Global Orthopedic Trauma Devices Market By Product Type (Internal Fixators and External Fixators), By End-user (Hospitals, Ambulatory Surgical Centers and Orthopedic & Trauma Centers), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2026

- Report ID: 176831

- Number of Pages: 247

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

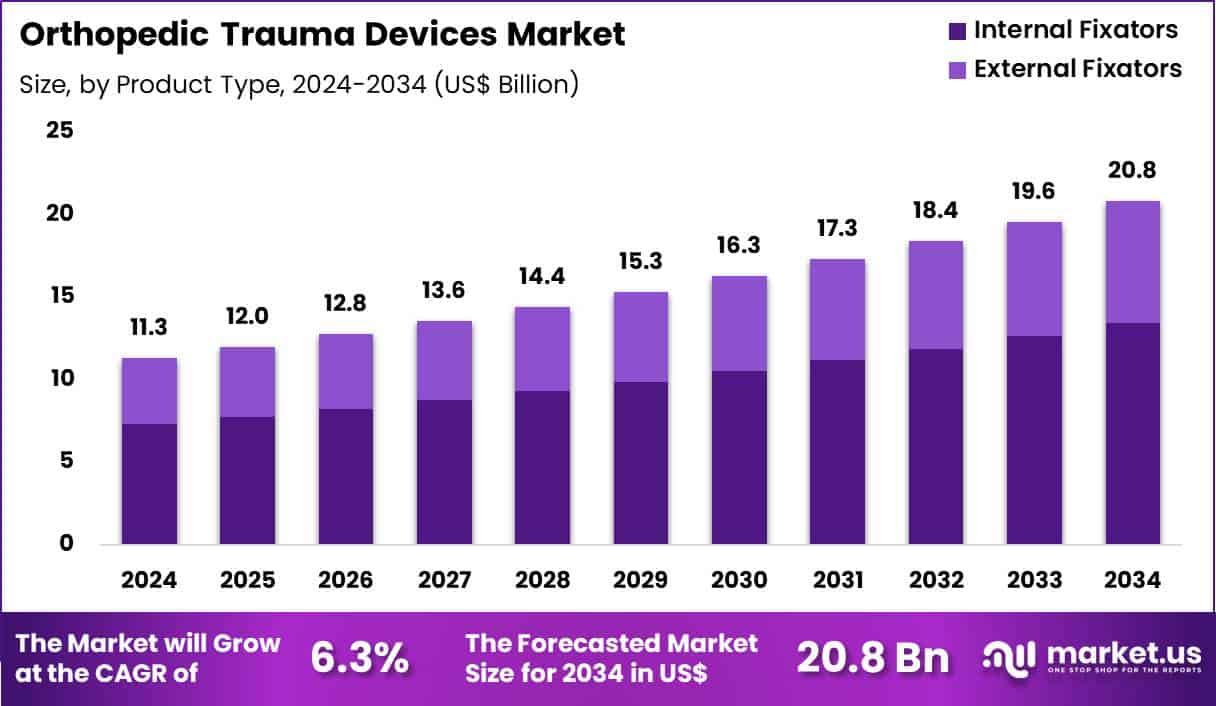

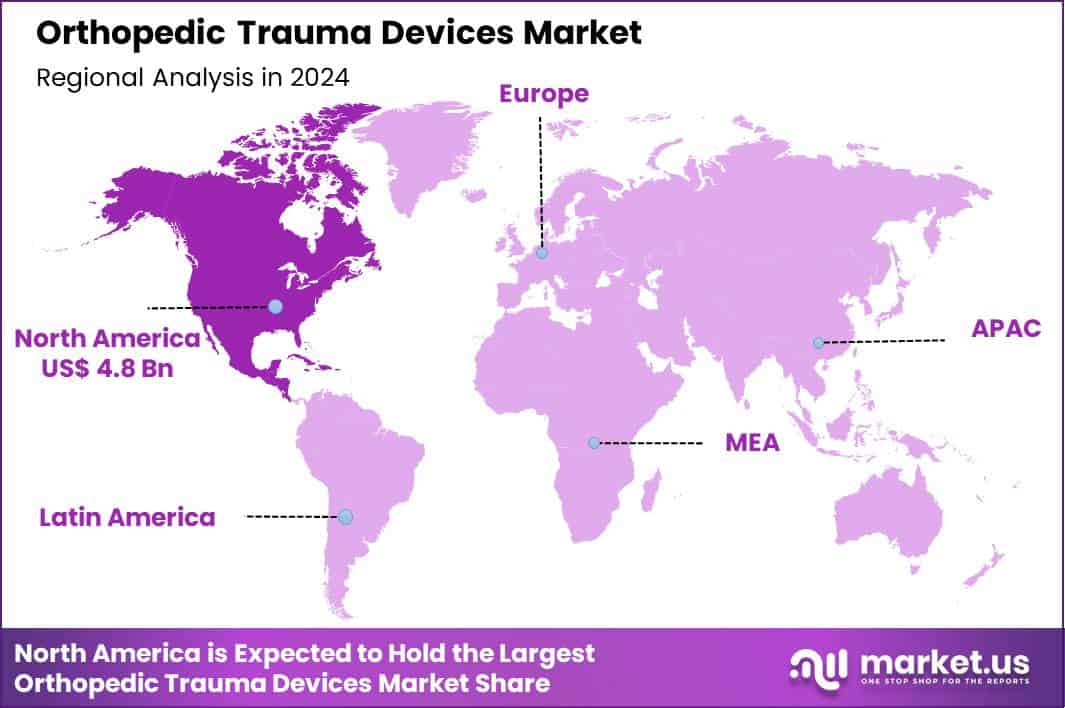

Global Orthopedic Trauma Devices Market size is expected to be worth around US$ 20.8 Billion by 2034 from US$ 11.3 Billion in 2024, growing at a CAGR of 6.3% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 42.9% share with a revenue of US$ 4.8 Billion.

Rising incidence of traumatic injuries from accidents, falls, and sports activities drives the orthopedic trauma devices market as surgeons require advanced fixation systems that restore bone alignment and enable early mobilization. Orthopedic surgeons increasingly utilize locking compression plates to stabilize complex fractures in long bones, providing angular stability and reducing screw pullout in osteoporotic or comminuted patterns.

These devices support intramedullary nailing for femoral and tibial shaft fractures, allowing load-sharing mechanics that promote callus formation and accelerate weight-bearing recovery. Clinicians apply cannulated screws in periarticular fractures, achieving precise compression across joint surfaces in tibial plateau and distal radius injuries.

