Global Perfusion Systems Market By Product Type (Cardiopulmonary Perfusion System (Oxygenators, Monitoring System, Heart-Lung Machine, Cannula, and Others), Cell Perfusion System (Small Mammal Organ Perfusion System, Microfluidic Perfusion System, Gravity/Pressure-driven Perfusion System, and Bioreactor Perfusion System), and Ex-Vivo Organ Perfusion System (Normothermic and Hypothermic)), By End-user (Hospitals, Clinics, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 136554

- Number of Pages: 293

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

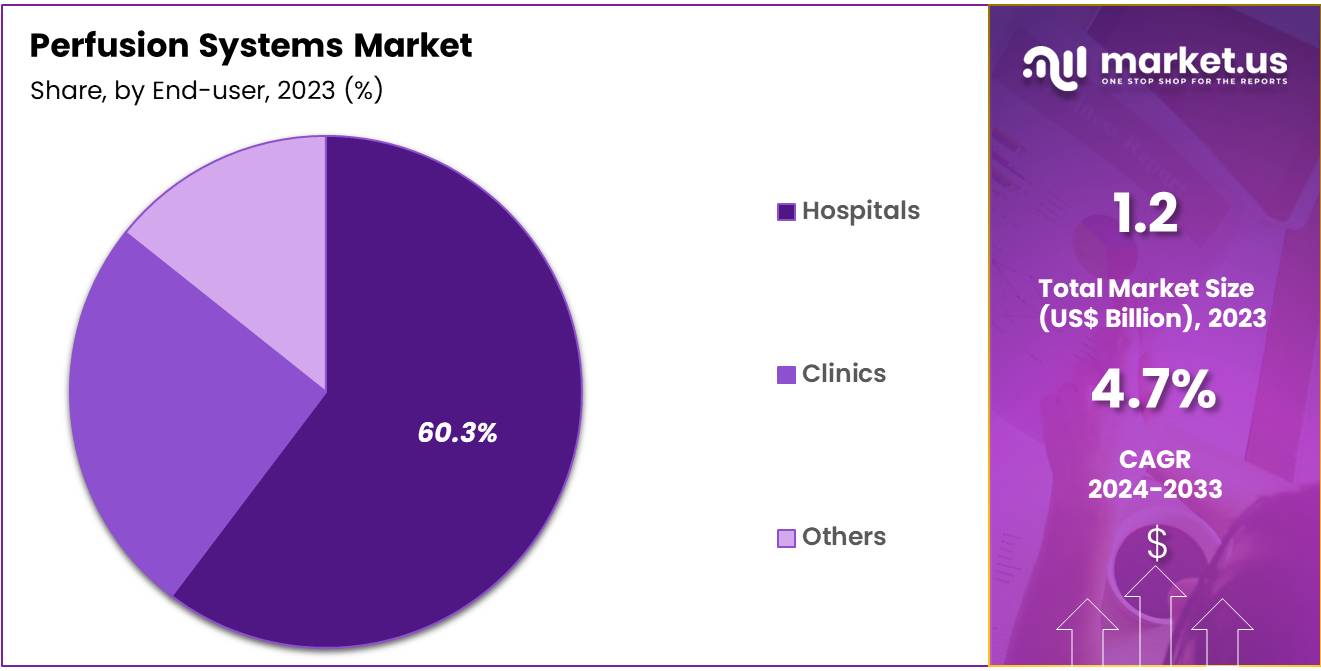

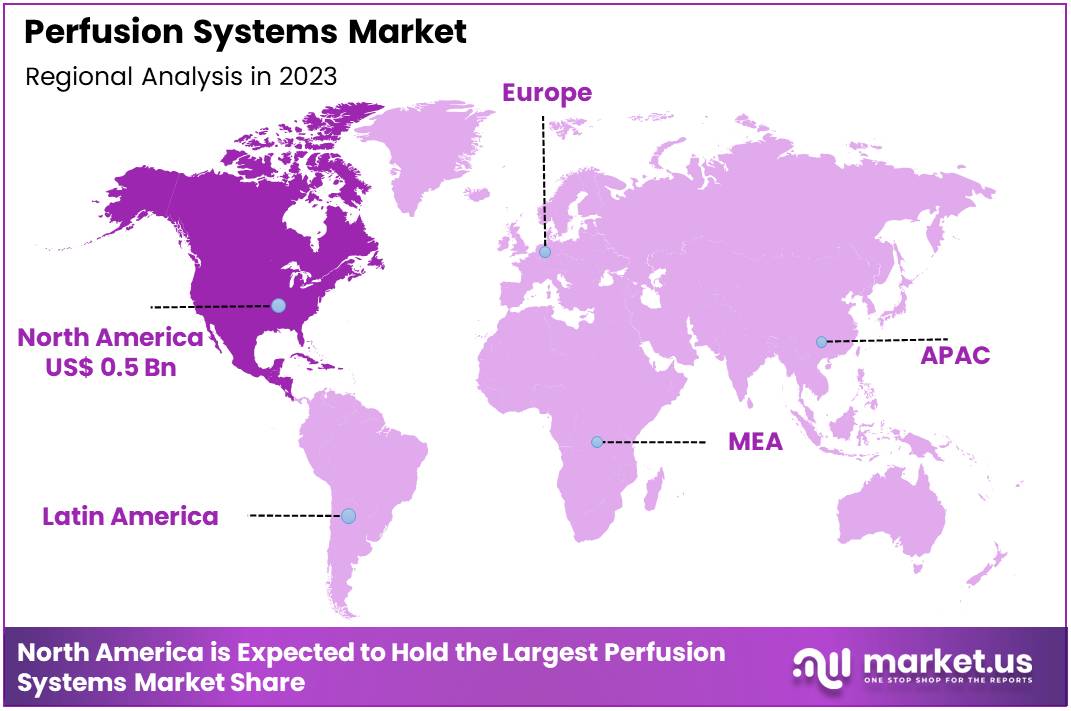

Global Perfusion Systems Market size is expected to be worth around US$ 1.9 billion by 2033 from US$ 1.2 billion in 2023, growing at a CAGR of 4.7% during the forecast period 2024 to 2033. In 2023, North America led the market, achieving over 39.2% share with a revenue of US$ 0.5 Million.

Increasing demand for advanced medical technologies drives growth in the perfusion systems market, as these systems play a crucial role in organ transplantation, cardiac surgeries, and critical care management. Perfusion systems provide continuous blood flow to vital organs during surgery, enabling better recovery outcomes and reducing complications.

