Point of Care Lipid Test Market By Product Type (Devices and Consumables), By Application (Hyperlipidemia, Hypertriglyceridemia, Tangier Disease, Hyperlipoproteinemia, Familial Hypercholesterolemia and Others), By Indication (Lipid and Lipoprotein Disorders, Atherosclerosis, Liver and Renal Diseases and Diabetes Mellitus and Others), By End-User (Diagnostic Laboratories, Hospitals and Clinics, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153505

- Number of Pages: 341

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

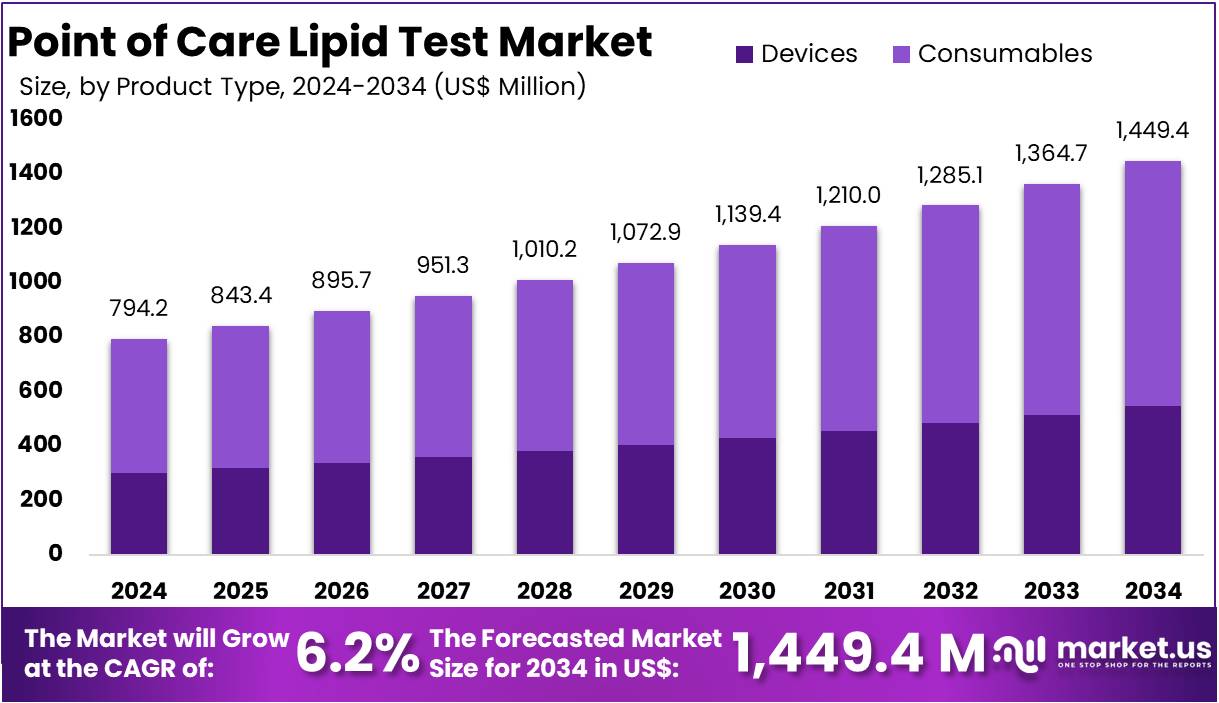

The Point of Care Lipid Test Market Size is expected to be worth around US$ 1,449.4 million by 2034 from US$ 794.2 million in 2024, growing at a CAGR of 6.2% during the forecast period 2025 to 2034.

The Point of Care (PoC) Lipid Test market has witnessed substantial growth due to the increasing prevalence of cardiovascular diseases (CVDs) and the rising demand for rapid, convenient diagnostic solutions. PoC lipid testing offers the advantage of providing immediate results, allowing healthcare providers to quickly assess lipid levels and adjust treatment plans accordingly, which is crucial for managing conditions like hyperlipidemia, diabetes, and hypertension. These tests are used for monitoring cholesterol, triglycerides, and other lipid parameters, making them essential for preventive healthcare and early diagnosis of heart disease.

