Global Radio Transmitter Market By Type (Digital and Analog), By Frequency Range (FM Radio Transmitter, Shortwave Radio Transmitter, and Medium Wave Transmitter), By End-Use Industry, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Sept. 2023

- Report ID: 15197

- Number of Pages: 242

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Driving Factor

- Restraining Factor

- Growth Opportunity

- Latest Trend

- By Type Analysis

- By Frequency Range Analysis

- By End-Use Industry Analysis

- Key Market Segments

- Geopolitical and Recession Impact Analysis

- Regional Analysis

- Market Share and Key Player Analysis

- Recent Developments

- Report Scope

Report Overview

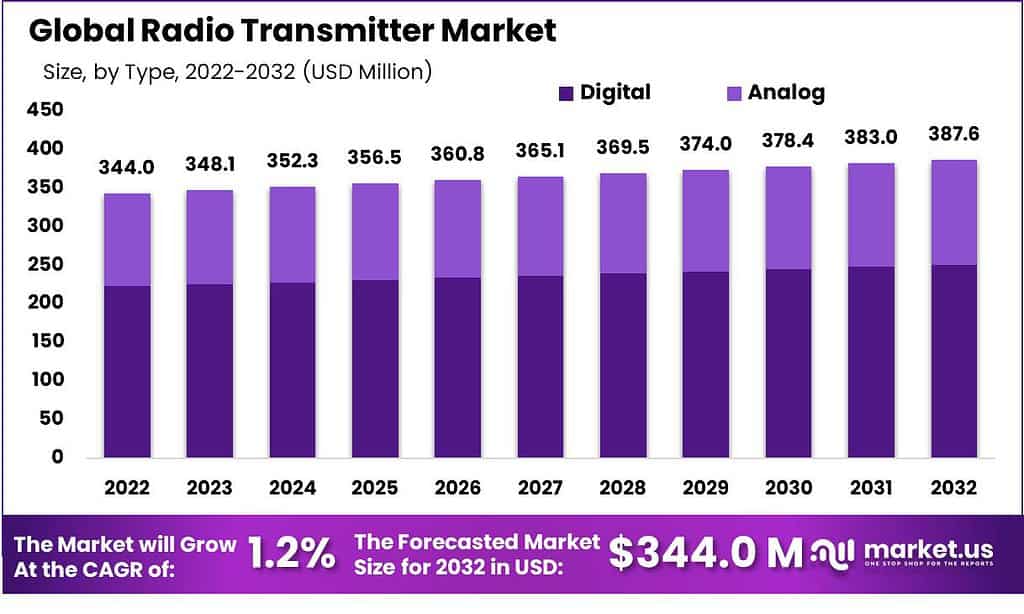

The Global Radio Transmitter market is predicted to be valued at USD 344.0 Million in 2022 and USD 387.6 Million by 2032. Over the projection period, sales in the Radio Transmitter market are expected to increase at a CAGR of 1.2%.

The radio transmitter market is a cornerstone of global communications and thrives in an age where connectivity reigns supreme. These critical devices facilitate the transmission of radio waves, serving industries from broadcasting to military and public safety. With technological advancements and digitalization, the market has witnessed a transformative shift, paving the way for innovative solutions. It involves analog and digital transmitters, catering to diverse frequency ranges and applications.

As the world becomes increasingly interconnected, opportunities within the market abound. Notable companies vie for dominance, offering high-efficiency and reliable transmitters. The sector’s dynamism, spurred by the growing demand for efficient broadcasting and communication, promises a future where radio transmitters continue to play a pivotal role in global connectivity.

Note: Actual Numbers Might Vary in the final report

Key Takeaways

- In 2022, the Global Radio Transmitter Market was valued at US$ 344.0 Million.

- The market is estimated to register the highest CAGR of 2% between 2023 and 2032.

- The market is propelled by the relentless evolution of communication needs.

- Stringent regulatory compliance requirements can obstruct the growth of the market.

- The rise of IoT and smart city initiatives is expected to create many opportunities in the market over the forecast period.

- The trend of miniaturization of transmitters is currently seen in the market.

- Based on Type, digital radio transmitters dominate the market by holding a major revenue share of 64.8%.

