Global Oocyte Retrieval Needles Market By Product Type (Single Lumen Needle and Double Lumen Needle), By End-user (Hospitals, Fertility Clinics, Clinical Research Institutes and Surgical Centers), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171341

- Number of Pages: 275

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

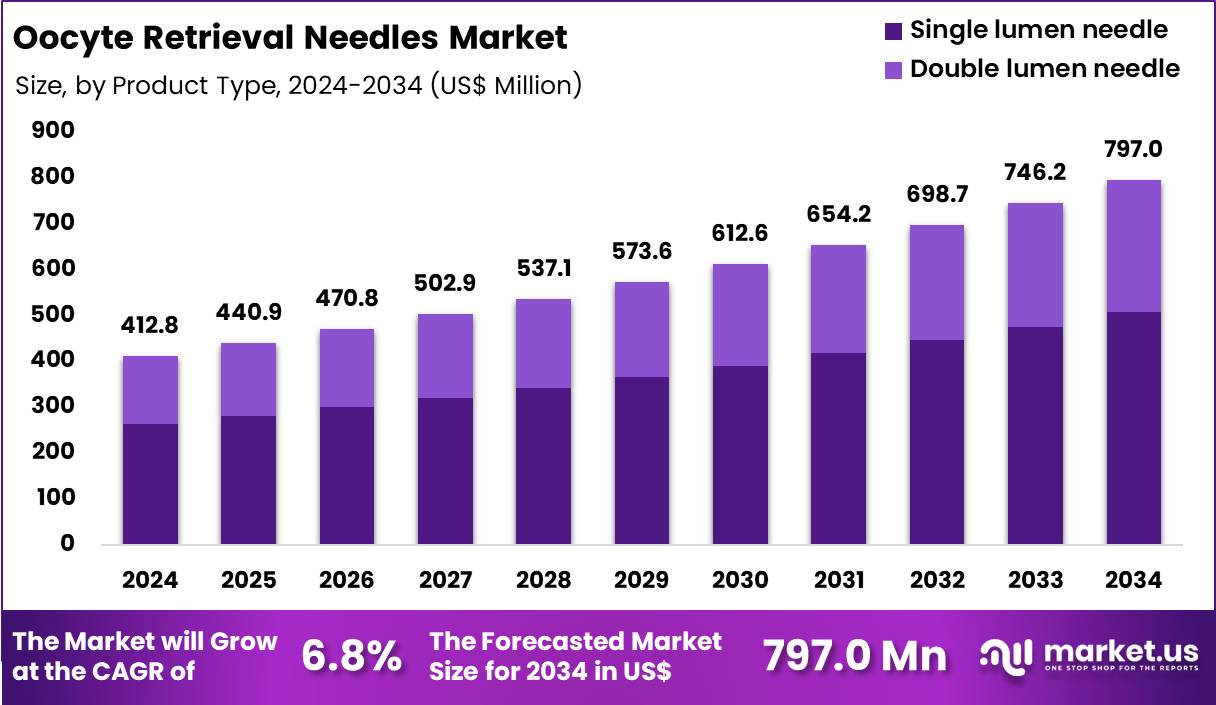

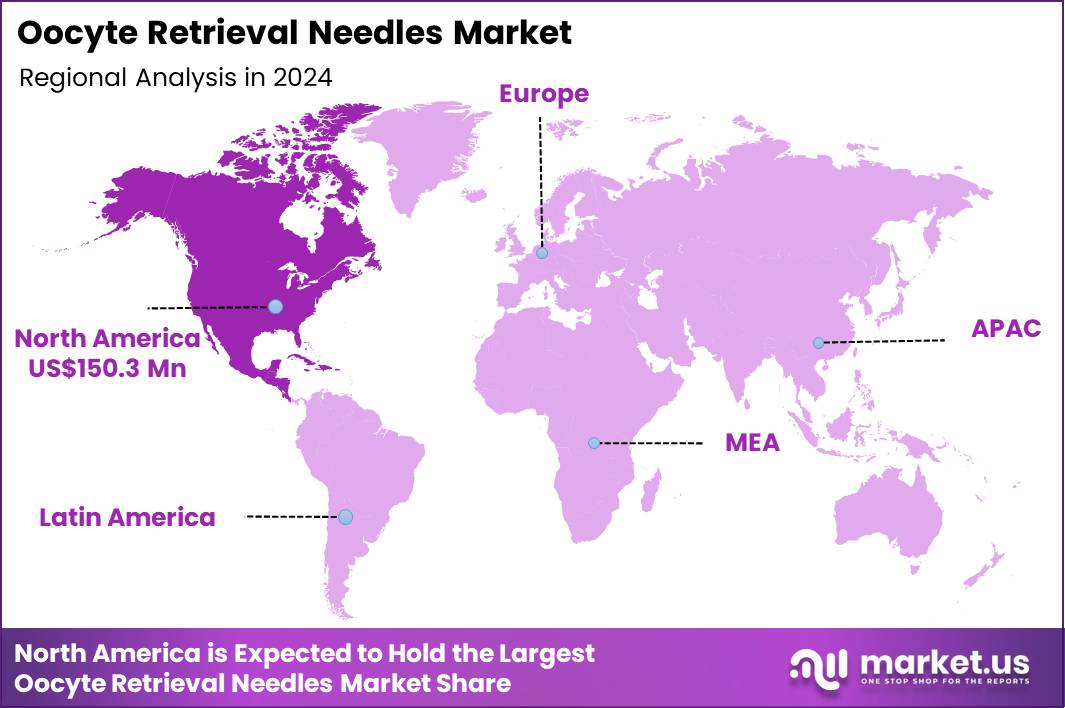

Global Oocyte Retrieval Needles Market size is expected to be worth around US$ 797.0 Million by 2034 from US$ 412.8 Million in 2024, growing at a CAGR of 6.8% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 36.4% share with a revenue of US$ 150.3 Million.

Increasing demand for assisted reproductive technologies propels the Oocyte Retrieval Needles market, as fertility specialists seek instruments that maximize oocyte yield while minimizing procedural complications and patient discomfort. Manufacturers innovate with single-lumen and double-lumen designs featuring thin walls and echogenic markings to enhance ultrasound guidance and reduce tissue trauma.

These needles apply in standard in vitro fertilization cycles for follicular aspiration under transvaginal ultrasound, intracytoplasmic sperm injection procedures requiring high oocyte quality, egg freezing protocols for fertility preservation in cancer patients, and donor oocyte retrieval for surrogacy arrangements. Collaborative efforts between device makers and IVF providers create opportunities for customized needle specifications that align with clinic-specific protocols.

