Global Polyphenylene Sulfide Market, By Type (Linear PPS, Cured PPS, and Branched PPS), By Application (Automotive, and Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 101235

- Number of Pages: 264

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

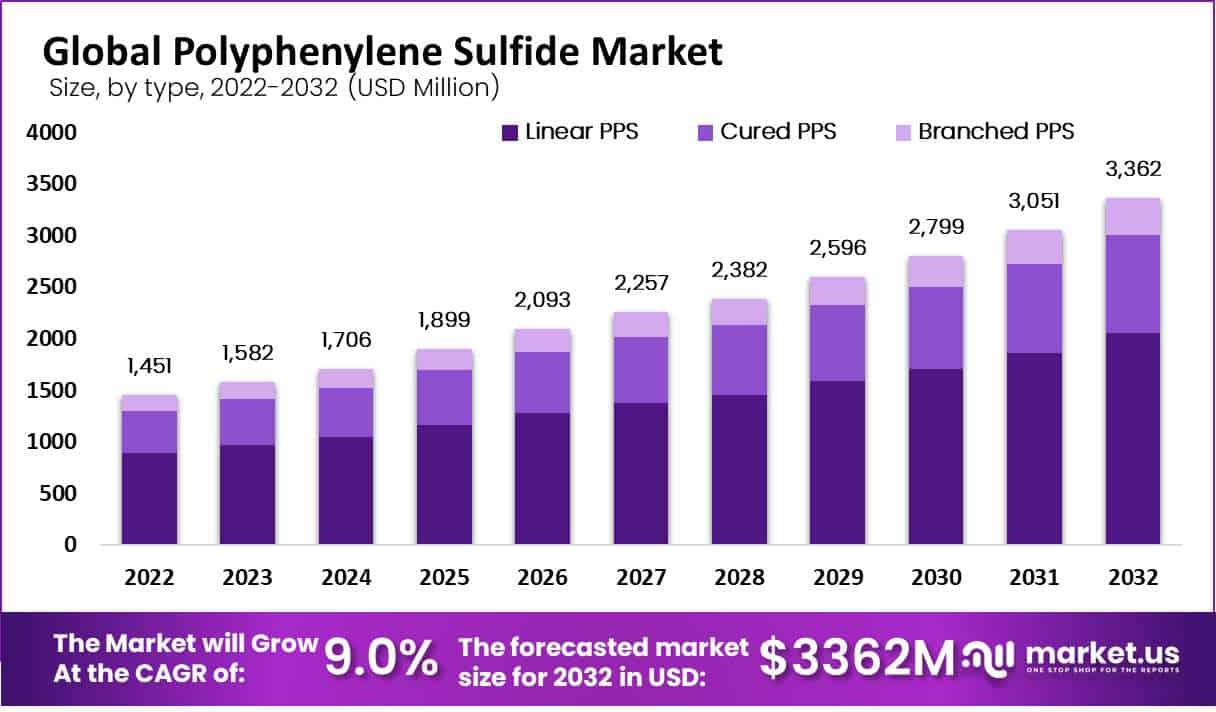

In 2022, the global polyphenylene sulfide market size accounted for USD 1451 million and is expected to reach USD 3362 million in 2032. This market is estimated to register a CAGR of 9.0% between 2023 and 2032. The global polyphenylene sulfide (pps) market for this particular type of engineering plastic, including its production, sales, and consumption worldwide.

The market is driven by the increasing demand for PPS in various end-use industries due to its high-performance properties like resistance to high temperatures and chemicals, and its ability to maintain dimensional stability.

