Global Online Recipe Box Delivery Market Size, Share, Industry Analysis Report By Service Type (Subscription-Based, One-Time Orders, Customized Meal Plans, Dietician/Nutritionist-Curated Boxes), By Platform (Mobile App, Website, Third-Party Aggregators), By Packaging Format (Pre-Portioned Ingredients, Fully Cooked & Ready-to-Eat, Do-It-Yourself (DIY) Cooking Kits, Frozen Meal Boxes, Others), By Delivery Frequency (Daily, Weekly, Monthly), By End User (Households / Individuals, Working Professionals, Elderly Consumers, Health Enthusiasts, Corporate / Office Packages, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 165347

- Number of Pages: 211

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Adoption Rate and Usage Statistics

- By Service Type

- By Platform

- By Packaging Format

- By Delivery Frequency

- By End User

- Emerging Trends

- Growth Factors

- Key Market Segments

- Regional Analysis

- Key Regions and Countries

- Driver

- Restraint

- Opportunity

- Challenge

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

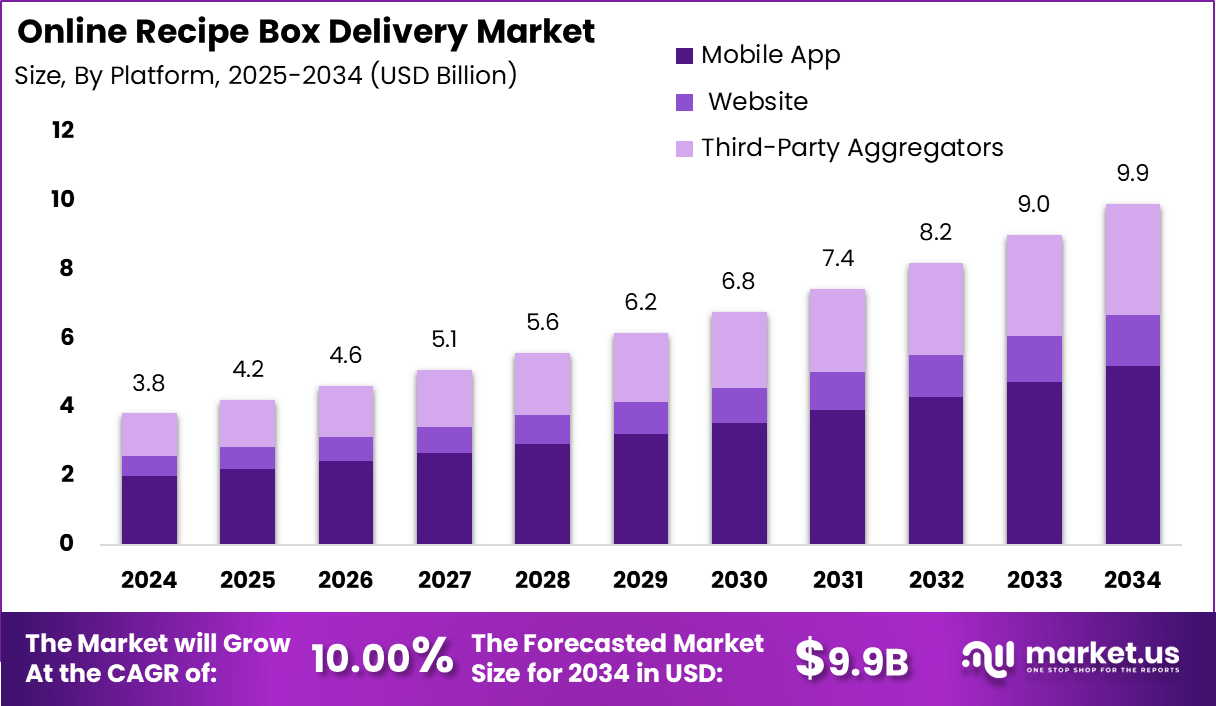

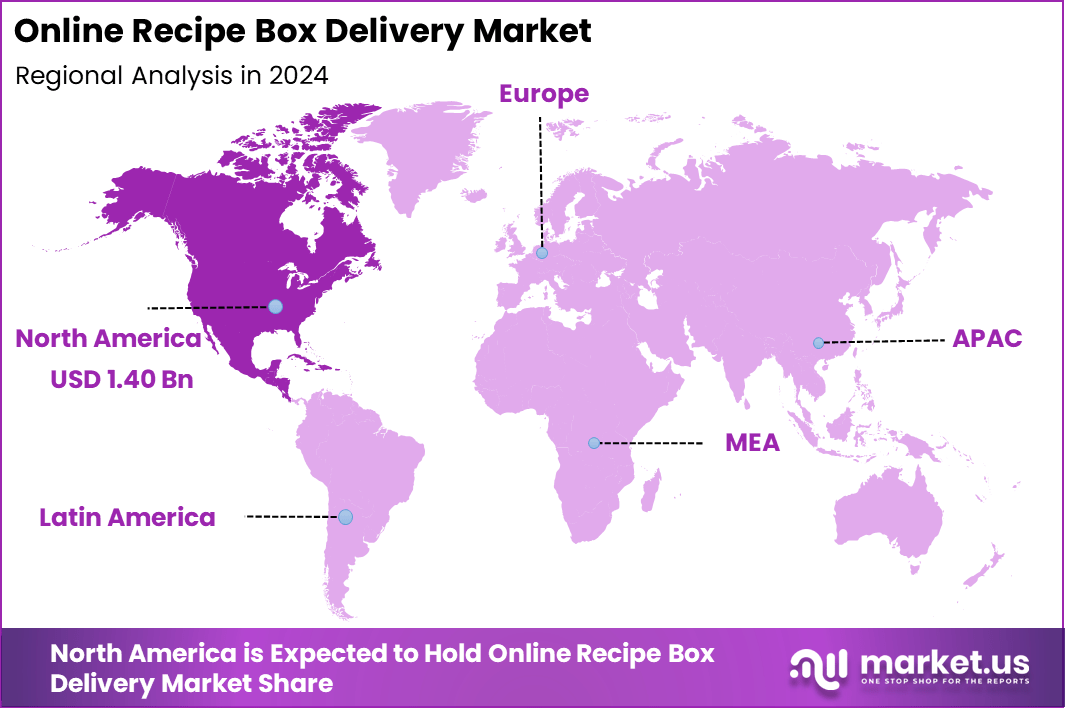

The Global Online Recipe Box Delivery Market generated USD 3.8 billion in 2024 and is predicted to register growth from USD 4.0 billion in 2025 to about USD 9.9 billion by 2034, recording a CAGR of 10% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 36.9% share, holding USD 1.40 Billion revenue.

The online recipe box delivery market has experienced substantial growth in recent years, reflecting a shift in consumer behaviour toward convenience and home-cooked meals delivered in a curated format. Several industry-facing reports note that the market was already worth several billion in recent years and is expected to continue expanding significantly. The expansion has been supported by the widening of service models (subscription, one-time box, flexible plans) and geographic expansion into new regions.

The growth of this market can be attributed to multiple enabling factors. Firstly, consumer lifestyles have become increasingly busy, reducing the time available for shopping and meal planning, thereby raising the appeal of pre-portioned recipe boxes. Secondly, health and wellness trends have elevated demand for meal solutions that offer balanced nutrition, controllable portions and fresh ingredients. Thirdly, the growth of e-commerce and digital delivery infrastructure (including mobile ordering, efficient logistics for perishable items) has made the service more accessible.

Approximately 60% of people value easy-to-follow recipes and pre-measured ingredients as key benefits, promoting repeat subscriptions and brand loyalty. Demand analysis shows that subscription-based delivery models dominate, with users appreciating the routine of regular, scheduled deliveries that simplify weekly meal preparation. Retail and corporate wellness programs also adopt meal kits to promote health among employees and customers.

