Global Propylene Glycol Ether Market Size, Share, And Enhanced Productivity By Product Type (Propylene Glycol Mono Methyl Ether (PM), Dipropylene Glycol Mono Methyl Ether (DPM), Tripropylene Glycol Mono Methyl Ether (TPM)), By Application (Chemical intermediate, Solvent, Coalescing agent, Electronics, Coatings, Others), By End-use (Construction, Automotive, Electronics, Printing and Packaging, Pharmaceuticals, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2026

- Report ID: 176413

- Number of Pages: 321

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

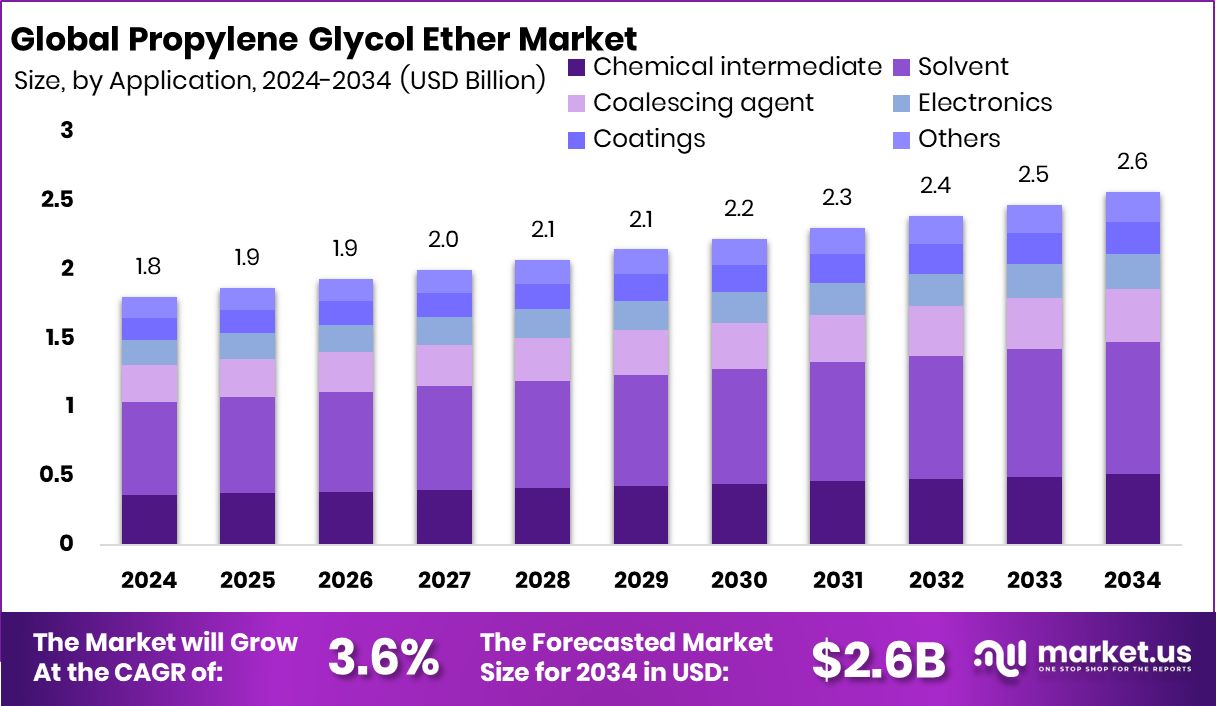

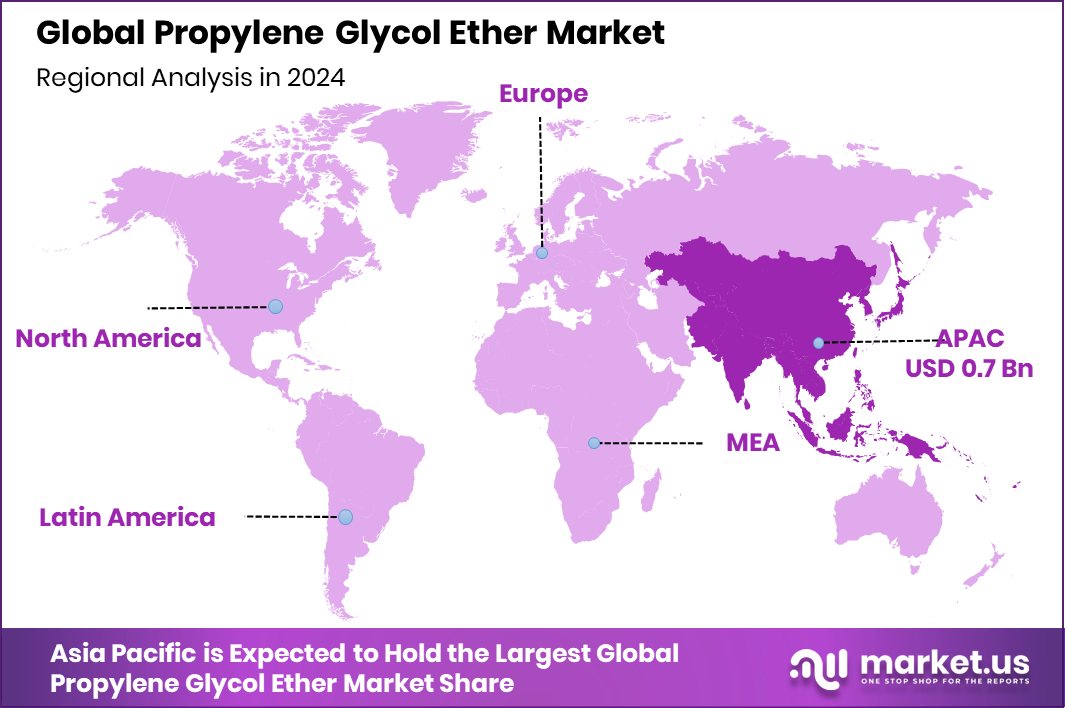

The Global Propylene Glycol Ether Market is expected to be worth around USD 2.6 billion by 2034, up from USD 1.8 billion in 2024, and is projected to grow at a CAGR of 3.6% from 2025 to 2034. Asia Pacific showed a 41.7% share, generating USD 0.7 Bn within the market segment.

Propylene glycol ethers are versatile solvents created from propylene oxide, valued for their ability to dissolve resins, oils, dyes, and polymers without producing harsh odors. They are widely used in coatings, electronics, printing, and industrial formulations because they offer good evaporation balance and compatibility with water-based systems. These qualities make them essential ingredients in sectors shifting away from heavy, hazardous solvents.

