Global Photovoltaic Materials Market Size, Share, And Business Benefits By Type (Thin Film, Crystalline Materials, Others), By Material (Silicon-based, Non-Silicon based), By End Use (Utility, Residential, Commercial and Industrial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: August 2025

- Report ID: 154985

- Number of Pages: 335

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

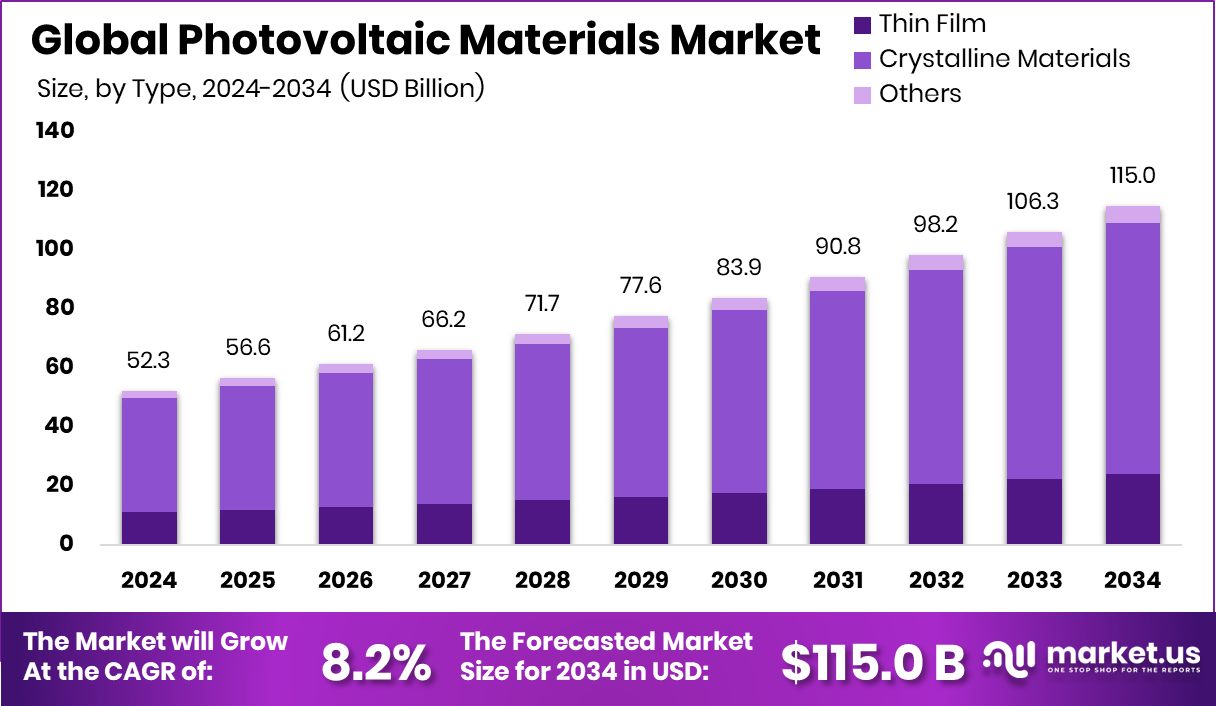

The Global Photovoltaic Materials Market is expected to be worth around USD 115.0 billion by 2034, up from USD 52.3 billion in 2024, and is projected to grow at a CAGR of 8.2% from 2025 to 2034. Asia Pacific dominates with a 47.20% share in photovoltaic materials.

Photovoltaic materials are specialized substances that can convert sunlight directly into electricity through the photovoltaic effect. These materials, which include crystalline silicon, thin-film compounds, and emerging organic or perovskite-based options, are used to manufacture solar cells that form the core component of solar panels. Their efficiency, durability, and cost play a decisive role in determining the overall performance and viability of solar energy systems.

The photovoltaic materials market refers to the global industry engaged in the production, development, and commercialization of materials used in solar energy generation. This market encompasses a wide range of material types, including semiconductors, conductive coatings, and encapsulants, serving utility-scale, commercial, and residential solar projects. It is influenced by trends in renewable energy adoption, manufacturing innovations, and government energy policies. Spain has allocated over €210 million to boost solar PV manufacturing projects. Also, Hemlock Semiconductor has secured up to US$325 million in funding under the revised CHIPS Act.