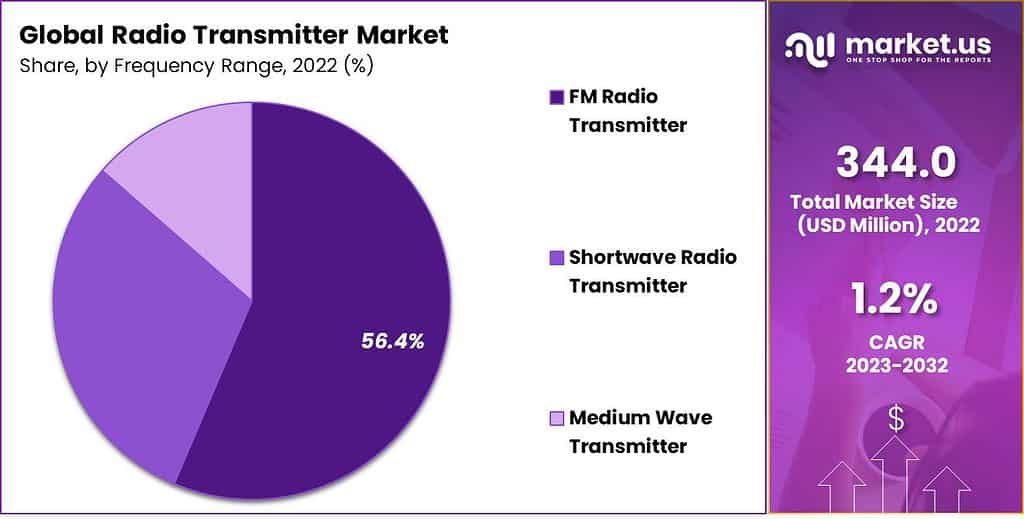

- Based on Frequency Range, FM radio transmitter leads the market with a major revenue share of 56.4%.

- Based on End-Use Industry, the aerospace & defense industry dominates the market with a major revenue share of 36.4%.

- Disrupted supply chains and economic slowdowns can significantly affect the growth of the market.

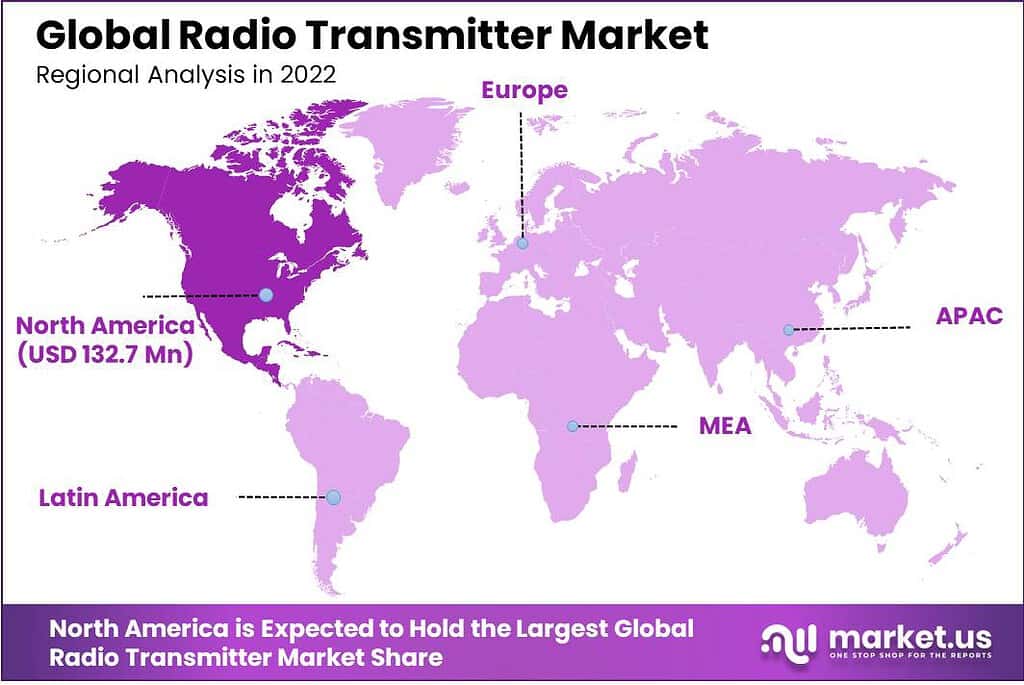

- Based on Region, North America dominates the market with a major revenue share of 38.6%.

- Some of the key players in the market are Harris Corporation, NEC Corporation, Rohde & Schwarz, GatesAir, Nautel, and Others.

Driving Factor

The Market is Propelled by the Relentless Evolution of Communication Needs

In an era of constant connectivity, radio transmitters are indispensable for diverse industries, from broadcasting to public safety. Key drivers include advancements in digital technology, necessitating more efficient and versatile transmitters. The surge in wireless communication demands high-quality broadcasting, fostering market growth. Additionally, the growing adoption of digital radio and expanding defense and emergency services applications drive the market’s upward trajectory. These factors, coupled with the demand for reliable and energy-efficient solutions, ensure a promising future for the Global Radio Transmitter Market.

