Global Protein Films Market By Type (Wheat Gluten Films, Collagen Films, Gelatin Films, Corn Zein Films, Casein Films, Other Types) By End User (Food & Beverages, Pharmaceuticals) By Region And Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends And Forecast 2024–2033

- Published date: Feb 2024

- Report ID: 26889

- Number of Pages: 234

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

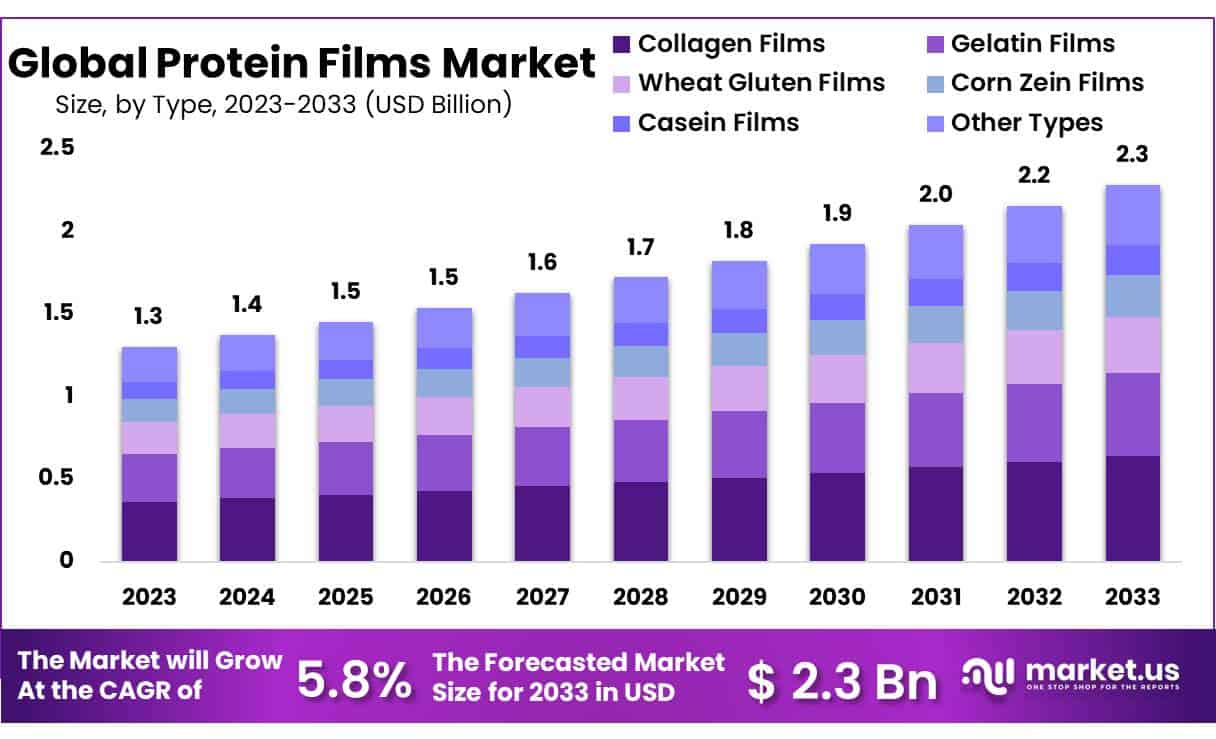

The Global Protein Films Market size is expected to be worth around USD 2.3 Billion by 2033 from USD 1.3 Billion in 2023, growing at a CAGR of 5.8% during the forecast period from 2024 to 2033.

Protein films are slender, see-through sheets crafted from natural proteins like gelatin, whey protein, and casein. They serve as packaging materials within the food industry, offering an eco-friendly and sustainable substitute for conventional plastic packaging. The manufacturing process involves dissolving protein in water, followed by spreading the solution onto a surface to create a delicate film. Afterward, the film undergoes drying and can be molded into diverse packaging formats such as bags or trays.

Protein films serve as carriers for antioxidants, antimicrobials, colors, and flavors – aiding to increase safety and shelf-life in packaged goods. With technological advancement and continued investment in R&D, more proteins than ever are now utilized as edible films – including whey, wheat gluten, and mung bean proteins among many others. Notably collagen films have recently drawn considerable interest from consumers – collagen serves as a structural protein used to connect cartilage tendons bone tissue ligaments etc.

