Point of Care Diagnostics Market By Product Type (Glucose Testing, HbA1c Testing, Coagulation Testing, Fertility/Pregnancy Testing, Infectious Disease Testing, Cardiac Marker Testing, Others) By Technology (Lateral Flow Assays, Molecular Diagnostics, Immunoassay Analyzers, Glucose Monitoring Systems, Rapid Tests) By Application (Blood Glucose Monitoring, Infectious Disease Testing, Cardiac Marker Testing, Cancer Marker Testing, Drug Abuse Testing) By Sample Type (Blood, Urine, Nasal Swabs, Fecal Samples) By End-User (Hospitals & Clinics, Laboratories, Home Care Settings, Physician Offices), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 25166

- Number of Pages: 322

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Product Type Analysis

- Technology Analysis

- Application Analysis

- Sample Type Analysis

- End-User Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunities

- Impact of Macroeconomic / Geopolitical Factors

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

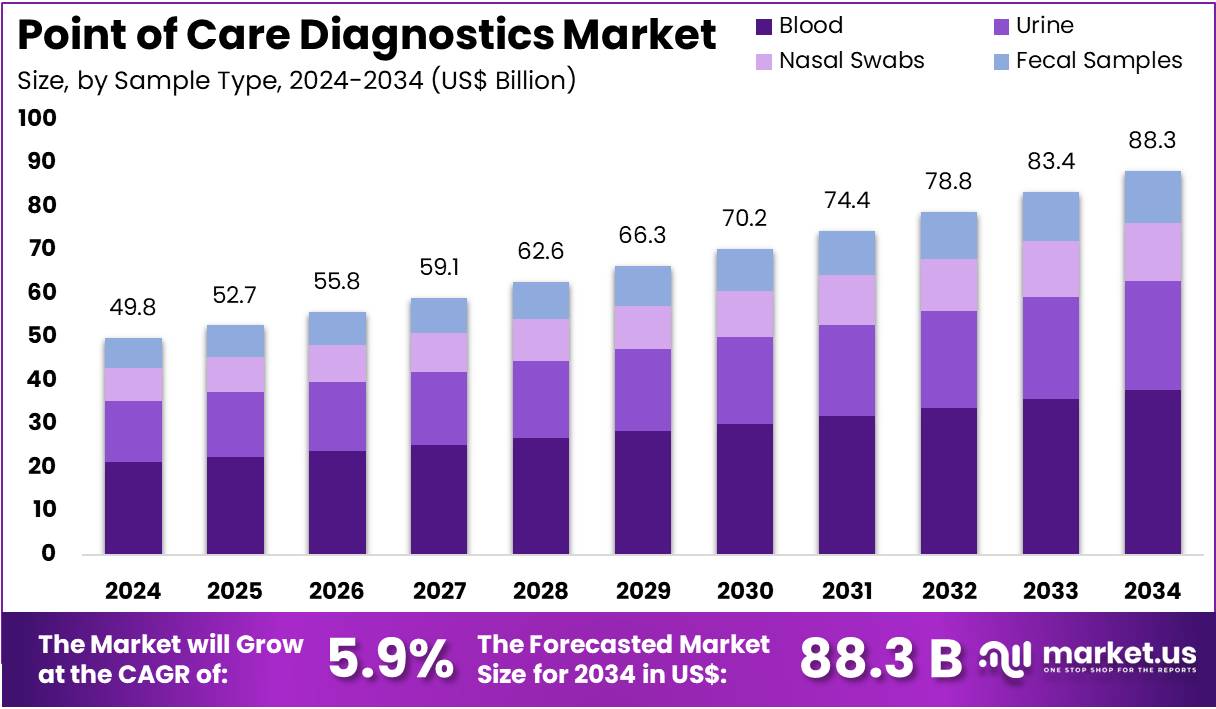

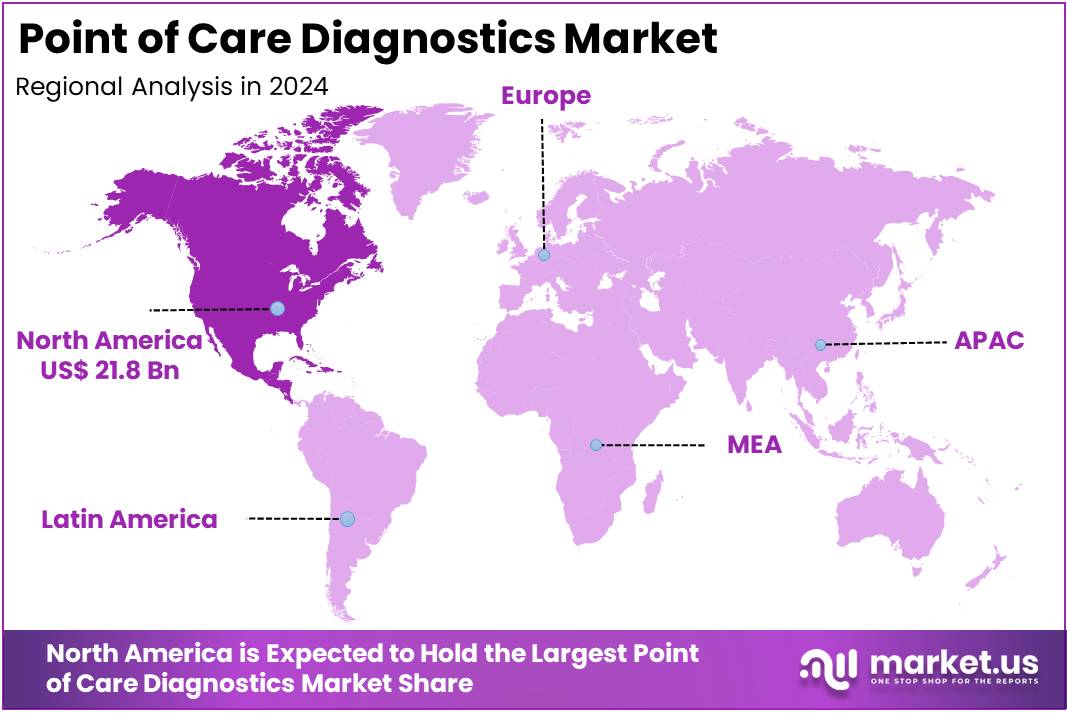

The Point of Care Diagnostics Market Size is expected to be worth around US$ 88.3 billion by 2034 from US$ 49.8 billion in 2024, growing at a CAGR of 5.9% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 43.8% share and holds US$ 21.8 Billion market value for the year.

The Point-of-Care (POC) diagnostics market is undergoing a period of robust expansion, propelled by several key market drivers. A primary catalyst is the increasing geriatric population, a demographic particularly susceptible to a host of chronic and infectious diseases. This growing patient base creates a critical and continuous demand for efficient, immediate diagnostic solutions. The inherent ability of POC diagnostic tests to deliver rapid results at the patient’s location, rather than relying on centralized laboratories, is a fundamental factor fueling their adoption.

This trend is further supported by the growing adaptability of mobile diagnostic devices, especially in emerging economies where healthcare infrastructure may be less developed. The decentralization of healthcare, moving diagnostics closer to the patient, is a major theme driving market growth. This is reinforced by a steady stream of new product introductions from leading companies, which are consistently bringing to market advanced devices with enhanced precision and user-friendly interfaces. For instance, in February 2024, Roche launched three new coagulation tests for oral Factor Xa inhibitors, which aid in critical clinical decision-making for patients on these anticoagulants.

The market’s growth is also being driven by significant investment from both public and private entities. These funding initiatives are designed to accelerate the introduction of advanced diagnostic technologies and expand testing availability to lower tiers of the healthcare system. The urgency of this need is underscored by sobering statistics from government organizations. For example, the Centers for Disease Control and Prevention (CDC) reports that the number of adults in the US with diagnosed diabetes has been consistently rising, with over 15.8% of all adults having total diabetes in 2023, and that number increasing with age. This high prevalence of chronic conditions highlights the need for quick, accessible diagnostic tools for effective disease management.

