Global Pet Oral Care Products Market by Product Type (Toothbrush, Toothpaste, Dental Claws, Water Additives, Breath Freshener Spray, Dental Wipes, & Others), By Pets (Dogs, Cats, Horses, & Others), By Distribution Channel (Veterinary Hospitals, Private Clinics, Home Care, Retail Pharmacies, Online Stores, Other Distribution Channels), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct 2024

- Report ID: 35604

- Number of Pages: 296

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

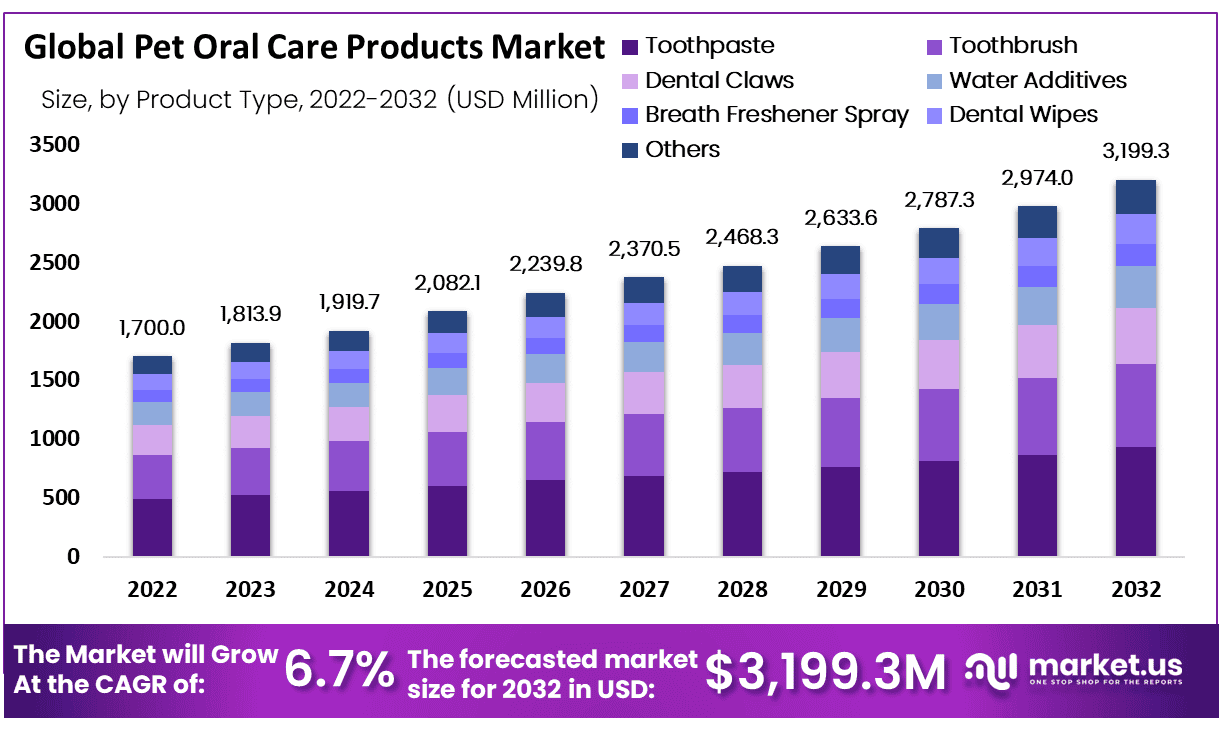

The Pet Oral Care Products Market size is expected to be worth around USD 3,199.3 Million by 2032, from USD 1,813.9 Million in 2023, growing at a CAGR of 6.7% during the forecast period from 2023 to 2032.

The Pet Oral Care Products Market encompasses a range of products designed to maintain and improve oral hygiene for pets, including toothbrushes, toothpaste, dental chews, and mouthwashes. These products are essential for preventing dental issues such as plaque, tartar buildup, and gum disease in pets, which can lead to more serious health complications.

