Global Prefilled Formalin Vials Market By Volume, By Packaging Type (Polypropylene (PP) Prefilled Vials & Jars and High-Density Polyethylene (HDPE) Containers), By Application (Histopathology, Cytology, Cancer Biopsy and Others), By End-User (Hospitals & Surgical Centers, Diagnostic Laboratories, Forensic Laboratories, Veterinary Hospitals & Clinics, Contract Research Organizations (CROs) and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 172799

- Number of Pages: 254

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

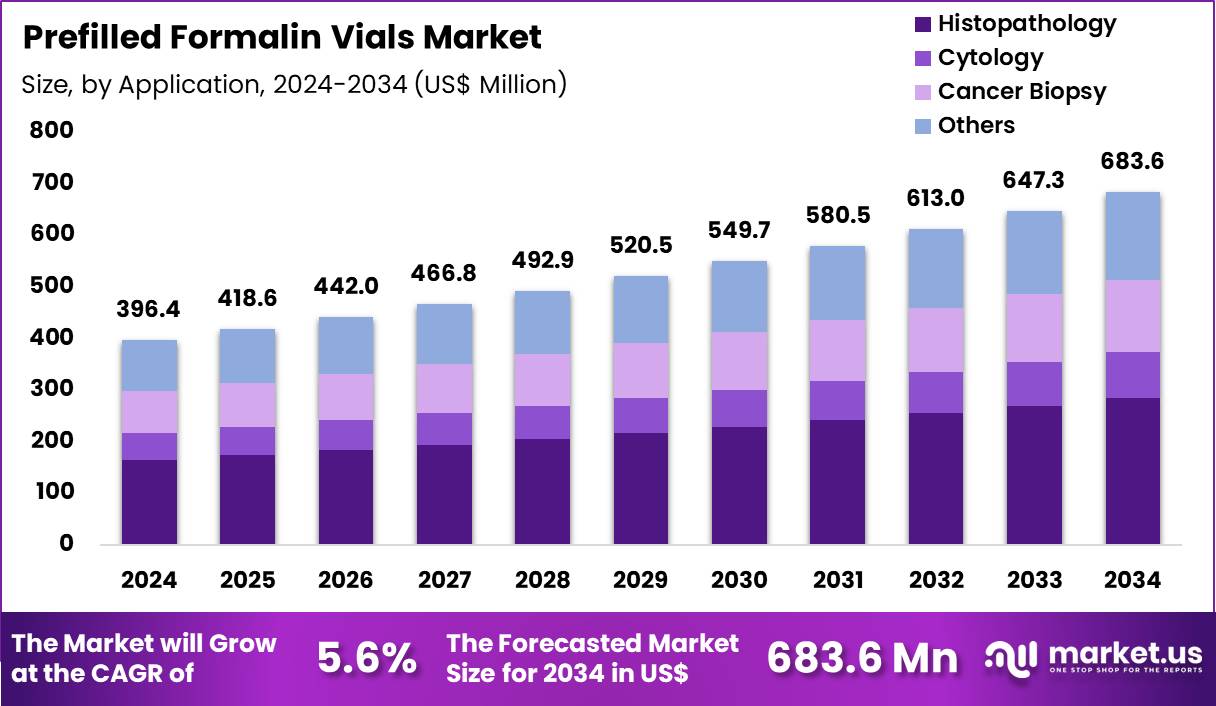

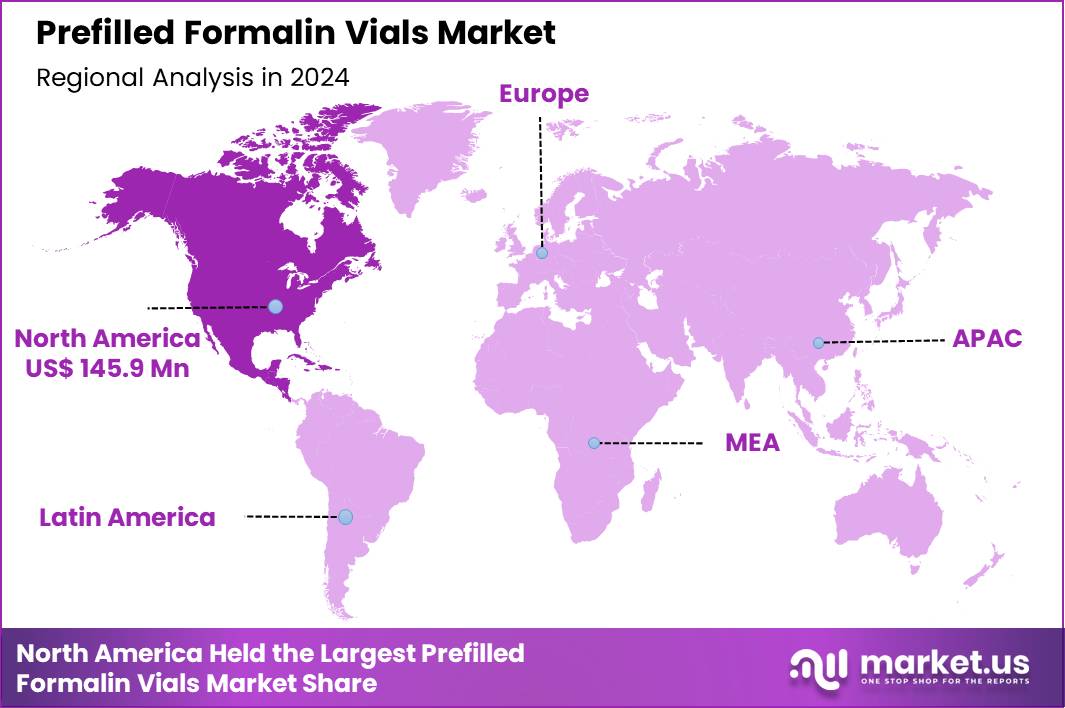

The Global Prefilled Formalin Vials Market size is expected to be worth around US$ 683.6 Million by 2034 from US$ 396.4 Million in 2024, growing at a CAGR of 5.6% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 36.8% share with a revenue of US$ 145.9 Million.

Growing emphasis on laboratory safety and workflow efficiency drives adoption of prefilled formalin vials that minimize direct exposure to hazardous formaldehyde during tissue specimen handling. Pathologists routinely employ these vials for immediate fixation of endoscopic biopsies, preserving cellular architecture in gastrointestinal samples for accurate polyp and lesion evaluation. These containers support dermatological applications by fixing skin punch biopsies, enabling detailed assessment of melanocytic lesions and inflammatory dermatoses.