The demographic shift is a critical factor influencing this market. According to a UN report, the number of individuals aged 65 and above is projected to double by 2050 to over 1.5 billion. This aging population is more vulnerable to diseases such as obesity, diabetes, and cardiovascular ailments, which necessitates the use of advanced diagnostic technologies. Furthermore, the World Health Organization (WHO) estimates that non-communicable diseases are responsible for a significant portion of deaths globally, many of which can be managed more effectively with early and accurate POC diagnostics.

The National Institute of Biomedical Imaging and Bioengineering (NIBIB) also recognizes this need, and through its Point-of-Care Technologies Research Network (POCTRN), it funds the development of diagnostic technologies that can provide real-time medical evaluations at the point of care. These combined factors solidify the foundation for a strong and sustained growth trajectory for the POC diagnostics market.

Key Takeaways

- In 2024, the market for point of care diagnostics generated a revenue of US$ 49.8 billion, with a CAGR of 5.9%, and is expected to reach US$ 88.3 billion by the year 2034.

- The product type segment is divided into glucose testing, HbA1c testing, coagulation testing, fertility/pregnancy testing, infectious disease testing, cardiac marker testing, others, with glucose testing taking the lead in 2023 with a market share of 38.5%.

- Considering technology, the market is divided into lateral flow assays, molecular diagnostics, immunoassay analyzers, glucose monitoring systems, rapid tests. Among these, lateral flow assays held a significant share of 41.3%.

- Furthermore, concerning the application segment, the market is segregated into blood glucose monitoring, infectious disease testing, cardiac marker testing, cancer marker testing, drug abuse testing. The blood glucose monitoring sector stands out as the dominant player, holding the largest revenue share of 35.0% in the point of care diagnostics market.

- The sample type segment is segregated into blood, urine, nasal swabs, fecal samples, with the blood segment leading the market, holding a revenue share of 42.9%.

