Global Office Supplies Market Size, Share, Growth Analysis By Product - Paper Supplies (Notebooks & Notepads, Printing Paper, Others), Writing Supplies (Pens & Pencils, Highlighters & Markers, Others), Filing Supplies (File Folders, Envelopes, Others), Desk Supplies (Desk & Drawer Organizer, Paperweights & Stamp Pads, Others), Binding Supplies, Others, By Distribution Channel (Offline, Online), By End-use (Corporates, Educational Institutes, Hospitals, Hotels, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145673

- Number of Pages: 267

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

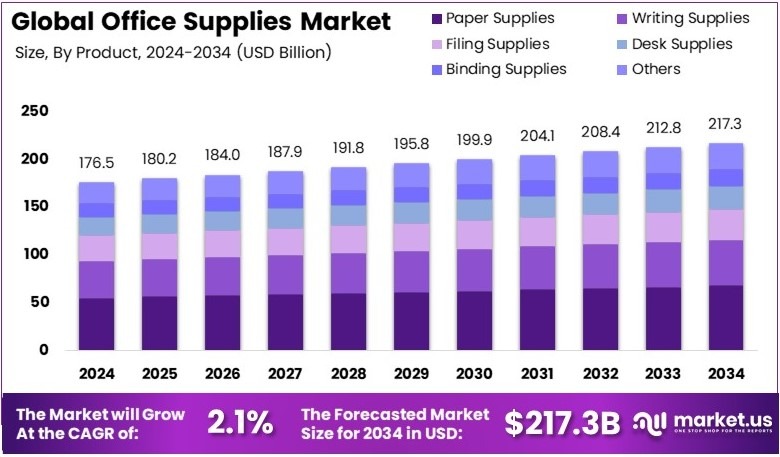

The Global Office Supplies Market size is expected to be worth around USD 217.3 Billion by 2034, from USD 176.5 Billion in 2024, growing at a CAGR of 2.1% during the forecast period from 2025 to 2034.

Office supplies are items used in the daily operations of an office. These include products such as pens, paper, binders, computers, and other equipment necessary for administrative work. Office supplies help ensure smooth, efficient functioning in any workplace environment.

The office supplies market involves the production and sale of items required for business operations. This includes a wide range of products, from paper and writing instruments to computers and furniture. The market is driven by the need for businesses to maintain smooth operations and support office tasks effectively.

The office supplies market is growing, driven by several factors. As more businesses and employees return to the office, demand for office supplies remains strong. For instance, 74% of office visitation in Manhattan reached 74% of 2019 levels by May 2024, showing recovery and a steady demand for office-related products.

Furthermore, the rise of remote and hybrid work arrangements is influencing the office supplies market. According to Quantum Workplace, 32% of employees prefer to work fully remotely, while 41% favor a hybrid setup. This shift is increasing the need for home office supplies, creating new opportunities for suppliers to meet these demands.

The market is becoming more competitive, with numerous suppliers offering similar products. Companies must innovate to stand out by focusing on quality, convenience, and price. As 7,538 coworking spaces were reported in the U.S. by the third quarter of 2024, the rise in coworking environments presents additional competition and market opportunities for office supply companies.

On a broader scale, the demand for office supplies is fueled by businesses across various sectors, but local market conditions may vary. For example, cities with high office visitation, like Manhattan, have higher demand compared to other areas. As more businesses embrace hybrid work, the need for flexible, high-quality supplies will continue to grow.

Key Takeaways

- The Office Supplies Market was valued at USD 176.5 Billion in 2024, and is expected to reach USD 217.3 Billion by 2034, with a CAGR of 2.1%.

- In 2024, Paper Supplies lead with 31.2%, attributed to their essential role in documentation and education.

- In 2024, Offline channels dominate with 67.8%, due to bulk procurement by institutions and better supply logistics.