Clinicians utilize prefilled vials in surgical settings to immerse excised tumors, ensuring optimal preservation for margin analysis in oncologic resections. These products facilitate cytological preparations by stabilizing fine-needle aspiration samples from thyroid and breast nodules prior to processing. In July 2024, StatLab Medical Products brought a new 30,000-square-foot manufacturing facility online in Newtown, Wales, and followed this investment with direct commercial entry into France and Germany in August 2025.

The facility was designed to scale production of core histology consumables, including prefilled formalin vials, to meet increasing demand across the European Union. Automated filling and packaging systems at the site enhance accuracy and reduce exposure risks, while the company’s direct presence in these markets allows closer technical support and fewer distribution bottlenecks for large pathology networks.

Manufacturers target opportunities to develop varying vial capacities tailored for specific biopsy volumes, optimizing fixation in prostate needle core procedures through standardized immersion. Developers engineer tamper-evident seals and leak-proof closures, expanding reliability for transporting gynecological curettage samples in endometrial cancer diagnostics. These vials open avenues in veterinary pathology, preserving animal tissue specimens for zoonotic disease investigations and comparative oncology studies.

Opportunities emerge in research biobanking, where prefilled containers maintain long-term integrity of archived samples for molecular pathology assays. Companies advance child-resistant caps to enhance safety in mixed-use laboratory environments handling pediatric ear, nose, and throat specimens. Firms pursue customizable labeling integrations, streamlining chain-of-custody documentation for forensic autopsy tissue collections.