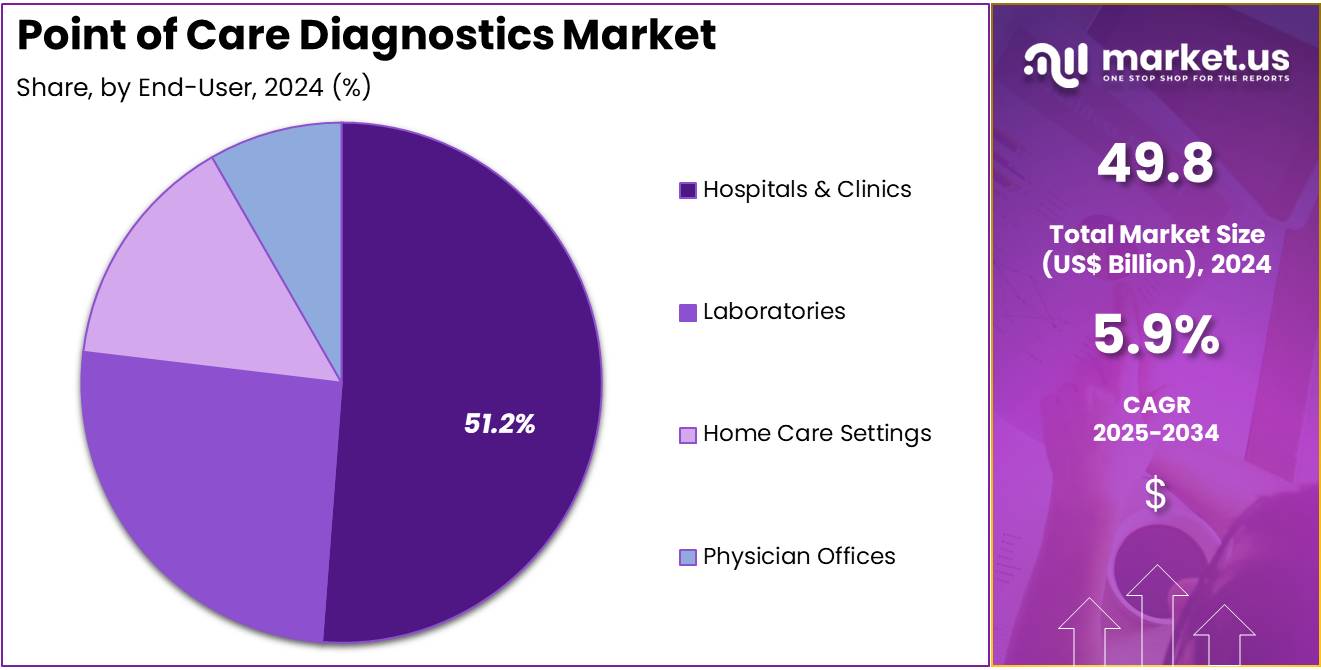

- Considering end-user, the market is divided into hospitals & clinics, laboratories, home care settings, physician offices. Among these, hospitals & clinics held a significant share of 51.2%.

- North America led the market by securing a market share of 43.8% in 2023.

Product Type Analysis

Glucose testing holds the largest share of 38.5% in the point of care diagnostics market. This segment’s growth is expected to continue due to the increasing prevalence of diabetes and the growing need for frequent monitoring of blood glucose levels. Glucose testing is essential for managing both type 1 and type 2 diabetes, which affects millions of people globally. As patients and healthcare providers focus on controlling blood sugar levels, the demand for point-of-care glucose testing devices, which provide immediate results, is likely to grow.

Additionally, the increasing adoption of self-monitoring glucose meters, especially in home care settings, will drive further growth in this segment. Technological advancements, such as the development of non-invasive glucose testing methods, are anticipated to fuel the demand for glucose testing solutions even more. As the global focus on preventive healthcare and chronic disease management intensifies, glucose testing will continue to be a key area of growth in the market.

Technology Analysis

Lateral flow assays account for 41.3% of the technology segment in the point of care diagnostics market. This growth is expected to continue as lateral flow assays are widely used for their simplicity, speed, and affordability in providing diagnostic results. These tests are commonly used for a variety of applications, including infectious disease testing, pregnancy testing, and glucose monitoring. Their ease of use and rapid results make them a popular choice for both healthcare professionals and patients.

The increasing demand for at-home testing kits, particularly for conditions like COVID-19, is likely to drive the growth of lateral flow assays. Additionally, lateral flow assays are becoming more sophisticated, with improved sensitivity and specificity, expanding their application across more clinical areas. The market for these assays is expected to expand as consumers seek fast, accurate, and convenient diagnostic solutions, both in healthcare facilities and at home.

Application Analysis

Blood glucose monitoring holds 35.0% of the application segment in the point of care diagnostics market. This segment’s growth is expected to continue as more patients with diabetes require frequent monitoring of their blood glucose levels to effectively manage their condition. With the rising global prevalence of diabetes and the increasing demand for personalized healthcare, the need for convenient and accurate blood glucose monitoring solutions is likely to grow.

Technological advancements, such as continuous glucose monitoring (CGM) systems, have further contributed to the growth of this segment by providing real-time glucose data and improving patient compliance. As self-care becomes increasingly important in managing chronic conditions, the demand for user-friendly and efficient blood glucose monitoring systems, especially for home use, is expected to increase. The adoption of smart devices and mobile applications for data tracking and analysis will likely drive further growth in this segment, making blood glucose monitoring a key focus in the point of care diagnostics market.

Sample Type Analysis

Blood accounts for 42.9% of the sample type segment in the point of care diagnostics market. This growth is expected to continue as blood samples are essential for a wide range of diagnostic tests, including glucose testing, coagulation testing, and infectious disease testing. Blood samples provide comprehensive information that helps healthcare providers make accurate diagnoses and treatment decisions, making them a preferred choice for diagnostic testing.

