Global PDC Drill Bits Market Size, Share, And Industry Analysis Report By Product Type (Matrix Body PDC Bits, Steel Body PDC Bits, Hybrid PDC Bits), By Size of PDC Cutter (Less than 9 mm, 9 to 14 mm, 15 to 24 mm, Above 24 mm), By Number of Blades (Upto 6, 6 to 10 Blades, Above 10), By Application (Oil and Gas Drilling, Shale, Sandstone, Limestone, Geothermal Drilling, Mining Operations, Water Well Drilling, Construction Projects), By End-use (On Shore, Off Shore), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 176086

- Number of Pages: 276

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

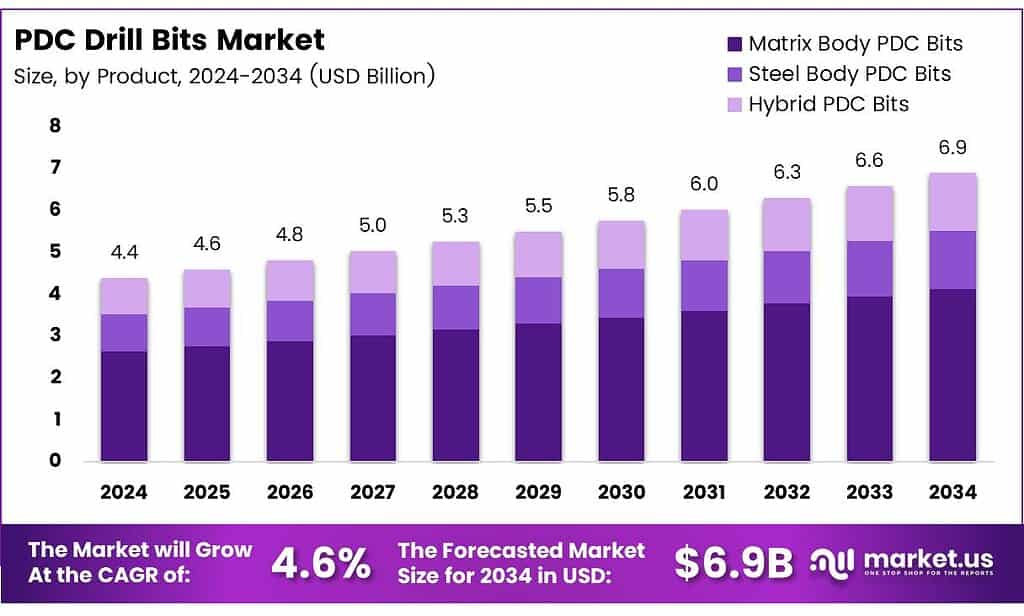

The Global PDC Drill Bits Market size is expected to be worth around USD 6.9 billion by 2034, from USD 4.4 billion in 2024, growing at a CAGR of 4.6% during the forecast period from 2025 to 2034.

The PDC Drill Bits Market continues to evolve as operators seek faster drilling speeds, longer tool life, and lower well construction costs. As energy projects expand globally, demand for polycrystalline diamond compact bits strengthens because they support deeper, more complex wells while reducing non-productive time. The market, therefore, remains a priority segment in modern drilling operations.

PDC drill bits benefit from rising unconventional exploration, where shale and tight formations require high-durability cutting structures. Additionally, increased digital monitoring and better cutter placement improve drilling efficiency, allowing service providers to optimize penetration rates. Thus, the market gains momentum as operators shift to high-performance bit designs.

- PDC bits use highly engineered cutter structures that improve cutting efficiency and durability. Standard 13-mm cutters are built with a tungsten-carbide cylinder about 8 mm high and a diamond layer nearly 2 mm thick, often shaped with a 45°×0.4-mm chamfer or a wider 45°×0.7-mm profile for added strength. Their advanced design has helped PDC bits capture over one-third of global drilling footage, with U.S. manufacturers generating more than $260 million in annual sales.

Strong lifecycle economics also drive adoption. A single PDC bit can save operators more than USD 100,000 over its working life compared with roller-cone bits, making it a cost-efficient choice for drilling programs. These operational and financial advantages continue to reinforce a positive long-term outlook for the global PDC Drill Bits Market.

Moreover, opportunities emerge from government-backed upstream investments, especially in regions expanding domestic energy security. Regulators also promote safety standards and encourage the adoption of durable drilling tools that reduce environmental risks by lowering bit-trip frequency. Procurement strategies increasingly favor high-quality PDC bits with predictable performance and extended lifecycle value.

