Global Processed Animal Protein Market Size, Share, And Industry Analysis Report By Source (Poultry, Pork, Beef, Others), By Form (Dry, Liquid), By Application (Animal Feed, Fertilizers, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 169604

- Number of Pages: 244

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

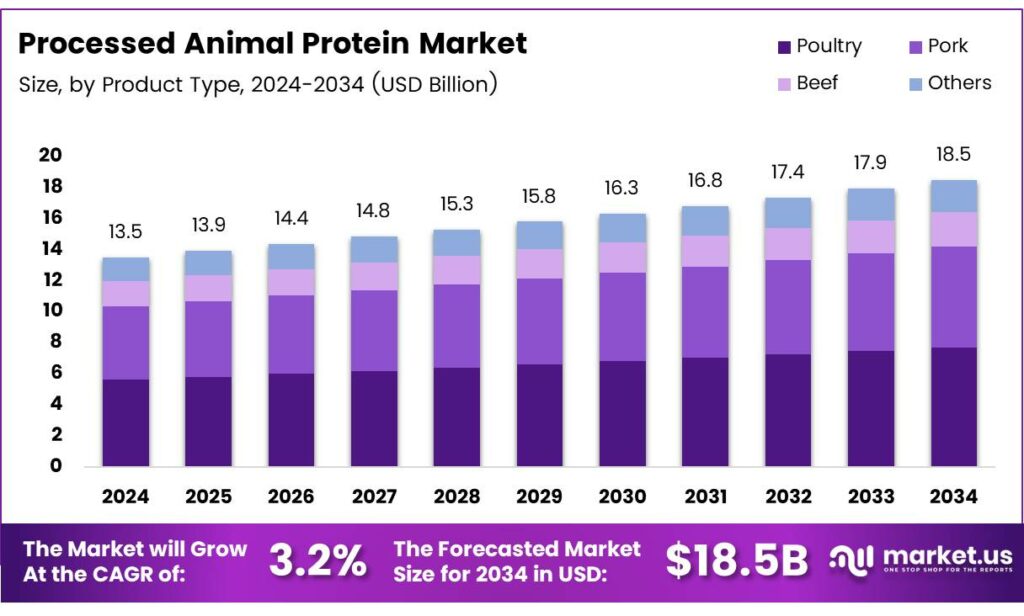

The Global Processed Animal Protein Market size is expected to be worth around USD 18.5 billion by 2034, from USD 13.5 billion in 2024, growing at a CAGR of 3.2% during the forecast period from 2025 to 2034.

The Processed Animal Protein market represents the organized conversion of animal by-products into high-value nutritional ingredients for feed, fertiliser, and agricultural applications. Practically, it supports circular bioeconomy models by reducing waste and improving resource efficiency across livestock value chains. As demand diversifies, processed proteins increasingly align sustainability with commercial feed performance objectives.

Processed Animal Protein itself refers to heat-treated, rendered, or hydrolysed materials derived from approved animal sources. Traceability and nutritional density. Consequently, regulators position PAPs as controlled, value-added inputs rather than waste, supporting market credibility among feed producers and integrated farming systems.

Opportunities also emerge from precision nutrition and functional feed ingredients. Advances in processing technologies improve digestibility and amino acid availability, enabling targeted use across species. PAP adoption grows in aquafeed and specialised livestock diets, while fertiliser applications extend market reach into regenerative agriculture and soil health management systems.

- The European Fat Processors and Renderers Association, PAPs serve compound feed, aqua feed, pet food, and fertilisers, with inclusion levels ranging between 5–30% depending on species and formulation needs. Furthermore, technical guidance highlights flexible dosage strategies, supporting efficient protein incorporation without compromising feed safety or performance.

Hydrolysed feather press water demonstrates protein digestibility exceeding 90%, due to controlled thermal and enzymatic treatment. Similarly, product documentation indicates ProtiPlu liquid feed contains around 10% dry matter, of which 80% is fully digestible protein, alongside approximately 15% fat, supporting animal growth, reproduction, and productivity.

Key Takeaways

- The Global Processed Animal Protein Market is projected to reach USD 18.5 billion by 2034, rising from USD 13.5 billion in 2024, at a steady CAGR of 3.2% during the forecast period from 2025 to 2034.

- Poultry is the leading source segment, holding a dominant share of 44.9% in 2024.

- Dry processed animal protein dominates the form segment with a market share of 77.2% in 2024.

