Global Polyurethane Synthetic Leather Market By Product Type (Water-Based PU Leather and Solvent-Based PU Leather), By Applications (Automotive, Footwear, Furniture, Apparel, and Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 157539

- Number of Pages: 274

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overviews

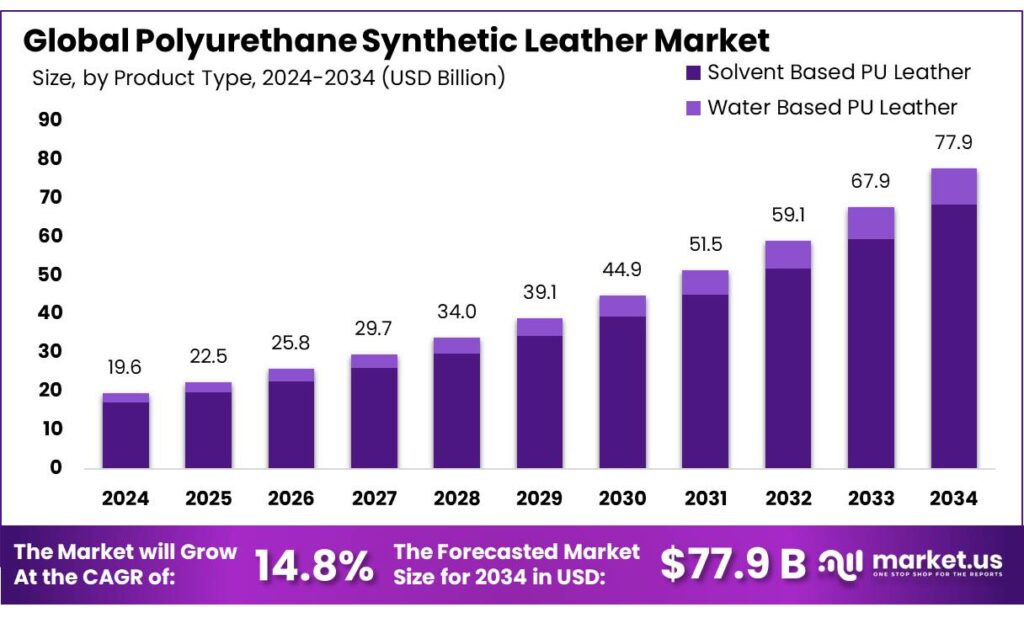

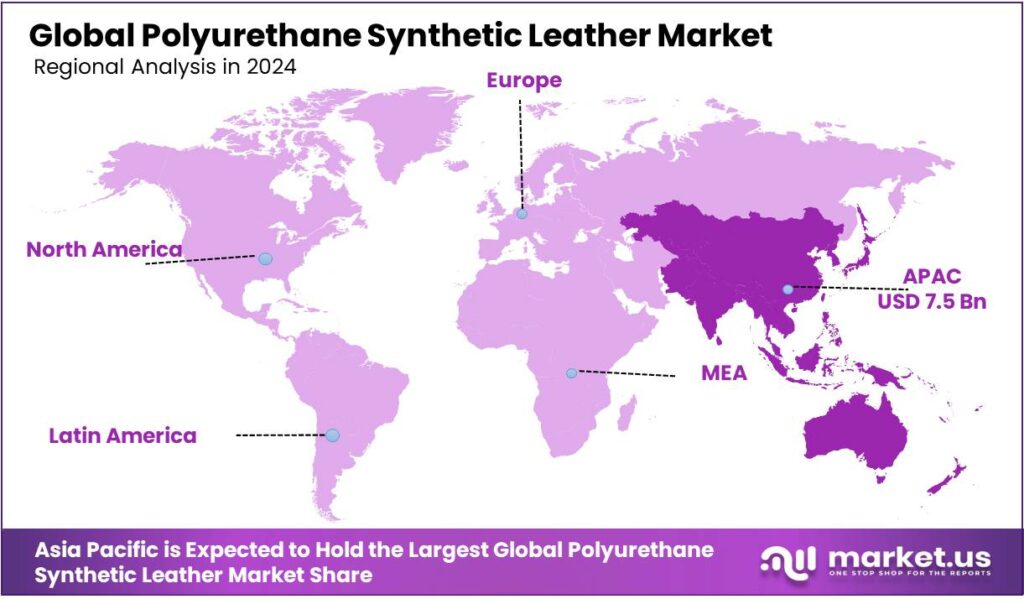

The Global Polyurethane Synthetic Leather Market size is expected to be worth around USD 77.9 Billion by 2034, from USD 19.6 Billion in 2024, growing at a CAGR of 14.8% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 38.6% share, holding USD 7.5 Billion in revenue.

Polyurethane (PU) faux leather is a synthetic material designed to resemble genuine leather. It is made by coating a fabric backing, such as cotton or polyester, with a layer of polyurethane, a type of plastic polymer. It is a popular vegan alternative to animal leather, offering a more affordable and cruelty-free option. Traditionally, PVC leather was mostly sought after for automotive applications, footwear, and apparel. However, PU leather has superior properties compared to PVC leather, such as high durability, good texture, better softness, and longer lifespan. One of the major drivers of the PU synthetic leather is its inexpensive nature.

