Global Ready To Cook Soup Market Size, Share, And Industry Analysis Report By Product Type (Tomato Ready to Eat Soup, Beans Ready to Eat Soup, Chicken Ready to Eat Soup, Beef Ready to Eat Soup, Mixed Vegetables Ready to Eat Soup), By Form (Dry Soup, Wet Soup), By Packaging Type (Packets, Bottles, Cans), By Application (Residential, HoReCa), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Online Sales Channel), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 175348

- Number of Pages: 256

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

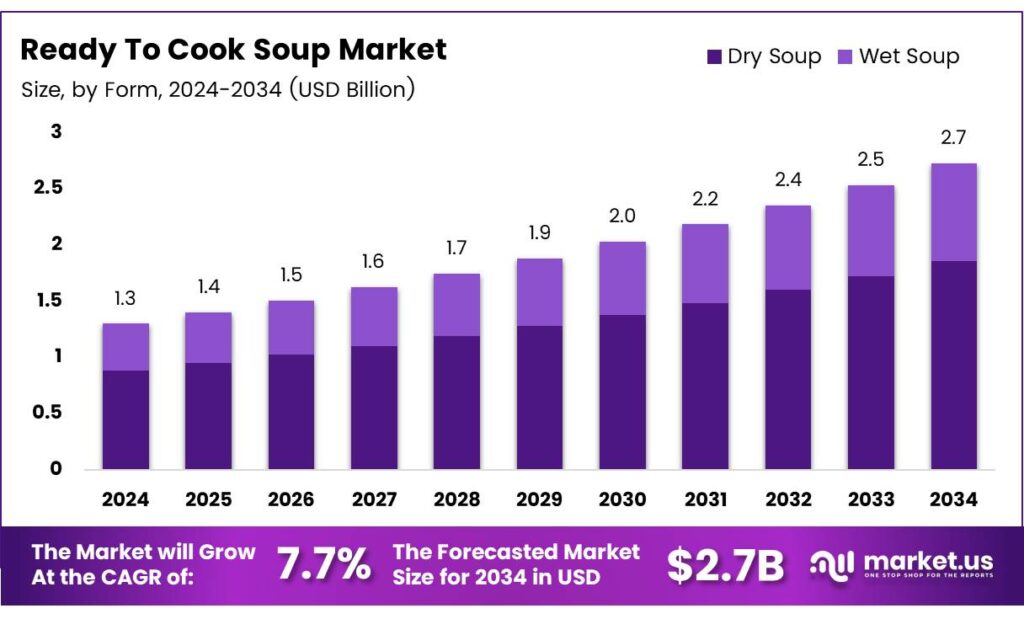

The Global Ready To Cook Soup Market size is expected to be worth around USD 2.7 billion by 2034, from USD 1.3 billion in 2024, growing at a CAGR of 7.7% during the forecast period from 2025 to 2034.

The Ready-to-Cook (RTC) Soup Market is growing rapidly as busy urban lifestyles and rising dual-income households drive demand for quick meal options like dehydrated mixes, instant bases, and semi-prepared broth kits. However, high sodium levels remain a concern, with the WHO recommending <2000 mg per day and studies showing many RTC products exceeding this limit by 17.1–167.3%, emphasizing the need for healthier formulations.

The market benefits from consumers seeking warm, nutritious, and easy-to-store options that reduce kitchen time without compromising flavor. Companies increasingly innovate RTC soup formulations with healthier bases, reduced additives, and clean-label claims, aligning with shifting dietary preferences. As household structures evolve, RTC soups remain a practical alternative to traditional cooking.

- WHO-aligned nutritional guidelines show that instant soups and bouillons may contain up to 600 mg/100 g of sodium. Encouragingly, studies demonstrate that salt content in instant chicken soups can be reduced by 15%, while vegetable soups allow up to 30% reduction without reducing taste. Sodium in spicy soups can be reduced by 32.5% using 0.7% monosodium glutamate, supporting healthier reformulations.

Furthermore, rising awareness around nutrition labeling and sodium guidelines influences innovation. Regulatory bodies encourage lower-salt formulations, reduced saturated fats, and transparent ingredient disclosures. This pushes manufacturers to reformulate soups without compromising sensory appeal. The shift also creates opportunities for low-sodium, gluten-free, high-protein, and plant-forward soup mixes positioned for health-conscious buyers.