External fixation frames facilitate temporary stabilization in open fractures or polytrauma cases, maintaining length and alignment while permitting soft tissue management and wound care. Intramedullary nails with interlocking screws address diaphyseal fractures in the humerus and femur, minimizing rotational instability and supporting complex revision scenarios.

Manufacturers pursue opportunities to develop bioresorbable implants that degrade over time, expanding applications in pediatric fractures where permanent hardware risks growth plate interference. Developers advance anatomically contoured plates with variable-angle locking mechanisms, improving fit and reducing soft tissue irritation in periarticular and pelvic injuries. These innovations facilitate minimally invasive techniques that preserve periosteal blood supply and accelerate healing in high-energy trauma.

Opportunities emerge in smart implants with embedded sensors that monitor strain and healing progression, enabling data-driven rehabilitation protocols. Companies invest in patient-specific 3D-printed fixation devices that match individual anatomy, optimizing outcomes in complex acetabular and scapular fractures.

Recent trends emphasize hybrid systems combining rigid fixation with dynamic elements, enhancing load distribution and reducing complications in osteoporotic and periprosthetic fractures across diverse trauma indications.

Key Takeaways

- In 2024, the market generated a revenue of US$ 11.3 Billion, with a CAGR of 6.3%, and is expected to reach US$ 20.8 Billion by the year 2034.

- The product type segment is divided into internal fixators and external fixators, with internal fixators taking the lead with a market share of 64.5%.

