Global Pet Toys Market Report By Product Type (Balls, Rope & Tugs Toys, Interactive Toys, Plush Toys, Chew Toys, Other Product Types), By Pet (Dogs, Cats, Birds, Other Pets), By Distribution Channel (Online, Offline), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: October 2024

- Report ID: 101393

- Number of Pages: 315

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

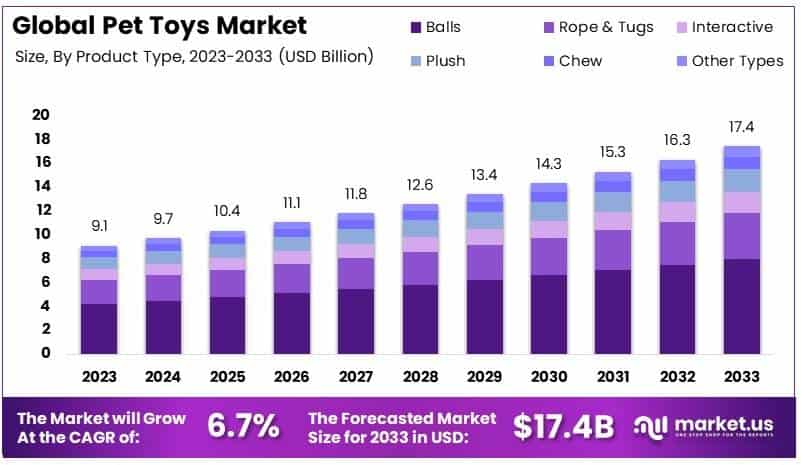

The Global Pet Toys Market size is expected to be worth around USD 17.4 Billion by 2033, from USD 9.1 Billion in 2023, growing at a CAGR of 6.7% during the forecast period from 2024 to 2033.

Pet toys are products designed to entertain and engage pets, such as dogs, cats, birds, and small animals. These toys help pets stay active, mentally stimulated, and reduce boredom. They come in many types, including chew toys, balls, interactive gadgets, and plush toys. The primary aim is to provide physical and mental well-being for pets.

The pet toys market refers to the global industry that manufactures and sells toys designed specifically for pets. This market covers a wide range of products aimed at different pet species, each with unique needs. The market has been expanding, driven by the growing number of pet owners who treat their pets like family members, seeking to improve their quality of life.

The pet toys market is expanding, driven by the rise in pet ownership and consumer preferences for quality pet care products. As per the American Pet Products Association (APPA), 86.9 million U.S. households owned a pet in 2023, accounting for 66% of all households. This figure shows an increase from 62% in 2022.

In the UK, pet ownership rose by 9% between 2021 and 2024, reaching 32 million. These trends reflect the growing importance of pets in households and the willingness of owners to invest in toys that enhance their pets’ well-being and lifestyle. The market benefits from these dynamics, as pet owners seek interactive and engaging products for their animals.

The demand for pet toys is largely driven by a shift towards sustainable and eco-friendly options. Consumers are increasingly conscious of the environmental impact of their purchases. For example, Petco announced its plan to increase its range of sustainable pet products to 50% by 2025, showing how major retailers are responding to this trend.

The preference for eco-friendly materials and products is creating opportunities for manufacturers who can adapt to these consumer needs. As a result, the market is evolving beyond traditional plastic toys to include natural and recyclable materials like biodegradable plastic, aligning with global sustainability goals.

Despite this growth, the pet toy market faces challenges related to environmental impact. According to the Yale Environment Review, 80% of pet toys eventually end up in landfills, contributing significantly to global plastic waste. Manufacturers and retailers are under pressure to offer products that not only meet consumer expectations but also address these environmental concerns.

The pet toy market is competitive, with established brands and new entrants vying for market share. The market shows signs of saturation, particularly in developed regions like North America and Europe, where pet ownership rates are already high.

As a result, companies are focusing on product differentiation through innovation and customization. This includes offering toys designed for specific breeds, age groups, or pet preferences, as well as expanding into interactive, pet wearables and tech-enabled toys.

Key Takeaways

- The Pet Toys Market was valued at USD 9.1 billion in 2023, expected to reach USD 17.4 billion by 2033, with a CAGR of 6.7%.

- In 2023, Balls dominated the product type segment with 46% due to their popularity and versatility for interactive play.