Technological advancements in PoC devices, such as handheld analyzers and portable test kits, have significantly improved the accuracy and ease of use. These devices are increasingly integrated with digital health platforms, enabling remote monitoring and real-time data sharing with healthcare providers. The market is driven by growing healthcare awareness, a shift toward decentralized care, and the need for cost-effective testing in both developed and emerging markets.

In January 2025, The Indian Institute of Technology (IIT) Guwahati, under the leadership of Prof. Dipankar Bandyopadhyay from the Centre for Nanotechnology and the Department of Chemical Engineering, has pioneered a nanoscale technique to enhance the detection of cholesterol and triglycerides. By combining Surface-Enhanced Raman Scattering (SERS) with bimetallic nanostructures, the team has successfully achieved high-precision detection of these vital biomarkers in human blood.

However, challenges remain in ensuring the accuracy and reliability of PoC tests, particularly in low-resource settings. Despite this, the market is projected to continue expanding, fueled by increased adoption in hospitals, diagnostic clinics, and home care settings. The PoC lipid test market is expected to grow significantly, supported by rising awareness and healthcare investments.

Key Takeaways

- In 2024, the market for Point of Care Lipid Test generated a revenue of US$ 794.2 million, with a CAGR of 6.2%, and is expected to reach US$ 1,449.4 million by the year 2034.

- The product type segment is divided into Devices, and Consumables with Consumables taking the lead in 2023 with a market share of 62.2%.

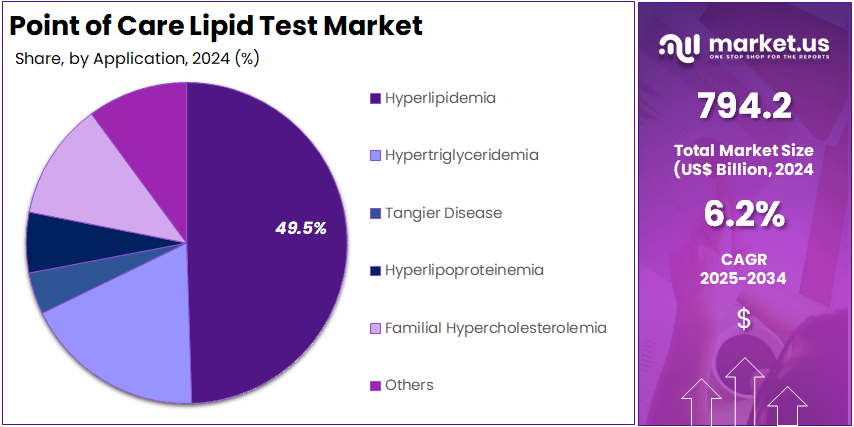

- By Application, the market is bifurcated into Hyperlipidemia, Hypertriglyceridemia, Tangier Disease, Hyperlipoproteinemia, Familial Hypercholesterolemia, and Others with Hyperlipidemia leading the market with 49.5% of market share.

- By Indication, the market is segregated into Lipid and Lipoprotein Disorders, Atherosclerosis, Liver and Renal Diseases, Diabetes Mellitus, and Others, with Lipid and Lipoprotein Disorders taking the lead in the market with 51.8% market share.

- Furthermore, concerning the End-User segment, the market is segregated into Diagnostic Laboratories, Hospitals and Clinics, and Others. The Diagnostic Laboratories stands out as the dominant segment, holding the largest revenue share of 49.8% in the Point of Care Lipid Test market.

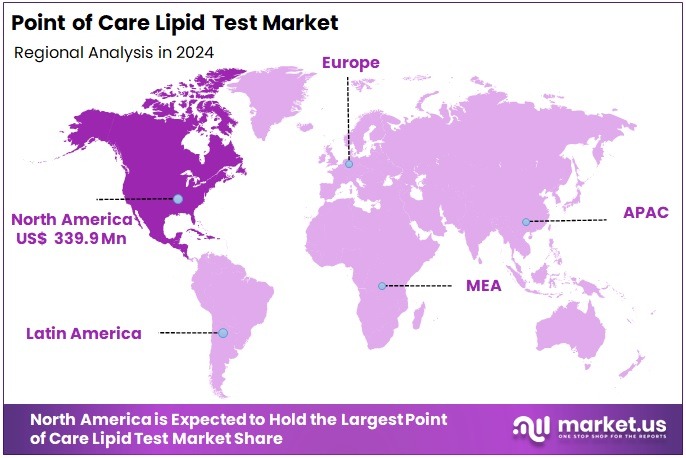

- North America led the market by securing a market share of 42.8% in 2023.

