Global People Counting System Market By Technology (Infrared Beam , Video-based, Thermal Imaging, Other Technologies), By End-User (Retail, Transportation, Hospitality, Healthcare, Sports and Entertainment, Other End-Users), By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: May 2023

- Report ID: 30450

- Number of Pages: 251

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

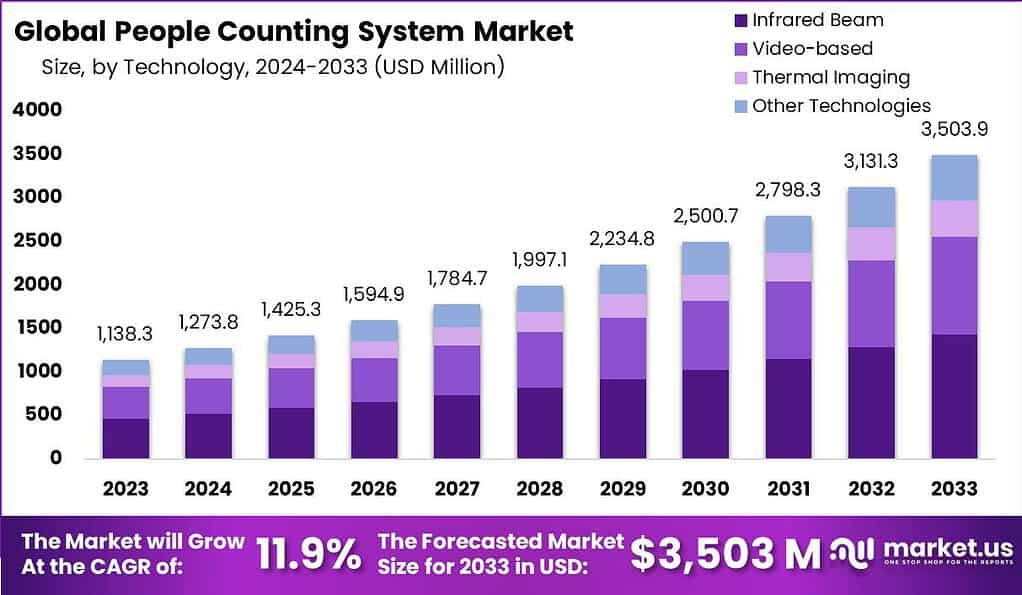

The Global People Counting System Market size is expected to be worth around USD 3,503.9 Million by 2033, from USD 1,138.9 Million in 2023, growing at a CAGR of 11.9% during the forecast period from 2024 to 2033.

People counting systems are technology solutions designed to accurately track and count the number of individuals entering or exiting a specific area or premises. These systems utilize various technologies such as video cameras, thermal sensors, and infrared beams to capture data and provide valuable insights on foot traffic patterns. The people counting system market refers to the industry involved in developing, manufacturing, and deploying these systems to meet the needs of different sectors.

The people counting system market has witnessed significant growth in recent years, driven by several factors. One of the key factors is the increasing need for accurate and real-time data on foot traffic. Organizations across various industries, including retail, transportation, hospitality, and entertainment, rely on this data to optimize operations, improve customer experiences, and make informed business decisions.

Transportation hubs such as airports, train stations, and bus terminals utilize people counting systems to manage crowd flow, enhance security measures, and optimize resource allocation. By accurately monitoring passenger numbers, these systems enable authorities to implement effective crowd management strategies, ensure passenger safety, and improve overall operational efficiency.

The people counting system market presents various opportunities for industry players. There is a growing demand for advanced technologies such as computer vision and artificial intelligence (AI) in people counting systems. Integration with other systems, such as access control or customer relationship management (CRM) platforms, can provide comprehensive insights and enable further automation and optimization.

Key Takeaways

- The Global People Counting System Market size is expected to reach USD 3,503.9 Million by 2033, projected at a CAGR of 11.9%

- In 2023, the Infrared Beam segment held a dominant position in the People Counting System Market, capturing more than a 41% share.

