Global IT Infrastructure Management Tools Market Size, Share, Statistics Analysis Report By Component (Software, Hardware, Services), By Deployment Mode (On-Premises, Cloud), By Organization Size (Small and Medium Enterprises, Large Enterprises), By End-User (BFSI, Healthcare, Retail, Manufacturing, IT and Telecommunications, Government, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 144779

- Number of Pages: 307

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Analyst’s Viewpoint

- U.S. Market Leadership

- Component Analysis

- Deployment Mode Analysis

- Organization Size Analysis

- End-User Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Emerging Trends

- Business Benefits

- Key Player Analysis

- Top Opportunities for Players

- Recent Developments

- Report Scope

Report Overview

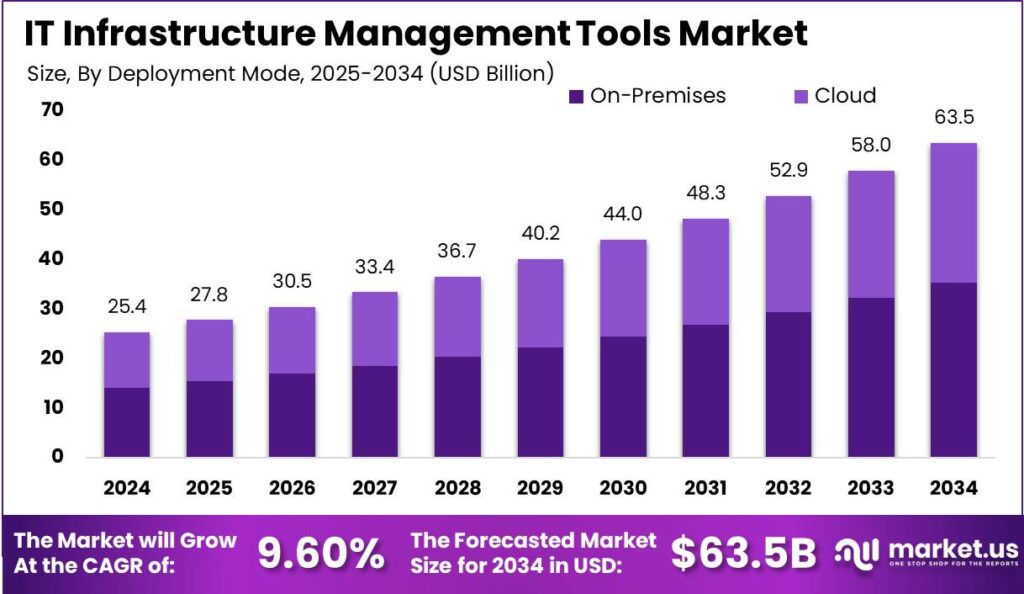

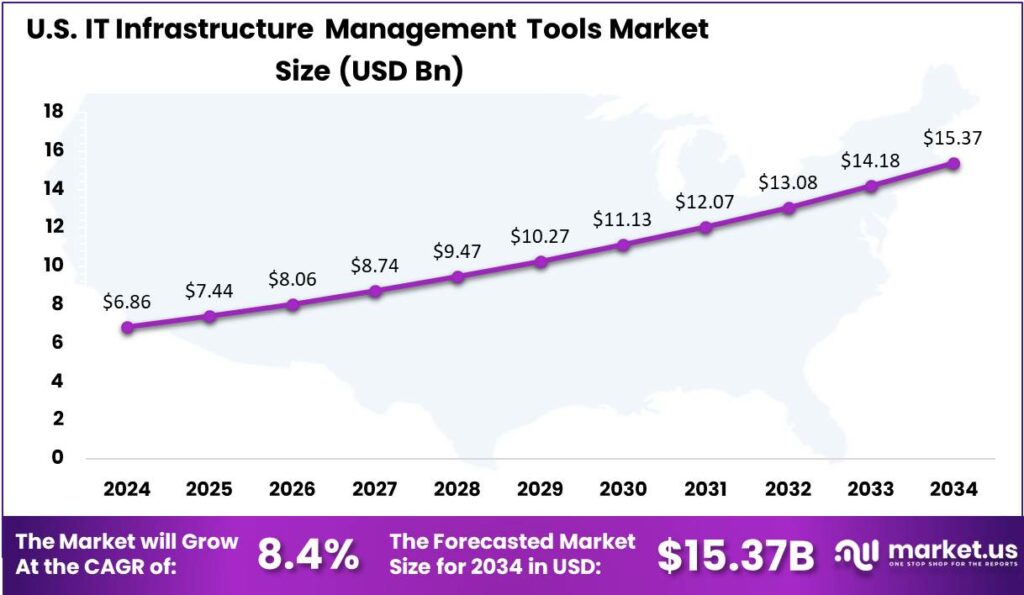

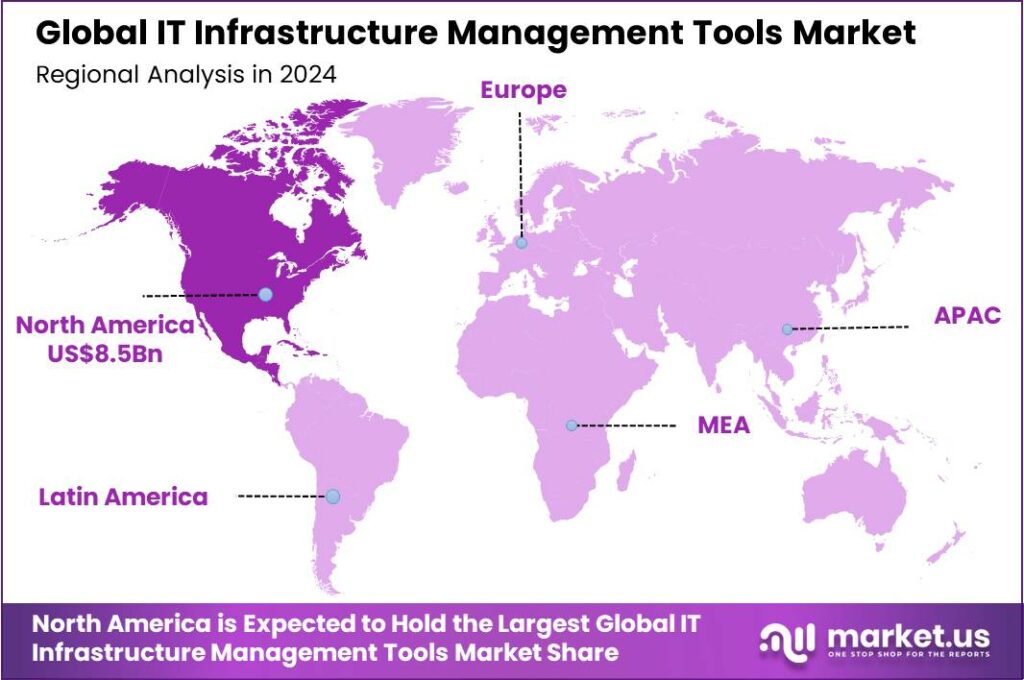

The IT Infrastructure Management Tools Market size is expected to be worth around USD 63.5 Billion By 2034, from USD 25.4 Billion in 2024, growing at a CAGR of 9.60% during the forecast period from 2025 to 2034. In 2024, North America led the IT infrastructure management tools market with a 33.8% share and USD 8.5 bn in revenues. The U.S. market was valued at USD 6.86 billion and is expected to grow at a CAGR of 8.4%.

IT infrastructure management tools encompass a comprehensive suite of solutions designed to optimize the efficiency, reliability, and performance of IT systems within organizations. These tools support various operations such as network management, server administration, and data storage management. As IT environments become more complex and digital processes grow, these tools are essential for ensuring smooth and efficient business operations.

The demand for IT infrastructure management tools is fueled by the need for greater operational agility, improved security, and reduced system downtime. As businesses expand their digital presence and integrate hybrid cloud environments, they are increasingly adopting these tools to strengthen IT governance and risk management practices.

