Global Powder Dietary Supplements Market By Product Type (Protein Powders, Multivitamin and Mineral Powders, Amino Acid Powders, Meal Replacement Powders, Probiotic and Prebiotic Powders, Herbal and Botanical Powders, Electrolyte and Hydration Powders, Collagen and Beauty-from-Within Powders, Weight Management Powders, Specialty Functional Powders), By Ingredient (Animal-based, Plant-based, Synthetic/Isolated Nutrients), By Functionality, By Consumer Group, By End Use, By Distribution Channel, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 155749

- Number of Pages: 357

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Product Type Analysis

- By Ingredient Analysis

- By Functionality Analysis

- By Consumer Group Analysis

- By End Use Analysis

- By Distribution Channel Analysis

- Key Market Segments

- Emerging Trends

- Drivers

- Restraints

- Opportunity

- Regional Insights

- Key Players Analysis

- Recent Industry Developments

- Report Scope

Report Overview

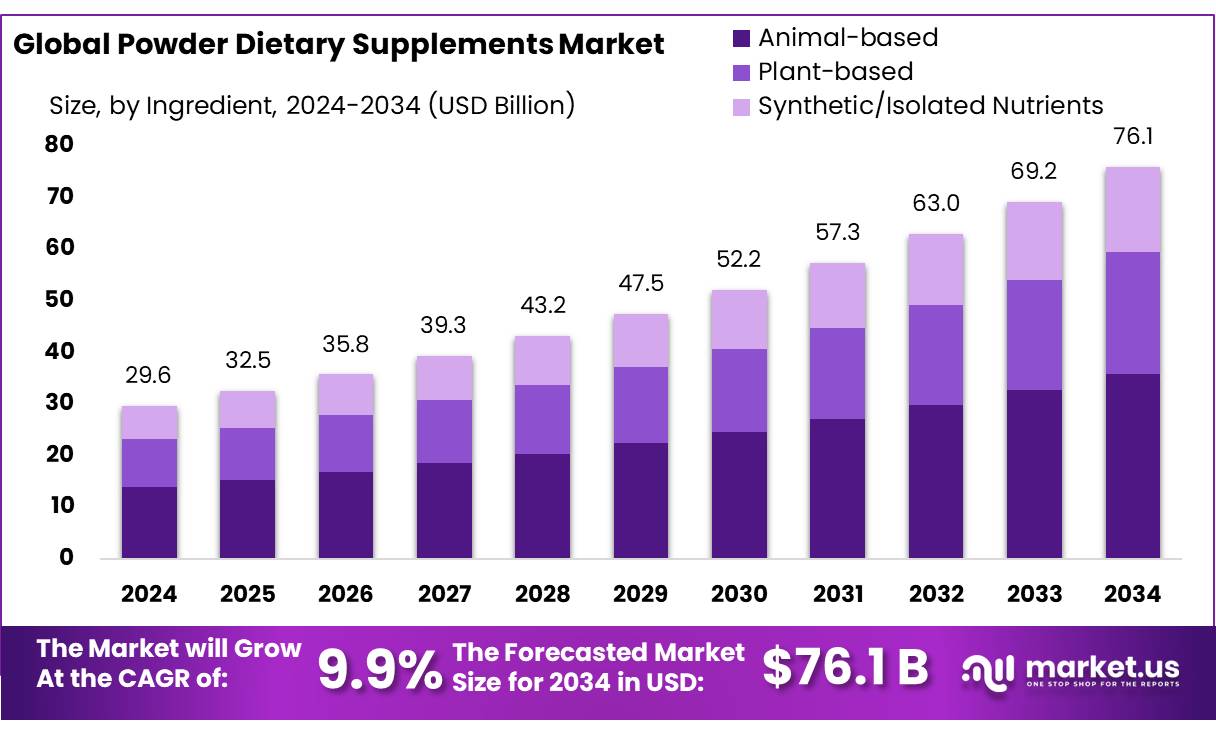

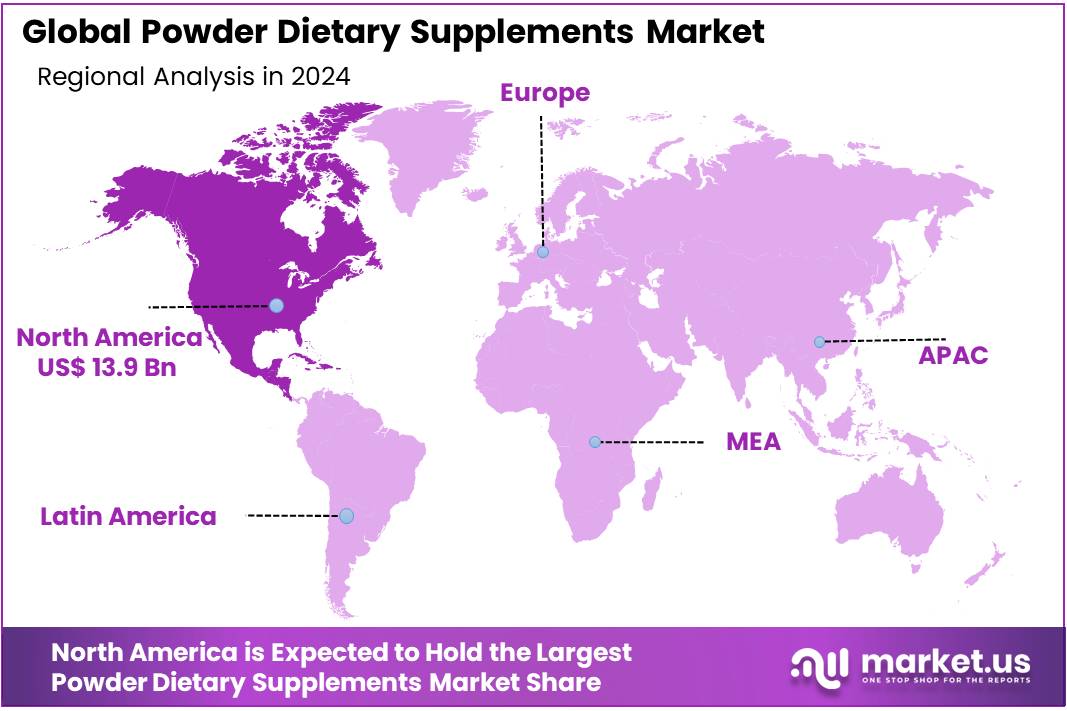

The Global Powder Dietary Supplements Market size is expected to be worth around USD 76.1 Billion by 2034, from USD 29.6 Billion in 2024, growing at a CAGR of 9.9% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 47.2% share, holding USD 13.9 Billion revenue.

