Global Agentic AI in Fraud Detection & Prevention Market Size, Share, Statistics Analysis Report By Component (Solution (Fraud Analytics, Authentication, Governance, Risk, and Compliance, Others), Services (Professional Services, Managed Services), By Application (Identity Theft, Money Laundering, Payment Fraud, Others), By Organization (SMEs, Large Enterprises), By Vertical (BFSI, Government and Defense, Healthcare, IT and Telecom, Industrial and Manufacturing, Retail and E-commerce, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: February 2025

- Report ID: 139668

- Number of Pages: 354

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

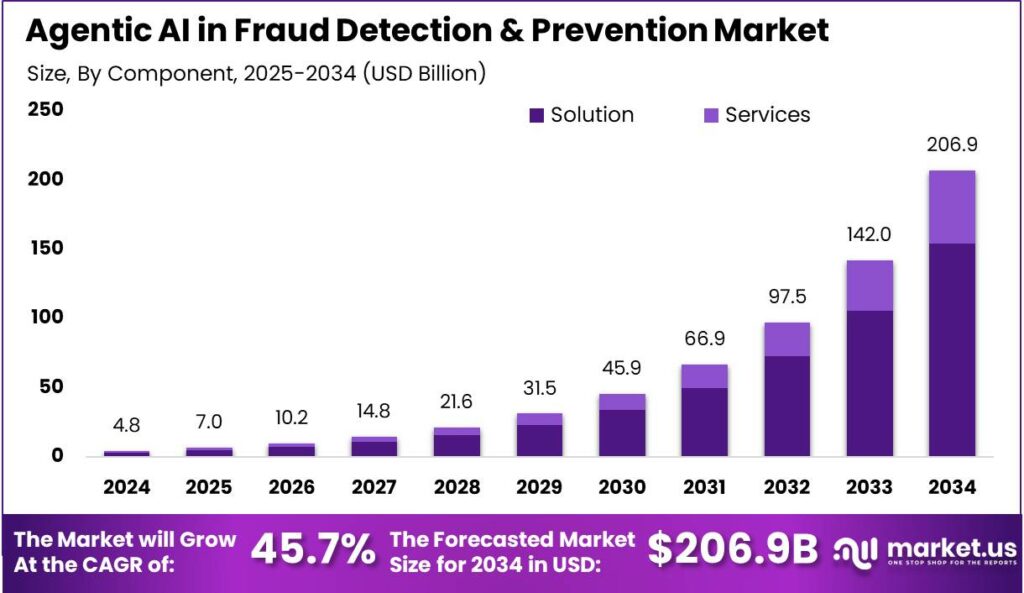

The Global Agentic AI in Fraud Detection & Prevention Market size is expected to be worth around USD 206.9 Billion By 2034, from USD 4.8 Billion in 2024, growing at a CAGR of 45.70% during the forecast period from 2025 to 2034. North America held a significant market share of over 39.2% in 2024, with a market value of approximately USD 1.8 billion.

The market for agentic AI in fraud detection is rapidly growing due to its ability to enhance the accuracy and efficiency of fraud prevention systems. Financial institutions and businesses increasingly recognize the value of integrating agentic AI into their security frameworks to handle the escalating complexity and volume of financial transactions.

Key drivers of the agentic AI market include the increasing volume of online transactions and the need for real-time fraud detection solutions that can adapt to evolving threats. The rising sophistication of fraud tactics also compels businesses to adopt advanced technologies that can outpace fraudsters.

Moreover, regulatory pressures and the need for compliance in financial operations further fuel the adoption of agentic AI systems, as they can efficiently navigate complex regulatory landscapes and ensure compliance through meticulous transaction monitoring and risk management.

Additionally, regulatory pressures compel businesses to maintain robust fraud detection systems, further boosting the adoption of these technologies. The ongoing advancements in AI and machine learning technologies continue to improve the accuracy and effectiveness of Agentic AI systems, making them an increasingly viable option for organizations looking to enhance their fraud detection capabilities.

The growing popularity of agentic AI is driven by its scalability and robustness. As AI technologies mature, they become more accessible and cost-effective for businesses of all sizes. The integration of AI with technologies like blockchain and predictive analytics further boosts its effectiveness, enhancing its ability to detect and prevent fraud.

The opportunities in the agentic AI market for fraud detection are vast, with innovations like deep learning and neural networks expanding its capabilities. As more industries, including healthcare and public administration, recognize AI’s potential, the technology is being applied to new areas, ensuring greater integrity and efficiency in fraud prevention.