The growing focus on cybersecurity, due to increasing cyber threats, is boosting demand for tools that can monitor, detect, and mitigate security risks. Additionally, the push for digital transformation across industries is driving organizations to adopt these tools to enhance the scalability and reliability of their IT infrastructure.

Organizations are adopting these advanced technologies mainly to enhance their operational agility and to better manage the complexity of modern IT environments. The move towards multi-cloud and hybrid environments, facilitated by AI-driven automation, helps businesses dynamically allocate resources and optimize system performance

Opportunities in the IT infrastructure management tools market include the integration of AI and machine learning for smarter, proactive management, such as predictive maintenance and better analytics. Additionally, the shift towards sustainable IT practices presents chances to develop eco-friendly solutions that lower energy use and carbon footprints.

Market expansion in IT infrastructure management tools will be driven by the growth of IoT, smart devices, and big data analytics. As organizations rely more on real-time data and connectivity, the demand for advanced tools to manage large networks and ensure smooth operations is expected to increase.

Key Takeaways

- The Global IT Infrastructure Management Tools Market size is expected to reach USD 63.5 Billion by 2034, up from USD 25.4 Billion in 2024, growing at a CAGR of 9.60% during the forecast period from 2025 to 2034.

- In 2024, the Software segment dominated the IT Infrastructure Management Tools market, capturing more than 44.87% share.

- The On-Premises segment of the market held a dominant position in 2024, capturing over 55.67% share.

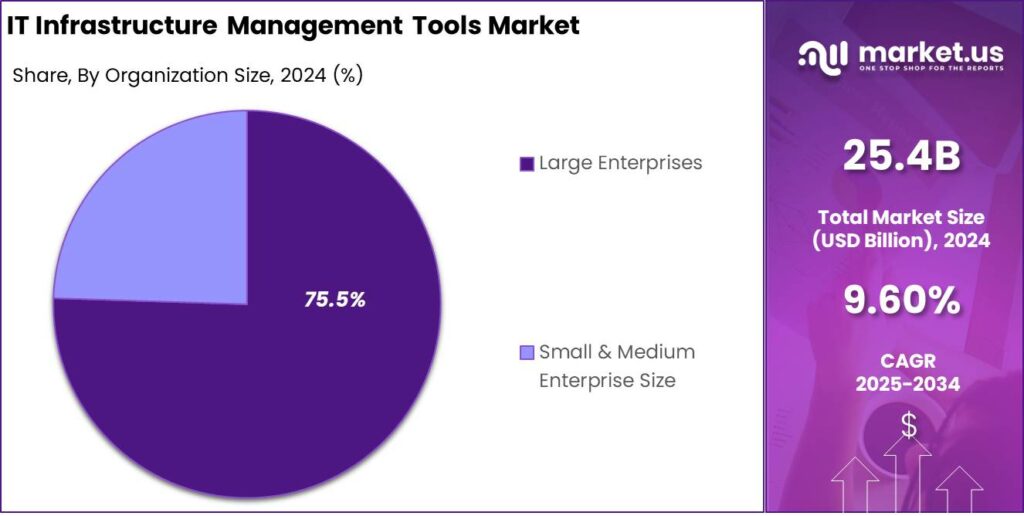

- In 2024, Large Enterprises represented the largest share, holding more than 75.5% of the overall IT infrastructure management tools market.

- The BFSI (Banking, Financial Services, and Insurance) segment captured more than 32.6% share in 2024, making it a dominant player in the market.

- North America led the IT infrastructure management tools market in 2024, holding a dominant position with over 33.8% share, translating to USD 8.5 billion in revenues.

- The IT infrastructure management tools market in the United States was valued at USD 6.86 billion in 2024 and is projected to expand at a CAGR of 8.4%.

Analyst’s Viewpoint

The IT infrastructure management market is being shaped by several key factors, including the growing demand for cloud services, the integration of AI in IT operations, and the shift toward multicloud environments. Additionally, the need for stronger data security measures, along with regulatory pressures on data privacy and energy efficiency, are guiding the strategies of businesses.

