Global qPCR Instruments Market By Instrument Type (Real-time qPCR systems, Point-of-care, Digital PCR (dPCR) systems, High-throughput qPCR platforms, Multiplex/microfluidic qPCR systems), By Application (Infectious disease diagnostics, Oncology & cancer biomarker testing, Genetic/ genomic research and gene expression profiling, Agricultural / animal health testing, Other applications), By End-User (Diagnostic laboratories, Hospitals & clinics, Pharma & biotech companies, and Other end-users), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 167129

- Number of Pages: 242

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

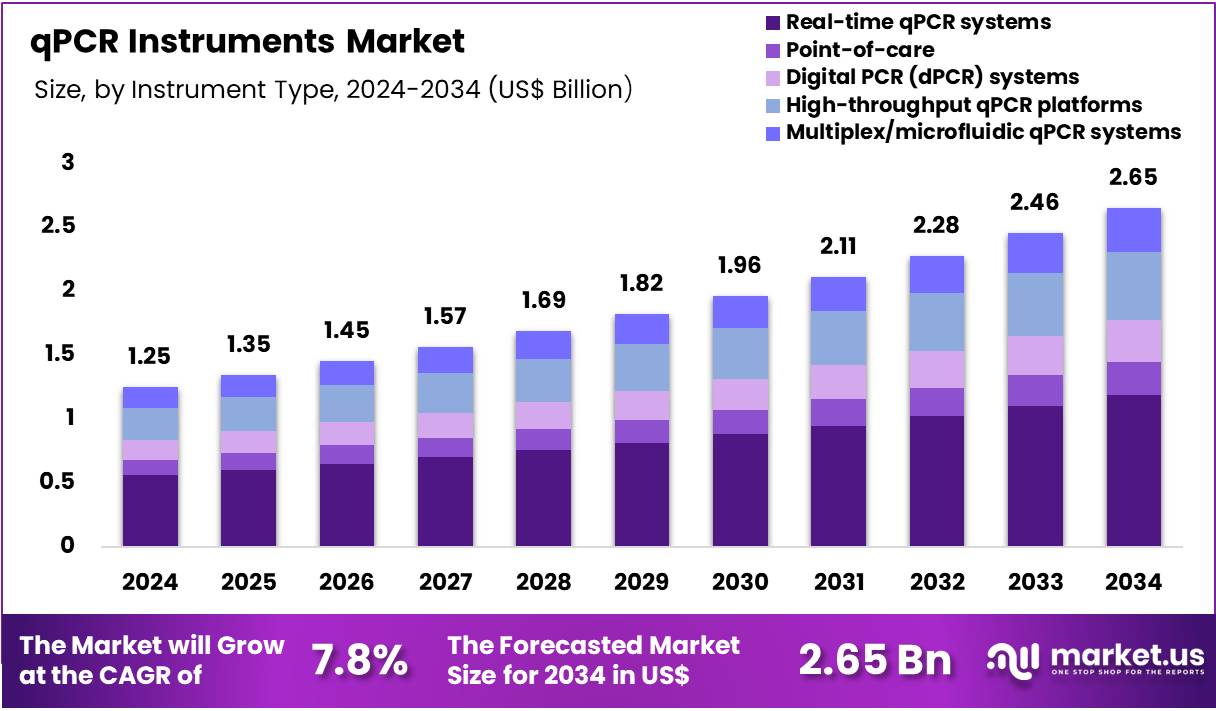

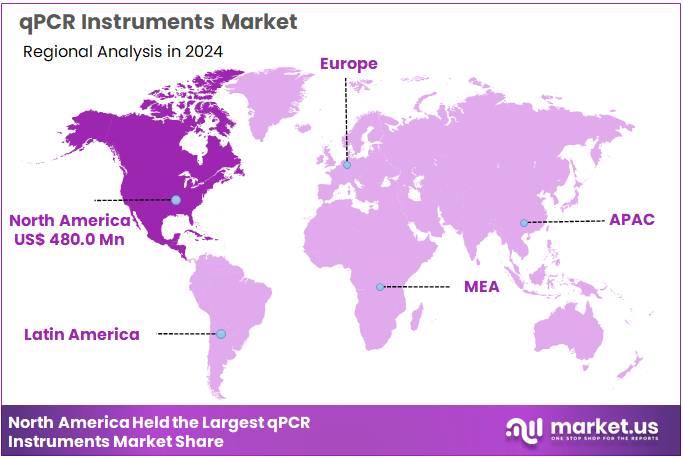

Global qPCR Instruments Market size is expected to be worth around US$ 2.65 Billion by 2034 from US$ 1.25 Billion in 2024, growing at a CAGR of 7.8% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 38.4% share with a revenue of US$ 480.0 Million.

