Global Rail Logistics Market Size, Share, Growth Analysis By Service (Transportation Services, Integration & Consulting Services, Freight Forwarding Services, Warehousing and Distribution Services, Value-Added Logistics Services, Inventory Management Services), By Cargo Type (Bulk, Containerized, Others), By End Use (Mining and Metals, Retail & E-commerce, Agriculture & Food, Automotive, Energy, Chemical, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 150081

- Number of Pages: 340

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

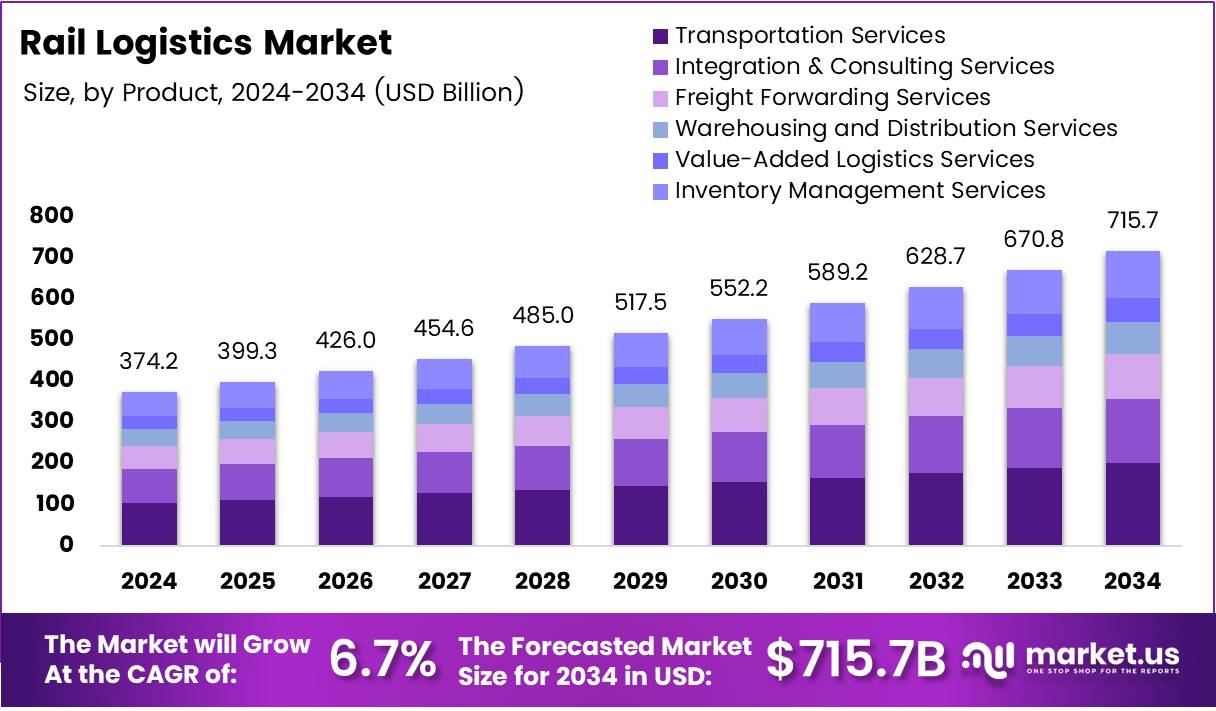

The Global Rail Logistics Market size is expected to be worth around USD 715.7 Billion by 2034, from USD 374.2 Billion in 2024, growing at a CAGR of 6.7% during the forecast period from 2025 to 2034. This growth is driven by the increasing demand for efficient, cost-effective transportation solutions and continued investments in infrastructure development.

Key Takeaways

- Global Rail Logistics Market is projected to reach USD 715.7 Billion by 2034, growing at a CAGR of 6.7% from 2025 to 2034.

- Transportation Services held a 29.8% share in 2024, driven by increasing demand for cost-effective transportation solutions.

- Bulk cargo dominated with the largest share in By Cargo Type Analysis in 2024, supporting industries like mining and agriculture.

- Mining and Metals was the leading segment in By End Use Analysis in 2024, driven by the transportation needs of coal, ores, and metals.

