Global Organic Gummy Worms Market Size, Share, And Industry Analysis Report By Flavor (Strawberry, Cherry, Grapefruit, Watermelon, Orange, Raspberry, Mango, Others), By Distribution Channel (Supermarkets and Hypermarkets, Specialty Stores, Convenience Stores, Online Retail, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2026

- Report ID: 177498

- Number of Pages: 351

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

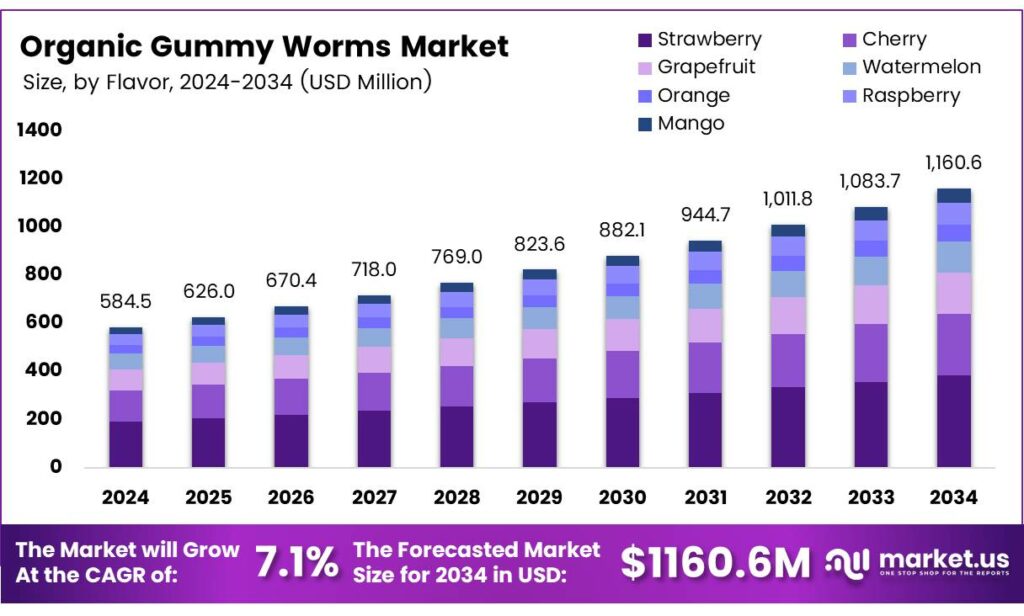

The Global Organic Gummy Worms Market size is expected to be worth around USD 1160.6 million by 2034 from USD 584.5 million in 2024, growing at a CAGR of 7.1% during the forecast period 2025 to 2034.

Organic gummy worms represent a fast-growing segment within natural confectionery. These chewy treats use certified organic ingredients and plant-based formulations. Manufacturers eliminate artificial colors, synthetic flavors, and high-fructose corn syrup from recipes. Health-conscious consumers drive demand for clean-label candy alternatives. Parents increasingly choose organic options for children’s snacks.

- Manufacturers are now developing reduced-sugar gummies with 50% less sugar, achieved by using pistachio green hull extract (PGHE), stevia, and optimized gelatin starch ratios. By adjusting PGHE (1–5%), stevia (0.013–0.040%), and varying starch blends, researchers created gummies containing only about 12% sucrose while maintaining strong antioxidant activity, natural flavor, and natural color—offering a healthier treat without artificial additives or loss of taste.

Market expansion reflects broader trends in organic food consumption. Retailers dedicate more shelf space to natural confectionery products. Additionally, e-commerce platforms facilitate direct-to-consumer brand relationships. Distribution networks continue expanding through specialty stores and mainstream supermarkets. Regulatory frameworks support organic certification standards globally.

