Global Radial Compression Devices Market By Product Type (Band/Strap-Based, Knob-Based, Plate-Based, Others), By Usage (Disposable, Reusable), By End-User (Hospitals, Independent Catheterization Laboratories, Ambulatory Surgical Centers, Specialized Clinics), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169309

- Number of Pages: 299

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

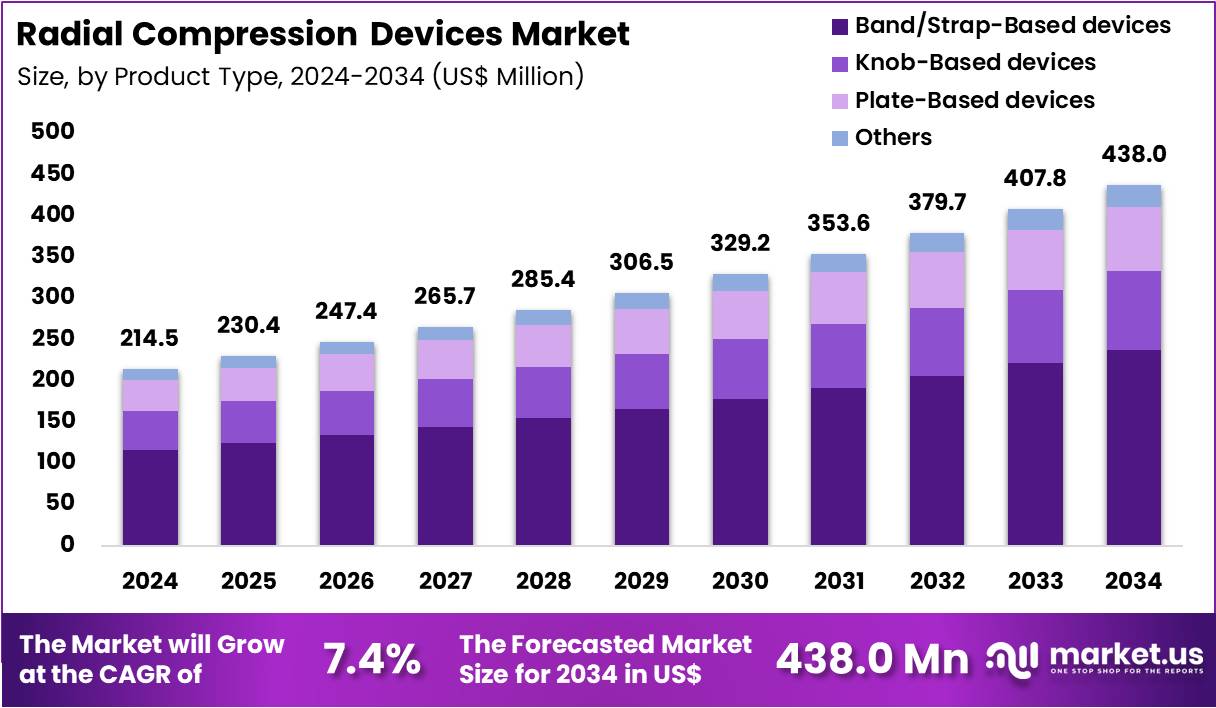

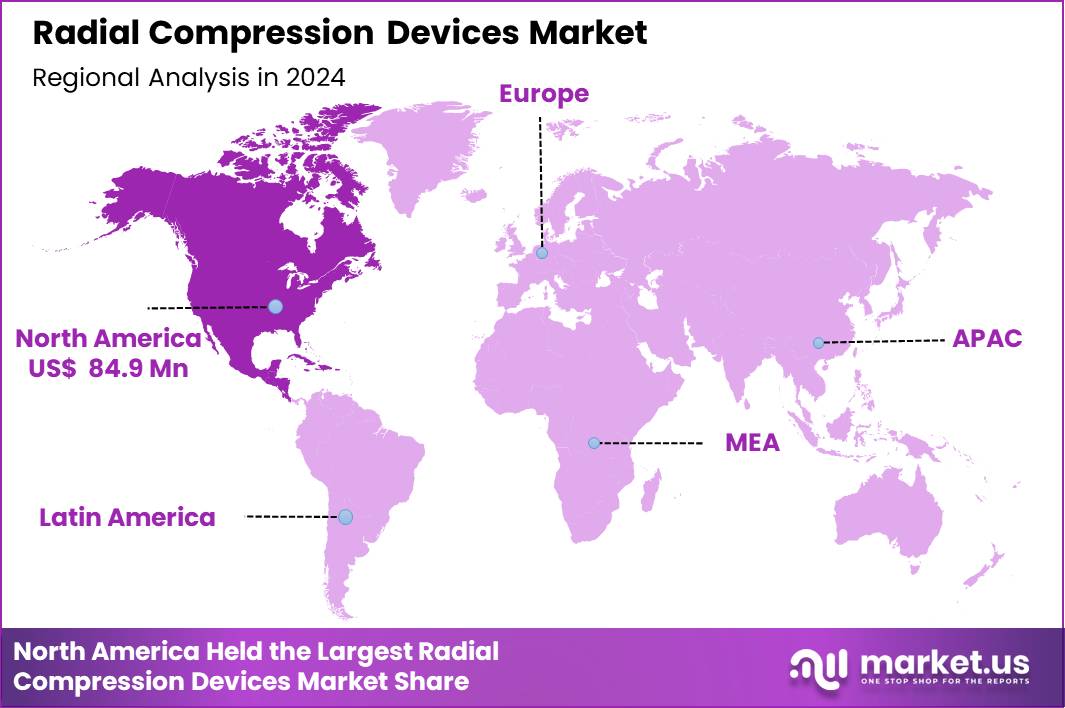

Global Radial Compression Devices Market size is expected to be worth around US$ 438.0 Million by 2034 from US$ 214.5 Million in 2024, growing at a CAGR of 7.4% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 39.6% share with a revenue of US$ 84.9 Million

The Radial Compression Devices Market is expected to grow steadily as radial artery access becomes the preferred method for cardiac catheterization due to lower vascular complications, shorter recovery time, and reduced hospital stays. These devices apply controlled compression at the radial artery puncture site after angiography or percutaneous coronary intervention (PCI).

The market benefits strongly from increasing PCI volumes, rising adoption of minimally invasive cardiac procedures, and a shift from femoral to radial access in interventional cardiology. Globally, over 10–12 million PCI procedures are performed annually (ESC & global cath-lab registry estimates). Radial access is used in more than 60% of global PCI cases and exceeds 80–90% in several countries (Japan, UK, Scandinavian nations). PCI procedure volumes are increasing at 4–5% annually due to rising CVD incidence.

Hospitals, catheterization laboratories, and ambulatory surgical centers continue to expand usage as radial access is clinically endorsed for improved patient comfort and lower bleeding risks. Manufacturers such as Terumo Corporation, Abbott, Merit Medical, and Teleflex have advanced compression mechanisms ranging from band-based to knob-based adjustable systems supporting adoption across diverse clinical settings. The market also benefits from the increasing preference for single-use, sterile compression bands, aligning with infection-prevention guidelines.

Growing prevalence of cardiovascular diseases, increasing interventional cardiologists trained in radial techniques, and enhanced device ergonomics collectively expand market penetration. Improved product designs such as transparent plates, step-wise pressure adjusters, and hydromechanical systems enhance efficiency and safety during post-procedure hemostasis.

Key Takeaways

- In 2024, the market generated a revenue of US$ 214.5 million, with a CAGR of 7.4%, and is expected to reach US$ 438.0 million by the year 2034.