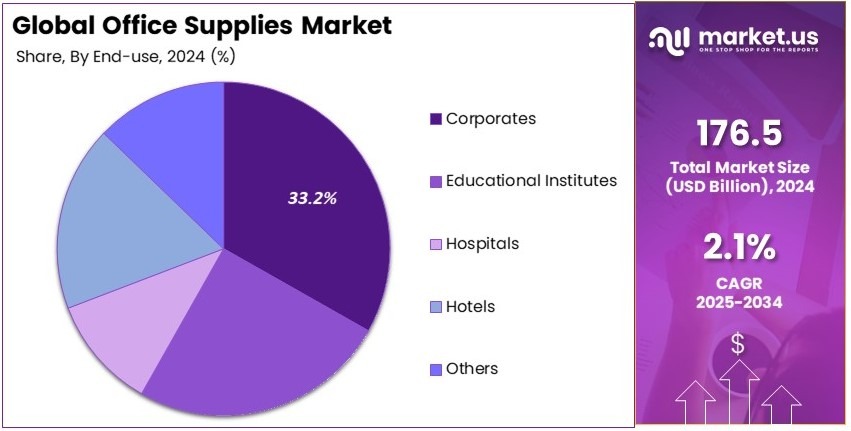

- In 2024, Corporates hold the largest share at 33.2%, driven by ongoing administrative and operational needs.

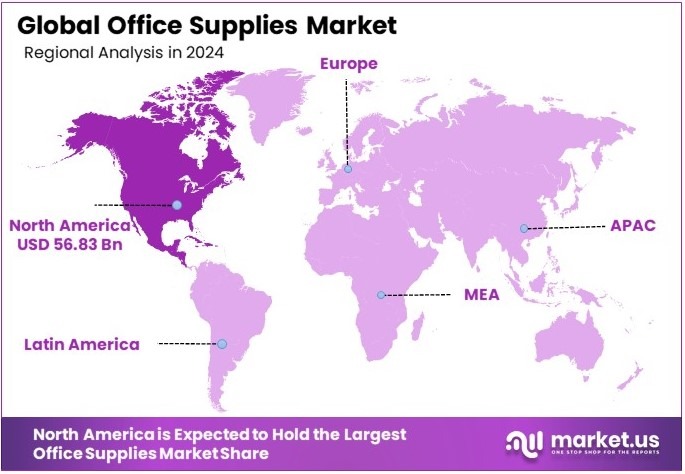

- In 2024, North America leads regionally with 32.2% and USD 56.83 Billion, supported by mature corporate and education sectors.

Countries and Market Size

Saudi Arabia

In 2024, the Saudi Arabia office supplies market was valued at approximately US$219.5 million and is expected to grow moderately at a CAGR of 1.3% through 2030. This growth is primarily driven by the country’s ongoing efforts to diversify its economy beyond oil, boosting sectors like education, government services, and corporate offices, which increases demand for office supplies and stationery products.

France

The office supplies market in France reached around US$2.8 billion in 2024 and is forecasted to grow at a CAGR of 1.6% until 2030. Growth in this market is supported by France’s strong presence of small and medium enterprises (SMEs) and a stable corporate environment, alongside increasing adoption of eco-friendly and sustainable office products, which is shaping buying preferences.

Brazil

Brazil’s office supplies market was valued at roughly US$578.2 million in 2024, with an expected CAGR of 0.9% from 2025 to 2030. The market growth is influenced by the expansion of the country’s educational institutions and corporate sector, although economic fluctuations pose challenges, the steady increase in remote and hybrid work models also supports demand for home office supplies.

India

In 2024, India’s office supplies market was valued at about US$3.8 billion and is projected to grow at a CAGR of 1.7% during 2025–2030. This growth is fueled by rapid urbanization, the rise of startups and new businesses, and increased government spending on infrastructure and education, all driving higher consumption of office stationery and supply products across the country.

Product Analysis

Paper Supplies sub-segment dominates with 31.2% due to its widespread use in various industries.

The Office Supplies Market is significantly driven by the Paper Supplies segment, which holds a 31.2% market share. This sub-segment is dominated by products such as notebooks, notepads, and printing paper, which are essential in daily office operations.

Paper is widely used across many industries, including education, corporate, and healthcare sectors, making it a crucial component in office supplies. The growing demand for notebooks and notepads in educational institutes and offices contributes to the large share of this sub-segment. Additionally, printing paper is indispensable for communication, documentation, and record-keeping in businesses worldwide.