The powder dietary supplements concentrates sector—encompassing protein powders, vitamins, minerals, herbal extracts, and amino acids—routinely plays a pivotal role in modern nutrition by offering a concentrated, flexible, and transportable form of essential nutrients supporting immunity, muscle health, and general wellness. Powder formulations are particularly valued for their solubility, ease of blending, formulation flexibility, and shelf‑stability, making them a cornerstone of functional nutrition.

Additionally, the Pradhan Mantri Bharatiya Janaushadhi Pariyojana (PMBJP), launched in 2008, aims to provide quality generic medicines at affordable prices to the public. As of 2024, over 10,000 PMBJP Kendras operate across India, supported by subsidies, training programs, and quality assurance protocols to maintain public trust in generic medicines.

A key factor propelling this growth is the government’s supportive initiatives. The Ministry of Food Processing Industries (MoFPI) has implemented schemes such as the Pradhan Mantri Kisan Sampada Yojana and the Formalization of Micro Food Processing Enterprises (FME) scheme, with an outlay of INR 10,000 crore, aimed at enhancing infrastructure and promoting innovation in the food processing sector. Additionally, the introduction of the Harmonized System of Nomenclature (HSN) codes and the Production-Linked Incentive (PLI) scheme for nutraceuticals are expected to streamline trade and encourage domestic manufacturing.