Key Takeaways

- The Global PDC Drill Bits Market is projected to grow from USD 4.4 billion in 2024 to USD 6.9 billion by 2034 at a CAGR of 4.6%.

- Matrix Body PDC Bits lead the product type segment with a 67.2% market share.

- In cutter size, the 15 to 24 mm category dominates with 45.7% share.

- By blade count, 6 to 10 blades configurations hold the largest share at 59.1%.

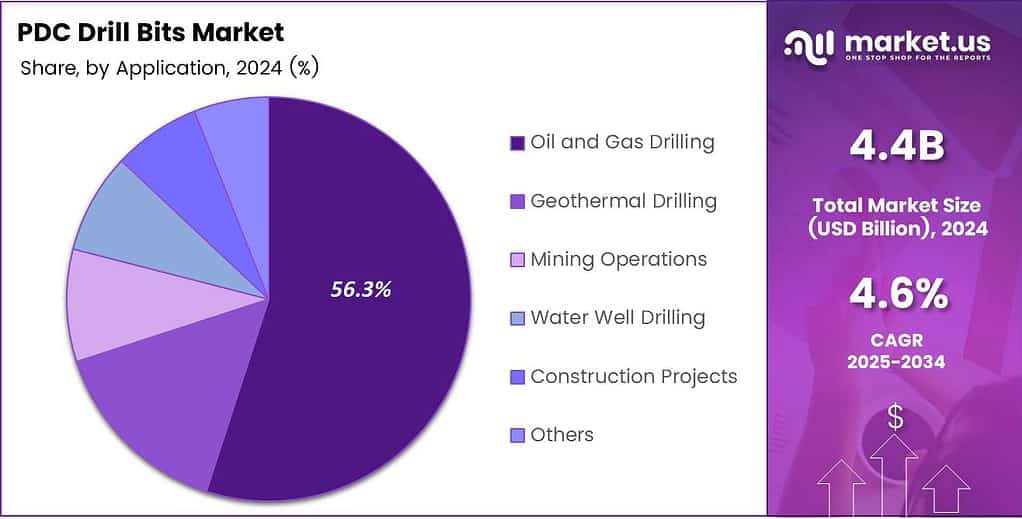

- Oil and Gas Drilling remains the top application segment with 56.3% contribution.

- Onshore end-use leads the market with a 67.8% share.

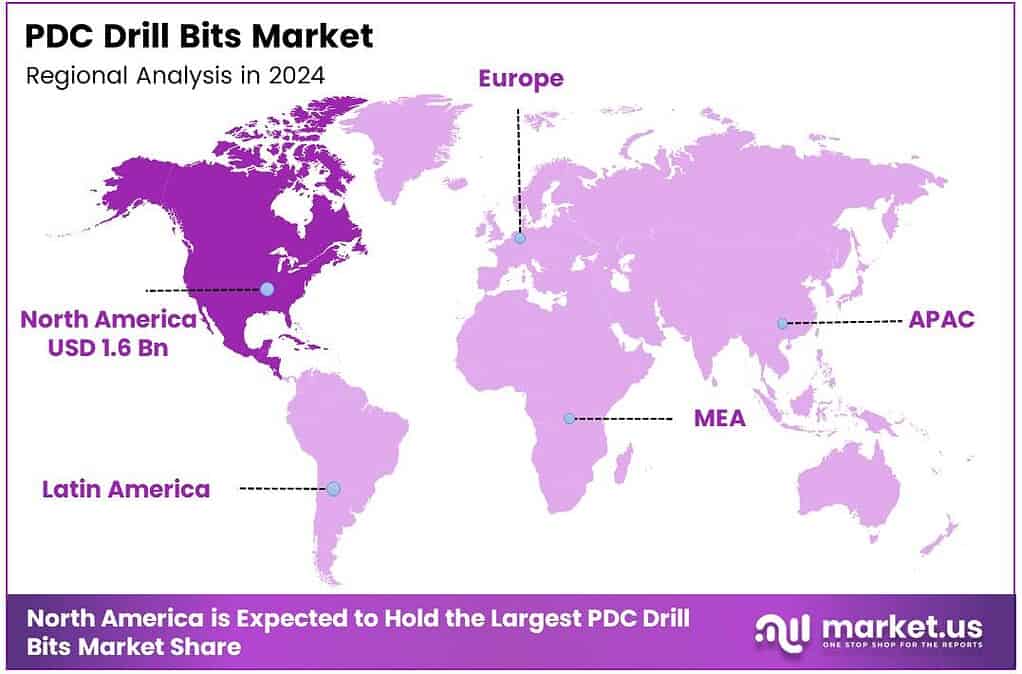

- North America dominates regionally with a 37.9% share valued at USD 1.6 billion.