- The Product Type segment is divided into Band/Strap-Based devices, Knob-Based devices, Plate-Based devices, and Others, with Band/Strap-Based devices taking the lead in 2024 with a market share of 54.2%

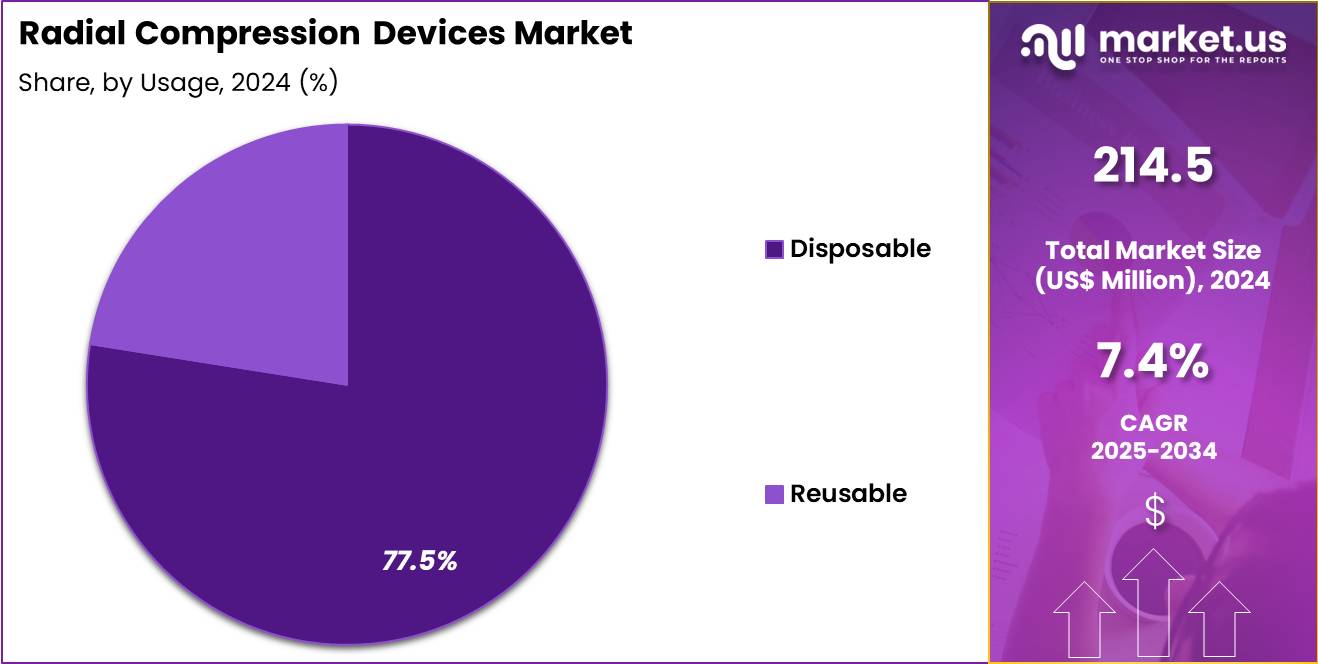

- The Usage segment is divided into Disposable, and Reusable, with Disposable testing taking the lead in 2024 with a market share of 77.5%.

- The End-User segment is divided into Hospitals, Independent Catheterization Laboratories, Ambulatory Surgical Centers and Specialized Clinics, with Hospitals taking the lead in 2024 with a market share of 43.1%

- North America led the market by securing a market share of 39.6% in 2024.

Product Type Analysis

Band/Strap-Based devices hold an estimated 54.2% market share owing to their intuitive design, rapid application, and consistent hemostasis performance. These bands are widely preferred in PCI recovery areas due to clear pressure control, transparent pads for visual inspection, and broad product availability across regions. Their adoption is reinforced by clinical guidelines supporting radial access as the first-line approach in coronary procedures.

Knob-Based devices demand continues to increase as knob-based systems allow precise incremental pressure adjustments, improving patient comfort and reducing radial artery occlusion risk. Their mechanical adjustability appeals to interventional cardiologists seeking fine-tuned compression control.

Plate-Based devices use rigid or semi-rigid plates that stabilize the device placement and ensure targeted pressure distribution. They are increasingly used in high-volume cath labs where fast setup and reliable placement are critical. Others, including hybrid pneumatic systems and emerging adjustable compression platforms, hold a smaller share primarily within specialized facilities and innovation-driven markets.