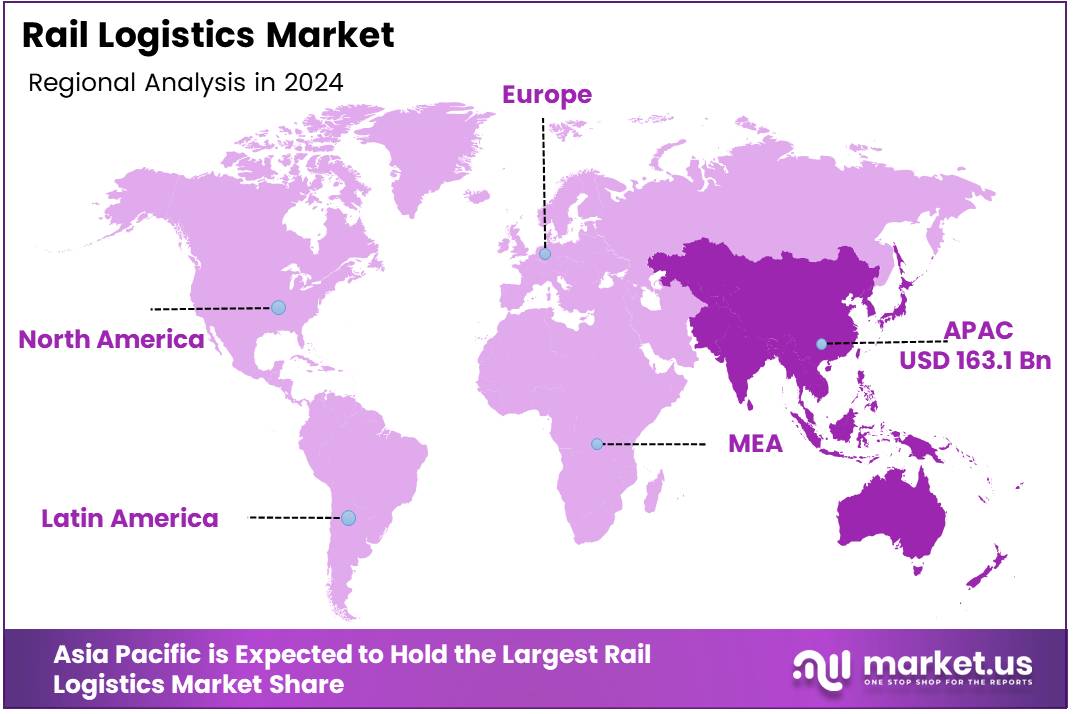

- Asia Pacific led the market with 43.6% share valued at USD 163.1 Billion in 2024, bolstered by a robust railway network and significant government investment.

The Rail Logistics Market is a vital component of the global supply chain, responsible for the transportation of goods over long distances via railways. This mode of transport has proven to be cost-effective and efficient for bulk goods, making it a preferred choice for heavy freight.

The market has shown notable growth, driven by increasing demand for cost-efficient and sustainable transportation solutions. In 2024, according to Times of India, freight transported by Indian Railways increased by nearly 2%, from 993.5 MT in 2023 to 1,014.4 MT. This growth indicates a steady rise in the reliance on rail logistics for handling a significant portion of goods movement across regions.

Opportunities in the Rail Logistics Market are being shaped by advances in infrastructure, technology, and increasing government investment. Governments worldwide are recognizing the strategic importance of rail freight as a mode of transport for bulk goods, particularly in emerging economies. This has resulted in major investments aimed at improving the rail infrastructure, modernizing railcars, and enhancing connectivity between key freight hubs.

The focus is on expanding rail networks, improving operational efficiency, and reducing transportation costs, making it more attractive for businesses to rely on rail for their logistics needs.

The China-Europe Railway, according to JusdaGlobal, has been a game-changer in the global rail logistics landscape. In 2024, the railway experienced a dramatic surge in freight train services, growing from 1,702 to over 17,000 services, marking an average annual growth rate of 39.5%.

This vast expansion showcases the growing importance of rail transport for cross-border logistics, linking more than 30 countries across Eurasia. With 186,000 TEUs of cargo in May 2024, the China-Europe railway has proven its capability to meet the growing demand for global trade.

The rail logistics industry also benefits from government regulations that promote sustainability and eco-friendly transportation options. Rail is considered a greener alternative to road and air freight, with its lower carbon emissions and higher energy efficiency.

Governments are encouraging the adoption of rail freight by offering incentives, tax breaks, and infrastructural support, further boosting the industry’s growth. In summary, the Rail Logistics Market is positioned for continued expansion, driven by investments, government support, and technological advancements that will enhance efficiency and connectivity in the global supply chain.

As the market continues to grow, stakeholders should focus on leveraging advancements in digitalization, automation, and sustainability to meet future demands. Enhanced coordination between rail operators and logistics providers will be key to driving further growth in this sector, making rail logistics an increasingly vital pillar of global trade.

Service Analysis

In 2024, Transportation Services held a dominant market position in the By Service Analysis segment of the Rail Logistics Market, with a 29.8% share.