The ease of obtaining blood samples, combined with the ability to perform a wide range of tests at the point of care, is expected to drive the growth of this segment. Advances in blood collection devices, such as lancets and blood collection tubes, are likely to make blood sampling more convenient and less invasive, increasing patient acceptance. The global rise in chronic conditions, such as diabetes and cardiovascular diseases, which require frequent monitoring of blood biomarkers, will further contribute to the expansion of this segment in the point of care diagnostics market.

End-User Analysis

Hospitals & clinics represent 51.2% of the end-user segment in the point of care diagnostics market. This growth is expected to continue as hospitals and clinics are the primary settings for the diagnosis and treatment of patients, particularly those with chronic conditions or acute illnesses. The increasing demand for rapid, on-site diagnostic testing in hospitals and clinics, especially for infectious diseases, cardiac events, and diabetes management, is likely to drive the adoption of point of care diagnostics.

The ability to provide immediate results enhances clinical decision-making and improves patient outcomes, which is especially important in emergency and critical care settings. As hospitals continue to prioritize quick, accurate diagnostic solutions to enhance patient care and optimize workflow, the demand for point of care diagnostic devices will remain strong. Additionally, the growing focus on cost-effective healthcare delivery in hospitals and clinics will contribute to the continued growth of this segment in the market.

Key Market Segments

By Product Type

- Glucose Testing

- HbA1c Testing

- Coagulation Testing

- Fertility/Pregnancy Testing

- Infectious Disease Testing

- Cardiac Marker Testing

- Others

By Technology

- Lateral Flow Assays

- Molecular Diagnostics

- Immunoassay Analyzers

- Glucose Monitoring Systems

- Rapid Tests

By Application

- Blood Glucose Monitoring

- Infectious Disease Testing

- Cardiac Marker Testing

- Cancer Marker Testing

- Drug Abuse Testing

By Sample Type

- Blood

- Urine

- Nasal Swabs

- Fecal Samples

By End-User

- Hospitals & Clinics

- Laboratories

- Home Care Settings

- Physician Offices

Drivers

The increasing prevalence of chronic and infectious diseases is driving the market

The point of care (POC) diagnostics market is primarily driven by the escalating global burden of chronic and infectious diseases, which necessitates rapid and accessible testing. POC devices offer a crucial advantage by providing quick results at the patient’s bedside, in a clinic, or even at home, enabling immediate clinical decisions and a swift initiation of treatment. This is particularly vital for managing chronic conditions that require frequent monitoring.

According to a 2023 report from the Centers for Disease Control and Prevention (CDC), approximately 194 million US adults had one or more chronic conditions in 2023, representing 76.4% of the adult population. The rise of these conditions, including diabetes and cardiovascular diseases, creates a continuous demand for diagnostic tools that can provide instant feedback.

Furthermore, the World Health Organization (WHO) reported in 2022 that 14% of adults worldwide were living with diabetes, a figure that has more than doubled since 1990. The ability to perform rapid, on-the-spot glucose and HbA1c testing is therefore essential. This growing prevalence of diseases, combined with the increasing emphasis on early detection and prevention, firmly establishes the need for efficient and accessible POC diagnostic solutions.

Restraints

The high initial cost of devices and stringent regulatory pathways are restraining the market

A significant restraint on the point of care diagnostics market is the high initial cost of purchasing and implementing these advanced devices, coupled with the complex and time-consuming regulatory approval processes. While individual tests are often inexpensive, the initial capital expenditure for the analyzers and readers can be substantial, making it a difficult investment for smaller clinics and healthcare facilities with limited budgets. The cost of a sophisticated POC system, especially one with integrated connectivity and multiple test capabilities, can run into tens of thousands of dollars.

Compounding this challenge is the stringent regulatory environment, particularly with the US Food and Drug Administration (FDA). The regulatory pathway for new diagnostic devices, which often involves extensive clinical trials and data submission, can be a multi-year process.