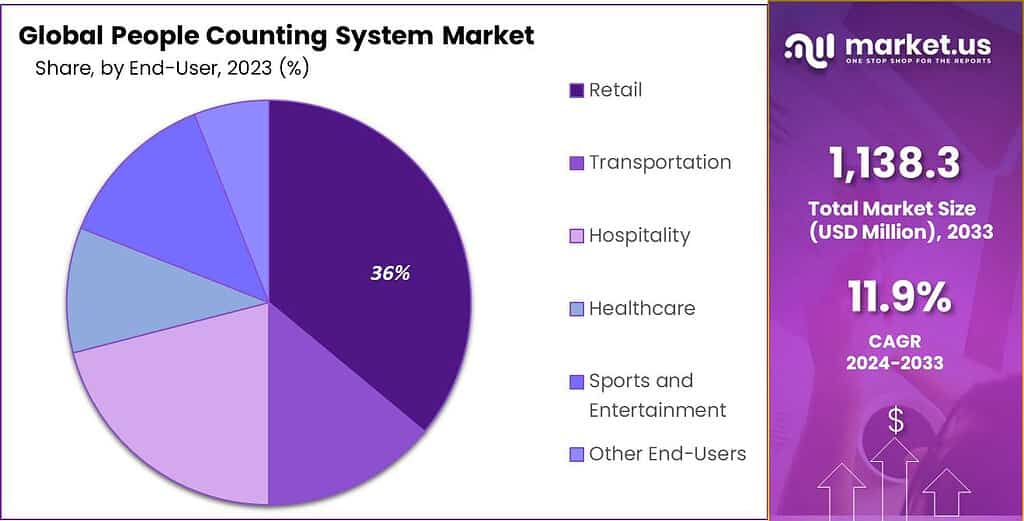

- In 2023, the Retail segment held a dominant market position in the People Counting System Market, capturing more than a 36% share.

- In 2023, North America held a dominant market position in the People Counting System Market, capturing more than a 30% share.

- A significant number of retailers are embracing the use of people counting systems in their operations. About 67% of retailers are planning to put these systems in place by 2023 to better understand customer behavior, improve the shopping experience, and efficiently manage staff levels.

- For 52% of businesses, integrating people counting systems with existing video surveillance technology is a key focus in 2023. This integration aims to bolster security measures while simultaneously providing valuable operational insights.

- In the hospitality sector, there’s an anticipated growth of 28% in the adoption of people counting systems in 2023. The drive behind this increase is the need for effective occupancy monitoring and crowd management to enhance guest experiences.

- Looking ahead to 2024, the demand for people counting systems equipped with advanced analytics, such as heat mapping and dwell time analysis, is expected to surge by 35%. These capabilities offer businesses deeper insights into customer engagement and space utilization.

- Transportation hubs are also not left behind, with a projected increase of 40% in the use of people counting systems by 2024. The growth is primarily fueled by the need to manage passenger flows more effectively and enhance security protocols.

- The healthcare industry is anticipated to see a 25% increase in the adoption of people counting systems in 2024. These systems are crucial for managing patient flow and ensuring adherence to social distancing guidelines effectively.

- Thermal imaging-based people counting systems, known for their contactless and accurate counting capabilities, are expected to witness a growth of 20% in 2023. This technology is especially relevant in today’s health-conscious environment.

- Lastly, the demand for people counting systems that utilize multi-sensor fusion technology, combining video analytics and infrared sensors, is projected to grow by 28% in 2024. This reflects a growing trend towards more sophisticated and integrated solutions for people counting and space analytics

Technology Analysis

In 2023, the Infrared Beam segment held a dominant position in the People Counting System Market, capturing more than a 41% share. This leading status can be attributed to the segment’s high accuracy, cost-effectiveness, and the ability to function effectively in diverse environmental conditions.