Transportation Services played a significant role in the global rail logistics market in 2024, securing 29.8% share. This segment’s growth is attributed to the increasing demand for efficient and cost-effective transportation solutions. With a robust infrastructure in place, transportation services continue to be pivotal in ensuring the smooth movement of goods across regions.

Integration & Consulting Services are also crucial in optimizing the logistics process. As businesses seek to streamline operations, the need for consulting services that provide tailored solutions continues to rise. These services have shown considerable growth as they help clients manage complex logistical challenges and integrate new technologies.

Freight Forwarding Services, though smaller in share compared to Transportation Services, continue to experience steady growth. Their role in managing and coordinating the transportation of goods adds significant value to the logistics ecosystem.

Warehousing and Distribution Services have grown in importance as demand for storage capacity and timely distribution increases. These services facilitate seamless inventory management and enable businesses to meet customer demands efficiently.

Value-Added Logistics Services enhance the overall value proposition of logistics, offering services such as packaging, labeling, and assembly, which have become essential in meeting customer requirements.

Inventory Management Services are vital in maintaining supply chain efficiency. With the increasing complexity of global trade, managing inventory effectively has become crucial for businesses in this space.

Cargo Type Analysis

In 2024, Bulk held a dominant market position in the By Cargo Type Analysis segment of the Rail Logistics Market

Bulk cargo dominated the rail logistics market in 2024, contributing the largest share within the By Cargo Type Analysis segment. This dominance can be attributed to the ongoing demand for the transportation of heavy, non-perishable goods such as minerals, grains, and coal. The efficiency of bulk transport by rail ensures that large quantities can be moved over long distances in a cost-effective manner, providing essential support to industries such as mining and agriculture.

Containerized cargo follows closely in importance, with its growth fueled by the increasing need for intermodal transportation. This method allows for goods to be transported efficiently across rail, road, and sea, meeting the demands of global trade.

Other types of cargo also contribute to the market, although their share is smaller in comparison. These shipments typically include specialized products that require specific handling and transport conditions, further diversifying the logistics offering.

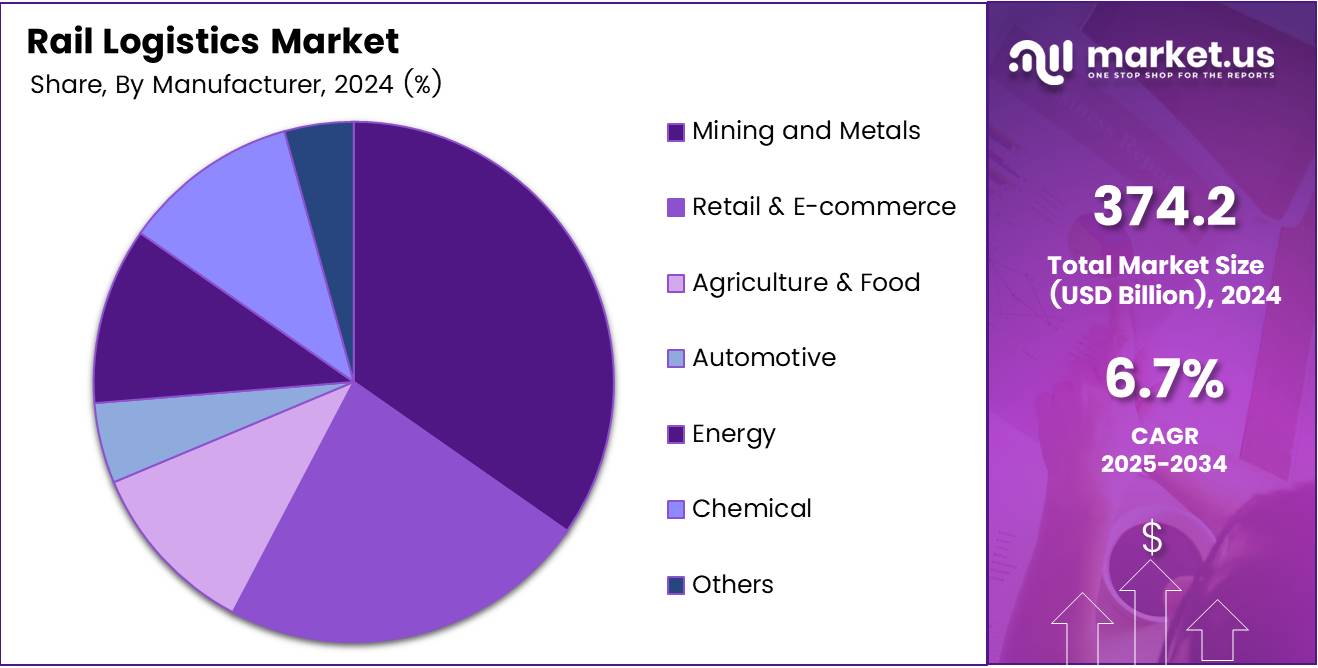

End Use Analysis

In 2024, Mining and Metals held a dominant market position in the By End Use Analysis segment of the Rail Logistics Market

