Global Inbound Logistics Market Size, Share, Growth Analysis By Service (Transportation, Warehousing and Storage, Inventory Management, Procurement Services, Others), By Mode of Transportation (Road, Rail, Air, Sea), By End Use (Retail & e-commerce, Manufacturing, Automotive, Pharmaceuticals, Food and beverages, Electronics, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 142663

- Number of Pages: 372

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

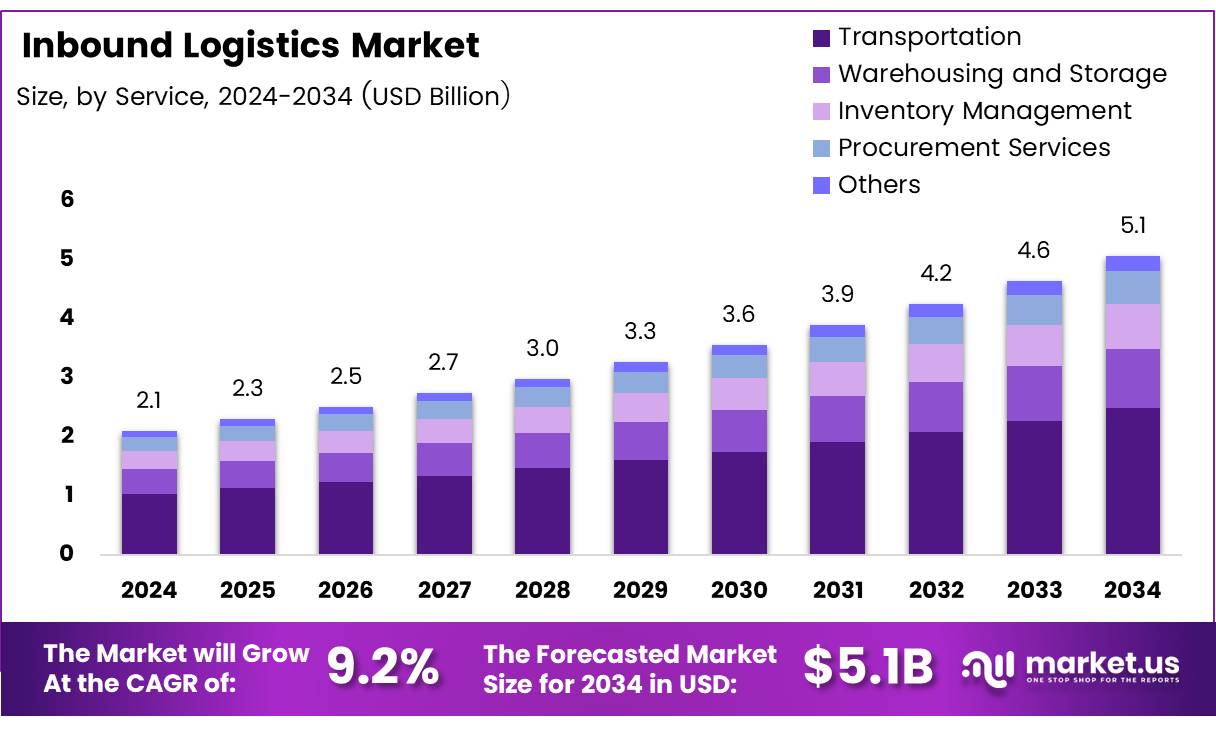

The Global Inbound Logistics Market size is expected to be worth around USD 5.1 Billion by 2034, from USD 2.1 Billion in 2024, growing at a CAGR of 9.2% during the forecast period from 2025 to 2034.

Inbound logistics encompasses the processes involved in the receipt, handling, and storage of raw materials and parts coming from suppliers to manufacturers. This sector is crucial for maintaining the efficacy and efficiency of supply chains, ensuring that production processes are not disrupted and that inventory levels are optimized to meet production demands.

The Inbound Logistics Market is a dynamic segment characterized by its critical role in optimizing supply chain operations and reducing costs. As businesses increasingly focus on core competencies, the reliance on specialized third-party services that manage inbound logistics has intensified.