Top Market Takeaways

- By service type, subscription-based delivery holds 40.4% of the market, driven by consumers’ preference for convenience, variety, and regular meal planning support through recurring deliveries.

- By platform, mobile apps lead with 52.5% share, reflecting the growing role of smartphones and user-friendly app interfaces in ordering, customizing, and managing recipe box deliveries.

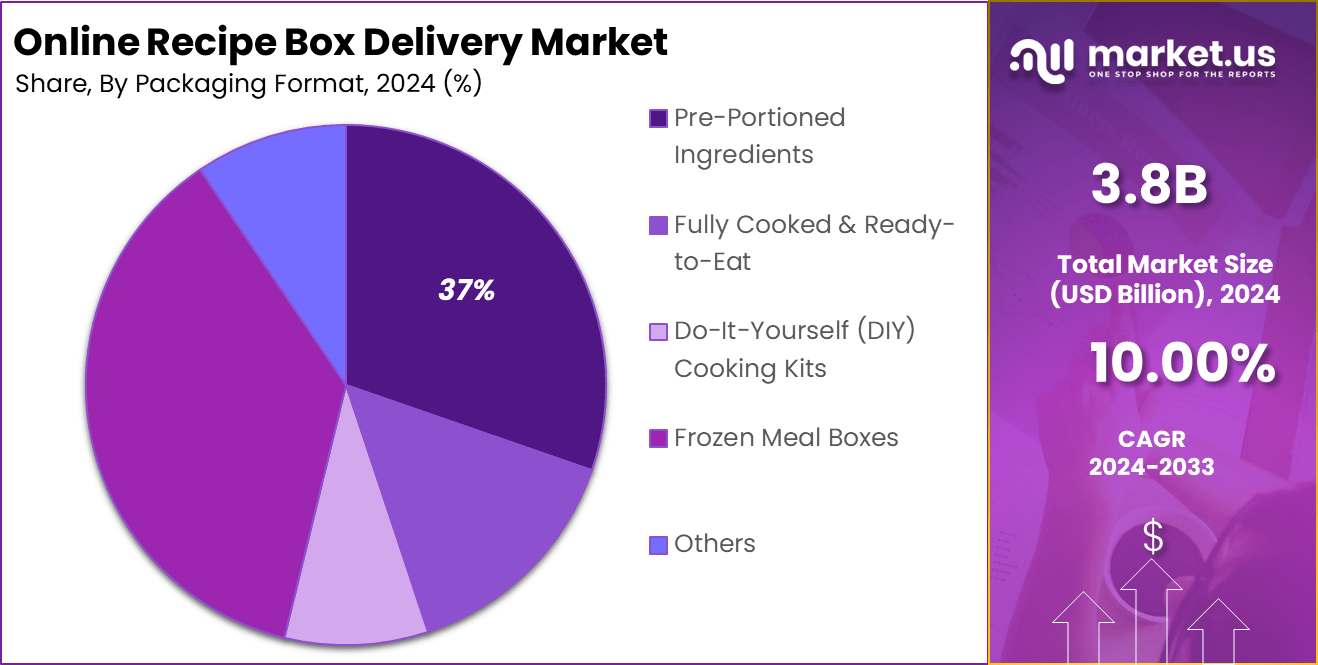

- By packaging format, pre-portioned ingredients constitute 37.4% share, helping reduce food waste and simplify cooking by providing exact amounts needed per recipe.

- By delivery frequency, daily delivery dominates at 48.8%, catering to customers seeking fresh meals and flexible meal plans with frequent new recipes.

- By end user, households and individuals comprise 36.7% of the market, supported by rising interest in home cooking, health-conscious eating, and culinary exploration.

- Regionally, North America holds about 36.9% of the market.