Key Takeaways

- Market Size: Protein Films Market size is expected to be worth around USD 2.3 Billion by 2033 from USD 1.3 Billion in 2023.

- Market Growth: The market growing at a CAGR of 5.8% during the forecast period from 2024 to 2033.

- Type Analysis: Collagen films dominate the protein films market with an estimated 28% market share.

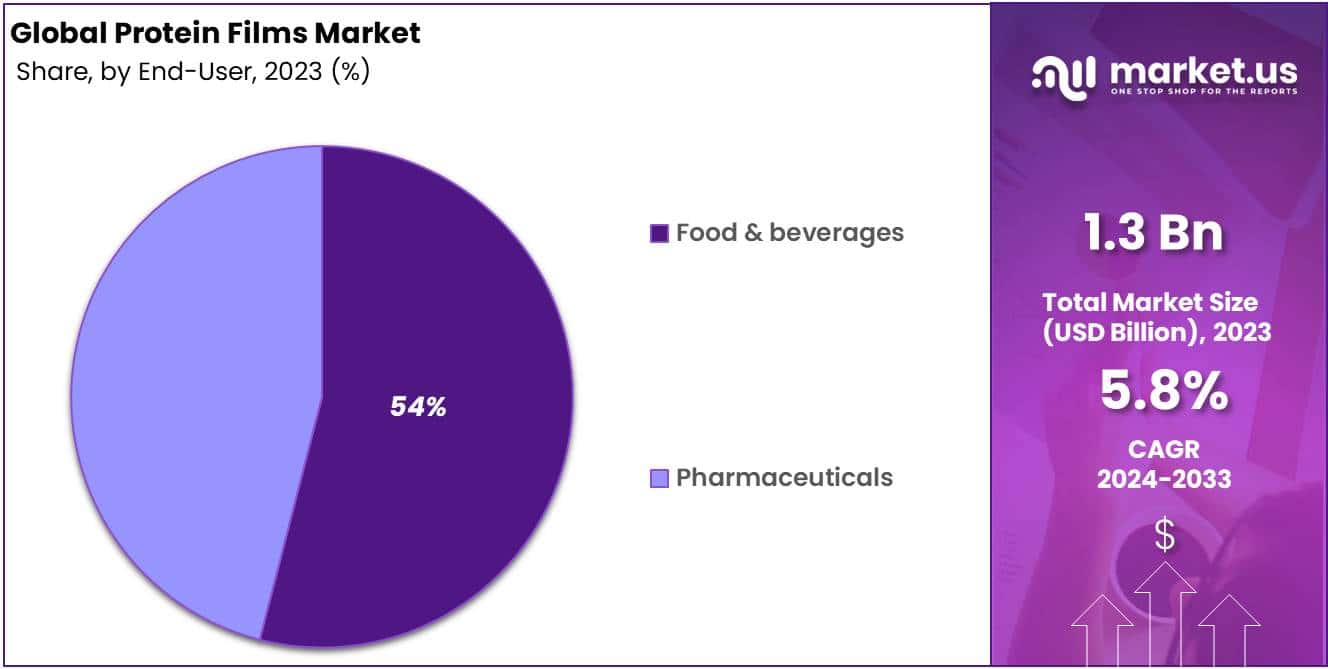

- End User Analysis: The food and beverages industries hold 54% market share for protein films market.

