Global Pea Protein Market Size, Share, Business Environment Analysis By Product (Isolates, Concentrates, Textured, Hydrolysates), By Form (Dry, Wet), By Source (Yellow Split Peas, Others), By Nature (Organic, Conventional), By Application (Food and Beverages, Personal Care and Cosmetics, Animal Feed, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 136253

- Number of Pages: 362

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

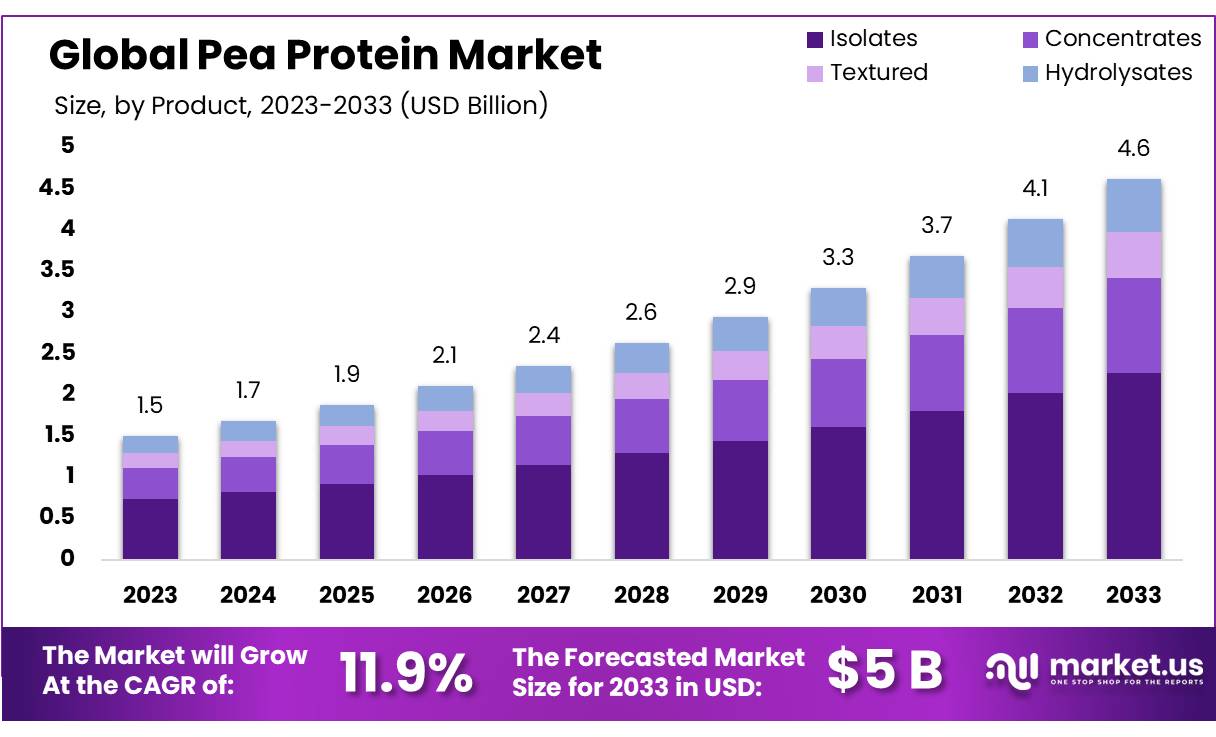

The Global Pea Protein Market size is expected to be worth around USD 4.6 Bn by 2033, from USD 1.5 Bn in 2023, growing at a CAGR of 11.9% during the forecast period from 2024 to 2033.

Pea protein is a high-quality plant-based protein derived from yellow peas (Pisum sativum), commonly used as a protein supplement in various foods and beverages. It is rich in essential amino acids, making it a complete protein source, particularly for vegans and vegetarians. Unlike some plant-based proteins, pea protein is allergen-friendly and is often preferred by individuals with allergies to soy, dairy, or gluten. It is commonly used in protein powders, meat alternatives, plant-based milk, and nutritional bars.