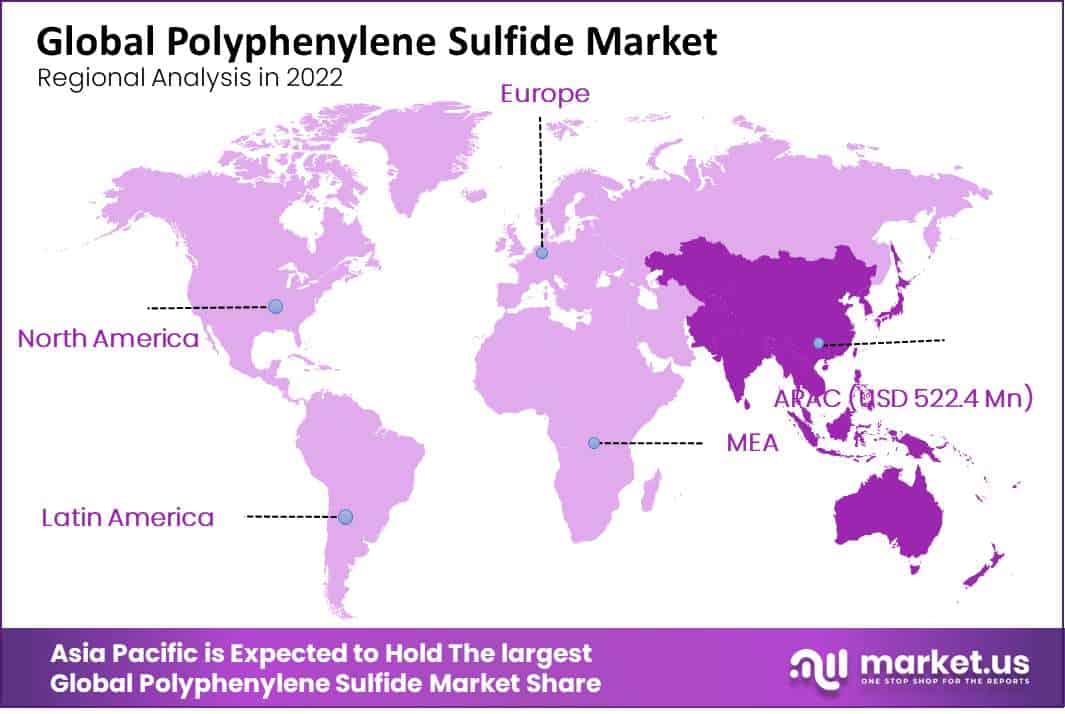

The market is also influenced by technological advancements in PPS production and increasing awareness of the benefits of using PPS in different industries. The Asia-Pacific region is the largest market for PPS owing to the presence of different end-use industries such as automotive, electrical and electronics, and industrial, along with the availability of lowest-cost raw materials and labor.

Key Takeaways

- Market Size: It is anticipated that the global polyphenylene sulfide market will experience a compound annual growth rate (CAGR) of 9.0% between 2023-2032.

- Market Trend: Polyphenylene Sulfide (PPS) continues its impressive momentum within industries seeking high-performance and heat-resistant materials.

- Type Analysis: In 2022, the linear PPS type dominated the polyphenylene sulfide market, holding an impressive total revenue share of 61%. This can be attributed to its high crystallinity, superior dimensional stability, and excellent mechanical and thermal properties.