Usage Analysis

Disposable devices dominate with around 77.5% market share. The preference for single-use sterile compression bands has grown substantially due to stricter infection-prevention measures, especially in high-volume hospitals and interventional centers. Their convenience, reduced risk of cross-contamination, and no-reprocessing requirement make them operationally superior.

Reusable devices represent approximately 22.5% of the market and are primarily used in facilities with cost-containment priorities. Although cost-effective in the long run, their cleaning and sterilization demands restrict wider adoption compared to disposables.

By End-User

Hospitals lead with roughly 43.1% market share as they conduct the majority of angiography and PCI procedures globally. High patient turnover, trained interventional cardiologists, and dedicated cath labs sustain strong demand. Independent Catheterization Laboratories perform large volumes of diagnostic and interventional procedures and rely heavily on efficient, single-use compression systems to minimize turnaround time.

Ambulatory Surgical Centers supported by the rise of outpatient PCI procedures and growing preference for shorter hospital stays. Specialized Clinics largely driven by cardiac specialty clinics offering outpatient catheterization and follow-up care.

Key Market Segments

By Product Type

- Band/Strap-Based devices

- Knob-Based devices

- Plate-Based devices

- Others

By Usage

- Disposable

- Reusable

By End User

- Hospitals

- Independent Catheterization Laboratories

- Ambulatory Surgical Centers

- Specialized Clinics

Drivers

Growing adoption of radial access in cardiovascular procedures

Radial access adoption is accelerating globally, strongly driving demand for radial compression devices. Over 70% of PCI procedures in Europe and nearly 65–75% in North America now use radial artery access, according to clinical registries.

The switch from femoral to radial access reduces bleeding complications by up to 60%, shortens patient ambulation time to 2–3 hours, and decreases same-day discharge rates by nearly 40%, making radial access the preferred clinical standard for both diagnostic angiography and PCI. Countries such as Japan and the US have documented rising radial-first strategies due to their cost benefits, since radial access can reduce hospitalization expenses by US$ 800–1,200 per patient.

The rising burden of cardiovascular diseases responsible for ~20.5 million deaths globally in 2023 continues to increase angiography and PCI volumes, further expanding the need for post-procedure hemostasis solutions. Additionally, global training initiatives, such as those led by the Society for Cardiovascular Angiography & Interventions (SCAI), have significantly improved radial proficiency among interventional cardiologists.

Restraints

Risk of radial artery occlusion (RAO) and device-related limitations

Despite strong adoption, radial access carries procedural limitations, particularly the risk of Radial Artery Occlusion (RAO), which ranges from 1% to 10% depending on compression duration and pressure control. RAO reduces the ability to reuse the radial artery for future interventions and may shift clinicians toward alternative access points.

Excessive compression pressure, improper device placement, and extended compression times are major contributors to RAO. Studies show that improper use of compression devices can increase RAO incidence by nearly 3–4×, highlighting the need for advanced pressure-regulated technologies.

Cost constraints also restrict market expansion in emerging economies. Disposable radial compression devices, costing US$ 15–35 per unit, may be expensive for high-volume government hospitals in South Asia, Africa, or Latin America. Reusable devices require sterilization, inventory tracking, and reprocessing imposing operational burdens that smaller clinics are unable to manage efficiently.

Post-procedure complications such as swelling, discomfort, and hematoma reported in up to 8% of patients can discourage use in sensitive patient groups.

Opportunities

Innovation in pressure-adjustable and ergonomic compression systems

The biggest opportunity lies in the development of next-generation radial compression devices featuring precise pressure tuning, decompression control, and ergonomic stabilization. With RAO prevention becoming a priority, manufacturers are designing devices with step-wise deflation, transparent inspection windows, and hydromechanical adjusters.

For example, new prototype platforms using pneumatic micro-control valves have shown up to 40% reduction in RAO rates during clinical trials. Demand is strong among high-volume facilities performing 10,000–25,000 radial catheterizations annually.

Growth in emerging markets further amplifies opportunity. Asia-Pacific alone performs more than 8 million cardiac catheterization procedures annually, with radial access being adopted rapidly in China, India, and Southeast Asia due to expanding hospital infrastructure and government cardiac-care investments. Latin America and the Middle East also present growing demand as public and private hospitals shift to minimally invasive cardiac interventions.