Increasing validation of point-of-care accuracy drives the qPCR Instruments Market, as portable devices match laboratory standards in anticoagulation monitoring. Cardiologists deploy Xprecia Prime™ systems for rapid INR results in outpatient clinics, enabling same-day warfarin dose adjustments. These meters support emergency departments by providing immediate prothrombin time assessment in bleeding events, guiding reversal agent administration.

Research studies compare meter performance against central lab analyzers, building evidence for regulatory approvals. In 2024, a clinical study demonstrated equivalent accuracy of the Xprecia Prime™ Coagulation System to Roche’s CoaguChek® XS and Sysmex CS-2500. This validation accelerates market growth by promoting transition to decentralized INR testing environments.

Growing endorsement of patient self-management creates opportunities in the qPCR Instruments Market, as home devices empower individuals on long-term anticoagulation. Hematologists train patients to use self-testing meters for weekly INR checks, reducing clinic visits and improving therapeutic control. These tools aid atrial fibrillation management by facilitating frequent monitoring in elderly populations, minimizing stroke risks.

Digital connectivity features upload results to electronic health records, enabling remote physician oversight. In August 2025, an international consensus paper reaffirmed clinical effectiveness of patient self-testing and self-management comparable to clinic care. This endorsement drives market expansion through expanded insurance coverage and adoption of home INR systems.

Rising domestic manufacturing investments propel the qPCR Instruments Market, as resilient supply chains ensure device availability and component quality. Medical device firms leverage expanded facilities to innovate meter designs with enhanced user interfaces, improving patient compliance. These investments support veterinary applications by producing animal-specific INR meters for research and clinical use.

Trends toward modular production platforms accelerate customization for niche anticoagulation needs. Although Abbott Laboratories’ US$536 million Ohio investment targets nutrition, it exemplifies industry commitment to US manufacturing resilience. This trend positions the market for sustained growth by securing diagnostic device supply and fostering technological advancements.

Common qPCR Instruments Used Commercially

Company Name Instrument Name(s) Agilent (Stratagene) AriaMX MX3000P®, MX3005P®, MX4000P® Analytik Jena qTOWER, qTOWER 2.x BMS Mic Bio-Rad® CFX96™, CFX384™, CFX Connect™ Chromo4™, MiniOpticon™, Opticon™, Opticon™ 2 iCycler®, iQ™5, MyiQ™ BJS Xxpress® Cepheid® SmartCycler® Eppendorf Mastercycler® ep realplex, Mastercycler® ep realplex 2S Fluidigm BioMark™ Hain Lifescience FluoroCycler® 96 IT-IS Life Science MyGo Pro, MyGo Mini PCRmax Eco™ Qiagen (Corbett) Rotor-Gene™ 3000, Rotor-Gene™ 6000, Rotor-Gene™ Q Roche LightCycler® 480, LightCycler® 96, LightCycler® Nano Takara Thermal Cycler Dice® (TP800) Techne® PrimeQ, Quantica® Thermo Fisher (Applied Biosystems / Life Technologies) StepOne™, StepOne™ Plus 5700, 7000, 7300 7500, 7500 FAST QuantStudio™ 3, 5, 6, 7, 12k Flex ViiA7™ 7700, 7900, 7900HT, 7900HT FAST Piko Real® Agilent (Stratagene) AriaMX MX3000P®, MX3005P®, MX4000P® Analytik Jena qTOWER, qTOWER 2.x Key Takeaways

- In 2024, the market generated a revenue of US$ 1.25 Billion, with a CAGR of 7.8%, and is expected to reach US$ 2.65 Billion by the year 2034.

- The Instrument Type segment is divided into Real-time qPCR systems, Point-of-care, Digital PCR (dPCR) systems, High-throughput qPCR platforms, and Multiplex/microfluidic qPCR systems, with Real-time qPCR systems taking the lead in 2024 with a market share of 44.8%.