By Product Type Analysis

Matrix Body PDC Bits dominate with 67.2% due to their durability and strong wear resistance.

In 2025, Matrix Body PDC Bits held a dominant market position in the By Product Type segment of the PDC Drill Bits Market, with a 67.2% share. These bits continued gaining preference as operators prioritized longevity, reduced bit failures, and improved drilling performance across harsh formations, especially in high-pressure, high-temperature wells.

Steel Body PDC Bits maintained steady adoption as users sought faster drilling rates and improved cutting efficiency. These bits gained traction in regions where operators preferred lower upfront costs and easier repair capabilities. Their strong machining flexibility helped manufacturers deliver customized designs for varying well depths and formation hardness.

Hybrid PDC Bits expanded gradually as operators explored tools offering improved stability and controlled torque response. These bits integrated roller-cone features with PDC cutters, delivering balanced performance in complex lithology. Their strength lies in reducing vibrations while enabling smoother drilling transitions, supporting their adoption in directional and horizontal drilling projects.

By Size of PDC Cutter Analysis

15 to 24 mm Cutters dominate with 45.7%, backed by balanced penetration and durability.

In 2025, the 15 to 24 mm cutter size held a dominant market position in the By Size of PDC Cutter segment of the PDC Drill Bits Market, with a 45.7% share. This range provided an ideal blend of durability and aggressiveness, allowing operators to improve drilling efficiency across medium-hard formations.

Less than 9 mm cutters found niche use in applications requiring finer cutting control and reduced vibration. These sizes supported precise drilling in softer formations and enhanced tool stability in shallow wells, making them suitable for specialized engineering needs across water wells and construction-related drilling operations.

9 to 14 mm cutters offered moderate aggressiveness, gaining adoption in drilling zones requiring controlled performance without compromising efficiency. Their versatility and affordability made them relevant across mid-range drilling environments. Operators valued them for maintaining steady penetration rates while preserving bit structural integrity.

Above 24 mm cutters were selected for applications prioritizing high penetration rates through harder formations. Their larger contact area enabled aggressive cutting and deeper engagement. These cutters proved effective in demanding oil and gas projects where operators sought significant reductions in drilling time per interval.

By Number of Blades Analysis

6 to 10 Blades dominate with 59.1% due to smoother drilling control.

In 2025, the 6 to 10 Blades category held a dominant market position in the By Number of Blades segment of the PDC Drill Bits Market, with a 59.1% share. This configuration ensured balanced load distribution, improved stability, and strong penetration rates, making it highly suitable for directional and horizontal drilling programs.

Upto 6 Blades bits were adopted where fast penetration and aggressive cutting were required. Their open structure allowed enhanced cleaning and optimized cutting removal, particularly in softer formations. Operators favored these bits for cost-effective drilling and reduced torque fluctuations in shallow and mid-depth wells.

Above 10 Blades bits cater to complex wells requiring maximum durability and tight control over wellbore quality. Their dense blade arrangement improved cutter support, reducing damage while enhancing bit life. These configurations were often preferred in deep, abrasive formations where maintaining a smooth wellbore trajectory was crucial.

By Application Analysis

Oil and Gas drilling dominate with 56.3%, driven by rising energy demand.

In 2025, Oil and Gas Drilling held a dominant market position in the By Application segment of the PDC Drill Bits Market, with a 56.3% share. Growing global exploration, renewed drilling investments, and adoption of horizontal drilling techniques significantly strengthened demand for high-performance PDC drill bits.

Geothermal Drilling gained attention as renewable energy initiatives expanded worldwide. The need for tools capable of withstanding extreme temperatures and highly abrasive formations pushed operators toward robust PDC designs that offered extended life and reliable performance in deep geothermal wells.

Mining Operations used PDC bits for faster penetration in mineral exploration programs. Their efficiency in hard-rock settings helped reduce operational time and drilling expenses. Mining firms increasingly adopted these bits to enhance drilling productivity and improve structural stability in exploratory holes.

Water Well Drilling remained stable as communities and industries expanded groundwater access projects. PDC bits provide longer service life and improved cost efficiency in varying soil conditions, making them ideal for both rural and urban well-drilling requirements.

Construction Projects applied PDC bits for structural foundation drilling and geological surveys. Their strong resistance to wear supported faster site preparation. Infrastructure development programs worldwide increased demand for reliable drilling components.

By End-use Analysis

On Shore dominates with 67.8%, supported by large-scale land drilling.