Other sub-segments like Writing Supplies, Filing Supplies, and Desk Supplies also contribute significantly to the market but with smaller shares. Writing Supplies, including pens, pencils, and highlighters, are essential tools in any office, but they do not see the same volume of use as paper supplies.

Filing Supplies, such as file folders and envelopes, play a critical role in organizing documents but are a secondary need compared to the constant use of paper in daily tasks. Desk Supplies, including organizers and paperweights, support the office environment but are considered less essential than paper supplies.

Distribution Channel Analysis

Offline sub-segment dominates with 67.8% due to customer preference for in-person shopping.

In the Distribution Channel segment, Offline sales dominate with 67.8% of the market share. This is primarily due to the convenience and reliability that physical stores offer. Many businesses and institutions prefer to purchase office supplies in person to immediately obtain the required products. Additionally, offline channels allow customers to examine the quality of products, especially in categories like paper and filing supplies.

For example, many buyers may want to test the weight and texture of paper before making a purchase. Furthermore, offline stores like office supply chains, hypermarkets, and stationery shops are strategically located, making them easily accessible for businesses that need to stock up on supplies regularly.

Online retail, though growing, holds a smaller share of the market. Online stores provide convenience for bulk orders and the ability to compare prices across different brands. However, for time-sensitive purchases, offline stores remain the go-to option for most businesses. The online segment is expected to grow further as e-commerce becomes more integral to office supply shopping, especially for smaller businesses or remote workers.

End-Use Analysis

Corporates sub-segment dominates with 33.2% due to high demand for office supplies.

The Corporates sub-segment leads the market with a 33.2% share. This is because large corporations, small businesses, and government offices require a wide variety of office supplies for daily operations. Corporates account for a significant portion of the overall demand for paper, writing instruments, and filing supplies.

The volume of supplies purchased by businesses in different industries, from banking to manufacturing, supports the dominance of this sub-segment. Corporations often buy supplies in bulk, further driving the demand in the market.

Other end-use segments, such as Educational Institutes, Hospitals, and Hotels, also play a vital role in the market. Educational institutions rely heavily on paper supplies, notepads, and writing materials, but their demand is smaller compared to corporations.

Hospitals use office supplies for administrative purposes, though their focus is more on medical supplies. Hotels, while needing office supplies for administration and guest services, are a smaller segment when compared to corporate entities.

Key Market Segments

By Product

- Paper Supplies

- Notebooks & Notepads

- Printing Paper

- Others

- Writing Supplies

- Pens & Pencils

- Highlighters & Markers

- Others

- Filing Supplies

- File Folders

- Envelopes

- Others

- Desk Supplies

- Desk & Drawer Organizer

- Paperweights & Stamp Pads

- Others

- Binding Supplies

- Others

By Distribution Channel

- Offline

- Online

By End-use

- Corporates

- Educational Institutes

- Hospitals

- Hotels

- Others

Driving Factors

Sustained Demand from Small Businesses and Educational Institutions Drives Market Growth

The sustained demand for office supplies from small businesses and educational institutions is a significant driver of the market. Small businesses continue to grow and require essential office products like paper, ink, and folders to maintain daily operations.

Educational institutions also create steady demand for office supplies, especially in terms of stationery, notebooks, and other consumables needed for classrooms and administrative purposes. With the consistent need for these products, the market sees a regular cycle of demand, ensuring stable sales and growth.

In addition, the post-pandemic shift to remote work has also contributed to increased demand for office supplies. Many small businesses and educational institutions have expanded their home office setups, creating a need for more supplies such as ergonomic desks, chairs, and organizational tools.

As a result, the demand for basic office supplies has remained steady and is projected to continue growing as businesses and institutions stabilize their operations.

Restraining Factors

Digitalization and Remote Work Restrain Office Supplies Market Growth

The office supplies market faces several restraining factors that are hindering its growth. One of the primary challenges is the widespread adoption of digital tools and the shift toward paperless environments, significantly reducing the demand for traditional supplies such as paper, pens, and filing products.