In 2023, the European Commission announced an investment of EUR 20 million in research for plant-based protein development, including pea protein. Similarly, the U.S. Department of Agriculture (USDA) has been supporting plant-based protein initiatives under the 2023 Agricultural Innovation Agenda, with an allocation of USD 5 million for plant-based protein research, including pea protein.

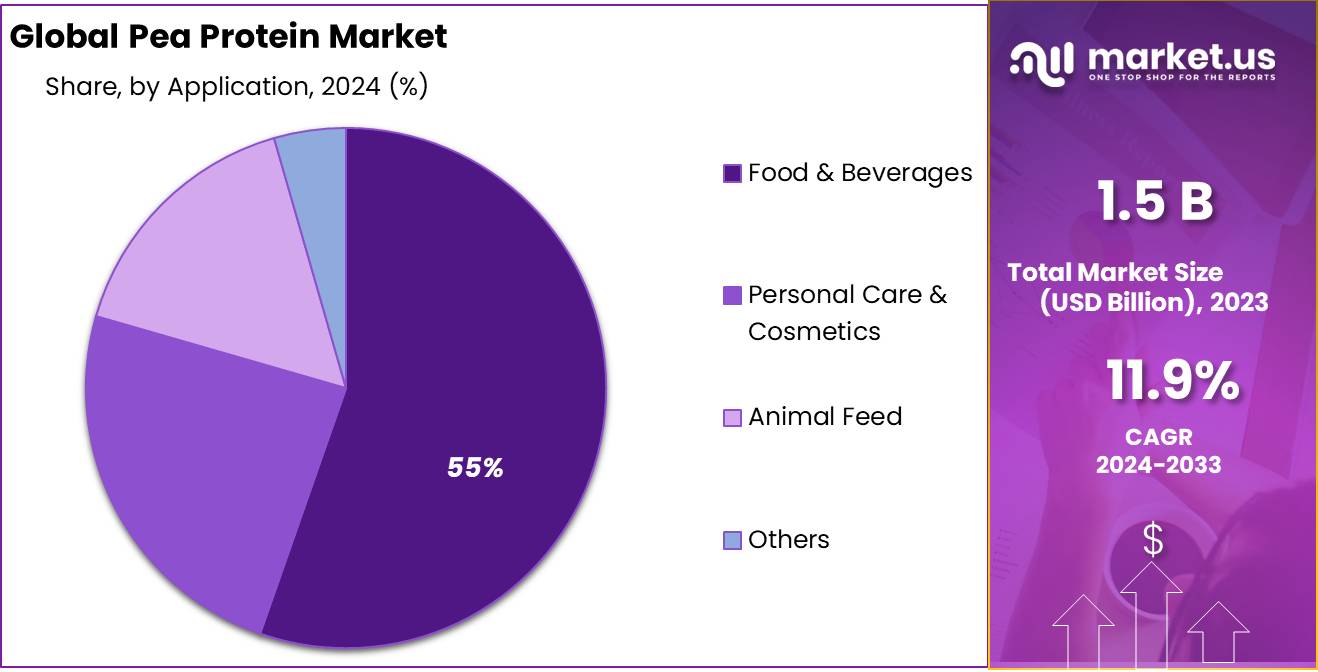

The food and beverage industry is the largest end-user of pea protein, accounting for about 50-55% of the global market share in 2023. This segment includes a variety of applications, from plant-based meat substitutes to dairy alternatives.

According to a report from the European Commission, the global consumption of plant-based meat alternatives grew by 25% in 2023 alone, a trend directly benefitting pea protein producers. In the United States, plant-based food sales reached USD 8 billion in 2023, marking a 10% year-on-year increase, with pea protein being one of the key ingredients in these products.

Pea protein imports and exports have been growing steadily in line with market demand. In 2023, the global export value of pea protein was estimated to be approximately USD 300 million, with Canada, the largest producer of peas, accounting for over 45% of the exports.

The U.S. imported pea protein worth approximately USD 80 million in 2023, reflecting a growth of 18% compared to 2022. In the same year, the European Union imported pea protein valued at EUR 90 million, a 12% increase from the previous year, driven by the demand for plant-based food ingredients.