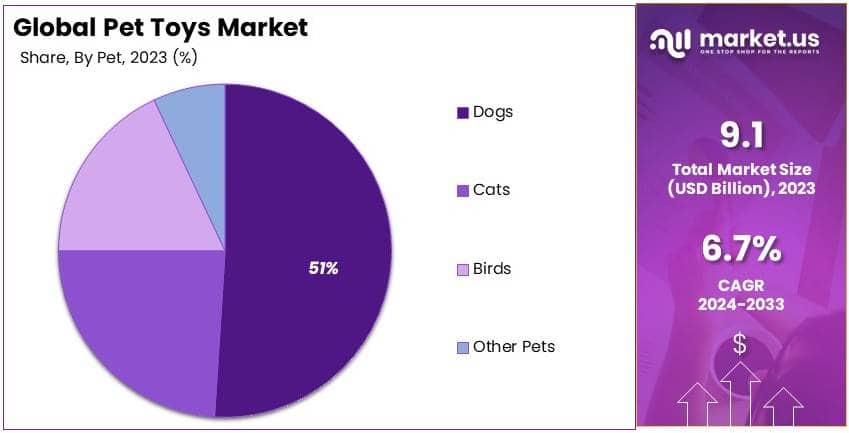

- In 2023, Dogs led the pet segment with 51% as the most common pet type, driving high demand for dog-specific toys.

- In 2023, the Offline channel held the highest revenue share, reflecting consumer preference for physical stores when buying pet toys.

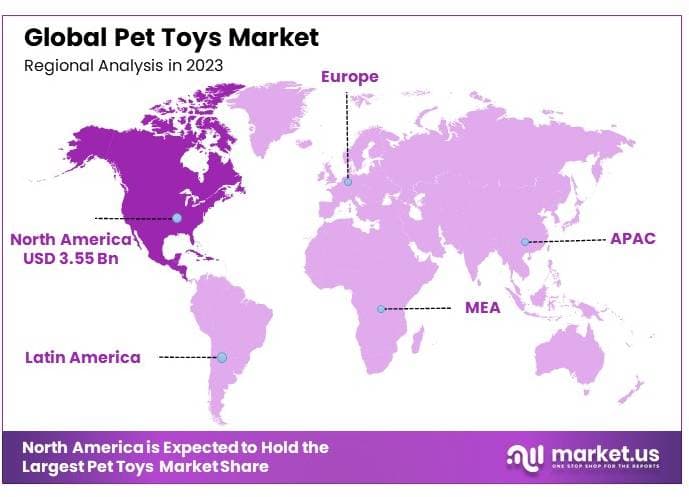

- North America dominated with 39% share, generating over USD 3.55 billion in 2023, driven by high pet ownership rates and spending.

Product Type Analysis

Balls dominate with 46% market share in 2023 due to high demand for fetch games and easy availability.

The Pet Toys Market is categorized by product types, including balls, rope & tug toys, interactive toys, plush toys, chew toys, and other types. Balls hold the largest share, accounting for 46% of the market in 2023. This dominance is due to their simplicity, versatility, and appeal to pets, especially dogs.

Balls are widely used for fetch games, which are highly popular among pet owners as they encourage physical activity and bonding. The availability of different sizes, textures, and materials also makes balls a preferred choice for various pets, from dogs to smaller animals.

Rope & tug toys are also significant in the market. These toys are particularly popular for interactive play and training exercises with dogs. They support physical activity and help pets build strength. The demand for these toys is growing as pet owners seek durable and engaging options.

Interactive toys are seeing a rise in demand. These toys include puzzles and motion-activated devices that stimulate pets mentally. With a focus on pet enrichment and reducing boredom, interactive toys are becoming essential for both dogs and cats, contributing to the segment’s growth.

Plush toys, designed for comfort and companionship, are commonly used by dogs and cats. While they are not as durable as other toys, they appeal to pets that enjoy cuddling or light play, supporting a niche but consistent market demand.

Chew toys are vital, especially for puppies and dogs, as they support dental health and help manage teething discomfort. This segment is expanding as more pet owners prioritize oral health for their pets.

Other product types include specialty toys like flying discs or squeaky toys, which serve specific needs for pet entertainment. While these toys have smaller market shares, they add diversity to the market and cater to various pet preferences.

Pet Analysis

Dogs dominate with 51% market share in 2023 due to higher ownership rates and spending on pet toys.

The market is segmented by the type of pet, including dogs, cats, birds, and other pets. The dog segment holds the largest market share at 51% in 2023. This dominance is due to the higher number of dog owners and their spending habits.