The rise of remote and hybrid work models has also decreased centralized office procurement, as employees rely on minimal or personalized setups at home. Environmental sustainability concerns further contribute to the decline, as both companies and consumers move away from single-use and non-eco-friendly products.

Additionally, supply chain disruptions and fluctuating raw material prices impact product availability and increase costs. Intense competition, particularly from e-commerce platforms offering lower prices, puts pressure on margins for traditional suppliers. Lastly, economic uncertainties and tighter corporate budgets often lead to reduced spending on non-essential office supplies.

Growth Opportunities

Eco-Friendly Innovations and Wellness Accessories Provide Growth Opportunities

There are several growth opportunities in the Office Supplies Market, especially in the area of eco-friendly innovation. The development of recycled and eco-friendly office products is gaining traction as businesses and consumers become more environmentally conscious. Brands that focus on sustainable materials for their products, such as recycled paper, biodegradable pens, and eco-friendly folders, are seeing increased demand.

In addition to sustainability, the growth of ergonomic and wellness-focused office accessories is another opportunity. With more people working from home, there is a growing emphasis on comfort and well-being. Office furniture and accessories designed for health and productivity, such as ergonomic chairs, standing desks, and lumbar support, are in high demand.

Another opportunity lies in the increased B2B demand for bundled procurement and managed supply services. Companies are looking for more efficient ways to purchase office supplies in bulk while also managing their inventories. Lastly, the development of smart office supplies, like pens with memory or digital integration, presents an exciting opportunity to cater to the growing need for technology-driven office solutions.

Emerging Trends

Aesthetic Design and Customization Are Latest Trending Factors

Several trends are currently shaping the Office Supplies Market. One major trend is the shift toward minimalist and aesthetically designed office supplies. Consumers are increasingly looking for office products that not only function well but also look attractive on their desks. This trend has sparked demand for sleek, stylish items like color-coordinated folders, desks, and organizers.

Additionally, the rising popularity of planners and journaling tools is fueling demand in the personal productivity space. Many consumers are turning to planners and journals to help organize their work, set goals, and track progress. Custom print-on-demand options for notebooks and desk organizers are also gaining traction. These services allow businesses and individuals to create personalized stationery that reflects their brand or style.

Moreover, the emergence of modular storage and desk setup systems is becoming increasingly popular. These systems allow users to customize their office setups, creating a more efficient and aesthetically pleasing workspace. As these trends continue, the demand for well-designed and functional office supplies will continue to rise.

Regional Analysis

North America Dominates with 32.2% Market Share

North America leads the Office Supplies Market with a 32.2% share, amounting to USD 56.83 billion. This dominance is driven by a robust corporate sector, high demand for office essentials, and significant investments in workplace infrastructure. The strong economy, high level of digitalization, and large number of businesses in North America all contribute to this market’s size.

The region benefits from its developed retail networks, both physical and online, which makes it easy for consumers and businesses to access office supplies. The increasing trend of remote work has also contributed to the rise in demand for home office supplies. Additionally, the wide range of products available—from paper supplies to desk equipment—caters to both large corporations and small businesses, further boosting market growth.

Looking ahead, North America’s market share is likely to remain stable due to its strong economy, the continued rise of remote work, and an ongoing focus on workplace efficiency. Companies will continue to seek sustainable office supplies, and e-commerce will keep growing, offering more convenience to businesses and consumers alike.

Regional Mentions:

- Europe: Europe holds a steady share in the Office Supplies Market, driven by increasing focus on eco-friendly products and sustainable office solutions. Countries like Germany and the UK are significant players, with demand growing for both office supplies and eco-conscious alternatives.

- Asia Pacific: The Asia Pacific region is seeing rapid expansion in the Office Supplies Market due to economic growth and increasing business activities, especially in countries like China and India. The demand for office supplies is rising as urbanization and the middle class expand.

- Middle East & Africa: The Middle East and Africa are gradually expanding their market presence, driven by infrastructure development and increasing office spaces. Companies in regions like the UAE are investing in modern office supplies as businesses grow.