An analysis of FDA data from 2015 to 2024 revealed that even devices granted Breakthrough Device designation, a program designed to expedite review, faced mean decision times of 152 days for the 510(k) pathway and 230 days for the PMA pathway. This lengthy and costly regulatory hurdle not only delays market entry for innovative products but also raises development costs, which can ultimately be passed on to healthcare providers and consumers, thereby hindering widespread adoption.

Opportunities

The shift towards decentralized and home-based healthcare is creating growth opportunities

The accelerating global trend towards decentralized healthcare and home-based testing represents a major opportunity for the market. This shift is driven by a desire to reduce hospital visits, lower healthcare costs, and empower patients to take a more active role in managing their own health. Point of care diagnostics are at the forefront of this movement, offering convenient and rapid testing outside of traditional clinical settings. The US Department of Health and Human Services (HHS) Office of Inspector General (OIG) stated that the use of remote patient monitoring in Medicare increased dramatically from 2019 to 2022, showcasing a clear momentum toward remote care.

Furthermore, the Centers for Medicare & Medicaid Services (CMS) has been actively expanding coverage for telehealth and remote monitoring services, with CMS data showing continued growth in telehealth use by Medicare beneficiaries through December 2024. This regulatory support and growing patient acceptance are creating an ideal environment for the development and adoption of user-friendly, home-based diagnostic kits. The increasing availability of these tools for conditions like diabetes, infectious diseases, and chronic respiratory illnesses is enabling a more proactive and preventative approach to health, ultimately driving significant market expansion.

Impact of Macroeconomic / Geopolitical Factors

The point-of-care diagnostics market is currently shaped by a variety of macroeconomic and geopolitical factors that are affecting manufacturers and suppliers. The ongoing inflationary pressures have led to rising costs for essential components like raw materials, enzymes, and specialized electronic parts, all of which are crucial for manufacturing diagnostic products. This trend is mirrored in broader economic indicators; for instance, the US Bureau of Economic Analysis (BEA) reported a 2.6% year-over-year increase in the Personal Consumption Expenditures (PCE) price index for medical care services in June 2025. This rise in healthcare inflation directly contributes to higher operational costs for healthcare providers.

At the same time, geopolitical instability is disrupting the global supply chains for these critical inputs. A 2024 report on healthcare supply chain challenges revealed that such conflicts have resulted in a 2.9% annual rise in supply chain costs, driven largely by increased prices for raw materials, freight, and labor. To cope with these challenges, companies are focusing on improving operational efficiency and strategic procurement practices. Those with resilient supply chains and the ability to effectively manage these cost pressures are better positioned to maintain profitability and market stability, underscoring the importance of a nimble, proactive approach for long-term success.

US tariff policies are creating significant challenges within the supply chain for point-of-care diagnostic products. New tariffs imposed on diagnostic equipment and reagents from key international suppliers have raised the landed cost of these essential goods. According to a 2025 analysis, certain diagnostic reagents and lab supplies are now subject to duties as high as 25% or more, depending on their classification and country of origin. These additional costs are ultimately passed along the supply chain, placing pressure on distributors’ margins and increasing the overall cost for laboratories and healthcare providers. As a result, this impacts the profitability of adopting new diagnostic technologies and raises the cost burden on consumers, reducing accessibility to critical healthcare.

On the other hand, these tariffs provide an opportunity for US-based manufacturers to gain a competitive edge, as they are not subjected to the same import duties. This is prompting healthcare providers to consider shifting their purchasing preferences towards domestically produced goods to ensure more reliable supply chains and predictable pricing. The shift towards local manufacturing is not only mitigating the impact of tariffs but also driving investments in domestic production capabilities, helping US manufacturers strengthen their market position. The industry is responding to these challenges by adopting flexible strategies, such as optimizing logistics and sourcing alternative suppliers, to navigate this evolving landscape.

Latest Trends

The integration of digital health, connectivity, and AI is a recent trend

A significant trend observed in 2024 and 2025 is the increasing integration of digital health, connectivity, and artificial intelligence (AI) into point of care diagnostic devices. Modern POC devices are no longer standalone tools; they are becoming part of a connected ecosystem that links patient data to healthcare providers and electronic health records (EHRs) in real-time. This integration allows for automated data logging, secure data sharing, and enhanced diagnostic capabilities.

