Nuclear Medicine Market By Product Type (Diagnostics (SPECT, PET), Therapeutics (Alpha Emitters, Beta Emitters, Brachytherapy)), By Application(Cardiology, Oncology, Neurology, Thyroid, Lymphoma, Bone Metastasis, Urology, Pulmonary Scans, Endocrine Tumor, Other), By End-user(Hospitals, Diagnostic Centers, Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 21148

- Number of Pages: 309

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

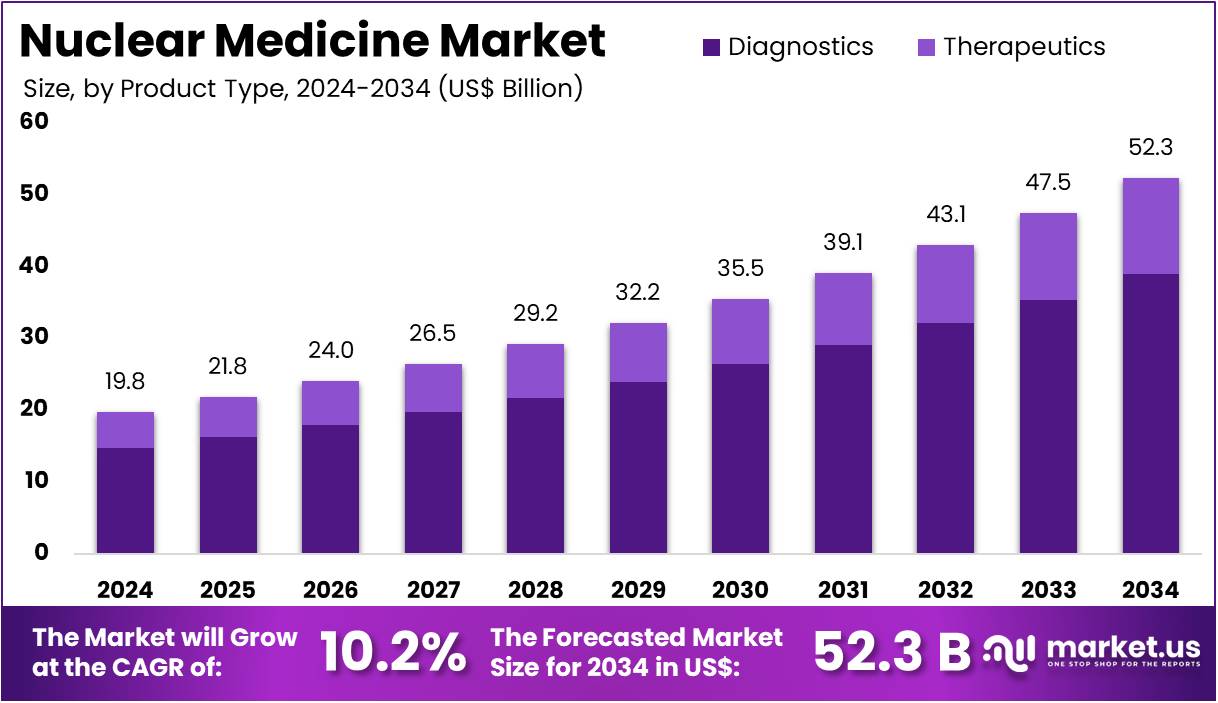

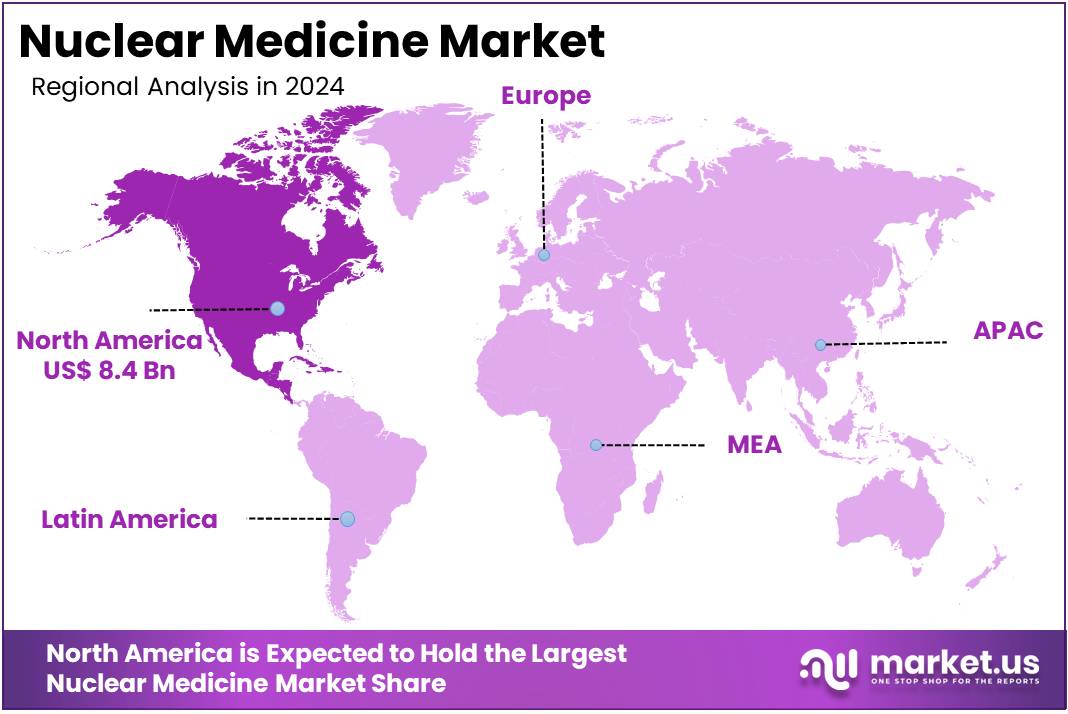

The Nuclear Medicine Market Size is expected to be worth around US$ 52.3 billion by 2034 from US$ 19.8 billion in 2024, growing at a CAGR of 10.2% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 42.5% share and holds US$ 8.4 Billion market value for the year.

Rising global disease burdens, particularly in oncology and cardiology, are a primary driver of the nuclear medicine market. Nuclear medicine offers highly specific diagnostic and therapeutic capabilities, allowing clinicians to visualize and treat diseases at the molecular level. With the World Health Organization (WHO) reporting an estimated 20 million new cancer cases and 9.7 million cancer-related deaths globally in 2022, there is immense demand for therapies that can precisely target cancerous cells while sparing healthy tissue.

