Global Polyamide 6/12 Copolymer Market Size, Share, And Industry Analysis Report By Product Type (Injection Molding Grade, Extrusion Grade, Others), By Application (Automotive, Electrical and Electronics, Consumer Goods, Others), By Region, and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 169930

- Number of Pages: 227

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

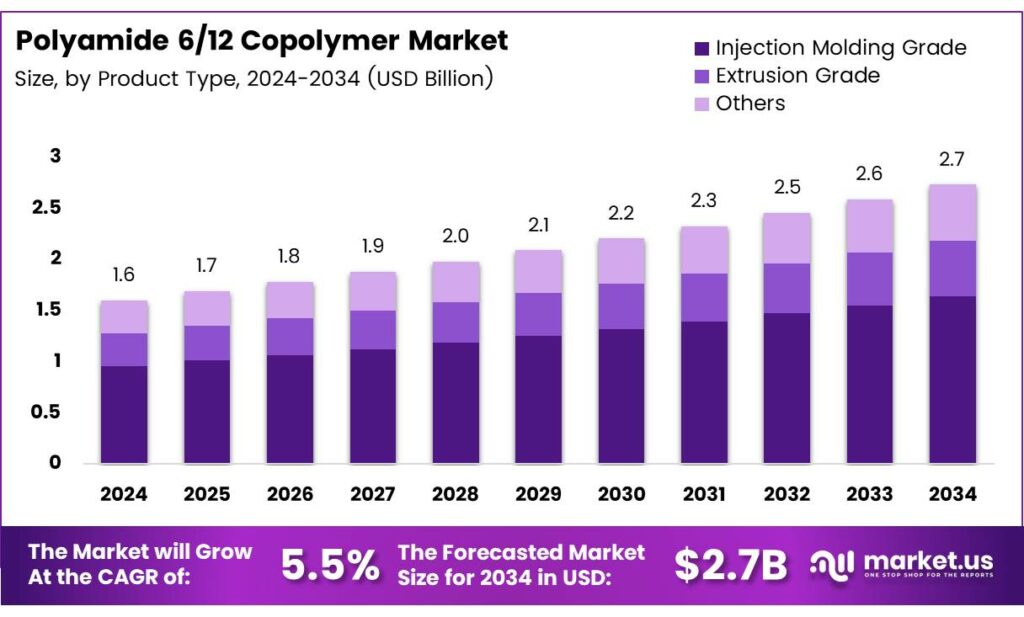

The Global Polyamide 6/12 Copolymer Market size is expected to be worth around USD 2.7 billion by 2034, from USD 1.6 billion in 2024, growing at a CAGR of 5.5% during the forecast period from 2025 to 2034.

Polyamide 6/12 copolymer is an engineered thermoplastic combining Nylon 6 toughness with Nylon 12 flexibility. It is positioned between durability and process stability. This balance supports use in automotive tubing, industrial components, and precision molded parts requiring consistent mechanical performance and chemical resistance.

The Polyamide 6/12 Copolymer Market serves applications demanding lightweight metal replacement and long service life. Growth is driven by transportation electrification, fuel-efficiency regulations, and demand for high-performance polymers. Buyers increasingly prefer materials offering predictable processing, lower failure rates, and stable thermal behavior across operating environments.

Technically, PA 6 and PA 6-6 form the performance foundation of PA 6/12 systems. Ullmann’s Encyclopedia of Industrial Chemistry, PA 6 melts at 223°C through caprolactam ring-opening polymerization. Nylon 6-6 melts at 255°C, synthesized via hexamethylenediamine and adipic acid polycondensation, supporting higher temperature engineering applications.

- Effective moisture control is essential for stable processing and consistent product quality in PA 6/12 copolymers. BASF technical processing guides pre-drying limits moisture to 0.2%, with drying temperatures maintained between 80–110 °C. PA 6 and PA 6-6 remain thermally stable up to 310 °C, offering a reliable processing window before degradation begins.

Material structure and mechanical strength reinforce the industrial value of PA 6/12. DSM polymer data sheets report a semi-crystalline structure with a glass transition of 40–65 °C and melting behavior between 210–220 °C, while decomposition only occurs near 450–465 °C. DuPont property guides show Young’s modulus at 2100–2250 MPa and density of 1.06 g/cm³, positioning PA 6/12 between high toughness and thermal balance.

Key Takeaways

- The Global Polyamide 6/12 Copolymer Market is projected to grow from USD 1.6 billion by 2024 to USD 2.7 billion by 2034, reflecting a CAGR of 5.5% during 2025–2034.

- Injection Molding Grade leads the product type segment with a dominant share of 59.2%, supported by strong processing efficiency and versatility.