The market has witnessed significant growth due to increasing awareness among pet owners about the importance of pet health and the direct correlation between oral hygiene and overall health. The expansion of the Pet Oral Care Products Market is driven by several key factors.

Firstly, the rising pet ownership globally acts as a primary catalyst for increased demand for pet care products. As pets are increasingly considered part of the family, owners are investing more in their health and well-being.

Secondly, there is a growing awareness among veterinarians and pet owners about the links between oral health and systemic health issues, which encourages the preventative use of oral care products. Additionally, innovations in pet oral care products, such as organic and natural options, align with the broader consumer preference towards sustainable and chemical-free products.

Globally, pets are a central part of many households, with dogs and cats being the most common. In the United States alone, there are approximately 90 million dogs and over 94 million cats. The trend of pet humanization, where pets are treated with the same care and respect as human family members, continues to drive the pet care market, including sectors such as food, wellness, and specifically, oral care, reflecting a broader understanding of the health needs of pets.

The Pet Oral Care Products Market is evolving rapidly within the broader context of a robust and expanding pet industry. According to Spots, the pet industry as a whole constitutes a substantial $103.6 billion national industry, with a notable 40.5% of this revenue deriving solely from food and treats.

Specifically, the Pet Oral Care segment benefits directly from the overall industry’s growth, which sees an annual increase of 11.6%. This growth is underpinned by the substantial spending habits of pet-owning households, which average $1,120 annually on pet-related expenses. With two-thirds of American households owning at least one pet, the market for pet oral care products is buoyed by consistent consumer demand.

The competitive landscape of the pet industry shows a significant concentration of market share, where two major corporations account for nearly half of the industry’s total market share. This highlights a competitive yet lucrative market environment for Pet Oral Care Products. The industry giants, PetSmart, Inc., and PETCO, dominate with 34% and 15% market shares respectively, setting competitive benchmarks in product offerings, including those for pet oral care.

With the U.S. pet owners spending approximately $42.0 billion annually on pet food and treats, the oral care segment is well-positioned to tap into consumer spending trends, leveraging both the necessity and discretionary spending on pet health and wellness.

According to The Zebra, as of 2024, 66% of U.S. households own a pet, with 86.9 million families having some form of animal companionship. This surge in pet ownership, coupled with Americans spending approximately $136 billion annually on their pets, is fueling growth in the pet oral care products market. Millennials, who represent a significant portion of pet owners, with at least 37 million owning pets, further drive demand for specialized care products.

Additionally, the global pet population, consisting of 900 million dogs and 370 million cats, highlights a vast market opportunity for oral care solutions. In the U.S. alone, 4 million dogs and cats are adopted from shelters each year, while Wyoming leads with 72% of households owning pets. The increasing pet adoption and ownership trends create a fertile ground for the expansion of pet oral care products as part of a broader focus on pet health and wellness.

Key Takeaways

- The Pet Oral Care Products Market is projected to grow significantly, reaching USD 3,199.3 million by 2032, up from USD 1,813.9 million in 2023, with a compound annual growth rate (CAGR) of 6.7% during the forecast period.

- Toothpaste dominates the Pet Oral Care Products Market with a 29% market share, leading the category due to its effectiveness in preventing dental issues in pets.

- Dogs hold the largest share in the Pet Oral Care Products Market at 35.2%, driven by the rising awareness of canine dental health and increased product variety.

- Veterinary Hospitals lead the market with a 31% share, benefiting from consumer trust and professional product recommendations.

- North America dominates the Pet Oral Care Products Market, holding a 35.6% share, with a strong market value of USD 605.2 million due to increasing pet humanization and rising veterinary health expenditures.

- Growth Opportunity: The surge in global pet ownership, especially with 66% of U.S. households owning pets in 2024, is a major driver of market growth.

- Restraining Factor: High product costs and limited consumer awareness are significant challenges limiting the broader adoption of pet oral care products.

By Product Type Analysis

Toothpaste Leads Pet Oral Care Products Market with 29% Largest Market Share

In 2022, Toothpaste held a dominant market position in the By Product Type segment of the Pet Oral Care Products Market, capturing more than a 29% share. Among the various product types, toothbrushes, dental chews, water additives, breath freshener sprays, dental wipes, and other product types also contributed to the market diversity, each addressing different aspects of pet dental health.