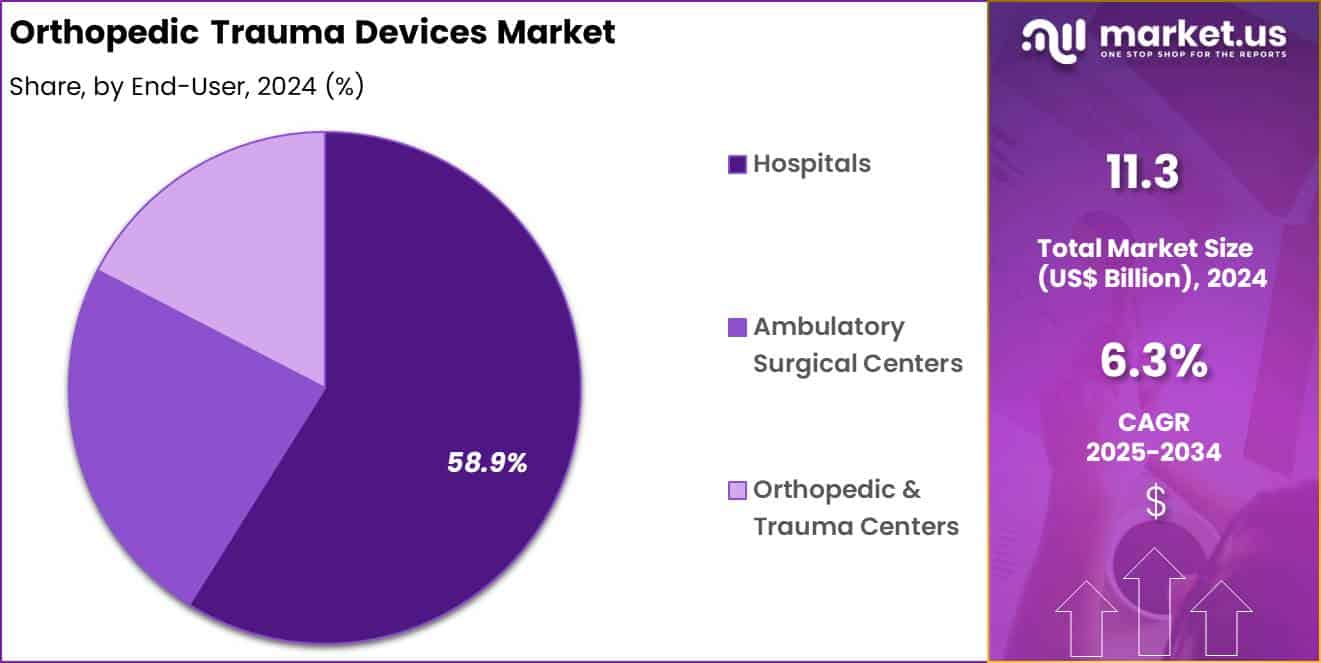

- Considering end-user, the market is divided into hospitals, ambulatory surgical centers and orthopedic & trauma centers. Among these, hospitals held a significant share of 58.9%.

- North America led the market by securing a market share of 42.9%.

Product Type Analysis

Internal fixators contributed 64.5% of growth within product type and led the orthopedic trauma devices market due to their clinical effectiveness in stabilizing complex fractures. Surgeons rely on plates, screws, rods, and nails to achieve rigid fixation and precise anatomical alignment.

These devices support early mobilization, which reduces complications and shortens hospital stays. Increasing incidence of road accidents, sports injuries, and age-related fractures raises procedure volumes that favor internal fixation solutions.

Growth strengthens as minimally invasive surgical techniques expand across trauma care. Advancements in implant materials improve strength, biocompatibility, and durability. Surgeons prefer internal fixators for long-term stability and predictable healing outcomes.

Training familiarity and standardized surgical protocols reinforce adoption. The segment is projected to remain dominant as trauma management increasingly emphasizes internal stabilization and faster functional recovery.

End-User Analysis

Hospitals accounted for 58.9% of growth within end-user and dominated the orthopedic trauma devices market due to their role in managing high-acuity trauma cases. Emergency departments serve as primary entry points for fracture treatment, which concentrates device usage within hospitals.

Availability of imaging, surgical teams, and postoperative care strengthens hospital reliance on trauma implants. Multidisciplinary coordination improves treatment outcomes and supports higher procedural throughput.

Growth continues as hospitals expand trauma services and upgrade orthopedic operating rooms. Accreditation requirements and trauma care protocols reinforce implant availability. Teaching hospitals further drive demand through continuous training and research.

Centralized referral systems direct complex cases to hospital settings. The segment is anticipated to remain the primary growth driver as hospitals continue to anchor trauma and fracture management services.

Key Market Segments

By Product Type

- Internal Fixators

- External Fixators

By End-user

- Hospitals

- Ambulatory Surgical Centers

- Orthopedic & Trauma Centers

Drivers

Increasing prevalence of road traffic injuries is driving the market.

The escalating number of road traffic injuries worldwide has significantly increased the demand for orthopedic trauma devices to treat fractures and related musculoskeletal damage in affected individuals. Improved reporting mechanisms and global health surveillance have led to better documentation of these incidents, highlighting the need for advanced fixation solutions.

According to the U.S. Department of Transportation’s National Highway Traffic Safety Administration, an estimated 39,345 people died in motor vehicle traffic crashes in 2024. This figure represents a decrease from previous years but still underscores the substantial burden on healthcare systems requiring trauma interventions.