Nuclear medicine fulfills this need by delivering radiation directly to tumors, which improves treatment outcomes and minimizes severe side effects. The increasing number of patients living with long-term cancer diagnoses also necessitates ongoing monitoring, which nuclear medicine supports with its advanced imaging modalities.

Growing technological sophistication and a shift toward personalized medicine are major trends shaping the market. The concept of “theranostics,” which combines a diagnostic scan and a targeted therapeutic dose, is gaining significant momentum in oncology, allowing for highly individualized treatment plans. The integration of advanced hybrid imaging systems, such as PET/CT and SPECT/CT, is also enhancing diagnostic accuracy and allowing for earlier disease detection.

Furthermore, companies are developing novel radiopharmaceuticals that can target a wider range of molecular pathways. For instance, the FDA’s recent draft guidance on optimizing dosages for oncology therapeutic radiopharmaceuticals shows a clear push towards personalized treatment plans and the development of new, more precise therapies.

Increasing strategic collaborations and public funding initiatives are creating significant opportunities for market expansion. Leading players are entering into agreements to develop and commercialize new radiopharmaceuticals, accelerating the pipeline of novel treatments. The National Institutes of Health (NIH) and the Department of Energy (DOE) are major funders of nuclear medicine research, supporting everything from basic science to the development of new radionuclide production facilities.