In recent years, several companies have invested in improving the product quality and manufacturing technology of PU leather. One such development is the innovation in bio-based PU synthetic leather, which is considered more sustainable than conventional PU synthetic leather. Despite the technological and technical advancements, environmental concerns regarding the polyurethane synthetic leather might be a significant challenge in the industry.

- According to the American Chemistry Council, a two-year study by the Center for the Polyurethanes Industry (CPI) revealed that in the United States, Canada, and Mexico, overall polyurethane production totaled 9.1 billion pounds in 2023.

Key Takeaways

- The global polyurethane synthetic leather market was valued at USD 19.6 billion in 2024.

- The global polyurethane synthetic leather market is projected to grow at a CAGR of 14.8% and is estimated to reach USD 77.9 billion by 2034.

- Based on product types, solvent-based polyurethane synthetic leather dominated the market in 2024, comprising about 87.8% share of the total global market.

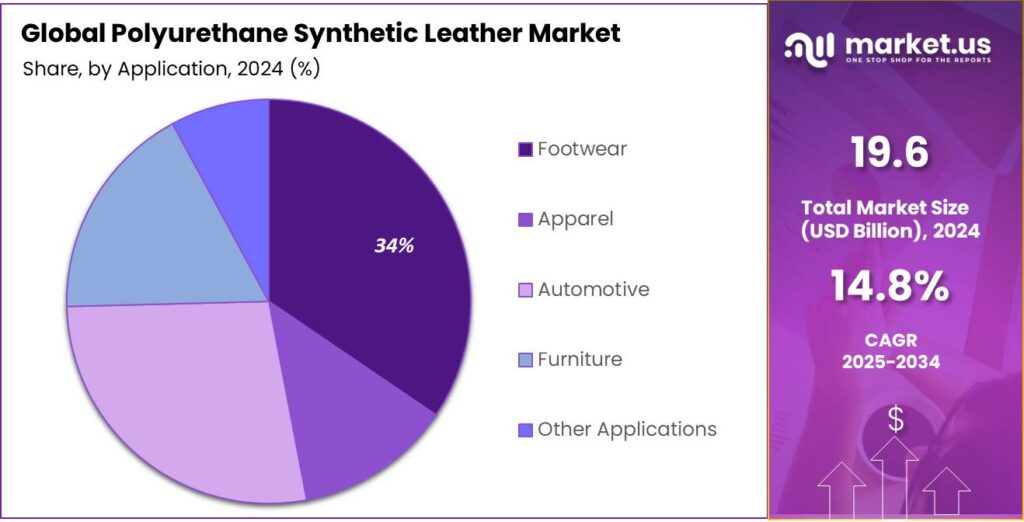

- Among the applications of polyurethane synthetic leather is widely used in the footwear industry, and hence it dominated the market in 2024, accounting for around 34.5% of the market share.

