Global Propolis Market By Product Type (Capsules And Tablets, Liquids, and Other Product Types), By Distribution Channel (Retail Store, Online, and Other Distribution Channel), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2023

- Report ID: 34527

- Number of Pages: 382

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

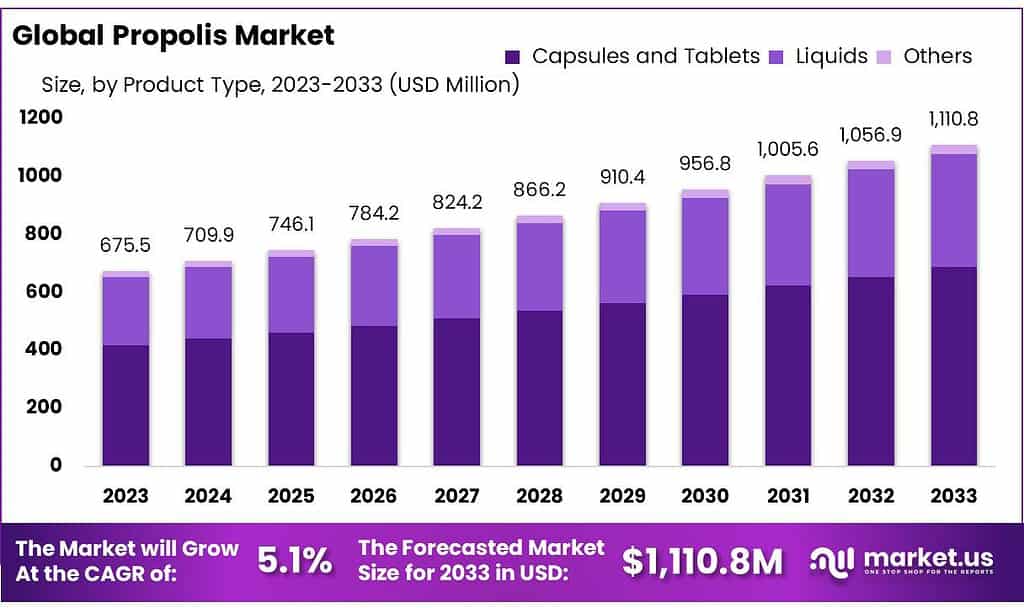

The Propolis Market size is expected to be worth around USD 1110.8 Million by 2033, from USD 675.46 Million in 2023, growing at a CAGR of 5.1% during the forecast period from 2023 to 2033.

Major factors driving the market growth are the increasing demand for propolis within the healthcare and pharmaceutical industries. Propolis can also be used in dermatology products to treat acne, skin infections, burns, and neurodermatitis. This product is useful in treating cancer with ointments. It helps to reduce the growth of tumorous cells as well as their multiplication.

Propolis is made from the buds of poplar and cone-bearing trees. It is rare to find it in its purest form, so beehives are the best source. This product can be used for the treatment of cold sores and diabetes. It is a product that has seen an increase in demand over recent years. Accordingly, it is expected that the market will grow during the assessment period.

*Actual Numbers Might Vary In The Final Report

Key Takeaways

- Market Growth Projection: The Propolis Market is estimated to reach approximately USD 1110.8 billion by 2033, showing a substantial increase from USD 675.46 million in 2023, with a projected CAGR of 5.1%.

- Healthcare Demand: The market’s growth is primarily fueled by rising demand within healthcare and pharmaceutical sectors. Propolis finds applications in treating various conditions like acne, skin infections, burns, neurodermatitis, and even aiding in cancer treatment.

- Product Types and Preferences: Capsules and tablets currently dominate the market with over 61% share due to ease of consumption and dosage control. Liquid propolis is gaining traction, expected to grow by 3% owing to increased demand, changing lifestyles, and digestive benefits.