Market expansion is evident as agentic AI penetrates global markets, driven by the increasing demand for technology solutions that can provide real-time, accurate fraud detection. The expansion is not just in terms of geographical reach but also in the depth and variety of applications tailored to specific industry needs.

Key Takeaways

- The Global Agentic AI in Fraud Detection & Prevention Market is expected to be worth around USD 206.9 Billion by 2034, growing from USD 4.8 Billion in 2024, reflecting a CAGR of 45.70% during the forecast period from 2025 to 2034.

- In 2024, the Solution segment dominated the market, holding more than 74.6% of the share.

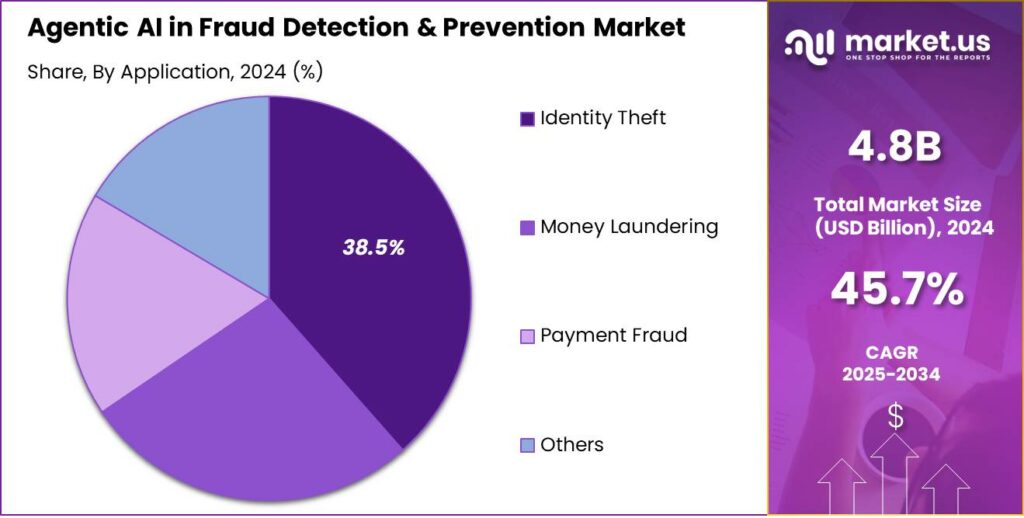

- The Identity Theft segment also held a dominant position in 2024, capturing more than 38.5% of the market share within the agentic AI in fraud detection and prevention.

- In 2024, Large Enterprises dominated the Agentic AI in Fraud Detection & Prevention Market, accounting for over 78.4% of the market share.

- The BFSI (Banking, Financial Services, and Insurance) segment was the largest in 2024, commanding more than 30.6% of the market share.