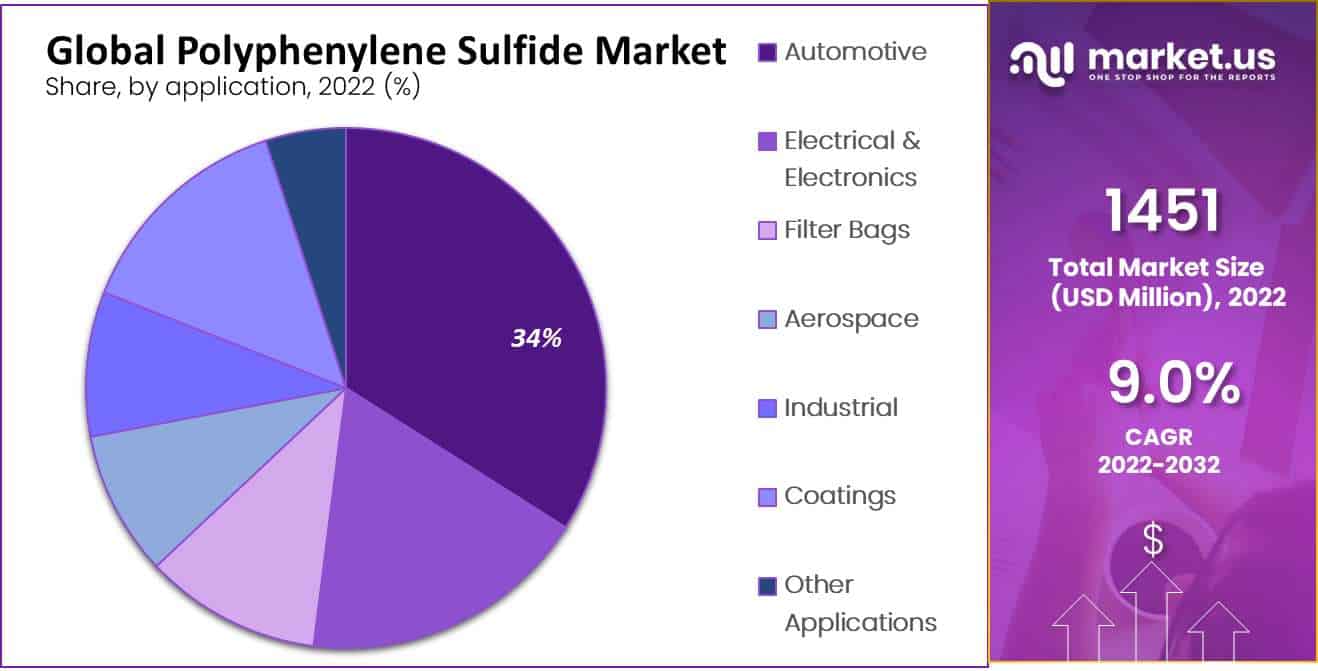

- Application Analysis: Of these categories, the automotive segment stands out as the most profitable in the global polyphenylene sulfide market, contributing to a substantial total revenue share of 34% in 2022.

- Drivers: Increasing demand for high-performance plastics, rising focus on lightweight materials, and growth in automotive production.

- Restraints: Challenges in recycling PPS, limited processing capabilities, and competition from other high-performance polymers.

- Opportunities: Expansion in electronics and electrical sectors, technological advancements in PPS production, and growing demand in emerging economies.

- Challenges: Environmental concerns regarding PPS production, volatility in raw material prices, and stringent regulations.

- Regional Analysis: Anticipated to possess the highest CAGR in the industry, Asia Pacific holds the largest polyphenylene sulfide market share at 36%.

- Key Players Analysis: Major players in the polyphenylene sulfide market include Toray Industries Inc., DIC CORPORATION, Solvay S.A., Lion Idemitsu Composites Co. Ltd, Polyplastics Co. Ltd., Tosoh Corporation, SK chemicals, Chengdu Letian Plastics Co. Ltd., Celanese Corporation, TEIJIN LIMITED, SABIC, Zhejiang NHU Co. Ltd., LG Chem, RTP Company, Ensinger, Other Key Players.

Driving Factors

Growing Demand for PPS in The Automotive Industry & Industrial Applications.

PPS is broadly used in the production of automotive components like fuel system components, electrical components, and under-the-hood applications owing to its high-temperature resistance, chemical resistance, and dimensional balance.

The rising requirement for lightweight and fuel-efficient vehicles has led to the adoption of PPS in automotive applications, driving the growth of the PPS market. PPS is used in different industrial applications like pumps, valves, and bearings owing to its high-temperature resistance, chemical resistance as well excellent dimensional stability.

The rise of industrial applications like oil & gas, chemical processing, and power generation is driving the requirement for PPS. The development of the latest PPS formulations and improved processing techniques have led to price-effective and highest-performance products, driving the growth of the PPS market.

For example, the use of the latest catalysts and modified monomers has led to the development of PPS with improved properties like higher heat resistance, better processability, and improved electrical properties.