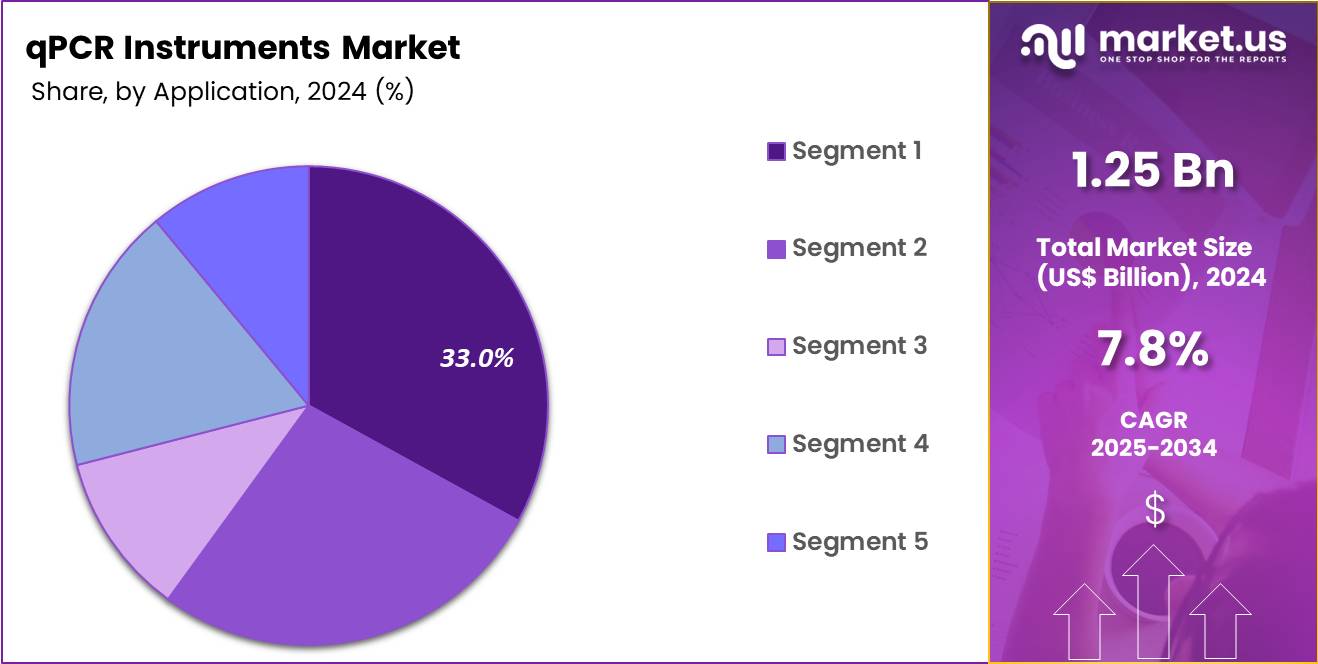

- The Application segment is divided into Infectious disease diagnostics, Oncology & cancer biomarker testing, Genetic/genomic research and gene expression profiling, Agricultural/animal health testing, and Other applications, with Infectious disease diagnostics taking the lead in 2024 with a market share of 42.5%.

- The End-User segment is divided into Diagnostic laboratories, Hospitals & clinics, Pharma & biotech companies, and Other end-users, with Diagnostic laboratories taking the lead in 2024 with a market share of 38.7%.

- North America led the market by securing a market share of 38.4% in 2024.

Instrument Type Analysis

Real-time qPCR systems account for 44.8% of the qPCR Instruments market. Real-time qPCR systems dominate the instrument category because they remain the global standard for rapid, sensitive, and quantifiable nucleic-acid detection across clinical, research, and industrial settings. These systems provide the capability to monitor amplification in real time, which is essential for diagnosing pathogens, quantifying viral loads, and assessing gene expression.

For example, during COVID-19, real-time qPCR was the primary diagnostic method, with laboratories worldwide conducting hundreds of millions of real-time PCR assays for SARS-CoV-2 detection. This established a massive installed base of real-time qPCR platforms across hospitals, diagnostic labs, public-health agencies, and academic centers. Beyond infectious diseases, real-time qPCR is heavily used in oncology for quantifying biomarkers such as BCR-ABL in leukemia or EGFR mutations in lung cancer, supporting early diagnosis and treatment monitoring.