The growing prevalence of cardiovascular diseases, with heart disease responsible for approximately 655,000 deaths annually in the United States according to the Centers for Disease Control & Prevention (CDC), has spurred the need for reliable perfusion solutions. Opportunities also arise from the expanding focus on minimally invasive surgeries and advanced cardiac procedures, where perfusion systems ensure organ preservation and function during complex surgeries.

Technological advancements, such as the development of automated and real-time monitoring systems, enhance the precision and efficiency of these devices. The integration of perfusion systems with artificial intelligence (AI) and machine learning offers promising growth potential by enabling more personalized and predictive healthcare.

Additionally, as healthcare providers strive to reduce surgery-related complications and improve patient outcomes, the demand for perfusion systems in both routine and emergency procedures continues to rise. Rising awareness regarding the benefits of organ preservation during surgeries and critical care further drives market expansion, while increasing healthcare investments globally fuel innovation and product development in this field.

Key Takeaways

- In 2023, the market for Perfusion Systems generated a revenue of US$ 2 billion, with a CAGR of 4.7%, and is expected to reach US$ 1.9 billion by the year 2033.

- The product type segment is divided into cardiopulmonary perfusion system, cell perfusion system, and ex-vivo organ perfusion system, with cardiopulmonary perfusion system taking the lead in 2023 with a market share of 50.1%.