Product Type Analysis

The Consumables segment dominated the Point of Care (PoC) Lipid Test Market with 62.2% market share. Consumables, including test strips, cassettes, and cartridges, are crucial components for conducting PoC lipid tests. These products are used repeatedly with the PoC devices, making them a key revenue driver for manufacturers. Unlike the PoC devices themselves, which are a one-time purchase, consumables require regular replacement, leading to a continuous revenue stream. The affordability and accessibility of consumables make them particularly attractive for smaller healthcare facilities, clinics, and even home testing environments.

Additionally, the adoption of PoC tests in rural and remote areas is largely fueled by the availability and ease of using consumables. As the healthcare industry shifts toward decentralization, where testing is done closer to patients in non-traditional settings, consumables are integral to this transition. Furthermore, the growing prevalence of lifestyle-related diseases such as diabetes and cardiovascular conditions has increased the demand for frequent lipid testing, further fueling the demand for consumables. Manufacturers are continuously innovating to enhance the performance, reliability, and accuracy of consumables, thereby maintaining their dominant position in the market.

Application Analysis

Hyperlipidemia is the dominant application in the PoC Lipid Test Market with 49.5% market share, accounting for a significant portion of the demand for lipid testing solutions. Hyperlipidemia, characterized by high cholesterol levels, is a primary risk factor for cardiovascular diseases, including heart attacks and strokes. The increasing prevalence of this condition globally, driven by factors such as poor diet, lack of physical activity, and rising obesity rates, makes regular lipid testing essential.

PoC lipid tests offer patients and healthcare providers a quick and easy way to monitor lipid levels, enabling early intervention and personalized treatment strategies. Early diagnosis and ongoing monitoring are key to managing hyperlipidemia and preventing complications. With an aging global population and the growing burden of lifestyle diseases, the demand for PoC lipid tests in hyperlipidemia is expected to rise.

As per a report by NCBI in August 2023, Hyperlipidemia is most prevalent in patients with premature coronary artery disease (CAD), which is defined as CAD occurring in males before the age of 55 to 60 years and in females before the age of 65 years. In such cases, the incidence of hyperlipidemia is approximately 75-85%, compared to about 40-48% in a control population of similar age without premature CAD. It is estimated that more than 50% of American adults have elevated LDL levels, with fewer than 35% of those individuals effectively managing their high LDL levels.

Indication Analysis

Lipid and Lipoprotein Disorders is the dominating indication segment in the PoC Lipid Test Market accounting for 51.8% market share. These disorders include high cholesterol, triglycerides, and other lipoprotein imbalances, which are critical risk factors for cardiovascular diseases. Recent studies show that 15%–20% of rural residents and 25%–30% of urban residents have elevated cholesterol levels. In India, the most prevalent lipid disorders are borderline high LDL-C, low HDL-C, and elevated triglycerides.

Given the increasing global burden of these disorders due to factors such as unhealthy diets, sedentary lifestyles, and genetic predispositions, there is a growing need for regular lipid monitoring. PoC lipid testing devices enable healthcare providers to perform these tests quickly and efficiently, offering immediate results for diagnosis and treatment planning.

Regular monitoring of lipid levels allows for better management of these conditions and helps prevent complications such as atherosclerosis, heart attacks, and strokes. As awareness about the impact of lipid imbalances on overall health continues to rise, more individuals are seeking convenient and accessible testing options, driving the demand for PoC lipid tests. Furthermore, lipid disorders are closely linked with chronic conditions like diabetes, which further increases the market potential for PoC testing.