In 2025, onshore operations held a dominant market position in the By End-use segment of the PDC Drill Bits Market, with a 67.8% share. Land-based drilling benefited from lower operational costs, expanding energy investments, and increasing unconventional resource development, all of which supported strong consumption of efficient PDC drill bits.

Offshore drilling continued contributing steadily as deeper wells and complex geological settings required high-strength drilling tools. PDC bits remained essential for enhancing penetration rates and improving operational safety. Demand grew in regions advancing deepwater exploration to strengthen long-term energy security.

Key Market Segments

By Product Type

- Matrix Body PDC Bits

- Steel Body PDC Bits

- Hybrid PDC Bits

By Size of PDC Cutter

- Less than 9 mm

- 9 to 14 mm

- 15 to 24 mm

- Above 24 mm

By Number of Blades

- Upto 6

- 6 to 10 Blades

- Above 10

By Application

- Oil and Gas Drilling

- Shale

- Sandstone

- Limestone

- Geothermal Drilling

- Mining Operations

- Water Well Drilling

- Construction Projects

- Others

By End-use

- On Shore

- Off Shore

Emerging Trends

Rapid Adoption of Advanced Cutter Technologies Shapes Market Trends

A major trend shaping the PDC drill bits market is the continuous improvement in cutter technology. Manufacturers are using new materials, thermal stability enhancements, and advanced diamond layering techniques to increase bit durability and drilling speed. These innovations attract operators aiming for efficiency.

- The U.S. Department of Energy (DOE) published a funding notice for Enhanced Geothermal Systems (EGS) pilot demonstrations, with a listed second-round funding amount of USD 14.2 million. That type of support encourages field trials where drill-bit durability, cutter wear, and stable rate of penetration become make-or-break factors.

Another rising trend is the customization of drill bits based on formation characteristics. Using simulation software and digital design tools, companies now create bits tailored to specific geological conditions. This improves performance and reduces operational risks.

Drivers

Rising Oil and Gas Exploration Activities Drive Market Growth

The growing energy demand is pushing companies to increase drilling activities across both conventional and unconventional reserves. This rise in exploration work is boosting the need for reliable and high-performance PDC drill bits. Their strong cutting structure and ability to withstand harsh drilling conditions make them a preferred choice for operators looking to reduce downtime.

The shift toward deeper wells and complex formations further increases the adoption of PDC drill bits. Their long service life, faster penetration rate, and reduced operational costs make them suitable for challenging drilling environments. As more countries invest in expanding their domestic energy production, demand remains strong.

The market also benefits from technological improvements that enhance durability and performance. Innovations such as improved cutter materials and optimized bit design help oilfield companies drill faster with a lower risk of failure. These performance advantages continue to push the market forward.

Restraints

High Initial Costs of Premium Drill Bits Restrict Market Adoption

One of the main restraints in the PDC drill bits market is the high upfront cost of advanced drill bits. Premium bits use superior materials and advanced engineering, making them more expensive compared to conventional alternatives. This limits adoption among small drilling contractors with limited budget flexibility.

- Additionally, the performance of PDC bits can be affected by extremely hard or abrasive formations. In such cases, rapid wear leads to shorter tool life and high replacement expenses. In the U.S. Energy Information Administration’s Drilling Productivity, total DUC wells across the listed regions were 4,510 in April 2024.

Fluctuations in oil prices also create an uncertain investment environment. When prices fall, drilling activities reduce, which directly impacts demand for PDC bits. This cyclical nature of the oil and gas industry remains a long-term restraint for the market.

Growth Factors

Growing Interest in Unconventional Reserves Creates New Market Opportunities

As countries look for new energy sources, shale reserves, tight gas, and other unconventional formations are becoming key exploration targets. These formations demand stronger and more efficient drill bits, creating fresh opportunities for PDC bit manufacturers. Their ability to maintain performance in difficult terrains supports this shift.

Digitalization and automation in drilling operations are also opening new growth avenues. Sensors, real-time data, and predictive analytics allow operators to optimize drilling parameters, making PDC bits even more effective. Manufacturers that integrate smart technologies into their design can capture new demand.

Expanding offshore exploration projects offer another opportunity. As companies move into deeper and more complex waters, the need for performance-driven drilling tools increases. This creates long-term growth potential for premium PDC drill bits across global markets.

Regional Analysis

North America Dominates the PDC Drill Bits Market with a Market Share of 37.9%, Valued at USD 1.6 Billion

North America leads the global PDC Drill Bits Market, supported by advanced drilling technologies and strong shale gas exploration activities. The region’s dominance, holding 37.9% share and generating USD 1.6 billion, comes from continuous investment in unconventional oil and gas production. Additionally, improvements in deepwater and horizontal drilling techniques strengthen long-term demand, keeping the region at the forefront of innovation and operational efficiency.