In agriculture, real-time qPCR detects plant pathogens like Xylella fastidiosa, preventing crop losses. Its broad applicability, high sensitivity, cycle-to-cycle quantification ability, and compatibility with SYBR Green, TaqMan probes, and multiplexing workflows make it indispensable. Because real-time qPCR is embedded in nearly every molecular diagnostics and genomic workflow, it remains the clear leader among instrument types.

In November 2024, Takara Bio USA, Inc., a wholly owned subsidiary of Takara Bio Inc., announced the introduction of the SmartChip ND Real-Time PCR System, an automated, research-use-only (RUO) high-throughput qPCR platform designed for infectious disease research. The company has begun accepting orders for the SmartChip ND Real-Time PCR System, expanding its portfolio of advanced molecular research solutions.

Application Analysis

Infectious disease diagnostics dominate the application segment with 42.5% share because qPCR remains the gold-standard method for detecting bacterial, viral, and fungal pathogens with high sensitivity and specificity. Globally, infectious diseases continue to account for over 13 million deaths annually, creating a massive demand for rapid molecular tests. qPCR is the primary method for diagnosing influenza, RSV, tuberculosis, HIV viral load, hepatitis genotyping, and emerging pathogens.

For example, during COVID-19, qPCR served as the global backbone of testing, with governments, hospitals, and public-health agencies performing hundreds of millions of qPCR tests. Beyond pandemics, qPCR is crucial for detecting antimicrobial resistance genes, such as mecA (MRSA), NDM-1, and KPC, enabling clinicians to adjust treatment in real time.

In neonatal care, qPCR helps identify sepsis-causing pathogens within hours far faster than culture methods. In regions facing outbreaks of dengue, Zika, or chikungunya, qPCR enables rapid vector-borne disease confirmation. The dominance of this segment comes from the ongoing global burden of infectious diseases, the need for fast turnaround times, and the unmatched sensitivity of qPCR in early detection.

End-User Analysis

Diagnostic laboratories dominate the end-user segment with 38.7% market share in 2024 because they perform the majority of molecular testing for infectious diseases, oncology biomarkers, viral load quantification, and genetic screening. These labs process large volumes of patient samples daily sometimes thousands per facility—and rely on qPCR for its unmatched sensitivity and rapid detection capability.

For example, national reference labs conduct surveillance for influenza, RSV, Clostridioides difficile, tuberculosis, and sexually transmitted infections, all of which require qPCR workflows. In oncology, diagnostic labs measure genes involved in treatment decisions, such as BCR-ABL for chronic myeloid leukemia, EGFR mutations in lung cancer, or HER2 expression in breast cancer. qPCR is also widely used in prenatal and newborn-screening programs, including detecting SMA (SMN1 gene deletions) or cystic fibrosis mutations.

Key Market Segments

By Instrument Type

- Real-time qPCR systems

- Point-of-care

- Digital PCR (dPCR) systems

- High-throughput qPCR platforms

- Multiplex/microfluidic qPCR systems

By Application

- Infectious disease diagnostics

- Oncology & cancer biomarker testing

- Genetic/ genomic research and gene expression profiling

- Agricultural / animal health testing

- Other applications

By End-User

- Diagnostic laboratories

- Hospitals & clinics

- Pharma & biotech companies

- Other end-users

Drivers

Rising Burden of Infectious & Genetic Diseases

A major driver for qPCR instruments is the rising burden of infectious and genetic diseases, which pushes healthcare systems toward fast, sensitive nucleic-acid detection technologies. For example, the WHO reports more than 1.3 billion influenza cases globally each year, with seasonal outbreaks requiring rapid molecular confirmation. qPCR remains the gold standard for pathogen detection, with sensitivity levels often exceeding 95%, making it indispensable in clinical labs.

Tuberculosis continues to affect over 10.6 million people annually, and many countries now rely on qPCR-based assays for rapid rifampicin-resistance testing. In oncology, the need for early gene-expression profiling has surged as cancer incidences reach over 20 million cases every year, with qPCR used to quantify biomarkers such as BCR-ABL, EGFR, and KRAS mutations. During COVID-19, laboratories worldwide processed hundreds of millions of qPCR tests, demonstrating the scalability and reliability of the technology.

