Global Insurance IT Spending Market By Type (Software Spending, Hardware Spending, It Services Spending), By Application (Commercial P&C Insurance, Personal P&C Insurance, Health And Medical Insurance, Life And Accident Insurance, Insurance Administration And Risk Consulting, Annuities), By Region And Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends And Forecast by 2024-2033

- Published date: March 2024

- Report ID: 14185

- Number of Pages: 370

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

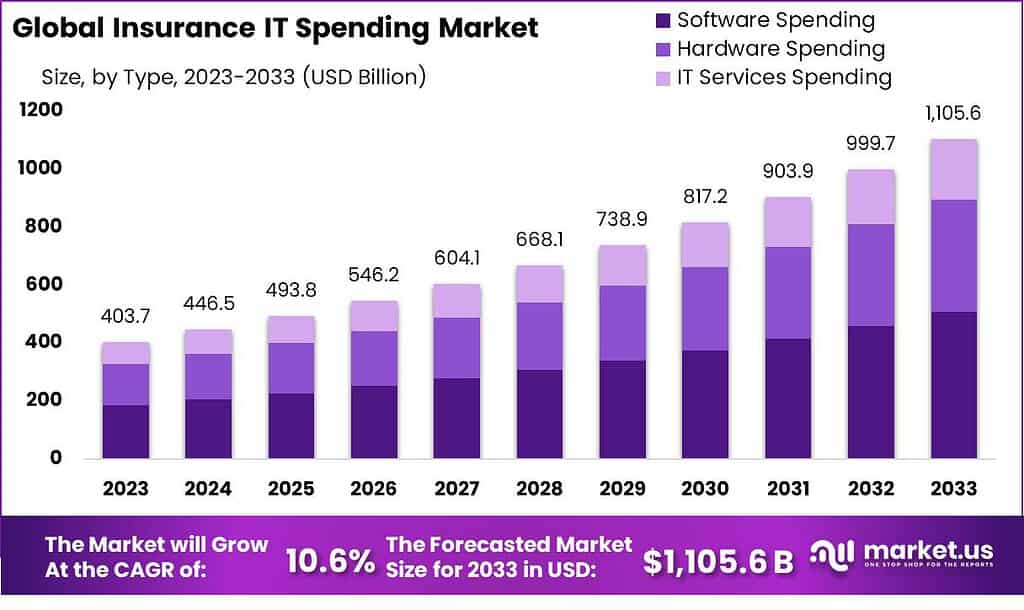

The Global Insurance IT Spending Market size is expected to be worth around USD 1,105.6 Billion by 2033, from USD 403 Billion in 2023, growing at a CAGR of 10.6% during the forecast period from 2024 to 2033.

Insurance IT spending refers to the allocation of financial resources by insurance companies towards information technology (IT) initiatives and investments. In the insurance industry, IT plays a crucial role in enabling efficient operations, improving customer service, managing risks, and staying competitive in a rapidly evolving digital landscape.

The insurance IT spending market has been witnessing steady growth as insurance companies recognize the importance of technology in driving business transformation. With the increasing adoption of digital platforms, insurers are investing in IT infrastructure, software applications, and services to enhance their operational capabilities and deliver better customer experiences.

One of the major drivers of insurance IT spending is the need for streamlined operations and cost optimization. Insurance companies are leveraging technology solutions to automate manual processes, improve efficiency, and reduce administrative overheads. This includes implementing core insurance systems, claims management software, policy administration platforms, and customer relationship management (CRM) systems. By embracing modern IT solutions, insurers can streamline their operations, enhance productivity, and reduce operational costs.

Furthermore, the need for robust data analytics capabilities is driving insurance IT spending. Insurers are leveraging advanced analytics tools and technologies, such as predictive modeling and machine learning, to gain actionable insights from vast amounts of data. These insights help insurers assess risks accurately, detect fraud, optimize pricing strategies, and enhance underwriting processes. By harnessing the power of data analytics, insurance companies can make data-driven decisions, improve risk management, and drive business growth.

Key Takeaways

- The Global Insurance IT Spending Market is expected to reach USD 974.8 billion by 2032, with a steady CAGR of 10.6%.