Industry leaders introduce biodegradable polymer vials that retain fixation efficacy while addressing environmental concerns in high-volume diagnostic laboratories. Developers refine neutral buffered formulations to improve antigen retrieval in immunohistochemistry for neurology brain biopsies. Market participants launch stackable designs with quick-access lids, facilitating efficient handling during Mohs micrographic surgery for basal cell carcinoma.

Innovators embed QR code tracking for digital workflow integration in large-scale colorectal screening programs. Companies prioritize shatter-resistant materials that withstand transport stresses in remote surgical outreach initiatives. Ongoing innovations emphasize volume-indicator markings, ensuring precise specimen-to-fixative ratios across diverse histopathological evaluations.

Key Takeaways

- In 2024, the market generated a revenue of US$ 396.4 Million, with a CAGR of 5.6% , and is expected to reach US$ 683.6 Million by the year 2034.

- The volume segment is divided into <10 mL, 10–20 mL, 20–60 mL, 60–120 mL, 120–500 mL and 500 mL–1 litre, with 60–120 ml taking the lead in 2024 with a market share of 25.2%.

- Considering packaging type, the market is divided into polypropylene (PP) prefilled vials & jars and high-density polyethylene (HDPE) containers. Among these, polypropylene (pp) prefilled vials & jars held a significant share of 81.0%.

- Furthermore, concerning the application segment, the market is segregated into histopathology, cytology, cancer biopsy and others. The histopathology sector stands out as the dominant player, holding the largest revenue share of 41.6% in the market.

