Global Power to Liquid Market Size, Share Analysis Report By Source (Solar, Wind, Hydroelectric Power, Others), By Technology (Electrolysis-based PtL, Fischer-Tropsch Synthesis, Biological Conversion, Methanol Conversion), By Fuel Type (Synthetic Hydrocarbons, Hydrogen, Methanol), By Application (Transportation, Industrial) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153329

- Number of Pages: 283

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

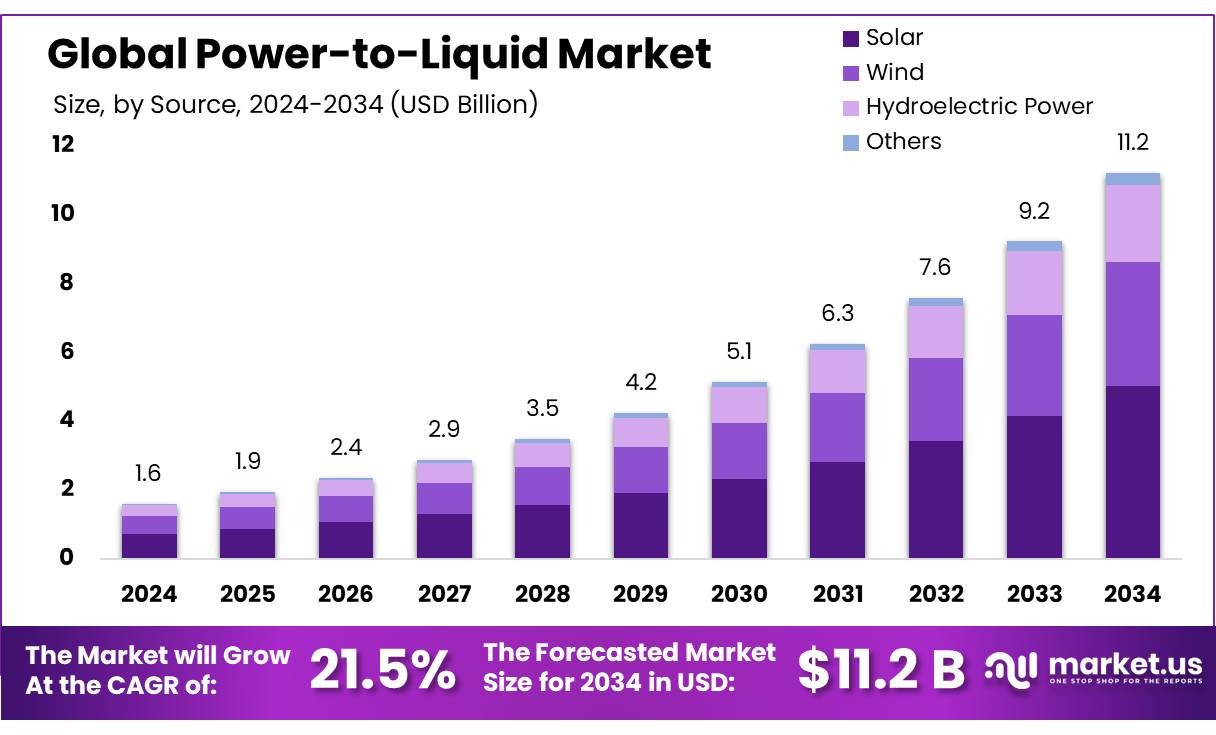

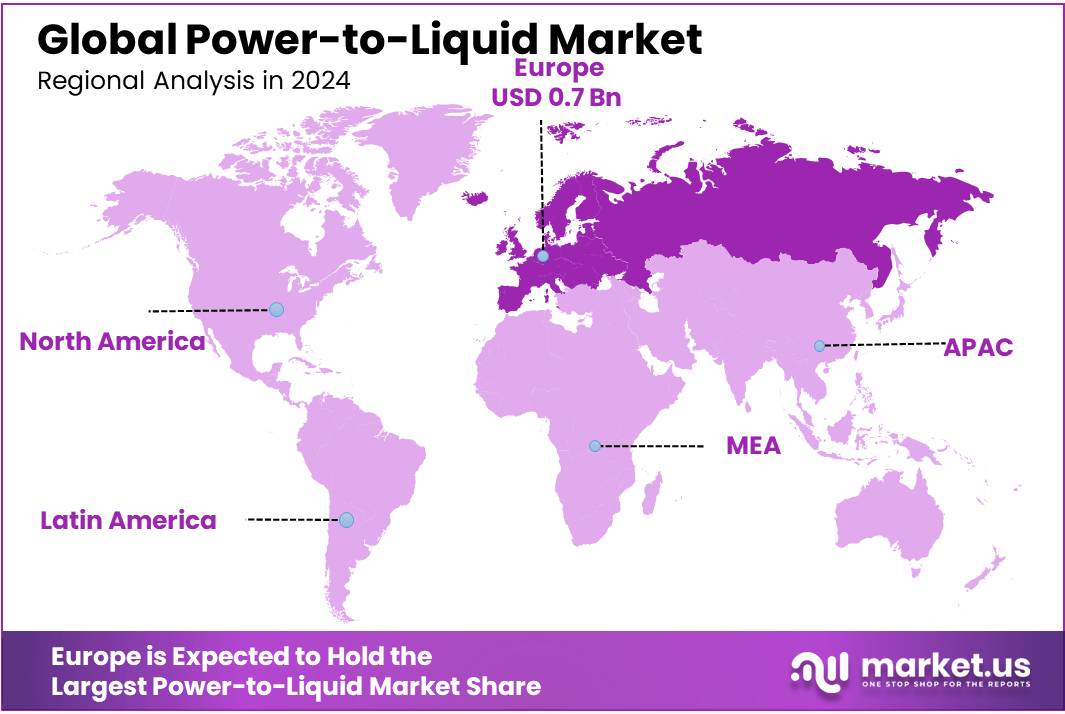

The Global Power to Liquid Market size is expected to be worth around USD 11.2 Billion by 2034, from USD 1.6 Billion in 2024, growing at a CAGR of 21.5% during the forecast period from 2025 to 2034. In 2024, Europe held a dominant market position, capturing more than a 47.8% share, holding USD 0.7 Billion revenue.

Power to Power to Liquid enables the conversion of renewable electricity, water, and carbon dioxide into sustainable liquid fuels—such as synthetic hydrocarbons and methanol—via intermediate green hydrogen and Fischer Tropsch processes. This pathway is considered essential for decarbonizing aviation, maritime transport, and heavy industries where electrification remains challenging. International energy bodies have highlighted PtL as a strategic route to achieving net zero emissions by mid century.

The Liquid technology is rapidly evolving, with several pilot and demonstration projects underway globally. For instance, in 2012, Carbon Recycling International launched a PtL plant in Iceland capable of producing 1.3 million liters of methanol annually, utilizing CO2 from a nearby geothermal plant. By 2015, the plant’s capacity was expanded to over 5 million liters per year. Similarly, in Werlte, Germany, a PtL facility was inaugurated in 2021 to produce synthetic jet fuel using the Fischer-Tropsch method. These initiatives underscore the growing interest and investment in PtL technologies.