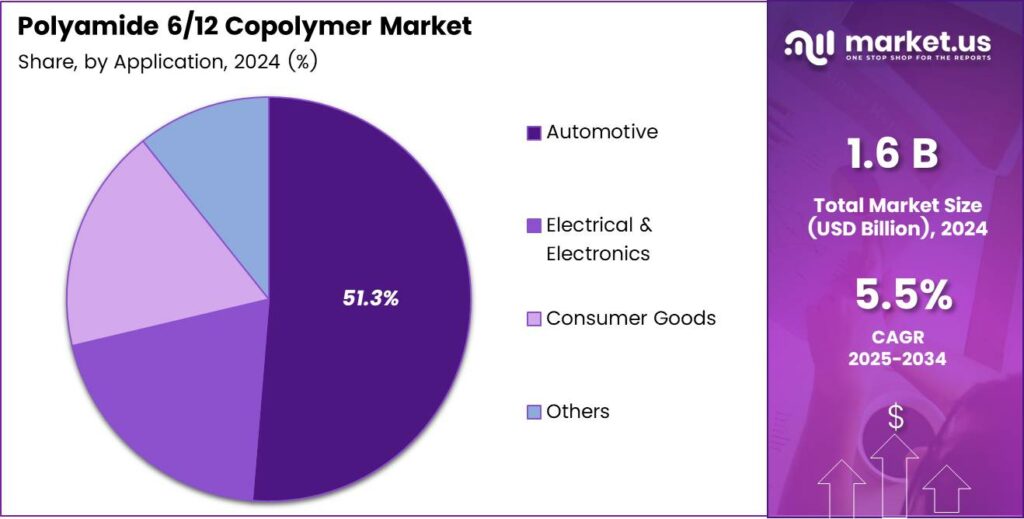

- The Automotive segment is the largest application area, accounting for 51.3% of total market demand in 2024.

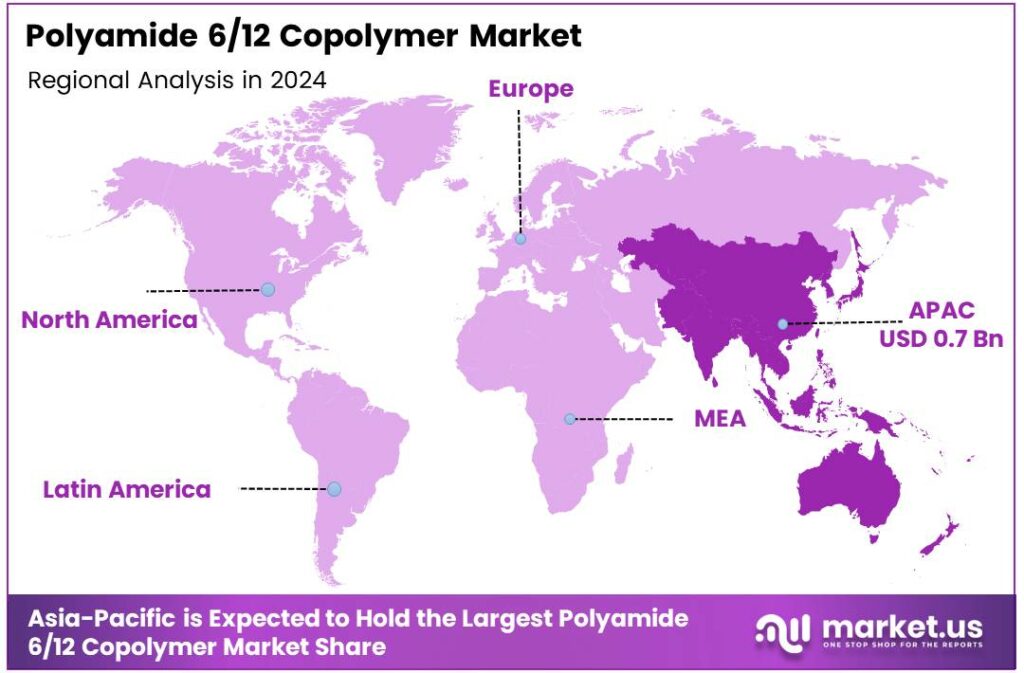

- Asia-Pacific dominates the regional landscape with a market share of 44.3%, valued at approximately USD 0.7 billion.

By Product Type Analysis

Injection Molding Grade dominates with a 59.2% share due to its versatility and processing efficiency.

In 2024, Injection Molding Grade held a dominant market position in the By Product Type analysis segment of the Polyamide 6/12 Copolymer Market, with a 59.2% share. This leadership is supported by its smooth flow behavior, dimensional stability, and suitability for complex shapes, making it widely preferred across precision-engineered plastic components.