On the government‑initiative front, several programs help underpin demand for fortified powders and concentrate supplements. Under the Ni‑Kshay Poshan Yojana, all TB patients receive nutritional support worth ₹3,000–₹6,000, benefiting around 25 lakh TB patients annually; and Energy Dense Nutrition Supplementation (EDNS) is targeted at approximately 12 lakh underweight patients, with the initiative carrying an additional outlay of ₹1,040 crore. Complementary to this, ICDS (Integrated Child Development Services), launched in 1975, delivers daily supplementary nutrition—typically 500 kcal and 12–15 g protein per child aged under six—via Anganwadi centers. The Balwadi Nutrition Programme, initiated in 1970, similarly provided 300 kcal and 10 g protein per child per day

Key Takeaways

- Powder Dietary Supplements Market size is expected to be worth around USD 76.1 Billion by 2034, from USD 29.6 Billion in 2024, growing at a CAGR of 9.9%.

- Protein Powders held a dominant market position, capturing more than a 31.8% share.

- Animal-based held a dominant market position, capturing more than a 47.2% share.

- Sports & Performance Nutrition held a dominant market position, capturing more than a 38.9% share.

- Adults held a dominant market position, capturing more than a 56.6% share.

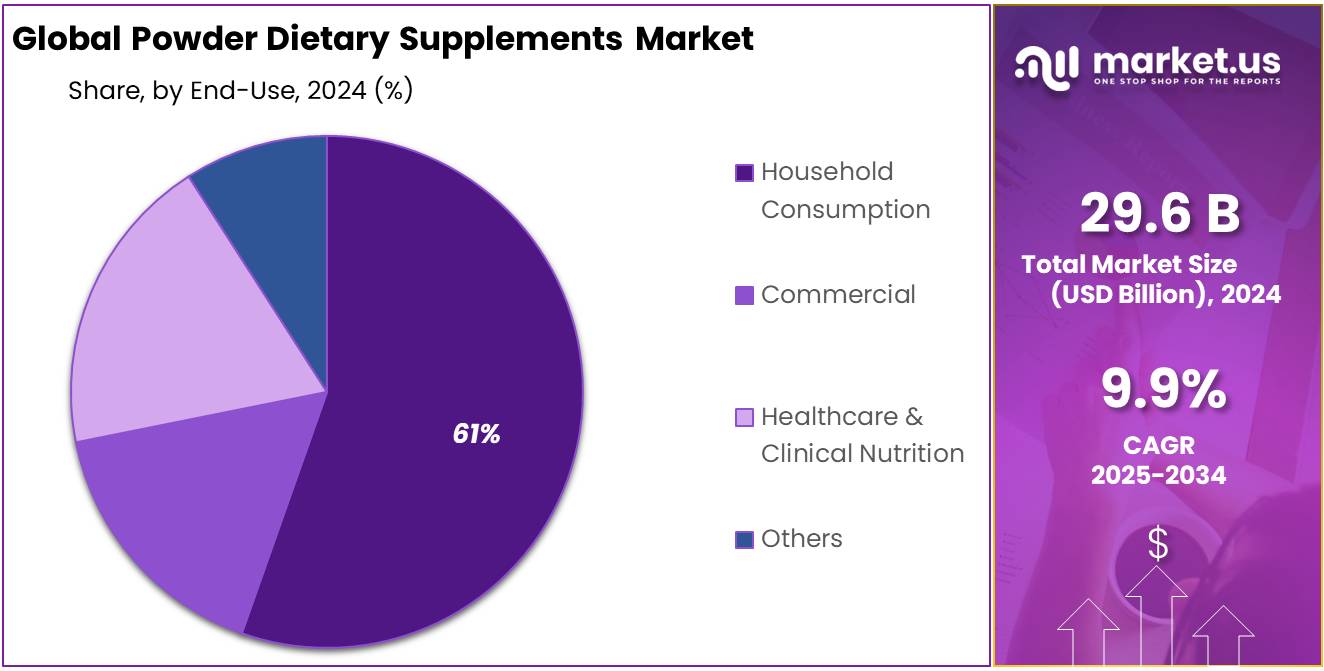

- Household Consumption held a dominant market position, capturing more than a 61.4% share.