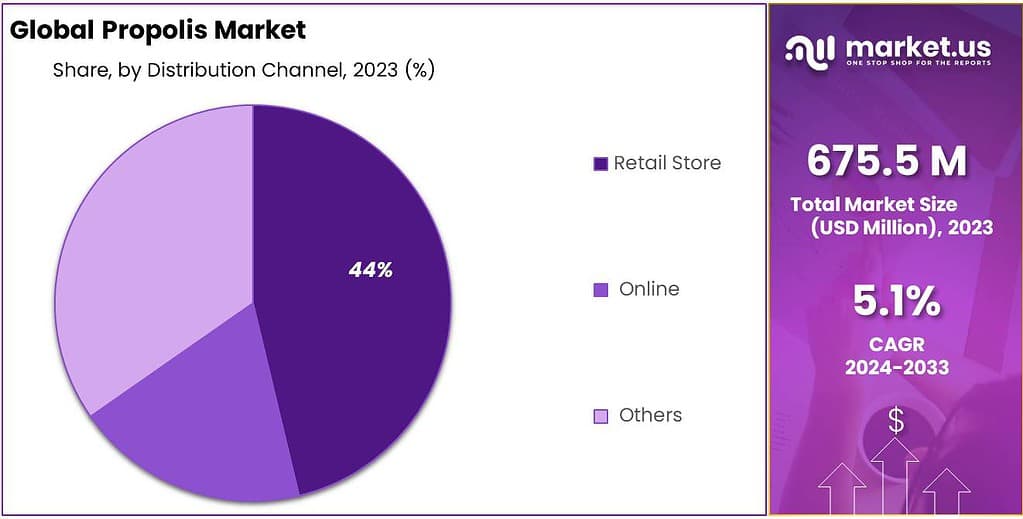

- Distribution Channels: Retail stores hold a significant share (72%) as a primary channel for Propolis products, offering direct access and consultation. However, online sales are predicted to witness the fastest growth due to discounts, a variety of brands, and convenience.

- Market Drivers: Increased interest in propolis-based products by major manufacturers, coupled with endorsements and improved packaging strategies, contributes to market momentum. The demand has surged due to people seeking immune-boosting options amidst the COVID-19 pandemic.

- Challenges: Potential side effects and allergenic reactions pose constraints to market growth. Lack of uniform standards across brands and varying regulatory frameworks globally create complexities in the market landscape.

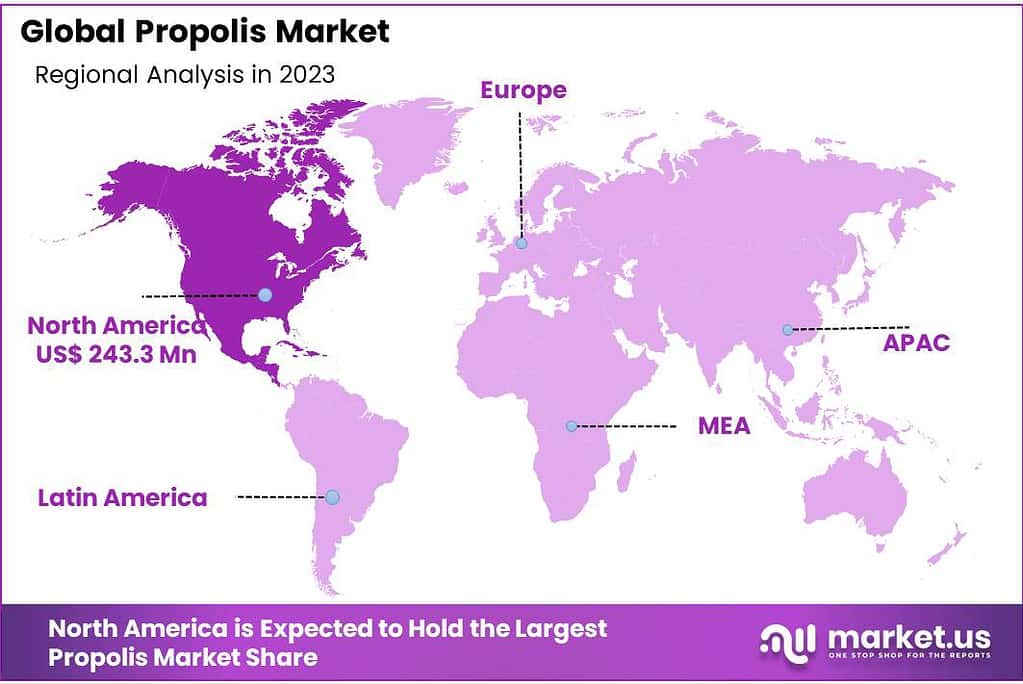

- Regional Analysis: North America currently leads the market due to high demand in the US, especially for conditions like genital herpes. Asia Pacific shows a notable CAGR of 2.7% between 2023-2032, attributed to rising disposable incomes and an increase in cancer cases.