Dog owners tend to invest more in pet toys, prioritizing physical activity, training, and comfort for their pets. Products like balls, chew toys, and interactive toys are especially popular among dog owners. The variety of toys available specifically for dogs further supports this segment’s dominance, as the industry continues to innovate with products tailored to dog behavior and needs.

The cat segment is also growing, as cat owners increasingly seek enrichment products to keep their pets engaged. Interactive toys and animated toys such as feather wands and laser pointers, are popular in this segment. The rising trend of treating cats as family members drives growth in this area.

Bird toys have a smaller market share but are important for bird owners who focus on stimulation and mental engagement for their pets. Toys like mirrors, ladders, and swings are common in this category. As bird ownership increases, there is potential for growth in this sub-segment.

Other pets, such as rabbits, hamsters, and reptiles, also have a niche but consistent demand for toys that cater to their specific behaviors. Although this sub-segment is smaller, it supports market growth by offering specialized products for a wider range of pets.

Distribution Channel Analysis

Offline distribution dominates with the highest revenue share in 2023 due to customer trust and the ability to physically inspect products.

The market is divided into online and offline distribution channels. Offline sales lead with the highest revenue share in 2023. This dominance is driven by pet owners’ preference to visit physical stores where they can inspect and choose products directly.

Pet specialty stores and supermarkets often offer personalized services, advice, and demonstrations that build customer trust. The convenience of immediate purchases and the ability to see the quality of products up close also contribute to the high sales figures in the offline segment. Retailers often run promotions and discounts, further attracting customers to physical stores.

The online distribution channel is rapidly growing as e-commerce expands. This segment is gaining popularity due to the convenience of home delivery and the wide range of products available online. Pet owners benefit from comparing prices, reading reviews, and accessing exclusive online discounts. As e-commerce platforms improve their services and logistics, the online segment is expected to see continued growth.

Both channels play essential roles in the market. While offline sales dominate, the online channel’s growth offers flexibility and variety to consumers, making it a significant contributor to the overall market expansion.

Key Market Segments

By Product Type

- Balls

- Rope & Tugs Toys

- Interactive Toys

- Plush Toys

- Chew Toys

- Other Product Types

By Pet

- Dogs

- Cats

- Birds

- Other Pets

By Distribution Channel

- Online

- Offline

Drivers

Growing Pet Adoption Rates Drives Market Growth

The pet toys market is significantly driven by the growing rates of pet adoption worldwide. As more individuals and families adopt pets, the demand for pet care products, including toys, rises. This surge in pet ownership boosts market growth, as toys are essential for pets’ physical and mental well-being.

Additionally, the increasing humanization of pets further supports market expansion. Pet owners are treating pets as family members, leading to a higher demand for high-quality and premium toys that enhance their pets’ quality of life. This trend pushes companies to innovate and offer more engaging and interactive toys.

Rising disposable income levels also contribute to market growth. With more spending power, pet owners are willing to invest in premium and innovative products that provide better experiences for their pets. This financial flexibility allows consumers to explore new types of pet toys, such as interactive or tech-enabled options.

Moreover, the demand for toys that provide mental stimulation and entertainment for pets is increasing. Pet owners recognize the importance of keeping their pets engaged and active, which leads to a growing market for specialized toys that cater to various needs, including cognitive development and exercise.

Restraints

High Costs of Premium Pet Toys Restraints Market Growth

The high costs of premium pet toys act as a restraining factor in the market. Many consumers, especially in price-sensitive regions, find it difficult to justify the purchase of expensive pet products, leading them to opt for more affordable alternatives. This price disparity limits the market reach for high-end brands.

Moreover, the availability of cheaper alternatives, such as locally produced or imported low-cost toys, further challenges the growth of premium pet toys. These inexpensive options attract budget-conscious consumers, reducing the potential customer base for higher-priced products.

Limited product durability is another concern. Pet toys, especially those made of plastic or fabric, often have a short lifespan, leading to dissatisfaction among consumers. The frequent need for replacements not only raises costs for pet owners but also impacts their perception of product value.

Environmental concerns regarding the use of plastic in pet toys restrain market growth. With increasing awareness of plastic pollution, consumers are becoming cautious about purchasing non-sustainable pet products. This shift in consumer behavior puts pressure on manufacturers to develop eco-friendly solutions, which can be costly and time-consuming, further affecting market dynamics.

Opportunity

Expansion in Emerging Markets Provides Opportunities

The expansion of the pet toys market into emerging markets presents significant growth opportunities. With rising disposable incomes and changing lifestyles in regions like Asia-Pacific and Latin America, pet ownership is increasing, driving demand for pet care products, including toys. Companies expanding into these markets can capture a growing customer base.