Private and public investments in pea protein production have been robust in 2023. Roquette Frères, a leading producer of pea protein, announced an investment of USD 200 million in expanding its pea protein production facility in the U.S.

The company aims to increase its output by 40% over the next two years to meet growing demand. Additionally, in 2023, Ingredion Incorporated acquired The Green Lab, a startup focused on innovative plant-based proteins, including pea protein, for a reported sum of USD 50 million. This acquisition highlights the growing trend of innovation and consolidation in the pea protein market.

Innovation in pea protein has been driven by advancements in processing technologies to improve its texture and flavor profile. In 2024, Impossible Foods announced the launch of a new plant-based burger using pea protein, designed to appeal to a broader range of consumers. The company reported that the new product had already secured a 20% market share in the U.S. plant-based meat segment within the first six months of its launch.

Looking forward, the pea protein market is expected to continue its upward trajectory, with estimates suggesting it could reach USD 3.5 billion by 2030. Government regulations, consumer preferences, and ongoing industry investments in product innovation are expected to remain key drivers of this growth. Pea protein’s benefits, including its high protein content and sustainable production process, will likely solidify its position as a leading ingredient in the global plant-based food and beverage market.

Key Takeaways

- Pea Protein Market size is expected to be worth around USD 4.6 Bn by 2033, from USD 1.5 Bn in 2023, growing at a CAGR of 11.9%.

- Isolates held a dominant market position, capturing more than 49.5% of the global pea protein market share.

- Dry pea protein held a dominant market position, capturing more than 78.4% of the global market share.

- Yellow Split Peas held a dominant market position, capturing more than 82.2% of the global pea protein market share.

- Conventional pea protein held a dominant market position, capturing more than 88.1% of the global market share.

- Food & Beverages held a dominant market position, capturing more than a 55.3% share of the pea protein market.

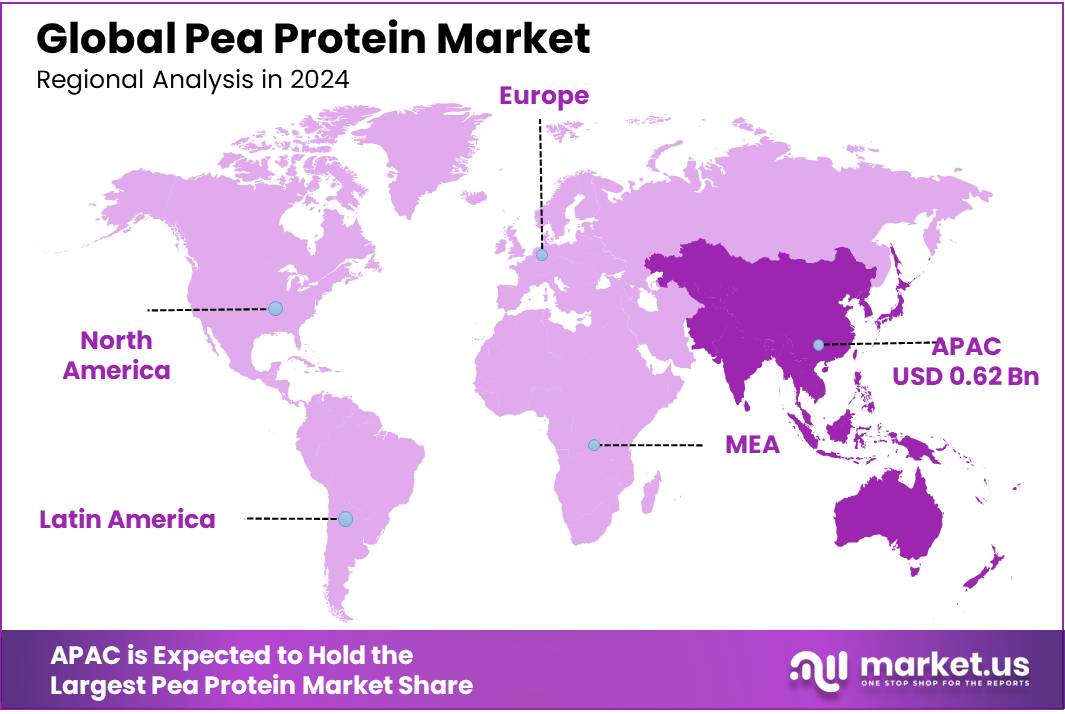

- Asia Pacific (APAC) region dominated the pea protein market, capturing 41.1% of the global market share, valued at approximately USD 0.62 billion.