Restraining Factor

Stringent Regulatory Compliance Requirements Can Obstruct the Growth of the Market

The shift toward digitalization, while driving innovation, poses a challenge in terms of retrofitting existing analog infrastructure. Economic fluctuations can affect investments in broadcasting equipment, impacting market growth. Moreover, stringent regulatory compliance requirements for frequency allocation and licensing can slow down product development and market expansion. The emergence of alternative communication technologies like streaming services and podcasts poses a threat, diverting attention and resources away from traditional radio. These restraints necessitate strategic adaptability within the industry to navigate the evolving landscape of the market.

Growth Opportunity

The Rise of IoT and Smart City Initiatives are Expected to Create Many Opportunities in the Market over the Forecast Period

The surge in demand for digital radio broadcasting, driven by superior audio quality and interactive features, offers a substantial growth avenue. Emerging markets, especially in Asia-Pacific and Latin America, exhibit untapped potential as radio broadcasting infrastructure expands. The rise of IoT and smart city initiatives fuels the need for reliable communication systems, driving the adoption of advanced radio transmitters. Additionally, innovations in energy-efficient and compact transmitter solutions cater to evolving industry requirements.

Latest Trend

Trend of Miniaturization of Transmitters

With superior audio quality and interactive features, digital radio gains momentum, driving increased demand. Moreover, the convergence of radio with online streaming services enhances accessibility and content diversity, reshaping the industry landscape. Miniaturization and energy efficiency are at the forefront, enabling the development of compact and eco-friendly transmitters. The market also witnesses growing interest in Software-Defined Radio (SDR) technology, which provides flexibility and adaptability to changing communication needs.

By Type Analysis

Digital Radio Transmitters Dominate the Market by Holding the Major Revenue Share of 64.8%

The market is divided into digital and analog based on type. Among these types, digital radio transmitters dominate the market by covering a major revenue share of 64.8%. Digital transmitters offer superior audio quality and transmission efficiency, meeting the evolving expectations of consumers and broadcasters. The global trend toward digitalization and the transition from analog to digital broadcasting standards has accelerated the adoption of digital transmitters. Moreover, the increasing prevalence of digital radio platforms and broadcasting networks worldwide supports the continued growth of digital radio transmitters. As a result, they remain the preferred choice for broadcasters and communication providers seeking advanced, reliable, and feature-rich solutions.

By Frequency Range Analysis

FM Radio Transmitter Lead the Market with a Major Revenue Share of 56.4%

On the basis of the frequency range, the market is classified into FM radio transmitters, shortwave radio transmitters, and medium wave transmitters. From these frequency ranges, FM radio transmitter leads the market by holding a major revenue share of 56.4%. FM radio broadcasting offers high-quality audio transmission, making it a preferred choice for music and voice content delivery, catering to a wide audience. FM frequencies are well-suited for urban and suburban areas, where the majority of radio listeners reside. Additionally, the stability and reliability of FM radio signals contribute to its dominance in broadcasting. While shortwave and medium wave transmitters serve specific niche applications and long-distance broadcasting, FM radio transmitters remain the primary choice for local and regional radio stations, making them the dominant frequency range in the market.

Note: Actual Numbers Might Vary in the final report

By End-Use Industry Analysis

Aerospace & Defense Industry Dominates the Market with a Major Revenue Share of 36.4%

Based on end-use industry, the market is classified into automotive, aerospace & defense, consumer electronics, and other end-use industries. Out of these end-use industries, aerospace & defense industry dominates the market by covering the major revenue share of 36.4%. The aerospace and defense industries rely heavily on radio transmitters for secure communications that are mission-critical, including military operations, air traffic control, and space exploration. Moreover, advancements in defense technologies as well as sophisticated communication systems have created demand for high-performance radio transmitters. Satellite communications and Unmanned Aerial Vehicles (UAVs) further reinforce this market growth. Furthermore, rigorous reliability, durability, and encryption requirements ensure radio transmitters are integral to aerospace & defense industry operations.

Key Market Segments

Type

- Digital

- Analog

Frequency Range

- FM Radio Transmitter

- Shortwave Radio Transmitter

- Medium Wave Transmitter

End-Use Industry

- Automotive

- Aerospace and Defense

- Consumer Electronics

- Other End-Use Industries

Geopolitical and Recession Impact Analysis

Disrupted Supply Chains and Economic Slowdowns can Significantly Affect the Growth of the Market

Geopolitical instability, such as trade disputes or sanctions and disruption in the supply chain leads to component shortages & increased manufacturing costs. The restrictions on technology exports can also hinder the market’s growth, particularly for defense-related applications. During economic recessions, reduced consumer spending affects advertising revenues, impacting investments in broadcasting equipment. Additionally, price conscious consumers may delay purchases of consumer electronics which can impact the market’s revenue growth.