Toothbrushes facilitate physical plaque removal, while dental chews and water additives offer more passive care options. Breath freshener sprays and dental wipes provide alternatives for pets that resist conventional brushing methods, catering to a wide range of consumer preferences and pet needs. The varied product offerings highlight the market’s adaptability to pet owner demands for comprehensive oral health solutions.

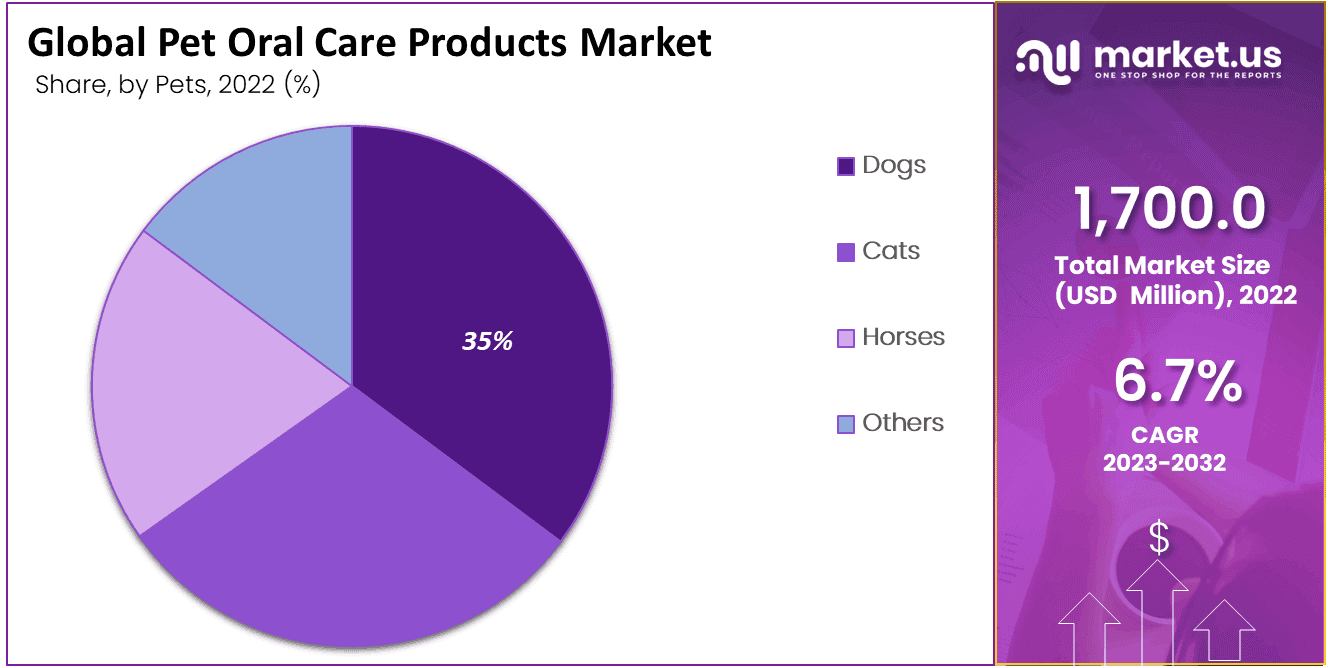

By Pets Analysis

Dogs Dominant the Pet Oral Care Products market with 35.2% Largest Market Share

In 2022, Dogs led the Pet Oral Care Products Market, capturing the largest share at 35.2%. This dominance is primarily driven by rising awareness of canine dental health among pet owners, combined with the increasing variety of dental products available specifically for dogs. These products, ranging from dental chews to enzymatic toothpastes, have seen heightened demand as consumers prioritize preventive care to avoid costly veterinary treatments. Additionally, the trend toward premium, vet-approved oral care products for dogs has further propelled the growth of this segment, making it the most significant contributor to the market.