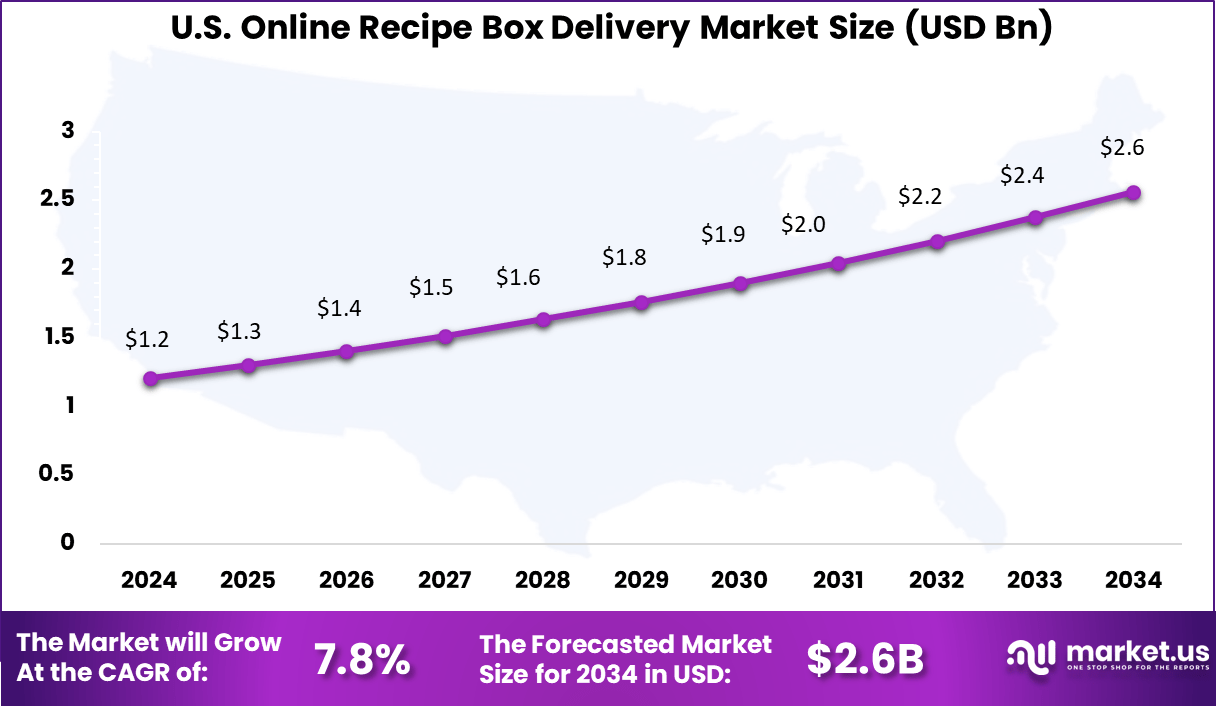

- The U.S. market size is approximately USD 1.21 billion in 2025.

- The market is growing at a CAGR of 7.8%, driven by rising awareness of healthy eating, growing urbanization, increased digital engagement, and adoption of meal kit delivery services accelerated by lifestyle changes such as the pandemic.

- Key trends include expansion in dietary-specific options (vegan, gluten-free), eco-friendly packaging, personalized meal customization, integration of e-commerce platforms, and the rise of subscription models enhancing customer retention.

Adoption Rate and Usage Statistics

- Market penetration: Around 5% of US adults use a meal kit service each month. This remains lower than the adoption of online grocery delivery services at about 10%, and lower than the usage of broader food delivery apps such as DoorDash or Uber Eats, which reach around 17% of adults monthly.

- User base: The number of US meal kit users is projected to reach 8.1 million by 2030, supported by convenience-driven habits and rising interest in at-home meal preparation.

- Demographics: Meal kit services are most commonly used by Gen Z and Millennials, urban households, and families with children. One survey reported that 90.1% of new users lived in urban areas, and 82% had children in their households, indicating strong appeal among younger and family-oriented consumers.

