Global Pet Obesity Management Market Report By Product Type (Therapeutic Food, Supplements), By Animal Type (Dogs, Cats, Other Animals), By Treatment Type (Diet Programs, Exercise Programs, Surgical Solutions, Behavioral Therapy), By Distribution Channel (Pet Specialty Stores, E-commerce, Veterinary Clinics, General Retail Stores), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 132124

- Number of Pages: 222

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

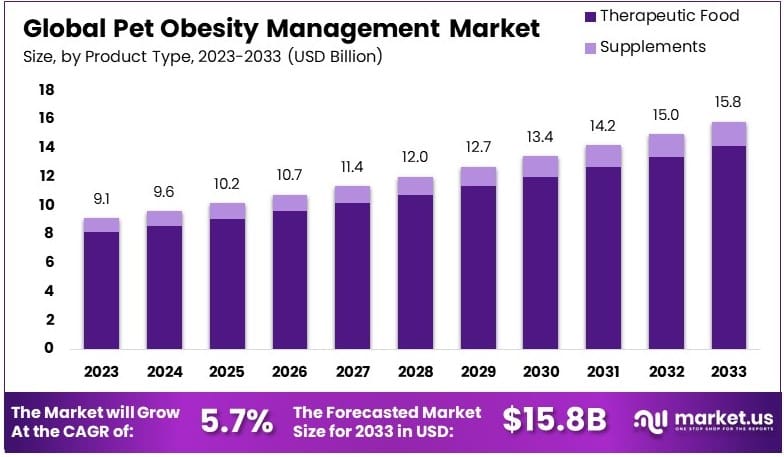

The Global Pet Obesity Management Market size is expected to be worth around USD 15.8 Billion by 2033, from USD 9.1 Billion in 2023, growing at a CAGR of 5.7% during the forecast period from 2024 to 2033.

Pet Obesity Management involves strategies and products aimed at controlling excess weight in pets, including customized exercise plans, dietary recommendations, and medical treatments when necessary. This field is essential for sustaining pets’ health and mitigating risks associated with overweight conditions.

Pet Obesity Management Market comprises a range of products and services designed to address pet obesity. This market segment includes specialty diets, supplements for weight management, veterinary services, and digital tools such as apps and wearables that help monitor pet health.

The significance of Pet Obesity Management is magnified by the rising awareness among pet owners about the health dangers posed by pet obesity. The market benefits from a robust demand for effective weight control solutions, sparking innovation and competitiveness among suppliers.

Despite the high incidence rates of pet obesity, with 59% of dogs and 61% of cats being overweight or obese, recognition by owners is surprisingly low; only 28% of cat owners and 17% of dog owners acknowledge their pets’ excess weight. This discrepancy underscores a substantial market potential for educational and diagnostic interventions.

Shifting pet ownership trends further shape the market landscape. For instance, in the U.S., the number of households owning pets was recorded at 86.9 million in 2023-2024, which represents a slight decrease from 70% of households in 2022 but shows growth from 56% in 1988. This evolving demographic is indicative of changing consumer behaviors, which could influence market strategies.

Meanwhile, the UK experienced a significant uptick in pet ownership, with total pet numbers climbing to 32 million in 2024, up 9% from 2021. This increase, encompassing a variety of pet types, shows a broadening of the market and opens avenues for targeted obesity treatment products tailored to diverse needs.

However, as pet ownership rates stabilize and market saturation approaches, competition among established players and new entrants is expected to intensify. Companies are expected to leverage product differentiation, including innovative weight management solutions and tailored nutrition plans, to gain a competitive edge.

Key Takeaways

- Pet Obesity Management Market was valued at USD 9.1 Billion in 2023, expected to reach USD 15.8 Billion by 2033, with a CAGR of 5.7%.

- In 2023, Therapeutic Food dominated the product type segment with 89.49% due to its effectiveness in managing pet weight.

- In 2023, Dogs led the animal type segment, attributed to higher obesity rates among this group.