Infrared beam technology, by virtue of its non-intrusive nature and ease of installation, has become a preferred choice for enterprises looking to monitor foot traffic without compromising on privacy or spatial aesthetics. Its widespread application in sectors such as retail, transportation, and public venues underscores its pivotal role in the overarching market.

The predominance of the Infrared Beam technology in the People Counting System Market is further bolstered by its evolution and integration with advanced analytics. Businesses leverage these systems not just for counting people but also for gaining insights into customer behaviors, peak traffic times, and space utilization. This dual utility enhances operational efficiencies and strategic decision-making.

Furthermore, with technological advancements reducing the cost of sensors and associated hardware, the adoption rate of infrared beam-based counting solutions has seen a significant upswing. This trend is reflective of a broader market preference for reliable, unobtrusive, and economically viable people counting solutions.

End-User Analysis

In 2023, the Retail segment held a dominant market position in the People Counting System Market, capturing more than a 36% share. This prominence is primarily due to the critical role such technologies play in optimizing store performance, enhancing customer experience, and increasing operational efficiency.

Retailers employ people counting systems to track foot traffic, understand shopper behavior, and manage queues effectively, thereby enabling more strategic floor management and staffing. The deployment of these systems aids in analyzing peak shopping hours, optimizing store layouts, and assessing the effectiveness of marketing campaigns, making them indispensable tools for retail management.

The leadership of the Retail segment is further reinforced by the sector’s rapid adoption of data-driven decision-making processes. In an era where retail competition is intensifying, both in physical stores and online, the ability to gather and analyze shopper data in real-time has become a significant competitive advantage.

People counting systems provide retailers with actionable insights into customer preferences and patterns, facilitating personalized marketing strategies and improving customer satisfaction. Additionally, the integration of people counting technologies with other retail analytics tools has enabled retailers to achieve a holistic view of store performance, enhancing overall profitability.

Key Market Segments

By Technology

- Infrared Beam

- Video-based

- Thermal Imaging

- Other Technologies

By End-User

- Retail

- Transportation

- Hospitality

- Healthcare

- Sports and Entertainment

- Other End-Users

Driver

The rise in the use of people counting systems to enhance marketing efficacy.

The global market for people counting systems is experiencing substantial growth, primarily driven by the increasing adoption of these systems across various industries. Key sectors include retail, transportation, and corporate, among others, where people counting technologies such as video-based systems, thermal imaging, and infrared beams are utilized.

The expansion of this market is further propelled by the need for businesses to monitor daily customer visits, manage resources efficiently, and enhance customer experiences. The integration of advanced technologies like AI and machine learning with these systems allows for in-depth retail analytics, queue management, and optimization of staff and space utilization. The aim to track marketing effectiveness and improve operational efficiencies significantly contributes to the adoption rate of people counting systems, with a notable impact on market growth.

Restraint

The escalation of privacy concerns due to the deployment of video-based people counting technologies.

Despite the benefits, the market faces challenges, particularly regarding privacy concerns associated with video-based counting systems. The capability of these systems to provide detailed analytics on customer behavior and movements has raised privacy issues, deterring some potential users.

The tension between leveraging advanced technology for business intelligence and ensuring individual privacy remains a significant concern, potentially impeding market growth. The apprehension about privacy infringement is a critical restraint that market participants need to address to maintain the momentum of people counting system adoption.

Opportunity

The increasing implementation of people counting systems within work environments.

Workspaces present a significant opportunity for the application of people counting systems. These technologies are increasingly being deployed in corporate environments to manage space efficiently, enhance security, and optimize resource allocation based on accurate occupancy data.

The ability of people counting systems to provide real-time data on space usage helps businesses in decision-making processes related to facility management and operational planning. As workspaces evolve with the integration of smart technologies, the demand for sophisticated people counting solutions is expected to rise, offering substantial market opportunities.

Challenge

The variation in store metrics curtails the efficiency of video-based counting systems.