- Latin America: Latin America is experiencing steady growth in the Office Supplies Market, particularly in countries like Brazil and Mexico. As the corporate sector grows, there is rising demand for office essentials, with small and medium enterprises driving this market.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

In the Office Supplies Market, several companies stand out for their wide product offerings and strong market presence. 3M is a global leader, known for its innovative office products such as Post-it Notes, office tapes, and adhesives. Its strong brand recognition, research and development capabilities, and wide distribution network make it a dominant player in the market. 3M’s ability to innovate and meet consumer needs has helped it maintain a solid foothold in the office supplies industry.

Hamelin is another key player, primarily recognized for its paper products. Known for its high-quality notebooks, file folders, and binders, Hamelin has established a strong presence in Europe and other international markets. The company’s focus on environmentally friendly products and sustainability efforts has contributed to its growing market share.

Lyreco has a robust position in the office supplies market, particularly in Europe and Asia. Specializing in the supply of office products and services to businesses, Lyreco offers a wide range of products, including furniture, stationery, and cleaning supplies. The company’s B2B approach and emphasis on customer service and tailored solutions make it a key player in office supply distribution.

Newell Brands owns several well-known office supply brands, including Sharpie, Paper Mate, and Elmers. Known for a diverse product range that includes pens, markers, and stationery, Newell Brands continues to perform strongly across retail and office supply channels. The company’s focus on product quality, innovation, and strong retail relationships helps maintain its competitive edge.

These companies dominate the office supplies market through a combination of product innovation, sustainability efforts, and broad distribution networks, ensuring their continued growth and influence in the industry.

Major Companies in the Market

- 3M

- Hamelin

- Lyreco

- Newell Brands

- Crayola

- Pentel Co., Ltd.

- Faber-Castell

- ACCO Brands

- Staples, Inc.

- Kokuyo Co., Ltd.

Recent Developments

- In October 2024, The Business Supplies Group announced the acquisition of Office IS, aiming to strengthen its market presence and expand its product portfolio in business supplies. This strategic move is expected to enhance service capabilities and increase customer reach.

- In May 2025, Kokuyo set ambitious plans to achieve three-fold growth in India through a new acquisition. This expansion is designed to boost Kokuyo’s footprint in the Indian office supplies market and capture a larger share amid rising demand.

- In April 2025, RAJA Group signed a significant agreement with AURELIUS to acquire Viking and the Office Depot Europe operating business across seven countries. This acquisition is poised to expand RAJA Group’s European operations and solidify its position in the office supplies sector.

- In April 2024, South Korean furniture manufacturer KOAS Co. launched ‘Space,’ a brand focused on minimalist and functional office furniture. The collection includes sleek desks, height-adjustable sit-stand desks, versatile bookshelf-desk combos, and various tables designed to optimize workspace aesthetics and efficiency.

- In February 2023, Taiwanese designer Beflo unveiled the Tenon, a luxury modular smart desk designed for home offices. Features include height adjustability, built-in power plugs, USB ports, ambient lighting, smart sensors, and an optional mobile app to enhance productivity and well-being in home workspaces.

Report Scope

Report Features Description Market Value (2024) USD 176.5 Billion Forecast Revenue (2034) USD 217.3 Billion CAGR (2025-2034) 2.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product – Paper Supplies (Notebooks & Notepads, Printing Paper, Others), Writing Supplies (Pens & Pencils, Highlighters & Markers, Others), Filing Supplies (File Folders, Envelopes, Others), Desk Supplies (Desk & Drawer Organizer, Paperweights & Stamp Pads, Others), Binding Supplies, Others, By Distribution Channel (Offline, Online), By End-use (Corporates, Educational Institutes, Hospitals, Hotels, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape 3M, Hamelin, Lyreco, Newell Brands, Crayola, Pentel Co., Ltd., Faber-Castell, ACCO Brands, Staples, Inc., Kokuyo Co., Ltd., Office Depot, LLC., Shoplet, Winc Australia Pty. Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- 3M

- Hamelin

- Lyreco

- Newell Brands

- Crayola

- Pentel Co., Ltd.

- Faber-Castell

- ACCO Brands

- Staples, Inc.

- Kokuyo Co., Ltd.