Cats, holding the second-largest share, have also seen increased attention in oral care, though the market remains smaller compared to dogs due to the more challenging nature of feline oral care. Meanwhile, Horses and Other Pets represent niche segments within the overall market. Although these categories are growing steadily, driven by specialized pet care trends, they remain much smaller, with fewer product offerings and limited consumer adoption compared to dogs and cats.

By Distribution Channel Analysis

Veterinary Hospitals Dominant the Pet Oral Care Products Market with 31% Largest Market Share

In 2022, Veterinary Hospitals led the distribution channel segment of the Pet Oral Care Products Market, capturing more than 31% of the market share. This dominance can be attributed to the trusted nature of veterinary hospitals as primary points of care for pets, where professional recommendations drive the purchase of high-quality, veterinary-grade oral care products.

Veterinary hospitals have become the preferred source for these products due to the increasing focus on preventive care and regular dental check-ups, which are often bundled with product sales. This segment is projected to grow at a notable CAGR of 7.1%, indicating sustained consumer reliance on veterinary expertise for pet oral health management.

Other channels such as Private Clinics and Home Care represent significant contributors as well, though smaller in scale compared to veterinary hospitals. Retail Pharmacies and Online Stores are gaining traction, particularly with online platforms offering convenience and a broader range of products, but these channels have not yet surpassed the influence of professional care settings. Other Distribution Channels, including specialized pet stores, remain niche but are expanding due to increasing demand for targeted and premium oral care solutions.

Key Market Segments

By Product Type

- Toothbrush

- Toothpaste

- Dental Chews

- Water Additives

- Breath Freshener Spray

- Dental Wipes

- Other Product Types

By Pets

- Dogs

- Cats

- Horses

- Other Pets

By Distribution Channel

- Veterinary Hospitals

- Private Clinics

- Home Care

- Retail Pharmacies

- Online Stores

- Other Distribution Channels

Driver

Increasing Pet Ownership

The surge in global pet ownership is a fundamental driver of growth in the pet oral care products market. According to various industry reports, pet ownership has been steadily increasing, particularly in developed economies, where nearly 67% of households in the U.S. owned a pet as of 2023. This rise is fueled by demographic trends such as increased urbanization, higher disposable incomes, and shifting perceptions of pets as integral family members rather than mere companions.

This expansion in the pet-owning population directly increases demand for pet healthcare products, including oral care solutions. As pet owners become more attuned to their pets’ overall well-being, oral hygiene has emerged as a critical component of routine care. The American Veterinary Medical Association highlights that over 80% of dogs and 70% of cats show signs of oral disease by age three, underscoring the need for preventive dental care.

Restraint

High Product Costs and Limited Consumer Awareness

The Pet Oral Care Products Market faces significant challenges due to high product costs and limited consumer awareness, which collectively act as barriers to market expansion. High product costs often deter pet owners from regular purchases, especially in markets where pet healthcare is still gaining recognition. Additionally, the limited awareness among consumers about the necessity and benefits of pet oral care products further restricts market penetration.

These factors combined not only slow down the adoption rate of oral care routines among pet owners but also limit the market’s growth potential. Addressing these issues through educational campaigns and pricing strategies could be pivotal in transforming these restraints into growth opportunities, by increasing consumer engagement and making these products more accessible financially. This dual approach could help expand the market base, as more pet owners recognize the long-term health benefits and cost savings associated with maintaining their pets’ oral hygiene.

Opportunity

Increasing Awareness of Pet Dental Health

The pet oral care market is the increasing awareness among pet owners of the importance of dental health for their animals. Veterinary health professionals and pet advocacy groups are intensifying efforts to educate the public about the consequences of neglecting a pet’s dental care, which can include serious health issues ranging from gingivitis to systemic infections.

As awareness grows, so does the demand for products that can prevent these health issues, contributing directly to the expansion of the pet oral care market. This heightened awareness is expected to propel the adoption of dental-specific products, establishing routine dental care as a norm rather than an exception among pet owners.