Restraining Factors

Fluctuating Prices of Raw Materials and Limited Availability of Raw Materials Required for PPS Production

The prices of materials used in PPS production like p-dichlorobenzene and sodium sulfide market are subject to fluctuations owing to supply and demand factors, geopolitical problems, and natural disasters. Fluctuations in the prices of these raw materials can affect the cost of production and the pricing of the final product, which can be a restraint for the PPS market.

The production of PPS requires the use of specific raw materials that are not universally available. This can lead to supply chain disruptions and affect the availability and pricing of PPS, which can be a restraint for the market.

By Type Analysis

The Linear PPS Fragment is The Most Lucrative Fragment In the Type of Polyphenylene Sulfide Market.

Based on type, the market for polyphenylene sulfide market is divided into linear PPS, cured PPS, and branched PPS. Among these types, the linear PPS segment is the most lucrative in the global polyphenylene sulfide market.

The total revenue share of the linear PPS type is 61% in 2022 for the polyphenylene sulfide market. Owing to its high crystallinity, good dimensional stability, and excellent mechanical and thermal properties.

It is used in different applications such as automotive, electrical electronics, and industrial. Another branched PPS is a type of PPS that has a lower melting point and better processability compared to linear PPS. It is used in various applications such as electrical and electronics, industrial, and coatings.

By Application Analysis

The Automotive Fragment is The Most Lucrative Fragment in the Application Type of Polyphenylene Sulfide Market.

Based on application, the market for polyphenylene sulfide market is divided into automotive, electrical & electronics, filter bags, aerospace, industrial, coatings, and other applications. Among these types, the automotive segment is the most lucrative in the global polyphenylene sulfide market. The total revenue share of the automotive type is 34% in 2022 for the polyphenylene sulfide market.

PPS is used in different automotive applications like fuel system components, electrical components, and under-the-hood applications owing to its high-temperature resistance, chemical resistance, and dimensional stability.

Apart from this PPS is widely used in electrical and electronics applications such as connectors, switches, and sockets owing to its high dielectric strength, dimensional stability, and resistance to high temperatures and chemicals.

Key Market Segments

Based on Type

- Linear PPS

- Cured PPS

- Branched PPS

Based on Application

- Automotive

- Electrical & Electronics

- Filter Bags

- Aerospace

- Industrial

- Coatings

- Other Applications

Growth Opportunity

Growing Demand for PPS in The Healthcare Sector and Lightweight and fuel-efficient Materials In The Transportation Industry

PPS is used in medical devices and equipment owing to its highest temperature resistance, chemical resistance, and dimensional stability. The rising demand for the highest-performance materials in the healthcare sector, driven by the aging population and the requirement for advanced medical treatments, is expected to drive the growth of the PPS market.

The transportation industry is increasingly focused on minimizing the weight of vehicles to innovate fuel efficiency and decrease emissions. PPS is a lightweight & highest performance material that can be used in automotive and aerospace applications, driving the demand for PPS.

Latest Trends

Increasing Focus on Sustainability and Development of New PPS Formulations.

Increasing Focus on Sustainability and Development of New PPS Formulations.

The demand for sustainable and eco-friendly materials is on the rise, driven by increasing environmental concerns & government regulations. PPS is the highest-performance material that can be recycled, which makes it an attractive option for sustainable applications.

The trend toward sustainability is expected to drive the creation of PPS in the coming years. The development of the latest PPS formulations is an ongoing trend in the market, driven by the need for the highest-performance materials in different applications.

New formulations of PPS with improved properties like higher heat resistance, better processability, and improved electrical properties are being developed to meet the evolving wants of end-use industries.

PPS is a popular material for 3D printing owing to its high-temperature resistance, chemical resistance, and dimensional stability. The rising uses of 3D printing in different industries are driving the requirement for PPS as a 3D printing material.

Regional Analysis

Asia Pacific Accounted The Largest Revenue Share in Polyphenylene Sulfide Market In 2022.

With a market share of 36% and the largest market share, Asia Pacific is anticipated to have the industry’s highest CAGR. Owing to the region’s growing industrialization & urbanization as well as the rising requirement for highest performance materials. it is anticipated that the PPS market will expand in the Asia-Pacific region. A further significant market for PPS is North America.