Several factors are propelling the growth of PtL technologies. The increasing deployment of renewable energy sources, such as wind and solar, provides the necessary electricity for PtL processes. Moreover, advancements in electrolysis and CO₂ capture technologies are enhancing the efficiency and scalability of PtL systems. The aviation sector, in particular, is a significant driver, with the U.S. Department of Energy’s SAF Grand Challenge aiming to produce 3 billion gallons of Sustainable Aviation Fuel (SAF) per year by 2030 and 35 billion gallons by 2050 . This ambitious goal underscores the critical role of PtL in achieving net-zero emissions in aviation.

Technological advancements are also propelling the PtL sector forward. Companies like Lydian Labs and INERATEC are developing modular PtL systems that can operate flexibly with fluctuating renewable energy inputs, reducing capital costs and enhancing scalability. INERATEC, for example, is set to commission Europe’s largest e-fuel plant in 2025, with a €70 million investment from the European Investment Bank.

Looking ahead, the future growth of PtL technologies appears promising. The International Energy Agency (IEA) projects a significant increase in global energy demand by 2050, with transportation energy needs expected to grow by over 20%. Moreover, advancements in PtL efficiency and reductions in production costs are anticipated to enhance the economic viability of these technologies. For instance, recent studies have demonstrated that optimizing operational parameters in a 1 MW PtL plant can reduce production costs to approximately €1.83 per kilogram, with an efficiency of 61.3%.

Key Takeaways

- The global Power-to-Liquid (PtL) market is projected to grow from USD 1.6 billion in 2024 to approximately USD 11.2 billion by 2034, registering a strong CAGR of 21.5% over the forecast period.