RTC soups attract consumers prioritizing immunity, digestion, and functional nutrition. Rising adoption of dehydrated vegetables, lentil blends, and fortified broths strengthens market momentum. Meanwhile, technological advancements in drying and flavor-encapsulation methods help companies maintain aroma, color, and nutrient retention across long-shelf-life formats.

Key Takeaways

- The Global Ready To Cook Soup Market is projected to reach USD 2.7 billion by 2034, up from USD 1.3 billion in 2024, at a CAGR of 7.7% from 2025 to 2034.

- Tomato Ready to Eat Soup leads the product segment with a 27.9% market share.

- Dry Soup is the dominant form, holding 69.2% of the market in 2025.

- Packets lead the packaging type segment with a 49.5% share due to affordability and convenience.

- The Residential application segment dominates with 67.3% share in 2025.

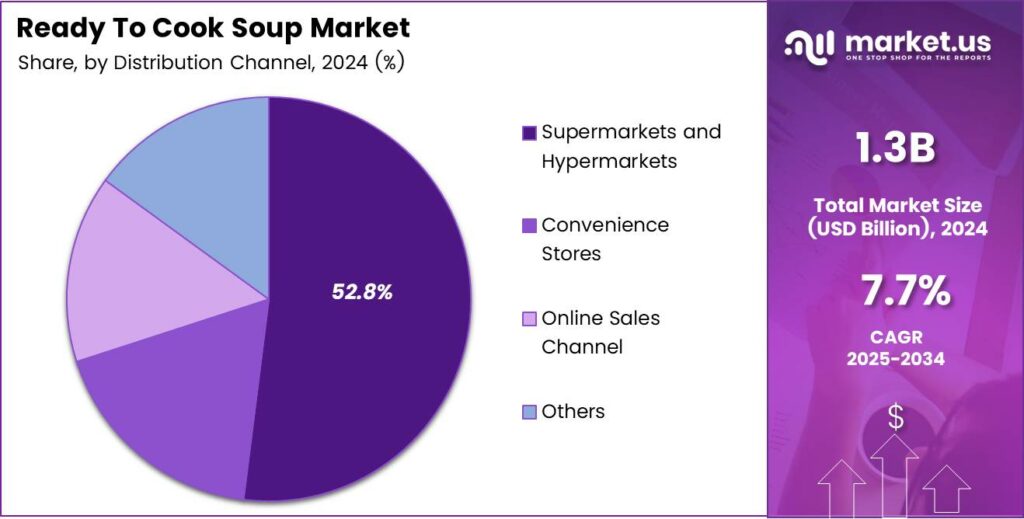

- Supermarkets and Hypermarkets account for the highest distribution share at 52.8%.

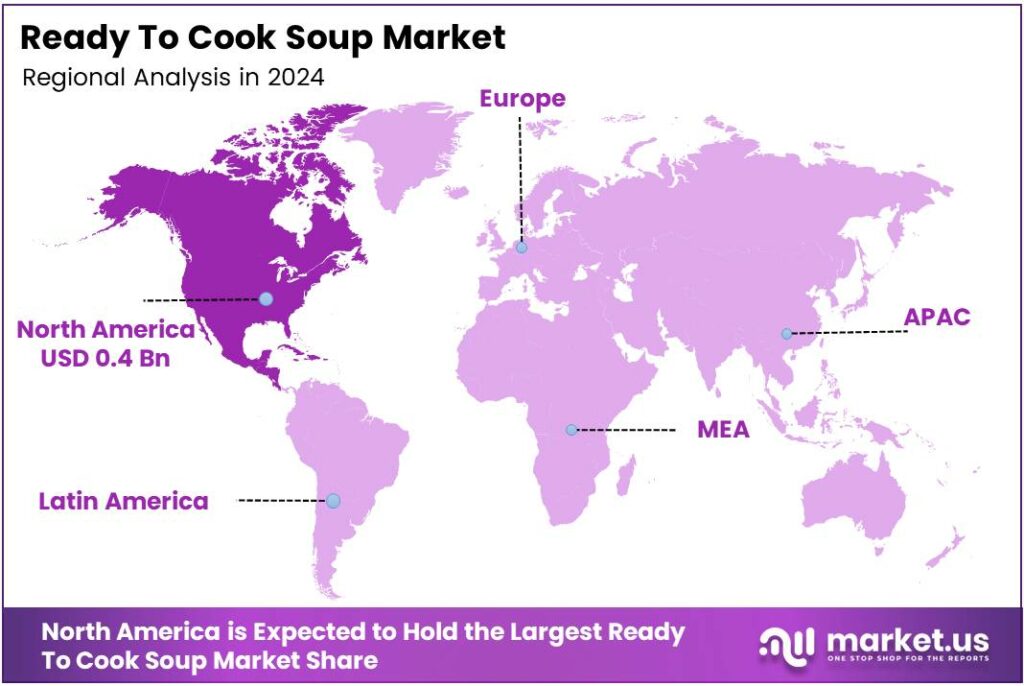

- North America leads regionally with 38.4% share, valued at USD 0.4 billion in 2025.