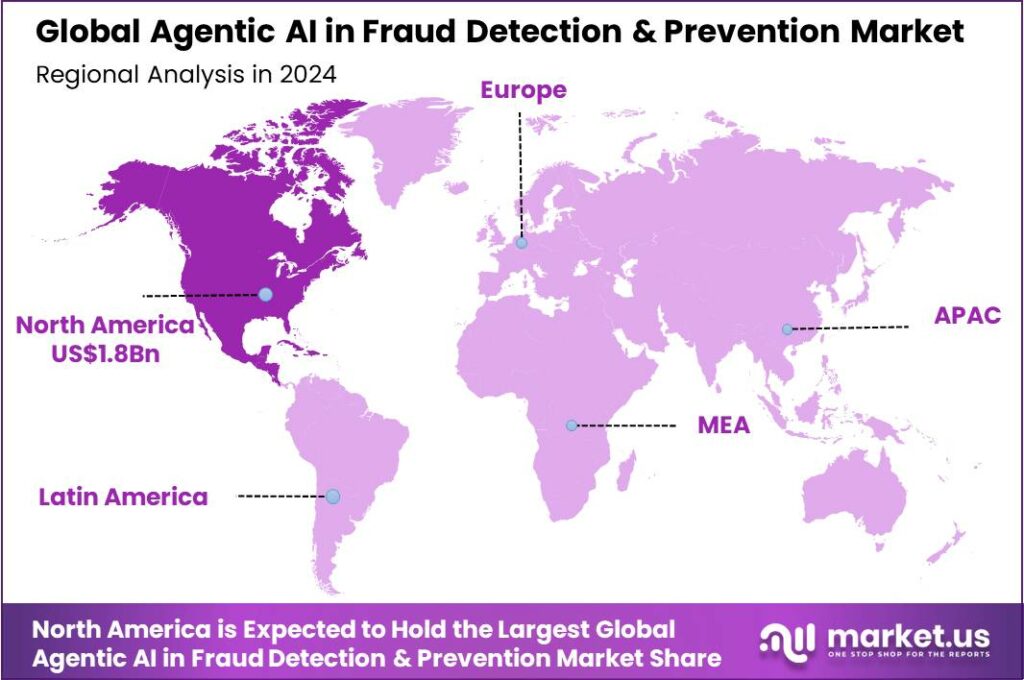

- North America held a significant market share of over 39.2% in 2024, with a market value of approximately USD 1.8 billion.

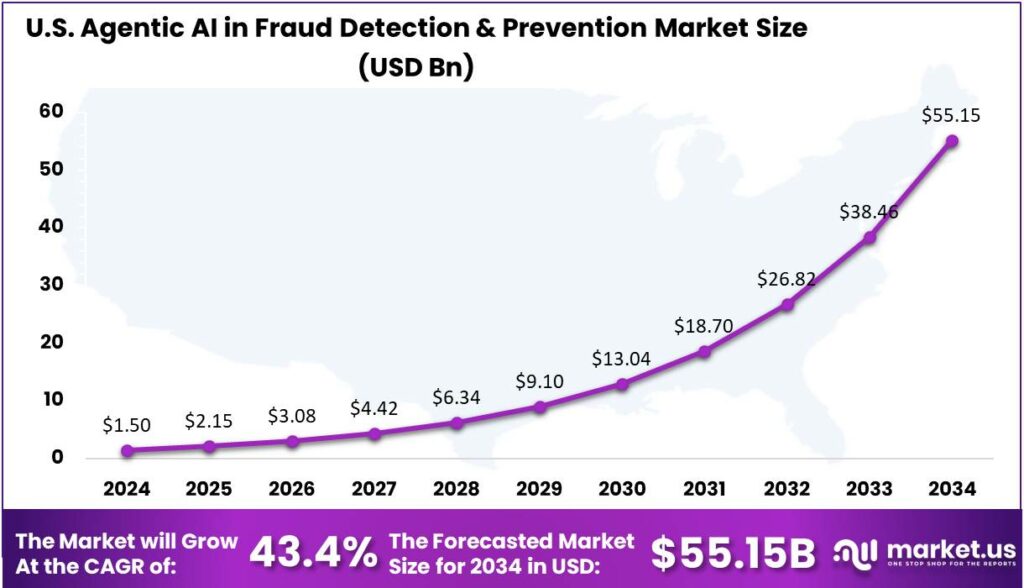

- The U.S. Agentic AI in Fraud Detection & Prevention Market is projected to be valued at USD 1.50 billion in 2024, with a CAGR of 43.4%.

U.S. Market Size

The market for Agentic AI in Fraud Detection and Prevention in the U.S. is anticipated to reach a valuation of $1.50 billion by the year 2024.It is expected to grow at a CAGR of 43.4%, driven by the increasing adoption of advanced AI technologies in fraud detection systems.

The growing demand for AI systems is driven by their ability to detect and prevent fraud in real-time across sectors like banking, insurance, and retail. Agentic AI technologies, such as machine learning and predictive analytics, are essential for organizations protecting their operations and sensitive data from cyber threats.

As the market expands, companies are investing heavily in research and development to further refine AI capabilities, aiming to stay ahead of sophisticated fraudulent schemes. This investment is expected to foster innovation in the AI space, leading to more effective and adaptable fraud prevention solutions that can handle the dynamic nature of fraud in the digital age.

In 2024, North America held a dominant market position in the Agentic AI in Fraud Detection & Prevention Market, capturing more than a 39.2% share. This region’s market value stood at approximately USD 1.8 billion, underlining its pivotal role in the global landscape.

North America’s advanced IT infrastructure and competitive financial sector play a key role in its dominance. U.S. companies are leading the way in integrating AI technologies to combat increasingly sophisticated fraud, especially in sectors like banking, healthcare, and e-commerce, which are often targeted by cybercriminals.

Moreover, the North American market benefits from the presence of major players in the AI and cybersecurity fields. These companies are not only advancing technology but also setting global trends. Their focus on innovation and developing cutting-edge agentic AI solutions for proactive fraud detection and prevention is key to maintaining the region’s market leadership.