- Frequency of use: While meal kit-specific frequency data is limited, broader food delivery behavior shows that 28.2% of Americans use delivery apps at least once per week. This indicates the potential for higher engagement if meal kit providers align offerings with general food delivery habits.

By Service Type

In 2024, Subscription-based models are the most widely used way to access online recipe box delivery, making up 40.4% of the market. This approach is popular because it offers regular deliveries without the need for repeated ordering. Many users appreciate the ability to plan meals ahead and avoid last-minute shopping, which fits well with busy schedules and changing routines.

Subscribers also value the flexibility to pause, skip, or adjust their deliveries as needed. This makes the service suitable for people with unpredictable lifestyles or those who want to try new recipes without long-term commitments. The predictability and ease of use help build loyalty and keep users coming back for more.

By Platform

In 2024, Mobile apps are the main way people order recipe boxes, accounting for 52.5% of all orders. The convenience of managing subscriptions, customizing meals, and tracking deliveries from a smartphone is a major draw. Most users find it easy to browse menus, save favorites, and reorder with just a few taps, which saves time and effort.

The mobile experience is designed to be fast and user-friendly, with features like push notifications and quick access to customer support. This helps users stay engaged and makes it simple to adapt their meal plans on the go. The app-based approach is especially popular among younger, tech-savvy consumers who value speed and convenience.

By Packaging Format

In 2024, Pre-portioned ingredients are used in 37.4% of recipe box deliveries. This format helps users avoid waste by providing exactly what is needed for each recipe. It also makes meal prep easier, as there is no need to measure or guess ingredient amounts, which is helpful for beginners and busy households.

Customers like the simplicity and control that pre-portioned ingredients offer. It supports healthier eating habits and reduces the stress of cooking, making it easier to try new recipes and stick to dietary goals. The focus on portion control is a key reason why this format continues to grow in popularity.

By Delivery Frequency

In 2024, Daily delivery is the most common option, chosen by 48.8% of users. This frequency suits people who want fresh ingredients every day and prefer to cook meals close to the time of delivery. It is especially popular among those who cook frequently and want to minimize storage needs.

The regular schedule helps users maintain a consistent meal routine and reduces the need for bulk shopping. Daily deliveries also make it easier to plan meals and avoid last-minute grocery runs, which is a big advantage for busy households and individuals.

By End User

In 2024, Households and individuals make up 36.7% of the end users for online recipe box delivery. This group includes families, couples, and single people who want convenient, home-cooked meals without the hassle of planning and shopping. The service is valued for saving time and introducing new recipes to the household.

Many users find that recipe boxes help them eat healthier and spend less time in the kitchen. The ability to cater to different tastes and dietary needs within a household is a major benefit. This segment is especially active among young professionals and families looking for efficient meal solutions.

Emerging Trends

The online recipe box delivery market is advancing on the back of some very clear and consumer-driven trends. One significant trend is the growing demand for healthy, personalized, and convenient meal solutions that fit busy lifestyles. Consumers increasingly seek options that cater to specialized diets such as vegan, keto, or gluten-free, which pushes companies to innovate with customizable meal plans.

Sustainability also plays a major role, with shoppers valuing eco-friendly packaging and ethically sourced ingredients. Technology integration, including AI-driven recommendations and easy-to-use apps, enhances the ordering experience and helps build stronger customer loyalty.

Growth Factors

A major growth driver for this market is the lifestyle shift towards home cooking combined with the desire to save time and reduce food waste. As urban households experience busier routines, having fresh ingredients and recipes delivered simplifies meal preparation without compromising quality.

Regional variations play an important part, with North America and Europe leading due to higher disposable incomes and well-established delivery infrastructure, while Asia Pacific shows strong emerging potential fueled by rapid urbanization and digital adoption. Furthermore, the rise in single-person households boosts demand for portion-controlled meal kits.