Pea Protein Business Environment Analysis

The business environment for pea protein in 2023 has been shaped by multiple factors, driving both growth and competition in the market. As consumer demand for plant-based alternatives to animal proteins continues to surge, pea protein has emerged as one of the key players in the plant-based protein segment.

This shift is primarily due to increasing awareness about health, sustainability, and ethical concerns related to animal agriculture. Pea protein, being allergen-free, high in protein content, and environmentally friendly, fits perfectly into the growing demand for clean-label, plant-based products.

In 2024, the growth trend continues, with pea protein being a major component in various food and beverage products. Many companies are focusing on product innovation to cater to changing consumer preferences.

Companies like Roquette and Ingredion are expanding their pea protein portfolios by investing in more sustainable extraction processes and introducing new formulations. The popularity of plant-based meat alternatives is another factor propelling the demand for pea protein. Additionally, the food service industry is increasingly incorporating pea protein in plant-based menus, from burgers to dairy-free milk, which further boosts market growth.

In terms of regional trends, North America continues to dominate the pea protein market, accounting for a significant share in 2023, mainly due to a high demand for plant-based products and increasing veganism. Europe follows closely, with a rapidly growing segment in plant-based protein products.

Asia-Pacific is also a key region for growth, with countries like China and India showing increasing consumer interest in health-conscious eating habits and plant-based options. However, supply chain challenges and raw material sourcing in the region may impact growth in the short term, especially with the competition for pea protein supply intensifying.

By Product

In 2023, Isolates held a dominant market position, capturing more than 49.5% of the global pea protein market share. Pea protein isolates are highly concentrated and contain up to 85-90% protein content, making them the preferred choice for manufacturers of protein powders, meal replacements, and meat alternatives. The demand for isolates continues to surge, particularly in North America and Europe, driven by their versatility in food and beverage formulations and their suitability for vegan and gluten-free diets. In 2024, the market for isolates is expected to maintain steady growth, with a projected CAGR of 10.5%.

On the other hand, Concentrates accounted for around 28-30% of the pea protein market in 2023. Pea protein concentrates, with a protein content of 60-70%, are popular in various food applications, including snacks, protein bars, and functional beverages. This segment has seen increasing demand due to its affordability compared to isolates, making it an attractive option for cost-sensitive products. The growth of plant-based and health-focused products is anticipated to drive the concentrates segment, with the market expected to grow at a CAGR of 8.5% in 2024.

Textured Pea Protein continues to see adoption in the plant-based meat industry, capturing about 10-12% of the global market share in 2023. With a protein content of approximately 50-55%, textured pea protein offers a fibrous, meat-like texture, which has made it a key ingredient in the production of plant-based burgers, sausages, and other meat alternatives. As more consumers shift towards plant-based diets, the demand for textured pea protein is projected to grow significantly, with an anticipated CAGR of 12.3% in 2024.

Lastly, Hydrolysates, though a smaller segment, accounted for roughly 7-8% of the market share in 2023. These pea protein derivatives are broken down into smaller peptides, making them easier to digest and absorb, and are commonly used in sports nutrition and medical food products. While hydrolysates are growing steadily due to their specialized applications, their growth rate is slower compared to other product types, with a projected CAGR of 6.7% in 2024.

By Form

In 2023, Dry pea protein held a dominant market position, capturing more than 78.4% of the global market share. The dry form is preferred due to its extended shelf life, ease of storage, and versatility in production. It is commonly used in protein powders, plant-based meat alternatives, and baked goods.