In 2024, Mining and Metals held the largest share in the By End Use Analysis segment of the Rail Logistics Market, driven by the significant volume of materials such as coal, ores, and metals that require transportation via rail. This sector remains integral to the global economy, as these commodities are essential for industries ranging from energy production to manufacturing.

Retail & E-commerce has witnessed steady growth in recent years as the demand for rapid, reliable delivery of goods increases. Rail logistics offers a solution for the efficient movement of goods from distribution centers to retail hubs, helping companies meet the rising expectations of consumers.

Agriculture & Food, another key sector, relies heavily on rail logistics for the transportation of bulk agricultural products. These goods, such as grains and produce, benefit from rail’s ability to carry large quantities over long distances.

Automotive logistics also utilizes rail transportation to move finished vehicles and parts. This segment has seen growth as the demand for global trade in automobiles expands.

Energy and Chemical industries depend on rail logistics for the movement of raw materials and finished goods. These sectors require reliable and secure transportation networks to ensure continuous supply chains. Other industries such as pharmaceuticals and construction materials also contribute to the overall demand for rail logistics services.

Key Market Segments

By Service

- Transportation Services

- Integration & Consulting Services

- Freight Forwarding Services

- Warehousing and Distribution Services

- Value-Added Logistics Services

- Inventory Management Services

By Cargo Type

- Bulk

- Containerized

- Others

By End Use

- Mining and Metals

- Retail & E-commerce

- Agriculture & Food

- Automotive

- Energy

- Chemical

- Others

Drivers

Increasing Demand for Cost-Effective and Eco-Friendly Transportation Drives Market Growth

The rail logistics market is seeing steady growth as more businesses seek affordable and environmentally friendly transport solutions. Rail offers lower fuel costs and emits fewer greenhouse gases compared to road and air transport, making it a preferred option for bulk goods and long-distance shipping.

Modern technologies are also transforming rail infrastructure. Upgrades like smart signaling, automated systems, and better tracking tools are making rail logistics more efficient, reliable, and attractive for large-scale transportation needs.

Another key factor boosting the market is the growth of intermodal transport systems. These allow easy movement of goods between rail, road, and sea, helping businesses streamline their supply chains and reduce transit times.

Restraints

High Initial Infrastructure Development Costs Restrain Market Growth

Rail logistics requires a large upfront investment to build and maintain infrastructure such as tracks, terminals, and loading equipment. These high costs can limit new developments, especially in emerging markets where funding may be tight.

Another major challenge is the strong competition from road and air transport. These alternatives often provide faster or more flexible options, especially for short distances or time-sensitive deliveries, which can reduce demand for rail logistics in certain regions.

As a result, despite its benefits, rail logistics growth can be slowed down by financial and operational challenges that limit its expansion and modernization.

Growth Factors

Rising Demand for E-Commerce Driving Logistics Needs

E-commerce growth is pushing companies to improve logistics networks, and rail plays a big role in meeting that demand. With increasing online orders, businesses are turning to rail for bulk shipping to distribution centers efficiently.

The use of automation and artificial intelligence (AI) is also creating new opportunities. These technologies help manage freight operations better, optimize routes, and reduce delays, making rail logistics more competitive and responsive.

High-speed rail development for freight transport is another promising area. It allows faster movement of goods over long distances, which can support just-in-time delivery models and enhance overall supply chain performance.

Emerging Trends

Increased Focus on Sustainability and Green Logistics Drives Market Trends

The push for greener supply chains is shaping the future of rail logistics. Many companies and governments are choosing rail over other transport modes to cut emissions and reduce their environmental footprint.

The use of the Internet of Things (IoT) is also trending, enabling real-time tracking of goods. This increases transparency, improves planning, and reduces delays, which are crucial for customer satisfaction and efficiency.

Additionally, big data and analytics are transforming rail logistics. Companies are now using data to forecast demand, manage risks, and optimize supply chain operations, making rail a smarter and more strategic option in logistics.

Regional Analysis

Asia Pacific Dominates the Rail Logistics Market with a Market Share of 43.6%, Valued at USD 163.1 Billion

Asia Pacific leads the global rail logistics market, accounting for 43.6% of the overall share, valued at USD 163.1 billion. The region benefits from a well-established railway network, robust intermodal transport integration, and substantial government investment in infrastructure modernization. Countries like China and India are prioritizing freight efficiency, which is driving consistent growth in the sector.