- Considering end-user, the market is divided into hospitals, clinics, and others. Among these, hospitals held a significant share of 60.3%.

- North America led the market by securing a market share of 39.2% in 2023.

Product Type Analysis

The cardiopulmonary perfusion system segment led in 2023, claiming a market share of 50.1% owing to the increasing number of cardiac surgeries globally, such as coronary artery bypass grafting (CABG) and heart valve replacement procedures, which require cardiopulmonary bypass. With the rising incidence of cardiovascular diseases, healthcare providers are likely to adopt these systems more frequently to maintain patient stability during surgeries.

Additionally, advancements in technology, including the development of more compact and efficient systems, are anticipated to further drive the demand for cardiopulmonary perfusion devices. The growing preference for minimally invasive procedures and the increasing focus on improving patient outcomes are also contributing factors.

Moreover, the rise in healthcare spending across emerging economies, where modern medical technologies are rapidly being integrated, is expected to boost the adoption of these devices, creating a favorable market environment.

End-user Analysis

The hospitals held a significant share of 60.3% due to several key factors. Hospitals are increasingly adopting advanced perfusion systems to enhance the quality of care during complex surgeries, particularly in cardiology and organ transplantation. The need for precise and reliable equipment to manage critical patients undergoing surgery is likely to fuel the demand for these systems.

Moreover, the expansion of healthcare infrastructure in both developed and developing regions is estimated to further drive market growth, as hospitals continue to invest in cutting-edge technologies. The growing focus on improving healthcare standards, along with the need for specialized treatment capabilities, is likely to sustain the growth of this segment.

Key Market Segments

Product Type

- Cardiopulmonary Perfusion System

- Oxygenators

- Monitoring System

- Heart-Lung Machine

- Cannula

- Others

- Cell Perfusion System

- Small Mammal Organ Perfusion System

- Microfluidic Perfusion System

- Gravity/Pressure-driven Perfusion System

- Bioreactor Perfusion System

- Ex-Vivo Organ Perfusion System

- Normothermic

- Hypothermic

End-user

- Hospitals

- Clinics

- Others

Drivers

Rising Prevalence of Cardiovascular Diseases Drives the Perfusion Systems Market

Growing prevalence of cardiovascular diseases drives the perfusion systems market. Cardiovascular diseases (CVDs) are rapidly becoming a leading cause of mortality worldwide, with the World Health Organization (WHO) reporting nearly 17.9 million deaths each year due to these conditions. The increasing number of surgeries, including coronary artery bypass grafting (CABG) and heart valve replacements, necessitates the use of advanced medical technologies, including perfusion equipment.

These devices ensure the proper circulation of blood during surgeries, where the heart and lungs are temporarily stopped. As the global population ages and the prevalence of conditions like hypertension, diabetes, and obesity rises, the need for effective cardiovascular treatments is anticipated to surge. The global perfusion systems market is projected to experience robust growth as healthcare providers strive to meet the rising demand for life-saving surgical interventions.

As a result, the development of innovative perfusion technologies is likely to intensify, aiming to improve the success rates of cardiovascular procedures. Hospitals and surgical centers are increasingly investing in high-end perfusion systems, reflecting the industry’s response to the mounting need for advanced heart-lung machines. This trend is expected to continue as the prevalence of heart disease shows no signs of slowing down, further driving demand for perfusion solutions globally.

Restraints

High Costs Restrain the Perfusion Systems Market

One significant restraint in the perfusion systems market is the high cost associated with the acquisition and maintenance of advanced perfusion equipment. These systems require substantial upfront investment due to their complex technology and the need for specialized components and regular servicing. For hospitals and healthcare facilities, especially in emerging economies, the high capital expenditure required to purchase and maintain these systems presents a barrier to widespread adoption.