Technological innovation remains at the heart of the IT infrastructure management sector. The adoption of technologies such as AI, machine learning, and advanced analytics is transforming the landscape. These technologies are enabling more efficient management of IT resources, predictive maintenance, and improved security protocols.

The regulatory landscape, emphasizing privacy, data protection, and sustainability, is influencing IT infrastructure design, especially in regions like the European Union. Strict data usage and green technology regulations are prompting companies to invest in compliant, future-proof technologies, fueling demand for advanced management tools.

U.S. Market Leadership

In 2024, the market for IT infrastructure management tools in the United States was valued at USD 6.86 billion. It is projected to expand at a compound annual growth rate (CAGR) of 8.4%. The growth of this market can be attributed to several key factors.

Firstly, the increasing complexity of IT environments, driven by the integration of cloud services, big data technologies, and cybersecurity solutions, necessitates robust management tools. These tools enable organizations to monitor, manage, and optimize their IT infrastructures effectively.

The expansion of the IT infrastructure management tools market is driven by the ongoing digital transformation across industries. As businesses move online and adopt digital solutions, there’s a growing need for tools that provide scalability, flexibility, and security, boosting demand for both traditional and innovative management solutions.

Stricter regulatory compliance requirements are driving companies to maintain greater IT system transparency and control. IT infrastructure management tools are essential for ensuring compliance by providing detailed logs, performance reports, and security updates. This compliance-driven demand is expected to support continued market growth.

In 2024, North America held a dominant market position in the IT infrastructure management tools market, capturing more than a 33.8% share with revenues amounting to USD 8.5 billion. This leadership can be attributed to several region-specific factors that support the robust development and adoption of these technologies.

The substantial market share held by North America is primarily driven by the presence of a large number of global and regional enterprises with advanced IT needs, coupled with a strong technological infrastructure. Furthermore, the region is home to leading technology companies and innovators who continually push for advancements in IT management solutions.

North America’s dominance in this market is largely due to the strong focus on cybersecurity and regulatory compliance. U.S. companies, in particular, face strict data privacy and security regulations, driving them to invest in robust IT infrastructure management tools that ensure compliance and safeguard against cyber threats.

Adoption of technologies like cloud computing, AI, and machine learning has boosted the market by enhancing IT infrastructure management tools. These technologies improve efficiency, predictive maintenance, and decision-making, driving continued demand and solidifying the region’s global leadership.

Component Analysis

In 2024, the Software segment held a dominant position in the IT Infrastructure Management Tools market, capturing more than a 44.87% share. This segment’s leadership is primarily driven by the critical need for efficient software solutions that can manage and monitor increasingly complex IT infrastructures.

The software segment’s prominence in the market is driven by ongoing digital transformation initiatives, which require robust solutions for managing expanded IT resources. Software solutions are also highly scalable and can be easily updated to address new challenges, making them key to adaptive IT strategies.

The continuous evolution of technology, including the integration of AI and machine learning in IT infrastructure management software, has further propelled the dominance of this segment. These technologies enhance the capability of software tools to predict failures and automate routine tasks, thereby reducing downtime and improving operational efficiency.

The preference for software solutions is driven by their cost-effectiveness and strong ROI. With lower upfront costs than hardware, software solutions optimize IT asset usage and reduce maintenance expenses, offering significant long-term benefits. This economic advantage reinforces the software segment’s leading position in the IT infrastructure management tools market.

Deployment Mode Analysis

In 2024, the On-Premises segment of the IT Infrastructure Management Tools market held a dominant position, capturing more than a 55.67% share. This substantial market share is attributed to several factors that align with the specific needs and operational strategies of various organizations.

On-premises solutions provide enhanced control over IT systems and data, which is crucial for industries like finance, government, and healthcare. These sectors prioritize on-premises tools due to strict data security requirements and regulatory compliance standards, which demand direct oversight and physical security.

On-premises deployment often leads to lower long-term costs for larger organizations. While the initial infrastructure investment can be substantial, it helps avoid recurring cloud subscription fees. Furthermore, on-premises tools are more cost-effective when scaled to meet the needs of large IT environments with existing supporting infrastructure.