The World Nuclear Association estimated that over 10,000 hospitals globally used medical radioisotopes in April 2024, with approximately 90% of those procedures being for diagnostic purposes, highlighting the widespread and essential role of nuclear medicine in modern healthcare. This robust ecosystem of public funding, private innovation, and regulatory support ensures the market will continue to see strong and sustained growth.

Key Takeaways

- In 2024, the market for nuclear medicine generated a revenue of US$ 19.8 billion, with a CAGR of 10.2%, and is expected to reach US$ 52.3 billion by the year 2034.

- The product type segment is divided into diagnostics and therapeutics, with diagnostics taking the lead in 2023 with a market share of 74.6%.

- Considering application, the market is divided into cardiology, oncology, neurology, thyroid, lymphoma, bone metastasis, urology, pulmonary scans, endocrine tumor, and other. Among these, urology held a significant share of 34.1%.

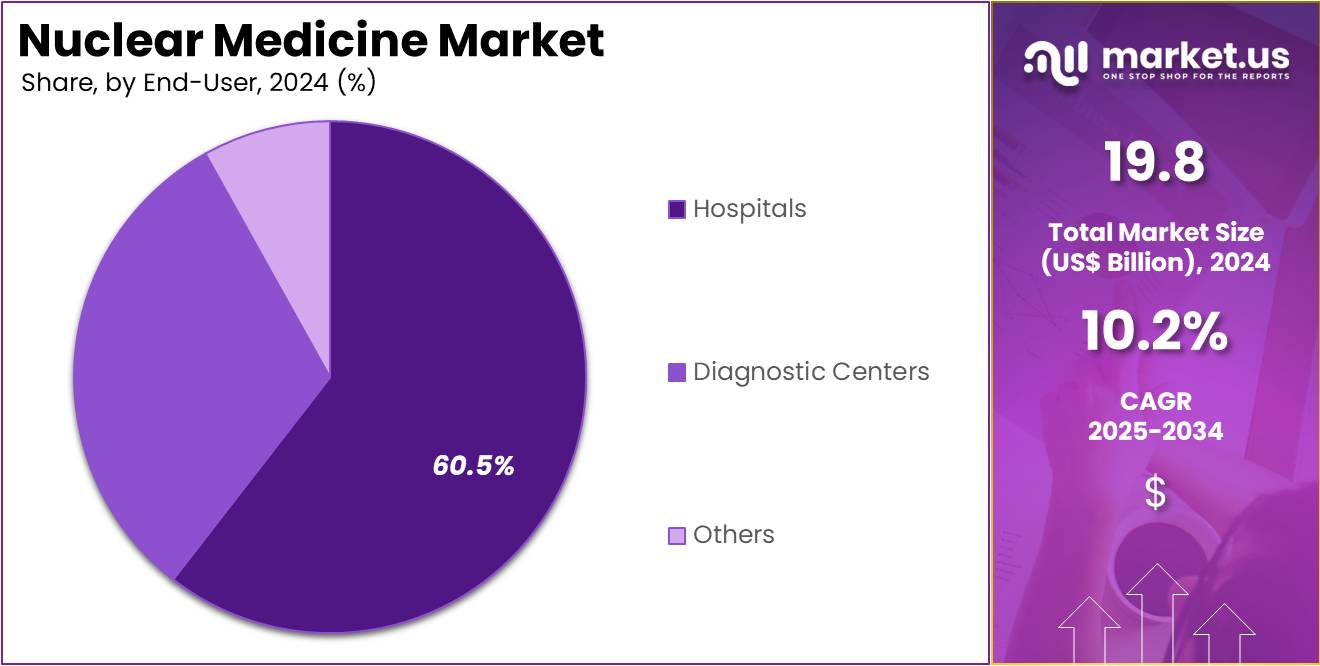

- Furthermore, concerning the end-user segment, the market is segregated into hospitals, diagnostic centers, and others. The hospitals sector stands out as the dominant player, holding the largest revenue share of 60.5% in the nuclear medicine market.