Regional Analysis

North America Dominates the Market with Major Revenue Share of 38.6%

The North America region leads the market with a major revenue share of 38.6%. North America boasts a mature and technologically advanced broadcasting industry, with a high density of radio stations and a strong focus on digital broadcasting standards. The North America region is home to leading radio transmitter manufacturers and research institutions, fostering innovation and development. Moreover, North America’s defense and aerospace sectors rely heavily on radio transmitters for secure communication, driving demand. Furthermore, the presence of major broadcasting networks and media companies sustains a consistent need for state-of-the-art transmitters. All these factors are driving the growth of the North America region in the market.

The Asia Pacific region is expected to grow at the fastest CAGR throughout the forecast period. Continuously increasing demand for consumer electronics is expected to drive the growth of the Asia Pacific region in the market.

Note: Actual Numbers Might Vary in the final report

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

As of 2022, Harris Corporation holds a significant share of around 23%. Its dominance is attributed to its extensive product portfolio, technological innovations, and strong presence in North America and Europe. The rest of the market is comprised of many players, contributing to a highly competitive landscape. These key companies are adopting various strategies like mergers, acquisitions, collaboration, and partnerships to strengthen their position in the market. Some of the key players in the market are Harris Corporation, NEC Corporation, Rohde & Schwarz, GatesAir, Nautel, Elenos, Broadcast Electronics, Thales Group, RIZ-Transmitters Co., Continental Electronics, Thomson Broadcast and Other Key Players.

Top Key Players in the Radio Transmitter Market

- Harris Corporation

- NEC Corporation

- Rohde & Schwarz

- GatesAir

- Nautel

- Elenos

- Broadcast Electronics

- Thales Group

- RIZ-Transmitters Co.

- Continental Electronics

- Thomson Broadcast

- Other Key Players

Recent Developments

- In July 2023, Rohde and Schwarz showcased sustainable broadcasting in a connected world by highlighting high-performance, energy-efficient transmitters at NAB.

- In September 2022, Rohde & Schwarz launched the R&S TH1 transmitter platform, a high-power liquid-cooled transmitter designed for UHF bands. This transmitter offers software-defined operation for versatile functionality and support across all UHF bands.

Report Scope

Report Features Description Market Value (2022) USD 344.0 Mn Forecast Revenue (2032) USD 387.6 Mn CAGR (2023-2032) 1.2% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type – Digital and Analog; By Frequency Range – FM Radio Transmitter, Shortwave Radio Transmitter, and Medium Wave Transmitter; By End-Use Industry – Automotive, Aerospace & Defense, Consumer Electronics, and Other End-Use Industries. Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, and Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, and Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Harris Corporation, NEC Corporation, Rohde & Schwarz, GatesAir, Nautel, Elenos, Broadcast Electronics, Thales Group, RIZ-Transmitters Co., Continental Electronics, Thomson Broadcast, and Other Key Players. Customization Scope Customization for segents, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is a radio transmitter?Radio transmitters are electronic devices which convert electrical signals into electromagnetic radio waves that travel without being limited by physical medium. Radio transmitters have many uses within broadcasting, telecommuting and navigation applications.

How is big Global Radio Transmitter market?The Global Radio Transmitter market is predicted to be valued at USD 344.0 Million in 2022 and USD 387.6 Million by 2032. Over the projection period, sales in the Radio Transmitter market are expected to increase at a CAGR of 1.2%.

What are the main applications of radio transmitters?Radio transmitters have many applications, from AM and FM broadcasting, wireless communication (e.g. cell phones) and radar systems to two-way radios and military communications.

What are two types of radio transmitter?Two types of radio transmitters are:

- Amplitude modulation (AM) transmitters: These transmitters vary the amplitude (strength) of the carrier wave to represent the information signal.

- Frequency modulation (FM) transmitters: These transmitters vary the frequency of the carrier wave to represent the information signal.

What are the 5 components of a radio transmitter?The five main components of a radio transmitter are:

- Oscillator: The oscillator generates the RF carrier wave.

- Modulator: The modulator impresses the information signal onto the carrier wave.

- Power amplifier: The power amplifier amplifies the modulated carrier wave.

- Filter: The filter removes any unwanted signals from the modulated carrier wave.

- Antenna: The antenna transmits the modulated carrier wave to the receiver.

Are there specific trends in radio transmitter technology that are worth noting?Yes. Some notable trends include the adoption of software-defined radio (SDR) technology, advancements in digital modulation techniques, increased power efficiency and miniaturization of transmitters.

-

-

- Harris Corporation

- NEC Corporation

- Rohde & Schwarz

- GatesAir

- Nautel

- Elenos

- Broadcast Electronics

- Thales Group

- RIZ-Transmitters Co.

- Continental Electronics

- Thomson Broadcast

- Other Key Players