Manufacturers can also expand through cost-optimized disposable bands for price-sensitive markets, bundled consumables for cath labs, and training-based partnerships. Increasing outpatient PCI, projected to grow by 15–18% annually, will create a strong need for fast, easy-to-use compression systems. Together, these factors create a robust opportunity pipeline for innovative, clinically safer radial compression devices

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors influence the Radial Compression Devices Market primarily through healthcare spending patterns, supply chain stability, and cardiovascular procedure volumes. Periods of economic slowdown often lead hospitals to prioritize essential cardiovascular interventions, which maintain the demand for radial access supplies, but purchasing shifts toward cost-efficient compression devices.

Inflation in 2023–2024 increased global prices of medical-grade plastics, adhesives, and silicone components by 12–18%, raising procurement costs for disposable radial bands. Many manufacturers depend on material supply chains spanning China, the US, Germany, and Southeast Asia, making them vulnerable to geopolitical disruptions such as trade restrictions, shipping bottlenecks, or export-regulation changes affecting medical polymers and precision injection-molded parts.

Geopolitical tensions also disrupt international logistics, lengthening delivery timelines for cath labs that perform millions of coronary angiography and PCI procedures annually. Hospitals in developing regions may postpone equipment upgrades due to currency depreciation or reduced import capacity. Conversely, rising cardiovascular disease rates largely unaffected by geopolitics continue to ensure procedural demand remains resilient.

Additionally, government-backed healthcare expansions in Asia-Pacific, the Middle East, and parts of Africa support ongoing adoption of radial access despite global uncertainty. Overall, the market shows moderate sensitivity to macroeconomic pressures but strong long-term demand due to the essential nature of cardiac interventions.

Latest Trends

Shift toward disposable, ergonomic, and RAO-preventive compression systems

A major trend shaping the market is the move toward disposable, single-use compression bands designed for improved infection control and workflow efficiency. Hospitals increasingly prefer disposables to comply with global sterilization and traceability standards, leading to a 77% adoption rate in 2024. These devices reduce cross-contamination risks and eliminate reprocessing, making them particularly attractive for high-turnover cath labs.

Another trend is the integration of RAO-minimizing features, such as patent hemostasis techniques, transparent visualization windows, and gradual step-down deflation mechanisms. Clinical studies show that devices enabling controlled pressure reduction can lower RAO rates by 30–50%, prompting demand for more sophisticated compression systems. Hospitals are shifting from basic straps to pressure-adjustable technologies that enhance patient comfort and preserve long-term vascular integrity.

The rise of same-day discharge PCI programs, especially in North America and Europe, is another catalyst. Centers performing day-care coronary procedures favor compression devices that allow fast ambulation within 1–2 hours, aligning with outpatient workflow models.

Regional Analysis

North America is leading the Radial Compression Devices Market

North America represents the largest share of the Radial Compression Devices Market of 39.6% in 2024 due to its high procedural volume, advanced cardiac-care infrastructure, and widespread adoption of radial-first strategies. In the US alone, more than 10 million diagnostic angiography and PCI procedures are performed annually, with radial access usage exceeding 65–70% in major cardiovascular centers.

The region benefits from strong penetration of leading manufacturers such as Terumo, Abbott, Merit Medical, and Teleflex, ensuring continuous product availability and clinician training. The high burden of cardiovascular diseases responsible for ~930,000 annual deaths in the US drives consistent demand for safe post-procedure hemostasis solutions.

Furthermore, same-day discharge PCI programs, implemented in over 40% of US hospitals, drive strong uptake of disposable compression bands that enable rapid ambulation. Favorable reimbursement structures, mature cath lab networks, and high clinical awareness reinforce North America’s dominant position in this market.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is the fastest-growing region, propelled by rising cardiovascular disease prevalence, rapid expansion of cath labs, and increasing shift toward minimally invasive radial access. The region performs over 8–10 million coronary catheterization procedures annually, with countries such as China, India, Japan, and South Korea increasing radial access usage by 15–20% year-on-year.