- In 2024, solar energy emerged as the leading source in the PtL market, accounting for more than 44.9% of the total market share, owing to its widespread availability and scalability.

- Electrolysis-based PtL technology held the top position in 2024, securing over 55.1% of the market share due to its effectiveness in generating green hydrogen from renewable electricity.

- Synthetic hydrocarbons dominated the fuel type segment in 2024, representing more than 58.2% of the market, primarily due to their compatibility with existing fuel infrastructure.

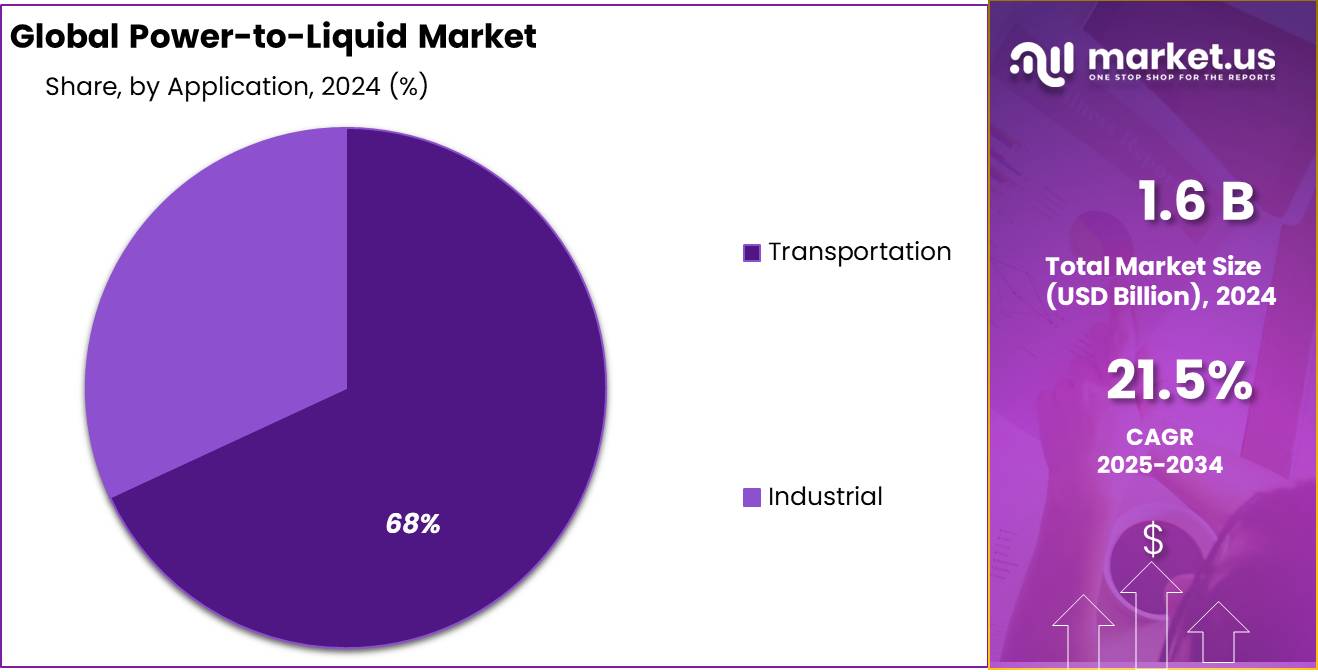

- Transportation stood out as the major application segment, contributing over 68.3% of the market share in 2024, driven by growing demand for low-carbon fuels in aviation, shipping, and heavy-duty road transport.

- Europe led the regional landscape in 2024, capturing a dominant 47.8% share of the global PtL market, with a total market value of around USD 0.7 billion, supported by strong policy frameworks and industrial activity.

By Source Analysis

Solar Leads Power-to-Liquid Market with 44.9% Share in 2024 Amid Growing Renewable Integration

In 2024, solar held a dominant market position, capturing more than a 44.9% share in the global Power-to-Liquid (PtL) market. This strong lead is mainly driven by the increasing deployment of solar photovoltaic (PV) systems worldwide, particularly in sun-rich regions such as the Middle East, North Africa, and parts of Asia-Pacific. Solar energy has become a reliable and widely accessible renewable source, offering a steady stream of electricity crucial for running electrolyzers used in PtL processes.