End-User Analysis

Diagnostic Laboratories are the leading end-users in the PoC Lipid Test Market accountng for overv 49.8% market share in 2024, owing to their significant role in providing accurate and reliable test results. Diagnostic labs are equipped with advanced technologies and skilled personnel who can perform a wide range of medical tests, including lipid panels, efficiently and accurately. These labs have become the primary setting for the widespread use of PoC lipid tests due to their ability to handle high volumes of testing and provide quick results.

In particular, diagnostic labs are often the first point of contact for individuals who require lipid testing for monitoring heart disease risk factors. The integration of PoC devices into diagnostic laboratories has allowed for faster turnaround times, which is critical for the timely management of lipid disorders and cardiovascular diseases. Moreover, the high volume of tests conducted in diagnostic labs has made PoC lipid testing more cost-effective, benefiting both healthcare providers and patients.

Key Market Segments

By Product Type

- Devices

- Consumables

By Application

- Hyperlipidemia

- Hypertriglyceridemia

- Tangier Disease

- Hyperlipoproteinemia

- Familial Hypercholesterolemia

- Others

By Indication

- Lipid and Lipoprotein Disorders

- Atherosclerosis

- Liver and Renal Diseases

- Diabetes Mellitus

- Others

By End-User

- Diagnostic Laboratories

- Hospitals and Clinics

- Others

Drivers

Increasing Prevalence of Cardiovascular Diseases

One of the primary drivers for the growth of the Point of Care (PoC) Lipid Test market is the rising global prevalence of cardiovascular diseases (CVDs). CVDs, including heart disease and stroke, are among the leading causes of mortality worldwide. According to the World Health Organization (WHO), CVDs are responsible for approximately 32% of global deaths.

As per the report by CDC, In 2023, cardiovascular disease claimed the lives of 919,032 individuals, accounting for approximately 1 in every 3 deaths. From 2020 to 2021, heart disease incurred a cost of about US$ 417.9 million, encompassing healthcare services, medications, and lost productivity resulting from premature death. As the prevalence of risk factors such as high cholesterol, hypertension, and diabetes increases, there is a heightened need for regular lipid testing for early detection and management of these conditions.

PoC lipid tests offer the convenience of fast, accurate, and immediate results, enabling healthcare providers to assess patients’ lipid levels and adjust treatment plans on the spot. This shift toward preventive healthcare and early detection is essential for reducing the burden of CVDs. Moreover, PoC tests allow patients to monitor their lipid levels regularly, which is critical for managing chronic conditions like hyperlipidemia.

Restraints

Accuracy and Reliability Concerns

While the PoC lipid testing market is growing rapidly, accuracy and reliability remain significant concerns. PoC devices, due to their compact size and quick result time, often struggle to match the accuracy levels of laboratory-based tests. This is particularly crucial in lipid testing, where precise measurements of cholesterol levels, triglycerides, and other lipid parameters are vital for effective treatment. Any discrepancies or inaccuracies in these tests could lead to misdiagnosis or inappropriate treatment, affecting patient outcomes.

Moreover, PoC lipid tests sometimes produce variable results based on factors like user handling, equipment calibration, and sample quality. These concerns are particularly pronounced in regions with inadequate healthcare infrastructure, where PoC devices may not be well-maintained or calibrated regularly. Regulatory bodies, including the U.S. Food and Drug Administration (FDA), closely monitor these issues, urging manufacturers to enhance the precision and consistency of their devices. As demand for PoC testing rises, addressing accuracy and reliability challenges will be crucial for market growth.

Opportunities

Expansion in Emerging Markets

Emerging markets, particularly in Asia-Pacific, Latin America, and Africa, present a significant growth opportunity for the PoC lipid test market. These regions are experiencing an increase in lifestyle-related diseases such as obesity, diabetes, and cardiovascular conditions due to urbanization, dietary changes, and sedentary lifestyles. With the rising healthcare demand in these regions, there is a growing need for cost-effective and accessible diagnostic tools.

