Global Psychedelic Mushroom Market Size, Share, Analysis Report By Form (Fresh/Whole, Dried, Processed), By Product Type (Psilocybe, Gymnopilus, Panaeolus), By Application (Recreational, De-addiction, Herapeutic, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 155809

- Number of Pages: 326

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

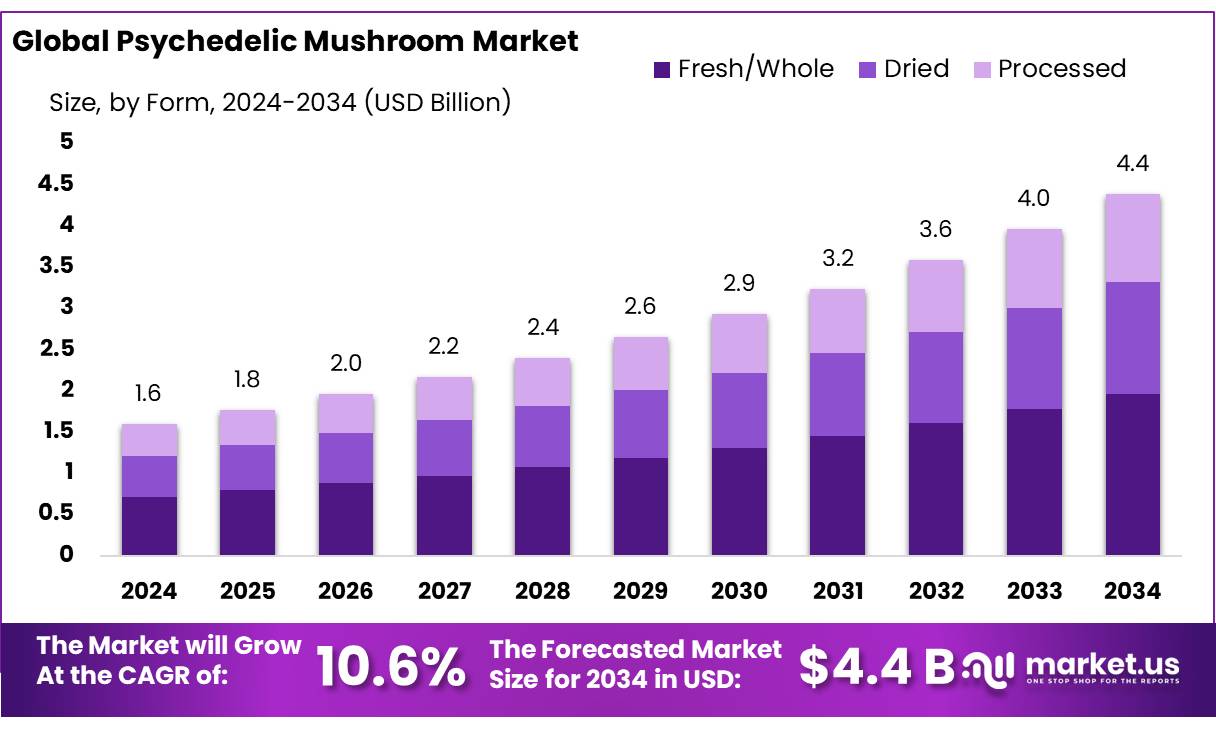