Additionally, the specialized training required for healthcare professionals to operate perfusion machines adds to the overall cost burden. Smaller medical facilities may struggle to justify the investment, limiting their ability to implement advanced systems and, in turn, restricting market growth in certain regions.

Furthermore, reimbursement issues and the relatively slow pace of healthcare insurance coverage expansion in some regions further complicate adoption, hindering the broader implementation of perfusion systems globally.

Opportunities

High Degree of Innovation Creates Growth Opportunities for the Perfusion Systems Market

High levels of innovation present a significant opportunity for the perfusion systems market. As technologies evolve, new advancements, such as the VersaLive platform developed by researchers at the Telethon Institute of Genetics and Medicine in Italy, are anticipated to drive growth.

This microfluidic platform, unveiled in October 2022, offers exceptional versatility for perfusion cell culture, enabling applications like time-lapse imaging, immunostaining, and cell recovery. Such innovations are likely to accelerate the adoption of perfusion systems in both research and clinical settings, offering enhanced precision and efficiency in cellular studies. The increasing demand for more sophisticated, adaptable, and automated systems is projected to further bolster market expansion.

Innovations such as VersaLive not only enhance the functionality of existing systems but also open new avenues for personalized medicine and advanced therapeutics. The continuous development of cutting-edge technologies in perfusion systems is expected to meet the evolving needs of pharmaceutical research, biomanufacturing, and regenerative medicine, positioning the market for sustained growth.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the perfusion systems market. Economic downturns, such as recessions, tend to limit healthcare budgets and slow down capital expenditures, thereby affecting the procurement of advanced medical equipment. On the other hand, economic recovery periods foster investment in healthcare infrastructure, boosting the adoption of perfusion systems. Geopolitical tensions and trade restrictions can disrupt supply chains, leading to delays in manufacturing and higher costs.

However, the global push towards improving healthcare systems, particularly in emerging economies, creates long-term growth prospects for the market. Additionally, the increasing demand for organ transplantation and advancements in healthcare technology mitigate the negative impacts of economic instability. The market is expected to continue thriving, driven by continuous innovations in perfusion technologies and an expanding global focus on patient care and organ preservation.

Latest Trends

Rising Mergers and Acquisitions Creating Lucrative Prospects for the Market

Rising mergers and acquisitions have become a dominant trend in the perfusion systems market, driving its expansion. High consolidation among major players is anticipated to streamline production processes, enhance research and development capabilities, and improve market reach. In August 2023, TransMedics Group, Inc. acquired the LifeCradle Heart Preservation System and Ex-Vivo Organ Support System technologies from Bridge to Life Ltd.

This strategic acquisition will likely broaden TransMedics’ portfolio, enhancing its position in the organ transplantation space. Such moves are expected to accelerate product innovation, with companies leveraging their combined resources to bring more advanced and efficient perfusion systems to market.

Additionally, partnerships between medical device companies and research institutions are expected to foster the development of cutting-edge technologies. This includes innovations in perfusion cell culture, such as the VersaLive microfluidic platform unveiled by a research team from the Telethon Institute of Genetics and Medicine in Italy. These advances are expected to open new avenues for personalized medicine, regenerative therapies, and organ preservation.

Regional Analysis

North America is leading the Perfusion Systems Market

North America dominated the market with the highest revenue share of 39.2% owing to several factors. The rising incidence of heart diseases, with the CDC reporting that around 805,000 people in the U.S. experience heart attacks each year, has created a robust demand for advanced surgical and perfusion technologies.

This need is further amplified by the growing awareness of the importance of organ preservation and transplantation. In December 2023, a breakthrough experiment led by researchers at the Perelman School of Medicine demonstrated the potential of perfusion technologies in organ transplantation. The team successfully circulated blood through a genetically modified pig liver outside the body, showcasing the increasing role of perfusion systems in improving patient care and outcomes.