PoC lipid tests offer a viable solution for these markets as they are affordable, require minimal infrastructure, and can be used in a variety of settings, from rural areas to urban clinics. Governments and healthcare organizations in these regions are investing in expanding access to healthcare services, particularly for non-communicable diseases like heart disease. Moreover, the growing awareness about cardiovascular diseases and the benefits of early detection is further driving the adoption of PoC testing devices.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors play a significant role in shaping the point-of-care (POC) lipid test market, influencing its growth and accessibility. On the macroeconomic side, economic downturns and inflation can lead to reduced healthcare budgets, which may limit investments in advanced diagnostic technologies, including POC lipid testing devices. This can particularly affect healthcare systems in resource-constrained environments. Additionally, fluctuations in raw material prices, such as reagents and components for testing devices, can drive up production costs, making these devices less affordable for both healthcare providers and patients. Lower disposable incomes in certain regions may further limit the demand for these tests.

Geopolitically, trade policies, tariffs, and international tensions can disrupt the global supply chain of components needed for POC lipid tests, leading to delays and increased costs. Furthermore, varying regulatory requirements across countries can slow the introduction of new testing devices, impacting their market penetration. Political instability in certain regions can also limit the deployment of advanced healthcare solutions, as inadequate infrastructure hinders the adoption of such technologies. Despite these challenges, the market continues to expand, fuelled by advancements in testing technology, the increasing prevalence of cardiovascular diseases, and growing awareness about the importance of cholesterol monitoring for overall health.

Latest Trends

Integration with Digital Health Platforms

A key trend in the PoC lipid test market is the increasing integration of these devices with digital health platforms. PoC lipid testing devices are evolving from standalone diagnostic tools into integrated solutions that connect directly to digital health platforms, mobile applications, and electronic health records (EHRs). This integration allows for real-time data sharing, remote monitoring, and enhanced decision-making. Patients and healthcare providers can track lipid levels over time, receive alerts for abnormal results, and adjust treatment plans accordingly.

The integration with digital health platforms also enables the use of artificial intelligence (AI) and machine learning to predict patient outcomes based on historical data, optimizing treatment strategies. This trend is particularly significant as telemedicine and remote healthcare continue to grow, driven by the increasing demand for home-based care and digital health solutions. As healthcare becomes more patient-centric, the seamless integration of PoC testing with digital platforms is expected to enhance patient engagement, improve outcomes, and increase the efficiency of healthcare delivery.

Regional Analysis

North America is leading the Point of Care Lipid Test Market

North America is leading the Point of Care (PoC) Lipid Test Market due to several key factors, including advanced healthcare infrastructure, high awareness of cardiovascular diseases, and a strong focus on preventive care. The region is home to some of the most sophisticated healthcare systems globally, equipped with state-of-the-art diagnostic technologies and a high rate of adoption for PoC testing solutions. The rising prevalence of cardiovascular diseases (CVDs), such as coronary artery disease, heart attacks, and strokes, has driven the demand for regular lipid testing to monitor cholesterol, triglycerides, and other lipid parameters.

Moreover, increasing healthcare costs and the need for early detection and cost-effective solutions have contributed to the growing adoption of PoC lipid testing, particularly in clinics, diagnostic centers, and home care settings. The convenience of on-site testing, immediate results, and faster decision-making are key advantages that PoC lipid tests provide to both healthcare providers and patients. Additionally, a shift toward decentralized healthcare and the growing trend of telemedicine have further fueled the demand for PoC devices in the region.

Regulatory support from health organizations such as the U.S. Food and Drug Administration (FDA) and continuous innovations by leading manufacturers have also supported market growth. As a result, North America is expected to maintain its dominant position in the PoC lipid test market in the coming years.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Point of Care Lipid Test market includes Abbott Laboratories, PTS Diagnostics, ACON Laboratories, Nova Biomedical, Roche Diagnostics, EKF Diagnostics, Sinocare Inc., MiCo BioMed, Menarini Diagnostics, SD Biosensor, Inc., Callegari Srl, Guilin Urit Electronic Group Co., Ltd., Lepu Medical, Medicalsystem Biotechnology Co., Ltd., and Others.