- Supermarkets/Hypermarkets held a dominant market position, capturing more than a 34.10% share.

- North America region truly took the lion’s share of the global Powder Dietary Supplements market, holding more than 47.2%, which equates to roughly USD 13.9 billion.

By Product Type Analysis

Protein Powders lead with 31.8% thanks to convenience and everyday fitness use.

In 2024, Protein Powders held a dominant market position, capturing more than a 31.8% share. The category benefited from simple use (scoop-and-mix), wide flavor choice, and strong placement in gyms, pharmacies, and online stores. Brands leaned on whey and plant blends, single-serve sachets, and clear protein drinks to keep trial high. Clean-label claims and lactose-free or vegan options helped powders serve both athletes and casual wellness users without changing routines.

In 2025, the lead continued as retailers expanded private labels and ready-to-mix formats stayed price-competitive versus capsules or gummies on cost per serving. Cross-over into weight management, meal replacement, and healthy aging kept powders on shopping lists, while bundling with shaker bottles and sampler packs supported repeat purchase. Overall, protein powders remained the anchor of the powder supplements aisle, driving traffic and trade promotions across channels.

By Ingredient Analysis

Animal-based ingredients lead with 47.2% because they deliver taste and complete proteins.

In 2024, Animal-based held a dominant market position, capturing more than a 47.2% share. The lead came from trusted staples like whey and casein for muscle recovery, plus collagen for joint and beauty needs. These powders mix well, taste familiar, and carry clear benefits that shoppers understand. Brands also leaned on egg protein, bone broth, and micro-encapsulated marine sources to widen use beyond sports into daily wellness.

In 2025, animal-based kept its edge as labels improved digestibility, offered lactose-managed options, and highlighted traceable, clean sourcing. Retailers backed the trend with simple flavors, starter packs, and subscriptions, while co-branding with gyms and coaches kept trial high. Even as blended formulas grew, consumers still reached first for animal-based when they wanted reliable results, smooth mouthfeel, and an easy path to higher daily protein.

By Functionality Analysis

Sports & Performance Nutrition leads with 38.9% as active lifestyles fuel powder use.

In 2024, Sports & Performance Nutrition held a dominant market position, capturing more than a 38.9% share. The segment’s strength came from everyday gym-goers and team athletes who want quick recovery, steady energy, and lean muscle support in simple scoop-and-mix formats. Brands kept users engaged with clean labels, fast-dissolving powders, and flavors that work with water or milk. Pre-, intra-, and post-workout lines made it easy to stack products without changing daily routines.

In 2025, momentum stayed firm as retailers highlighted starter bundles and subscription refills, while coaches and fitness apps nudged consistent use around training plans. Cross-over benefits—hydration, mobility, and weight management—helped the category reach beyond hardcore athletes into casual wellness. Overall, sports powders remained the first stop for consumers who want reliable results, great mixability, and a clear link between effort in the gym and progress they can feel.

By Consumer Group Analysis

Adults lead with 56.6% because powders fit everyday wellness routines.

In 2024, Adults held a dominant market position, capturing more than a 56.6% share. Demand centered on simple, mix-and-go formats that support daily needs such as protein intake, multivitamin coverage, collagen for joint and skin health, and electrolyte top-ups for hydration. Adults favored clean-label recipes, low sugar, and lactose-managed or plant-inclusive options, while single-serve sachets and large value tubs made dosing and budgeting easy. Gyms, pharmacies, and online subscription packs kept usage consistent, and workplace fitness programs nudged repeat purchase.

In 2025, the Adults segment maintained its lead as brands bundled complementary benefits—protein plus electrolytes, collagen with vitamin C, and stimulant-free pre-workout blends—so users could cover recovery, energy, and general wellness with fewer SKUs. Private labels improved taste and mixability, helping price-sensitive shoppers stay in the category. Overall, adults kept powders at the center of everyday health routines because they are convenient, versatile across goals, and easy to stack with meals or workouts.

By End Use Analysis

Household Consumption dominates with 61.4% as pantry-ready tubs and sachets win daily use.