In February 2025, Allwin Medical Devices Inc. from the U.S. and Singapore-based Esco Medical formed a collaboration to expand the availability of specialized scientific equipment worldwide, directly supporting IVF sector needs including precision consumables like oocyte retrieval needles. This partnership enhances global supply chains and fosters innovation in needle ergonomics for broader clinical adoption.

Growing adoption of minimally invasive fertility techniques accelerates the Oocyte Retrieval Needles market, as clinics prioritize needles that shorten procedure times and improve recovery for patients undergoing multiple cycles. Biotechnology firms develop 18- to 20-gauge options with triple-cut bevels that facilitate smooth follicle penetration and continuous aspiration flow.

Applications encompass polycystic ovary syndrome management through controlled ovarian hyperstimulation followed by targeted retrieval, endometriosis-related infertility treatments to harvest viable oocytes despite adhesions, advanced maternal age cycles focusing on oocyte quality over quantity, and research applications in in vitro maturation where immature oocytes require gentle handling.

Emerging opportunities include integration with robotic-assisted systems for enhanced precision in high-volume centers. Diagnostic advancements in ultrasound compatibility further drive needle evolution, enabling real-time visualization that boosts success rates. This focus on efficiency positions the market for sustained expansion amid rising fertility treatment volumes.

Rising emphasis on patient-centered innovations invigorates the Oocyte Retrieval Needles market, as developers incorporate ergonomic handles and reduced-diameter shafts to alleviate pain and anxiety during transvaginal aspiration. Companies launch Teflon-coated variants that minimize oocyte stress and adhesion during extraction, supporting higher fertilization rates.