One of the primary challenges in the people counting system market is the limitation posed by differential store metrics on the effectiveness of video-based counters. Video-based systems, while offering high accuracy in people counting and analytics, may not always align with the specific metrics or KPIs relevant to different retail environments.

This discrepancy can affect the utility and perceived value of such systems, as businesses seek tailored solutions that directly impact their operational goals and customer engagement strategies. The challenge lies in developing adaptable and flexible counting systems that can accommodate the diverse needs of retailers, ensuring relevance and effectiveness across various store formats.

Growth Factors

The People Counting System Market is witnessing significant growth, driven by several key factors:

- Technological Advancements: Innovations in AI, machine learning, and analytics integration enhance the accuracy and capabilities of people counting systems. These advancements support diverse applications, from retail analytics to space optimization.

- Increased Demand for Retail Analytics and Customer Insights: Retailers are leveraging people counting systems to gain insights into customer behavior, optimize store layouts, and improve customer service. The data obtained aids in strategic decision-making and marketing effectiveness.

- Smart City Initiatives: The integration of people counting systems in transportation, public spaces, and municipal facilities supports smart city developments. These systems help manage crowd control, enhance public safety, and improve urban planning efforts.

- Focus on Operational Efficiency: In sectors such as transportation and corporate environments, people counting systems facilitate efficient resource allocation, space management, and safety enhancements, contributing to operational improvements.

Emerging Trends

The market for People Counting Systems is also shaped by emerging trends:

- Integration with IoT and Smart Infrastructure: The convergence of people counting systems with IoT devices and smart infrastructure enables more sophisticated management of spaces and resources. This integration offers real-time analytics and connectivity, enhancing the utility and application of counting systems across industries.

- Adoption in Workspaces for Occupancy Analytics: With the evolving dynamics of workspaces, including the rise of hybrid work models, there’s an increasing trend towards using people counting systems for occupancy analytics. These systems help organizations optimize office space usage and enhance employee experiences.

- Privacy-preserving Technologies: In response to privacy concerns, especially related to video-based systems, there’s a trend towards developing privacy-preserving counting technologies. These innovations aim to balance the need for accurate data collection with respect for individual privacy.

- Customization and Flexibility: The demand for customizable solutions that can adapt to specific industry needs is rising. Businesses seek people counting systems that can be tailored to their unique metrics and analytics requirements, indicating a trend towards more flexible and adaptable technologies.

Use Cases

The deployment of people counting systems across various industries showcases their versatility and the value they add in different contexts. Here are several use cases illustrating the applications and benefits of these technologies:

- Retail Analytics and Store Optimization: In the retail sector, people counting systems are instrumental in analyzing foot traffic, tracking customer movements within the store, and identifying peak shopping hours. This data helps retailers optimize store layouts, improve staffing decisions, and enhance the overall shopping experience. For instance, understanding traffic patterns can inform the placement of high-demand products to increase sales.

- Workspace Management: With the rise of flexible working arrangements, these systems help manage office spaces more efficiently. By monitoring occupancy levels, companies can optimize the use of meeting rooms, workstations, and common areas. This application is particularly relevant for adapting to hybrid work models, where the demand for office space fluctuates.

- Public Safety and Crowd Management: During events or in public transportation hubs, people counting systems contribute to safety by monitoring crowd density in real-time. This capability allows for the timely management of crowd flow and can prevent overcrowding, enhancing public safety and ensuring compliance with capacity regulations.

- Energy Efficiency: In buildings and facilities, integrating people counting systems with HVAC (heating, ventilation, and air conditioning) systems can lead to significant energy savings. By adjusting heating and cooling based on actual occupancy, buildings can operate more sustainably, reducing energy consumption and costs.

- Transportation and Infrastructure Planning: For transportation authorities, understanding passenger flow is crucial for service planning and infrastructure development. People counting systems in train stations, airports, and bus terminals provide data that can inform schedule adjustments, route planning, and the allocation of resources to improve passenger experience and operational efficiency .