The Propylene Glycol Ether Market refers to the global supply, production, and use of these solvents across industries such as construction, automotive, pharmaceuticals, and packaging. Demand is shaped by the need for high-performance materials that comply with new environmental and workplace safety expectations. Growth also aligns with wider economic and infrastructure investments. For instance, SUNY Purchase College receiving $50 million in energy funding highlights how institutional projects continue supporting coatings and construction materials that use glycol ether solvents.

Demand is further influenced by economic pressures and long-term financial planning, reflected in reports such as projections that young workers could lose $110,000 in lifetime earnings to maintain Social Security solvency. These shifts affect consumer markets connected to packaging, housing, and durable goods manufacturing.

Opportunities also emerge as regions adapt to funding challenges—such as California homeowners contributing to a $1 billion insurer support plan—or as smaller firms like Orca Money enter solvent liquidation. These transitions often drive industries to seek efficient, compliant chemical ingredients, keeping propylene glycol ethers relevant across multiple applications.

Key Takeaways

- The Global Propylene Glycol Ether Market is expected to be worth around USD 2.6 billion by 2034, up from USD 1.8 billion in 2024, and is projected to grow at a CAGR of 3.6% from 2025 to 2034.

- In the Propylene Glycol Ether Market, Propylene Glycol Mono Methyl Ether dominated with a strong 48.2% share.

- The solvent segment led the Propylene Glycol Ether Market, holding a notable 37.6% overall share.