Growth in this market is driven by the global shift toward clean and renewable energy to reduce carbon emissions. Supportive government incentives, falling production costs, and technological advancements are accelerating adoption rates across developed and emerging economies. The U.S. Department of Energy has announced $3 billion in funding to support battery manufacturing and recycling initiatives. Also, Art-PV India has received a $10 million grant aimed at advancing solar cell manufacturing capabilities.

Demand is increasing due to rising solar power installations worldwide, driven by the need for energy security and the declining cost per watt of solar power generation. Expanding electrification in off-grid areas is also contributing to stronger consumption of photovoltaic materials.

Key Takeaways

- The Global Photovoltaic Materials Market is expected to be worth around USD 115.0 billion by 2034, up from USD 52.3 billion in 2024, and is projected to grow at a CAGR of 8.2% from 2025 to 2034.

- Crystalline materials hold a 74.9% share in the Photovoltaic Materials Market, dominating global solar cell production.

- Silicon-based materials account for 89.2% of the market share, reflecting their efficiency and reliability in photovoltaic applications.

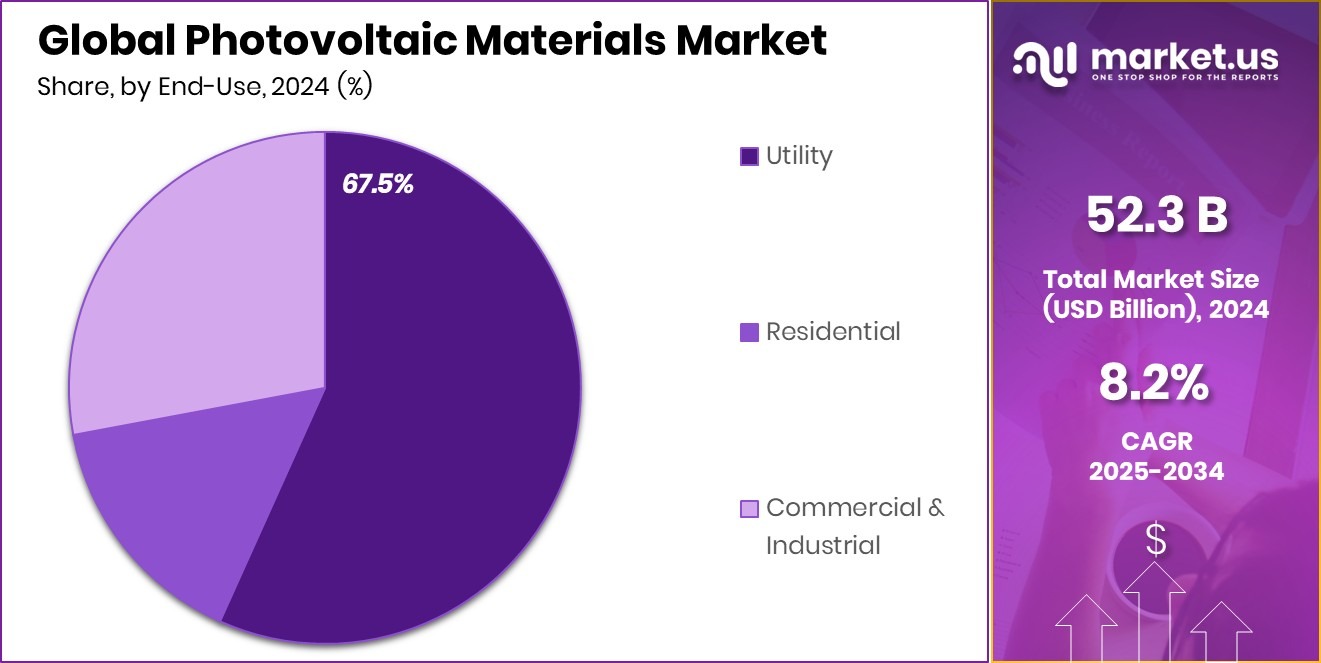

- The utility sector leads with a 67.5% share, driving large-scale demand in the photovoltaic materials market.