- Key Market Players: Companies like Apis Flora, Herb Pharm LLC, Bee Health Limited, Comvita Ltd, among others, are actively engaged in propolis product development and innovations to meet the rising demand.

Product Type Analysis

In 2023, capsules and tablets held the highest market share for Propolis Market products with over 61% share. Capsules and tablets offer ease of consumption and dosage control to consumers, making them popular choices among health-conscious individuals searching for supplements with Propolis.

This is because it’s the simplest type of propolis and customers love it. These products can be used to treat many diseases and improve the immune system. Propolis tablets and capsules are also sold as a dietary food supplement. This will support the industry’s sales.

Because of rising demand, the segment of liquid products is expected to experience 3% growth over the forecast period. Other factors that are driving industry growth include rising demand for liquid propolis, increasing disposable incomes, and changing lifestyles. It is also beneficial for digestion. This is why its demand will continue to rise shortly. Accordingly, this segment will experience growth in the future.

Distribution Channel Analysis

In 2023, the Retail segment took the lead in the Propolis Market, securing over a 72% share. Retail stores remain the primary distribution channel for Propolis products, offering consumers direct access to a wide range of options.

This traditional channel includes pharmacies, health stores, and supermarkets, providing in-person consultations and product visibility, which often appeals to customers seeking immediate purchase and advice.

From 2023 to 2032, the online distribution channel segment will experience the fastest CAGR. Propolis can also be purchased online for a low price. There are many benefits to purchasing propolis online, including discounts, coupon benefits, and other benefits. You can also find a variety of propolis products of different brands on the online platform. This segment is forecast to see growth during the forecast period.

*Actual Numbers Might Vary In The Final Report

Key Market Segments

By Product Type

- Capsules And Tablets

- Liquids

- Other Product Types

By Distribution Channel

- Retail Store

- Online

- Other Distribution Channel

Drivers

Propolis market growth can be directly tied to medical and healthcare sector interest in propolis as well as increased awareness of its therapeutic advantages, with this combination driving major manufacturers’ propolis-based product launches for specific health requirements, fueling greater global interest in this natural product. Major manufacturers are already actively producing propolis products with medical benefits and making them available, further fuelling interest among global markets in propolis as a viable product option.

Celebrity endorsements and improved packaging strategies have further propelled market momentum. Because COVID-19 doesn’t have effective treatments and causes many deaths, people want things that make their immunity stronger. Propolis has stuff like antioxidants and other things that fight germs and help the body’s defenses.

That’s why lots of people want it now. Leading manufacturers are diversifying their propolis-based product lineup to address various medical needs. To remain competitive and expand their market presence, companies are investing in upgraded packaging and promotional initiatives such as celebrity endorsements to stay ahead of competitors and increase consumer interest in propolis-based offerings. These strategies aim to strengthen their traction and raise consumer interest.

Restraints

The Propolis Market faces constraints due to potential side effects that can trigger sensitivities in a small portion of individuals allergic to bee-related products. As the use of propolis increases, there’s a corresponding rise in reported cases of hypersensitivity, posing a challenge to the anticipated growth of the market. Moreover, the lack of uniform standards across various brands poses another hurdle in the development of the Global Market for propolis-based products.

This comprehensive propolis market report delineates recent developments, trade regulations, import-export dynamics, production analyses, optimizations in the value chain, market shares, impacts from local market players, and opportunities in emerging revenue streams.

Opportunities

Propolis markets typically use the term “new product launches and product assortments” to refer to the introduction and diversification of offerings within their propolis-based product lineup, whether through novel items derived from propolis or by expanding the current lineup with additional items.

Propolis-based supplements, cosmetics, or medicinal products such as capsules, creams, ointments or tinctures may also be produced to meet specific health or skincare needs. Furthermore, this process could involve blending propolis with other ingredients to produce novel formulations tailored specifically for specific health or skincare issues.