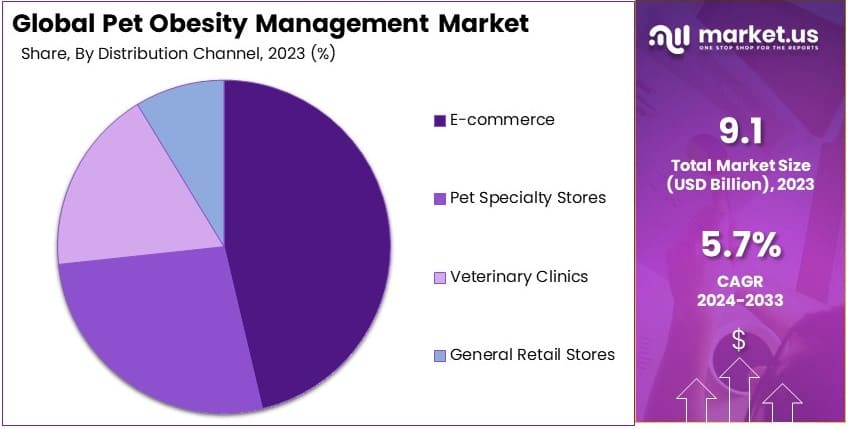

- In 2023, E-commerce dominated the distribution channel, driven by convenience and product availability for consumers.

- In 2023, Diet Programs held significant market share in treatment type, emphasizing non-invasive obesity management solutions.

- In 2023, North America led the market with 38.7% due to advanced pet healthcare infrastructure and high pet ownership rates.

Type Analysis

Therapeutic Food Dominates with 89.49% Due to High Efficacy in Managing Pet Obesity

In the Pet Obesity Management Market, the “Type” segment is primarily led by therapeutic food, capturing a dominant 89.49% share. This predominance is largely due to its effectiveness in addressing the specific dietary needs of overweight pets.

Therapeutic pet food is specially formulated to provide all necessary nutrients while managing caloric intake, making it an essential tool in combatting pet obesity. Veterinarians frequently recommend these foods as they are scientifically proven to help reduce weight safely and maintain overall health.

Supplements, the other sub-segment within this category, play a supportive role in obesity management. They are used to complement the diet with additional nutrients that support metabolic health and weight management.

While not as dominant as therapeutic food, supplements are crucial for complete nutritional profiles, especially in cases where pets may have specific deficiencies or health concerns that diet alone cannot address.

Animal Type Analysis

Dogs Lead in the Pet Obesity Management Market

In the “Animal Type” segment, dogs represent the largest sub-segment. The prevalence of obesity in dogs, combined with their owners’ willingness to invest in specialized dietary plans, drives significant demand for obesity management solutions.

This trend is supported by an increasing awareness among pet owners about the health risks associated with obesity, such as diabetes and joint problems, which further stimulates the market for dog-specific obesity management products.

Cats also hold a considerable share of the market, with dietary needs that differ from dogs due to their distinct physiological makeup. Cat-specific products are designed to address these differences, focusing on factors like lower carbohydrate content and higher protein levels to aid in weight management.

Other animals, including birds, small mammals, and reptiles, constitute a smaller but growing segment. These species require tailored solutions that account for their unique dietary and metabolic needs, providing growth opportunities within the niche markets of the pet obesity management industry.

Treatment Type Analysis

Diet Programs Are the Most Effective Treatment Type for Managing Pet Obesity

Among treatment types, diet programs are the most prevalent method for managing pet obesity. These programs are tailored to the specific needs of the pet, considering factors like age, health status, and breed.

Customized diet plans not only ensure that pets receive the appropriate caloric intake but also adjust nutrient levels to support overall health and weight loss. This customization is key to the success of diet programs, making them a cornerstone of obesity management strategies.

Exercise programs complement diet plans by helping to increase energy expenditure. Tailored exercise routines are especially important for pets that do not naturally engage in sufficient physical activity. These programs often include activities that are enjoyable for the pet, like using pet toys, encouraging regular participation.

Surgical solutions and behavioral therapies are less common but vital for certain cases. Surgical interventions might be considered for severe obesity where other methods have failed, while behavioral therapies can help address the habits contributing to weight gain, such as overeating or inactivity.

Distribution Channel Analysis

E-commerce Dominates Distribution Channel Due to Convenience and Broad Product Availability

E-commerce leads the distribution channels in the Pet Obesity Management Market due to its convenience and the wide availability of products it offers. Online platforms cater to a growing consumer preference for shopping from home, providing access to a vast array of products across different brands and price points.

Detailed product information, customer reviews, and easy comparison tools enhance the shopping experience, making it more likely for pet owners to find suitable obesity management solutions online.

Pet specialty stores are crucial for providing expert advice and immediate product availability. These stores often offer personalized service, helping pet owners make informed decisions about the best products for their pets’ specific needs.

Veterinary clinics are key points of sale for therapeutic foods and supplements, as they provide direct recommendations based on the pet’s health assessment. General retail stores offer convenience but typically have a more limited selection, focusing on mass-market products rather than specialized obesity management solutions.