This sustained diagnostic demand from respiratory diseases to antimicrobial-resistance surveillance reinforces the necessity for advanced qPCR instruments. As genetic and infectious disease testing continues to grow across hospitals, reference labs, and public-health programs, qPCR systems remain a critical diagnostic backbone.

Restraints

High Instrument & Consumable Costs

A key restraint in the qPCR instruments market is the high cost of equipment and consumables, which limits adoption, especially in low-resource settings. High-performance qPCR platforms often contain precision optics, temperature-control modules, and fluorescence detection systems that significantly increase manufacturing and maintenance expenses.

Many laboratories in low-income regions operate with per-test reimbursement rates under USD 5–7, making it difficult to sustain workflows where qPCR consumables can exceed USD 1–2 per reaction, particularly for multiplex assays. A global assessment of laboratory capacity published by the WHO showed that over 45% of diagnostic facilities in low-income countries lack access to molecular platforms due to capital barriers.

Even in developed markets, academic labs often restrict usage because reagent kits, plastics, and fluorescent probes account for over 60% of total operational cost in some molecular programs. Beyond consumables, validation, calibration, and software-licensing requirements add recurring expenses.

As a result, many institutions continue using older thermal cyclers or lower-sensitivity alternatives, slowing the upgrade to advanced qPCR systems. These cost constraints significantly limit penetration and restrict broader adoption across decentralized and mid-sized laboratories.

Opportunities

Growth of Decentralized, Rapid, & Point-of-Care Molecular Testing

A major opportunity lies in the rapid global shift toward decentralized and point-of-care (POC) molecular testing. Healthcare systems are increasingly moving diagnostics out of central labs to improve turnaround times. For instance, emergency departments performing rapid infectious-disease diagnostics report reductions of 30–50% in patient wait times when molecular platforms are used near the point of care. Rural and semi-urban regions—where over 45% of the global population lives—require compact molecular tools due to limited access to centralized labs.

During COVID-19, mobile and field labs processed millions of qPCR tests, demonstrating strong feasibility for portable platforms. POC molecular testing for respiratory viruses alone grew to tens of millions of tests annually, highlighting an expanding user base for compact qPCR instruments. As antimicrobial resistance rises, with 5 million deaths associated globally each year, rapid pathogen-resistance detection at decentralized sites becomes a priority.

Portable qPCR devices that integrate sample prep, amplification, and data reporting can support hospitals, remote clinics, emergency care units, veterinary centers, and environmental monitoring programs. This shift creates a strong opportunity for manufacturers to design affordable, automated, cartridge-based qPCR instruments tailored for non-specialist settings.

In November 2023, Roche announced the launch of the LightCycler® PRO System, built on the trusted gold-standard technology of its previous LightCycler® platforms. The new system delivers enhanced performance and improved usability, aiming to bridge the gap between translational research and in-vitro diagnostic applications.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical dynamics are exerting a noticeable influence on the qPCR instruments market as global laboratories, health systems, and research institutions adjust to shifting economic conditions and cross-border uncertainties. Periods of inflation and currency depreciation have increased the cost of scientific equipment, especially in low- and middle-income regions where laboratories already operate with restricted budgets.

Since qPCR instruments require precision optics, thermal blocks, and fluorescent detection modules, component costs ranging from semiconductors to specialty plastics have risen. This has pushed procurement cycles further out, with many public laboratories extending the lifespan of older instruments. Supply-chain disruptions triggered by geopolitical tensions, trade restrictions, and transport delays have also affected timely availability of consumables such as enzymes, probes, and plastic ware.

For example, during recent global logistics bottlenecks, many laboratories reported delays of 4–8 weeks in receiving qPCR reagents, influencing testing capacity for infectious diseases and clinical workloads.

Geopolitical conflicts further impact disease-surveillance programs, increasing reliance on mobile and decentralized molecular testing. Regions facing humanitarian crises often experience higher outbreaks of TB, cholera, measles, and vector-borne infections, creating urgent demand for portable qPCR platforms capable of operating in field conditions.