A July 2025 analysis of FDA-approved digital health technologies revealed a surge in AI-enabled devices, with 253 AI-enabled devices authorized in 2024 alone. These AI-driven algorithms can analyze complex diagnostic data from POC devices to provide more accurate interpretations, identify patterns that may be missed by human observers, and even make predictive recommendations.

For instance, a wearable device could use AI to analyze vital signs data and alert a clinician to a potential health crisis before symptoms become severe. The connectivity component also streamlines workflow, reduces manual errors, and ensures that patient information is securely and instantly available to the entire care team, transforming POC testing from a simple diagnostic step into a cornerstone of a comprehensive, data-driven healthcare strategy.

Regional Analysis

North America is leading the Point of Care Diagnostics Market

The North American point-of-care (POC) diagnostics market holds a commanding position, accounting for a 43.8% share and holds US$ 21.8 Billion revenue of the global market in 2024. This leadership is attributed to a combination of factors, including a rapidly aging population, high healthcare expenditures, and a robust environment for technological innovation. The US Census Bureau projects that the number of Americans aged 65 and older will increase from 58 million in 2022 to 82 million by 2050. This demographic shift drives a greater need for accessible and rapid diagnostic solutions to manage age-related chronic conditions.

Moreover, the widespread adoption of digital health infrastructure, such as Electronic Medical Records (EMRs) and Picture Archiving and Communication Systems (PACS), facilitates the seamless integration of POC data, further propelling market expansion. Key industry players are also actively contributing to market growth through innovative product launches, such as Abbott’s FreeStyle Libre 3 integrated continuous glucose monitoring system, which received US FDA clearance in April 2023.

The US is the primary driver of this regional market, with a high concentration of dental clinics and a strong emphasis on compliance with regulatory standards. The Centers for Disease Control and Prevention (CDC) reports that in 2021, over 1.2 million new cases of diabetes were diagnosed in US adults, a condition that necessitates frequent and rapid monitoring, for which POC devices are ideally suited.

The presence of major industry players and their consistent focus on developing innovative and user-friendly diagnostic systems also contributes significantly to market growth. For instance, in February 2019, HemoCue, a POC-focused subsidiary of Danaher, introduced its Hb 801 hemoglobin test system in the US, designed for rapid anemia detection. Such product innovations, combined with a supportive regulatory framework, ensure a strong and expanding market for POC diagnostics in North America.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The point-of-care diagnostics market in Asia Pacific is anticipated to emerge as the fastest-growing market during the forecast period. The region’s growth is propelled by rapidly developing healthcare infrastructure and a high prevalence of chronic and infectious diseases. For example, the International Diabetes Federation (IDF) projects that by 2050, the number of people with diabetes in the Asia Pacific region will reach 589 million, highlighting a critical and expanding need for easy-to-use diagnostic tools. The rising adoption of POC diagnostics in various clinical settings, including operating rooms and emergency units, is also expected to increase due to their efficiency and ability to provide early and accurate results.

The market’s expansion is further supported by government initiatives and the increasing adoption of miniaturized diagnostic models. In China, where the prevalence of chronic diseases is rising steadily, the government is actively promoting digital health solutions. The National Health Commission of China estimates that the number of people with chronic diseases will continue to grow, which will necessitate the use of portable and efficient diagnostic tools.

The UNAIDS 2024 regional profile for Asia and the Pacific also reports that in 2023, 6.7 million people were living with HIV, and over 300,000 new infections were reported in the region in 2024. This ongoing burden of infectious diseases drives the demand for rapid diagnostic tests. Local companies are also contributing to market growth through continuous research and development, product development, and strategic partnerships, solidifying Asia Pacific as a key driver of the global POC diagnostics market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading firms in the diagnostics market pursue growth by focusing on technological innovation, strategic partnerships, and market penetration. They invest heavily in developing sophisticated testing platforms that enable rapid, on-the-spot results, improving clinical workflows and patient management.