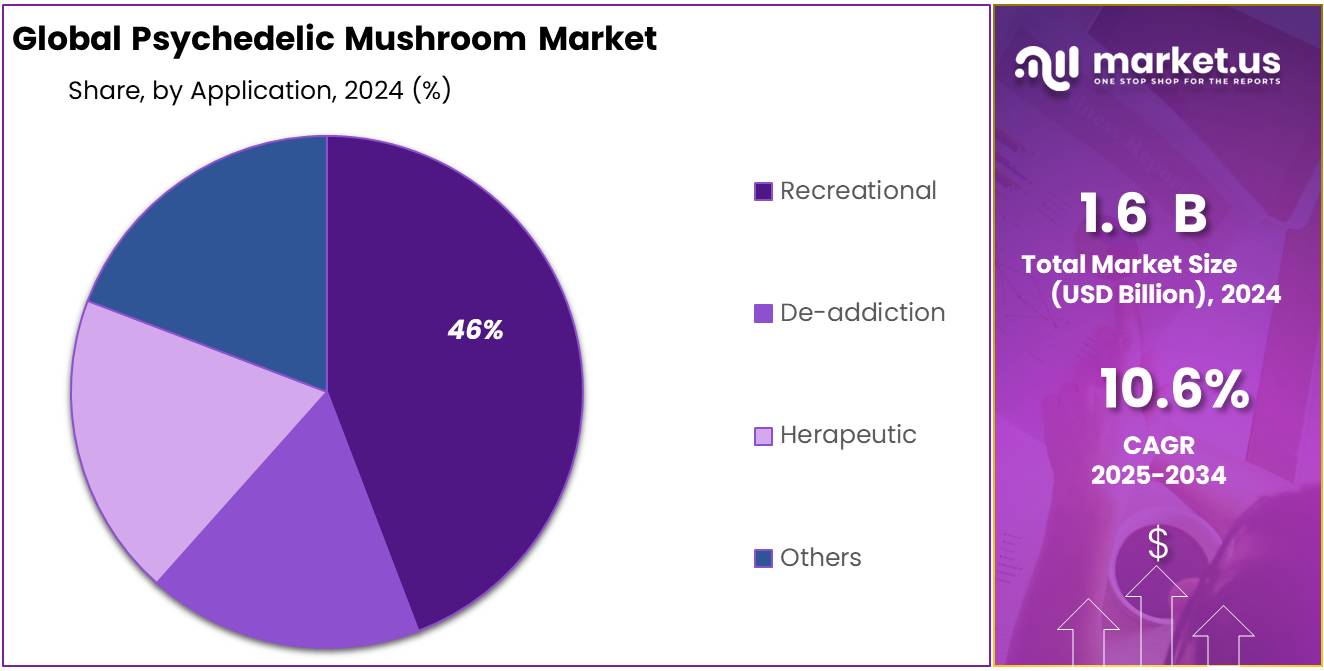

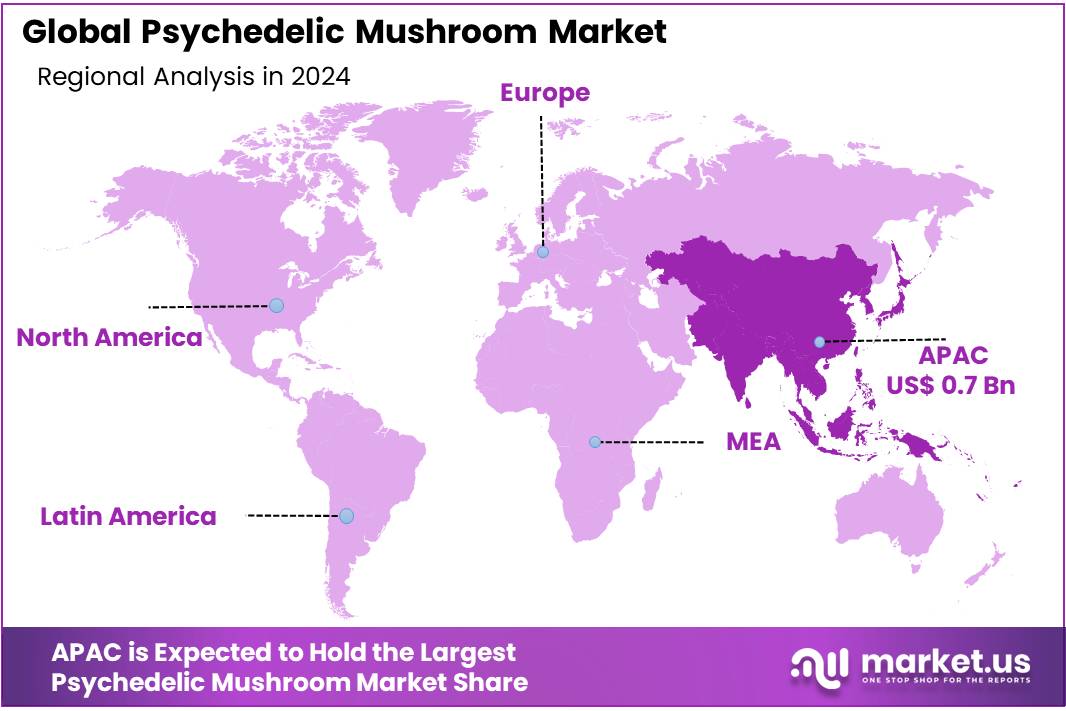

The Global Psychedelic Mushroom Market size is expected to be worth around USD 4.4 Billion by 2034, from USD 1.6 Billion in 2024, growing at a CAGR of 10.6% during the forecast period from 2025 to 2034. In 2024, Asia Pacific held a dominant market position, capturing more than a 43.8% share, holding USD 0.7 Billion revenue.