By Product Type Analysis

Tomato Ready to Eat Soup dominates with 27.9% due to its wide acceptance and consistent household demand.

In 2025, Tomato Ready to Eat Soup held a dominant market position in the ‘By Product Type’ Analysis segment of the Ready To Cook Soup Market, with a 27.9% share. Its balanced taste, easy preparation, and appeal among all age groups supported strong consumption across regions, boosting its ongoing market leadership.

Beans Ready to Eat Soup continued to expand as consumers looked for high-fiber and plant-protein options. Its demand grew steadily as health-focused shoppers preferred nutritious and filling soups. The segment benefited from rising interest in clean-label ingredients and convenient meal solutions.

Chicken Ready to Eat Soup gained popularity due to its familiar taste profile and protein-rich composition. Consumers appreciated its comfort-food appeal and the availability of premium variants with herbs and natural seasonings. Rising adoption in both households and foodservice outlets strengthened its presence.

Beef Ready to Eat Soup maintained stable growth, driven by consumers who preferred hearty and savory flavors. Its thicker textures and rich taste made it a preferred choice during colder seasons. The segment saw increased traction in markets with strong beef consumption habits.

By Form Analysis

Dry Soup dominates with 69.2% because of its long shelf life and easy storage.

In 2025, Dry Soup held a dominant market position in the ‘By Form’ Analysis segment of the Ready To Cook Soup Market, with a 69.2% share. Its lightweight packaging, affordability, and longer shelf stability made it the preferred choice among budget-conscious and convenience-driven consumers globally.

Wet Soup maintained a strong position as buyers looked for fresh-tasting, ready-to-cook formats that offer restaurant-like flavors. Its thicker consistency and premium ingredient mix appealed to emerging urban consumers. The growing placement of wet soups in chilled aisles boosted visibility and acceptance.

By Packaging Type Analysis

Packets dominate with 49.5% due to affordability and convenience.

In 2025, Packets held a dominant market position in the ‘By Packaging Type’ Analysis segment of the Ready To Cook Soup Market, with a 49.5% share. Their lightweight design, low cost, and wide retail distribution helped packets remain the most practical and accessible packaging choice for mass consumers.

Bottles continued to gain traction as brands introduced premium, ready-to-cook liquid bases. These formats allowed consumers to store and reuse products easily. The segment benefited from rising interest in preservative-free and fresh-style formulations.

Cans held a steady presence, especially among consumers who valued durability and prolonged storage. Canned ready-to-cook soups offered reliability in emergencies and bulk-buying situations. Consistent demand came from regions where canned goods are part of traditional pantry stocking habits.

By Application Analysis

Residential dominates with 67.3%, driven by rising home cooking trends.

In 2025, ‘Residential’ held a dominant market position in the ‘By Application’ Analysis segment of the Ready To Cook Soup Market, with a 67.3% share. Busy lifestyles, growing nuclear families, and the need for quick meals supported higher adoption of ready-to-cook soups at home.

HoReCa demand expanded as restaurants and cafés increasingly used ready-to-cook mixes to reduce preparation time. Consistent flavor profiles, bulk availability, and cost efficiency made them popular in commercial kitchens seeking convenience without compromising quality.

Others included institutional buyers such as schools, hospitals, and corporate cafeterias. These establishments valued ready-to-cook soups for their portion control and easy serving processes. Moderate yet steady growth was observed across emerging markets.

By Distribution Channel Analysis

Supermarkets and Hypermarkets dominate with 52.8% due to higher visibility and wider assortment.

In 2025, Supermarkets and Hypermarkets held a dominant market position in the ‘By Distribution Channel’ Analysis segment of the Ready To Cook Soup Market, with a 52.8% share. Their large shelf space, attractive deals, and variety of brands helped strengthen shopper preference.

Convenience Stores played a key role in quick purchases, especially in urban neighborhoods. Their proximity, extended hours, and smaller pack options attracted on-the-go consumers looking for fast meal solutions.