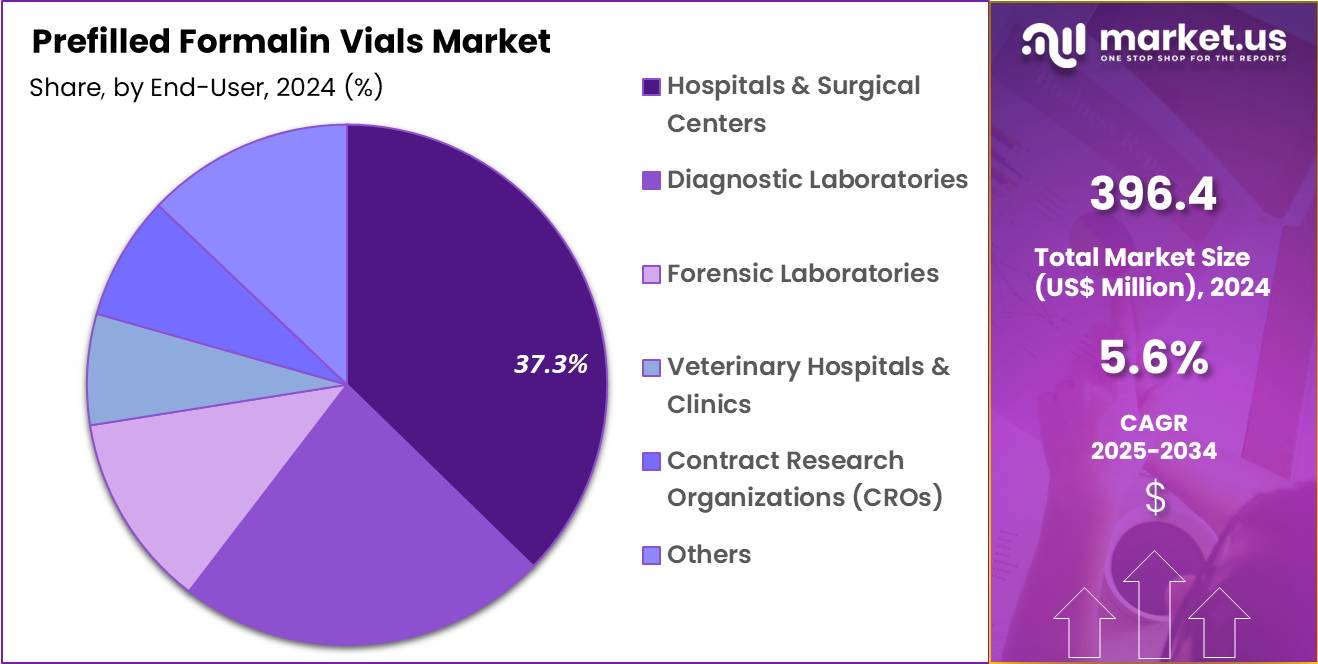

- The end-user segment is segregated into hospitals & surgical centers, diagnostic laboratories, forensic laboratories, veterinary hospitals & clinics, contract research organizations (CROs) and others, with the hospitals & surgical centers segment leading the market, holding a revenue share of 37.3%.

- North America led the market by securing a market share of 36.8% in 2024.

Volume Analysis

The 60–120 mL volume segment accounted for 25.2% of the prefilled formalin vials market, reflecting its optimal balance between sample adequacy and handling efficiency. Pathology teams favor this volume for routine tissue specimens because it ensures proper fixation ratios for small to medium biopsies. Surgical workflows increasingly standardize specimen containers to reduce variability and handling errors. This size supports compliance with fixation guidelines that emphasize sufficient formalin-to-tissue volume.

Reduced spillage risk and easier transport improve laboratory safety and turnaround times. Procurement teams prefer standardized volumes to streamline inventory management. Compatibility with common specimen sizes lowers wastage and repeat sampling. Training protocols often reference this volume for routine procedures, reinforcing adoption. Growing surgical case volumes sustain consistent demand. This segment is projected to expand steadily due to workflow standardization and safety-driven practices.

Packaging Type Analysis

Polypropylene prefilled vials and jars represented 81.0% of the prefilled formalin vials market, driven by material performance and regulatory alignment. PP offers strong chemical resistance to formalin, which preserves container integrity during storage and transport. Lightweight construction improves handling ergonomics and reduces shipping costs.

Transparency supports visual inspection of fill levels and specimens, enhancing quality control. Manufacturers achieve tight tolerances with PP, which supports leak-resistant closures. Autoclavability and impact resistance improve durability across clinical environments. Sustainability initiatives favor recyclable polymers with established supply chains.

Consistent molding quality supports large-scale production and reliability. Widespread regulatory acceptance accelerates procurement decisions. This segment is anticipated to maintain dominance due to safety, durability, and cost efficiency.

Application Analysis

Histopathology accounted for 41.6% of the prefilled formalin vials market, reflecting sustained demand from tissue-based diagnostics. Rising biopsy volumes across oncology and chronic disease management increase fixation needs. Standardized prefilled containers reduce pre-analytical variability, which improves diagnostic accuracy. Laboratories prioritize ready-to-use solutions to shorten specimen handling time.

Accreditation requirements emphasize controlled fixation conditions, supporting prefilled adoption. Integration with automated histology workflows enhances efficiency. Training and SOPs frequently specify prefilled formalin for tissue processing. Growing cancer screening programs expand routine histopathology workloads. Quality assurance programs reinforce consistent fixation practices. This application segment is expected to grow due to expanding diagnostic intensity and standardization.

End-User Analysis

Hospitals and surgical centers held a 37.3% share of the prefilled formalin vials market, reflecting their central role in specimen generation. High procedural throughput creates continuous demand for ready-to-use fixation solutions. Operating rooms favor prefilled containers to minimize exposure risks and preparation steps. Centralized purchasing supports bulk procurement and standardization across departments.

Compliance with occupational safety protocols drives adoption of sealed, prefilled formats. Integration with surgical kits improves workflow efficiency. Onsite pathology coordination benefits from consistent container specifications. Training initiatives reinforce standardized specimen handling. Expansion of ambulatory and inpatient surgeries sustains volume growth. This end-user segment is likely to remain dominant due to scale, safety priorities, and procedural intensity.