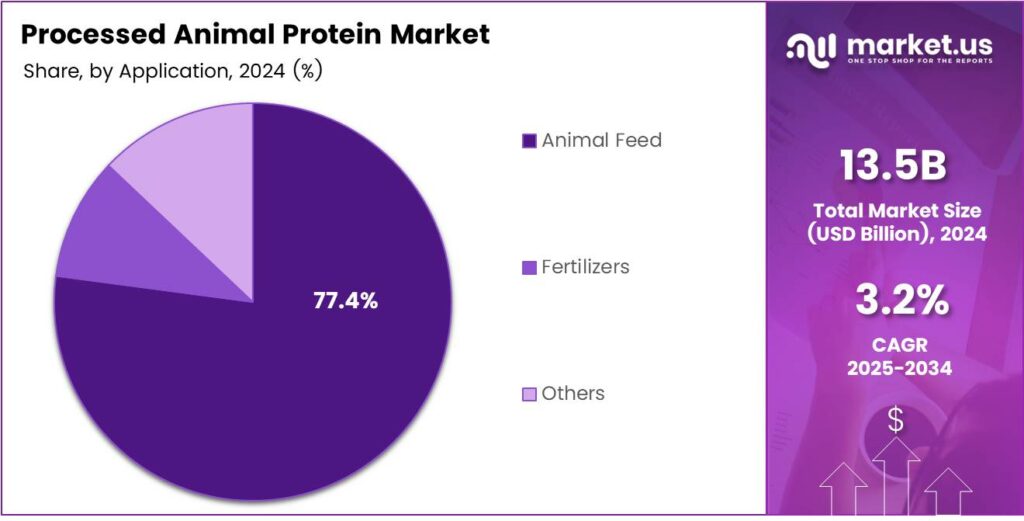

- Animal Feed is the largest application segment, accounting for 77.4% of total market demand in 2024.

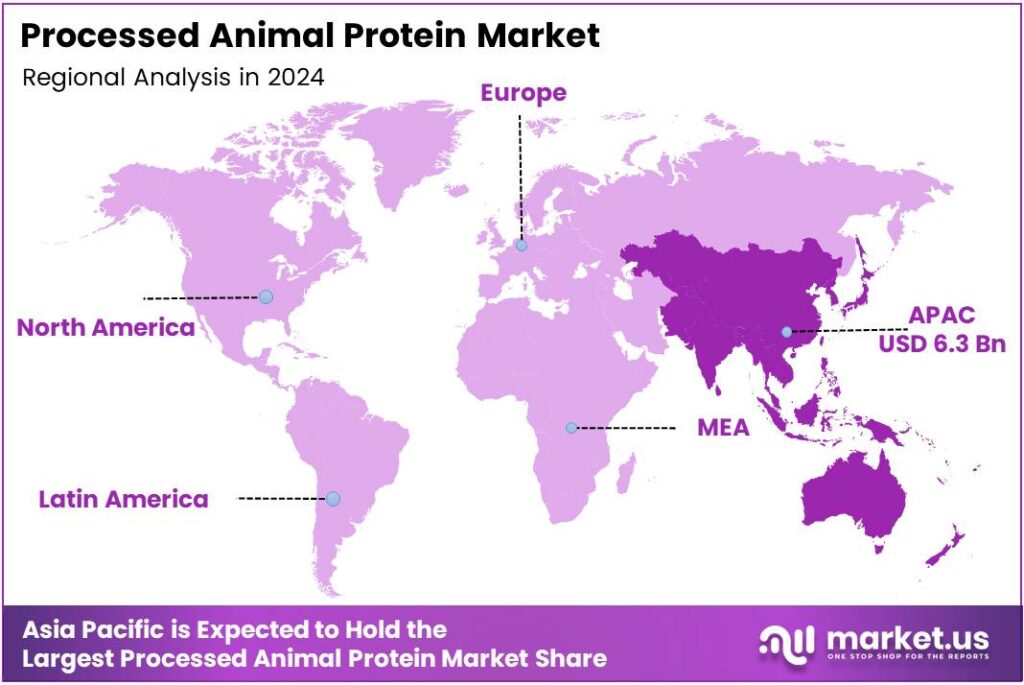

- Asia-Pacific is the dominant regional market, capturing 46.8% share and valued at USD 6.3 billion in 2024.

By Source Analysis

Poultry dominates with 44.9% due to its consistent availability and wide acceptance across feed applications.

In 2024, Poultry held a dominant market position in the By Source Analysis segment of the Processed Animal Protein Market, with a 44.9% share. Moreover, poultry by-products are widely processed into protein meals. They support cost-efficient nutrition solutions. Additionally, stable supply chains strengthen poultry’s leadership.

In contrast, Pork contributes steadily to the processed animal protein market. It is commonly used in regions with high pork consumption. Consequently, pork-based proteins support balanced amino acid profiles. However, cultural restrictions limit adoption in some markets, slowing its overall expansion compared to poultry.

Meanwhile, Beef-based processed proteins remain important for high-value feed formulations. They offer strong protein density and functional benefits. Nevertheless, higher raw material costs restrict large-scale usage. Therefore, beef proteins are often reserved for premium or specialized animal nutrition applications.