- Insurers are set to allocate 27% of their IT budgets to digital transformation initiatives in 2023.

- 68% of insurers view the modernization of their core systems as a crucial IT goal for 2023 and 2024, according to Novarica.

- The demand for cloud-based solutions in the insurance sector is expected to surge by 35% in 2024, propelled by the needs for scalability and cost efficiency.

- Deloitte has discovered that 54% of insurance companies are planning to boost their cybersecurity investment by at least 10% in 2023.

- The Insurance Information Institute has noted that spending on data analytics and business intelligence by insurers is projected to rise by 28% in 2024.

- According to Capgemini research, 62% of insurers prioritize modernizing their policy administration systems as a key IT focus for 2023 and 2024.

- Accenture’s findings indicate that 71% of insurance companies intend to invest in customer experience and engagement platforms during 2023 and 2024.

- The Insurance Technology Association (ITA) forecasts a 25% growth in demand for InsurTech solutions in 2023, driven by innovation and customer-focused services.

- 48% of insurers are planning to ramp up their investment in Robotic Process Automation (RPA) solutions in 2024.

- The adoption of blockchain technology within the insurance industry is expected to increase by 30% in 2024

Product Type Analysis

In 2023, the software spending segment held a dominant market position in the Insurance IT Spending Market. This dominance can be attributed to the increasing need for advanced software solutions in the insurance sector. Insurance companies are making strategic investments in various technological solutions, such as customer relationship management (CRM) systems, policy management software, and claims processing software. The primary objectives behind these investments are to boost operational efficiency, elevate the quality of customer service, and ensure compliance with rigorous regulatory standards.

The hardware spending segment also plays a crucial role in this market. While the trend is leaning toward cloud-based solutions, there still exists a substantial demand for physical hardware, including servers, data storage systems, and networking equipment. Insurance companies persist in their investments in hardware to sustain their IT infrastructure, particularly for data centers and on-premise solutions.

IT services spending is another key segment in this market. This includes expenditures on consulting, support, maintenance, and integration services. As insurance companies implement complex IT solutions, the demand for professional services to manage these systems is on the rise. IT services are critical for ensuring the smooth operation of software and hardware, helping insurers to maximize the value of their IT investments.

Based on Application Analysis

In 2023, the Commercial Property and Casualty (P&C) Insurance segment held a dominant market position in the Insurance IT Spending Market. This segment’s leading status is largely due to the complex nature of commercial insurance policies and the need for sophisticated IT solutions to manage them. IT spending in this sector focuses on systems for underwriting, claims processing, and customer management, enabling insurers to handle large volumes of policies more efficiently and accurately.

The Personal P&C Insurance segment also represents a significant portion of IT spending in the insurance market. Investment in this area is driven by the need for user-friendly digital platforms that allow customers to purchase policies, make claims, and manage their accounts online. As personal insurance customers increasingly prefer digital interactions, insurers are investing in technologies to enhance the online experience and streamline operations.

Health and Medical Insurance is another key area of IT spending. This segment requires specialized software for handling patient records, claims, and regulatory compliance. With the growing focus on telemedicine and digital health services, IT spending is also directed towards integrating these new service models into existing systems.

Life and Accident Insurance is evolving with IT investments in areas such as data analysis and predictive modeling. These technologies help insurers in assessing risks more accurately and developing customized insurance products.

The Insurance Administration and Risk Consulting segment demands substantial IT spending, particularly for data analysis and management software. These tools are essential for insurers to provide effective risk consulting services and efficient policy administration.

Lastly, the Annuities segment is seeing increased IT spending, particularly in developing systems that support complex annuity products. This includes investments in platforms for managing annuity accounts, processing transactions, and complying with evolving financial regulations.

Each of these segments represents a unique aspect of the insurance industry, requiring tailored IT solutions to address specific challenges and opportunities. As the industry continues to digitalize, IT spending across these areas is crucial for insurers to remain competitive and meet the changing needs of their customers.

Driving Factors

Digital Customer Expectations

The insurance industry is experiencing a significant transformation driven by rising digital customer expectations. In today’s digital age, consumers demand instant, accessible, and personalized services, mirroring their experiences in sectors like retail and banking. This shift compels insurers to modernize their legacy systems and adopt digital technologies to offer seamless online experiences, mobile accessibility, and customized insurance products.