This market segment involves a variety of services such as transportation management, inventory management, warehousing, and material handling, which are essential for streamlined operations in manufacturing and production industries.

The Inbound Logistics Market is experiencing substantial growth, driven by the increasing complexity of supply chains and the need for efficient inventory management. According to Shiprocket, in a recent survey, 88% of third-party logistics providers stated that they offer inbound logistics solutions in 2023, highlighting the widespread recognition of its importance.

Furthermore, over 65% of logistics companies have adopted AI-driven solutions to enhance their operations, as reported by Contimod. This integration of technology facilitates more precise demand forecasting and inventory control, significantly reducing waste and improving service delivery.

Government investments and regulations also play a pivotal role in shaping the market dynamics. As governments worldwide implement stricter regulations on supply chain transparency and sustainability, companies are compelled to invest in more efficient and compliant inbound logistics solutions. This regulatory environment not only ensures better compliance but also opens up opportunities for innovation and development in the sector.

Amidst regulatory changes, merchants are adjusting their strategies to stay competitive. According to Ware2Go, 68% of merchants are revising their inventory procurement and inbound logistics strategies this year. This shift is indicative of a broader trend where businesses are seeking to become more agile and responsive to market changes. Such strategic adjustments are essential for companies aiming to enhance their operational efficiencies and reduce lead times, thereby maintaining their competitive edge in the market.

Key Takeaways

- Global Inbound Logistics Market projected to grow from USD 2.1 billion in 2024 to USD 5.1 billion by 2034, at a CAGR of 9.2%.

- Transportation services led the By Service Analysis segment in 2024, holding a 44.6% share, crucial for efficient inbound logistics operations.

- Road transport dominated the mode of transportation in 2024, with a 52.8% share, benefiting from extensive road networks.