These specialized needles serve in gestational carrier programs for efficient multi-follicle harvesting, oncofertility preservation via rapid retrieval before chemotherapy, veterinary-assisted reproduction in endangered species for genetic banking, and educational simulations for training embryologists on optimal technique.

Trends toward disposable, sterile designs open avenues for cost-effective bulk procurement in ambulatory surgical centers. Clinical studies increasingly validate smaller gauge needles for equivalent yields with lower complication risks, influencing guideline updates. This patient-oriented trajectory cements the market’s role in advancing equitable access to reproductive care.

Key Takeaways

- In 2024, the market generated a revenue of US$ 412.8 Million, with a CAGR of 6.8%, and is expected to reach US$ 797.0 Million by the year 2034.

- The product type segment is divided into single lumen needle and double lumen needle, with single lumen needle taking the lead in 2024 with a market share of 63.8%.

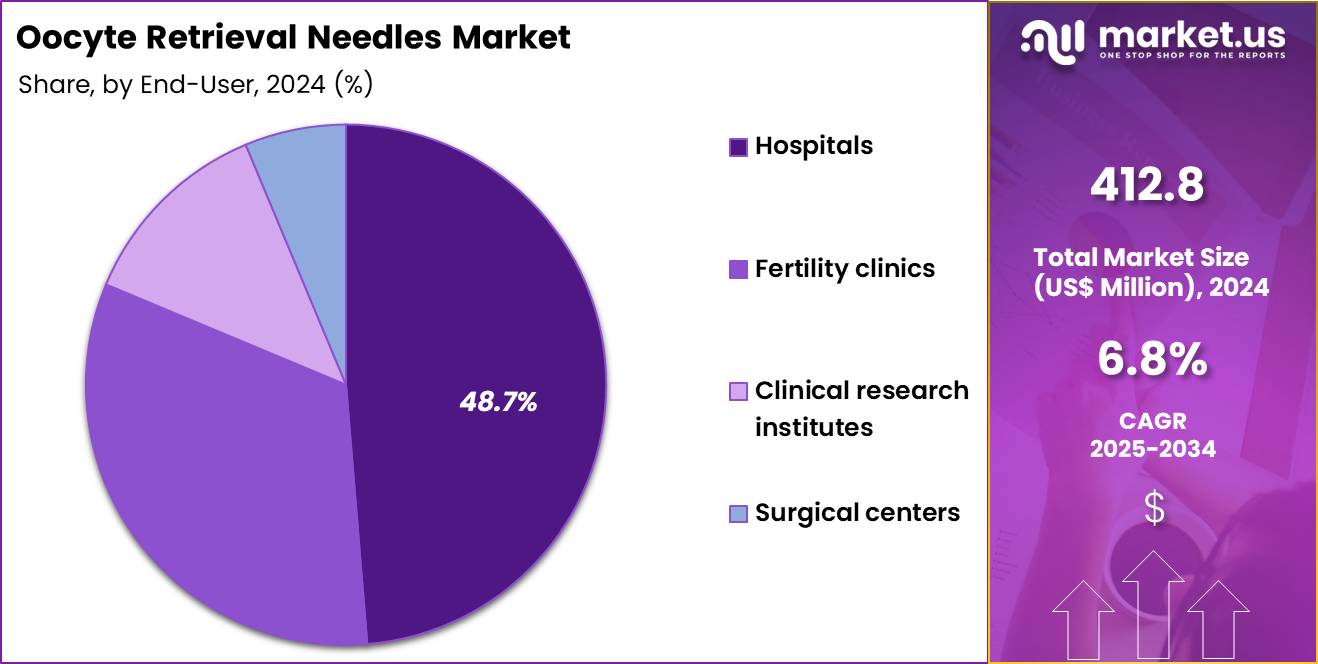

- Considering end-user, the market is divided into hospitals, fertility clinics, clinical research institutes and surgical centers. Among these, hospitals held a significant share of 48.7%.