Consequently, manufacturers invest in sustainable supply chain partnerships. Certified organic raw materials ensure product authenticity and consumer trust. Innovation drives product differentiation in competitive landscapes. Companies develop sugar-free variants using natural sweeteners. Furthermore, functional ingredients like probiotics enhance nutritional profiles. Allergen-free formulations address specific dietary restrictions and preferences.

Key Takeaways

- The Global Organic Gummy Worms Market is valued at USD 584.5 million in 2024, projected to reach USD 1160.6 million by 2034, at a CAGR of 7.1% during the forecast period 2025-2034

- The Strawberry Flavor segment dominates with 23.7% market share in 2025

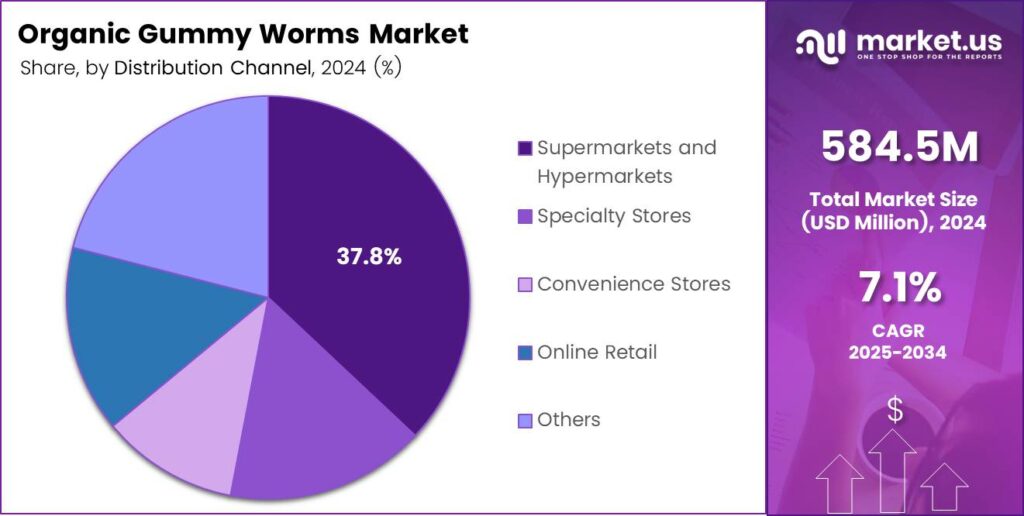

- Supermarkets and Hypermarkets lead distribution channels with 37.8% share

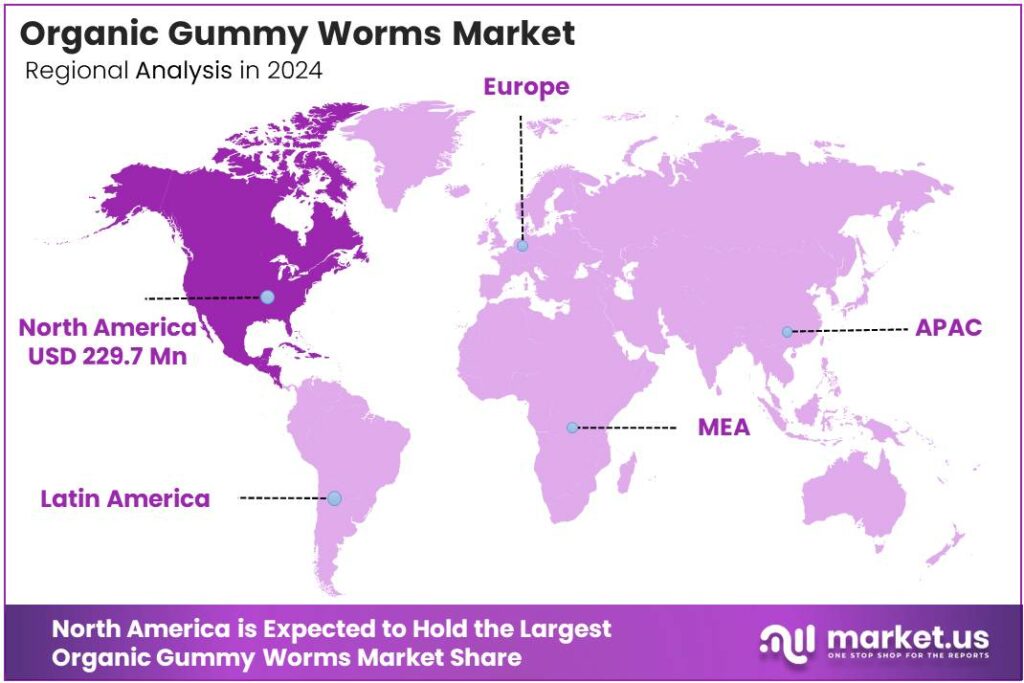

- North America holds a dominant regional position with 39.3% share, valued at USD 229.7 million

Flavor Analysis

Strawberry dominates with 23.7% due to universal consumer appeal and natural sweetness.

In 2025, Strawberry held a dominant market position in the By Flavor segment of the Organic Gummy Worms Market, with a 23.7% share. This flavor leads through widespread recognition and accessibility across demographics. Moreover, strawberry aligns with clean-label positioning through natural fruit essence integration.

Cherry maintains a strong presence as a classic candy flavor preference. Consumers appreciate its bold taste profile and nostalgic associations. Additionally, cherry variants offer rich color naturally derived from organic fruit concentrates. Grapefruit attracts health-conscious buyers seeking tangy alternatives. This citrus option differentiates brands in crowded markets.

Watermelon delivers a refreshing taste, particularly popular during summer seasons. Brands leverage this flavor for seasonal product launches. Consequently, watermelon variants drive impulse purchases in warm-weather markets. Orange provides familiar citrus notes with broad consumer acceptance. This flavor works well in multi-pack assortments and variety options.

Raspberry offers premium positioning through distinctive berry characteristics. Consumers perceive raspberry as upscale compared to common flavors. Additionally, this variant supports higher price points in specialty retail channels. Mango taps into tropical fruit trends, gaining momentum globally. This flavor attracts diverse consumer segments, including ethnic markets.