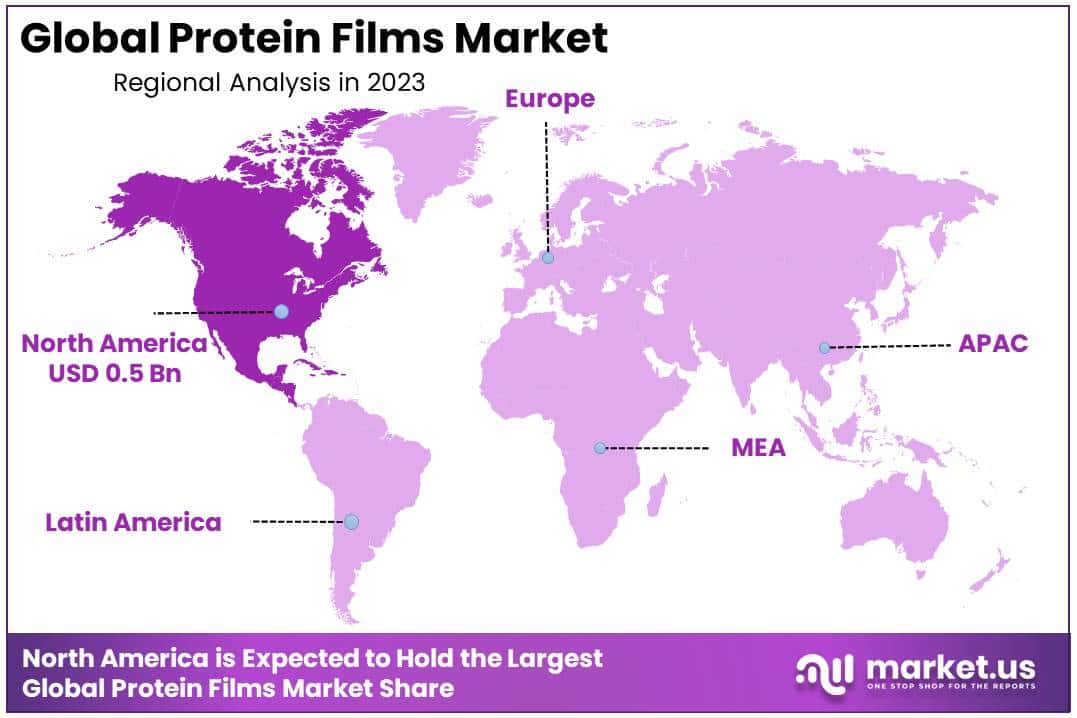

- Regional Analysis: North America currently leads with 39% market share and USD 0.5 billion in annual revenues.

- Environmental Sustainability: With growing environmental concerns, protein films offer a viable alternative to traditional plastic packaging materials. They are biodegradable, compostable, and derived from renewable sources such as plant proteins.

- Expanding Application Scope: Protein films find applications across various industries, including food packaging, pharmaceuticals, and cosmetics. Their versatility and compatibility with different products contribute to their expanding market reach.

Type Analysis

Collagen films dominate the protein films market with an estimated 28% market share. Comprised primarily of collagen-derived films, these esteemed biocompatible and biodegradable barrier properties make collagen films highly prized in this sector of the market. Other key players in the protein film market include Wheat Gluten Films, Gelatin Films, Corn Zein Films and Casein Films among many others.

Wheat Gluten Films have gained widespread recognition due to their renewable and sustainable properties, Gelatin Films from animal bones and skin can provide versatile film-forming abilities, Corn Zein Films from corn protein boast outstanding mechanical properties as well as biodegradability, while Casein Films from milk protein provide great barrier properties and biocompatibility.

These protein films find applications across several sectors such as food packaging, pharmaceuticals and cosmetics – driving innovation and growth in the protein film market.

End User Analysis

The food and beverages industries hold 54% market share for protein films market. Protein films find extensive use within this industry due to their versatility, sustainability and functional properties; such films serve various functions in food packaging such as extending shelf life, maintaining freshness and product safety – as well as meeting consumer demand for eco-friendly and biodegradable solutions that drive their adoption throughout this landscape.

Food and beverages remain the dominant sector for protein films; however, the pharmaceutical industry also presents opportunities. Protein films are used for drug delivery systems, wound dressings, bioactive coatings, wound care solutions, controlled release coatings and bioactive coatings in this sector due to their biocompatibility and controlled release properties. As pharmaceutical companies prioritize sustainable packaging and drug delivery solutions more frequently, demand for protein films within this sector should increase; contributing further growth of the protein films market overall.

Market Segments

Type

- Wheat Gluten Films

- Collagen Films

- Gelatin Films

- Corn Zein Films

- Casein Films

- Other Types

End User

- Food & Beverages

- Pharmaceuticals

Driver

Growing Demand for Sustainable Packaging Solutions

Rising awareness regarding environmental sustainability has been one of the key forces driving protein film market growth. Protein films offer biodegradable and compostable alternatives to petroleum-based plastics; as consumers become more eco-conscious there has been an upsurge in demand for packaging that reduces its environmental impact; protein films made of renewable sources like whey, collagen or soy are quickly gaining favor as an eco-friendly packaging material – prompting more manufacturers and packaging companies to turn towards these eco-friendly films as sustainable packaging solutions that helps boost market expansion.