Key Market Segments

By Service Type

- Subscription-Based

- One-Time Orders

- Customized Meal Plans

- Dietician/Nutritionist-Curated Boxes

By Platform

- Mobile App

- Website

- Third-Party Aggregators

By Packaging Format

- Pre-Portioned Ingredients

- Fully Cooked & Ready-to-Eat

- Do-It-Yourself (DIY) Cooking Kits

- Frozen Meal Boxes

- Others

By Delivery Frequency

- Daily

- Weekly

- Monthly

By End User

- Households / Individuals

- Working Professionals

- Elderly Consumers

- Health Enthusiasts

- Corporate / Office Packages

- Others

Regional Analysis

North America continued to dominate the online recipe box delivery market, accounting for approximately 36.9% of global revenue. The market is valued at over USD 2.2 billion, driven by consumer trends toward convenience, healthier eating habits, and diverse meal offerings. Urban consumers, busy professionals, and health-conscious households increasingly rely on subscription meal kits that offer fresh, pre-portioned ingredients and easy-to-follow recipes.

The expansion of e-commerce and logistics infrastructure further facilitates this growth, making meal kit delivery a popular choice across diverse demographics. Sustainable sourcing, organic options, and allergen-friendly recipes are key differentiators that companies capitalize on to attract a growing customer base. This dynamic market continues to evolve, supported by innovative packaging, digital platforms, and personalized nutrition plans.

The U.S., the online recipe box delivery market is valued around USD 1.21 billion and growing at a steady CAGR of 7.8%. The U.S. market shows strong uptake driven by convenience-oriented consumers, technological integration in ordering and delivery, and a heightened focus on wellness and home cooking.

The U.S. consumer preferences for premium, organic, and diet-specific meal solutions fuel continuous innovation and diversification. All these factors reinforce the U.S. position as the largest and most influential market within North America for online recipe box delivery.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Demand for High Payload and Flight Stability

A key driver for the octocopter drone market is the growing demand for aerial platforms capable of carrying heavier payloads while maintaining flight stability. Octocopters, with their eight rotors, offer superior redundancy and control compared to quadcopters, making them ideal for commercial uses such as agriculture, logistics, cinematography, and infrastructure inspection.

The ongoing advancements in battery technology, autonomous navigation, and AI flight controls have increased octocopters’ flight duration and operational range. These improvements, combined with rising government investments in drone-based infrastructure and regulatory support, position octocopters as essential tools in modern aerial applications, fueling market growth.

Restraint

Regulatory Ambiguity and High Costs

Despite their benefits, octocopter drones face restraints due to regulatory uncertainties and high acquisition costs. Many countries lack clear UAV regulations, especially concerning airspace access, privacy protections, and commercial operations. This ambiguity complicates drone deployment and increases compliance costs, limiting market expansion in certain regions.

Additionally, octocopters generally have higher procurement and maintenance costs compared to smaller drones. The expense, combined with a shortage of qualified drone operators and technical support personnel, particularly affects small to medium businesses, restricting market penetration and adoption pace.

Opportunity

Expansion in Agriculture, Logistics, and Emergency Services

The octocopter drone market holds significant opportunities across diverse sectors such as precision agriculture, logistics, and emergency response. In agriculture, octocopters enable precise application of fertilizers and pesticides, increasing productivity while reducing waste. In logistics, their payload capacity supports efficient last-mile delivery, especially in hard-to-reach areas and urban environments.

Emergency services benefit from octocopters through rapid assessment, search and rescue operations, and medical supply delivery to disaster zones. Growing interest from e-commerce companies and defense agencies further amplifies opportunities as octocopters contribute to automation and resilience across industries.

Challenge

Technical Constraints and Public Perception

A major challenge in the octocopter drone market lies in managing the technical limitations related to battery life and flight endurance. Carrying heavier payloads demands increased power, which can reduce operational time and range. Optimizing this balance without compromising performance requires ongoing research and innovation in lightweight materials and energy-efficient systems.

Public concerns around noise pollution, safety hazards, and potential misuse also challenge market growth. Negative perceptions and resistance from communities can result in stricter regulations and operational restrictions. Addressing these challenges involves not only technological advancements but also transparent communication, safety assurances, and community engagement.