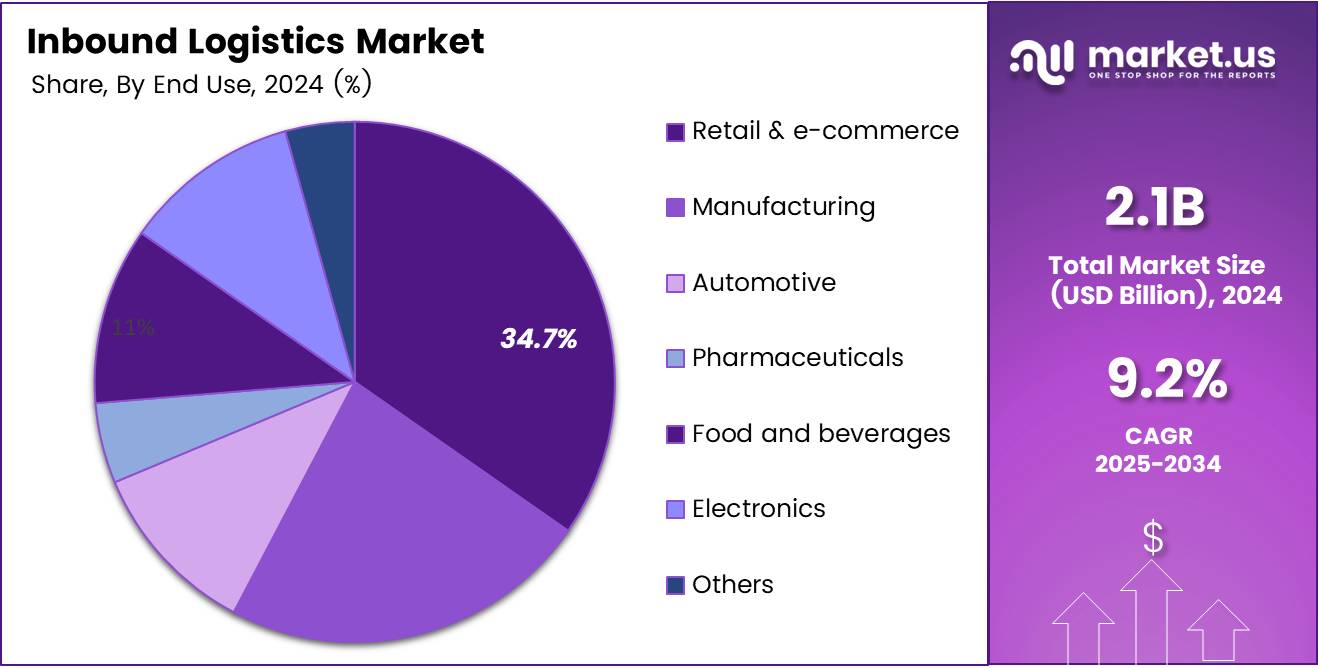

- Retail & e-commerce sector was the largest in the By End Use Analysis segment in 2024, comprising 34.7% of the market, driven by increasing online shopping and e-commerce growth.

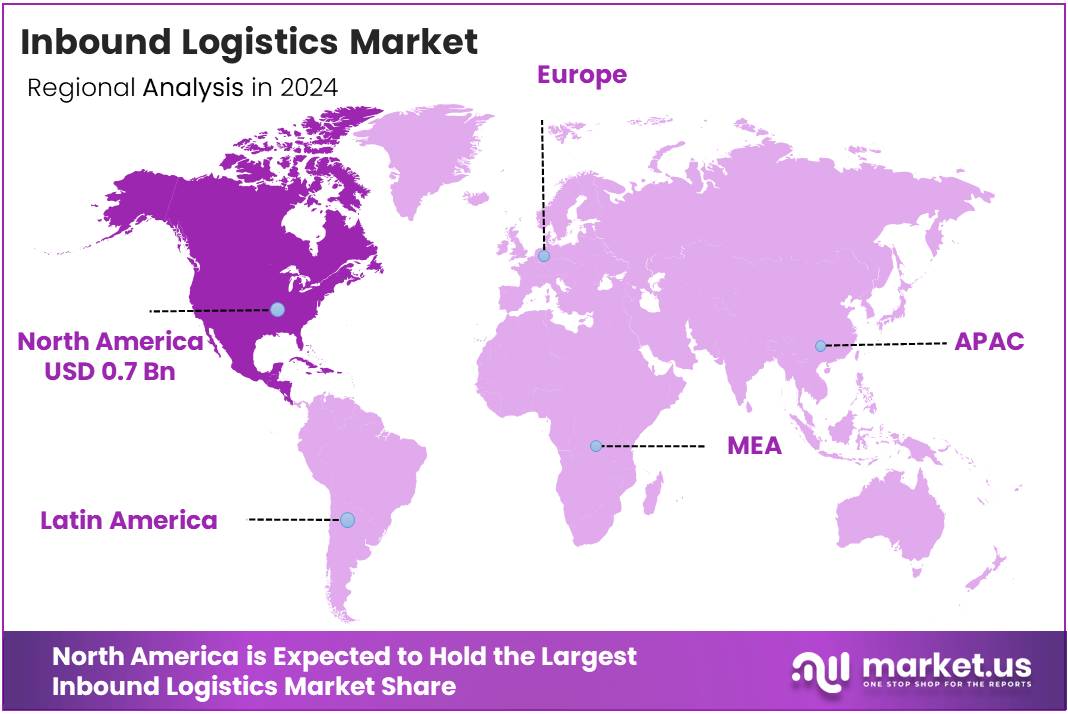

- North America held the largest regional market share in 2024 at 35.8%, equivalent to USD 0.37 billion, reflecting robust market activity.

Service Analysis

Transportation Leads the Pack in Inbound Logistics Services with a 44.6% Market Share

In 2024, the By Service Analysis segment of the Inbound Logistics Market was prominently led by Transportation, which accounted for a significant 44.6% share. This segment’s dominance can be attributed to the critical role transportation plays in the seamless execution of inbound logistics, ensuring timely and efficient delivery of goods across various industries.