Companies form collaborations with hospitals, research institutions, and technology firms to expedite product development and expand their commercial reach. They also actively pursue mergers and acquisitions to diversify their portfolios and enter new geographic markets. Additionally, these businesses prioritize regulatory excellence, ensuring their advanced solutions comply with evolving global standards while also offering customizable, user-friendly platforms to build strong customer relationships.

Abbott Laboratories stands as a prominent global leader in the diagnostics sector. The company’s core strategy centers on a diversified portfolio of diagnostic and medical products. Through relentless innovation and robust R&D, Abbott develops and commercializes cutting-edge testing platforms for a wide range of diseases, particularly in infectious diseases and chronic care management. Abbott leverages a strong global presence and strategic acquisitions to expand its footprint, ensuring a broad and trusted product offering that aligns with the long-term healthcare trends of both developed and emerging markets.

Top Key Players in the Point of Care Diagnostics Market

- Werfen

- Trividia Health, Inc

- Trinity Biotech

- Siemens Healthcare GmbH

- Sekisui Diagnostics

- QuidelOrtho Corporation

- Qiagen

- Nova Biomedical

- Hoffmann-La Roche Ltd

- Danaher Corporation

- bioMerieux

- Becton Dickinson (BD)

- Abbott

Recent Developments

- In May 2024, F. Hoffman-La Roche Ltd. gained FDA approval for its HPV self-testing kit, a tool designed to detect early signs of cervical cancer risk in women.

“With vaccinations, innovative diagnostic tools, and screening programs, achieving the WHO’s goal of eliminating cervical cancer by 2030 is within reach. Our HPV self-collection solution helps support this goal by reducing barriers and providing access to HPV screening by allowing people to privately collect their own sample for HPV testing.” –Matt Sause, CEO (Roche Diagnostics)

- In March 2024, SEKISUI Diagnostics received Emergency Use Authorization (EUA) for its OSOM Flu SARS-CoV-2 Combo Test, which is now authorized for use in both professional healthcare settings and at-home testing.

“We first entered the home testing market with our COVID-19 test as we understand these are valuable tools to reduce the spread of respiratory infections and improve the health of all people. The OSOM Flu SARS-CoV-2 Combo Test takes our offering to the next level with the ability to get two answers with one sample providing fast, actionable results to consumers as well as healthcare professionals.” –Erica Blight, VP, Customer Care & Marketing, Clinical Research (Sekisui Diagnostics)

Report Scope

Report Features Description Market Value (2024) US$ 49.8 billion Forecast Revenue (2034) US$ 88.3 billion CAGR (2025-2034) 5.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Glucose Testing, HbA1c Testing, Coagulation Testing, Fertility/Pregnancy Testing, Infectious Disease Testing, Cardiac Marker Testing, Others) By Technology (Lateral Flow Assays, Molecular Diagnostics, Immunoassay Analyzers, Glucose Monitoring Systems, Rapid Tests) By Application (Blood Glucose Monitoring, Infectious Disease Testing, Cardiac Marker Testing, Cancer Marker Testing, Drug Abuse Testing) By Sample Type (Blood, Urine, Nasal Swabs, Fecal Samples) By End-User (Hospitals & Clinics, Laboratories, Home Care Settings, Physician Offices) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Werfen, Trividia Health, Inc, Trinity Biotech, Siemens Healthcare GmbH, Sekisui Diagnostics, QuidelOrtho Corporation, Qiagen, Nova Biomedical, F. Hoffmann-La Roche Ltd, Danaher Corporation, bioMerieux, Becton Dickinson (BD), Abbott. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Point Of Care Diagnostics MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Point Of Care Diagnostics MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Werfen

- Trividia Health, Inc

- Trinity Biotech

- Siemens Healthcare GmbH

- Sekisui Diagnostics

- QuidelOrtho Corporation

- Qiagen

- Nova Biomedical

- Hoffmann-La Roche Ltd

- Danaher Corporation

- bioMerieux

- Becton Dickinson (BD)

- Abbott