Distribution Channel Analysis

Supermarkets and Hypermarkets dominate with 37.8% due to their extensive reach and consumer shopping habits.

In 2025, Supermarkets and Hypermarkets held a dominant market position in the By Distribution Channel segment of the organic gummy worms market, with a 37.8% share. These large-format retailers provide maximum product visibility and accessibility. Moreover, dedicated organic sections facilitate consumer discovery and impulse buying behaviors.

Specialty Stores cater to dedicated natural food shoppers seeking curated selections. These retailers offer expert staff guidance and premium product assortments. Additionally, specialty channels command higher margins through value-added shopping experiences.

Convenience Stores capture on-the-go consumption occasions and last-minute purchases. Urban locations drive foot traffic for quick snack solutions. Furthermore, single-serve packaging formats perform exceptionally well in this channel.

Online Retail expands rapidly through direct-to-consumer brand engagement. Digital platforms enable subscription models and personalized product recommendations. Consequently, e-commerce reduces geographic barriers and facilitates niche product discovery.

Others include vending machines, pharmacies, and alternative retail formats. These channels provide supplementary distribution points reaching specific demographics. Therefore, diversified presence strengthens overall market penetration strategies.

Key Market Segments

By Flavor

- Strawberry

- Cherry

- Grapefruit

- Watermelon

- Orange

- Raspberry

- Mango

- Others

By Distribution Channel

- Supermarkets and Hypermarkets

- Specialty Stores

- Convenience Stores

- Online Retail

- Others

Emerging Trends

Functional Ingredients and Allergen-Free Formulations Reshape Product Development

Rapid movement toward allergen-free gummy formulations addresses dietary restriction concerns. Manufacturers eliminate common allergens, including gluten, dairy, and nuts, from recipes. Moreover, dedicated production facilities prevent cross-contamination risks. This trend expands addressable markets among sensitive consumer populations significantly.