- Asia Pacific was the largest market for polyurethane synthetic leather in 2024, with approximately 38.6% share of the total global market.

Product Type Analysis

Solvent-Based Polyurethane Leather Dominated the Market Due to Its Manufacturing Simplicity Compared to Water-Based Polyurethane Leather.

On the basis of product type, the polyurethane synthetic leather market is segmented into water-based PU leather and solvent-based PU leather. Solvent-based PU leather dominated the market in 2024 with a market share of 87.8%. Solvent-based PU leather is traditionally manufactured more because it offers a better resemblance to real leather’s texture and look at a lower cost, and the manufacturing process is well-established.

However, it relies on harmful organic solvents such as dimethylformamide, which cause pollution and health risks. Due to this pollution and health risks, water-based PU leathers are gaining traction and are expected to surpass solvent-based production in the future, driven by increasing demand for environmentally friendly products and stricter regulations. Water-based PU uses water as the solvent, significantly reducing the emission of volatile organic compounds (VOCs) and other pollutants. However, solvent-based methods are still prevalent due to their established technology and cost-effectiveness.

Application Analysis

In 2024, the Apparel Products Dominated the Polyurethane Synthetic Leather Market.

Footwear has emerged as the largest application of polyurethane (PU) synthetic leather, accounting for nearly 34.5% of global consumption, because it combines the key attributes of performance, affordability, and versatility that the industry demands. PU synthetic leather provides an excellent balance of durability, flexibility, and lightweight properties, making it highly suitable for shoes that must withstand daily wear while remaining comfortable. Unlike apparel or furniture, footwear requires materials with high abrasion resistance, strong tear strength, and superior hydrolysis resistance, which PU delivers more effectively than other synthetic alternatives such as PVC.

Moreover, footwear production is highly cost-sensitive, and PU offers an affordable substitute for natural leather while enabling manufacturers to maintain aesthetics, color variety, and texture options. Additionally, the rise of fast fashion and e-commerce has increased demand for stylish yet affordable footwear, and PU synthetic leather is the material of choice for achieving both functional and visual goals. Furthermore, the apparel segment is the third most dominant application of polyurethane synthetic leather. PU leather is significantly less expensive than genuine leather, making stylish apparel more accessible to a wider audience.

It is an affordable, durable, and versatile alternative to genuine leather that is water-resistant, easy to clean, and available in many colors and textures, which makes it an ideal option for the manufacturing of apparel products, such as jackets and bags. Apart from apparel, the automotive sector is also a major segment that uses PU synthetic leather. As the requirements for durability, flame retardance, stain resistance, and other performance attributes in automotive interiors continue to rise, synthetic polyurethane (PU) leather and its composites have been more widely applied, serving as a viable alternative.

Key Market Segments

By Product Type

- Water-Based PU Leather

- Solvent-Based PU Leather

By Application

- Automotive

- Footwear

- Furniture

- Apparel

- Other Applications

Drivers

Demand for an Inexpensive and Vegan Alternative to Leather Drives the Polyurethane Synthetic Leather Market.

The polyurethane synthetic leather market is significantly driven by rising consumer demand for the cheap and cruelty-free alternative to traditional leather in industries such as fashion, footwear, and automotive. The price of traditional leather is often very high.

- For instance, three ounces of cowhide leather can be priced up to USD 300. PU synthetic leather offers a more affordable option compared to genuine leather, making it attractive for mass production.

Additionally, approximately 25.8 million individuals globally tried veganism in January 2025. As veganism rises, the demand for cruelty-free polyurethane synthetic leather rises. In addition to the footwear and apparel industry, there is an increase in demand for synthetic leather from the automotive and furniture industries. It is widely used in the automotive industry for interior components, such as seats, dashboards, and door panels. In the furniture industry, it is used to cover entire furniture or sectionals, as it is affordable and versatile.

Restraints

Environmental Concerns Might Hamper the Growth of the Polyurethane Synthetic Leather Market.