Component Analysis

In 2024, the Solution segment held a dominant position in the Agentic AI in Fraud Detection & Prevention market, capturing more than a 74.6% share. This segment includes various sub-components such as fraud analytics, authentication technologies, and governance, risk, and compliance systems.

The Solution segment’s dominance is driven by the growing complexity and volume of financial transactions, requiring strong fraud detection and prevention. Fraud analytics technologies use advanced algorithms to identify irregular patterns, preventing fraudulent activities before they happen.

Fraud analytics solutions are crucial for the growth of the Solution segment, using machine learning and data analysis to detect potential fraud. Their ability to adapt to evolving fraudulent tactics without human intervention boosts their effectiveness.

Authentication technologies play a key role in the Solution segment’s market leadership by addressing rising cyber threats. Secure authentication and access control systems protect sensitive data, ensuring only authorized access. The growing use of multi-factor authentication (MFA) and advanced methods has fueled this sub-segment’s growth.

Application Analysis

In 2024, the Identity Theft segment held a dominant market position within the agentic AI in fraud detection and prevention market, capturing more than a 38.5% share. This segment’s leadership can be attributed to the increasing digitization of personal information and the corresponding rise in identity theft crimes.

The shift to online operations, accelerated by the global pandemic, has increased exposure to identity theft. Agentic AI systems now play a key role in analyzing transactional data across platforms, detecting inconsistencies and fraud patterns, driving demand in this segment.

One of the key reasons the Identity Theft segment leads in the market is the complexity and sophistication of modern identity theft schemes. Fraudsters today employ advanced tactics that can bypass traditional security measures, making it imperative for detection systems to evolve.

Tighter global data protection and privacy regulations, like GDPR, have driven companies to implement robust systems to secure personal data. Agentic AI systems assist organizations in complying with these laws by offering advanced tools to monitor and protect consumer data, thereby strengthening the Identity Theft segment’s market share.

Organization Analysis

In 2024, the Large Enterprises segment held a dominant market position in the Agentic AI in Fraud Detection & Prevention Market, capturing more than a 78.4% share. This dominance is primarily due to the high volume of transactions processed by large enterprises, which increases the risk and potential impact of fraudulent activities.

Large enterprises often possess the financial capability to invest in advanced AI technologies, which are still relatively expensive. This investment allows them to leverage comprehensive and customized AI solutions that can handle complex data patterns and large datasets, capabilities that are essential for effective fraud detection.

Large enterprises, especially in sectors like finance, healthcare, and telecommunications, face stricter regulations. Compliance often demands robust fraud detection systems. Agentic AI helps these companies meet legal standards while securing customer trust by protecting data and financial assets.

Additionally, the strategic partnerships between large enterprises and leading AI technology providers foster innovation and development in fraud prevention solutions tailored for large-scale operations. These collaborations help in refining the AI models continuously, thereby enhancing their accuracy and efficiency in fraud detection.

Vertical Analysis

In 2024, the BFSI (Banking, Financial Services, and Insurance) segment held a dominant market position in the Agentic AI in Fraud Detection & Prevention Market, capturing more than a 30.6% share. This leadership is largely attributed to the inherently high risk of fraud in financial transactions and the critical need for secure operations in this sector.

The complexity and volume of transactions in the BFSI sector necessitate robust and intelligent systems capable of real-time analysis and decision-making. Agentic AI systems are particularly effective in this environment as they can quickly analyze vast amounts of data to identify patterns and anomalies indicative of fraudulent activity.

The rapid digitization of financial services, including online banking and mobile transactions, has widened the attack surface for cybercriminals. The BFSI sector’s investment in agentic AI-driven solutions is crucial for mitigating risks across these digital channels. These AI systems evolve by learning new fraudulent tactics, improving their effectiveness over time.

The BFSI sector’s focus on innovation accelerates advancements in AI technologies. By collaborating with tech firms, financial institutions develop cutting-edge solutions to predict and prevent a wide range of frauds, positioning the sector as both a market leader and a technological pioneer in fraud detection and prevention.

Key Market Segments

By Component

- Solution

Fraud Analytics

Authentication

Governance, Risk, and Compliance

Others - Services

Professional Services

Managed Services

By Application

- Identity Theft

- Money Laundering

- Payment Fraud

- Others

By Organization

- SMEs

Large Enterprises

By Vertical

- BFSI

- Government and Defense

- Healthcare

- IT and Telecom

- Industrial and Manufacturing

- Retail and E-commerce

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Enhanced Operational Efficiency

Agentic AI automates complex, data-intensive tasks traditionally handled by humans, such as monitoring transactions and identifying fraudulent patterns. By processing vast amounts of data in real-time, it swiftly detects anomalies, reducing the time and resources spent on manual oversight.