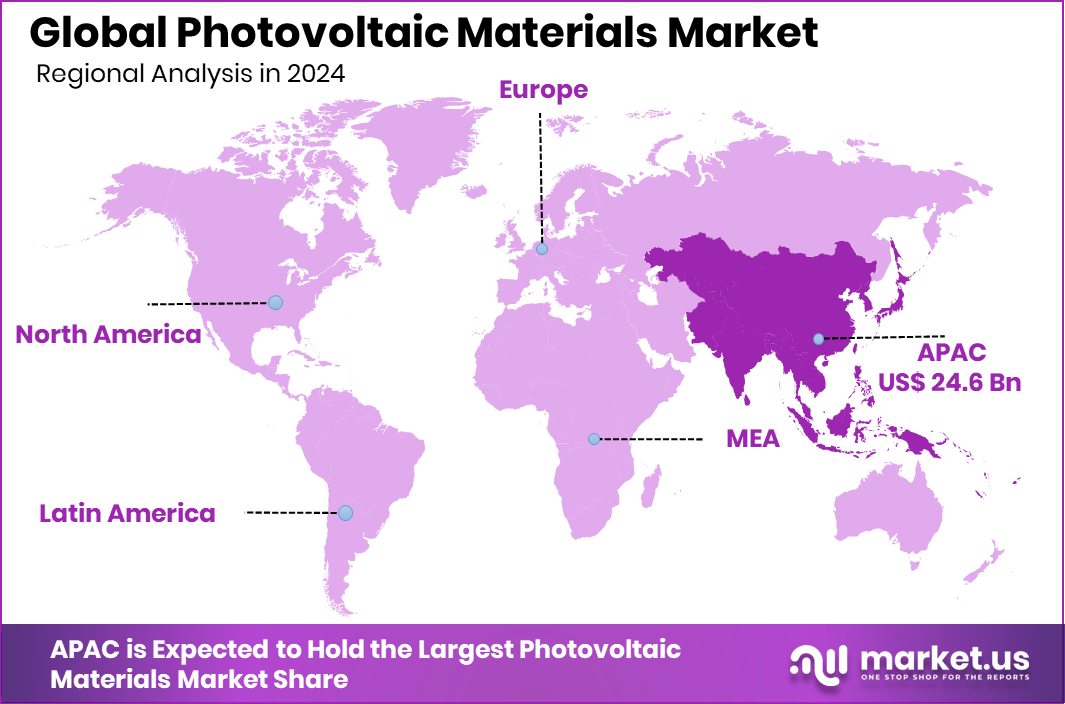

- Strong solar adoption drives Asia Pacific’s USD 24.6 Bn market.

By Type Analysis

Crystalline materials hold a 74.9% share, dominating the global photovoltaic materials market demand.

In 2024, Crystalline Materials held a dominant market position in the By Type segment of the Photovoltaic Materials Market, accounting for a significant 74.9% share. This leadership can be attributed to their proven efficiency, long operational lifespan, and widespread adoption in both residential and commercial solar installations.

Crystalline materials, primarily monocrystalline and polycrystalline silicon, are favored for their high energy conversion rates and durability under varied climatic conditions, making them a reliable choice for large-scale deployments. Their well-established manufacturing processes and mature supply chain infrastructure further enhance their cost-effectiveness, enabling mass adoption across global markets.

The dominance of crystalline materials is also supported by continuous technological advancements aimed at increasing module efficiency and reducing production costs. Integration of passivated emitter rear cell (PERC) technology and bifacial designs within crystalline modules has further elevated performance standards.

Moreover, their compatibility with a wide range of installation environments, from rooftop systems to utility-scale solar farms, strengthens their market appeal. As the global focus on renewable energy intensifies, crystalline materials are expected to maintain their strong market position, benefiting from both existing demand and future expansion in emerging markets where solar infrastructure is rapidly developing.

By Material Analysis

Silicon-based products account for 89.2%, driving efficiency in the photovoltaic materials market.

In 2024, Silicon-based materials held a dominant market position in the By Material segment of the Photovoltaic Materials Market, capturing an impressive 89.2% share. This strong market presence is primarily driven by silicon’s well-established role as the most widely used material in solar cell manufacturing, attributed to its high efficiency, abundance, and proven long-term stability.

Silicon-based photovoltaic materials, particularly in crystalline form, deliver consistent energy conversion performance across diverse environmental conditions, making them the preferred choice for large-scale, residential, and commercial solar projects worldwide.

The dominance of silicon-based materials is further reinforced by advancements in production technologies that have reduced manufacturing costs while enhancing efficiency levels. Techniques such as passivated emitter rear cell (PERC) technology and improved wafer designs have contributed to maximizing energy output and lowering the levelized cost of electricity (LCOE).