Technologies Advance Protein Film Technology

Technological advancements play a pivotal role in driving innovation and expanding protein film applications. Researchers and manufacturers alike are continuously discovering innovative processing techniques and formulations to increase the properties of protein-based films such as barrier properties, mechanical strength and flexibility. Nanotechnology allows for molecular-level manipulation of protein film structures for improved performance characteristics. Edible protein films featuring functional additives like antimicrobial agents and antioxidants expands their use for food packaging and preservation, driving increased adoption across various industries including food & beverages, pharmaceuticals & cosmetics.

Trend

Increase in Consumer Preference for Plant-Based Diets

This rise in consumer preference for diets rich in plant proteins has had an enormous effect on the protein film market, significantly shifting consumer preference toward plant-based protein diets and shaping it further. Since consumers increasingly look for alternatives to animal-derived products for health, ethical, and environmental considerations, plant-based proteins – and packaging materials made with plants – have become an increasing demand.

Protein films derived from plants such as pea, rice and potato are becoming increasingly popular due to their sustainability, allergen-free properties and versatility. Manufacturers have taken notice, capitalizing on this trend by developing plant-based protein films to meet growing consumer demands for eco- and vegan-friendly packaging solutions. This trend should lead to wider use of plant-based protein films in packaging applications like food wraps, pouches and sachets.

Transition Toward Circular Economy Models

The global shift towards circular economy models is having an impactful result on protein films market by encouraging closed-loop systems and optimizing resource use efficiency. Protein-based films align perfectly with circular economy principles as they’re made from renewable resources and can easily be composted or recycled at the end of their lives. Governments, regulatory bodies and industry stakeholders have increasingly recognized the significance of sustainable packaging solutions and are creating policies to encourage circular economy practices.

As such, more emphasis is being put on designing packaging materials like protein films with recycling, biodegradability and reuse in mind. This trend has resulted in collaborative partnerships among packaging manufacturers, waste management companies and recyclers to develop infrastructure and processes to facilitate collection, sorting and recycling of protein-based packaging materials, opening new opportunities for market expansion.

Restraints

Cost and Scalability Challenges

While protein films offer eco-friendly benefits, their cost and scalability challenges pose threats that impede market expansion. Protein-based films typically involve more intricate manufacturing techniques and equipment compared to regular plastic films, and as such have higher manufacturing costs than their plastic counterparts. Raw materials such as plant proteins or animal by-products may fluctuate based on factors like seasonal fluctuations and supply chain disruptions, making their availability and costs variable.

Scaling production to meet commercial demand while upholding quality and consistency presents logistical and operational difficulties for manufacturers, and poses cost and scalability barriers that prevent small and medium-sized enterprises (SMEs) and startups from entering the protein film market; further restricting growth and adoption rates of this industry.

Performance Limitations and Compatibility Concerns

Protein films may exhibit performance limitations and compatibility issues in certain applications, which could impede market expansion. While protein-based films offer biodegradability and compostability benefits, their barrier properties may fall below those offered by traditional plastics; leading to concerns regarding shelf life extension, product protection and preservation. Protein films may interact with certain food products and alter their flavor, texture and aroma, thus rendering them unsuitable for packaging applications that involve certain applications of this nature.

Protein films do not meet all of the specifications necessary for high-performance packaging applications such as barrier films for perishable food products or medical devices, creating additional challenges for manufacturers and end-users seeking solutions that balance sustainability with functionality and performance.

Opportunity

Expanding Applications in the Food & Beverage Sector

Food and beverage manufacturing represents an unprecedented market for protein films due to increasing consumer demands for sustainable packaging solutions as well as their preferences for natural and healthy products. Protein films offer several distinct advantages that make them suitable for food and beverage packaging applications, including biodegradability, barrier properties and customizability, making them suitable for fresh produce packaging, snacks packaging and ready-to-eat meal applications.

As food companies strive to differentiate their offerings and appeal to eco-conscious customers, there has been an increased interest in using protein film manufacturers’ protein packaging materials as part of their sustainability initiatives. This offers protein film manufacturers opportunities to partner with food companies to design custom solutions that fulfill product specifications while meeting environmental concerns.

Rising Opportunities in Healthcare and Personal Care

Protein films market players see potential in healthcare and personal care industries due to an increasing need for sustainable packaging solutions for pharmaceuticals, medical devices, and cosmetic products. Protein-based films boast special characteristics such as biocompatibility, flexibility and controlled release capabilities that make them suitable for healthcare and personal care applications like drug delivery systems, wound dressings or cosmetic packaging.