Psychedelic mushroom concentrates—high-potency extracts derived from psilocybin-containing fungi—are emerging as specialized therapeutic formulations in the evolving medicinal psychedelics market. These concentrates offer controlled dosing and ease of administration compared to whole mushrooms, making them particularly attractive for clinical, wellness, and therapeutic contexts.

Key industrial drivers include expanding therapeutic applications and evolving regulatory frameworks. Clinical recognition continues to grow: for example, the U.S. Department of Veterans Affairs in Australia will fund MDMA‑ and psilocybin‑assisted therapies for veterans with PTSD and treatment‑resistant depression under stringent clinical oversight.

Similarly, in the U.S., states such as Oregon and Colorado have taken concrete steps toward establishing regulated medical psilocybin programs: Oregon’s supervised‑use model launched licensed service centers (e.g., Epic Healing Eugene received over 3,000 waitlist requests shortly after opening), and Colorado began issuing Medical Assisted Use licenses in March 2025. Moreover, New Mexico enacted the Medical Psilocybin Act in April 2025 to allow therapeutic use under licensed healthcare supervision.

Additionally, leveraging national research frameworks such as India’s Open Source Drug Discovery (OSDD) program—which received ₹45.96 crores (approx. USD 12 million) in funding from the Government of India (2008–2012)—could facilitate open, collaborative exploration of psychedelic compound biochemistry and extraction innovations

Key Takeaways

- Psychedelic Mushroom Market size is expected to be worth around USD 4.4 Billion by 2034, from USD 1.6 Billion in 2024, growing at a CAGR of 10.6%.

- Fresh/Whole mushrooms took the lead in the psychedelic mushroom market, commanding more than 44.8% of total market share.

- Psilocybe emerged as the clear front-runner in the psychedelic mushroom market, accounting for more than 67.4% of the total share.

- Recreational segment clearly took the lead in the psychedelic mushroom market, capturing more than 46.6% of total applications.

- Asia-Pacific (APAC) region emerged as the dominant force in the psychedelic mushroom market in 2024—securing a commanding 43.8% share, equivalent to approximately USD 0.7 billion.

By Form Analysis

Fresh/Whole dominates with over 44.8% in 2024 due to its natural appeal and popularity.

In 2024, Fresh/Whole mushrooms took the lead in the psychedelic mushroom market, commanding more than 44.8% of total market share. This form remains highly attractive because it is closest to its natural state, offering consumers a sense of purity and authenticity. People often trust and prefer fresh mushrooms, especially when using them for research, therapeutic trials, or experiential purposes. Handling and processing are simpler, and the perception of “whole-food” integrity resonates with both practitioners and end users.

Looking into 2025, while we don’t yet have an exact percentage beyond the 2024 figure, it’s reasonable to expect that Fresh/Whole will continue to perform strongly. Given its strong foundation and the continued consumer preference for unprocessed, natural formats, Fresh/Whole is well-positioned to maintain its dominance. Factors like ease of use, minimal processing requirements, and the perceived freshness advantage could keep its share stable or growing modestly.

By Product Type Analysis

Psilocybe takes the lead in 2024, owning over 67.4% of the market thanks to its recognized potency and popularity.

In 2024, Psilocybe emerged as the clear front-runner in the psychedelic mushroom market, accounting for more than 67.4% of the total share. This dominance isn’t surprising—Psilocybe species are well-known and extensively studied, making them the go-to choice for research, therapeutic trials, and consumer use. Their strong reputation for potency and consistent active compound levels gives stakeholders confidence, from cultivators to end users. Because of this, Psilocybe continues to attract the lion’s share of attention and demand.

Moving into 2025, while exact figures haven’t been released yet, the momentum is likely carrying forward. With Psilocybe’s well-established standing and trusted profile, it stands a solid chance of maintaining—or even slightly growing—its commanding position. The simplicity of working with familiar strains, combined with user trust built over time, gives it an edge that’s hard to shake.

By Application Analysis

Recreational use leads the pack in 2024, accounting for over 46.6% of the market thanks to broader acceptance and demand.

In 2024, the Recreational segment clearly took the lead in the psychedelic mushroom market, capturing more than 46.6% of total applications. This strong showing stems from growing social acceptance and evolving cultural interest in non-medical use. Many people are drawn to the personal experiences that psychedelic mushrooms can bring—curiosity, self-exploration, even community-oriented gatherings all play a part. The simplicity of the recreational route—fewer formal hurdles compared to medical or research applications—also makes it more accessible for many individuals.