Launches and assortments present opportunities for companies operating in the propolis market. By introducing new products or expanding their current lineup, businesses can meet changing consumer demands while reaching more customers and possibly gain a competitive edge in the market. This strategy allows firms to remain adaptable and innovative as market trends change over time while offering customers solutions from propolis that fit a range of health and wellness needs.

Challenges

Navigating challenges within the propolis market involves addressing several hurdles that can hinder its growth. One significant challenge pertains to potential side effects associated with propolis usage. Some individuals may experience sensitivities or allergic reactions, particularly those allergic to bee-related products.

This raises concerns and necessitates careful consideration of consumer safety and product usage. The lack of standardization across different brands and products poses a challenge. The absence of uniform quality standards or regulations among propolis-based products can impact consumer trust and market stability. It creates a complex landscape where consumers might encounter varying product qualities or efficacy levels, leading to uncertainty and potential market setbacks.

Regulatory constraints also stand as a challenge in propolis market growth. Different regions may have distinct regulatory frameworks regarding the use and certification requirements for propolis in nutritional products or supplements.

Adhering to diverse regulatory standards can pose difficulties for market players in terms of compliance and market penetration, especially across international borders. These challenges necessitate the need for comprehensive quality control measures, standardized regulations, and heightened consumer awareness to sustain growth and foster confidence within the propolis market.

Regional Analysis

North America held the highest revenue share at over 36% in 2023. This is due to the high demand for propolis in Canada and the U.S. The U.S. is seeing an increase in genital herpes cases. This has led to a rise in demand for propolis in this region.

The U.S. ranks among the countries with the highest incidences of genital and other herpes viruses. Rising demand for imports is expected to drive significant growth in the industry over the forecast period.

Asia Pacific will see a 2.7% CAGR between 2023-2032. This is due to the rising demand for propolis. Further driving market growth is the rise in disposable income. The growth of the regional market is also expected to be driven by an increase in cancer cases. The propolis market in the region is expected to grow over the forecast period.

*Actual Numbers Might Vary In The Final Report

Кеу Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Innovating new products for the rising demand for propolis is the main focus of many companies. The market is open to new players due to its low entry barriers and greater market potential. Product development is possible in regions with high demand because of the growing demand for propolis.

Key Market Players

- Apis Flora

- Herb Pharm LLC

- Bee Health Limited

- YS Organic Bee Farms

- Comvita Ltd

- Wax Green

- Apiary Polenecter

- Uniflora Health Foods

- Other Key Players

Recent Development

In 2023, Comvita Ltd, an established source for authentic Manuka honey, announced the introduction of Immune Bee Propolis which contains double the active ingredients found in its daily dose.

Report Scope

Report Features Description Market Value (2022) US$ 675.46 Mn Forecast Revenue (2032) US$ 1110.8 Mn CAGR (2023-2032) 5.1% Base Year for Estimation 2022 Historic Period 2018-2022 Forecast Period 2023-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Company Profiles, Recent Developments Segments Covered By Product Type (Capsules And Tablets, Liquids, and Other Product Types), By Distribution Channel (Retail Store, Online, and Other Distribution Channel) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, and rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; The Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA. Competitive Landscape Apis Flora, Herb Pharm LLC, Bee Health Limited, YS Organic Bee Farms, Comvita Ltd, Wax Green, Apiary Polenecter, Uniflora Health Foods, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). Frequently Asked Questions (FAQ)

What is propolis?Propolis is a resinous substance collected by bees from tree buds, sap flows, or other botanical sources. Bees use propolis to seal and protect their hives, thanks to its antimicrobial and antiseptic properties.

What are the main uses of propolis?Propolis has various uses, including dietary supplements, herbal medicine, skincare products, and even in certain food and beverage formulations due to its potential health benefits.

What are the health benefits associated with propolis?Propolis is believed to have antibacterial, antiviral, anti-inflammatory, and antioxidant properties. It's used to support immune health, wound healing, oral health, and more.

-

-

- Apis Flora

- Herb Pharm LLC

- Bee Health Limited

- YS Organic Bee Farms

- Comvita Ltd

- Wax Green

- Apiary Polenecter

- Uniflora Health Foods

- Other Key Players