At the same time, heightened global biosurveillance efforts sparked by emerging pathogens and antimicrobial resistance have encouraged governments to fund national molecular-diagnostics networks. Investments in genomic preparedness, including early detection of zoonotic spillovers, have strengthened qPCR adoption in strategic laboratories.

Latest Trends

Automation, Multiplexing, and AI-Integrated Workflows

A significant trend shaping the qPCR instruments market is the rapid shift toward automation, multiplexing, and digital-analytics integration. Modern qPCR platforms now perform high-multiplex reactions detecting 4–6 targets per sample, enabling simultaneous identification of multiple viruses or gene signatures.

Automated liquid-handling integration reduces human error by up to 70%, according to laboratory workflow studies, and decreases hands-on time for high-volume labs processing thousands of samples daily. Cloud-connected qPCR instruments allow laboratories to store, analyze, and compare large datasets across multiple facilities, supporting epidemiological surveillance.

Research labs using AI-enhanced qPCR analysis report 20–30% improvements in curve-fitting accuracy, enabling more precise quantification of low-abundance transcripts. In cancer genomics, automation paired with multiplexing supports complex assays, such as profiling 50+ gene-expression panels used in personalized medicine.

The push toward robotics-assisted workflows common in high-throughput academic and pharmaceutical settings is further accelerating demand for qPCR instruments that integrate seamlessly into digital laboratory-information systems. As precision medicine expands globally and researchers generate billions of nucleic-acid data points annually, automation and AI-driven analytics continue to define the next generation of qPCR technology.

Regional Analysis

North America is leading the qPCR Instruments Market

North America represents the largest regional market accounting for 38.4% market share for qPCR instruments due to its advanced healthcare infrastructure, high diagnostic testing volume, and strong investment in molecular biology and genomics. The region performs some of the highest numbers of infectious-disease tests globally such as influenza, RSV, HIV viral load monitoring, and antimicrobial-resistance screening creating continuous demand for qPCR workflows.

The United States operates more than 260,000 CLIA-certified laboratories, many of which rely on real-time qPCR platforms for routine diagnostics. Public-health agencies such as the CDC and PHAC routinely use qPCR for surveillance of respiratory viruses, foodborne pathogens, and emerging threats like monkeypox or novel coronaviruses.

North America is also home to major instrument manufacturers, academic research centers, and biotech hubs—Boston, San Diego, Toronto—which drive high adoption for gene-expression studies, oncology biomarker validation, and clinical-trial molecular assays. This strong infrastructure makes North America the region with the highest installed base of qPCR systems.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is the fastest-growing region for qPCR instruments, driven by expanding healthcare capacity, rising infectious-disease burdens, and rapid growth in genomics and biotechnology sectors. Countries such as China, India, South Korea, Japan, and Singapore are scaling molecular-diagnostics infrastructure to improve disease surveillance and early detection.

The region experiences significant outbreaks of dengue, tuberculosis, influenza, and zoonotic infections, all of which rely on qPCR for accurate confirmation. India alone reports 2.4 million TB cases annually, reinforcing continual demand for nucleic-acid testing. Meanwhile, China’s genomic initiatives, including large-scale programs for population sequencing and cancer screening, rely heavily on high-throughput and digital PCR technologies.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the market include Thermo Fisher Scientific, Inc., Bio-Rad Laboratories, Inc., F. Hoffmann-La Roche Ltd., Agilent Technologies, Inc., QIAGEN N.V., Abbott Laboratories, BIOMÉRIEUX SA, Danaher Corporation, Azure Biosystems, Inc., Bio Molecular Systems, Takara Bio, Inc., Siemens Healthineers AG, and Other key players.

Thermo Fisher Scientific remains one of the foremost leaders in the qPCR instruments market, driven by its extensive portfolio that includes the QuantStudio™ series, ViiA™7, and StepOne™ systems. These platforms are widely adopted across diagnostic laboratories, biotechnology companies, and academic institutions due to their high sensitivity, flexible throughput options, and strong software ecosystem. Thermo Fisher’s ability to integrate consumables, assays, and instrumentation gives it a strong competitive advantage, especially in clinical and high-throughput applications.

Bio-Rad Laboratories holds a significant position through its CFX series of real-time PCR systems, which are known for robust temperature uniformity and user-friendly interface. Bio-Rad’s ecosystem, including reagents and data-analysis tools, supports applications ranging from infectious-disease diagnostics to gene-expression research.