Orthopedic trauma devices, including plates, screws, and intramedullary nails, are essential for stabilizing injuries sustained in such accidents. Medical professionals are increasingly utilizing these devices to facilitate faster recovery and reduce long-term disabilities in trauma patients. The direct link between vehicular incidents and severe orthopedic conditions further accelerates the adoption of innovative trauma management tools.

International health organizations stress the importance of preparedness for injury care in high-risk regions. Prominent manufacturers are enhancing product lines to address this persistent clinical challenge. This driver interconnects with urbanization trends contributing to higher accident rates in densely populated areas.

Restraints

Stringent regulatory requirements are restraining the market.

The rigorous approval processes imposed by health authorities for orthopedic trauma devices extend development timelines and heighten financial burdens on producers. Comprehensive evaluations to confirm device safety and performance necessitate substantial investments in clinical studies and documentation.

Emerging companies frequently struggle with the resources needed to navigate complex certification pathways for new trauma implants. Oversight focuses on preventing device failures, which constrains swift technological advancements in the sector. In areas with dynamic regulatory landscapes, adaptations can disrupt supply chains and product launches.

Developers dedicate considerable funds to ongoing compliance monitoring, diverting from expansion initiatives. This restraint reduces availability in markets demanding updated pharmaceutical norms. Sector groups push for uniform guidelines to lessen these loads, although enforcement stays stringent. Notwithstanding innovative potential, approval obstacles curtail prompt industry access. Streamlining regulatory efficiencies is fundamental to countering this market barrier.

Opportunities

Growth in emerging markets revenues is creating growth opportunities.

The progressive rise in revenues from emerging markets signifies avenues for orthopedic trauma devices to penetrate expanding healthcare frameworks in these locales. Augmented governmental outlays on medical infrastructure bolster the assimilation of sophisticated trauma solutions in budding economies.

Heightened recognition of effective fracture treatments propels requisition for dependable fixation apparatuses in such territories. Cooperative ventures with indigenous allocators aid conformance and proficient ingress for transnational fabricators. The voluminous patient cohorts in populous states magnify latent for apparatus employment in varied therapeutic contexts.

Stryker reported emerging markets contributing 5.6% of total net sales in 2024. This proportion denotes amplifying income fluxes from under-saturated zones external matured domains. Instructional schemes for medical experts augment adeptness in maneuvering progressed mechanisms. This prospect permits worldwide enterprises to variegate beyond inundated bazaars. Altogether, nascent proliferations harmonize with endeavors to span universal medical incongruities.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic conditions influence the orthopedic trauma devices market through hospital purchasing power, trauma care volumes, and capital allocation decisions. Inflation and higher interest rates raise operating costs for healthcare providers, which increases price sensitivity around implants, plates, nails, and fixation systems.

Geopolitical tensions disrupt supplies of medical grade metals, sterilization services, and precision components, creating sourcing risk and longer lead times. Current US tariffs on imported implants and raw materials increase manufacturing and procurement costs, which compresses margins and complicates contract pricing. These factors challenge smaller vendors and delay inventory expansion at cost constrained hospitals.

On the positive side, trade pressure supports domestic manufacturing, recycled metal sourcing, and supplier diversification. Rising incidence of accidents, sports injuries, and aging related fractures sustains steady procedural demand. With disciplined sourcing, surgeon focused innovation, and efficient distribution, the market remains positioned for stable and confident growth.

Latest Trends

Introduction of antibacterial implant coatings is a recent trend in the market.

In 2024, the endorsement of novel antibacterial coatings for orthopedic implants has augmented infection prevention in trauma surgeries. These coatings integrate antimicrobial agents to inhibit bacterial adhesion on device surfaces. Onkos Surgical received FDA De Novo approval in April 2024 for its NanoCept antibacterial coating technology. This authorization marks a pivotal step for coatings tailored to tumor and revision arthroplasty.

Fabricators are emphasizing biocompatibility to guarantee sustained efficacy without compromising host tissue integration. Therapeutic utilizations encompass high-risk procedures where infection rates pose significant concerns. The inclination confronts conventional limitations in postoperative care through proactive microbial control.

Supervisory trajectories have acclimated to validate these intricate biologics. Sector synergies concentrate on amplifying formulations for diminished revision necessities. These evolutions aspire to elevate results in intricate fracture reconstructions.

Regional Analysis

North America is leading the Orthopedic Trauma Devices Market

North America holds a 42.9% share of the global Orthopedic Trauma Devices market, manifesting considerable growth in 2024 attributable to augmented incidences of fractures from vehicular collisions and recreational pursuits, alongside a burgeoning elderly cohort susceptible to osteoporosis-related injuries.