Online Sales Channels grew as digital shopping increased across regions. Consumers appreciated doorstep delivery, subscription offers, and the ability to compare brands instantly. Promotions and bundled packs further encouraged repeat purchases.

Key Market Segments

By Product Type

- Tomato Ready to Eat Soup

- Beans Ready to Eat Soup

- Chicken Ready to Eat Soup

- Beef Ready-to-Eat Soup

- Mixed Vegetables Ready to Eat Soup

- Others

By Form

- Dry Soup

- Wet Soup

By Packaging Type

- Packets

- Bottles

- Cans

By Application

- Residential

- HoReCa

- Others

By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Sales Channel

- Others

Emerging Trends

Growing Preference for Global Flavors and Premium Soup Varieties Shapes Market Trends

A key trend influencing the ready-to-cook soup market is the rising demand for global and exotic flavors. Consumers today are more willing to experiment with international tastes such as Thai curry, Mexican tortilla, or Japanese miso. This shift encourages brands to diversify product lines and introduce premium flavor combinations.

- The rising demand for functional soups is driven by consumers seeking more nutrition, with brands adding protein, fiber, immune-boosting herbs, and superfoods. With people spending only 0.65 hours a day on food prep, ready-to-cook soups appeal by cutting effort to a few steps—open, mix, heat, and stir—while still offering a home-style feel.

Sustainability is also shaping the market. Many consumers prefer brands that use eco-friendly packaging or responsibly sourced ingredients. As a result, companies are investing in recyclable materials, clean-label recipes, and transparent sourcing practices to strengthen brand loyalty.

Drivers

Rising Demand for Quick and Convenient Meal Solutions Drives Market Growth

The ready-to-cook soup market is gaining strong momentum as more consumers shift toward convenient meal options that fit their busy routines. With urban lifestyles becoming faster, people increasingly prefer foods that reduce preparation time while still offering comfort and taste. Ready-to-cook soups provide an easy solution by requiring only hot water or minimal cooking, making them suitable for working individuals and students.

- Ready-to-cook soups fill this gap by offering a quick, satisfying option without compromising on flavor. The CDC has highlighted how brand differences can be dramatic: sodium in chicken noodle soup can vary by as much as 840 mg per serving, which makes comparison shopping meaningful for households trying to manage salt.

Additionally, the rise of single-person households supports market expansion. People living alone often look for portion-controlled, easy-to-prepare foods, and ready-to-cook soups meet this need effectively. These products reduce food wastage while offering a variety of flavors to match changing preferences.

Restraints

Health Concerns Related to Processed Ingredients Limit Market Expansion

One of the major restraints for the ready-to-cook soup market is the rising concern surrounding processed food consumption. Many of these soups contain preservatives, flavor enhancers, or high sodium levels, which some consumers view as unhealthy. As people become more aware of nutritional risks, they may hesitate to consume processed soup products regularly.

Another barrier is the increasing preference for fresh and homemade food. With growing awareness of clean eating, some consumers prefer to prepare soups from scratch using fresh vegetables and natural ingredients. This shift reduces the frequency of purchasing ready-to-cook soup products, especially among health-focused buyers.

Price sensitivity also plays a role, particularly in developing markets. Ready-to-cook soups can sometimes be priced higher than homemade alternatives, reducing affordability for lower-income households. This limits market penetration in regions where cost is a major purchasing driver.

Growth Factors

Rising Demand for Healthier and Natural Soup Formulations Creates New Opportunities

A major growth opportunity in the ready-to-cook soup market lies in the rising consumer interest in healthier food choices. Companies are increasingly developing natural, organic, and preservative-free soup variants to meet this demand. These formulations appeal to buyers who want convenience without compromising on nutrition.

Plant-based diets are also creating new opportunities. With more consumers exploring vegan or vegetarian lifestyles, manufacturers can expand their portfolios with plant-forward soups rich in vegetables, legumes, and herbs. These offerings help companies attract a broader audience and tap into the growing wellness trend.

Another opportunity emerges from expanding e-commerce penetration. Online grocery platforms have made it easier for consumers to access international soup flavors, increasing product visibility and variety. Brands can launch exclusive online packs, bundle deals, or subscription models to improve sales.

Regional Analysis

North America Dominates the Ready-to-Cook Soup Market with a Market Share of 38.4%, Valued at USD 0.4 Billion

North America holds the leading position in the Ready To Cook Soup Market, supported by strong consumer preference for convenient, heat-and-serve meal options and expanding adoption among working households. The region’s dominance, accounting for 38.4% of total market share and valued at USD 0.4 billion, is further strengthened by rising demand for healthier, low-sodium soup formats.