Moreover, the declining cost of solar power—now competitive with fossil fuels in many regions—has further supported its rise in this market. In 2025, the share of solar is expected to remain strong as new PtL facilities come online, especially those co-located with solar farms to optimize efficiency and grid stability. Solar’s compatibility with decentralized energy systems also gives it an edge over other sources, making it a key pillar in the transition to synthetic liquid fuels.

By Technology Analysis

Electrolysis-based PtL dominates with 55.1% in 2024, driven by clean hydrogen production needs

In 2024, Electrolysis-based Power-to-Liquid (PtL) held a dominant market position, capturing more than a 55.1% share. This leading position is supported by the rising global focus on green hydrogen as a clean energy carrier. Electrolysis technology uses electricity—preferably from renewable sources—to split water into hydrogen and oxygen, providing a carbon-free hydrogen input essential for producing synthetic fuels. As governments and industries aim to reduce reliance on fossil fuels, the preference for electrolysis has grown due to its ability to align with net-zero goals.

Countries in Europe, North America, and Asia are heavily investing in electrolyzer infrastructure, encouraged by incentives and decarbonization targets. In 2025, the dominance of electrolysis-based PtL is expected to continue, fueled by expanding solar and wind energy installations that provide the renewable power needed for large-scale electrolysis operations. This method not only ensures low lifecycle emissions but also offers scalability for industrial applications, making it a vital pathway for the sustainable fuel transition.

By Fuel Type Analysis

Synthetic Hydrocarbons lead with 58.2% share in 2024, driven by compatibility with existing fuel systems

In 2024, Synthetic Hydrocarbons held a dominant market position, capturing more than a 58.2% share in the Power-to-Liquid market. Their popularity stems from their direct compatibility with current fuel infrastructure, including pipelines, engines, and refueling systems. This makes them a practical choice for sectors like aviation, shipping, and heavy-duty transport, where alternative fuels often require costly system upgrades.

Produced using captured carbon dioxide and green hydrogen, synthetic hydrocarbons also support carbon-neutral fuel goals without compromising performance or storage stability. In 2025, demand for synthetic hydrocarbons is expected to stay strong, especially as regulatory frameworks begin favoring low-emission fuels and as oil-dependent industries seek drop-in replacements to meet sustainability targets. Their energy density and reliability continue to make them the most attractive option within the PtL fuel category.

By Application Analysis

Transportation dominates with 68.3% share in 2024, led by rising clean fuel demand in aviation and shipping

In 2024, Transportation held a dominant market position, capturing more than a 68.3% share in the global Power-to-Liquid market. This strong lead is driven by the urgent need to decarbonize long-distance mobility sectors such as aviation, marine, and heavy road transport—industries where battery-electric solutions remain limited. Power-to-Liquid fuels, especially synthetic hydrocarbons, are being adopted as drop-in alternatives due to their high energy density and compatibility with existing engines and infrastructure.

Governments across Europe and North America are introducing mandates and incentives that favor sustainable aviation fuels and clean maritime fuels, further pushing transportation’s share in the PtL space. By 2025, this trend is expected to continue as airlines and shipping operators ramp up procurement of low-emission fuels to meet global climate targets. The ability of PtL fuels to reduce lifecycle CO₂ emissions without requiring major equipment changes makes them especially valuable in this application segment.

Key Market Segments

By Source

- Solar

- Wind

- Hydroelectric Power

- Others

By Technology

- Electrolysis-based PtL

- Fischer-Tropsch Synthesis

- Biological Conversion

- Methanol Conversion

By Fuel Type

- Synthetic Hydrocarbons

- Hydrogen

- Methanol

By Application

- Transportation

- Industrial

Emerging Trends

A Game Changer for Remote Food Supply Chains

A notable trend in Power-to-Liquid (PtL) technology is the development of modular PtL systems, which are transforming how remote food supply chains access sustainable fuels. Traditional PtL plants require substantial infrastructure, making them challenging to deploy in isolated areas. However, in 2024, Lydian Labs introduced a modular PtL system powered by captured CO₂, solar, and nuclear energy. This innovation allows for decentralized fuel production, enabling remote food processing facilities to produce their own sustainable fuels locally. Such advancements are crucial for reducing transportation emissions and ensuring energy security in food supply chains.

The scalability of these modular systems is particularly beneficial for regions with limited access to centralized energy infrastructure. By utilizing renewable energy sources and captured CO₂, these systems not only produce sustainable fuels but also contribute to carbon reduction efforts. This approach aligns with global sustainability goals and supports the transition towards a circular economy in the food industry.