The pressure to meet these expectations acts as a catalyst for digital transformation, pushing insurers to invest in new technologies such as artificial intelligence (AI), machine learning (ML), and blockchain. These investments not only enhance customer satisfaction but also improve operational efficiency and competitiveness. The urgency to align with digital customer expectations is a primary driver for the accelerated IT spending in the insurance sector, aiming to deliver more responsive, transparent, and customer-centric services

Restraining Factor

Regulatory Compliance

A significant restraint facing the insurance industry’s IT spending and technological advancement is the stringent regulatory environment. Insurance companies operate under a complex and often changing regulatory framework that varies by region and type of insurance. Compliance with these regulations requires substantial investment in IT systems capable of managing and reporting data accurately.

Furthermore, as insurers embrace digital transformation, they must also navigate new regulations concerning digital data protection, cybersecurity, and privacy laws such as GDPR in Europe and CCPA in California. Adhering to these regulations demands continuous updates and audits of IT systems, which can divert resources from innovative projects to compliance-related activities. This focus on compliance not only increases operational costs but also limits the agility of insurance companies to adopt new technologies and respond to market changes quickly.

Growth Opportunity

Emerging Technologies

Emerging technologies present a significant opportunity for the insurance industry to revolutionize its operations, products, and customer service. Technologies like artificial intelligence (AI), blockchain, the Internet of Things (IoT), and telematics offer insurers the tools to enhance risk assessment, streamline claims processing, and offer personalized customer experiences. For example, AI and machine learning can analyze vast amounts of data to predict risks more accurately and tailor insurance products to individual needs.

Blockchain technology promises to improve trust and transparency in transactions, reduce fraud, and streamline claims processes. IoT and telematics allow for real-time data collection, enabling usage-based insurance models that can lead to more fair pricing and risk assessment. By investing in these technologies, insurers can unlock new markets, improve customer satisfaction, and gain a competitive edge in the rapidly evolving digital landscape.

Challenge

Legacy System Modernization

One of the most significant challenges facing the insurance industry is the modernization of legacy IT systems. Many insurers rely on outdated software and hardware that are not equipped to support the demands of modern digital services. These legacy systems can be inflexible, expensive to maintain, and incompatible with new technologies, hindering innovation and efficiency.

The process of modernizing these systems is fraught with challenges, including high costs, operational disruptions, and the risk of data migration errors. Additionally, there is often a skills gap within organizations, as the workforce may not be familiar with newer technologies. Overcoming these obstacles requires careful planning, significant investment, and a strategic approach to integration.

Market Segmentation

Based on Product Type

- Software Spending

- Hardware Spending

- IT Services Spending

Based on Application

- Commercial P&C Insurance

- Personal P&C Insurance

- Health and Medical Insurance

- Life and Accident Insurance

- Insurance Administration and Risk Consulting

- Annuities

Regional Analysis

In 2023, North America continues to lead the global insurance IT spending market, owing to large investments by major insurers in modernizing legacy systems, embracing cloud platforms, advanced data analytics, AI capabilities and robust cybersecurity measures. There is an urgent need to digitize core processes and enhance customer engagement.

Europe trails close behind as a mature insurance market, with IT spending aimed at complying with stringent regulations around data privacy and protection, while transitioning to open and flexible digital systems. The Asia Pacific is witnessing brisk growth in IT spending, led by emerging insurance markets like China, India and Southeast Asia.

Investments here are focused on building mobile and web capabilities, digital payment integration and localization of services to serve the vast tech-fluent consumer base. Overall, critical insurance IT spending drivers globally are aging infrastructure overhaul, process automation, sophisticated data insights, and information security frameworks.

Latin America, while a smaller market compared to others, is showing significant growth potential in insurance IT spending. The focus in this region is on improving accessibility and affordability of insurance through digital channels, which is driving investments in IT infrastructure.