Key Market Segments

By Volume

- <10 mL

- 10–20 mL

- 20–60 mL

- 60–120 mL

- 120–500 mL

- 500 mL – 1 Litre

By Packaging Type

- Polypropylene (PP) Prefilled Vials & Jars

- High-Density Polyethylene (HDPE) Containers

By Application

- Histopathology

- Cytology

- Cancer Biopsy

- Others

By End-User

- Hospitals & Surgical Centers

- Diagnostic Laboratories

- Forensic Laboratories

- Veterinary Hospitals & Clinics

- Contract Research Organizations (CROs)

- Others

Drivers

Rising cancer incidence is driving the market

The prefilled formalin vials market is propelled by the rising incidence of cancer, which increases the demand for tissue biopsies requiring formalin preservation for pathological examination. Healthcare providers rely on prefilled vials to ensure safe and standardized fixation of specimens, facilitating accurate diagnosis. Manufacturers develop vials with consistent formalin concentrations to support the growing volume of oncology-related procedures.

Regulatory emphasis on quality in tissue handling further encourages adoption of prefilled options in laboratories. Clinical workflows benefit from the convenience of prefilled vials, reducing preparation time during high-volume biopsy processing. Global health initiatives targeting cancer screening amplify the need for reliable preservation tools.

Pharmaceutical collaborations advance vial designs compatible with automated pathology systems. Patient outcomes improve with timely and precise histopathological analyses enabled by preserved samples. According to the American Cancer Society’s Cancer Facts & Figures 2024, an estimated 2,001,140 new cancer cases were projected in the United States. This epidemiological surge sustains market expansion by necessitating enhanced specimen management solutions.

Restraints

Stringent regulatory guidelines for container changes are restraining the market

The prefilled formalin vials market faces constraints from stringent regulatory guidelines governing changes to container closure systems, which require detailed reporting and validation for glass vials and stoppers. Developers must submit post-approval changes to ensure product stability and safety, complicating modifications to vial designs. Regulatory agencies demand risk assessments for any alterations, delaying innovation in prefilled formats.

Manufacturers invest in extensive testing to comply with updated guidance, elevating development costs. Healthcare facilities hesitate to adopt new vial configurations amid potential approval delays. Global harmonization efforts remain incomplete, creating inconsistencies in compliance across regions. Pharmaceutical firms prioritize established systems to avoid regulatory scrutiny on changes.

Clinical laboratories encounter administrative burdens in documenting vial integrity for audits. The U.S. Food and Drug Administration issued guidance on Container Closure System and Component Changes: Glass Vials and Stoppers in July 2024. These requirements collectively hinder rapid market adaptation and product diversification.

Opportunities

Expansion in cancer screening programs is creating growth opportunities

The prefilled formalin vials market presents growth opportunities through the expansion of cancer screening programs, which drive demand for efficient specimen preservation in diagnostic workflows. Health authorities allocate funding to initiatives promoting early detection, increasing biopsy volumes and vial utilization. Developers can innovate vials with enhanced safety features to align with program requirements for standardized handling.

Regulatory support for screening efforts facilitates market entry for compliant prefilled products. Pharmaceutical partnerships focus on supplying vials to large-scale programs targeting high-risk populations. Clinical research benefits from preserved samples enabling biomarker studies within screening frameworks.

Patient access improves with streamlined preservation methods in community-based screening sites. Global collaborations extend opportunities to underserved regions through program implementations. The White House’s Cancer Moonshot initiative received USD 1.7 billion in the President’s FY 2024 Budget to advance cancer care and research. These investments position the market for broadened applications in preventive oncology.

Impact of Macroeconomic / Geopolitical Factors

Increasing healthcare budgets and expanding pathology services worldwide fuel growth in the prefilled formalin vials market, prompting manufacturers to ramp up production of ready-to-use containers that ensure safe tissue preservation for diagnostics. Company leaders strategically invest in scalable facilities, capitalizing on rising cancer screenings and biopsy demands to secure market share in high-potential regions.