The reliability and performance consistency of on-premises tools is a critical factor for their dominance. By hosting and managing their IT infrastructure in-house, organizations can ensure a more consistent network performance, crucial for mission-critical applications. This is particularly important in industries where real-time data access and processing are vital for day-to-day operations.

Organization Size Analysis

In 2024, the Large Enterprises segment held a dominant market position, capturing more than a 75.5% share of the overall IT infrastructure management tools market. This leadership is primarily driven by the scale and complexity of IT operations in large organizations, which require sophisticated tools for managing distributed assets, ensuring uptime, and streamlining IT workflows.

Large enterprises typically have the financial and technical resources to invest in full-scale IT infrastructure management suites. These include features such as AI-driven alerting systems, cross-platform integration, and automated remediation capabilities. Such functionalities are essential for avoiding service disruptions and managing risk in high-stakes digital ecosystems.

Moreover, large firms often operate within heavily regulated industries such as finance, healthcare, and telecommunications, where infrastructure reliability and security are non-negotiable. This creates a greater need for end-to-end visibility and control, reinforcing the adoption of robust infrastructure management solutions at the enterprise level.

The focus on digital transformation in large organizations drives demand for IT infrastructure tools. Investments in cloud, big data, and enterprise applications require robust infrastructure foundations, making these tools essential for planning, deployment, and maintenance. This positions infrastructure management tools as both a technical asset and a business enabler.

End-User Analysis

In 2024, the BFSI (Banking, Financial Services, and Insurance) segment held a dominant market position in the IT infrastructure management tools market, capturing more than a 32.6% share. This substantial market dominance can be largely attributed to the critical need within the sector for robust IT infrastructure to ensure seamless, secure, and efficient operations.

The BFSI sector relies heavily on IT infrastructure management tools due to the immense volume of data it handles daily, including sensitive financial information and personal customer data. The necessity to manage, secure, and optimize this data effectively is paramount, driving the high adoption of advanced management tools.

Regulatory compliance is a major driver in the BFSI sector, as financial institutions must meet strict data security, privacy, and resilience standards. IT infrastructure management tools are crucial for monitoring compliance, reporting anomalies, and ensuring adherence to these rigorous regulations.

The digital transformation in the BFSI sector, driven by online banking, mobile services, and digital payments, requires robust IT infrastructure management. These tools ensure seamless digital platform operations, improve customer experiences, and enable innovative services. As a result, demand for IT infrastructure management tools in the BFSI sector continues to grow, supporting both stability and innovation.

Key Market Segments

By Component

- Software

- Hardware

- Services

By Deployment Mode

- On-Premises

- Cloud

By Organization Size

- Small and Medium Enterprises

- Large Enterprises

By End-User

- BFSI

- Healthcare

- Retail

- Manufacturing

- IT and Telecommunications

- Government

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Integration of Artificial Intelligence (AI) and Automation

The integration of Artificial Intelligence (AI) and automation into IT infrastructure management tools has significantly transformed the operational landscape of organizations. By automating routine tasks such as system monitoring, performance analysis, and issue resolution, these tools have enhanced operational efficiency and reduced the likelihood of human error.

AI-driven analytics provide predictive insights, enabling proactive maintenance and minimizing system downtimes. This shift towards intelligent automation allows IT personnel to focus on strategic initiatives, fostering innovation and improving service delivery.

Consequently, the demand for AI and automation capabilities within IT infrastructure management tools has seen a substantial increase, driving market growth as organizations seek to optimize their IT operations and maintain a competitive edge.

Restraint

High Implementation and Maintenance Costs

Despite the advantages offered by IT infrastructure management tools, the high costs associated with their implementation and maintenance present a significant barrier, particularly for small and medium-sized enterprises (SMEs). The initial investment includes expenses for software acquisition, hardware upgrades, and integration services.

Additionally, ongoing costs encompass system updates, staff training, and technical support. For organizations with limited financial resources, these expenditures can be prohibitive, leading to reluctance in adopting comprehensive IT management solutions. This financial constraint hampers market expansion, as potential users may opt for less expensive, albeit less effective, alternatives or continue with manual processes.