Europe shows steady growth driven by ongoing offshore oilfield development in the North Sea and rising energy security strategies across EU countries. Technological upgrades in drilling equipment and renewed exploration activities support regional demand. Moreover, sustainability-driven extraction practices and digital drilling advancements continue to enhance market adoption across the region.

Asia Pacific expands rapidly as major economies increase oil and gas exploration to meet growing industrial energy needs. The region benefits from rising deepwater exploration in countries like Malaysia, China, and India. Government-led investments in domestic hydrocarbon production and drilling modernization further accelerate market growth, making the Asia Pacific one of the fastest-growing regions.

The Middle East & Africa region holds strong potential due to abundant proven oil reserves and continuous upstream investment. National oil companies’ focus on maximizing output from mature fields drives demand for high-performance drilling technologies. Expansion of deep offshore projects in Africa also contributes to stable market development across the region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2025, Schlumberger will remain a high-impact player in PDC drill bits because it pairs bit design with downhole data and drilling optimization as one workflow. For operators, this matters most in harder formations where stability, ROP consistency, and fewer trips can determine well economics. Its strength is execution at scale—global field support plus repeatable engineering performance.

Baker Hughes Company remains competitive by pushing durability and cutter layout improvements that target longer bit life without sacrificing penetration rates. The company’s value is strongest where runs are complex—directional wells, abrasive intervals, and high-temperature sections—because predictable performance reduces hidden costs like NPT and tool failures. In 2025, customers keep rewarding suppliers that can prove reliability run after run.

Haliburton continues to win business by aligning PDC bit programs with complete drilling services and on-site operational control. The practical advantage is speed of decisions—bit selection, parameter tuning, and run learning can be tightened across a full campaign, not just a single well. This makes Haliburton attractive in shale and development drilling, where consistency and cycle-time reductions are the main targets.

Sandvik AB stands out through its materials expertise and manufacturing discipline, which supports premium cutters, robust bodies, and stable quality across production batches. In 2025, this matters because buyers are more selective: they want measurable improvements in wear resistance and predictable bit behavior, especially in challenging rock mechanics. Sandvik’s position benefits from industrial-grade R&D and process control.

Top Key Players in the Market

- Schlumberger

- Baker Hughes Company

- Haliburton

- Sandvik AB

- Archway Engineering (UK) Ltd

- Infinity Tool Manufacturing

- NOV (National Oilwell Varco)

- SLB

- Wuxi Geological Drilling Equipment Co., Ltd.

- Rockpecker Limited

Recent Developments

- In 2025, SLB introduced several advancements in PDC drill bit technologies focused on improving durability. The Axe TR triple-ridged diamond element was developed for the AxeBlade Ridged Diamond Element Bit, offering a 15% increase in impact strength to handle challenging drilling conditions.

- In 2025, Baker Hughes made notable strides in PDC bit innovations, emphasizing performance in extreme conditions and directional drilling. The PermaFORCE elite PDC drill bit was highlighted in industry trends, featuring advanced cutter materials, shaped-cutter technology, application-specific cutting structures, and enhanced body materials for improved ROP and durability.

Report Scope

Report Features Description Market Value (2024) USD 4.4 Billion Forecast Revenue (2034) USD 6.9 Billion CAGR (2025-2034) 4.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Matrix Body PDC Bits, Steel Body PDC Bits, Hybrid PDC Bits), By Size of PDC Cutter (Less than 9 mm, 9 to 14 mm, 15 to 24 mm, Above 24 mm), By Number of Blades (Upto 6, 6 to 10 Blades, Above 10), By Application (Oil and Gas Drilling, Shale, Sandstone, Limestone, Geothermal Drilling, Mining Operations, Water Well Drilling, Construction Projects, Others), By End-use (On Shore, Off Shore) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Schlumberger, Baker Hughes Company, Haliburton, Sandvik AB, Archway Engineering (UK) Ltd, Infinity Tool Manufacturing, NOV (National Oilwell Varco), SLB, Wuxi Geological Drilling Equipment Co. Ltd., Rockpecker Limited Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Schlumberger

- Baker Hughes Company

- Haliburton

- Sandvik AB

- Archway Engineering (UK) Ltd

- Infinity Tool Manufacturing

- NOV (National Oilwell Varco)

- SLB

- Wuxi Geological Drilling Equipment Co., Ltd.

- Rockpecker Limited