Trends

Veterinary-Recommended Products

Pet Oral Care Products Market, a significant trend shaping consumer purchasing behaviors and product development is the escalating demand for veterinary-recommended products. This trend stems from increasing pet owner awareness about the critical role oral health plays in overall pet well-being. As a result, consumers are gravitating towards products endorsed by veterinarians, which are perceived as more reliable and effective.

Manufacturers are responding by collaborating more closely with veterinary professionals to design and test their offerings, ensuring they meet stringent health standards and efficacy claims. These products often incorporate advanced formulations or ingredients that are scientifically proven to reduce plaque, tartar build-up, and gingivitis, which are common issues in pets.

Additionally, the endorsement from veterinary professionals helps brands differentiate themselves in a crowded market, adding a layer of trust and expertise to their product lines. This trend is not only influencing product formulations but also marketing strategies.

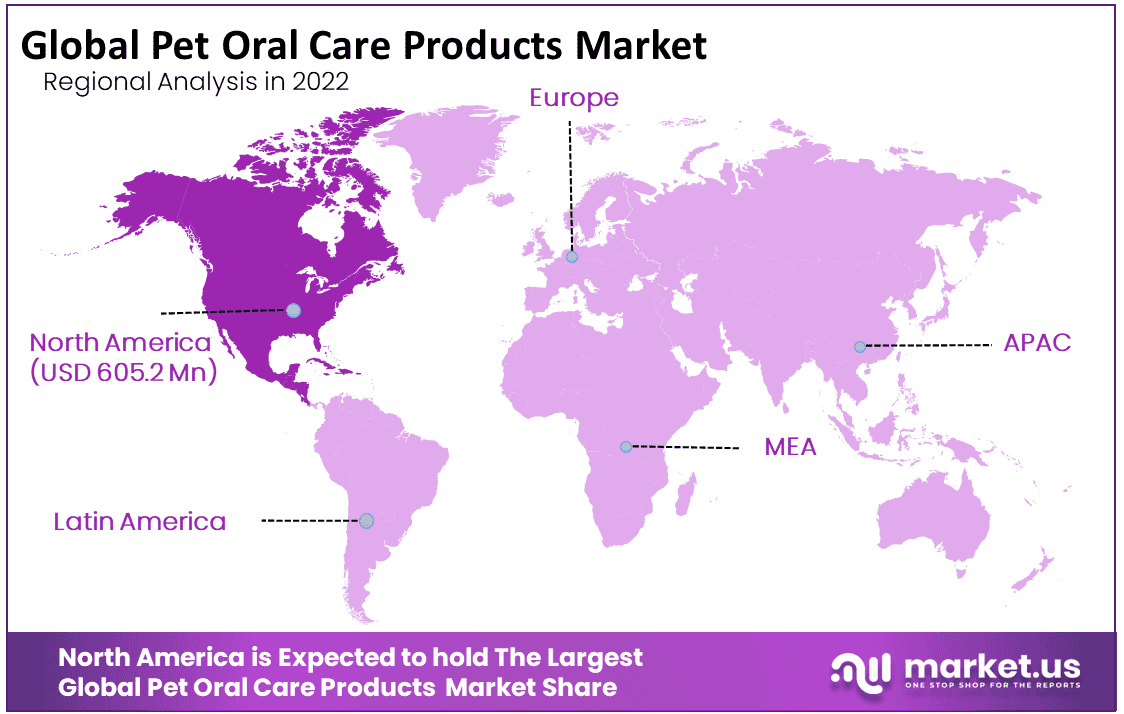

Regional Analysis

In the Pet Oral Care Products Market, North America has emerged as a predominant region, accounting for 35.6% of the global market share. This region’s market value stands at an impressive US$ 605.2 million, underscoring its significant impact on the overall industry landscape.

The robust growth in North America can be attributed to heightened awareness among pet owners about the importance of oral hygiene for animals coupled with a strong presence of major market players who continuously innovate and expand their product lines.