Government initiatives are further accelerating this trend. For instance, the U.S. Department of Energy announced $41 million in funding for 14 projects aimed at developing technologies for harnessing renewable energy sources like wind and solar to produce sustainable fuels. These investments support the development of PtL technologies, including modular systems, by providing financial resources for research and development.

Drivers

Government Support and Policy Incentives

One of the most significant driving factors for the adoption of Power-to-Liquid (PtL) technology in the food industry is the robust support from government policies and incentives. Governments worldwide are increasingly recognizing the importance of sustainable energy solutions and are implementing measures to encourage the development and deployment of PtL technologies.

- For instance, in the United States, the Biden-Harris Administration launched the Sustainable Aviation Fuel (SAF) Grand Challenge in 2021, aiming to scale domestic SAF production to 3 billion gallons by 2030 and 35 billion gallons by 2050 . This initiative not only targets the aviation sector but also stimulates innovation and investment in related technologies, including PtL.

Similarly, in Europe, the German Federal Ministry of Transport and Digital Infrastructure (BMVI) has been actively funding the construction and operation of development platforms for PtL fuels. In August 2021, BMVI launched a call for funding to establish a PtL development platform with a production capacity of up to 10,000 tons of PtL fuel per year . Such initiatives are pivotal in advancing PtL technology and its integration into various industries, including food processing.

These government-backed programs provide financial assistance, research funding, and policy frameworks that reduce the financial risks associated with adopting new technologies. By creating a favorable environment for innovation, governments are playing a crucial role in accelerating the transition to sustainable energy solutions like PtL.

Restraints

High Production Costs and Financial Risks

A significant challenge hindering the widespread adoption of Power-to-Liquid (PtL) technology in the food industry is its high production cost. Currently, the cost of producing PtL fuels is estimated at $3.5 to $5 per liter, whereas conventional jet fuel costs approximately $0.5 to $0.6 per liter. This substantial price difference poses a considerable barrier for industries, including food production and transportation, which operate on tight margins and are sensitive to fuel expenses.

The elevated costs are primarily attributed to the high energy requirements for processes like electrolysis and carbon capture. For instance, producing green hydrogen, a key component in PtL fuels, can cost between $4.0 and $9.0 per kilogram, depending on factors such as electricity prices and electrolyzer technology. Additionally, the capital and operational expenditures associated with PtL facilities further escalate the overall production costs. These financial burdens make it challenging for food-related industries to justify the transition to PtL fuels without substantial subsidies or long-term financial incentives.

The financial risks associated with investing in PtL technology also deter potential investors. Many financial institutions and investors express concerns over the technology’s maturity and the uncertainty surrounding its future viability. This apprehension leads to difficulties in securing funding for large-scale PtL projects, thereby slowing down the development and deployment of this promising technology.

Opportunity

Government Incentives Fueling Power-to-Liquid Growth

One of the most promising avenues for scaling Power-to-Liquid (PtL) technology lies in the robust support from government incentives and funding programs. These initiatives are particularly vital for industries like food production and transportation, where transitioning to sustainable fuels can be financially challenging.

In the United States, the Department of Energy (DOE) has committed over $38 million to 16 projects aimed at advancing cross-sector technologies, including PtL processes. This funding is part of the DOE’s broader strategy to enhance industrial efficiency and decarbonization efforts across various sectors.

Similarly, the U.S. Department of Energy’s 2023 Billion-Ton Report highlights the country’s potential to sustainably produce over 1 billion tons of biomass annually. This biomass could be utilized to generate more than 60 billion gallons of low greenhouse gas liquid fuels, including those produced through PtL methods. Such initiatives not only support the development of sustainable fuels but also stimulate economic opportunities in agricultural and rural communities.

These government-backed programs provide financial assistance, research funding, and policy frameworks that reduce the financial risks associated with adopting new technologies. By creating a favorable environment for innovation, governments are playing a crucial role in accelerating the transition to sustainable energy solutions like PtL.

Regional Insights

Europe leads Power-to-Liquid market with 47.8% share, valued at USD 0.7 billion in 2024

In 2024, Europe emerged as the leading region in the global Power-to-Liquid (PtL) market, capturing a dominant 47.8% share, with a market value reaching USD 0.7 billion. This regional leadership is largely driven by Europe’s strong policy backing for renewable energy and carbon-neutral fuels, supported by strategic climate targets under the European Green Deal and the Fit for 55 package.