Extrusion Grade holds an important supporting role and is steadily adopted for applications requiring continuous profiles. It is commonly used for tubing, films, and sheets where uniform thickness and mechanical consistency are required. As manufacturing processes evolve, extrusion-grade materials gain relevance for industrial and semi-structural applications.

The Others category includes customized and blended grades developed for niche performance needs. These grades are selected for specific thermal, chemical, or mechanical requirements. Although smaller in share, this segment supports innovation, enabling manufacturers to address specialized use cases across emerging and experimental product designs.

By Application Analysis

Automotive dominates with a 51.3% share driven by lightweighting and durability requirements.

In 2024, Automotive held a dominant market position in the By Application analysis segment of the Polyamide 6/12 Copolymer Market, with a 51.3% share. This dominance is linked to rising demand for lightweight, fuel-efficient vehicles where polymers replace metal parts while maintaining strength, impact resistance, and long-term performance.

Electrical and Electronics applications rely on Polyamide 6/12 copolymers for insulation components, connectors, and housings. The material’s balance of thermal stability and electrical resistance supports safe operation in compact electronic designs. Growth remains steady as electronic devices become smaller and more durable.

The Consumer Goods segment uses these copolymers in household items, tools, and personal products. Their abrasion resistance and smooth finish enhance product durability and aesthetics. Meanwhile, the Others segment covers industrial equipment and specialty uses, sustaining demand through customized functional requirements.

Key Market Segments

By Product Type

- Injection Molding Grade

- Extrusion Grade

- Others

By Application

- Automotive

- Electrical and Electronics

- Consumer Goods

- Others

Emerging Trends

Shift Toward High-Performance and Low-Maintenance Polymers Shapes Trends

One important trend in the Polyamide 6/12 copolymer market is the shift toward high-performance polymers that require less maintenance. End users are looking for materials that perform consistently over long periods without frequent failures. Polyamide 6/12 fits well into this trend.

- Manufacturers are also focusing on improving processing efficiency through better compound formulations. These improvements help reduce waste and improve surface finish, making the material more attractive for precision components. The International Energy Agency recorded over 14 million electric cars sold globally, increasing demand for lightweight polymer tubing and insulation around battery systems.

Sustainability considerations are another growing trend. Companies are exploring ways to optimize material usage and improve recyclability within engineering plastics. While still evolving, this trend encourages innovation around Polyamide 6/12 and supports its long-term relevance in advanced material markets.

Drivers

Growing Use in Lightweight Automotive Components Drives Market Growth

The Polyamide 6/12 copolymer market is strongly driven by its increasing use in automotive applications. As vehicle manufacturers focus on reducing weight to improve fuel efficiency and lower emissions, materials that combine strength with low weight are preferred.

Polyamide 6/12 offers good mechanical strength, flexibility, and resistance to fuels and oils, making it suitable for fuel lines, connectors, and under-the-hood components. Another key driver is its low moisture absorption compared to other polyamides. This property helps maintain dimensional stability even in humid or high-temperature environments.

The growing demand for durable and long-lasting materials in electrical and electronics applications also supports market growth. Polyamide 6/12 performs well in insulation and protective components, where stability and safety are critical. Overall, its balanced performance profile supports wider industrial adoption.

Restraints

High Production Costs Compared to Conventional Polyamides Restrain Growth

One major restraint affecting the Polyamide 6/12 copolymer market is its higher production cost. Compared to standard polyamides, the raw materials and manufacturing processes are more complex. This cost difference makes some manufacturers hesitant to switch, especially in price-sensitive applications.

- Limited availability of specific feedstocks further adds to cost pressure. Any fluctuation in raw material supply can impact pricing and production planning. Bio-based polyamide intermediates can significantly cut emissions. Bio-derived feedstocks can reduce polymer carbon footprints by 20–70%, depending on source and process.

Processing requirements also act as a restraint. Polyamide 6/12 needs controlled moisture and temperature conditions during molding. These requirements may increase operational complexity for manufacturers without advanced processing infrastructure. Together, these factors slow adoption in cost-driven mass applications.

Growth Factors

Rising Demand from Electrical and Specialty Industrial Applications Creates Opportunities

The Polyamide 6/12 copolymer market has strong growth opportunities in specialized electrical and industrial applications. As equipment becomes more compact and performance-driven, materials with stable mechanical and thermal properties are in demand. Polyamide 6/12 meets these needs well.