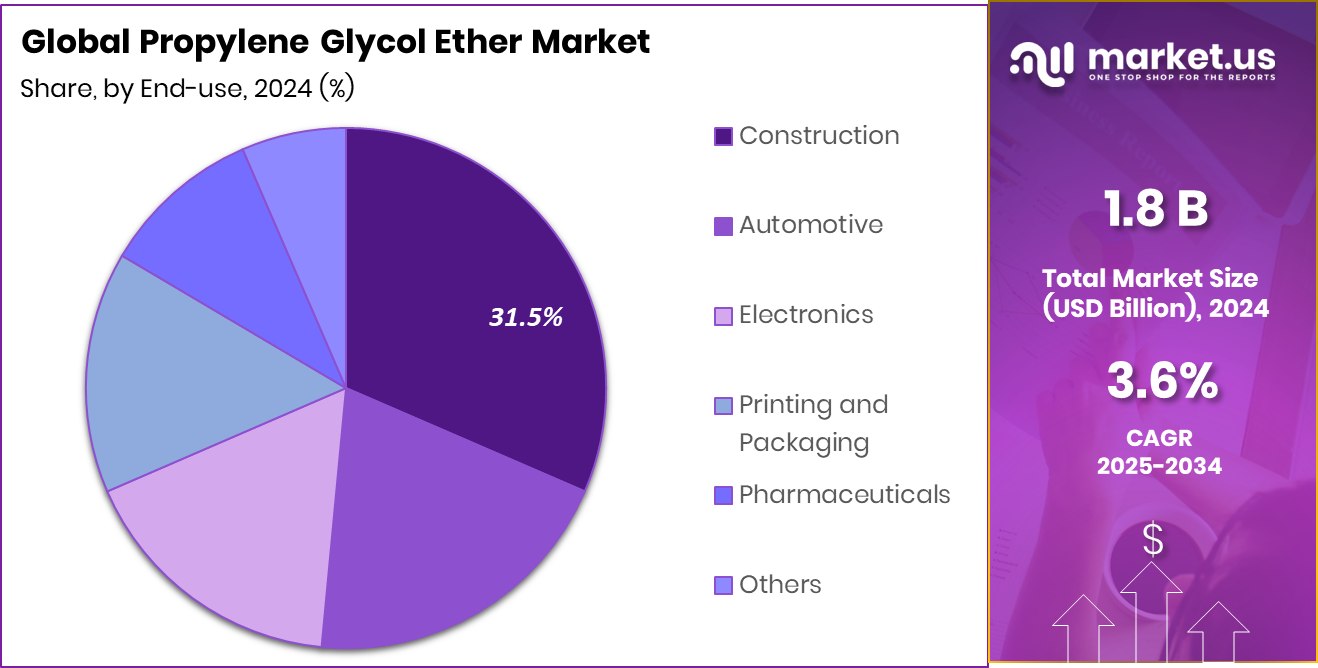

- Construction emerged as the top end-use category in the Propylene Glycol Ether Market with 31.5% share.

- Asia Pacific reached 41.7% regionally, generating USD 0.7 Bn in market revenue overall.

By Product Type Analysis

The propylene glycol ether market saw PM dominating with 48.2% product share.

In 2024, the Propylene Glycol Ether Market was led by Propylene Glycol Mono Methyl Ether (PM) with a strong 48.2% share, reflecting its wide acceptance as a high-performance solvent across coatings, paints, inks, and cleaning formulations. Its strong solvency power, low toxicity profile, and compatibility with waterborne systems made it a preferred choice as industries shifted toward safer and more efficient chemical ingredients.

Demand for PM also increased as manufacturers focused on low-VOC and eco-friendlier product lines, especially within architectural and industrial coatings. The compound’s ability to improve flow, leveling, and drying time kept it central to many production lines. Its balanced performance and regulatory compliance helped maintain its leading role throughout the year.

By Application Analysis

Solvent applications led the propylene glycol ether market, capturing 37.6% overall share.

In 2024, the Solvent segment dominated the Propylene Glycol Ether Market with 37.6%, driven by extensive use in paints, varnishes, printing inks, household cleaning products, and automotive formulations. The market saw rising demand for glycol ether solvents because they offer excellent solvency, fast evaporation control, and improved formulation stability without compromising worker or environmental safety.

Manufacturers increasingly preferred these solvents for waterborne coatings due to their ability to enhance viscosity, dispersion, and overall performance. Growth in chemical processing, packaging inks, and surface treatment solutions also added to the segment’s momentum. As industries moved toward more sustainable and compliant solvent systems, propylene glycol-based options continued to gain traction as safer and more efficient alternatives.