Opportunity

Growing Adoption of Cloud Computing

The rapid adoption of cloud computing services presents a significant opportunity for the IT infrastructure management tools market. As organizations migrate to cloud environments, the complexity of managing hybrid and multi-cloud infrastructures increases. This complexity necessitates advanced management tools capable of providing visibility, control, and optimization across diverse platforms.

Vendors have the opportunity to develop and offer solutions tailored to cloud infrastructure management, addressing challenges such as resource allocation, cost management, and security compliance. By aligning product offerings with the evolving needs of cloud-centric operations, companies can tap into a growing market segment and drive revenue growth.

Challenge

Ensuring Cybersecurity in Complex IT Environments

Ensuring robust cybersecurity within increasingly complex IT environments remains a formidable challenge for organizations. The proliferation of connected devices, remote work arrangements, and cloud services has expanded the attack surface, making systems more vulnerable to cyber threats.

IT infrastructure management tools must incorporate comprehensive security features, including real-time threat detection, automated response mechanisms, and compliance monitoring, to effectively safeguard against breaches.

Developing advanced security capabilities requires continuous innovation and investment. Organizations must also stay updated on evolving cyber threats and regulatory changes, which demand ongoing staff training and system updates. Addressing these challenges is essential for maintaining trust and ensuring IT resilience.

Emerging Trends

In recent years, IT infrastructure management tools have evolved to meet the changing needs of businesses. A key trend is the integration of Artificial Intelligence (AI) and Machine Learning (ML), which enables predictive analytics, automates routine tasks, and improves decision-making, ultimately enhancing operational efficiency.

Another emerging trend is the adoption of hybrid and multi-cloud strategies, which offer businesses greater flexibility and scalability by integrating on-premises infrastructure with cloud resources. IaaS and PaaS models enable scalable infrastructure and efficient application deployment, reducing the need for significant hardware investments.

Edge computing has also gained traction, driven by the proliferation of Internet of Things (IoT) devices. By processing data closer to its source, edge computing reduces latency and bandwidth usage, enhancing the performance of applications reliant on real-time data.

Business Benefits

IT infrastructure management tools optimize system performance by reducing bottlenecks and automating repetitive tasks, which allows employees to focus on strategic objectives rather than troubleshooting technical issues. This leads to increased operational efficiency and productivity, directly impacting the bottom line of a business.

Implementing IT infrastructure management tools can result in significant cost savings by streamlining resource allocation, minimizing redundant hardware, and automating manual tasks. This optimization reduces operational costs, lowers the risk of costly repairs or replacements, and maximizes the value of IT investments.

Modern IT infrastructure tools offer real-time data analytics and cloud services, helping businesses make quick, informed decisions. This access to reliable data improves strategies, enhances customer service, and strengthens market positioning.

Key Player Analysis

Several companies have emerged as key players in this space, offering innovative solutions that cater to various needs ranging from cloud computing to network management and security.

IBM Corporation has been a dominant force in the IT infrastructure management market for decades. IBM provides businesses with a range of services, including cloud management, data analytics, AI solutions, and hybrid cloud infrastructure, combining advanced technology with enterprise-grade solutions.

Microsoft Corporation is another major player in the IT infrastructure management market, primarily due to its Azure cloud platform. Azure has become one of the leading cloud services in the industry, providing businesses with reliable, secure, and scalable cloud solutions. In addition to cloud services, Microsoft offers tools for virtualization, network management, and IT automation, which help organizations improve efficiency and reduce costs.

Hewlett Packard Enterprise (HPE) stands out for its strong focus on providing hybrid IT infrastructure solutions. HPE’s products, such as HPE GreenLake, enable businesses to manage both on-premises and cloud infrastructure seamlessly. This hybrid approach allows organizations to scale their operations while keeping costs under control.

Top Key Players in the Market

- IBM Corporation

- Microsoft Corporation

- Hewlett Packard Enterprise (HPE)

- Cisco Systems, Inc.