Inflationary pressures, however, elevate raw material and logistics expenses, compelling firms to optimize operations and pass on costs that strain hospital procurement budgets during economic downturns. Geopolitical instabilities, such as U.S.-China trade frictions and conflicts in key chemical supply areas, interrupt shipments of formalin and plastic components, leading to inventory shortages and delayed deliveries for dependent suppliers.

Current U.S. tariffs under Section 301 impose up to 25 percent duties on Chinese-origin medical containers and lab equipment as of December 2025, raising import costs for American distributors and challenging pricing competitiveness in domestic channels. These tariffs additionally spark retaliatory responses from global partners, limiting U.S. exports of specialized vials and hindering cross-border R&D efforts. Nonetheless, the tariff landscape accelerates shifts toward domestic sourcing and North American manufacturing alliances, building more reliable networks that enhance innovation and promise stable, profitable expansion ahead.

Latest Trends

Introduction of impact-resistant prefilled specimen jars is a recent trend

In 2024, the prefilled formalin vials market has observed a notable trend toward the introduction of impact-resistant prefilled specimen jars, designed to enhance safety during transportation and storage. Manufacturers prioritize durable materials like polypropylene to minimize breakage risks in laboratory settings. Healthcare providers adopt these jars to reduce exposure hazards associated with formalin spills.

Developers integrate proprietary closure systems to improve sealing and handling ergonomics. Clinical feedback drives refinements in jar designs for compatibility with centrifugation processes. Regulatory considerations accommodate these innovations for compliance in specimen management. Academic evaluations highlight reduced incident rates with impact-resistant formats.

Collaborative industry efforts focus on standardizing jar specifications for broader adoption. Ethical protocols ensure user safety in diverse operational environments. Leica Biosystems introduced a range of prefilled formalin specimen jars that are impact-resistant and crafted from durable polypropylene material.

Regional Analysis

North America is leading the Prefilled Formalin Vials Market

In 2024, North America maintained a 36.8% share of the global prefilled formalin vials market, advanced by heightened pathology demands and regulatory emphases on specimen integrity during diagnostic expansions. Clinical laboratories and hospitals amplified procurement of standardized vials to ensure consistent tissue fixation for histopathological examinations, driven by surges in oncology screenings and infectious disease surveillance.

Manufacturers introduced tamper-evident, leak-proof designs compliant with Occupational Safety and Health Administration guidelines, facilitating seamless integration into high-volume biopsy workflows amid staffing optimizations. Pharmaceutical research entities outsourced sample preservation for clinical trials, prioritizing prefilled units to minimize formaldehyde exposure risks under environmental health directives.

Demographic shifts toward chronic illnesses necessitated reliable fixation solutions for renal and gastrointestinal biopsies, bolstering inventory in ambulatory surgical centers. Supply chain fortification post-disruptions guaranteed sterile, volume-calibrated vials, supporting rapid turnaround in molecular pathology.

Collaborative standards from professional associations promoted barcoded variants, enhancing traceability in multi-site studies. A Centers for Disease Control and Prevention transcript indicates that anatomic pathology encompasses approximately 350 million tests annually in the United States.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Healthcare authorities envision substantial progression in prefilled formalin vial adoption across Asia Pacific throughout the forecast period, propelled by intensifying cancer control programs and infrastructural upgrades in diagnostic facilities. Pathologists integrate ready-to-use containers into routine tissue processing, optimizing preservation for breast and lung malignancy assessments in populous urban hubs.

National ministries subsidize vial distributions to peripheral labs, enabling consistent fixation amid tropical humidity challenges that accelerate specimen degradation. Biotech innovators customize low-volume formats for pediatric oncology, addressing nutritional anemia-linked vulnerabilities in adolescent cohorts. Regional consortia standardize protocols for vial handling, empowering community hospitals to support epidemiological surveys on hepatic disorders.