- North America led the market by securing a market share of 36.4% in 2024.

Product Type Analysis

Single lumen needle, holding 63.8%, is expected to dominate because it supports smoother follicular aspiration with reduced tissue trauma, making it the preferred choice in IVF procedures worldwide. Fertility specialists increasingly adopt single lumen designs due to their simplicity, enhanced maneuverability, and lower risk of contamination during oocyte retrieval. Advancements in needle tip geometry strengthen accuracy and improve oocyte yield without compromising patient comfort.

Growing global demand for IVF treatments drives higher procedure volumes, which directly increases utilization of single lumen retrieval tools. Improved ultrasound visibility and ergonomic performance support consistent clinical outcomes. These factors keep single lumen needles anticipated to remain the leading product type in the market.

End-User Analysis

Hospitals, holding 48.7%, are projected to dominate because they manage a substantial share of infertility evaluations and assisted reproduction procedures, especially in regions where IVF is integrated into tertiary care services. Hospitals maintain advanced imaging systems and trained staff, ensuring reliable oocyte retrieval outcomes.

Increasing infertility rates and delayed family planning encourage more couples to seek treatment through hospital-based reproductive units. Hospitals also support high-risk patient profiles requiring integrated medical supervision during retrieval. Growing investments in reproductive medicine departments expand procedural capacity. These advantages keep hospitals expected to remain the dominant end-user segment in the oocyte retrieval needles market.

Key Market Segments

By Product Type

- Single Lumen Needle

- Double Lumen Needle

By End-user

- Hospitals

- Fertility Clinics

- Clinical Research Institutes

- Surgical Centers

Drivers

Growing demand for assisted reproductive technologies is driving the market

The escalating need for assisted reproductive technologies, particularly in vitro fertilization, has significantly boosted the utilization of oocyte retrieval needles as essential components in egg aspiration procedures. According to the Centers for Disease Control and Prevention, 435,426 assisted reproductive technology cycles were performed in the United States in 2022, reflecting a steady increase in procedural volumes. This surge correlates with heightened awareness and accessibility of fertility treatments among couples facing conception challenges.

Oocyte retrieval needles facilitate precise follicular puncture under ultrasound guidance, enabling the collection of viable eggs for subsequent fertilization. Demographic trends, including delayed childbearing and rising male infertility factors, further amplify the procedural demand. International guidelines from organizations like the World Health Organization advocate for expanded fertility services, indirectly supporting device procurement in clinical settings.

The integration of these needles into standardized protocols enhances operational efficiency in fertility centers worldwide. Economic analyses indicate that successful IVF outcomes justify investments in high-quality retrieval tools to maximize yield per cycle. Collaborative research emphasizes the role of reliable needles in improving oocyte quality and quantity. Collectively, this driver positions the market for continued expansion aligned with global reproductive health priorities.

Restraints

Risk of procedural complications is restraining the market

Oocyte retrieval procedures carry inherent risks, including ovarian puncture, bleeding, and infection, which temper clinician confidence and limit broader adoption of specialized needles. These adverse events, though rare, necessitate vigilant monitoring and can prolong recovery periods for patients. Variability in patient anatomy complicates needle trajectory, potentially increasing the incidence of unintended tissue trauma. Regulatory requirements for device safety profiles add layers of scrutiny, delaying innovations that could mitigate such risks.

The psychological burden on patients, coupled with informed consent processes, contributes to selective procedure scheduling. Resource limitations in under-equipped facilities exacerbate challenges, favoring conservative approaches over advanced needle variants. Longitudinal studies highlight correlations between procedural volume and complication rates, underscoring the need for extensive training. .

Cost implications of managing post-retrieval issues strain healthcare budgets, influencing procurement decisions. Ethical considerations around minimizing invasiveness further constrain experimental designs. Overall, this restraint underscores the imperative for enhanced safety features to foster unhindered market progression.

Opportunities

Shift toward single-lumen needle designs is creating growth opportunities

The transition to single-lumen oocyte retrieval needles offers streamlined aspiration without flushing capabilities, reducing procedural complexity and costs in resource-constrained environments. This design minimizes equipment needs, appealing to emerging fertility clinics in developing regions. Enhanced tip geometries in these needles improve follicular access, potentially elevating oocyte recovery rates.