Competitive Analysis

The online recipe box delivery market is growing steadily, driven by consumer demand for convenient, healthy, and easy-to-prepare meal solutions. The market includes major players such as Blue Apron, HelloFresh, Plated, Sun Basket, Green Chef, Purple Carrot, Home Chef, Abel & Cole, Riverford, Quitoque, Kochhaus, Marley Spoon, Middagsfrid, Allerhandebox, Chefmarket, Kochzauber, Fresh Fitness Food, and Mindful Chef among others.

Blue Apron pioneers with a diversified product range including classic meal kits, ready-to-cook, and fully prepared meals, with more than 530 million meal kits shipped to date. HelloFresh is a global leader offering a broad variety of recipes, including rapid-prep and health-focused options, supported by a user-friendly meal planner app.

Sun Basket emphasizes organic and sustainably sourced ingredients with chef-developed recipes tailored for health and dietary preferences. Green Chef specializes in diet-specific meal kits like keto, paleo, and vegan, certified by nutritionists. Purple Carrot focuses exclusively on plant-based, vegan meal kits with an emphasis on sustainability through recyclable packaging. Home Chef provides highly customizable meal kits allowing consumers to tailor meals according to their preferences.

Top Key Players in the Market

- Blue Apron

- Hello Fresh

- Plated

- Sun Basket

- Green Chef

- Purple Carrot

- Home Chef

- Abel & Cole

- Riverford

- Blue Apron

- Quitoque

- Kochhaus

- Marley Spoon

- Middagsfrid

- Allerhandebox

- Chefmarket

- Kochzauber

- Fresh Fitness Food

- Mindful Chef

- Other Major Players

Recent Developments

- September, 2025, Blue Apron relaunched with a new brand identity and an expanded product lineup. They introduced an la carte shopping model with no subscription needed, offering over 100 customizable meals weekly. The menu includes two new convenient product lines: pre-made meals ready in five minutes and quick-assembly bake meals. Delivery times improved to as fast as three days in many U.S. regions.

- August, 2025, HelloFresh expanded its menu with more than 100 recipes per week, doubling its healthy options. The lineup features global flavors, premium cuts, and larger portion sizes, focusing on health-conscious consumers and convenience. The company also reported improved operating margins and positive cash flow in Q2 2025 driven by efficiency programs and strategic investments.

Report Scope

Report Features Description Market Value (2024) USD 3.8 Bn Forecast Revenue (2034) USD 9.9 Bn CAGR(2025-2034) 10% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Service Type (Subscription-Based, One-Time Orders, Customized Meal Plans, Dietician/Nutritionist-Curated Boxes), By Platform (Mobile App, Website, Third-Party Aggregators), By Packaging Format (Pre-Portioned Ingredients, Fully Cooked & Ready-to-Eat, Do-It-Yourself (DIY) Cooking Kits, Frozen Meal Boxes, Others), By Delivery Frequency (Daily, Weekly, Monthly), By End User (Households / Individuals, Working Professionals, Elderly Consumers, Health Enthusiasts, Corporate / Office Packages, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Blue Apron, Hello Fresh, Plated, Sun Basket, Green Chef, Purple Carrot, Home Chef, Abel & Cole, Riverford, Quitoque, Kochhaus, Marley Spoon, Middagsfrid, Allerhandebox, Chefmarket, Kochzauber, Fresh Fitness Food, Mindful Chef, and other major players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Online Recipe Box Delivery MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample

Online Recipe Box Delivery MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Blue Apron

- Hello Fresh

- Plated

- Sun Basket

- Green Chef

- Purple Carrot

- Home Chef

- Abel & Cole

- Riverford

- Blue Apron

- Quitoque

- Kochhaus

- Marley Spoon

- Middagsfrid

- Allerhandebox

- Chefmarket

- Kochzauber

- Fresh Fitness Food

- Mindful Chef

- Other Major Players