In 2024, Household Consumption held a dominant market position, capturing more than a 61.4% share. Most buyers kept powders at home because they’re easy to store, measure, and mix into routines—morning shakes, post-workout drinks, or bedtime collagen. Brands met this need with big value tubs for families, single-serve sachets for travel, and flavors that work with water or milk. Retailers pushed bundle deals and subscriptions, which kept kitchen pantries stocked and encouraged consistent intake.

In 2025, the segment stayed ahead as at-home wellness habits matured: consumers looked for cleaner labels, faster dissolving blends, and simple add-ins like electrolytes or fiber without changing meals. Home use also benefited from hybrid work; people had more control over when they mix a scoop, so adherence stayed high. Overall, household buyers chose powders for convenience, predictable cost per serving, and the comfort of managing nutrition on their own schedule.

By Distribution Channel Analysis

Supermarkets/Hypermarkets lead with 34.10% as visibility, trust, and value packs drive baskets.

In 2024, Supermarkets/Hypermarkets held a dominant market position, capturing more than a 34.10% share. The channel won on simple strengths: wide shelf space for powders, clear price ladders from trial sachets to family tubs, and easy comparisons across flavors and formats. Shoppers trust these stores for authenticity, promos, and bundle deals with shakers or bars, so powders slip naturally into weekly grocery runs.

In 2025, momentum stays steady as retailers refine planograms, expand private-label options, and pair on-shelf education with diet-friendly signage and cross-merchandising near dairy, cereal, and fitness accessories. Click-and-collect and same-day delivery also help supermarkets/hypermarkets keep pantry replenishment effortless, reinforcing repeat purchase and brand discovery without changing everyday routines.

Key Market Segments

By Product Type

- Protein Powders

- Multivitamin & Mineral Powders

- Amino Acid Powders

- Meal Replacement Powders

- Probiotic & Prebiotic Powders

- Herbal & Botanical Powders

- Electrolyte & Hydration Powders

- Collagen & Beauty-from-Within Powders

- Weight Management Powders

- Specialty Functional Powders

By Ingredient

- Animal-based

- Plant-based

- Synthetic/Isolated Nutrients

By Functionality

- Sports & Performance Nutrition

- Weight Management & Meal Replacement

- Immunity & Digestive Health

- Cognitive Health & Focus

- Beauty & Anti-aging

- General Wellness & Preventive Health

By Consumer Group

- Adults

- Geriatric Population

- Children & Teenagers

- Athletes & Fitness Enthusiasts

- Pregnant & Lactating Women

By End Use

- Household Consumption

- Commercial

- Healthcare & Clinical Nutrition

- Others

By Distribution Channel

- Supermarkets/Hypermarkets

- Pharmacies & Drug Stores

- Online

- Specialty Nutrition & Health Stores

- Fitness Centers & Gyms

Emerging Trends

Embracing Natural Ingredients in Powder Dietary Supplements

In recent years, there has been a noticeable shift in the Indian powder dietary supplements market towards incorporating natural and traditional ingredients. This trend reflects a growing consumer preference for plant-based, sustainable, and culturally familiar nutritional sources. Products featuring indigenous ingredients like sattu, ragi, millets, almond powder, peanut powder, and dry peas powder are gaining popularity as consumers seek alternatives to imported supplements. These ingredients are not only rich in protein but also provide dietary fiber and essential micronutrients, making them ideal for promoting health and wellness.

The Food Safety and Standards Authority of India (FSSAI) has recognized the importance of these natural ingredients and has been working towards integrating them into the regulatory framework for dietary supplements. For instance, FSSAI has approved various traditional ingredients for use in dietary supplements, ensuring they meet safety and quality standards. This regulatory support encourages manufacturers to explore and utilize indigenous ingredients in their products.

This movement towards natural ingredients is further supported by government initiatives promoting the use of traditional knowledge and practices in health and nutrition. Programs like the National AYUSH Mission aim to promote the cultivation and use of medicinal plants, which can be incorporated into dietary supplements. Such initiatives not only support the growth of the dietary supplements market but also contribute to the preservation and promotion of India’s rich botanical heritage.