As regulatory agencies and consumers place increasing emphasis on safety, efficacy and environmental sustainability when purchasing healthcare and personal care products, there has been increased interest in exploring protein-based packaging alternatives as viable replacements for plastics or polymers. This provides protein film manufacturers with opportunities to collaborate with healthcare companies or cosmetic brands on innovative packaging solutions that comply with strict regulatory requirements while simultaneously minimising environmental impacts.

Regional Analysis

Protein films market projections suggest strong development across various regions, particularly North America (NA), Asia-Pacific (APAC), Europe, United States of America and China. Of the regions listed here, North America currently leads with 39% market share and USD 0.5 billion in annual revenues owing to rising adoption within food and beverage production industries; APAC will experience strong expansion due to growing sustainable packaging demands as well as stringent regulations surrounding plastic waste management while Europe may maintain significant market presence due to increasing preferences for biodegradable materials.

Market Player Analysis

The research report provides in-depth profiles of key players in the market, providing an in-depth perspective of its global competitive landscape. This section offers a holistic view of competitive dynamics encompassing mergers and acquisitions, future capacities, partnerships, financial summaries, collaborations, new product developments, product launches, as well as any relevant advancements.

Market Key Players

- Davisco

- Proliant Inc.

- Fonterra

- Tate and Lyle

- The Solae Company

- Cargill

- Werner Mathis USA Inc.

- Mocon Inc.

- Monosol, LLC

- Watson Inc.

Recent Developments

- Proliant Inc.: Acquired AGR Ingredients in June 2023, expanding their portfolio of biopolymers, potentially including protein-based options.

- Fonterra: Partnered with Ingredion in October 2022 to develop and commercialize whey protein-based films for food packaging.

- Tate and Lyle: Exploring the use of pea protein isolates for edible films and coatings.

- Cargill: Actively researching plant-based proteins for various applications, including films. Partnered with Novamonte in 2022 to develop bio-based films.

- Werner Mathis USA Inc.: Primarily a distributor of films and other packaging materials. May offer protein-based films from other manufacturers.

Report Scope

Report Features Description Market Value (2023) USD 1.3 Billion Forecast Revenue (2033) USD 2.3 Billion CAGR (2024-2033) 5.8% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type-(Wheat Gluten Films, Collagen Films, Gelatin Films, Corn Zein Films, Casein Films, Other Types) By End User-(Food & Beverages, Pharmaceuticals) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Davisco, Proliant Inc., Fonterra, Tate and Lyle, The Solae Company, Cargill, Werner Mathis USA Inc., Mocon Inc., Monosol, LLC, Watson Inc., Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are protein films?Protein films are thin, biodegradable films made from proteins derived from various natural sources such as plants, animals, and microorganisms. They are used as sustainable alternatives to traditional plastic packaging materials.

How big is the Protein Films Market?The global Protein Films Market size was estimated at USD 1.3 Billion in 2023 and is expected to reach USD 2.3 Billion in 2033.

What is the Protein Films Market growth?The global Protein Films Market is expected to grow at a compound annual growth rate of 5.8%. From 2024 To 2033

Who are the key companies/players in the Protein Films Market?Some of the key players in the Protein Films Markets are Davisco, Proliant Inc., Fonterra, Tate and Lyle, The Solae Company, Cargill, Werner Mathis USA Inc., Mocon Inc., Monosol, LLC, Watson Inc.

What are the advantages of protein films?Protein films offer several advantages, including biodegradability, compostability, renewability, and compatibility with different products. They also provide barrier properties against moisture, gases, and UV light, thus extending the shelf life of packaged goods.

What industries utilize protein films?Protein films find applications across various industries, including food packaging, pharmaceuticals, cosmetics, and agriculture. They are used for packaging perishable foods, drug delivery systems, personal care products, and as agricultural coatings for seed protection.

How are protein films produced?Protein films are typically produced through processes such as casting, extrusion, or compression molding. Proteins are extracted from raw materials such as soy, wheat, corn, or collagen, then processed into a film-forming solution, which is subsequently cast into thin films and dried.

-

-

- Davisco

- Proliant Inc.

- Fonterra

- Tate and Lyle

- The Solae Company

- Cargill

- Werner Mathis USA Inc.

- Mocon Inc.

- Monosol, LLC

- Watson Inc.