Opportunities also exist in fluid handling systems used in industrial automation and energy-related equipment. Its resistance to chemicals and stress cracking makes it suitable for long-life components. This reliability reduces maintenance and replacement costs, which appeals to industrial users.

Additionally, increasing focus on high-quality engineered plastics in emerging economies creates new demand. As manufacturing standards improve, industries are more open to premium materials that offer long-term value. These trends create steady growth potential for the market.

Regional Analysis

Asia-Pacific Dominates the Polyamide 6/12 Copolymer Market with a Market Share of 44.3%, Valued at USD 0.7 Billion

Asia-Pacific holds the leading position in the Polyamide 6/12 Copolymer Market, accounting for a dominant 44.3% share and reaching nearly USD 0.7 billion in market value. Rapid industrial growth across automotive manufacturing, consumer goods, and electrical components continues to drive strong regional demand. Expanding production bases in China, Japan, South Korea, and Southeast Asia support higher adoption of lightweight, durable polyamides.

North America represents a mature and technology-driven market for polyamide 6/12 copolymers, supported by advanced engineering plastics usage. Strong demand originates from automotive lightweighting, industrial tubing, and precision components requiring moisture resistance. Stable industrial output and consistent replacement demand contribute to steady regional performance. Emphasis on material reliability and long service life continues to support market expansion.

Europe’s market growth is driven by its well-established automotive, electrical, and industrial manufacturing base. The region shows increasing preference for high-performance polymers that provide dimensional stability and chemical resistance. Regulatory focus on material efficiency and sustainability also encourages the use of durable copolymers. Innovation in engineering plastics applications plays a key role in maintaining regional demand.

The Middle East and Africa market remains in an emerging phase, supported by gradual industrialization and infrastructure development. Growth is linked to rising investments in construction equipment, industrial hoses, and mechanical components. Expanding manufacturing hubs and increased adoption of engineered plastics signal long-term potential. However, market penetration remains moderate compared to developed regions.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, BASF SE remains a structurally important participant in the Polyamide 6/12 Copolymer Market due to its deep polymer science expertise and integrated production setup. The company’s strength lies in balancing mechanical performance with process stability, making its materials suitable for demanding automotive and industrial applications. BASF’s focus on formulation optimization and consistent quality helps downstream processors achieve tighter tolerances and longer component life.

Evonik Industries AG plays a strategic role through its emphasis on high-performance specialty polymers that address niche but fast-growing engineering requirements. In the PA 6/12 space, Evonik’s analytical approach to material purity, moisture resistance, and dimensional stability supports applications where reliability outweighs cost. Its strong customer collaboration model enhances adoption across precision components and advanced technical goods.

Arkema Group contributes to market evolution by aligning copolymer development with lightweighting and durability trends. Arkema’s capabilities in balancing flexibility and toughness position it well for components exposed to cyclic stress and harsh chemical environments. The company’s focus on material efficiency supports customers seeking performance gains without over-engineering parts.

Solvay S.A. brings a performance-driven outlook to the Polyamide 6/12 Copolymer Market, targeting applications that require thermal stability and chemical resistance. Its advanced polymer know-how allows for tailored solutions that meet stringent regulatory and operational demands. Solvay’s role is particularly relevant where long service life and consistent behavior under heat and load are critical decision factors.

Top Key Players in the Market

- BASF SE

- Evonik Industries AG

- Arkema Group

- Solvay S.A.

- Toray Industries, Inc.

- Lanxess AG

- RTP Company

- Others

Recent Developments

- In 2025, BASF introduced the world’s first thermoplastic polyamide engineered for high water permeability, enabling efficient moisture transport in applications such as cooling systems and textiles. This development enhances performance in humid environments, relevant to moisture-resistant polyamides like PA6/12.

- In 2025, Evonik partnered with Formerra to distribute its high-performance polyamides, including VESTAMID D (PA612), across the US, Canada, and Puerto Rico. This enhances supply chain access for PA612 in aerospace and automotive sectors, focusing on low-moisture absorption and durability.

Report Scope

Report Features Description Market Value (2024) USD 1.6 billion Forecast Revenue (2034) USD 2.7 billion CAGR (2025-2034) 5.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Injection Molding Grade, Extrusion Grade, Others), By Application (Automotive, Electrical and Electronics, Consumer Goods, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape BASF SE, Evonik Industries AG, Arkema Group, Solvay S.A., Toray Industries, Inc., Lanxess AG, RTP Company, Others Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Polyamide 6/12 Copolymer MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Polyamide 6/12 Copolymer MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BASF SE

- Evonik Industries AG

- Arkema Group

- Solvay S.A.

- Toray Industries, Inc.

- Lanxess AG

- RTP Company

- Others