- North America led the market by securing a market share of 42.5% in 2023.

Product Type Analysis

Diagnostics account for 74.6% of the product type segment in the nuclear medicine market. This growth is expected to continue as nuclear medicine plays an essential role in diagnosing various medical conditions, especially cancers, cardiovascular diseases, and neurological disorders. The ability of nuclear diagnostic imaging techniques, such as positron emission tomography (PET) and single-photon emission computed tomography (SPECT), to provide detailed and accurate information about the body’s internal processes is driving their widespread use. The increasing prevalence of chronic diseases, particularly cancer and heart disease, is likely to contribute to the demand for nuclear diagnostics.

Furthermore, advancements in imaging technologies that improve sensitivity, resolution, and the ability to detect diseases at an earlier stage are expected to further enhance market growth. As healthcare systems worldwide emphasize early diagnosis and preventive care, the demand for diagnostic procedures in nuclear medicine is projected to grow, particularly in developed markets. The integration of nuclear diagnostic tools with other imaging modalities like CT and MRI will likely drive further adoption in clinical settings.

Application Analysis

Urology accounts for 34.1% of the application segment in the nuclear medicine market. This segment’s growth is expected to continue due to the increasing use of nuclear medicine in the diagnosis and treatment of urological conditions, including prostate cancer, kidney disease, and bladder cancer. The adoption of nuclear medicine for the detection of urological cancers, particularly with the use of prostate-specific membrane antigen (PSMA) imaging, is anticipated to drive growth.

As the prevalence of prostate cancer continues to rise globally, the demand for effective diagnostic tools such as PET scans and SPECT for urological applications is likely to grow. Additionally, nuclear medicine provides critical information for staging cancer and assessing therapeutic outcomes, further boosting its use in urology. The development of radiopharmaceuticals for targeted therapy in urological cancers is also expected to enhance the role of nuclear medicine in urology. As healthcare providers increasingly focus on personalized medicine and precise diagnostic tools, the adoption of nuclear medicine in urology will likely continue to expand.

End-User Analysis

Hospitals represent 60.5% of the end-user segment in the nuclear medicine market. This growth is expected to continue as hospitals remain the primary setting for nuclear medicine procedures, particularly for diagnostic imaging and therapeutic treatments. Hospitals are increasingly investing in advanced imaging technologies, such as PET and SPECT, to enhance diagnostic accuracy and improve patient care. The growing prevalence of chronic diseases, especially cancer and cardiovascular conditions, is likely to drive the demand for nuclear medicine in hospital settings.

Furthermore, the ability of nuclear medicine to assist in staging diseases, planning treatments, and monitoring therapeutic efficacy is expected to increase its adoption in hospitals. With the rise in outpatient services and specialized treatment centers, hospitals will continue to be at the forefront of nuclear medicine use. The ongoing advancements in radiopharmaceuticals and therapeutic applications, such as targeted radiotherapy, are anticipated to contribute to the growth of this segment. The increasing demand for non-invasive and effective treatment options in hospital settings will likely further expand the role of nuclear medicine.

Key Market Segments

By Product Type

- Diagnostics

- SPECT

- TL-201

- TC-99m

- I-123

- GA-67

- Others

- PET

- SR-82/RB-82

- PYLARIFY

- Illuccix

- F-18

- Others

- SPECT

- Therapeutics

- Alpha Emitters

- RA-223

- Others

- Beta Emitters

- Y-90

- SM-153

- Re-186

- Lu-177

- I-131

- Others

- Brachytherapy

- Palladium-103

- Iridium-192

- Iodine-125

- Cesium-131

- Others

- Alpha Emitters

By Application

- Cardiology

- SPECT

- PET

- Therapeutic Applications

- Oncology

- Neurology

- Thyroid

- SPECT

- Therapeutic Applications

- Lymphoma

- Bone Metastasis

- SPECT

- Therapeutic Applications

- Urology

- Pulmonary Scans

- Endocrine Tumor

- Other

By End-user

- Hospitals

- Diagnostic Centers

- Others

Drivers

The rising prevalence of chronic diseases, particularly cancer and cardiovascular disease, is driving the market