The development of sustainable and eco-friendly toys is another opportunity for growth. As consumers become more environmentally conscious, the demand for sustainable products rises. Companies that innovate with biodegradable and recyclable materials can tap into this growing trend, positioning themselves as leaders in sustainable pet care solutions.

Customization and personalized pet toys offer further opportunities. Consumers are increasingly seeking products tailored to their pets’ needs and preferences, creating a market for personalized toys. Businesses that provide such options can differentiate themselves and build loyal customer bases.

The rise of online sales channels also enhances growth prospects. The convenience of e-commerce platforms allows companies to reach a broader audience, particularly in regions where physical stores may not be as prevalent. By optimizing their digital presence, companies can capitalize on the increasing trend of online pet care product shopping.

Challenges

Regulatory Compliance for Safety Standards Challenges Market Growth

Regulatory compliance for safety standards is a key challenge in the pet toys market. Pet products must adhere to strict safety regulations to ensure they are non-toxic and safe for animals. This compliance process can be time-consuming and costly for manufacturers, affecting their product development timelines and pricing strategies.

Fluctuations in raw material prices also pose challenges. The cost of materials such as rubber, plastic, and fabric can vary, impacting production costs and overall profitability. Manufacturers must navigate these fluctuations to maintain consistent pricing and product quality.

High competition among brands further challenges the market. With many established and new entrants offering a variety of pet toys, companies must continuously innovate to differentiate their products. This competitive environment can make it difficult for brands to maintain market share and attract loyal customers.

Supply chain disruptions, particularly those affecting the availability of raw materials and transportation logistics, add to the complexity. Delays in sourcing materials or delivering products can disrupt business operations, impacting the ability of companies to meet market demand and maintain customer satisfaction.

Growth Factors

Increasing Awareness of Pet Fitness and Mental Health Is Growth Factor

The growing awareness of pet fitness and mental health is a key factor driving the pet toys market. Pet owners are increasingly investing in toys that support their pets’ physical activity and cognitive development, leading to a demand for diverse and engaging products.

The expansion of pet-friendly retail spaces also contributes to market growth. As more retail spaces accommodate pet owners, there is a rising demand for products that cater to pet engagement. This trend encourages the development and sale of pet toys in these environments.

The rise in the number of pet exhibitions and events further supports market growth. These events offer platforms for companies to showcase their latest products and innovations, attracting a wide audience of pet enthusiasts and professionals. Exhibitions also serve as networking opportunities for businesses to expand their market reach.

Additionally, the growth in pet insurance adoption encourages pet owners to invest more in pet care products, including toys. With insurance covering pet health expenses, owners have greater financial flexibility to purchase premium toys that enhance their pets’ quality of life. These factors collectively drive growth in the pet toys market.

Emerging Trends

Demand for Smart Pet Toys Is Latest Trending Factor

The demand for smart pet toys is a significant trend influencing the market. With advancements in technology, pet owners are increasingly looking for interactive and tech-enabled products that engage their pets and provide convenience. This trend is driving the development of toys that incorporate features such as remote control, automation, and monitoring capabilities.

The popularity of subscription-based pet toy services is another trend. Consumers are attracted to the convenience and variety offered by pet subscription boxes, which provide a curated selection of toys and treats on a regular basis. This subscription model supports customer retention and encourages repeat purchases, benefiting the overall market.

A growing focus on health and wellness products for pets also shapes the market. Pet owners are becoming more conscious of their pets’ physical and mental well-being, leading to increased demand for toys designed to promote fitness and cognitive stimulation. This trend is driving innovation in products that support pet health, such as puzzle toys and exercise equipment.

The rise of pet influencer marketing and social media engagement further amplifies market trends. Pet owners are influenced by social media content featuring popular pet toys and brands. Companies leveraging these platforms can boost their visibility and connect directly with consumers, driving sales and brand loyalty.

Regional Analysis

North America Dominates with 39.0% Market Share

North America leads the pet toys market with a 39.0% market share, totaling USD 3.55 billion. This dominance is driven by a high rate of pet ownership, increasing spending on pet care, and growing trends of pet humanization. The region’s advanced retail infrastructure, including e-commerce platforms, further supports the distribution and accessibility of pet toys.

Regional dynamics such as a rising focus on pet wellness and the growing popularity of interactive and smart pet toys have boosted market performance. Additionally, strong consumer awareness regarding pet mental and physical health contributes to sustained demand for premium and innovative pet toys.