Agentic AI also enhances decision-making by providing real-time analytics, identifying patterns, and suggesting actionable insights. This enables leaders to make data-driven decisions swiftly, reducing the time spent on strategic planning and improving overall operational agility. Additionally, AI can automate repetitive processes, allowing employees to focus on higher-value tasks and fostering innovation within the organization.This optimization leads to cost savings, increased productivity, and more efficient resource allocation.

Restraint

Ethical and Governance Challenges

The autonomous nature of Agentic AI raises significant ethical and governance concerns. Without proper oversight, these systems might make decisions that are opaque or even biased, leading to unintended consequences. Ensuring transparency in AI decision-making processes is crucial.

Furthermore, organizations should implement continuous monitoring and auditing mechanisms to track AI behavior and detect any anomalies or biases in real-time. This ensures that AI systems are not only compliant with ethical standards but also adaptable to evolving legal and societal expectations. Regular updates to governance frameworks are crucial as AI technology advances, allowing for proactive mitigation of risks associated with emerging capabilities and ensuring accountability.

Opportunity

Proactive Fraud Detection

Agentic AI offers the opportunity to shift from reactive to proactive fraud detection. By continuously analyzing transaction data and learning from emerging patterns, AI systems can identify potential fraudulent activities before they cause significant harm.

This proactive approach not only safeguards assets but also enhances customer trust. For example, AI agents can monitor transactions in real-time to detect anomalies and identify patterns indicative of fraud or suspicious activity, enabling proactive responses that prevent financial losses. Furthermore, AI can continuously learn and adapt, improving its ability to detect new fraud techniques, ensuring that security measures remain robust and up-to-date in the face of evolving threats.

Challenge

Integration and Adaptation

Integrating Agentic AI into existing systems poses a significant challenge. Organizations must upgrade their technological infrastructures to support AI capabilities, which can be resource-intensive. Additionally, employees need to be reskilled to work effectively alongside AI systems.

Ensuring that AI systems can adapt to changing environments and regulations while maintaining accuracy and compliance adds another layer of complexity. Moreover, it’s vital to have robust transparency and explainability mechanisms in place to ensure that any decisions made by the AI system can be audited, understood, and trusted by regulators, stakeholders, and users. Effective management of these aspects is critical to leveraging the full potential of Agentic AI in transforming fraud detection and prevention.

Emerging Trends

Agentic AI, or autonomous artificial intelligence, is transforming how we detect and prevent fraud across various sectors. Unlike traditional systems that rely on predefined rules, agentic AI learns from vast amounts of data to identify unusual patterns and behaviors in real-time. This adaptability allows it to stay ahead of evolving fraudulent tactics.

In the e-commerce sector, agentic AI analyzes purchasing patterns to detect anomalies that may indicate fraudulent activities. By continuously learning from new data, it can identify and respond to emerging threats, ensuring a safer shopping experience for consumers.

Moreover, agentic AI is being utilized to combat sophisticated scams, such as deepfake videos. Tools have been developed to detect real-time video deepfakes, which are increasingly used in fraudulent schemes. By identifying inconsistencies in video content, these AI systems can alert users to potential scams, adding an extra layer of security.

Business Benefits

One of the primary advantages is enhanced efficiency. Traditional fraud detection methods often involve manual reviews and are limited by static rules, making them time-consuming and less effective against new types of fraud. Agentic AI automates the monitoring process, analyzing vast amounts of data in real-time and reducing the need for human intervention.

Another benefit is improved accuracy. Agentic AI improves over traditional systems by learning from historical data and adapting to new information. This allows it to spot subtle patterns, reduce false positives, and ensure legitimate transactions aren’t wrongly flagged, boosting customer satisfaction.

Manual fraud detection processes are resource-intensive and prone to human error. Agentic AI automates these tasks, significantly increasing efficiency. For instance, while a seasoned analyst might take 35 to 90 minutes to review a single alert, an AI agent can process 100,000 alerts in less than 10.01 seconds.

Key Player Analysis

Key players are driving innovation by integrating Agentic AI into their fraud detection solutions.

ACI Worldwide is a leader in providing fraud prevention solutions that integrate Agentic AI. The company leverages AI and machine learning to help financial institutions detect and prevent fraud in real-time. Their solutions focus on reducing fraud while ensuring seamless customer experiences.