Key Market Segments

By Product Type

- Therapeutic Food

- Supplements

By Animal Type

- Dogs

- Cats

- Other Animals

By Treatment Type

- Diet Programs

- Exercise Programs

- Surgical Solutions

- Behavioral Therapy

By Distribution Channel

- Pet Specialty Stores

- E-commerce

- Veterinary Clinics

- General Retail Stores

Drivers

Increasing Pet Ownership Rates Drives Market Growth

The surge in pet ownership globally significantly propels the Pet Obesity Management Market. As more households welcome pets, the demand for products and services that ensure their well-being rises. Additionally, urbanization has led to smaller living spaces, making pet owners more conscious of their pets’ health to prevent obesity-related issues.

Furthermore, demographic shifts, such as the increase in single-person households, contribute to higher pet adoption rates. This trend is particularly noticeable among millennials, who view pets as integral family members. Consequently, the market experiences sustained growth as manufacturers and service providers cater to the expanding pet population.

Moreover, cultural shifts that emphasize the importance of pet health and longevity encourage owners to invest in obesity management solutions. These factors collectively enhance market opportunities, driving innovation and increasing the availability of specialized products tailored to pet health needs.

Restraints

High Cost of Pet Obesity Management Solutions Restraints Market Growth

The elevated costs associated with pet obesity management pose significant challenges to market expansion. Many pet owners find it financially burdensome to invest in specialized diets, veterinary consultations, and fitness equipment for their pets. Additionally, the premium pricing of advanced nutritional products and weight management programs limits accessibility for a broader audience.

Furthermore, the lack of affordable options in the market deters potential customers from seeking professional help, thereby restricting market penetration. This financial barrier is exacerbated in regions with lower disposable incomes, where pet owners prioritize basic needs over specialized health solutions.

Consequently, the high cost of these services and products acts as a deterrent, slowing down the overall growth of the Pet Obesity Management Market. Addressing these cost-related challenges through affordable pricing strategies and scalable solutions is essential for overcoming this restraint and fostering broader market adoption.

Opportunity

Expansion of Online Retail Channels Provides Opportunities

E-commerce platforms offer pet owners convenient access to a wide range of obesity management products, including specialized diets, supplements, and fitness equipment. Additionally, the rise of pet subscription box for pet food and wellness products ensures consistent revenue streams for businesses.

Furthermore, online marketplaces enable manufacturers to reach a global audience, expanding their customer base beyond traditional geographic limitations. This digital shift also facilitates personalized marketing strategies, allowing companies to tailor their offerings based on consumer behavior and preferences.

Moreover, the integration of advanced technologies such as artificial intelligence and data analytics in online platforms enhances the shopping experience, making it easier for pet owners to find suitable solutions for their pets’ health needs.

Consequently, the growth of online retail channels not only increases market accessibility but also drives innovation and competition, fostering a more dynamic and responsive Pet Obesity Management Market.

Challenges

Resistance to Behavioral Change in Pet Owners Challenges Market Growth

Resistance to behavioral change among pet owners presents a significant challenge to the growth of the Pet Obesity Management Market. Many owners are accustomed to their pets’ existing feeding and exercise routines, making it difficult to adopt new, healthier practices.

Additionally, the lack of awareness or understanding of the long-term health risks associated with pet obesity further exacerbates this resistance.

Behavioral inertia often leads to inconsistent adherence to prescribed diets and fitness regimes, undermining the effectiveness of obesity management solutions. Moreover, emotional attachments to certain types of pet food or reluctance to alter established habits contribute to the difficulty in implementing necessary changes.

This challenge is compounded by the limited availability of educational resources that highlight the benefits of maintaining a healthy weight for pets. Consequently, overcoming resistance to behavioral change requires comprehensive education campaigns, user-friendly solutions, and ongoing support to encourage pet owners to prioritize their pets’ health and adopt sustainable obesity management practices.

Growth Factors

Increasing Investment in Pet Care Industry Are Growth Factors

Venture capitalists and private equity firms are channeling significant funds into startups and established companies that offer innovative solutions for pet health and wellness. This influx of capital facilitates research and development, leading to the creation of advanced products and services tailored to manage pet obesity effectively.

Additionally, increased investment supports the expansion of manufacturing capabilities and distribution networks, ensuring that high-quality obesity management solutions reach a broader audience.

Collaborations and partnerships between investors and industry players also drive market growth by fostering the development of comprehensive health management platforms that integrate various aspects of pet care.