North America Rail Logistics Market Trends

North America maintains a strong presence in the rail logistics market, underpinned by its extensive freight rail infrastructure and focus on energy-efficient cargo movement. The region’s market dynamics are influenced by rising demand for sustainable logistics solutions and interconnectivity with other transport modes. Investments in digitalization and autonomous rail systems further support market expansion.

Europe Rail Logistics Market Trends

Europe’s rail logistics market is shaped by stringent environmental regulations and strong cross-border freight movement within the EU. The shift from road to rail is encouraged through policy incentives, making rail an essential mode in sustainable supply chains. Ongoing electrification and innovation in freight corridors continue to strengthen the regional market outlook.

Middle East and Africa Rail Logistics Market Trends

The Middle East and Africa region is witnessing gradual growth in the rail logistics sector due to increased infrastructure development and regional connectivity initiatives. Governments are investing in freight corridors to support economic diversification and improve trade flow across key routes. Though currently smaller in scale, the market shows long-term growth potential.

Latin America Rail Logistics Market Trends

Latin America’s rail logistics market is evolving steadily, with countries working to improve outdated infrastructure and expand cargo rail capabilities. Economic shifts and regional trade agreements are contributing to an increased reliance on rail for bulk transport. However, fragmented networks and investment gaps continue to challenge faster market progression.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Rail Logistics Company Insights

In 2024, the global rail logistics market has been shaped by several key players driving innovation, efficiency, and sustainability. Rail Logistics, Inc. continues to make strides in integrating advanced tracking technologies and automation in freight management, enhancing end-to-end supply chain visibility. The company’s strategic focus on digital transformation places it at the forefront of operational optimization.

Canadian National Railway remains a dominant force in North America, leveraging its vast transcontinental network. Its investments in intermodal solutions and cross-border trade routes between Canada, the U.S., and Mexico have reinforced its competitive edge in long-haul freight transport.

PLS Logistic Services plays a crucial role by offering third-party logistics services tailored to complex supply chain needs. Its strength lies in its expansive carrier network and proprietary technology platform, which provides customers with cost-effective and flexible transportation solutions.

Union Pacific continues to leverage its massive infrastructure and data-driven logistics approach to maintain its leadership position. The company is also actively investing in sustainability initiatives, such as fuel-efficient locomotives and lower-emission practices, aligning with global environmental goals.

Collectively, these players are reshaping the rail logistics landscape through technological advancement, operational resilience, and a growing emphasis on green logistics. Their strategic moves in 2024 reflect the industry’s transition toward smarter, more integrated freight systems capable of meeting the evolving demands of global trade.

Top Key Players in the Market

- Rail Logistics, Inc.

- Canadian National Railway

- PLS Logistic Services

- Union Pacific

- BNSF Railway

- CSX Transportation

- Rhenus Group

- DHL

- CEVA Logistics

Recent Developments

- In May 2025, Helrom secured a $44 million green loan to accelerate its development of sustainable rail freight solutions. The funding aims to expand its innovative trailer-on-rail system across Europe.

- In February 2025, CargoBeamer raised €65 million to enhance its pan-European rail freight infrastructure. The investment will support terminal expansion and boost intermodal transport efficiency.

- In March 2024, SP Tech Solutions, a Polish rail-tech startup, closed a €2.7 million funding round. The capital will drive further innovation in rail transport optimisation technologies.

- In May 2024, RailState secured $4 million to expand its real-time rail network monitoring system. The U.S.-based firm plans to leverage AI for greater transparency and operational insights in rail logistics.

Report Scope

Report Features Description Market Value (2024) USD 374.2 Billion Forecast Revenue (2034) USD 715.7 Billion CAGR (2025-2034) 6.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Service (Transportation Services, Integration & Consulting Services, Freight Forwarding Services, Warehousing and Distribution Services, Value-Added Logistics Services, Inventory Management Services), By Cargo Type (Bulk, Containerized, Others), By End Use (Mining and Metals, Retail & E-commerce, Agriculture & Food, Automotive, Energy, Chemical, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Rail Logistics, Inc., Canadian National Railway, PLS Logistic Services, Union Pacific, BNSF Railway, CSX Transportation, Rhenus Group, DHL, CEVA Logistics Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Rail Logistics, Inc.

- Canadian National Railway

- PLS Logistic Services

- Union Pacific

- BNSF Railway

- CSX Transportation

- Rhenus Group

- DHL

- CEVA Logistics