Others include mixed and niche animal sources used in localized markets. These sources help utilize waste streams efficiently. However, inconsistent availability restricts scalability. Despite this, they support circular economy practices and contribute to overall market diversity.

By Form Analysis

Dry dominates with 77.2% due to easier storage, longer shelf life, and efficient transportation.

In 2024, Dry held a dominant market position in the By Form Analysis segment of the Processed Animal Protein Market, with a 77.2% share. Moreover, dry forms are widely favored for feed manufacturing. As a result, they simplify handling, improve stability, and reduce logistics challenges.

Dry-processed animal protein is extensively used across feed mills. Additionally, it allows precise formulation and consistent quality. Therefore, manufacturers prefer dry products for large-scale production. Its compatibility with automated systems further strengthens its dominance in global markets.

In comparison, Liquid processed animal protein serves niche applications. It is often used where rapid nutrient absorption is required. However, handling complexities and shorter shelf life limit adoption. Consequently, liquid forms remain secondary despite their functional advantages.

By Application Analysis

Animal Feed dominates with 77.4% driven by rising demand for efficient and protein-rich feed solutions.

In 2024, Animal Feed held a dominant market position in the By Application Analysis segment of the Processed Animal Protein Market, with a 77.4% share. Moreover, livestock and aquaculture rely heavily on processed proteins. Consequently, feed applications remain the primary consumption channel.

Processed animal protein improves feed efficiency and growth performance. Therefore, feed producers increasingly prefer these ingredients. Additionally, consistent quality supports large-scale farming operations. This reinforces livestock feed as the strongest application segment globally.

Meanwhile, Fertilizers represent a smaller yet important application. Animal protein by-products supply essential nutrients to the soil. However, limited awareness restricts broader adoption. Still, this segment supports sustainable agriculture and waste utilization initiatives.

Key Market Segments

By Source

- Poultry

- Pork

- Beef

- Others

By Form

- Dry

- Liquid

By Application

- Animal Feed

- Fertilizers

- Others

Emerging Trends

Shift Toward Sustainability and Traceability Shapes Market Trends

Sustainability is a key trend shaping the processed animal protein market. Feed producers and regulators are focusing on waste reduction and efficient resource use. Processed animal protein supports these goals by converting by-products into valuable inputs.

Traceability has also become more important. Buyers want clear information about sourcing and processing methods. Digital tracking and improved labeling help build trust and support compliance with regional feed regulations. Technological upgrades are influencing the market. Modern rendering systems improve protein quality, safety, and consistency.

Another trend is closer collaboration across the value chain. Meat processors, renderers, and feed producers are forming partnerships to secure supply and stabilize pricing. These collaborations improve efficiency and reduce risk. Together, these trends are shaping a more structured and transparent processed animal protein market.

Drivers

Rising Demand for High-Protein Animal Feed Drives Market Growth

The processed animal protein market is mainly driven by the growing need for protein-rich animal feed. Livestock farmers, aquaculture operators, and pet food producers are looking for reliable protein sources to improve animal growth and health. Processed animal proteins offer consistent quality and high digestibility, making them suitable for regular feed formulations.

- Fish farming requires nutrient-dense feeds to support faster growth cycles. Processed animal proteins help meet these nutritional needs while reducing dependence on plant-based proteins, which may face supply or price volatility. Livestock-derived foods account for about 33% of global protein intake and 17% of global calorie intake.

Sustainability is also pushing demand. Using animal by-products helps reduce waste from meat processing industries. This supports circular economy practices and lowers environmental burden. Feed manufacturers increasingly see processed animal protein as a responsible and efficient option.

Restraints

Strict Regulations on Animal Feed Safety Limit Market Expansion

One major restraint in the processed animal protein market is strict regulation. Many countries impose tight controls on the use of animal-derived proteins in feed. These rules aim to prevent disease transmission and ensure food safety, but they also add compliance costs for producers.

- Concerns around animal diseases still influence market confidence. Past outbreaks created long-lasting caution among regulators and feed buyers. Even with improved processing techniques, some regions remain hesitant to expand usage, especially in specific livestock feeds. Aquatic foods provided about 20% of the per-capita protein supply from all animal sources to over 3.2 billion people.

Consumer perception is another challenge. Some end users prefer plant-based or alternative proteins, driven by animal welfare and ethical concerns. This can reduce demand in certain markets, particularly where labeling and transparency influence purchasing decisions. These combined factors continue to restrain market growth.

Growth Factors

Growing Aquaculture and Pet Food Sectors Create New Opportunities

Strong growth in aquaculture presents major opportunities for processed animal protein suppliers. Fish and shrimp farming rely heavily on high-quality protein feeds. Processed animal proteins can improve feed efficiency and support healthier stock, making them attractive to feed producers.