The nuclear medicine market is experiencing significant growth, primarily driven by the escalating global burden of chronic diseases. This is particularly true for cancer and cardiovascular disease, where these diagnostic and therapeutic technologies are invaluable. Nuclear medicine procedures offer unique insights into the metabolic and functional processes of the body, enabling clinicians to detect diseases at their earliest stages, monitor treatment effectiveness, and deliver targeted therapy.

Based on the latest WHO data, cardiovascular diseases are the leading cause of death globally, accounting for an estimated 19.8 million deaths in 2022, primarily from heart attack and stroke. Cancer is also a major global health concern, with an estimated 20 million new cases and 9.7 million deaths in 2022, with this burden projected to increase significantly by 2050. This massive and growing patient population requires advanced imaging and treatment modalities to improve outcomes. As the global incidence of these conditions rises, the demand for sophisticated diagnostic tools and targeted radiopharmaceuticals is projected to increase, thereby acting as a primary driver of the market.

Restraints

The high cost of equipment and the short half-life of radiopharmaceuticals are restraining the market

A significant restraint on the market is the substantial capital investment required for nuclear medicine infrastructure and the logistical challenges posed by the short half-life of many radiopharmaceuticals. Acquiring and maintaining state-of-the-art imaging equipment, such as a PET-CT scanner, can cost millions of dollars, which can be a significant barrier for smaller hospitals and healthcare facilities. This high cost of entry limits the widespread adoption of nuclear medicine procedures, particularly in developing regions.

Furthermore, the short half-life of key isotopes like Molybdenum-99 (Mo-99) and Fluorine-18 (F-18) means that they must be produced, processed, and transported to the point of care within a very short window of time. Any disruption in the supply chain can lead to shortages and cancelled patient procedures, which can have a detrimental effect on patient care. The US Bureau of Labor Statistics reported that in 2023, there were approximately 17,800 nuclear medicine technologists, a specialized workforce necessary to safely handle these materials.

Opportunities

The increasing adoption of theranostics is creating growth opportunities

The market is presented with significant opportunities from the accelerating adoption of theranostics, a field that combines diagnostic imaging with targeted therapy. Theranostics uses a single molecular agent to both locate and treat a disease, often by using a radioactive tracer to identify cancer cells for imaging and then a different, more powerful radioactive particle attached to the same molecule to deliver a targeted dose of radiation to destroy those cells. This personalized approach to medicine is revolutionizing patient care, particularly in oncology.

According to the US Food and Drug Administration (FDA), several theranostic agents have been approved in the 2022-2024 period, including agents for prostate cancer and neuroendocrine tumors, indicating a strong regulatory and clinical acceptance. The ability to both diagnose and treat a disease with a single agent represents a paradigm shift in patient management, offering a more effective and less invasive alternative to traditional treatments.

Impact of Macroeconomic / Geopolitical Factors

The nuclear medicine industry is navigating a complex macroeconomic and geopolitical landscape that affects both production costs and the purchasing power of healthcare providers. Global inflation has continued to drive up the cost of essential materials, particularly isotopes and specialized reagents used in radiopharmaceutical production. Geopolitical tensions have further complicated the situation, with disruptions in trade routes and export restrictions causing instability in the global supply chain for vital isotopes.

A 2024 warning from the American Society of Nuclear Cardiology (ASNC) highlighted a significant shortage of Molybdenum-99 (Mo-99) due to unplanned maintenance at a key European reactor, revealing the vulnerabilities of a supply chain reliant on a limited number of global producers. In response, the industry is adapting by diversifying supplier networks and investing in local production to secure a more stable and resilient supply.