Environmental concerns regarding polyurethane origin, non-biodegradability, and potential pollution from manufacturing processes and end-of-life products create hurdles in the PU synthetic leather market. Although PU leather can imitate the appearance and texture of genuine leather, it is derived from petroleum-based products, and its production involves the use of toxic chemicals and solvents such as isocyanates and phthalates.

These substances pose a threat to human health and the environment at various stages of production and disposal. The production of PU involves the emission of volatile organic compounds (VOCs) and greenhouse gases, contributing to air pollution and climate change. Additionally, the release of hazardous chemicals into water sources during production contaminates aquatic ecosystems. Similarly, PU is not biodegradable and takes a long time to break down. When disposed of, it contributes to the accumulation of plastic waste in landfills, exacerbating the global plastic pollution crisis.

Opportunity

Technological Advancements Create Opportunities in the Polyurethane Synthetic Leather Market.

Technological and technical advancements are proactively catalyzing the polyurethane synthetic leather market through a spectrum of more sustainable and convenient products. These advancements focus on sustainability, performance, and smart integration to create higher-performing, eco-friendly, and functional PU leather for various industries.

- For instance, in July 2024, BASF launched Haptex 4.0, a polyurethane solution for the production of synthetic leather that is 100% recyclable.

Synthetic leather made with Haptex 4.0 and polyethylene terephthalate fabric can be recycled together using a formulation and recycling technical pathway without the need for a layer peel-off process, which makes the recycling of the materials possible. Similarly, in June 2024, the Mitchell Group announced the launch of NetZERO, which is a sustainable polymer textile platform realized in a polyurethane synthetic leather format. NetZERO is the water-based polymer engineered for a variety of coated upholstery applications, including healthcare, hospitality, contract, and other commercial segments.

Trends

Innovation in Bio-Based and Sustainable PU Leather.

As the awareness against petroleum products increases, there is a consumer preference shift towards bio-based products across various industries, which are considered sustainable. Innovations in bio-based and sustainable polyurethane leather focus on creating durable alternatives to traditional leather by reducing reliance on petroleum and animal products, utilizing waste streams, and developing environmentally friendly production methods. Many companies have invested in the research and development of such synthetic leathers.

For instance, Mitsubishi’s BioPTMG, which is a plant-derived polyol, imparts flexibility, durability, and high resilience to polyurethane and polyester products. In October 2024, it was adopted by Kahei as a bio-synthetic leather material to manufacture leather bags and other products. Similarly, Adriano Di Marti Company developed Desserto, which is a sustainable, plant-based leather alternative made from the pads of the organic nopal cactus. And LEAP is a bio-based, sustainable PU leather made with apple waste and a partially bio-based polyurethane coating using Covestro INSQIN technology.

Geopolitical Impact Analysis

Geopolitical Tensions Leading to Supply Chain Disruptions in the Polyurethane Synthetic Leather Market.

Geopolitical tensions have increasingly rippled through the global polyurethane synthetic leather market, disrupting supply chains and creating price hikes. PU leather is a downstream product of the petrochemical industry, which is highly sensitive to geopolitical conflicts. For instance, after the 2022 Russia-Ukraine conflict, there was a severe disruption in the supply chain of petroleum and petroleum-based products. Similarly, the Middle Eastern conflicts impact the petrochemical industry primarily by disrupting raw material supply chains.

This leads to higher feedstock prices, increased shipping costs and delays, and higher insurance premiums for trade routes like the Strait of Hormuz. As the countries in the Middle East are the key regions in the oil and gas industry, conflicts such as Israel-Palestine, the post-Assad era in Syria, and the civil war in Yemen, significantly impacted the petrochemical industry. Due to such instabilities, the price of PU resin, which makes up over 50% of synthetic leather production costs, increased significantly.

Regional Analysis

Asia Pacific was the Dominant Region in the Global Polyurethane Synthetic Leather Market in 2024.

Asia Pacific held the major share of the global polyurethane synthetic leather market, valued at around US$ 7.5 billion. The Asia‑Pacific region emerged as the leader in the global polyurethane synthetic leather market, commanding an estimated 38.6% of total revenue share. The dominance of the region is attributed to the cost-effectiveness and versatility of the product, and the large-scale production facilities of the PU leather in the region.