- Dell Technologies

- Oracle Corporation

- BMC Software, Inc.

- CA Technologies (Broadcom Inc.)

- ServiceNow, Inc.

- VMware, Inc.

- Splunk Inc.

- SolarWinds Corporation

- Micro Focus International plc

- ManageEngine (Zoho Corporation)

- Nutanix, Inc.

- Red Hat, Inc. (IBM)

- Ivanti

- Puppet, Inc.

- Chef Software, Inc.

- ScienceLogic, Inc.

- Others

Top Opportunities for Players

The IT Infrastructure Management Tools market is poised for transformation, with several emerging trends offering significant opportunities for industry players.

- AI and Machine Learning Enhancement in IT Operations (AIOps): AIOps is set to revolutionize IT operations by automating and enhancing tasks like event correlation, anomaly detection, and performance monitoring. This trend promises to streamline IT operations, thereby elevating customer experiences and reducing operational costs.

- Advanced Cybersecurity Measures: As cyber threats grow in sophistication, the importance of robust cybersecurity frameworks continues to escalate. Innovations in AI-driven security systems are expected to play a crucial role in protecting IT infrastructure against emerging threats, including the implementation of zero-trust architectures that operate on a “never trust, always verify” basis.

- Quantum Computing: This technology is on the brink of becoming mainstream, with potential applications in fields like cryptography and complex system modeling. IT infrastructure management can leverage quantum computing to solve problems that are currently beyond the scope of classical computing, offering a significant competitive edge.

- Edge Computing: This trend involves processing data closer to where it is generated rather than relying on a central data center. Edge computing reduces latency, improves response times, and decreases bandwidth use, which is crucial for supporting the growing number of IoT devices and mobile computing.

- Sustainable IT Practices: Environmental sustainability is becoming a priority, driving the adoption of green computing practices and energy-efficient data solutions. As regulations and societal expectations around environmental, social, and governance (ESG) factors tighten, sustainable IT practices not only help in reducing the ecological footprint but also in achieving cost efficiencies.

Recent Developments

- In January 2024, KKR finalized a deal to purchase VMware’s End User Computing business for about $4 billion. This acquisition focuses on VMware’s virtual desktop infrastructure solutions, which are crucial for remote work environments.

- In April 2024, Accenture completed its acquisition of CLIMB, a technology services provider specializing in IT infrastructure management. This move adds around 230 employees, enhancing Accenture’s capabilities in cloud and security technologies.

Report Scope

Report Features Description Market Value (2024) USD 25.4 Bn Forecast Revenue (2034) USD 63.5 Bn CAGR (2025-2034) 9.60% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software, Hardware, Services), By Deployment Mode (On-Premises, Cloud), By Organization Size (Small and Medium Enterprises, Large Enterprises), By End-User (BFSI, Healthcare, Retail, Manufacturing, IT and Telecommunications, Government, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Microsoft Corporation, Hewlett Packard Enterprise (HPE), Cisco Systems, Inc., Dell Technologies, Oracle Corporation, BMC Software, Inc., CA Technologies (Broadcom Inc.), ServiceNow, Inc., VMware, Inc., Splunk Inc., SolarWinds Corporation, Micro Focus International plc, ManageEngine (Zoho Corporation), Nutanix, Inc., Red Hat, Inc. (IBM), Ivanti, Puppet, Inc., Chef Software, Inc., ScienceLogic, Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  IT Infrastructure Management Tools MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

IT Infrastructure Management Tools MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- IBM Corporation

- Microsoft Corporation

- Hewlett Packard Enterprise (HPE)

- Cisco Systems, Inc.

- Dell Technologies

- Oracle Corporation

- BMC Software, Inc.

- CA Technologies (Broadcom Inc.)

- ServiceNow, Inc.

- VMware, Inc.

- Splunk Inc.

- SolarWinds Corporation

- Micro Focus International plc

- ManageEngine (Zoho Corporation)

- Nutanix, Inc.

- Red Hat, Inc. (IBM)

- Ivanti

- Puppet, Inc.

- Chef Software, Inc.

- ScienceLogic, Inc.

- Others