Following Transportation, the Warehousing and Storage segment also marked a notable presence, providing essential support for inventory management by securing goods until needed in the production process or for further distribution. Inventory Management services, integral for optimizing stock levels and reducing holding costs, also contributed appreciably to the market, enhancing operational efficiency across supply chains.

Procurement Services played a key role by ensuring that the necessary raw materials and parts were available for production without delays, thereby supporting continuous production cycles. The ‘Others’ category, which includes value-added services such as packaging, assembly, and quality control, also held a share of the market, although smaller, each adding layers of value to the inbound logistics operations.

These segments collectively shape the dynamics of the Inbound Logistics Market, with each playing a specialized role that underscores the interconnectedness and dependency of modern supply chains on proficient logistic services.

Transportation Analysis

Road Continues to Lead with 52.8% Share in Inbound Logistics Transportation

In 2024, the mode of transportation analysis within the inbound logistics market witnessed a prominent leadership by road transport, holding a 52.8% share. This dominance can be attributed to the extensive and well-maintained road networks facilitating efficient, cost-effective transportation of goods across diverse geographical landscapes. Road transport’s adaptability to varying cargo types and sizes further reinforces its leading position in the market.

Rail transport, characterized by its reliability and large-volume capacity, also plays a crucial role in the distribution process. It offers environmental efficiency and cost advantages, particularly over long distances, positioning it as a favorable option for bulk shipments and heavy goods.

Air transport, despite being the most expensive mode, offers unmatched speed and connectivity, making it indispensable for time-sensitive and high-value shipments. Its market share is driven by the escalating demand for rapid delivery services, especially in sectors like pharmaceuticals and perishable goods.

Sea transport, known for its high capacity and low cost per volume, remains vital for international trade. It supports the bulk movement of goods globally, benefiting from ongoing advancements in container shipping and maritime logistics technologies.

Each mode presents unique advantages, shaping the dynamics of the inbound logistics market based on specific industry needs and shipment requirements.

End Use Analysis

Retail & E-commerce Captures Largest Share of Inbound Logistics Market at 34.7%

In 2024, Retail & e-commerce maintained a dominant position in the By End Use Analysis segment of the Inbound Logistics Market, commanding a substantial 34.7% share. This sector’s prominence can be attributed to the escalating demand for faster delivery services fueled by the rise in online shopping and the expansion of e-commerce platforms globally.

Enhanced supply chain efficiencies and the integration of advanced technologies such as artificial intelligence and machine learning for inventory and warehouse management further bolstered the sector’s leading stance.

The manufacturing sector also showed significant engagement with inbound logistics, driven by the need for streamlined operations and cost reduction in material handling. Automotive, another key player, leveraged inbound logistics to tighten production schedules and reduce inventory costs, aligning with just-in-time manufacturing principles.

The pharmaceuticals sector emphasized compliance and safety in its logistics operations, ensuring the integrity of supply chains for sensitive products. Food and beverages, and electronics sectors similarly depended on efficient inbound logistics to manage perishable goods and high-value components, respectively.

Other industries, including construction and textiles, also contributed to the inbound logistics market, each adapting to unique supply chain challenges to optimize operations and reduce overheads. This comprehensive involvement across sectors underscores the integral role of inbound logistics in modern industry frameworks.

Key Market Segments

By Service

- Transportation

- Warehousing and Storage

- Inventory Management

- Procurement Services

- Others

By Mode of Transportation

- Road

- Rail

- Air

- Sea

By End Use

- Retail & e-commerce

- Manufacturing

- Automotive

- Pharmaceuticals

- Food and beverages

- Electronics

- Others

Drivers

Surge in E-commerce Spurs Inbound Logistics Enhancements

The inbound logistics market is experiencing significant growth, primarily driven by the escalating demand for e-commerce. This surge in online shopping necessitates a robust system to manage the flow of goods from suppliers to warehouses, ensuring that operations are both timely and efficient.