Distinguished corporations including Zimmer Biomet and DePuy Synthes have pioneered bioabsorbable screws and customizable plating systems that expedite healing and diminish revision surgeries in extremity and pelvic traumas. The continent’s expansive trauma networks have incorporated these advancements to manage polytrauma patients more effectively, bolstered by electronic health records for optimized surgical planning.

Directives from the Centers for Medicare & Medicaid Services have facilitated reimbursements for minimally invasive fixations, spurring deployments in level I trauma centers. Escalating sports participation among youth has necessitated specialized intramedullary nails for long bone repairs, while industry forums have disseminated best practices for implant selection.

Cooperative research with universities has validated novel locking mechanisms, elevating biomechanical stability in comminuted fractures. A 2024 analysis reported by Orthopedics Today indicated that US emergency departments manage more than 2.4 million shoulder-related injury cases each year, with close to 400,000 of these patients ultimately undergoing surgical treatment.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Experts forecast notable augmentation in the fracture management industry across Asia Pacific over the forecast period, since administrations amplify investments in emergency response systems to mitigate rising accident tolls from dense traffic.

Corporations in Taiwan and Malaysia fabricate versatile external fixators that suit varied anatomical needs, while surgeons in the Philippines refine techniques for intramedullary nailing to treat femoral shaft breaks efficiently. Healthcare operators in Vietnam procure advanced bioresorbable pins that promote natural bone regrowth, targeting pediatric cases with minimal invasiveness.

Financiers in Laos endorse initiatives that distribute low-cost screws to provincial hospitals, countering disparities in access for rural victims. Leaders in Brunei enact protocols that standardize rod insertions for spinal stabilizations, ensuring uniformity amid diverse populations.

Doctors in Bhutan harness digital modeling to customize plates for tibial plateau repairs, boosting recovery rates in mountainous terrains. Producers in Macao engineer hybrid constructs that integrate polymers for enhanced durability, appealing to humid environments. The NMPA approved 65 innovative medical devices in 2024, invigorating sector innovation.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key competitors in the orthopedic trauma devices market drive growth by broadening product portfolios with advanced fixation systems, biologics-infused implants, and minimally invasive solutions that improve surgical outcomes and reduce recovery times. They also deepen engagement with trauma centers and orthopedic specialists through clinical education, long-term service support, and outcome-data programs that reinforce adoption and surgeon preference.

Firms pursue targeted acquisitions that complement existing capabilities and accelerate entry into high-growth subsegments such as intramedullary nails and locking plates. Expanding commercial presence in North America, Europe, and emerging regions such as Asia Pacific strengthens revenue diversity amid increasing surgical volumes worldwide.

Zimmer Biomet Holdings exemplifies a global orthopedic leader with a comprehensive suite of trauma and extremities products, robust distribution networks, and a coordinated commercialization approach that aligns product innovation with evolving surgical standards. The company bolsters its competitive stance through disciplined R&D investment, strategic partnerships, and customer-centric programs that translate clinical insights into durable market traction.

Top Key Players

- Stryker

- Zimmer Biomet

- DePuy Synthes

- Smith and Nephew

- Medtronic

- Globus Medical

- Orthofix Medical

- Acumed

- Wright Medical

- Arthrex

Recent Developments

- In September 2024, Orthofix Medical introduced the Galaxy Fixation Gemini system, an external fixation solution developed for fracture management in trauma settings. The system is designed for rapid deployment, removing the need for tray sterilization and reducing space requirements, which makes it well suited for use in trauma bays and intensive care environments.

- In September 2024, Arthrex released OrthoPedia Patient, a digital education platform created to support patient understanding of orthopedic conditions and treatment options. Developed with input from clinical experts and reviewed by peers, the tool promotes self-guided learning and is continuously updated to align with current clinical research and care standards.

Report Scope

Report Features Description Market Value (2024) US$ 11.3 Billion Forecast Revenue (2034) US$ 20.8 Billion CAGR (2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Internal Fixators and External Fixators), By End-user (Hospitals, Ambulatory Surgical Centers and Orthopedic & Trauma Centers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Stryker, Zimmer Biomet, DePuy Synthes, Smith and Nephew, Medtronic, Globus Medical, Orthofix Medical, Acumed, Wright Medical, Arthrex Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Orthopedic Trauma Devices MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Orthopedic Trauma Devices MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Stryker

- Zimmer Biomet

- DePuy Synthes

- Smith and Nephew

- Medtronic

- Globus Medical

- Orthofix Medical

- Acumed

- Wright Medical

- Arthrex