Pharmaceutical exporters prioritize compliant units for international trials, bridging gaps in resource-limited settings through bulk procurement incentives. Extension services train technicians on safe disposal methods, curtailing occupational hazards in expanding veterinary pathology sectors. The World Health Organization estimates 2.37 million new cancer cases in the South-East Asia Region for 2022.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Prefilled Formalin Vials market drive growth by emphasizing standardized, leak-proof specimen fixation that improves safety, consistency, and workflow efficiency in pathology and diagnostic labs. Companies strengthen demand by aligning offerings with tightening regulatory and biosafety requirements, positioning prefilled formats as risk-reduction tools versus bulk formalin handling.

Commercial strategies focus on long-term supply agreements with hospitals, reference laboratories, and diagnostic networks to secure predictable volumes and recurring revenue. Product teams innovate around vial ergonomics, tamper-evident closures, and barcode traceability to support chain-of-custody and lab automation compatibility.

Market expansion targets regions upgrading histopathology infrastructure and adopting standardized specimen-collection protocols. Leica Biosystems exemplifies leadership through its pathology-focused portfolio, global distribution footprint, and commitment to safe, compliant specimen management solutions that support reliable tissue preservation across clinical settings.

Top Key Players

- Azer Scientific

- Globe Scientific

- Trajan Scientific and Medical

- Cardinal Health

- Diapath S.p.A

- Histo-Line Laboratories Srl

- Leica Microsystems Sales GmbH

- Magnacol Ltd.

- Genta Environmental Ltd.

- Carl Roth GmbH + Co. KG

- Serosep Limited

- Solmedia Limited

- Ultident Scientific

Recent Developments

- In February 2025, StatLab Medical Products completed the acquisition of Diapath S.p.A., an Italy-based manufacturer of histology and cytology consumables. The transaction, which followed an agreement reached in August 2024, strengthens StatLab’s international manufacturing base. By incorporating Diapath’s production expertise, StatLab expanded its capacity for specimen preservation products, particularly high-volume prefilled formalin containers. Localized manufacturing in Europe also reduces reliance on long-distance transport of hazardous chemicals, improving supply reliability for diagnostic laboratories across Europe and the Middle East.

- In April 2024, Medline Industries entered into a broad distribution partnership with Epredia, a global provider of anatomical pathology products within the PHC Group. Under the agreement, Medline began distributing Epredia’s pathology consumables in the United States, including prefilled formalin containers and specimen collection vials. The collaboration simplifies purchasing for hospitals and independent laboratories while improving access to standardized, leak-resistant preservation solutions that comply with laboratory safety and handling requirements.

Report Scope

Report Features Description Market Value (2024) US$ 396.4 Million Forecast Revenue (2034) US$ 683.6 Million CAGR (2025-2034) 5.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Volume (<10 mL, 10–20 mL, 20–60 mL, 60–120 mL, 120–500 mL and 500 mL–1 Litre), By Packaging Type (Polypropylene (PP) Prefilled Vials & Jars and High-Density Polyethylene (HDPE) Containers), By Application (Histopathology, Cytology, Cancer Biopsy and Others), By End-User (Hospitals & Surgical Centers, Diagnostic Laboratories, Forensic Laboratories, Veterinary Hospitals & Clinics, Contract Research Organizations (CROs) and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Azer Scientific, Globe Scientific, Trajan Scientific and Medical, Cardinal Health, Diapath S.p.A, Histo-Line Laboratories Srl, Leica Microsystems Sales GmbH, Magnacol Ltd., Genta Environmental Ltd., Carl Roth GmbH + Co. KG, Serosep Limited, Solmedia Limited, Ultident Scientific Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Prefilled Formalin Vials MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Prefilled Formalin Vials MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Azer Scientific

- Globe Scientific

- Trajan Scientific and Medical

- Cardinal Health

- Diapath S.p.A

- Histo-Line Laboratories Srl

- Leica Microsystems Sales GmbH

- Magnacol Ltd.

- Genta Environmental Ltd.

- Carl Roth GmbH + Co. KG

- Serosep Limited

- Solmedia Limited

- Ultident Scientific