Additionally, advancements in technology, including artificial intelligence (AI), the Internet of Things (IoT), and robotics, have revolutionized warehouse operations and inventory management, contributing to the heightened efficiency of inbound logistics systems.

The globalization of supply chains further complicates these processes, as companies now source materials from around the globe, adding layers of complexity to logistics management. Moreover, consumer expectations for faster delivery times compel companies to continually optimize their inbound logistics to meet these demands efficiently. This convergence of factors underscores the critical role of sophisticated inbound logistics in today’s fast-paced market environment.

Restraints

High Operational Costs Challenge the Efficiency of Inbound Logistics

In the inbound logistics market, various restraints can significantly hinder growth and operational efficiency. High operational costs, notably in transportation, labor, and warehousing, stand as a primary challenge.

These expenses not only escalate the overall cost of logistics operations but also affect the market’s ability to maintain efficient logistics workflows. Additionally, the integration of advanced technologies into existing systems presents another critical barrier.

While technological advancements aim to enhance logistic operations’ efficiency and reliability, the complexity and high costs associated with these integrations can impede their adoption. This slows down the improvement of logistics processes, further complicating the management of supply chains. Consequently, these factors collectively restrict the growth potential and operational effectiveness of the inbound logistics market, demanding strategic planning and innovation to mitigate these challenges.

Growth Factors

Emerging Markets Fuel Growth in Inbound Logistics

The inbound logistics market is poised for expansion as emerging markets offer fresh opportunities for the development of efficient supply chains and logistics networks. Strategic collaborations and partnerships between companies can foster shared logistics services and infrastructures, significantly reducing operational costs while enhancing service levels.

Moreover, the integration of advanced analytics and data science is becoming crucial, enabling firms to predict demand more accurately, manage inventories effectively, and optimize routing procedures.

Additionally, the shift towards circular supply chains, driven by the increasing adoption of circular economy principles, demands innovative logistics solutions that support the reuse and recycling of resources. This trend not only opens new avenues for growth but also aligns with global sustainability goals, making it a vital area for investment and development within the logistics sector.

Emerging Trends

Automation and Robotics Boost Efficiency in Inbound Logistics

The inbound logistics market is experiencing transformative shifts driven by several key factors enhancing operational efficiencies and responsiveness. Foremost, the integration of automation and robotics within warehousing operations marks a significant trend, streamlining processes such as sorting, storage, and retrieval of goods. This technological adoption not only speeds up operations but also reduces human error and enhances overall productivity.

Concurrently, blockchain technology is gaining traction for its role in fostering transparency and traceability in supply chains, ensuring a more trustworthy exchange of information across parties. Additionally, artificial intelligence (AI) is revolutionizing supply chain management with capabilities ranging from predictive analytics to real-time data processing, thus enabling more informed and rapid decision-making.

Moreover, recent global disruptions have compelled companies to prioritize the resilience of their supply chains, leading to strategic reevaluations and restructuring aimed at mitigating future risks. Collectively, these advancements are setting new standards for efficiency and reliability in the inbound logistics sector.

Regional Analysis

North America Leads with 35.8% Market Share, Fueled by Advanced Logistics Infrastructure and Digital Integration in Supply Chains

The Inbound Logistics market demonstrates a dynamic landscape across different geographical regions, each presenting unique trends and opportunities. In North America, the region dominates with a 35.8% market share, translating to USD 0.37 billion. This substantial portion can be attributed to advanced logistical infrastructure and the significant presence of logistics service providers who are adept at incorporating digital transformation strategies into supply chain operations.

Regional Mentions:

In Europe, the market benefits from stringent regulations which promote efficient logistics operations, combined with high demand for logistics automation. The region is characterized by a robust manufacturing sector and increased adoption of eco-friendly logistics solutions, contributing to steady growth in inbound logistics services.

Asia-Pacific is witnessing rapid growth in the inbound logistics market due to booming e-commerce sectors and manufacturing industries. Emerging economies such as China and India are pivotal, driven by urbanization, rising consumer spending, and improvements in cross-border trade policies. The strategic expansion of regional supply chains further enhances market prospects in this area.