The demand for dry pea protein continues to rise in the health and fitness sector, where it is incorporated into protein supplements and meal replacements. In 2024, the dry segment is expected to maintain its leadership, with a projected growth rate of 9.8% CAGR, driven by increasing consumer interest in high-protein diets and the expansion of plant-based product offerings.

The Wet form, though accounting for a smaller share of the market, is gaining traction due to its applications in beverages and ready-to-drink products. Wet pea protein, which contains higher moisture content, is typically used in plant-based dairy alternatives, such as non-dairy milk and yogurts.

In 2023, wet pea protein captured about 21.6% of the market, and its adoption is projected to grow at a moderate pace of 7.5% CAGR in 2024. As consumer preferences shift toward more liquid-based, convenient nutrition options, the wet form is expected to gain popularity, particularly in regions with growing demand for plant-based drinks.

By Source

In 2023, Yellow Split Peas held a dominant market position, capturing more than 82.2% of the global pea protein market share. Yellow split peas are the primary source for pea protein due to their high protein content, cost-effectiveness, and widespread availability. This variety of pea is rich in protein, making it ideal for large-scale protein extraction.

It is widely used in the production of protein powders, meat alternatives, and plant-based food products. With a growing demand for plant-based proteins and an increasing shift toward sustainable food sources, yellow split peas are expected to continue leading the market through 2024. The segment is projected to grow at a CAGR of 9.5%, driven by the rising popularity of plant-based diets and the need for allergen-free protein sources.

By Nature

In 2023, Conventional pea protein held a dominant market position, capturing more than 88.1% of the global market share. Conventional pea protein is more widely produced and cost-effective, making it the preferred choice for manufacturers, especially in the food and beverage industry.

It is sourced from peas grown with traditional agricultural practices, and its affordability allows it to be used in a variety of applications, including protein powders, meat alternatives, and snacks. The growth of the conventional segment is expected to remain robust in 2024, with a projected CAGR of 8.7%, driven by the increasing demand for affordable plant-based protein solutions and large-scale production capabilities.

Organic pea protein is produced using peas that are grown without synthetic fertilizers, pesticides, or genetically modified organisms (GMOs), appealing to health-conscious consumers and those prioritizing sustainability.

By Application

In 2023, Food & Beverages held a dominant market position, capturing more than a 55.3% share of the pea protein market. This significant share can be attributed to the growing consumer demand for plant-based protein alternatives, as well as the increasing adoption of pea protein in various food and beverage products. The rise of veganism, plant-based diets, and the desire for sustainable protein sources have made pea protein a key ingredient in a wide range of food items, from meat alternatives to snacks, smoothies, and energy bars. The demand for protein-rich, clean-label products further boosts the market share in this segment.

The Personal Care & Cosmetics sector also saw steady growth, driven by the increasing awareness about the benefits of natural and plant-based ingredients in skincare and haircare products. In 2023, this segment represented a smaller but significant portion of the pea protein market. Consumers’ preference for non-toxic, eco-friendly products has led to an increase in the use of pea protein in formulations for moisturizers, shampoos, conditioners, and other personal care products. This trend is expected to grow further as more brands transition to sustainable, plant-derived ingredients.

The Animal Feed segment, although smaller compared to Food & Beverages, has been gradually expanding. In 2023, this market captured a growing share, as pea protein is recognized for its high nutritional value and digestibility for livestock, pets, and aquaculture. This segment’s growth is fueled by the increasing focus on sustainable animal feed and the reduction of reliance on animal-derived protein sources.

Key Market Segments

By Product

- Isolates

- Concentrates

- Textured

- Hydrolysates

By Form

- Dry

- Wet

By Source

- Yellow Split Peas

- Others

By Nature

- Organic

- Conventional

By Application

- Food & Beverages

- Personal Care & Cosmetics

- Animal Feed

- Others

Drivers

Rising Demand for Plant-Based Proteins

One of the major driving factors behind the growth of the pea protein market is the rapidly increasing consumer demand for plant-based proteins. As more consumers shift towards plant-based diets for health, environmental, and ethical reasons, the demand for plant-based protein ingredients, including pea protein, has surged. This trend is not just a passing phase but part of a broader, long-term movement in the food industry.