PU synthetic leather is significantly less expensive to produce than genuine leather, making it an attractive material for cost-conscious manufacturers and price-sensitive consumers in many Asian markets. Additionally, the Asia-Pacific region, particularly China and India, has a robust and rapidly expanding manufacturing base with a high production capacity for synthetic materials. China is the world’s largest producer and exporter of faux leather and its products.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Global key players in the polyurethane synthetic leather market are focusing on sustainability and innovation to meet rising eco-regulations and consumer demand for vegan alternatives. They are also investing in performance enhancements like breathability, stain resistance, and durability to serve the automotive, footwear, and furniture sectors. Strategies include vertical integration to secure raw material supply, regional manufacturing hubs for agility, and collaborations with fashion and automotive brands to co-develop premium, compliant products. Additionally, players are emphasizing circularity, using recycled inputs, and offering mass customization to align with both cost pressures and ESG commitments.

There are several global key players in the polyurethane synthetic leather market, such as Kuraray, Asahi Kasei Corporation, Teijin, Mayur Uniquoters, Nan Ya Plastics, Alfatex Italia SRL, Huafeng Group, FILWEL, Yantai Wanhua Synthetic Leather Group, Zhejiang Hexin Science and Technology, Evonik Industries AG, and DIC Corporation. In the niche market of polyurethane synthetic leather, several players put efforts into strategic activities, such as product development, mergers, expansions, partnerships, and investments. For instance, in April 2022, Coronet Spa, based in Milan, acquired its rival, Synt3, a manufacturer of polyurethane-coated materials.

The Major Players in the Industry

- Kuraray Co., Ltd.

- San Fang Chemical Industrial Co., Ltd.

- Asahi Kasei Corporation

- Teijin Limited

- Mayur Uniquoters Ltd.

- Nan Ya Plastics Corp.

- Alfatex Italia SRL

- Huafeng Group

- FILWEL Co., Ltd.

- Yantai Wanhua Synthetic Leather Group Co., Ltd.

- Zhejiang Hexin Science and Technology Co., Ltd.

- Evonik Industries AG

- DIC Corporation

- Other Key Players

Key Developments

- In April 2025, Dongsung Chemical, an eco-friendly materials science company, announced the opening of its polyurethane (PU) production facility in Karawang, Indonesia.

- In June 2023, DIC Corporation announced the release of the HYDRAN GP series of environment-friendly waterborne polyurethane resins. These resins have a higher solid content and contain no amines, which helps to shorten process times and lessen odors, and reduce greenhouse gas emissions and volatile organic compounds (VOCs).

Report Scope

Report Features Description Market Value (2024) USD 19.6 Bn Forecast Revenue (2034) USD 77.9 Bn CAGR (2025-2034) 14.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Water-Based PU Leather, Solvent-Based PU Leather), By Applications (Automotive, Footwear, Furniture, Apparel, Other Applications) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Kuraray Co., Ltd., San Fang Chemical Industrial Co., Ltd., Asahi Kasei Corporation, Teijin Limited, Mayur Uniquoters Ltd., Nan Ya Plastics Corp., Alfatex Italia SRL, Huafeng Group, FILWEL Co., Ltd., Yantai, Wanhua Synthetic Leather Group Co., Ltd., Zhejiang Hexin Science and Technology Co., Ltd., Evonik Industries AG, DIC Corporation, Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Polyurethane Synthetic Leather MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Polyurethane Synthetic Leather MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Kuraray Co., Ltd.

- San Fang Chemical Industrial Co., Ltd.

- Asahi Kasei Corporation

- Teijin Limited

- Mayur Uniquoters Ltd.

- Nan Ya Plastics Corp.

- Alfatex Italia SRL

- Huafeng Group

- FILWEL Co., Ltd.

- Yantai Wanhua Synthetic Leather Group Co., Ltd.

- Zhejiang Hexin Science and Technology Co., Ltd.

- Evonik Industries AG

- DIC Corporation

- Other Key Players