The Middle East & Africa region is experiencing a transformation in its inbound logistics sector, propelled by infrastructural developments and government initiatives aiming to diversify economies beyond oil. The UAE and Saudi Arabia are at the forefront, investing heavily in logistics hubs and technological advancements to boost efficiency and connectivity.

Latin America, though smaller in market size, shows potential for significant growth. Factors such as increasing trade agreements and a growing retail sector are pivotal in driving the demand for efficient inbound logistics services. Additionally, efforts to modernize transportation infrastructure are expected to foster growth in this region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the global inbound logistics market, key players are poised to shape the industry landscape in 2024 significantly. CEVA Logistics, a prominent entity, continues to expand its global footprint by enhancing service delivery through technological integration and strategic partnerships. Similarly, Kuehne+Nagel leverages its robust network capabilities to offer tailored logistics solutions that cater to diverse industry needs, thus reinforcing its market presence.

XPO, Inc., known for its innovative approach, invests heavily in automation and digital platforms, which streamline operations and improve handling efficiencies. DB Schenker’s commitment to sustainability and efficient logistics solutions aligns with the increasing demand for eco-friendly practices within the sector.

United Parcel Service of America, Inc. (UPS) and FedEx are at the forefront in terms of scale and operational capacity. Their extensive networks facilitate effective management of inbound logistics, essential for timely deliveries. UPS, in particular, emphasizes advanced tracking systems and network optimization to enhance service reliability.

Ryder System, Inc., stands out for its fleet management expertise and logistic services that are crucial for cost efficiency and operational effectiveness. Expeditors International of Washington, Inc. capitalizes on its global logistics services and in-depth market knowledge to provide clients with competitive advantages in logistics planning.

Nippon Express and GEODIS focus on integrating global logistics operations with local expertise, thereby ensuring flexibility and responsiveness to market changes. The presence of other competitors in the market also stimulates innovation and service diversification, crucial for addressing the evolving demands of inbound logistics.

These key players are expected to drive growth and transformation in the inbound logistics market through strategic innovations, market expansion, and enhanced service offerings in 2024.

Top Key Players in the Market

- CEVA Logistics

- Kuehne+Nagel

- XPO, Inc.

- DB SCHENKER

- United Parcel Service of America, Inc.

- FedEx

- Ryder System, Inc.

- Expeditors International of Washington, Inc.

- Nippon Express

- GEODIS

- Others

Recent Developments

- In November 2024, DP World Australia expanded its logistics capabilities by acquiring Silk Logistics, enhancing its position in the supply chain sector.

- In September 2024, RXO completed its acquisition of Coyote Logistics, aiming to bolster its service offerings and broaden its logistical footprint.

- In December 2024, AVG Logistics announced the acquisition of a major stake in Kaizen Logistics, signifying a strategic move to strengthen its market presence.

- In March 2024, I Squared Capital successfully closed its acquisition of WOW Logistics, a prominent North American provider of logistics and supply chain services.

Report Scope

Report Features Description Market Value (2024) USD 2.1 Billion Forecast Revenue (2034) USD 5.1 Billion CAGR (2025-2034) 9.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Service (Transportation, Warehousing and Storage, Inventory Management, Procurement Services, Others), By Mode of Transportation (Road, Rail, Air, Sea), By End Use (Retail & e-commerce, Manufacturing, Automotive, Pharmaceuticals, Food and beverages, Electronics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape CEVA Logistics, Kuehne+Nagel, XPO, Inc., DB SCHENKER, United Parcel Service of America, Inc., FedEx, Ryder System, Inc., Expeditors International of Washington, Inc., Nippon Express, GEODIS, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- CEVA Logistics

- Kuehne+Nagel

- XPO, Inc.

- DB SCHENKER

- United Parcel Service of America, Inc.

- FedEx

- Ryder System, Inc.

- Expeditors International of Washington, Inc.

- Nippon Express

- GEODIS

- Others