Looking ahead to 2025, while precise figures for the recreational slice aren’t yet available, it’s reasonable to expect that this trend continues. Most indicators suggest the segment’s dominance will persist, given the ongoing conversations around legalization, decriminalization, and the general public’s openness to exploring alternative experiences.

Key Market Segments

By Form

- Fresh/Whole

- Dried

- Processed

By Product Type

- Psilocybe

- Gymnopilus

- Panaeolus

By Application

- Recreational

- De-addiction

- Herapeutic

- Others

Emerging Trends

FDA Advancing Synthetic Psilocybin Toward Approval

In July 2025, a key development unfolded: Compass Pathways, a biotech firm, announced it had successfully met the primary endpoint in its Phase 3 COMP005 trial using COMP360, a synthetic form of psilocybin, to treat people with treatment-resistant depression. Compared to placebo, a single 25 mg dose of COMP360 led to a statistically significant reduction in depressive symptoms, with a clinically meaningful change of –3.6 points in MADRS depression scores at six weeks—a difference that carried a p < 0.001 level of significance.

This isn’t happening in isolation. Regulators are taking note too. Recently, voices in health leadership—like FDA Commissioner Dr. Marty Makary and Health Secretary Robert F. Kennedy Jr.—have signaled a softer stance toward psychedelics, calling for open ears to patients and providers who’ve experienced meaningful shifts from these therapies. That type of acknowledgement, from the top of the system, helps build a bridge toward mainstream acceptance.

At its core, the trend toward FDA review of synthetic psilocybin taps into something deeply human—a longing for healing where there’s little today. The COMP360 results are more than clinical—they signal more structured access, potential insurance coverage, and a shift from underground or fringe status into regulated, evidence-backed medicine. When the system starts to validate an approach, patients, caregivers, and providers breathe a collective sigh of relief.

Drivers

Growing Government‑backed Research Funding and Policy Support

One standout example is the U.S. Department of Veterans Affairs (VA), which marked a watershed moment in December 2024 by approving its first psychedelic‑assisted therapy study in over 60 years, allocating $1.5 million specifically to investigate treatments for PTSD and alcohol use disorder in veterans. This funding not only provides much‑needed capital for rigorous research—it also signifies institutional buy-in at a high level, acknowledging psychedelics as a legitimate avenue for mental health treatment.

Beyond the VA, the U.S. Department of Defense (DoD) has also stepped up. In 2024, Congress authorized $10 million in funding dedicated to clinical trials involving psychedelic treatments through Section 723 legislation. This is especially noteworthy: it highlights how defense-related institutions are recognizing the potential of psychedelics to address issues like trauma and mental health among military personnel.

Across states, policy changes are unfolding too. In Colorado, as of March 24, 2025, state regulators issued the first licenses for medically assisted use of psilocybin—making Colorado only the second U.S. state after Oregon to move from decriminalization into structured, regulated therapeutic use. Meanwhile, New Mexico’s governor signed the Medical Psilocybin Act in April 2025, officially creating a therapeutic psilocybin program that allows patients with qualifying conditions to access the substance under licensed healthcare oversight.

Restraints

Strict Legal Status and Safety Concerns Hinder Industry Momentum

One of the most pressing barriers slowing down the growth of the psychedelic mushroom space is the stringent legal classification of psilocybin as a Schedule I controlled substance at the federal level, coupled with real and alarming safety incidents tied to unregulated products. These twin hurdles—legal risk and public health concerns—create a heavy drag on broader development, acceptance, and investment.

First, psilocybin’s Schedule I status in the United States means it is officially deemed to have “no accepted medical use” and a “high potential for abuse,” making its possession, manufacture, or distribution illegal under federal law. Penalties can be severe: depending on the jurisdiction, individuals may face substantial fines, up to year-long jail terms, or even felony charges for distributing psilocybin-containing mushrooms. This tight legal framework throttles legitimate access for research, therapeutic application, and product development.

Adding to the complication, public safety events tied to unregulated edible products have raised alarming red flags. A stark example involves the product line Diamond Shruumz—marketed as mushroom edibles—linked to at least 180 poisonings, including **73 hospitalizations and 3 deaths across 34 states by late 2024. These incidents weren’t minor—they triggered widespread recalls and prompted public health agencies to caution consumers strongly against purchasing unregulated mushroom edibles.