By End-use Analysis

Construction end-use strengthened demand, holding 31.5% market share worldwide.

In 2024, the Construction sector accounted for 31.5% of the Propylene Glycol Ether Market, supported by strong demand for architectural coatings, adhesives, sealants, and protective paints used in residential and commercial development. The sector relied heavily on glycol ethers for their ability to enhance coating flexibility, durability, and application smoothness across concrete, metal, and wood surfaces.

Expansion of urban infrastructure projects and renovation activities further strengthened consumption as builders sought high-performance solutions that met environmental and safety norms. Waterborne coatings gained popularity due to lower emissions and odor levels, increasing the use of propylene glycol ethers in formulation. Their role in improving long-term finish quality and weather resistance kept construction as a key end-use segment.

Key Market Segments

By Product Type

- Propylene Glycol Mono Methyl Ether (PM)

- Dipropylene Glycol Mono Methyl Ether (DPM)

- Tripropylene Glycol Mono Methyl Ether (TPM)

By Application

- Chemical intermediate

- Solvent

- Coalescing agent

- Electronics

- Coatings

- Others

By End-use

- Construction

- Automotive

- Electronics

- Printing and Packaging

- Pharmaceuticals

- Others

Driving Factors

Rising demand for eco-friendly solvent systems

The Propylene Glycol Ether Market continues to gain momentum as industries shift toward eco-friendly solvent systems that offer lower emissions, better worker safety, and improved compatibility with waterborne coatings. This transition is being reinforced by innovation in coating technologies and new investments flowing into material science. A notable example is Flō Optics securing $35 million in Series A funding to advance 3D-printed lens coatings, which rely on safer and more efficient solvent interactions.

Such developments signal a broader industry preference for sustainable chemical systems where glycol ethers play a central role due to their balanced solvency and lower environmental impact. As regulations tighten and manufacturers upgrade formulations, demand for cleaner solvent solutions continues to rise steadily.

Restraining Factors

High production costs slow market expansion

Despite rising demand, the Propylene Glycol Ether Market faces ongoing challenges linked to high production costs, including energy requirements, catalyst expenses, and the complexity of maintaining consistent purity levels. These factors can slow expansion, especially in regions where affordability strongly influences product selection.

A relevant example is NxLite raising $9.2 million in Series A funding to advance energy-control coating technologies, showing how innovation often requires major financial support due to elevated R&D and production costs. This mirrors the experience of glycol ether producers, who must invest heavily in process optimization and environmental compliance. As profitability pressures persist, cost barriers remain a major restraint on broader market adoption.

Growth Opportunity

Increasing adoption in advanced electronic manufacturing

Growth opportunities are expanding as advanced electronics manufacturing demands higher-performance solvents with excellent solvency, stability, and compatibility with sensitive components. Propylene glycol ethers meet these needs, making them suitable for cleaning agents, circuit board applications, specialty coatings, and precision manufacturing processes. These opportunities align with increased investment in technology infrastructure.

A strong example is AssetCool securing £10 million in Series A funding to scale its robotic grid-upgrade technology globally, illustrating how infrastructure modernization stimulates demand for high-quality industrial chemicals. As electronics production accelerates and manufacturers adopt stricter quality standards, glycol ethers gain greater relevance in supporting reliable, high-precision manufacturing workflows.

Latest Trends

Rapid shift toward safer industrial chemicals

A major trend shaping the Propylene Glycol Ether Market is the ongoing shift toward safer, more sustainable industrial chemicals that minimize hazards without compromising performance. Manufacturers are increasingly redesigning formulations to reduce harmful emissions while improving durability and processing efficiency. This shift is visible across the coatings and specialty chemicals landscape, supported by investments such as Ecoat securing €21 million to reinvent next-generation paint technologies centered on safer material choices. These developments reflect a clear movement toward cleaner chemical systems where glycol ethers fit naturally due to their favorable solvency and reduced toxicity. As industries modernize and regulations evolve, safer solvent families continue gaining traction across multiple applications.

Regional Analysis

Asia Pacific captured 41.7% of the propylene glycol ether market, valued at USD 0.7 Bn.