Moreover, US tariff policies are reshaping the medical device supply chain, presenting both challenges and new opportunities. The imposition of tariffs on imported diagnostic equipment, such as PET-CT scanners, and key components has led to higher costs for US-based hospitals and surgical centers. According to a 2024 fact sheet from the American Hospital Association (AHA), tariffs on specific medical devices have directly impacted their import prices, often passing on these additional costs to healthcare providers, thereby affecting procurement budgets and purchasing decisions.

However, this shift is also driving a resurgence in domestic manufacturing. Many companies are accelerating plans to establish or expand production facilities within the US to avoid these import duties. A recent government-sponsored trade initiative report revealed a notable increase in investments aimed at localizing medical device manufacturing. This trend is bolstering the US manufacturing base, helping to create a more secure and reliable supply chain.

Latest Trends

The development of novel radiotracers for neurology and cardiology is a recent trend

A significant trend in 2024 is the expansion of research and development efforts beyond oncology to create novel radiotracers for neurological and cardiovascular diseases. While nuclear medicine has long been a cornerstone of cancer care, a growing number of clinical trials are now focusing on a wider range of applications. For instance, new radiotracers are being developed to image the brain for conditions such as Alzheimer’s disease and Parkinson’s disease, enabling earlier and more accurate diagnosis.

A 2024 review published in a medical journal highlighted the potential of new PET tracers to image neuroinflammation and specific proteins in the brain, offering a new way to understand and monitor the progression of neurodegenerative disorders. The development of these specialized tracers is poised to expand the market into new clinical territories, creating opportunities for more precise and personalized care in fields beyond traditional oncology.

Regional Analysis

North America is leading the Nuclear Medicine Market

The North American market for nuclear medicine held a commanding 42.5% share of the global market in 2024. This leadership is a result of the region’s advanced healthcare infrastructure, significant government funding, and the rising prevalence of chronic diseases, particularly cancer. For instance, the American Cancer Society estimated that there would be 1.9 million new cancer cases diagnosed in the US in 2022. This substantial disease burden drives continuous demand for advanced diagnostic and therapeutic tools, where nuclear medicine plays a critical role in early detection, staging, and treatment monitoring.

The US Food and Drug Administration (FDA) is also actively approving new radiopharmaceuticals, accelerating their availability to patients. In March 2022, the FDA approved Pluvicto (lutetium Lu 177 vipivotide tetraxetan), a therapeutic radiopharmaceutical for prostate-specific membrane antigen-positive metastatic castration-resistant prostate cancer, showcasing the continued innovation in the field.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The Asia Pacific nuclear medicine market is anticipated to experience the fastest growth during the forecast period. This is largely a result of rapidly improving healthcare infrastructure, a significant increase in healthcare spending, and a large and aging population. According to the World Health Organization (WHO), non-communicable diseases, including cancer and cardiovascular diseases, are a major and growing burden in the region.

The International Agency for Research on Cancer (IARC) estimated that in 2022, China experienced over 4.8 million new cancer cases, while India recorded over 1.4 million. This high disease prevalence fuels the need for effective diagnostic and therapeutic solutions. The market’s growth is also supported by government initiatives to improve healthcare access and a growing focus on early disease diagnosis.

For example, in 2023, the Indian government’s Department of Health and Family Welfare’s estimated expenditure was US$ 10.42 billion, an increase of 13.0% from the previous fiscal year, with a portion of this funding likely allocated to improving medical facilities and equipment.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the nuclear medicine market are driving growth by implementing a dual strategy of technological innovation and vertical integration. Companies are investing heavily in research and development to advance hybrid imaging systems, such as PET/CT and SPECT/CT, and to develop novel radiopharmaceuticals for both diagnostic and therapeutic applications. They are also actively expanding their manufacturing and distribution networks, often through strategic acquisitions of smaller firms, to secure a reliable supply of isotopes and strengthen their global commercial footprint. This focus on “theranostics,” which combines diagnostics with targeted therapy, positions them at the forefront of personalized medicine.