In 2023, the plant-based meat market alone was valued at USD 5.1 billion and is expected to grow by 15.4% annually over the next few years. Within this category, pea protein plays a central role, especially in products like plant-based burgers, sausages, and nuggets, where it serves as a major protein source.

The increasing focus on reducing animal product consumption to lower the environmental impact is also fueling this trend. According to the Food and Agriculture Organization (FAO), livestock production accounts for 14.5% of global greenhouse gas emissions, prompting many consumers to reduce their meat intake in favor of sustainable, plant-based alternatives.

Government initiatives also contribute significantly to the growth of the pea protein market. Several governments worldwide are actively promoting plant-based diets as part of their efforts to achieve sustainability goals.

For instance, the European Union’s Farm to Fork Strategy, launched in 2020, aims to increase the share of plant-based foods in the European diet and reduce the environmental impact of agriculture. This strategy includes encouraging the use of plant-based proteins, with a specific focus on reducing reliance on animal-based products.

In the United States, plant-based products have seen a significant increase in demand, with retail sales of plant-based foods growing by 27% from 2020 to 2022, reaching a total market size of USD 7 billion in 2022. The plant-based protein category, which includes pea protein, accounted for a significant portion of this growth, driven by consumer awareness about health, sustainability, and food security.

According to The Good Food Institute and Plant Based Foods Association, U.S. retail sales of plant-based meat grew by 45% over the last three years, further cementing the role of pea protein in this growing sector.

The rise in veganism, particularly among younger consumers, is another important factor. Studies have shown that 68% of U.S. millennials are actively reducing their meat consumption, contributing to the growing preference for plant-based protein alternatives like pea protein.

Restraints

Supply Chain Challenges and Price Volatility

Despite the growing demand for pea protein, one of the key challenges the market faces is supply chain constraints and price volatility, which can affect both production and pricing stability. As the global demand for plant-based proteins rises, sourcing sufficient quantities of raw peas, coupled with challenges in processing and distribution, remains a major concern.

In 2023, the global supply of peas was estimated at 13.5 million metric tons, but due to factors like extreme weather conditions, fluctuating crop yields, and increasing competition for agricultural land, the pea protein supply chain has faced disruptions.

As a result, pea protein prices have experienced volatility. In 2023, the price of pea protein isolates increased by 5-7%, driven by higher raw material costs and transportation delays. According to a report by AgFunder Network Partners, supply chain disruptions in the agricultural sector have caused raw material costs for plant-based ingredients to rise by an average of 8-10% in 2023. This has made it more difficult for manufacturers to keep costs low while maintaining quality standards.

Additionally, the competition for land and resources between growing crops for food consumption and those used in biofuels or animal feed has led to further challenges. The land available for pea cultivation is limited, and expanding production to meet rising demand for pea protein is often hindered by environmental concerns and sustainability regulations. In some regions, the carbon footprint of pea farming has been cited as a barrier to scaling up production, as concerns over deforestation and excessive water use are growing.

Government initiatives and policies could mitigate some of these challenges, but the pace of change is slow. For example, while the EU has been investing in sustainable agriculture, with EUR 10 billion allocated under the Common Agricultural Policy (CAP) for sustainable farming practices in 2023, the impact on pea protein production is still uncertain. The focus remains primarily on major crops like wheat and corn, with legumes like peas receiving comparatively less attention.

Furthermore, despite government efforts to support plant-based food systems, the growing cost of production continues to affect product pricing. For instance, the U.S. Department of Agriculture (USDA) indicated in 2023 that commodity prices for peas have risen by 12-14% over the past two years, mainly due to transportation and labor shortages. These price increases impact the overall cost structure of pea protein products, which could slow down its adoption, particularly in price-sensitive markets.