Additionally, the extensive global supply chain and manufacturing infrastructure dedicated to silicon-based photovoltaics enable large-scale deployment, ensuring availability and cost competitiveness.

With growing demand for renewable energy solutions and expanding solar installations across emerging economies, silicon-based materials are poised to retain their leadership position, benefiting from continuous innovation and their unmatched track record in delivering reliable, efficient, and economically viable solar energy solutions.

By End Use Analysis

Utility applications capture a 67.5% share, leading growth in the photovoltaic materials market worldwide.

In 2024, Utility held a dominant market position in the By End Use segment of the Photovoltaic Materials Market, commanding a substantial 67.5% share. This dominance is largely attributed to the growing number of large-scale solar power projects aimed at meeting rising electricity demands and supporting renewable energy targets set by governments worldwide.

Utility-scale applications leverage photovoltaic materials in extensive solar farms, which are capable of generating high volumes of clean electricity and feeding it directly into national grids. The scale of these projects allows for cost efficiencies in installation, maintenance, and energy production, making them a preferred choice for expanding renewable energy capacity.

The strong market share of the utility segment is also supported by continuous investment in infrastructure and favorable policy frameworks that encourage the integration of solar energy into national power portfolios.

The ability of photovoltaic materials to deliver consistent output in large installations, combined with advancements in efficiency and durability, has further strengthened their role in this segment. With increasing demand for low-carbon energy sources and the need to replace aging fossil fuel plants, utility-scale projects are expected.

Key Market Segments

By Type

- Thin Film

- Crystalline Materials

- Others

By Material

- Silicon-based

- Non-Silicon based

By End Use

- Utility

- Residential

- Commercial and Industrial

Driving Factors

Rising Global Shift Towards Clean Energy Sources

One of the biggest driving factors for the Photovoltaic Materials Market is the growing shift towards clean and renewable energy worldwide. Governments, industries, and communities are focusing on reducing dependence on fossil fuels to lower carbon emissions and combat climate change. Solar power is a major part of this transition, and photovoltaic materials are at the heart of solar energy systems.

As more countries set ambitious renewable energy targets, the demand for efficient and affordable photovoltaic materials continues to rise. Technological improvements, better production methods, and falling installation costs are making solar energy more accessible. This global push for sustainable power is creating steady growth opportunities for the photovoltaic materials industry across both developed and developing regions.

Restraining Factors

High Production Costs of Advanced Photovoltaic Materials

A major restraining factor for the Photovoltaic Materials Market is the high production cost of advanced materials used in solar cells. While technology has improved efficiency, the processes required to manufacture high-quality photovoltaic materials often involve expensive equipment, skilled labor, and specialized raw materials. This makes the initial investment for solar projects higher, especially in regions with limited financial support or subsidies.

For developing countries, these costs can slow down the large-scale adoption of solar energy. Additionally, advanced materials like high-efficiency thin films or perovskites may still face challenges in mass production, further increasing their price. Unless production costs are reduced through innovation and scale, the growth potential of the photovoltaic materials market could be limited in certain areas.

Growth Opportunity

Innovation in Next-Generation High-Efficiency Solar Materials

A key growth opportunity in the Photovoltaic Materials Market lies in developing next-generation solar materials that offer higher efficiency, lighter weight, and greater flexibility. Emerging materials such as perovskites and advanced thin films have the potential to surpass traditional silicon in performance while reducing production costs. These innovations could open doors for new applications like building-integrated photovoltaics, wearable solar devices, and portable power solutions.

Improved efficiency means more electricity can be generated from smaller surfaces, making solar power viable in space-limited areas. With ongoing research, better stability, and easier manufacturing techniques, these materials could revolutionize the solar industry. Companies and researchers investing in this area are well-positioned to capture future demand and expand solar adoption globally.

Latest Trends

Growing Use of Bifacial Solar Panel Materials

One of the latest trends in the Photovoltaic Materials Market is the increasing use of bifacial solar panel materials. These materials are designed to capture sunlight from both the front and the back sides of the panel, boosting overall energy generation. By reflecting light from surfaces like the ground or rooftops onto the rear side, bifacial panels can achieve higher efficiency without taking up extra space.

This makes them highly attractive for large solar farms and commercial projects where maximum output is essential. The materials used for bifacial panels need to be durable, transparent on one side, and efficient at converting light into electricity. As installation techniques improve, bifacial technology is quickly becoming a preferred choice in solar projects.