The Middle East & Africa (MEA) region is gradually advancing in terms of insurance IT spending. This growth is spurred by the need to improve insurance penetration and the adoption of technologies like blockchain and AI in insurance processes. The region shows potential for further growth as insurance companies begin to explore digital avenues to reach new customers and streamline operations.

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key player analysis refers to the evaluation and assessment of the major companies operating in a particular industry or market. It involves identifying the leading firms and understanding their market position, strategies, competitive advantages, financial performance, and future outlook. The analysis of key players in the Insurance IT spending market is a critical aspect of understanding the competitive landscape and the factors that influence technology investments in the insurance sector.

Top Key Players

- Accenture

- CSC

- Fiserv

- Guidewire Software

- Oracle

- Andesa

- Cognizant

- EXL Service

- FIS

- Genpact

- Majesco

- Microsoft

- Pegasystems

- SAP

- StoneRiver

Recent Development

- In 2023, Cognizant may acquire more insurtechs to expand capabilities in AI, IoT and analytics.

- In 2023, Pega to enhance its digital transformation suite with expanded AI, RPA and customer engagement features.

Report Scope

Report Features Description Market Value (2023) US$ 403.7 Bn Forecast Revenue (2032) US$ 974.8 Bn CAGR (2023-2032) 10.6% Base Year for Estimation 2022 Historic Period 2016-2021 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Software Spending, Hardware Spending, It Services Spending), By Application (Commercial P&C Insurance, Personal P&C Insurance, Health And Medical Insurance, Life And Accident Insurance, Insurance Administration And Risk Consulting, Annuities) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Accenture, CSC, Fiserv, Guidewire Software, Oracle, Andesa, Cognizant, EXL Service, FIS, Genpact, Majesco, Microsoft, Pegasystems, SAP, StoneRiver Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Insurance IT Spending Market?The insurance IT spending market is the market for IT products and services purchased by insurance companies. This market includes a wide range of products and services, such as:

- Software: Insurance companies use a variety of software applications to manage their businesses, such as customer relationship management (CRM) software, claims management software, and underwriting software.

- Hardware: Insurance companies also use a variety of hardware devices, such as servers, storage devices, and networking equipment.

- Services: Insurance companies also purchase a variety of IT services, such as consulting services, implementation services, and managed services.

What are the drivers of growth in the insurance IT spending market?The insurance IT spending market is growing due to a number of factors, including:

- The increasing complexity of insurance products and services: Insurance products and services are becoming increasingly complex, which is driving the need for IT solutions that can help insurance companies manage these products and services.

- The growing demand for data analytics: Insurance companies are increasingly using data analytics to improve their business processes and make better decisions. This is driving the demand for IT solutions that can help insurance companies collect, store, and analyze data.

- The increasing need for security: Insurance companies are increasingly concerned about security, as they are a target for cyber attacks. This is driving the demand for IT solutions that can help insurance companies protect their data and systems.

What are the challenges facing the insurance IT spending market?The insurance IT spending market is facing a number of challenges, including:

- The high cost of IT: IT is a major expense for insurance companies, and the cost of IT is only increasing. This is making it difficult for insurance companies to budget for IT spending.

- The shortage of IT talent: There is a shortage of IT talent in the insurance industry, which is making it difficult for insurance companies to find and hire qualified IT professionals.

- The pace of technological change: The pace of technological change is rapid, and it can be difficult for insurance companies to keep up with the latest trends. This can make it difficult for insurance companies to get the most out of their IT investments.

What are the trends in the insurance IT spending market?The insurance IT spending market is undergoing a number of trends, including:

- The increasing focus on cloud computing: Cloud computing is becoming increasingly popular in the insurance industry, as it can help insurance companies save money and improve their agility.

- The growing adoption of big data analytics: Big data analytics is becoming increasingly important in the insurance industry, as it can help insurance companies make better decisions.

- The increasing focus on security: Security is becoming increasingly important in the insurance industry, as insurance companies are a target for cyber attacks.

Insurance IT Spending MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample

Insurance IT Spending MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Accenture

- CSC

- Fiserv

- Guidewire Software

- Oracle

- Andesa

- Cognizant

- EXL Service

- FIS

- Genpact

- Majesco

- Microsoft

- Pegasystems

- SAP

- StoneRiver