The company also plays an important role in digital PCR innovation, expanding its reach across oncology and rare-mutation analysis. F. Hoffmann-La Roche Ltd. contributes substantial value through its LightCycler® platforms, which are widely used in hospitals and reference laboratories.

Roche has strong clinical credibility, and its qPCR instruments are often integrated into regulated diagnostic workflows for virology, oncology, and transplant monitoring. Its global presence and established reagent portfolio strengthen its market influence.

QIAGEN N.V. remains a key player, especially through its Rotor-Gene® Q system, known for its unique rotary design that ensures exceptional temperature homogeneity. QIAGEN’s strong footprint in sample preparation, assay development, and molecular diagnostics consolidates its position across clinical and research applications.

Top Key Players

- Thermo Fisher Scientific, Inc.

- Bio-Rad Laboratories, Inc.

- Hoffmann-La Roche Ltd.

- Agilent Technologies, Inc.

- QIAGEN N.V.

- Abbott Laboratories

- BIOMÉRIEUX SA

- Danaher Corporation

- Azure Biosystems, Inc.

- Bio Molecular Systems

- Takara Bio, Inc.

- Siemens Healthineers AG

- Other key players

Recent Developments

- In July 2025, Bio-Rad announced the launch of four new Droplet Digital™ PCR (ddPCR™) platforms — the QX Continuum™ system and the QX700™ series (acquired via its purchase of Stilla Technologies). The expanded product line now joins Bio-Rad’s existing QX200™ and QX600™ systems, offering more than 400,000 validated assays. The new instruments feature advanced multiplexing (up to 7 colours) and high throughput (over 700 samples/day for QX700 series).

- In May 2025, QIAGEN announced a commercial partnership and co-marketing agreement with French company ID Solutions to expand its digital PCR (dPCR) assay offering for oncology research on the QIAcuity platform. ID Solutions will manufacture and supply research-use only assays (cfDNA & gDNA) optimized for cell-free DNA from plasma and for FFPE tissue, while QIAGEN will commercialize them in Europe initially.

- In April 2025, QIAGEN announced enhanced support for lentivirus-based applications within its QIAcuity digital PCR portfolio, aimed at quality-control workflows in cell and gene therapy (CGT) manufacturing. The expansion addresses demands in advanced biotherapeutics, such as CAR-T therapies, for precise and scalable viral-vector quantification.

- In November 2023, Roche launched the LightCycler PRO System, designed for both research and in-vitro diagnostic workflows. It builds on a legacy of LightCycler technology to offer improved temperature uniformity (via a new vapor-chamber design), user-interface upgrades and versatility across translational research and clinical diagnostics. Roche emphasised its role in outbreak-readiness and personalised medicine.

Report Scope

Report Features Description Market Value (2024) US$ 1.25 Billion Forecast Revenue (2034) US$ 2.65 Billion CAGR (2025-2034) 7.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Instrument Type (Real-time qPCR systems, Point-of-care, Digital PCR (dPCR) systems, High-throughput qPCR platforms, Multiplex/microfluidic qPCR systems), By Application (Infectious disease diagnostics, Oncology & cancer biomarker testing, Genetic/ genomic research and gene expression profiling, Agricultural / animal health testing, Other applications), By End-User (Diagnostic laboratories, Hospitals & clinics, Pharma & biotech companies, and Other end-users) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thermo Fisher Scientific, Inc., Bio-Rad Laboratories, Inc., F. Hoffmann-La Roche Ltd., Agilent Technologies, Inc., QIAGEN N.V., Abbott Laboratories, BIOMÉRIEUX SA, Danaher Corporation, Azure Biosystems, Inc., Bio Molecular Systems, Takara Bio, Inc., Siemens Healthineers AG, and Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Thermo Fisher Scientific, Inc.

- Bio-Rad Laboratories, Inc.

- Hoffmann-La Roche Ltd.

- Agilent Technologies, Inc.

- QIAGEN N.V.

- Abbott Laboratories

- BIOMÉRIEUX SA

- Danaher Corporation

- Azure Biosystems, Inc.

- Bio Molecular Systems

- Takara Bio, Inc.

- Siemens Healthineers AG

- Other key players