Regional Analysis

Asia Pacific held a 47.20% share, reaching USD 24.6 Bn.

In 2024, Asia Pacific emerged as the dominating region in the Photovoltaic Materials Market, accounting for a substantial 47.20% share, valued at USD 24.6 billion. This dominance is driven by rapid solar capacity expansion in countries such as China, India, Japan, and Australia, supported by favorable government policies, large-scale investments, and growing industrial demand for renewable energy. The region benefits from abundant sunlight, lower manufacturing costs, and a strong presence of photovoltaic material production facilities, enabling competitive pricing and high adoption rates.

North America is experiencing steady growth, supported by clean energy initiatives, grid modernization, and increasing residential solar installations, particularly in the United States. Europe continues to advance its solar capacity through ambitious decarbonization targets and widespread adoption of building-integrated photovoltaics.

The Middle East & Africa region is gradually expanding due to large utility-scale solar projects aimed at diversifying energy sources, while Latin America is witnessing rising installations driven by favorable climates and supportive energy policies. Overall, Asia Pacific’s dominant market position is expected to continue, fueled by technological advancements, expanding solar infrastructure, and its central role in the global supply chain for photovoltaic materials.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Wacker Chemie AG continues to play a crucial role with its advanced silicon-based materials, leveraging decades of chemical and material science expertise to enhance efficiency and stability in solar modules. The company’s focus on high-purity polysilicon remains central to supporting both large-scale solar farms and smaller installations.

DuPont maintains its strong presence through a wide range of high-performance photovoltaic materials, including encapsulants and backsheet technologies designed to improve module durability and energy yield. Its emphasis on reliability and product lifespan aligns with the market’s demand for long-term, cost-effective solar solutions. Honeywell International Inc. contributes through advanced films, coatings, and specialty materials that enhance module protection and performance under varying environmental conditions.

COVEME S.p.A., with its expertise in treated polyester films and specialty backsheets, supports both crystalline silicon and thin-film module production. The company’s materials are known for mechanical strength, weather resistance, and adaptability to emerging photovoltaic designs. Collectively, these companies are driving advancements in efficiency, durability, and scalability, ensuring that photovoltaic materials meet the demands of a rapidly expanding global solar market.

Top Key Players in the Market

- Wacker Chemie AG

- DuPont

- Honeywell International Inc.

- COVEME s.p.a.

- Mitsubishi Materials Corporation

- Targray

- HANGZHOU FIRST APPLIED MATERIAL CO.,LTD.

- Ferrotec Holdings Corporation

- Jinko Solar

- SunPower Corporation

Recent Developments

- In March 2025, Wacker began replacing fossil coal with biogenic carbon at its Holla, Norway site. This switch supports silicon production used in solar modules and helps avoid CO₂ emissions—an important step toward making its silicon value chain more climate-neutral. A long-term supply contract with Aymium in the U.S. underpins this shift.

- In June 2024, DuPont introduced its latest Tedlar® frontsheet at the SNEC International Photovoltaic Power Generation and Smart Energy Exhibition in Shanghai. This new frontsheet is ideal for flexible solar panels—such as those used for portable chargers or RV setups—thanks to its mechanical toughness, abrasion resistance, and high light transparency, making solar modules lighter and more adaptable.

Report Scope

Report Features Description Market Value (2024) USD 52.3 Billion Forecast Revenue (2034) USD 115.0 Billion CAGR (2025-2034) 8.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Thin Film, Crystalline Materials, Others), By Material (Silicon-based, Non-Silicon-based), By End Use (Utility, Residential, Commercial, and Industrial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Wacker Chemie AG, DuPont, Honeywell International Inc., COVEME s.p.a., Mitsubishi Materials Corporation, Targray, HANGZHOU FIRST APPLIED MATERIAL CO., LTD., Ferrotec Holdings Corporation, Jinko Solar, SunPower Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Photovoltaic Materials MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

Photovoltaic Materials MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Wacker Chemie AG

- DuPont

- Honeywell International Inc.

- COVEME s.p.a.

- Mitsubishi Materials Corporation

- Targray

- HANGZHOU FIRST APPLIED MATERIAL CO.,LTD.

- Ferrotec Holdings Corporation

- Jinko Solar

- SunPower Corporation