Compatibility with standard ultrasound systems broadens applicability across diverse clinical workflows. Manufacturers are exploring ergonomic enhancements to alleviate operator fatigue during high-volume sessions. Integration with digital tracking for needle performance data supports quality assurance initiatives.

Global partnerships facilitate technology transfer, enabling localized production for affordability. Validation trials demonstrate comparable efficacy to dual-lumen counterparts, building stakeholder trust. Scalability in ambulatory settings unlocks outpatient expansion opportunities. In essence, this evolution catalyzes accessible, efficient solutions for equitable fertility care delivery.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic forces propel the oocyte retrieval needles market forward as expanding healthcare budgets and rising infertility rates worldwide encourage fertility clinics to invest in specialized needles for efficient egg harvesting during IVF procedures. Manufacturers actively develop finer-gauge, ultrasound-guided designs, capitalizing on the surge in assisted reproductive technologies and supportive insurance policies in developed regions.

Persistent inflation and uneven economic recoveries, however, elevate raw material costs for stainless steel and plastics, prompting smaller clinics to postpone upgrades and extend the use of existing inventory in budget-constrained areas. Geopolitical tensions, particularly U.S.-China trade disputes and regional conflicts, frequently disrupt global supply chains for precision medical components, leading to delays and higher sourcing uncertainties for producers reliant on Asian manufacturing hubs.

Current U.S. tariffs impose substantial duties on imported medical needles and devices, driving up procurement expenses for American IVF centers and challenging affordability amid heavy reliance on overseas suppliers. These tariffs trigger retaliatory measures in foreign markets that restrict U.S. exports of advanced reproductive tools and complicate international R&D collaborations. Nevertheless, the policies accelerate investments in domestic production facilities and localized innovation, building more resilient supply networks that will enhance market stability and foster long-term growth in fertility care.

Latest Trends

FDA clearance of VitaVitro Double Lumen Oocyte Retrieval Needle is a recent trend

In November 2024, the U.S. Food and Drug Administration granted 510(k) clearance to Shenzhen VitaVitro Biotech Co., Ltd. for its Double Lumen Oocyte Retrieval Needle, designed for ultrasound-guided transvaginal aspiration and flushing of ovarian follicles. This approval validates the device’s substantial equivalence to predicate instruments, emphasizing its 17-gauge configuration for optimal tissue penetration.

The needle incorporates echogenic markings to enhance visibility under real-time imaging, facilitating precise navigation. Manufacturers highlight its reduced wall thickness for improved flexibility without compromising structural integrity. This development aligns with ongoing efforts to standardize retrieval tools amid rising procedural demands. Early adoptions in U.S. fertility centers underscore its role in minimizing patient discomfort through smoother insertion.

Regulatory documentation confirms biocompatibility and sterility assurance levels compliant with ISO 10993 standards. The clearance extends to single-use formats, promoting infection control in clinical practice. Industry observers note its potential to integrate with automated aspiration systems for future workflows. This 2024 milestone reflects a maturing regulatory landscape supportive of iterative advancements in reproductive device technology.

Regional Analysis

North America is leading the Oocyte Retrieval Needles Market

In 2024, North America held a 36.4% share of the global oocyte retrieval needles market, driven by surging demand for assisted reproductive technologies and refinements in minimally invasive procedures. Fertility clinics proliferate in urban centers, incorporating echogenic needles with ergonomic grips to optimize follicular aspiration yields during transvaginal retrievals.

Regulatory approvals from the U.S. Food and Drug Administration expedite adoption of single-lumen designs that reduce patient discomfort and procedural times. Collaborative research funded by the National Institutes of Health advances ultrasound-guided innovations, enhancing visualization for complex polycystic ovary cases. Demographic pressures from delayed childbearing among millennials fuel IVF enrollments, necessitating high-precision tools for mature oocyte harvest.