Opportunity

Growth Opportunities in the Expanding Plant-Based Meat Market

In 2023, the global plant-based meat market was valued at approximately USD 7.5 billion and is expected to grow at a compound annual growth rate (CAGR) of 15.8% between 2024 and 2030, reaching USD 15.6 billion by 2030, as reported by the Good Food Institute.

This growth is driven by the increasing adoption of plant-based diets, particularly among millennials and Gen Z, who are more likely to choose meat alternatives due to their environmental and health benefits. As plant-based meat products increasingly appear in mainstream grocery stores, fast food chains, and restaurants, the demand for pea protein as a primary ingredient in these products is expected to continue rising.

Pea protein plays a vital role in plant-based meat due to its excellent amino acid profile, which mimics the protein structure found in animal-based meats. The ingredient is commonly used in products like plant-based burgers, sausages, nuggets, and even deli meats.

Leading companies, such as Beyond Meat and Impossible Foods, are already incorporating pea protein in their formulations. Beyond Meat, for instance, has integrated pea protein as a key ingredient in its plant-based burgers and sausages, and the company saw a 35% growth in sales in 2023, further underscoring the increasing reliance on pea protein in this sector.

Additionally, government support for plant-based food innovations is bolstering growth in this segment. For example, the U.S. Department of Agriculture (USDA) and the European Union have introduced several initiatives to support plant-based food innovation and sustainable agriculture.

The USDA’s National Institute of Food and Agriculture (NIFA) has provided $16.5 million in funding to support plant-based protein research and development in the U.S. As plant-based meat manufacturers continue to scale production and improve the taste and texture of their products, demand for high-quality, cost-effective ingredients like pea protein is set to grow.

A report by the Food and Agriculture Organization (FAO) in 2022 highlighted that the food industry is responsible for approximately 30% of global greenhouse gas emissions, which has pushed both consumers and manufacturers to seek plant-based alternatives to mitigate climate change. Pea protein, being a more sustainable and lower-impact source of protein compared to animal products, aligns well with these environmental concerns.

Trends

Surge in Demand for Clean Label and Allergen-Free Products

A key trend currently shaping the pea protein market is the growing consumer preference for clean label and allergen-free products. As consumers become more health-conscious and aware of food ingredients, there has been an increased demand for products that are simple, natural, and free from allergens like soy, dairy, and gluten. Pea protein fits perfectly into this trend because it is an allergen-friendly, sustainable, and versatile ingredient used in a wide variety of clean-label foods.

In 2023, products such as plant-based milk, protein bars, meat alternatives, and dairy-free yogurts saw a significant uptick in pea protein use due to its hypoallergenic properties. With over 60% of the global population affected by some form of food allergy or sensitivity, as reported by the World Allergy Organization, the demand for allergen-free alternatives, like pea protein, is projected to rise even further in the coming years.

Government initiatives also play a crucial role in fostering the growth of allergen-free food products. The European Union, for example, has implemented stricter food labeling regulations in recent years, encouraging transparency and the use of allergen-free ingredients in food products. In North America, the U.S. Food and Drug Administration (FDA) has increased its focus on allergen labeling, making it easier for consumers to identify safe products, which boosts demand for allergen-free alternatives like pea protein.

Pea protein’s adaptability is also helping manufacturers tap into the growing market for plant-based products that meet clean-label standards. Brands like Beyond Meat and Impossible Foods, which rely on clean-label, plant-based ingredients, are increasingly incorporating pea protein as a core component in their products. According to Beyond Meat, its plant-based burger patty contains pea protein isolate as one of the primary protein sources, aligning with the growing demand for transparency and sustainability in food production.

Regional Analysis

In 2023, the Asia Pacific (APAC) region dominated the pea protein market, capturing 41.1% of the global market share, valued at approximately USD 0.62 billion. This region’s dominance is largely driven by the growing adoption of plant-based diets, the expansion of the plant-based meat industry, and the increasing consumer awareness of health and sustainability.

Countries like China, India, and Japan are witnessing a shift towards vegetarian and vegan diets, which has spurred the demand for alternative protein sources like pea protein. The region is expected to maintain its leading position, with a projected CAGR of 11.5% through 2024.