BAE Systems is another prominent player in the fraud detection market. The company’s solution uses advanced AI algorithms to monitor and assess transactions for suspicious behavior. By combining AI with cybersecurity expertise, BAE Systems offers a unique and powerful tool for businesses to protect themselves from fraud and data breaches.

Dell Inc. has positioned itself as a significant player in the fraud prevention field by offering AI-powered fraud detection systems designed to analyze transaction patterns and detect anomalies. By using machine learning and big data analytics, Dell’s solutions help businesses identify fraudulent activities faster and more efficiently.

Top Key Players in the Market

- ACI Worldwide

- BAE Systems

- Dell Inc.

- Equifax, Inc.

- Experian Information Solutions, Inc.

- Fiserv, Inc

- IBM Corp.

- NICE

- Oracle Corporation

- SAP SE

- SAS Institute Inc.

- LeewayHertz

- Others

Top Opportunities Awaiting for Players

- Advanced Threat Intelligence Integration: By incorporating AI-driven threat intelligence, companies can anticipate and prepare for emerging fraud tactics. This proactive stance enables organizations to stay ahead of sophisticated fraud schemes.

- Behavioral Analytics and Predictive Capabilities: AI’s ability to learn from user behaviors and predict fraudulent activities positions it as a crucial tool in preemptive fraud defense. By analyzing patterns such as login frequencies and transaction sizes, AI systems can flag anomalies in real-time, significantly reducing the incidence of fraud.

- Regulatory Compliance and Fraud Model Validation: With increasing regulatory scrutiny around fraud detection, there is a growing need for transparent and explainable AI models. Companies must adapt by enhancing the explainability of their AI systems and ensuring that they meet strict regulatory standards, offering significant opportunities for growth in compliance-focused AI solutions.

- Cross-industry Data Sharing Initiatives: The emergence of consortiums and partnerships among industries like finance, telecommunications, and social media facilitates enhanced data sharing. This collaborative approach not only broadens the scope of data available for AI analysis but also improves the accuracy and efficacy of fraud detection systems, creating a fortified defense against fraud.

- Integration of AI with Blockchain and Other Technologies: The convergence of AI with blockchain technology offers a robust framework for secure transactions and fraud prevention. This integration ensures transparency and immutability of records, providing an additional layer of security against fraud.

Recent Developments

- In February 2025, Visa finalized its acquisition of Featurespace to enhance its AI-driven fraud detection capabilities. This move strengthens Visa’s ability to use real-time, self-learning AI models for identifying and preventing fraudulent transactions.

- IBM launched a new suite of predictive AI tools in January 2025, focusing on anti-money laundering (AML) transaction monitoring and fraud detection. These tools leverage generative AI to provide actionable insights for compliance teams.

- In December 2024, SAP SE and SAS Institute announced a partnership to integrate their fraud analytics platforms with Agentic AI. This collaboration aims to deliver more accurate fraud predictions by analyzing complex transaction patterns.

- In October 2024, Experian launched Experian Assistant, a generative AI-enabled solution that accelerates the modeling lifecycle for fraud detection, reducing timelines from months to days or even hours. This solution integrates with the Experian Ascend Technology Platform.

Report Scope

Report Features Description Market Value (2024) USD 4.8 Bn Forecast Revenue (2034) USD 206.9 Bn CAGR (2025-2034) 45.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Solution (Fraud Analytics, Authentication, Governance, Risk, and Compliance, Others), Services (Professional Services, Managed Services), By Application (Identity Theft, Money Laundering, Payment Fraud, Others), By Organization (SMEs, Large Enterprises), By Vertical (BFSI, Government and Defense, Healthcare, IT and Telecom, Industrial and Manufacturing, Retail and E-commerce, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ACI Worldwide, BAE Systems, Dell Inc., Equifax, Inc. , Experian Information Solutions, Inc., Fiserv, Inc, IBM Corp., NICE, Oracle Corporation , SAP SE, SAS Institute Inc., LeewayHertz, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Agentic AI in Fraud Detection & Prevention MarketPublished date: February 2025add_shopping_cartBuy Now get_appDownload Sample

Agentic AI in Fraud Detection & Prevention MarketPublished date: February 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ACI Worldwide

- BAE Systems

- Dell Inc.

- Equifax, Inc.

- Experian Information Solutions, Inc.

- Fiserv, Inc

- IBM Corp.

- NICE

- Oracle Corporation

- SAP SE

- SAS Institute Inc.

- LeewayHertz

- Others