Furthermore, technological advancements, such as the development of more efficient and precise devices, have expanded the application of these systems beyond traditional surgeries. With healthcare investments growing and the adoption of innovative treatments increasing, the North American perfusion systems market is expected to continue its upward trajectory in the coming years, supported by both demand and technological evolution.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

In the Asia Pacific region, the perfusion systems market is expected to grow steadily during the forecast period. Rising healthcare expenditure, along with rapid advancements in medical technology, is likely to drive the demand for these systems. The increasing prevalence of chronic diseases, such as cardiovascular conditions, is anticipated to boost the adoption of advanced perfusion technologies for surgeries and organ transplants.

Furthermore, the expanding healthcare infrastructure in countries like China, India, and Japan is expected to create new opportunities for market growth. These countries are also focusing on improving their organ donation and transplantation systems, which is projected to increase the demand for perfusion solutions.

With more healthcare facilities adopting these technologies, coupled with a growing awareness of their benefits, the market is likely to expand significantly in the region. Additionally, government initiatives aimed at modernizing healthcare services are expected to contribute to the growth of the perfusion systems market in Asia Pacific.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the perfusion systems market adopt various strategies to drive growth, including investments in advanced technologies and the development of innovative, cost-effective solutions to meet evolving healthcare needs. Many companies focus on expanding their product portfolios through mergers, acquisitions, and partnerships to strengthen their market position.

Strategic collaborations with hospitals and medical institutions help enhance product visibility and usage. Additionally, key players invest heavily in research and development to introduce next-generation perfusion systems that improve patient outcomes and offer greater precision. Expanding their presence in emerging markets by targeting developing countries also plays a crucial role in growth.

Medtronic, a global leader in medical technology, is at the forefront of the perfusion systems market. Headquartered in Dublin, Ireland, the company specializes in a wide range of products, including advanced perfusion equipment, aiming to provide innovative healthcare solutions.

Medtronic’s strategic focus on research, acquisition of complementary technologies, and a robust global distribution network have significantly enhanced its position in the medical device industry. With a commitment to improving patient outcomes, the company consistently strives to develop and improve systems that aid in the treatment of cardiovascular and other critical conditions.

Top Key Players

- Thermo Fisher Scientific

- Sartorius

- Repligen

- Paragonix Technologies

- Nipro Corporation

- Medtronic

- MedicalExpo

- LivaNova PLC

Recent Developments

- In December 2021, Medtronic announced that its INVOS 7100 somatic/cerebral oximetry system had received 510(k) approval from the US FDA for use with children up to the age of 18.

- In April 2023, Repligen Corporation completed the acquisition of FlexBiosys Inc. based in Branchburg, NJ. This acquisition was anticipated to further enhance Repligen’s Fluid Management business and expand its portfolio of single-use bioprocessing bags and assemblies.

- In August 2023, Repligen and Sartorius introduced a unified bioreactor system that incorporates Repligen’s XCell ATF technology into Sartorius’ STR bioreactor. This integrated solution offers a simplified method for regulating cell growth and enhancing cell retention during perfusion processes, eliminating the need for a completely separate cell retention control tower.

Report Scope

Report Features Description Market Value (2023) US$ 1.2 billion Forecast Revenue (2033) US$ 1.9 billion CAGR (2024-2033) 4.7% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Cardiopulmonary Perfusion System (Oxygenators, Monitoring System, Heart-Lung Machine, Cannula, and Others), Cell Perfusion System (Small Mammal Organ Perfusion System, Microfluidic Perfusion System, Gravity/Pressure-driven Perfusion System, and Bioreactor Perfusion System), and Ex-Vivo Organ Perfusion System (Normothermic and Hypothermic)), By End-user (Hospitals, Clinics, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thermo Fisher Scientific, Sartorius, Repligen, Paragonix Technologies, Nipro Corporation, Medtronic, MedicalExpo, and LivaNova PLC. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Thermo Fisher Scientific

- Sartorius

- Repligen

- Paragonix Technologies

- Nipro Corporation

- Medtronic

- MedicalExpo

- LivaNova PLC