Moreover, government incentives and grants aimed at promoting pet health initiatives further enhance investment attractiveness, encouraging more stakeholders to enter the market. Consequently, the rising investment in the pet care sector not only accelerates the development of innovative obesity management solutions but also strengthens the overall market infrastructure.

Emerging Trends

Popularity of Wearable Devices for Pets Is Latest Trending Factor

The popularity of wearable devices for pets is one of the latest trending factors driving the Pet Obesity Management Market. These devices enable pet owners to monitor their pets’ physical activities and health metrics in real-time, providing valuable insights into their daily routines.

Additionally, pet wearables offers features such as GPS tracking, activity monitoring, and sleep analysis, which help in identifying and addressing obesity-related issues effectively.

The integration of these devices with mobile apps allows for seamless data synchronization and personalized health recommendations, enhancing the overall management experience. Furthermore, advancements in sensor technology have made these wearables more accurate and user-friendly, increasing their adoption among tech-savvy pet owners.

The ability to track progress and receive actionable feedback encourages consistent engagement with obesity management programs, leading to better health outcomes for pets. Consequently, the rising trend of wearable devices not only boosts market growth but also fosters innovation.

Regional Analysis

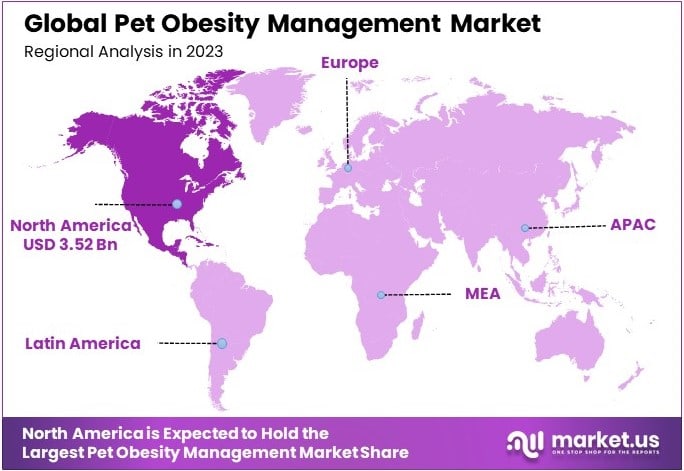

North America Dominates with 38.7% Market Share

North America leads the Pet Obesity Management Market with a 38.7% share, amounting to USD 3.52 billion. This dominance is driven by high pet ownership rates, an increasing focus on pet health, and access to advanced veterinary services. The region’s strong consumer spending on premium pet wellness products further supports this market presence.

North America benefits from a well-established pet care infrastructure and a culture that prioritizes pet health. This environment enables widespread access to weight management products and services. Additionally, the trend toward treating pets as family members (“humanization”) drives demand for specialized obesity solutions, supported by leading brands and veterinary clinics.

North America’s influence in the global Pet Obesity Management Market is expected to continue. Innovation in pet health solutions and ongoing awareness campaigns around pet obesity will strengthen the region’s market position. New product development in the pet health sector is likely to reinforce this regional dominance.

Regional Mentions:

- Europe: Europe holds a solid position in the Pet Obesity Management Market, supported by growing pet health awareness. A significant number of pet owners, especially in Western Europe, are investing in premium weight management products, often recommended by veterinarians, driving steady growth.

- Asia Pacific: Asia Pacific is an emerging region in the pet obesity market, fueled by increasing pet ownership and middle-class growth in urban areas. Local and international brands are expanding to meet the demand for affordable, quality pet health solutions.

- Middle East & Africa: The Middle East & Africa market is at an early stage, with limited awareness but increasing interest in pet obesity management. Urbanization and rising pet ownership in select cities are encouraging gradual adoption of premium pet care products.

- Latin America: Latin America shows moderate growth, driven by rising pet ownership and awareness about pet health. Urban centers, especially in Brazil and Mexico, see a growing demand for obesity management solutions, though affordability remains a key consideration.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Pet Obesity Management Market features prominent players focused on addressing pet obesity through specialized products and services. Leading companies in this market—Nestlé Purina PetCare, Mars Petcare (Royal Canin), Hill’s Pet Nutrition, and Blue Buffalo—are instrumental in driving innovation and meeting the rising demand for pet weight management solutions. Each company brings a unique approach, combining scientific research, product variety, and extensive distribution channels to capture market share.

Nestlé Purina PetCare emphasizes advanced nutritional solutions tailored to different pet needs. With a focus on quality and research, Purina leverages its expertise to develop weight control formulas that prioritize pet health. Their offerings often highlight balanced nutrients and ingredients that support weight management, attracting pet owners concerned with long-term health.