In North America, the market for pea protein is growing rapidly, valued at approximately USD 0.48 billion in 2023. The region benefits from a robust demand for plant-based proteins, driven by both consumer preferences for vegan and vegetarian food and increasing product innovation in plant-based meat alternatives. The U.S. and Canada are key markets for pea protein, particularly in plant-based foods and sports nutrition.

Europe holds a significant share of the market as well, with the demand for pea protein reaching USD 0.46 billion in 2023. The shift towards sustainable food sources and clean-label products in countries like Germany, the UK, and France has been a major factor driving the growth of pea protein in this region. Europe is expected to continue its steady growth, with a focus on plant-based dairy and meat alternatives.

In Latin America and the Middle East & Africa (MEA), pea protein adoption is growing but remains at a relatively smaller scale. However, these regions are showing potential for expansion, particularly as demand for healthier, plant-based food options rises.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The pea protein market is highly competitive, with key players focusing on innovation, strategic partnerships, and expanding production capacities to meet the growing demand for plant-based proteins. Axiom Foods, Inc. is one of the prominent players, known for its extensive range of plant-based proteins, including pea protein isolates and concentrates.

The company has strengthened its position in the market through sustainable sourcing and a focus on non-GMO products. Similarly, Burcon has been a significant player, particularly with its patented pea protein extraction technology, which allows for a high-quality, versatile protein that caters to both food and industrial applications. Nutrascience Corp and COSUCRA are also strong contenders, offering a variety of plant-based proteins and focusing on expanding their market footprint in North America and Europe.

Other notable companies in the pea protein market include DuPont, Ingredion, and Kerry Inc., which have made substantial investments in pea protein innovations. DuPont, through its Danisco brand, has been active in the development of specialized plant-based ingredients for the food and beverage industry.

Ingredion has been enhancing its pea protein portfolio to support the growing demand for clean-label and allergen-free products, while Kerry Inc. continues to expand its offerings with a focus on functional benefits. Roquette Frères and Puris Protein LLC are also major players, with Roquette being a leader in high-quality pea protein isolates, while Puris has made significant strides in the North American market by enhancing its production capabilities and securing partnerships with key food brands.

Top Key Players

- Axiom Foods, Inc.

- Burcon

- Nutrascience Corp

- COSUCRA.

- DuPont

- FENCHEM

- Ingredion.

- Kerry Inc

- Martin & Pleasance

- Nutri-Pea Limited

- Puris Protein LLC

- Roquette Frères

- Shandong Jianyuan Group

- Sotexpro SA

- The Green Labs LLC.

- The Scoular Company

Recent Developments

In 2024, Axiom Foods aims to further increase its market share by expanding its distribution channels in North America and Europe, regions where demand for plant-based proteins is growing rapidly.

In 2024 Burcon, the company aims to further expand its production capacity, with plans to scale up its facility in Canada, which has the potential to increase output to over 10,000 metric tons annually.

Report Scope

Report Features Description Market Value (2023) USD 1.5 Bn Forecast Revenue (2033) USD 4.6 Bn CAGR (2024-2033) 11.9% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Isolates, Concentrates, Textured, Hydrolysates), By Form (Dry, Wet), By Source (Yellow Split Peas, Others), By Nature (Organic, Conventional), By Application (Food and Beverages, Personal Care and Cosmetics, Animal Feed, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Axiom Foods, Inc., Burcon, Nutrascience Corp, COSUCRA., DuPont, FENCHEM, Ingredion., Kerry Inc, Martin & Pleasance, Nutri-Pea Limited, Puris Protein LLC, Roquette Frères, Shandong Jianyuan Group, Sotexpro SA, The Green Labs LLC., The Scoular Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Axiom Foods, Inc.

- Burcon

- Nutrascience Corp

- COSUCRA.

- DuPont

- FENCHEM

- Ingredion.

- Kerry Inc

- Martin & Pleasance

- Nutri-Pea Limited

- Puris Protein LLC

- Roquette Frères

- Shandong Jianyuan Group

- Sotexpro SA

- The Green Labs LLC.

- The Scoular Company