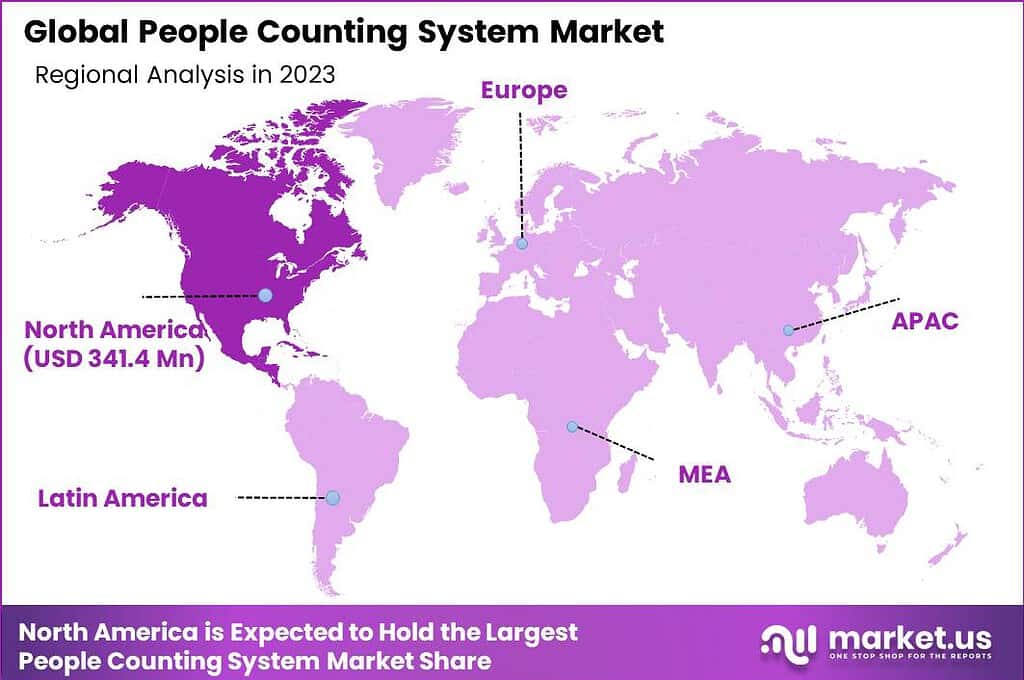

Regional Analysis

In 2023, North America held a dominant market position in the People Counting System Market, capturing more than a 30% share. This leadership can be attributed to the region’s rapid technological advancements, high adoption of smart retail solutions, and the significant presence of leading market players.

The demand for People Counting System in North America was valued at USD 341.4 billion in 2023 and is anticipated to grow significantly in the forecast period. North America’s emphasis on enhancing customer experiences in retail, transportation, and public spaces has driven the adoption of people counting systems. These systems are integral to gathering insights on foot traffic, optimizing operational efficiency, and improving safety protocols.

The robust infrastructure for technological innovation in the region, coupled with a strong emphasis on data-driven decision-making across various sectors, has propelled the market forward. The North American market benefits from a mature retail industry that is quick to adopt new technologies for competitive advantage. Retailers in this region utilize people counting systems not only for tracking footfall but also for tailoring marketing strategies, optimizing store layouts, and managing staffing needs more effectively.

Additionally, the growing focus on smart cities and intelligent transportation systems in North America has further bolstered the demand for accurate and reliable people counting solutions. These initiatives aim to enhance public transportation systems, improve public safety, and manage crowds in urban areas, underscoring the technology’s versatility and importance.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the People Counting System Market, several key players dominate, contributing to the market’s growth and innovation. These companies have established a significant presence globally due to their technological advancements, comprehensive product offerings, and strategic initiatives. Understanding the roles and contributions of these key players is essential for analyzing the market dynamics.

Top Key Players

- FLIR Systems Inc.

- Axis Communications AB

- Hikvision Digital Technology Co. Ltd.