Opportunity

Expanding Clinical Acceptance Through Legal and Research Advancements

In the United States, the journey toward psilocybin legitimacy took a pivotal turn when the Food and Drug Administration (FDA) granted it “breakthrough therapy” designation for treatment-resistant depression. This designation, given in both 2018 and again in 2019, signals that early clinical results are compelling enough to warrant a faster track toward approval. Such recognition by a key federal body lends scientific credibility, paving the way for more funded research and careful therapeutic use.

We also see states taking the lead on crafting controlled frameworks. Oregon led the way by passing Ballot Measure 109 in 2020, becoming the first U.S. state to both decriminalize psilocybin and legalize its supervised therapeutic use under a regulated system. Following Oregon’s example, Colorado enacted similar medical-use and decriminalization measures in 2022, further solidifying the trend toward cutting red tape and introducing oversight.

Such legal validation isn’t just symbolic—it means more institutions can conduct clinical trials with confidence. For instance, ClinicalTrials.gov currently lists over 130 psilocybin trials over the past two decades, giving researchers robust backbones for evidence-based study. And it’s not just numbers—real-world outcomes are encouraging.

A recent trial at the University of Washington showed a 21.33-point improvement in depression scores for frontline healthcare workers using psilocybin therapy, compared to a 9.33-point improvement with placebo. These results resonate; they’re about people rediscovering connection, motivation, and relief after burnout.

Regional Insights

APAC region leads Psychedelic Mushroom Market with a solid 43.8% share, valued at USD 0.7 billion

In a clear sign of its growing influence, the Asia-Pacific (APAC) region emerged as the dominant force in the psychedelic mushroom market in 2024—securing a commanding 43.8% share, equivalent to approximately USD 0.7 billion. This is more than just a number; it reflects cultural openness, expanding therapeutic interest, and regional momentum toward innovative solutions for mental health.

This regional strength isn’t happening in isolation. Across APAC, there’s a blend of tradition and innovation: societies long familiar with sacred, plant-based healing are increasingly receptive to structured, science-backed treatment models. Governments and research bodies are collaborating more openly, while health professionals are exploring new therapeutic frontiers—all of which point to a cultural shift toward acceptance, undergirded by regulation and clinical interest.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Optimi Health Corp., based in Canada, is a Health Canada–licensed GMP pharmaceutical manufacturer specializing in natural psilocybin, MDMA, and functional mushrooms. Founded in 2020, the company provides raw mushroom biomass, extracts, supplements, and drug products aimed at clinical and therapeutic markets. Operating through online channels and distributors, Optimi is also building large-scale cultivation facilities to ensure consistent, research-grade psilocybin supply.

Originally founded in 2019 in Canada, Field Trip Health established what was among the world’s first legal research and cultivation facilities specifically for psilocybin mushrooms in Jamaica. The company later split in 2022 into separate entities focused on treatment services and therapeutic R&D. Its early efforts included a ketamine-assisted psychotherapy app and clinics in major cities.

Based in Ontario, Revive Therapeutics expanded from cannabinoid R&D into psychedelics. They are conducting Phase I/II clinical trials using oral psilocybin—such as thin-film strips—for treating substance use disorders, including methamphetamine addiction, with nearly half of the trial participants enrolled and promising early efficacy data emerging.

Top Key Players Outlook

- Optimi Health

- Field Trip Health

- Revive Therapeutics

Recent Industry Developments

In 2024, Field Trip Health — originally a pioneer in opening clinics for ketamine-assisted psychotherapy and setting the stage for psychedelics like psilocybin — experienced significant change. Their clinics, which once spanned North America, saw a reduction in service revenue: outpatient clinic revenue in the U.S. dropped from USD 3.6 million in Q2 to USD 3.4 million in Q3, a 7% decrease.

In 2024 Optimi Health’s Role, the company secured a Drug Establishment Licence from Health Canada, formally authorizing it to manufacture and export MDMA and psilocybin capsules—even facilitating an initial 160‑dose supply to Australian psychiatrists under Australia’s Authorized Prescriber Scheme

Report Scope

Report Features Description Market Value (2024) USD 1.6 Bn Forecast Revenue (2034) USD 4.4 Bn CAGR (2025-2034) 10.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Fresh/Whole, Dried, Processed), By Product Type (Psilocybe, Gymnopilus, Panaeolus), By Application (Recreational, De-addiction, Herapeutic, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Optimi Health, Field Trip Health, Revive Therapeutics Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Psychedelic Mushroom MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Psychedelic Mushroom MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Optimi Health

- Field Trip Health

- Revive Therapeutics