- Increased popularity of probiotic-infused organic gummies merges candy with wellness. Brands incorporate beneficial bacteria strains supporting digestive health claims. Certified organic food sales in the United States reached an estimated $65.4 billion in 2024, a level not seen since before the pandemic, with clear year-on-year growth as more people look for reduced pesticides and clean-label options.

The growing trend of kid-focused functional candy launches combines nutrition with enjoyment. Products incorporate vitamins, minerals, and omega-3 fatty acids into formulations. Furthermore, brands position these as educational tools, teaching healthy eating habits. Therefore, functional organic gummies create new category opportunities, bridging candy and supplements.

Drivers

Rising Consumer Demand for Clean-Label Organic Confectionery Accelerates Market Growth

Consumers increasingly prefer organic confectionery products over conventional alternatives. Parents prioritize clean-label treats containing certified organic ingredients for children. Moreover, transparency in sourcing and manufacturing processes builds brand loyalty. This behavioral shift drives sustained market expansion across demographics.

Plant-based gummy formulations attract vegetarian and vegan consumer segments. Manufacturers replace gelatin with pectin and other plant-derived alternatives. Additionally, these products address religious dietary restrictions and ethical concerns. Consequently, broader consumer bases access organic gummy worm categories.

Retail penetration of organic candy brands expands through mainstream channels. Supermarkets allocate premium shelf space to natural confectionery sections. Furthermore, improved distribution networks reduce price gaps with conventional products. Therefore, accessibility improvements convert hesitant consumers into regular buyers.

Restraints

Elevated Production Costs and Ingredient Scarcity Challenge Market Accessibility

Higher production costs limit affordability for price-sensitive consumer segments. Organic certification processes and premium ingredients increase manufacturing expenses significantly. Moreover, economies of scale remain difficult for smaller specialty brands. This pricing barrier restricts market penetration in developing regions.

- Limited availability of certified organic raw ingredients constrains production capacity. Supply chains face challenges sourcing sufficient organic fruit concentrates and natural colorants. Organic food makes up only about 6% of total food sales in some regions, indicating that although demand is rising, many households still choose lower-priced conventional options for everyday purchases.

Certification requirements create barriers for new market entrants. Compliance costs and regulatory complexities favor established players with resources. Furthermore, ingredient traceability systems demand substantial infrastructure investments. Therefore, market consolidation trends may limit competitive diversity over time.

Growth Factors

Product Innovation and Digital Commerce Expansion Drive Market Opportunities

Innovation in sugar-free organic formulations opens new consumer segments. Manufacturers develop recipes using stevia and natural sweeteners without compromising taste. Moreover, reduced-sugar variants appeal to diabetic and health-conscious demographics. This product diversification strategy captures untapped market potential effectively.

Online specialty snack platforms facilitate direct brand-consumer relationships. Digital channels reduce traditional retail dependencies and distribution costs. Additionally, subscription models generate predictable revenue streams and customer retention. Consequently, e-commerce becomes a critical growth driver for emerging brands.

Adoption of fruit-and-vegetable-based natural colorants enhances clean-label positioning. Brands eliminate synthetic dyes using beetroot, turmeric, and spirulina extracts. Furthermore, these ingredients provide additional nutritional benefits and marketing advantages. Therefore, natural colorant integration strengthens competitive differentiation and premium positioning.

Regional Analysis

North America Dominates the Organic Gummy Worms Market with a Market Share of 39.3%, Valued at USD 229.7 Million

North America leads global markets through established organic food consumption patterns. The region benefits from robust retail infrastructure and high disposable incomes. Moreover, 39.3% market share reflects strong consumer awareness about clean-label products. The market valuation of USD 229.7 million demonstrates substantial commercial scale and growth potential.