Drivers

Rising Health Consciousness and Lifestyle Changes

In recent years, India has witnessed a significant shift in consumer behavior, with an increasing number of individuals prioritizing health and wellness. This transformation is largely attributed to heightened awareness about the importance of maintaining a balanced diet and the growing prevalence of lifestyle-related diseases such as diabetes, hypertension, and obesity. Consequently, there has been a surge in the demand for dietary supplements, particularly powder-based formulations, which are perceived as convenient and effective means to bridge nutritional gaps.

A significant factor driving this trend is the increasing adoption of preventive healthcare measures. Consumers are becoming more proactive in managing their health, opting for supplements that can enhance immunity, improve gut health, and support overall well-being. The convenience offered by powder supplements, which can be easily incorporated into daily routines, has further fueled their popularity.

The government’s role in promoting health and wellness has also been instrumental. Initiatives such as the Poshan Abhiyan aim to combat malnutrition and promote the consumption of fortified foods and supplements. Additionally, the Food Safety and Standards Authority of India (FSSAI) has established regulations to ensure the safety and efficacy of dietary supplements, thereby enhancing consumer trust in these products.

Restraints

Regulatory Challenges and Compliance in the Powder Dietary Supplements Market

The powder dietary supplements market in India is experiencing rapid growth, driven by increasing health consciousness and a shift towards preventive healthcare. However, this expansion is accompanied by significant regulatory challenges that impact both manufacturers and consumers.

The Food Safety and Standards Authority of India (FSSAI) plays a crucial role in regulating dietary supplements, ensuring their safety and efficacy. Under the Food Safety and Standards (Health Supplements, Nutraceuticals, Food for Special Dietary Use, Food for Special Medical Purpose, Functional Food, and Novel Food) Regulations, 2016, FSSAI sets standards for various categories of functional foods, including health supplements and nutraceuticals. These regulations cover aspects such as ingredient composition, labeling, and permissible additives to ensure consumer safety.

Despite these regulations, the market faces challenges related to non-compliance and enforcement. A notable concern is the prevalence of counterfeit and substandard products. For instance, in August 2025, Uttar Pradesh police uncovered a significant counterfeit health supplement racket in Muzaffarnagar, seizing fake goods worth Rs 2 crore. The seized products included counterfeit protein and omega-3 capsules, raw materials, and packaging falsely labeled as foreign-made. The accused admitted to sourcing raw materials, producing counterfeit supplements, and distributing them under well-known brand names, primarily to gyms, posing serious health risks.

To address such issues, FSSAI has implemented stricter regulations targeting misleading claims by protein supplement brands. A study conducted by FSSAI revealed that nearly 70% of India’s 36 most popular protein powders displayed incorrect information, with some brands offering only half of what they claimed. Additionally, around 14% contained harmful fungal aflatoxins, and 8% showed traces of pesticide residue. These findings prompted FSSAI to prepare stringent rules to safeguard consumers.

Opportunity

Government Initiatives and Support for the Powder Dietary Supplements Market

The Indian government’s proactive initiatives have significantly contributed to the growth and development of the powder dietary supplements market. Programs such as the Fit India Movement and Ayushman Bharat have played pivotal roles in promoting health and wellness across the nation.

The Fit India Movement, launched by the Government of India, aims to inspire individuals to prioritize physical activities and sports in their daily lives. This initiative has led to increased awareness about the importance of maintaining a healthy lifestyle, thereby driving the demand for dietary supplements that support overall well-being.

Ayushman Bharat, another significant program, focuses on providing accessible healthcare to the underserved populations. By improving healthcare infrastructure and promoting preventive health measures, Ayushman Bharat has created an environment conducive to the growth of the dietary supplements market.

Furthermore, the government’s support for traditional medicine systems, including Ayurveda, has led to a surge in the popularity of herbal and plant-based dietary supplements. This trend aligns with the growing consumer preference for natural and holistic health solutions.

Regional Insights

North America dominates with a commanding 47.2% share—translating to about USD 13.9 billion in 2024.