China alone has more than 28,000 hospitals capable of supporting interventional cardiology, fueling large-scale adoption of radial compression devices. Governments in India, Indonesia, and Vietnam are also expanding cardiac-care funding, enabling wider accessibility to modern PCI procedures. The cost-effectiveness of radial access requiring shorter hospital stays and fewer complications aligns well with APAC’s high patient volume and resource constraints.

Local manufacturers, including Lepu Medical and regional suppliers, offer competitively priced devices that accelerate uptake. Combined with growing training programs for interventional cardiologists, the region continues to register the highest CAGR in the global market.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the market include Terumo Corporation, Abbott Laboratories, Teleflex Incorporated (Vascular Solutions / Teleflex), Merit Medical Systems, Inc., TZ Medical, Inc., Lepu Medical Technology (Beijing) Co. Ltd, Advanced Vascular Dynamics / Forge Medical, Inc., Semler Technologies, Inc., Beijing Demax Medical Technology Co., Ltd., Comed B.V., Medas Inc., and Other key players.

Terumo leads the radial compression market with its widely adopted TR Band platform, known for transparent hemostasis pads and precise pressure control. Its strong global cath-lab presence and extensive radial-access training programs make it the dominant supplier worldwide. Abbott supports radial access through its vascular portfolio, offering compression systems designed for controlled hemostasis and reduced radial artery occlusion risk.

Its broad integration with coronary intervention devices strengthens adoption across high-volume hospitals and advanced cardiology centers. Teleflex, through Vascular Solutions, provides adjustable radial compression systems featuring ergonomic designs and precision pressure adjustments. Its focus on clinician-friendly features and expanding product innovation supports strong uptake among catheterization laboratories and outpatient cardiovascular centers.

Top Key Players

- Terumo Corporation

- Abbott Laboratories

- Teleflex Incorporated (Vascular Solutions / Teleflex)

- Merit Medical Systems, Inc.

- TZ Medical, Inc.

- Lepu Medical Technology (Beijing) Co. Ltd

- Advanced Vascular Dynamics / Forge Medical, Inc.

- Semler Technologies, Inc.

- Beijing Demax Medical Technology Co., Ltd.

- Comed B.V.

- Medas Inc.

- Other key players

Recent Developments

- In June 2023, TZ Medical, Inc. launched a radial-hemostasis device Roc Band. The device is designed to stop bleeding from the radial artery after procedures like cardiac catheterization by applying consistent and adjustable pressure

- In November, 2022, Merit Medical Systems, Inc. announced U.S. commercial release of PreludeSYNC EZ Radial Compression Device, a wristband-style radial compression device aimed at achieving patent hemostasis after radial artery access procedures.

Report Scope

Report Features Description Market Value (2024) US$ 214.5 Million Forecast Revenue (2034) US$ 438.0 Million CAGR (2025-2034) 7.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Band/Strap-Based, Knob-Based, Plate-Based, Others), By Usage (Disposable and Reusable), By End-User (Hospitals, Independent Catheterization Laboratories, Ambulatory Surgical Centers and Specialized Clinics) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Terumo Corporation, Abbott Laboratories, Teleflex Incorporated (Vascular Solutions / Teleflex), Merit Medical Systems, Inc., TZ Medical, Inc., Lepu Medical Technology (Beijing) Co. Ltd, Advanced Vascular Dynamics / Forge Medical, Inc., Semler Technologies, Inc., Beijing Demax Medical Technology Co., Ltd., Comed B.V., Medas Inc., and Other key players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Radial Compression Devices MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Radial Compression Devices MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Terumo Corporation

- Abbott Laboratories

- Teleflex Incorporated (Vascular Solutions / Teleflex)

- Merit Medical Systems, Inc.

- TZ Medical, Inc.

- Lepu Medical Technology (Beijing) Co. Ltd

- Advanced Vascular Dynamics / Forge Medical, Inc.

- Semler Technologies, Inc.

- Beijing Demax Medical Technology Co., Ltd.

- Comed B.V.

- Medas Inc.

- Other key players