Europe demonstrates strong growth driven by stringent food safety regulations. Consumers prioritize organic certifications and sustainable packaging initiatives. Additionally, premium pricing acceptance supports brand innovation and product differentiation. Countries like Germany and the UK lead regional consumption patterns.

Asia Pacific emerges as the fastest-growing region with expanding middle-class populations. Rising health consciousness drives demand for natural confectionery alternatives. Furthermore, increasing retail modernization facilitates organic product distribution. Markets in Japan, Australia, and urban China show particularly strong adoption.

Latin America experiences gradual growth constrained by affordability challenges. Urban consumers in Brazil and Mexico show growing interest in organic options. Moreover, e-commerce platforms help overcome limited physical retail availability. Regional brands adapt formulations to local flavor preferences successfully.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Black Forest Organic, a brand under Ferrara Candy Company, leads through authentic fruit-based formulations and mainstream retail presence. The company emphasizes real fruit juice and natural colors in product development. Their sustainability commitment achieved fully recyclable packaging by 2025 as planned. This environmental focus strengthens brand reputation among eco-conscious consumers seeking responsible confectionery choices.

Surf Sweets positions itself as an allergen-friendly organic candy specialist targeting sensitive consumers. The brand eliminates top allergens while maintaining appealing taste profiles and textures. Additionally, Surf Sweets leverages specialty retail channels for premium positioning and customer loyalty. Their focus on dietary inclusivity creates competitive advantages in growing allergy-aware markets.

YumEarth distinguishes itself through extensive flavor variety and transparent ingredient sourcing practices. The company offers certified organic and non-GMO products across multiple confectionery categories. Furthermore, YumEarth builds strong direct-to-consumer relationships through e-commerce platforms and subscriptions. This multi-channel approach ensures consistent growth and market penetration across demographics.

Annie’s Homegrown, a General Mills subsidiary, brings corporate resources to organic confectionery innovation. The brand introduced Organic Sweet and Sour Fruit Twists featuring vegan and gluten-free formulations. Moreover, Annie’s leverages General Mills distribution networks for superior retail accessibility nationwide. Their combination of innovation and scale creates formidable competitive positioning.

Top Key Players in the Market

- Black Forest Organic

- Surf Sweets

- YumEarth

- Annie’s Homegrown

- SmartSweets

- Torie & Howard

- Project 7

- The Organic Candy Factory

- Squish Candies

Recent Developments

- In 2025, Black Forest Organic, a brand under Ferrara Candy Company, focuses on gummies and fruit snacks made with real fruit juice and natural colors. Sustainability commitment to transition to fully sustainable packaging (recyclable, reusable, or compostable) by 2025, which was completed as planned.

- In 2025, Annie’s Homegrown, a General Mills subsidiary, will offer organic fruit snacks similar to gummy worms (e.g., bunny-shaped). Introduction of Organic Sweet and Sour Fruit Twists in Strawberry Lemonade and Green Apple flavors, marked as new on the site—vegan, gluten-free, and made with real fruit juice.

Report Scope

Report Features Description Market Value (2024) USD 584.5 Million Forecast Revenue (2034) USD 1160.6 Million CAGR (2025-2034) 7.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Flavor (Strawberry, Cherry, Grapefruit, Watermelon, Orange, Raspberry, Mango, Others), By Distribution Channel (Supermarkets and Hypermarkets, Specialty Stores, Convenience Stores, Online Retail, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Black Forest Organic, Surf Sweets, YumEarth, Annie’s Homegrown, SmartSweets, Torie & Howard, Project 7, The Organic Candy Factory, Squish Candies Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Organic Gummy Worms MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample

Organic Gummy Worms MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Black Forest Organic

- Surf Sweets

- YumEarth

- Annie's Homegrown

- SmartSweets

- Torie & Howard

- Project 7

- The Organic Candy Factory

- Squish Candies