- DILAX Intelcom GmbH

- RetailNext Inc.

- Countwise LLC

- Irisys (a Fluke company)

- V-Count

- ShopperTrak (part of Sensormatic Solutions)

- InfraRed Integrated Systems Ltd. (IRISYS)

- Traf-Sys Inc.

- Eurotech S.p.A.

- Other Key Players

Recent Developments

- In January 2024, Euclid Analytics, a leading provider of people counting and analytics solutions, was acquired by Sensormatic Solutions (a subsidiary of Johnson Controls) for ~$152.1 million, strengthening Sensormatic’s portfolio in retail analytics.

- Xovis AG, a Swiss company specializing in people counting solutions, recently unveiled the Xovis 3D Sphere in the first quarter of 2023. This innovative 3D sensor leverages advanced depth perception technology to enhance the accuracy of counting and tracking individuals

- In November 2022, Axis Communications AB introduced new functionality to its AXIS P8815-2 3D People Counter, incorporating tailgating detection to alert if more than one person enters a space within a set time interval.

Report Scope

Report Features Description Market Value (2023) US$ 1,138.3 Mn Forecast Revenue (2033) US$ 3,503.9 Mn CAGR (2024-2033) 11.9% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Technology (Infrared Beam , Video-based, Thermal Imaging, Other Technologies), By End-User (Retail, Transportation, Hospitality, Healthcare, Sports and Entertainment, Other End-Users) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape FLIR Systems Inc., Axis Communications AB, Hikvision Digital Technology Co. Ltd., DILAX Intelcom GmbH, RetailNext Inc., Countwise LLC, Irisys (a Fluke company), V-Count, ShopperTrak (part of Sensormatic Solutions), InfraRed Integrated Systems Ltd. (IRISYS), Traf-Sys Inc., Eurotech S.p.A., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is a people counting system, and how does it work?A people counting system is a technology used to monitor and track the number of individuals entering, exiting, or passing through a specific area or space. It typically employs sensors, cameras, or other devices to detect and count people accurately.

How big is People Counting System Market?The Global People Counting System Market size is expected to be worth around USD 3,503.9 Million by 2033, from USD 1,138.9 Million in 2023, growing at a CAGR of 11.9% during the forecast period from 2024 to 2033.

Which region will lead the people counting system market?In 2023, North America held a dominant market position in the People Counting System Market, capturing more than a 30% share.

What are the main applications of people counting systems?People counting systems find applications across various industries, including retail, transportation, hospitality, healthcare, and entertainment venues. They are used for crowd management, foot traffic analysis, retail analytics, security monitoring, and optimizing resource allocation.

What factors are driving the growth of the people counting system market?The growth of the people counting system market is driven by factors such as increasing demand for retail analytics, growing emphasis on security and safety measures, rising adoption of smart infrastructure solutions, and the need for real-time insights into customer behavior and foot traffic patterns.

Who are the key players in the people counting system market?Some key players operating in the people counting system market include FLIR Systems Inc., Axis Communications AB, Hikvision Digital Technology Co. Ltd., DILAX Intelcom GmbH, RetailNext Inc., Countwise LLC, Irisys (a Fluke company), V-Count, ShopperTrak (part of Sensormatic Solutions), InfraRed Integrated Systems Ltd. (IRISYS), Traf-Sys Inc., Eurotech S.p.A., Other Key Players

People Counting System MarketPublished date: May 2023add_shopping_cartBuy Now get_appDownload Sample

People Counting System MarketPublished date: May 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- FLIR Systems Inc.

- Axis Communications AB

- Hikvision Digital Technology Co. Ltd.

- DILAX Intelcom GmbH

- RetailNext Inc.

- Countwise LLC

- Irisys (a Fluke company)

- V-Count

- ShopperTrak (part of Sensormatic Solutions)

- InfraRed Integrated Systems Ltd. (IRISYS)

- Traf-Sys Inc.

- Eurotech S.p.A.

- Other Key Players