Mars Petcare, through its Royal Canin brand, is recognized for its specialized veterinary diets targeting various health issues, including obesity. By collaborating closely with veterinarians, Royal Canin produces formulations tailored to specific weight and metabolic needs. This focus on veterinary partnerships and scientifically backed diets strengthens Mars Petcare’s competitive edge in the pet obesity management market.

Hill’s Pet Nutrition has built a strong brand reputation with its Prescription Diet line, widely used for weight management in pets. Hill’s leverages research and clinical studies to create products that address obesity and associated health issues. This evidence-based approach has made Hill’s a trusted name among pet owners and veterinarians alike, solidifying its market position.

Blue Buffalo caters to health-conscious pet owners with its Natural Veterinary Diet and weight management products. Known for using high-quality, natural ingredients, Blue Buffalo appeals to a segment of the market prioritizing wholesome nutrition. Their focus on natural, grain-free, and protein-rich products differentiates them and captures a growing demand for healthier pet food solutions.

These companies collectively shape the pet obesity management landscape, offering specialized products that support the industry’s growth and address rising concerns over pet obesity. Their focus on research, quality, and specialized diets establishes them as key players driving value in this market.

Top Key Players in the Market

- Nestlé Purina PetCare

- Mars Petcare (Royal Canin)

- Hill’s Pet Nutrition

- Blue Buffalo

- The J.M. Smucker Company (Nutrish)

- Petco Animal Supplies, Inc.

- Virbac

- Dechra Pharmaceuticals

- Zoetis Inc.

- Elanco Animal Health

- PetIQ

- VCA Animal Hospitals

- Nulo Pet Food

- Farmina Pet Foods

- NutriSource Pet Foods

Recent Developments

- Dog Standards: On October 2024, Dog Standards launched a Topper program to combat pet obesity, noting that 59% of dogs are classified as overweight or obese. This initiative provides human-grade, gently cooked nutrition to supplement dogs’ regular meals, crafted by veterinary nutritionists to optimize nutrient intake without overfeeding, aimed at reducing obesity-related health risks such as cancer.

- PlantX Life Inc. and LIV3: On October 2024, PlantX Life Inc. entered into a joint venture with LIV3 to introduce the SugarShield supplement, targeting the $5.24 billion weight management market. PlantX will manage the design and e-commerce platform for SugarShield, while LIV3 handles product supply, with profits split equally between the partners.

- Pets at Home: On August 2024, Pets at Home opened a new £1 million integrated care center in Brentford, West London. This center, part of a trial for new “concept” facilities, features a revamped Vets for Pets practice, an extended health center, grooming room, and nutrition hub, with further openings planned in Hull, Kettering, and New Malden.

- Hill’s Pet Nutrition: On January 2024, Hill’s Pet Nutrition unveiled enhancements to its Prescription Diet product line, improving palatability and scientific formulation for pets with specific health needs. The updates include food for dogs with fat sensitivities and urinary health, and stress management diets for cats, developed using Hill’s Science of Taste technology.

Report Scope

Report Features Description Market Value (2023) USD 9.1 Billion Forecast Revenue (2033) USD 15.8 Billion CAGR (2024-2033) 5.7% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Therapeutic Food, Supplements), By Animal Type (Dogs, Cats, Other Animals), By Treatment Type (Diet Programs, Exercise Programs, Surgical Solutions, Behavioral Therapy), By Distribution Channel (Pet Specialty Stores, E-commerce, Veterinary Clinics, General Retail Stores) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Nestlé Purina PetCare, Mars Petcare (Royal Canin), Hill’s Pet Nutrition, Blue Buffalo, The J.M. Smucker Company (Nutrish), Petco Animal Supplies, Inc., Virbac, Dechra Pharmaceuticals, Zoetis Inc., Elanco Animal Health, PetIQ, VCA Animal Hospitals, Nulo Pet Food, Farmina Pet Foods, NutriSource Pet Foods Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Pet Obesity Management MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample

Pet Obesity Management MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Nestlé Purina PetCare

- Mars Petcare (Royal Canin)

- Hill's Pet Nutrition

- Blue Buffalo

- The J.M. Smucker Company (Nutrish)

- Petco Animal Supplies, Inc.

- Virbac

- Dechra Pharmaceuticals

- Zoetis Inc.

- Elanco Animal Health

- PetIQ

- VCA Animal Hospitals

- Nulo Pet Food

- Farmina Pet Foods

- NutriSource Pet Foods