GE HealthCare, a global leader in medical technology, provides a broad portfolio of products, services, and digital solutions. The company operates in four main segments, including imaging, ultrasound, patient care solutions, and pharmaceutical diagnostics. Within its imaging business, GE HealthCare manufactures a wide range of molecular imaging equipment and radiopharmaceuticals for diagnostic purposes. The company’s strategic emphasis on precision care, digital transformation, and enabling a more sustainable future for healthcare providers drives its innovation and strengthens its market position.

Top Key Players in the Nuclear Medicine Market

- The institute for radioelements

- The Australian Nuclear Science and Technology Organization

- NTP Radioisotopes SOC Ltd

- Nordion (Canada), Inc

- Mallinckrodt

- Lantheus Medical Imaging, Inc

- Jubilant Life Sciences Ltd

- GE Healthcare

- Eczacıbaşı-Monrol

- Eckert & Ziegler

- Cardinal Health

- Bracco Imaging S.P.A

Recent Developments

- October 2024: It was reported that Sanofi and Orano Med entered a strategic partnership to accelerate next-generation radioligand therapies (RLTs). A new entity under the Orano Med brand was planned to focus on discovery, design, and clinical development of RLTs using lead-212 (²¹²Pb), an alpha-emitting isotope.

- January 2024: It was observed that Lantheus Holdings, Inc. strengthened its position in the U.S. nuclear medicine market through collaborations with Perspective Therapeutics, Inc., securing an exclusive licensing option for Pb212-VMT-⍺-NET for neuroendocrine tumors and initiating co-development for early-stage prostate cancer therapies. An upfront cash payment of USD 28 million was made.

- December 2023: It was announced that Bristol Myers Squibb agreed to acquire RayzeBio for USD 4.1 billion. RayzeBio was advancing clinical trials for two candidates utilizing actinium-255, while its partner, Point, was conducting phase 3 trials for two lutetium-177 therapies. The acquisition was positioned as a strategic expansion of Bristol Myers Squibb’s oncology portfolio.

Report Scope

Report Features Description Market Value (2024) US$ 19.8 billion Forecast Revenue (2034) US$ 52.3 billion CAGR (2025-2034) 10.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Diagnostics (SPECT (TL-201, TC-99m, I-123, GA-67, and Others), PET (SR-82/RB-82, PYLARIFY, Illuccix, F-18, and Others)), Therapeutics (Alpha Emitters (RA-223, and Others), Beta Emitters (Y-90, SM-153, Re-186, Lu-177, I-131, and Others), Brachytherapy (Palladium-103, Iridium-192, Iodine-125, Cesium-131, and Others))) By Application (Cardiology (SPECT, PET, and Therapeutic Applications), Oncology, Neurology, Thyroid (SPECT and Therapeutic Applications), Lymphoma, Bone Metastasis (SPECT and Therapeutic Applications), Urology, Pulmonary Scans, Endocrine Tumor, and Other) By End-User (Hospitals, Diagnostic Centers, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape The institute for radioelements, The Australian Nuclear Science and Technology Organization, NTP Radioisotopes SOC Ltd, Nordion (Canada), Inc, Mallinckrodt, Lantheus Medical Imaging, Inc, Jubilant Life Sciences Ltd, GE Healthcare, Eczacıbaşı-Monrol, Eckert & Ziegler, Cardinal Health, Bracco Imaging S.P.A Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- The institute for radioelements

- The Australian Nuclear Science and Technology Organization

- NTP Radioisotopes SOC Ltd

- Nordion (Canada), Inc

- Mallinckrodt

- Lantheus Medical Imaging, Inc

- Jubilant Life Sciences Ltd

- GE Healthcare

- Eczacıbaşı-Monrol

- Eckert & Ziegler

- Cardinal Health

- Bracco Imaging S.P.A