Supply chain stabilizations post-disruption enable manufacturers to scale production of sterile, latex-free variants compliant with ISO standards. Professional societies promote standardized training modules, upskilling embryologists in needle handling to minimize trauma risks. These catalysts affirm a pivotal role in elevating fertility outcomes through technological sophistication. The Centers for Disease Control and Prevention reported 435,426 assisted reproductive technology cycles performed in the United States in 2022.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Clinicians anticipate robust escalation in oocyte retrieval instruments across Asia Pacific over the forecast period, as expanding fertility awareness reshapes healthcare priorities. Governments in Singapore and South Korea subsidize IVF access, outfitting public facilities with multi-port needles that facilitate simultaneous flushing and aspiration in high-volume settings.

Local medtech firms innovate cost-effective, radiopaque models tailored to diverse body types, empowering rural practitioners in India to conduct procedures with enhanced safety profiles. International collaborations via the Asia-Pacific Fertility Alliance standardize protocols, integrating haptic feedback systems to guide novice operators through ovarian punctures.

Rising disposable incomes among young professionals spur private chain expansions, stocking advanced bevel designs that preserve cumulus complexes for cryopreservation. Regulatory harmonization accelerates market entry for biodegradable sheaths, mitigating infection hazards in tropical climates.

Academic consortia validate ergonomic variants through randomized trials, refining gauge selections for optimal retrieval efficiencies. These advancements galvanize equitable progress, bolstering reproductive autonomy amid population dynamics. The World Health Organization reports that the prevalence of infertility stands at 23.2% in the Western Pacific Region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key manufacturers in oocyte-retrieval instrumentation strengthen growth by engineering needles with improved ultrasound visibility, reduced puncture resistance, and optimized lumen designs that enhance follicle aspiration efficiency while minimizing patient discomfort. They expand their presence by partnering with IVF clinics, fertility networks, and reproductive-medicine distributors to standardize high-performance consumables across multi-clinic groups.

Product teams refine ergonomic features and sterilization processes to support consistent procedure outcomes and reduce variability across operators. Companies differentiate through comprehensive fertility portfolios that bundle retrieval needles with aspiration sets, embryo-handling tools, and lab consumables, creating integrated procurement pathways for clinics.

They drive international expansion by aligning with regulatory requirements in fast-growing fertility markets and offering training programs that help embryologists adopt new needle technologies confidently. Cook Medical exemplifies this strategy with its longstanding expertise in reproductive-health devices, global manufacturing capabilities, and deep partnerships with fertility centers that rely on its precision-engineered retrieval needles to support high-quality IVF outcomes.

Top Key Players

- Cook Medical

- Vitrolife

- CooperSurgical

- Biopsybell

- Rocket Medical

- RI.MOS.

- Gynetics Medical Products

- Thomas Medical

Recent Developments

- In March 2025, Cook Medical released an advanced single-lumen oocyte aspiration needle incorporating a new patented bevel geometry. The updated design enhances entry efficiency and reduces trauma to ovarian follicles, aligning with industry goals to lower procedural invasiveness and improve outcomes in assisted reproductive technologies.

- In November 2024, CooperSurgical, Inc. completed the acquisition of Generate Life Sciences®, a major provider in the reproductive health sector. Generate Life Sciences® offers donor sperm and egg services, newborn stem cell banking, and a range of fertility-related treatments, expanding CooperSurgical’s portfolio within assisted reproduction and genetic preservation.

Report Scope

Report Features Description Market Value (2024) US$ 412.8 Million Forecast Revenue (2034) US$ 797.0 Million CAGR (2025-2034) 6.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Single Lumen Needle and Double Lumen Needle), By End-user (Hospitals, Fertility Clinics, Clinical Research Institutes and Surgical Centers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Cook Medical, Vitrolife, CooperSurgical, Biopsybell, Rocket Medical, RI.MOS., Gynetics Medical Products, Thomas Medical Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Oocyte Retrieval Needles MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Oocyte Retrieval Needles MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Cook Medical

- Vitrolife

- CooperSurgical

- Biopsybell

- Rocket Medical

- RI.MOS.

- Gynetics Medical Products

- Thomas Medical