North America’s influence in the pet toys market is expected to remain strong. The rising adoption of pets, along with continuous innovation in pet products, will likely fuel future growth. The region’s significant disposable income and consumer preferences for high-quality pet products are key drivers.

Regional Mentions:

- Europe:

Europe is a significant player in the pet toys market, with a strong emphasis on eco-friendly and sustainable products. The region’s focus on animal welfare and growing demand for organic and safe materials in pet toys drive market growth. - Asia Pacific:

Asia Pacific is witnessing rapid growth in the pet toys market, largely due to increased pet ownership and rising disposable incomes in countries like China and Japan. The market is driven by the growing popularity of pet culture in urban areas. - Middle East & Africa:

The pet toys market in the Middle East & Africa is growing, driven by increasing pet adoption and demand for luxury pet products. The expansion of retail chains and e-commerce platforms is also contributing to the region’s market growth. - Latin America:

Latin America is slowly expanding its presence in the pet toys market, supported by a growing interest in pet care and rising disposable incomes. The demand for high-quality and durable pet products, especially in Brazil and Mexico, is a key factor in market growth.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The pet toys market is growing rapidly due to rising pet ownership, increased spending on pet care, and the humanization of pets. Key players focus on creating innovative, durable, and safe products to meet the needs of pets and their owners.

Central Garden & Pet Company, Radio Systems Corporation, Kong Company, and Benebone LLC are the leading companies in this market. They are known for producing high-quality, durable, and engaging pet toys that cater to various types of pets, particularly dogs and cats.

Central Garden & Pet Company offers a wide range of pet products, including toys designed for different pet needs. Radio Systems Corporation, known for brands like PetSafe, focuses on interactive and electronic toys that promote physical and mental stimulation for pets.

Kong Company is a market leader in durable, chew-resistant toys, widely recognized for its popular rubber toys that help with pet training and anxiety relief. Benebone LLC specializes in chew toys made from durable, pet-safe materials that appeal to dogs’ natural instincts.

These companies invest in research and innovation to create toys that not only entertain but also improve pet health and behavior. Their strong distribution networks and brand reputation make them leaders in the pet toys market. With a focus on safety, sustainability, and pet wellness, these key players continue to influence trends and drive growth in the global pet toy industry.

Top Key Players in the Market

- Central Garden & Pet Company

- Petsport USA, Inc.

- Ethical Products, Inc.

- Radio Systems Corporation

- ZippyPaws

- Multipet International, Inc.

- Kong Company

- Benebone LLC

- Kyjen Company LLC

- Other Key Players

Recent Developments

- BARK and Dunkin: In September 2024, BARK and Dunkin’ celebrated their five-year partnership with the launch of a new line of pumpkin spice dog toys. The sales from this partnership benefit the Dunkin’ Joy in Childhood Foundation, which supports children facing hunger and illness.

- Godrej Consumer Products Pet Care: In August 2024, Godrej Consumer Products (GCPL) announced an investment of ₹500 crore over five years to enter the Indian pet care market through its subsidiary, Godrej Pet Care. The expansion will utilize their existing expertise in animal feed, with plans to commence manufacturing by the second half of FY26.

- Cheerble: In September 2024, Cheerble introduced two new interactive pet toys, the Wicked Ball Air and Wicked Ball M3. These toys are designed to enhance pet engagement through smart technology, offering various modes that adapt to pets’ play styles, including different bouncing patterns and obstacle avoidance.

- BARK: In August 2024, BARK launched its best-selling and limited-edition toy collections at Chewy. This strategic move is part of BARK’s broader strategy to reach a larger customer base, offering exclusive, seasonally themed toys that cater to dog owners seeking new and unique pet accessories.

Report Scope

Report Features Description Market Value (2023) USD 9.1 Billion Forecast Revenue (2033) USD 17.4 Billion CAGR (2024-2033) 6.7% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Balls, Rope & Tugs Toys, Interactive Toys, Plush Toys, Chew Toys, Other Product Types), By Pet (Dogs, Cats, Birds, Other Pets), By Distribution Channel (Online, Offline) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Central Garden & Pet Company, Petsport USA, Inc., Ethical Products, Inc., Radio Systems Corporation, ZippyPaws, Multipet International, Inc., Kong Company, Benebone LLC, Kyjen Company LLC, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Central Garden & Pet Company

- Petsport USA, Inc.

- Ethical Products, Inc

- Radio Systems Corporation

- ZippyPaws

- Multipet International, Inc.

- Kong Company

- Benebone LLC

- Kyjen Company LLC

- Other Key Players