Additionally, the increasing prevalence of dental diseases among pets, especially in dogs and cats, and the subsequent rise in veterinary health expenditures have fueled the demand for pet oral care products. The market in North America is also driven by the growing trend of pet humanization, where pets are increasingly treated as family members.

This shift in perception has led to more attentive care, including regular check-ups and preventive dental care, thereby propelling the market forward. The strategic positioning of these products in veterinary clinics and retail outlets further enhances accessibility and consumer penetration in this region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global Pet Oral Care Products Market is set for continued expansion in 2024, driven by rising pet ownership and increasing awareness of pet health and hygiene. Key players in the market, such as Vetoquinol SA, Virbac SA, and Boehringer Ingelheim International GmbH, leverage their strong pharmaceutical expertise to offer advanced dental care solutions, targeting both preventive and therapeutic needs. Their focus on veterinary recommendations and clinical efficacy places them at the forefront of the market.

Mars, Incorporated, a consumer goods giant with its established pet care brands, including Pedigree and Whiskas, benefits from robust distribution channels and brand recognition. This gives them a competitive edge in scaling pet oral care products to a broad consumer base.

Niche players like Healthymouth LLC and TropiClean Pet Products cater to the growing demand for natural and organic solutions, capitalizing on trends toward cleaner, chemical-free products. Their specialized formulations position them well for consumers seeking holistic care for their pets.

Dechra Pharmaceuticals plc and Ceva Sante Animale S.A. are key in veterinary-specific products, with a strong emphasis on scientific innovation and regulatory compliance. Their close ties with veterinary professionals enable them to drive adoption in clinical settings.

Emerging players like Imrex Inc. and AllAccem, Inc. focus on innovation and technology in oral hygiene, offering products with unique mechanisms or ingredients that differentiate them in the market.

Top Key Players in the Market

- Vetoquimol SA

- Virbac SA

- Boehringer Ingelheim International GmbH

- Healthymouth LLC

- All 4 Pets

- Dechra Pharmaceuticals plc

- TropiClean Pet Products

- Mars, Incorporated

- Imrex Inc.

- Ceva Sante Animale S.A.

- AllAccem, Inc.

- Other Key Players

Recent Developments

- In 2023, Boehringer Ingelheim launched the FRONTLINE Tri-Act® dental formula, which provides dual benefits of flea control and oral care, ensuring overall health in dogs.

- In 2023, Nestlé Purina PetCare introduced a new range of dental chews called Purina DentaLife Advanced, designed to offer comprehensive dental care solutions for dogs and cats by targeting hard-to-reach areas.

- In 2022, Virbac expanded its product line with C.E.T.® VeggieDent® Fr3sh® Tartar Control Chews, aimed at reducing tartar buildup and promoting oral hygiene, while offering natural and healthy ingredients for dogs.

Report Scope:

Report Features Description Market Value (2023) US$ 1,813.9 Mn Forecast Revenue (2032) US$ 3,199.3 Mn CAGR (2023-2032) 6.7% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type- Toothbrush, Toothpaste, Dental Claws, Water Additives, Breath Freshener Spray, Dental Wipes, and Other Product Types; By Pets- Dogs, Cats, Horses, and Other Pets; By Distribution Channel- Veterinary Hospitals, Private Clinics, Home Care, Retail Pharmacies, Online Stores, and Other Distribution Channels Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; The Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Vetoquimol SA, Virbac, Boehringer Ingelheim International GmbH, Healthymouth LLC, All 4 Pets, Dechra Pharmaceuticals plc, TropiClean Pet Products, Mars, Incorporated, Imrex Inc., Ceva Sante Animale S.A., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Pet Oral Care Products MarketPublished date: Oct 2024add_shopping_cartBuy Now get_appDownload Sample

Pet Oral Care Products MarketPublished date: Oct 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Vetoquimol SA

- Virbac SA

- Boehringer Ingelheim International GmbH

- Healthymouth LLC

- All 4 Pets

- Dechra Pharmaceuticals plc

- TropiClean Pet Products

- Mars, Incorporated

- Imrex Inc.

- Ceva Sante Animale S.A.

- AllAccem, Inc.

- Other Key Players