This is the result of the robust demand in the aerospace and automotive sectors. Owing to growing interest in sustainability and rising demand for high performance materials. North America’s PPS market is anticipated to expand.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The PPS market is fragmented with few players operating in the market. The market share of each player varies by region and application. For example, Toray Industries Inc. is a leading player in the global PPS market, with a vast range of PPS products.

The company focuses on expanding its PPS product portfolio through collaborations & partnerships with other players in the market.

Market Key Players

- Toray Industries Inc.

- DIC CORPORATION

- Solvay S.A.

- Lion Idemitsu Composites Co. Ltd

- Polyplastics Co. Ltd.

- Tosoh Corporation

- SK chemicals

- Chengdu Letian Plastics Co. Ltd.

- Celanese Corporation

- TEIJIN LIMITED

- SABIC

- Zhejiang NHU Co. Ltd.

- LG Chem

- RTP Company

- Ensinger

- Other Key Players

Recent Developments

January 2023, DIC Corporation introduced that it has acquired a majority stake in PPS compound manufacturer Amfine Chemical Corporation.

In December 2022, Solvay S.A. published that it has acquired a majority stake in a Chinese manufacturer of PPS compounds, Jiaxing Fortune Chemical Co., Ltd.

Report Scope

Report Features Description Market Value (2022) USD 1451 Mn Forecast Revenue (2032) USD 3362 Mn CAGR (2023-2032) 9.0% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type-Linear PPS, Cured PPS, and Branched PPS; By Application-Automotive, Electrical & Electronics, Filter Bags, Aerospace, Industrial, Coatings, and Other Applications; Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Toray Industries Inc., DIC CORPORATION, Solvay S.A., Lion Idemitsu Composites Co. Ltd, Polyplastics Co. Ltd., Tosoh Corporation, SK Chemicals, Chengdu Letian Plastics Co. Ltd., Celanese Corporation, TEIJIN LIMITED, SABIC, Zhejiang NHU Co. Ltd., LG Chem, RTP Company, Ensinger, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What will be the market size for Polyphenylene Sulfide Market in 2032?In 2032, the Polyphenylene Sulfide Market will reach USD 3362 million.

What CAGR is projected for the Polyphenylene Sulfide Market?The Polyphenylene Sulfide Market is expected to grow at 9.0% CAGR (2023-2032).

List the segments encompassed in this report on the Polyphenylene Sulfide Market?Market.US has segmented the Polyphenylene Sulfide Market Market by geographic (North America, Europe, APAC, South America, and MEA). By Type, market has been segmented into Linear PPS, Cured PPS and Branched PPS. By Application, the market has been further divided into Automotive, Electrical & Electronics, Filter Bags, Aerospace, Industrial, Coatings and Other Applications.

Which segment dominate the Polyphenylene Sulfide industry?With respect to the Polyphenylene Sulfide industry, vendors can expect to leverage greater prospective business opportunities through the Linear PPS segment, as this dominate this industry.

Name the major industry players in the Polyphenylene Sulfide Market.Toray Industries Inc., DIC CORPORATION, Solvay S.A., Lion Idemitsu Composites Co. Ltd, Polyplastics Co. Ltd., Tosoh Corporation and Other Key Players are the main vendors in this market.

Polyphenylene Sulfide MarketPublished date: Oct 2023add_shopping_cartBuy Now get_appDownload Sample

Polyphenylene Sulfide MarketPublished date: Oct 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Toray Industries Inc.

- DIC CORPORATION

- Solvay S.A.

- Lion Idemitsu Composites Co. Ltd

- Polyplastics Co. Ltd.

- Tosoh Corporation

- SK chemicals

- Chengdu Letian Plastics Co. Ltd.

- Celanese Corporation

- TEIJIN LIMITED

- SABIC

- Zhejiang NHU Co. Ltd.

- LG Chem

- RTP Company

- Ensinger

- Other Key Players