The pet food industry is another promising area. Pet owners increasingly seek nutritionally balanced food for dogs and cats. Processed animal proteins offer essential amino acids and enhance palatability, supporting premium and functional pet food formulations.

Emerging markets offer room for expansion as livestock production modernizes. As feed industries formalize and adopt quality standards, demand for stable and certified protein sources will increase. These trends point to a steady long-term opportunity for market participants.

Regional Analysis

Asia-Pacific Dominates the Processed Animal Protein Market with a Market Share of 46.8%, Valued at USD 6.3 billion

Asia-Pacific leads the processed animal protein market due to strong growth in aquaculture, livestock farming, and pet nutrition demand. Rising population, higher meat consumption, and expanding feed production capacity support steady uptake. The region also benefits from improved feed conversion efficiency targets and wider acceptance of protein recycling in animal nutrition systems.

North America shows stable demand driven by commercial livestock farming and advanced feed formulations. Strong regulatory oversight supports safe utilization in animal feed and fertilizers. Growing emphasis on circular economy practices and waste valorization further supports market development across integrated meat processing and rendering operations.

Europe is shaped by strict feed safety regulations and a growing focus on sustainable protein sources. Reauthorization of certain animal proteins for aquafeed has improved utilization rates. Demand is further supported by precision nutrition trends and reduced dependence on imported plant-based proteins.

The U.S. market is driven by large-scale meat processing and advanced rendering capabilities. High demand for pet food, animal feed, and organic fertilizers supports consistent consumption. Regulatory clarity and established supply chains enable steady adoption across multiple end-use segments.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The global Processed Animal Protein (PAP) market in 2024 reflects evolving dynamics driven by demand for sustainable protein recycling and cost-effective feed solutions. In this context, a handful of legacy producers remain dominant, leveraging scale, regulatory compliance, and integrated supply-chain reach.

Tyson Foods, Inc. has long been a powerhouse in meat production and the broader protein value chain. Its vast processing capacity and diversified operations grant it a formidable edge in PAP, allowing it to capture economies of scale and ensure stable supply for aqua- and pet-feed markets.

Darling Ingredients Inc. stands out for its focus on rendering and recycling of animal by-products. By converting what would be waste into high-value protein meals and fats, the company effectively taps into circular-economy trends, positioning itself as a sustainability-oriented supplier with broad global reach.

Ridley Corporation Limited — an established player in Australia and nearby regions — combines local market knowledge with feed formulation expertise. Its regional footprint helps it respond quickly to demand shifts, especially in poultry and aquaculture feed sectors, enabling more customized PAP offerings for those markets.

BOYER VALLEY COMPANY, LLC. — a U.S.-based rendering and grease-recovery specialist — benefits from its longstanding presence and strong relationships with livestock producers. Its rendering facilities provide a stable supply of PAP raw materials, giving it an advantage in delivering consistent protein meal quality to feed manufacturers.

Top Key Players in the Market

- Tyson Foods, Inc.

- Darling Ingredients Inc.

- Ridley Corporation Limited

- BOYER VALLEY COMPANY, LLC.

- Nordfeed

- West Coast Reduction Inc.

- Sanimax

- FASA Group.

- Leo Group Ltd.

Recent Developments

- In 2025, the USDA’s Animal and Plant Health Inspection Service (APHIS) outlined harmonized EU protocols for exporting insect-derived PAP (excluding pet foods). This includes veterinary health certificates confirming no ruminant materials and compliance with EU feed bans on mammalian PAP for farmed animals.

- In 2025, Tyson, a major protein producer, is referenced in competitor analyses but has limited direct PAP-focused announcements. Operations involve animal by-product streams, though emphasis remains on primary meat production. Tyson is noted as a key competitor in animal by-product processing, with shared exposure to EU TSE regulations banning PAP in ruminant feed.

Report Scope

Report Features Description Market Value (2024) USD 13.5 billion Forecast Revenue (2034) USD 18.5 billion CAGR (2025-2034) 3.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Poultry, Pork, Beef, Others), By Form (Dry, Liquid), By Application (Animal Feed, Fertilizers, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Tyson Foods, Inc., Darling Ingredients Inc., Ridley Corporation Limited, BOYER VALLEY COMPANY, LLC., Nordfeed, West Coast Reduction Inc., Sanimax, FASA Group., Leo Group Ltd. Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Processed Animal Protein MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Processed Animal Protein MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Tyson Foods, Inc.

- Darling Ingredients Inc.

- Ridley Corporation Limited

- BOYER VALLEY COMPANY, LLC.

- Nordfeed

- West Coast Reduction Inc.

- Sanimax

- FASA Group.

- Leo Group Ltd.