Abbott Laboratories offers innovative Point of Care (PoC) lipid testing solutions, including the Cholestech LDX™ and Afinion™ analyzers. These devices provide rapid and accurate results for lipid profiles, enabling healthcare professionals to manage cardiovascular health effectively. Abbott’s PoC solutions are widely used in clinics, hospitals, and remote settings. PTS Diagnostics manufactures the CardioChek® Plus analyzer, a leading PoC device for lipid testing. The device delivers quick, accurate results for lipid profiles, including cholesterol and triglycerides.

PTS Diagnostics’ products are designed to improve patient care with ease of use, supporting the growing demand for decentralized healthcare and preventive care solutions. ACON Laboratories produces the Mission® Cholesterol system, a PoC lipid testing solution that provides fast results for lipid panels. The handheld device is ideal for use in a variety of healthcare settings, from primary care clinics to home testing. ACON Laboratories focuses on delivering affordable, reliable, and user-friendly diagnostic tools.

Top Key Players in the Point of Care Lipid Test Market

- Abbott Laboratories

- PTS Diagnostics

- ACON Laboratories

- Nova Biomedical

- Roche Diagnostics

- EKF Diagnostics

- Sinocare Inc.

- MiCo BioMed

- Menarini Diagnostics

- SD Biosensor, Inc.

- Callegari Srl

- Guilin Urit Electronic Group Co., Ltd.

- Lepu Medical

- Medicalsystem Biotechnology Co., Ltd.

- Other Prominent Players

Recent Developments

- In September 2024: The Family Heart Foundation has officially launched Cholesterol Connect, a program designed to offer free at-home lipid screening alongside live, personalized support from the Family Heart Care Navigation Center. This initiative aims to educate individuals on how to reduce their risk of cardiovascular disease (CVD) by providing them with the necessary tools and guidance to manage their cholesterol levels effectively.

- In July 2024: Roche finalized its acquisition of LumiraDx’s Point-of-Care technology, a strategic move that significantly enhances its diagnostic portfolio. The integration of this advanced platform enables the performance of a wide range of immunoassay and clinical chemistry tests on a single device. The versatile nature of this platform also holds promising potential for future expansion into molecular testing, further strengthening Roche’s position in the point-of-care diagnostics market

- In January 2023: Cipla Limited launched Cippoint, an innovative point-of-care testing device aimed at expanding diagnostic capabilities across various health conditions. This cutting-edge device is designed to provide rapid, accurate diagnostics, particularly for metabolic markers, enabling healthcare professionals to perform tests at the point of care. With Cippoint, Cipla is addressing the growing demand for accessible and efficient diagnostic solutions, enhancing the speed and accuracy of diagnosis, which is crucial for timely intervention and better patient outcomes.

Report Scope

Report Features Description Market Value (2024) US$ 794.2 million Forecast Revenue (2034) US$ 1,449.4 million CAGR (2025-2034) 6.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Devices and Consumables), By Application (Hyperlipidemia, Hypertriglyceridemia, Tangier Disease, Hyperlipoproteinemia, Familial Hypercholesterolemia and Others), By Indication (Lipid and Lipoprotein Disorders, Atherosclerosis, Liver and Renal Diseases and Diabetes Mellitus and Others), By End-User (Diagnostic Laboratories, Hospitals and Clinics, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Abbott Laboratories, PTS Diagnostics, ACON Laboratories, Nova Biomedical, Roche Diagnostics, EKF Diagnostics, Sinocare Inc., MiCo BioMed, Menarini Diagnostics, SD Biosensor, Inc., Callegari Srl, Guilin Urit Electronic Group Co., Ltd., Lepu Medical, Medicalsystem Biotechnology Co., Ltd., and Others. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Point of Care Lipid Test MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Point of Care Lipid Test MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Abbott Laboratories

- PTS Diagnostics

- ACON Laboratories

- Nova Biomedical

- Roche Diagnostics

- EKF Diagnostics

- Sinocare Inc.

- MiCo BioMed

- Menarini Diagnostics

- SD Biosensor, Inc.

- Callegari Srl

- Guilin Urit Electronic Group Co., Ltd.

- Lepu Medical

- Medicalsystem Biotechnology Co., Ltd.

- Other Prominent Players