Countries such as Germany, the Netherlands, and Denmark have taken a proactive role in advancing PtL technologies, particularly through large-scale pilot projects, public-private partnerships, and substantial funding for electrolyzer and synthetic fuel infrastructure. The European Union has also proposed binding quotas for Sustainable Aviation Fuels (SAFs) under the ReFuelEU Aviation initiative, creating robust demand for PtL-based synthetic hydrocarbons across the transportation sector.

Furthermore, the availability of mature renewable energy networks, especially wind and solar, provides a consistent supply of green electricity for electrolysis-based PtL processes. Leading ports such as Rotterdam and Hamburg are being developed into major hydrogen and PtL fuel hubs, reinforcing the region’s industrial readiness and export capacity.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Ineratec, a German-based cleantech company, specializes in modular PtL systems that convert renewable electricity and CO₂ into sustainable fuels. The firm is known for its compact, containerized reactors that enable decentralized fuel production. Ineratec is currently scaling its operations with a major industrial PtL plant in Frankfurt, designed to produce up to 3,500 tons of synthetic fuels annually. By combining electrolysis and Fischer-Tropsch processes, the company aims to meet growing demand in aviation and shipping sectors.

Nordic Electrofuel AS, headquartered in Norway, focuses on developing large-scale e-fuel production facilities using renewable power and carbon capture. The company is constructing one of Europe’s first commercial PtL plants at Herøya Industrial Park, targeting annual output of 10 million liters of synthetic aviation fuel. Supported by national sustainability targets and EU climate policy, Nordic Electrofuel is positioned as a leading Nordic contributor to fossil-free fuel innovation and a reliable supplier for the regional aviation industry.

Topsoe, based in Denmark, plays a critical role in the Power-to-Liquid market through its proprietary Solid Oxide Electrolyzer Cells (SOEC) and Fischer-Tropsch technology. The company supports integrated PtL value chains that produce e-methanol, e-kerosene, and synthetic diesel. Topsoe is part of the “Green Fuels for Denmark” initiative, working alongside leading partners to produce sustainable fuels for shipping and aviation. Its strong R&D capability and industrial partnerships solidify its position as a technology leader in this emerging field.

Top Key Players Outlook

- Sasol

- Ineratech

- Nordic Electrofuel AS

- Topsoe

- Blue World Technologies

- Neste

- BP PLC

- Ludwig-Bölkow-Systemtechnik GmbH

- Sunfire GmbH

- Lanza Tech

- Lufthansa

- Neste

- SkyNRG

- Total Energies

- United Airlines

Recent Industry Developments

In 2024, Sasol, in collaboration with Topsoe, was selected to provide their G2L™ e-fuels technology for the German Aerospace Center’s (DLR) SAF demonstration plant at the Leuna Chemical Complex in Germany. This facility, expected to commence operations in Q4 2027, aims to produce 2,500 tons per year of SAF using renewable feedstocks like biogenic CO₂ and green hydrogen, with €130 million in funding from the German Federal Ministry for Digital and Transport.

In 2024 Blue World Technologies, achieved a significant milestone by successfully testing the world’s first 200 kW HT PEM fuel cell system, designed to operate on green methanol. This system demonstrated an electrical efficiency of up to 55% and is expected to provide fuel savings of 20-30% compared to conventional diesel generators.

Report Scope

Report Features Description Market Value (2024) USD 1.6 Bn Forecast Revenue (2034) USD 11.2 Bn CAGR (2025-2034) 21.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Solar, Wind, Hydroelectric Power, Others), By Technology (Electrolysis-based PtL, Fischer-Tropsch Synthesis, Biological Conversion, Methanol Conversion), By Fuel Type (Synthetic Hydrocarbons, Hydrogen, Methanol), By Application (Transportation, Industrial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Sasol, Ineratech, Nordic Electrofuel AS, Topsoe, Blue World Technologies, Neste, BP PLC, Ludwig-Bölkow-Systemtechnik GmbH, Sunfire GmbH, Lanza Tech, Lufthansa, Neste, SkyNRG, Total Energies, United Airlines Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Sasol

- Ineratech

- Nordic Electrofuel AS

- Topsoe

- Blue World Technologies

- Neste

- BP PLC

- Ludwig-Bölkow-Systemtechnik GmbH

- Sunfire GmbH

- Lanza Tech

- Lufthansa

- Neste

- SkyNRG

- Total Energies

- United Airlines