Europe continues to demonstrate steady growth, driven by a long-established culture of packaged soups and increasing emphasis on clean-label, organic, and vegan formulations. Consumer preferences are gradually shifting toward convenience-driven meal solutions, supporting higher uptake of dehydrated and ready-in-minutes soup products.

Asia Pacific shows significant growth potential due to rapid urbanization, expanding middle-income populations, and increasing acceptance of Western-style convenience meals. Busy work schedules and growing dual-income households are fueling demand for quick-preparation soups, especially among young consumers. Rising e-commerce penetration and increasing adoption of healthy, flavor-rich soup varieties contribute to the region’s accelerating market momentum.

The Middle East & Africa region is witnessing the gradual adoption of ready-to-cook soups, supported by changing food consumption patterns and growing exposure to international packaged food brands. The rising expatriate population and expansion of modern retail formats are also boosting category visibility. Although the market is still emerging, increasing interest in convenience-based meal solutions is expected to drive sustained demand in the coming years.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Conagra Brands, Inc. is well placed in 2025 to capture ready-to-cook soup demand through its scale in U.S. retail, strong frozen and shelf-stable execution, and disciplined promo strategy. From an analyst lens, its advantage is turning mainstream brands into “weekday meal helpers,” while using packaging, portioning, and flavor variety to keep repeat buying high.

Nestle S.A. benefits from global reach and deep capabilities in nutrition, R&D, and regional taste localization key for ready-to-cook formats where familiarity matters. In 2025, Nestlé’s edge is stretching soup beyond “winter comfort” into year-round use cases like quick lunches and lighter evening meals, supported by cleaner labels and balanced nutrition cues.

Amy’s Kitchen, Inc continues to appeal to health-forward consumers who want convenience without compromising ingredient trust. The brand’s opportunity in 2025 is to widen access and affordability while protecting its premium positioning—especially by expanding vegetarian-friendly varieties, simpler ingredient lists, and portion-controlled formats that fit busy routines.

The Kraft Heinz Company is likely to stay competitive by leveraging mass distribution and brand recognition to defend shelf space and drive volume. The 2025 playbook is value-led innovation: approachable flavors, family-size options, and quick-prep propositions, while steadily improving perceived quality through recipe upgrades and clearer front-of-pack communication.

Top Key Players in the Market

- Conagra Brands, Inc.

- Nestlé S.A.

- Amy’s Kitchen, Inc

- The Kraft Heinz Company

- Campbell Soup Company

- Pacific Foods

- Kettle & Fire

- General Mills Inc.

- Hindustan Unilever Limited

- Baxters Food Group Limited

Recent Developments

- In 2024, Conagra Brands, which offers ready-to-cook soups under brands like Healthy Choice and Gardein, has focused on broader frozen food innovations and portfolio adjustments in recent years. The company highlights consumer trends such as the rise in GLP-1 use, preferences for spice, and indulgent in-home dining experiences shaping the $91.3 billion U.S. frozen food market.

- In 2025, Nestlé, known for ready-to-cook soup products under brands like Maggi, has emphasized sustainability and packaging innovations in recent reports, though no direct developments in the soup category were found for 2025-2026 from the queried sources.

Report Scope

Report Features Description Market Value (2024) USD 1.3 Billion Forecast Revenue (2034) USD 2.7 Billion CAGR (2025-2034) 7.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Tomato Ready to Eat Soup, Beans Ready to Eat Soup, Chicken Ready to Eat Soup, Beef Ready to Eat Soup, Mixed Vegetables Ready to Eat Soup, Others), By Form (Dry Soup, Wet Soup), By Packaging Type (Packets, Bottles, Cans), By Application (Residential, HoReCa, Others), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Online Sales Channel, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Conagra Brands, Inc., Nestle S.A., Amy’s Kitchen, Inc, The Kraft Heinz Company, Campbell Soup Company, Pacific Foods, Kettle & Fire, General Mills Inc., Hindustan Unilever Limited, Baxters Food Group Limited Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Ready To Cook Soup MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Ready To Cook Soup MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Conagra Brands, Inc.

- Nestlé S.A.

- Amy's Kitchen, Inc

- The Kraft Heinz Company

- Campbell Soup Company

- Pacific Foods

- Kettle & Fire

- General Mills Inc.

- Hindustan Unilever Limited

- Baxters Food Group Limited