In 2024, the North America region truly took the lion’s share of the global Powder Dietary Supplements market, holding more than 47.2%, which equates to roughly USD 13.9 billion in sales. That level of dominance signals not just substantial consumption, but also the maturity and trust embedded in the region’s health and wellness ecosystem.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Amway reported global sales of USD 7.4 billion in 2024, with its nutrition category growing 2% and making up approximately 64% of overall revenue. Their Nutrilite™ brand continues to be the world’s top-selling vitamin and dietary supplement, drawing strength from innovations such as plant-science-backed “solutions” programs and investments in gut microbiome research. This underscores Amway’s continuing focus on health and wellbeing, supporting optimistic long-term prospects.

Nestlé Health Science positions itself at the cutting edge of nutritional therapy, serving a wide spectrum—from active lifestyle consumers to patients requiring medical and pharmaceutical-grade nutrition. As of late 2024, North America made up approximately 66% of its CHF 6.5 billion in sales (2023 figures). Their brands, including BOOST®, Nature’s Bounty®, and Orgain®, earned recognition in U.S. News & World Report’s 2024 rankings for best health products, reinforcing their reputation for quality and innovation.

Abbott achieved total revenue of USD 42.0 billion, with nutrition forming a meaningful part of its diverse portfolio. The Nutritional Products segment notably boosted its organic growth by 5.9%, and its operating earnings expanded by 12.9% over the prior year. Abbott also launched the PROTALITY™ high-protein shake specifically to support adults on weight-loss journeys aiming to preserve muscle mass.

Top Key Players Outlook

- Amway Corp.

- Nestle Health Science

- Abbott

- Bayer AG

- Glanbia plc

- Nature’s Way Brands, LLC

- OZiva

- Herbalife Nutrition Ltd.

- NOW Foods

- Otsuka Pharmaceutical

- Jarrow Formulas

Recent Industry Developments

In 2024, Amway reported USD 7.4 billion in total sales, with the nutrition category—propelled heavily by Nutrilite—growing 2% and accounting for 64% of overall turnover.

In 2024, Bayer AG saw its Consumer Health segment—including dietary supplements like Redoxon and Berocca—deliver €5.87 billion in sales, marking a 1.9% increase on a portfolio- and currency-adjusted basis—a solid sign that its supplement brands remain reliable favorites in homes and pharmacies.

Report Scope

Report Features Description Market Value (2024) USD 29.6 Bn Forecast Revenue (2034) USD 76.1 Bn CAGR (2025-2034) 9.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Protein Powders, Multivitamin and Mineral Powders, Amino Acid Powders, Meal Replacement Powders, Probiotic and Prebiotic Powders, Herbal and Botanical Powders, Electrolyte and Hydration Powders, Collagen and Beauty-from-Within Powders, Weight Management Powders, Specialty Functional Powders), By Ingredient (Animal-based, Plant-based, Synthetic/Isolated Nutrients), By Functionality (Sports and Performance Nutrition, Weight Management and Meal Replacement, Immunity and Digestive Health, Cognitive Health and Focus Beauty and Anti-aging, General Wellness and Preventive Health), By Consumer Group (Adults, Geriatric Population, Children and Teenagers, Athletes and Fitness Enthusiasts, Pregnant and Lactating Women), By End Use (Household Consumption, Commercial, Healthcare and Clinical Nutrition, Others), By Distribution Channel (Supermarkets/Hypermarkets, Pharmacies and Drug Stores, Online, Specialty Nutrition and Health Stores, Fitness Centers and Gyms) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Amway Corp., Nestle Health Science, Abbott, Bayer AG, Glanbia plc, Nature’s Way Brands, LLC, OZiva, Herbalife Nutrition Ltd., NOW Foods, Otsuka Pharmaceutical, Jarrow Formulas Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Powder Dietary Supplements MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Powder Dietary Supplements MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Amway Corp.

- Nestle Health Science

- Abbott

- Bayer AG

- Glanbia plc

- Nature's Way Brands, LLC

- OZiva

- Herbalife Nutrition Ltd.

- NOW Foods

- Otsuka Pharmaceutical

- Jarrow Formulas