks. Real-time monitoring uses advanced analytics, machine learning, and AI to analyze transaction data continuously, flagging suspicious activity right away.

For instance, if an unusual spending pattern or suspicious login is detected, the system can immediately alert the fraud team or block the transaction, preventing losses before they happen. This instant reaction capability is increasingly valuable for sectors like digital payments and e-commerce, where rapid transactions leave little room for delayed fraud detection.

This immediate fraud detection cuts down both direct financial losses and costs related to investigations, chargebacks, and regulatory fines. It also helps maintain customer trust by minimizing disruptions caused by fraud. For example, banks and payment networks deploying real-time systems reduce false positives and improve accuracy, which keeps legitimate transactions flowing while blocking suspicious ones effectively.

Restraint Analysis

Risk of False Positives and Customer Friction

A major restraint for real-time fraud monitoring systems is the risk of false positives – legitimate transactions flagged as suspicious. This can frustrate customers who face declined payments or additional identity checks unexpectedly. For instance, an anomaly like a sudden high-value purchase from a known customer might trigger a false alarm, requiring manual review or customer intervention.

High false positive rates increase operational workload for fraud teams and can harm customer experience, potentially driving users to competitors. Balancing the sensitivity of detection systems to reduce false positives while maintaining accuracy is complex.

Overly strict rules cause friction, and overly lenient systems may miss fraud. Real-time systems must continuously refine their models, but this can be resource-intensive and slow to adapt to new fraud methods. Organizations often hesitate to fully deploy real-time monitoring for fear of these unintended consequences disrupting customer relationships and increasing operational costs.

Opportunity Analysis

Expanding Use Beyond Payments into Broader Digital Security

An important opportunity lies in extending real-time monitoring technologies beyond payment fraud into broader digital security areas such as account takeovers, synthetic identity detection, and social engineering attacks. Real-time systems provide deeper behavioral insights and faster anomaly detection, which can protect various digital channels and services beyond financial transactions.

For example, monitoring login attempts and unusual user behaviors can prevent account takeovers on online banking and digital platforms, reducing losses and enhancing user trust. This expansion creates a new market for real-time fraud monitoring tools in sectors like telecommunications, insurance, and government services where identity fraud is rising.

Additionally, integrating behavioral biometrics and AI-powered risk scoring further enriches prevention capabilities. As digital fraud tactics evolve and regulatory demands for stronger security grow, this opportunity will drive innovation and wider adoption of real-time systems across industries.

Challenge Analysis

Managing Data Privacy and Regulatory Compliance

A critical challenge for real-time fraud monitoring is managing sensitive user data while complying with increasingly strict privacy and security regulations. These systems ingest and analyze vast amounts of personal and transactional data in real time, which raises concerns about data protection, anonymity, and cross-border data handling. For instance, adherence to laws like GDPR in Europe and CCPA in the US requires robust encryption, data minimization, and transparent handling processes, which can complicate system design and increase costs.

Organizations must continuously adapt their fraud monitoring technologies to stay compliant without losing effectiveness. Failure to comply can lead to heavy fines and damage to reputation. Securing customer data while enabling real-time analysis demands significant investments in infrastructure and expertise. Also, rapidly changing regulations globally mean real-time fraud monitoring solutions must be agile and scalable to keep pace, representing a continuous challenge for providers and users alike.

Competitive Analysis

In the real-time fraud monitoring market, Microsoft, Amazon Web Services (AWS), and Splunk hold leading positions with advanced data analytics, cloud platforms, and AI-driven tools. Their solutions enable enterprises to detect suspicious transactions instantly, reducing financial risk and ensuring compliance with regulations.

Specialized providers such as DataVisor, ACI Worldwide, RSA Security, and Nasdaq Canada strengthen the market with focused expertise in fraud prevention and transaction monitoring. Their platforms combine behavioral analytics, anomaly detection, and threat intelligence to secure payment systems and digital channels.

Emerging players including Confluent, Materialize, ProHance, Hopsworks, and Aerospike contribute with innovative data streaming, real-time analytics, and AI infrastructure technologies. These firms focus on enabling high-speed data processing and scalable fraud detection frameworks. Their solutions appeal to organizations seeking agility and customization, complementing established providers and driving competition.

Top Key Players in the Market

- DataVisor, Inc.

- Microsoft

- Confluent, Inc.

- ProHance

- Materialize, Inc.

- Nasdaq Canada Inc.

- Splunk LLC

- RSA Security LLC

- ACI Worldwide

- Hopsworks

- Amazon Web Services, Inc.

- Aerospike, Inc.

- Others

Recent Developments

- April 2025: Microsoft reported blocking $4 billion in fraud attempts within the past year and introduced AI-driven fraud prevention features across its platforms. These include deep learning-based domain impersonation protection, AI-based fake job detection on LinkedIn, and rapid detection of tech support fraud with real-time session termination to combat scams.

- December 2024: DataVisor Inc. launched the fastest and most accurate AI-powered platform for real-time fraud detection that computes high-volume data features with 100% precision. This technology targets hotspots and distinct counts in transaction streams, enabling unmatched fraud threat identification and prevention for large merchants and financial platforms handling millions of transactions daily.

- September 2024: Confluent Inc. acquired WarpStream, a startup focused on decoupling compute and storage for data streaming, to expand its real-time data streaming portfolio. This acquisition enhances real-time data processing flexibility, a critical element for fraud monitoring systems relying on streaming data analytics.

Report Scope

Report Features Description Market Value (2024) USD 10.6 Bn Forecast Revenue (2034) USD 161.4 Bn CAGR(2025-2034) 31.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Offering (Solution (Payment Fraud, Synthetic IDs, Account Takeover (ATO), Phishing and Social Engineering, Credit and Debit Card Fraud, Others (ACH Fraud, Money Laundering, etc.)), Services (Professional Services, Managed Services)), By Deployment (Cloud-Based, On-Premises), By Enterprise Size (Small & Medium Enterprise Size (SMEs), Large Enterprises), By Industry (Banking, Financial Services and Insurance (BFSI), Government and Public Sector, Aerospace & Defense, Healthcare, IT and Telecom, Automotive, Retail and E-commerce, Others (Gaming and Entertainment, Education, etc.)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape DataVisor Inc., Microsoft, Confluent Inc., ProHance, Materialize Inc., Nasdaq Canada Inc., Splunk LLC, RSA Security LLC, ACI Worldwide, Hopsworks, Amazon Web Services Inc., Aerospike Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Real-time Fraud Monitoring MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample

Real-time Fraud Monitoring MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample -

-