In 2024, the Asia-Pacific region dominated the Propylene Glycol Ether Market with a firm 41.7% share, valued at USD 0.7 Bn, driven by strong consumption in coatings, construction materials, printing inks, and industrial chemical formulations. The region’s expanding manufacturing base and large-scale infrastructure development supported consistent demand for glycol ether solvents used in waterborne paints and surface treatment products.

North America followed with steady usage across architectural coatings and household cleaning applications, supported by mature commercial and residential renovation activity. In Europe, demand remained stable due to strict regulatory preferences for safer, low-emission solvents, which strengthened the adoption of propylene glycol ether derivatives across industrial coatings and automotive refinishing.

The Middle East & Africa region saw gradual market expansion supported by construction and urban development. Latin America continued to grow, driven by increased use of glycol ethers in adhesives, paints, and industrial processing. Across all regions, the Asia Pacific maintained clear leadership due to its strong production capacity, growing industrial sectors, and rising consumption of solvent-based and waterborne formulations.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Dow Inc. continued to influence the global Propylene Glycol Ether Market through its broad solvent portfolio and strong focus on high-performance glycol ethers used in coatings, cleaning agents, and industrial formulations. The company’s long-standing expertise in producing consistent, high-purity materials allowed it to meet the evolving requirements of manufacturers seeking safer, more efficient alternatives for water-based and low-VOC applications. Its integrated supply chain strengthened its ability to support diverse end-use segments worldwide.

BASF SE maintained steady market relevance by emphasizing formulation versatility and product reliability across its glycol ether offerings. BASF’s strong position in industrial chemicals, combined with its continuous improvements in solvent quality, helped address the needs of construction, automotive coatings, and consumer product manufacturers. Its global production footprint supported demand from regions shifting toward cleaner and more compliant chemical ingredients.

LyondellBasell Industries also played a notable role in 2024 by supplying propylene-based derivatives that form the backbone of many glycol ether products. The company’s ability to manage large-scale production and maintain a consistent supply enabled it to serve coatings, printing ink, and industrial process chemical markets. Together, these companies shaped market stability by ensuring reliable availability of key solvents across expanding end-use industries.

Top Key Players in the Market

- Dow Inc.

- BASF SE

- LyondellBasell Industries

- Eastman Chemical Company

- Shell Chemicals

- Huntsman Corporation

- INEOS Group

- Sasol Limited

- SKC Co., Ltd.

- KH Neochem Co., Ltd.

Recent Developments

- In October 2024, LyondellBasell completed the acquisition of solvent-based recycling company APK AG in Merseburg, Germany, making it a full owner. This move is part of the company’s broader strategy to expand sustainable chemical technologies, including solvent applications that relate to propylene ether feedstocks and downstream derivatives. The integration of APK’s unique solvent technology supports LyondellBasell’s position in advanced polymer and solvent markets.

- In August 2024, Eastman Chemical Company announced early tender results for its cash offer to purchase up to $250 million of outstanding notes due in 2025. This activity reflects the company’s efforts to manage debt and streamline finances, which can indirectly support its chemical operations and product stability.

Report Scope

Report Features Description Market Value (2024) USD 1.8 Billion Forecast Revenue (2034) USD 2.6 Billion CAGR (2025-2034) 3.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Propylene Glycol Mono Methyl Ether (PM), Dipropylene Glycol Mono Methyl Ether (DPM), Tripropylene Glycol Mono Methyl Ether (TPM)), By Application (Chemical intermediate, Solvent, Coalescing agent, Electronics, Coatings, Others), By End-use (Construction, Automotive, Electronics, Printing and Packaging, Pharmaceuticals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Dow Inc., BASF SE, LyondellBasell Industries, Eastman Chemical Company, Shell Chemicals, Huntsman Corporation, INEOS Group, Sasol Limited, SKC Co., Ltd., KH Neochem Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Propylene Glycol Ether MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample

Propylene Glycol Ether MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Dow Inc.

- BASF SE

- LyondellBasell Industries

- Eastman Chemical Company

- Shell Chemicals

- Huntsman Corporation

- INEOS Group

- Sasol Limited

- SKC Co., Ltd.

- KH Neochem Co., Ltd.