North America Overprint Varnish Market by Type (UV Curable, Water-based, and Solvent-based), By Finish (Gloss, and Matte), By Substrate (Paper and Paperboard, Plastic, and Metal) By Application (Packaging, Commercial Print, Labels and Stickers, and Others), By Country and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2033

- Published date: Dec 2023

- Report ID: 111411

- Number of Pages: 242

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

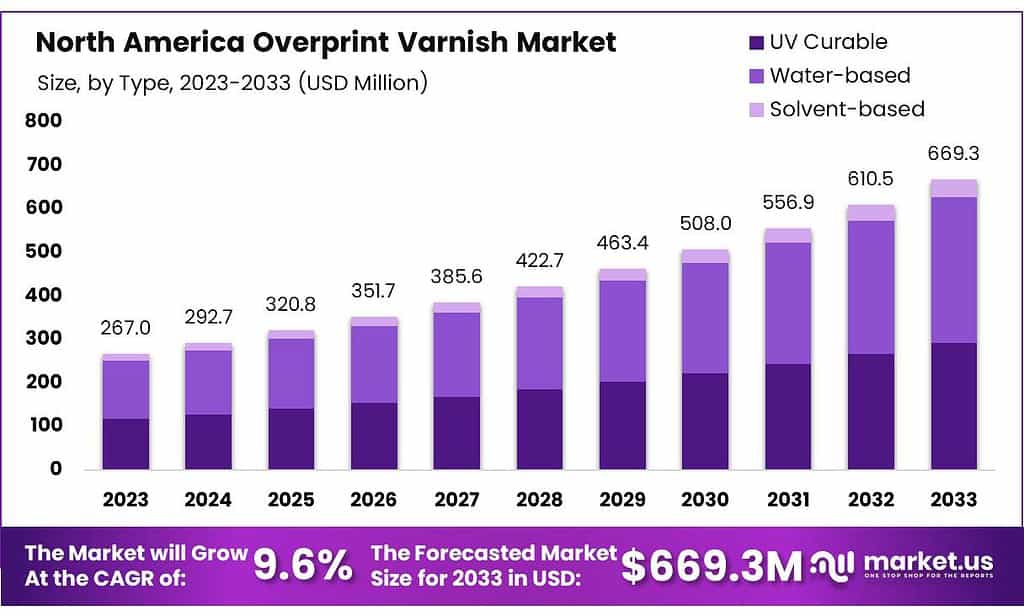

The North America Overprint Varnish Market size is expected to be worth around USD 669.3 Million by 2033, from USD 267.0 Million in 2023, growing at a CAGR of 9.6% during the forecast period from 2023 to 2033.

Overprint varnish is a specialized coating applied to printed materials, such as packaging, labels, and promotional materials, to enhance their visual appeal and durability. This clear or colored liquid coating is typically applied as a top layer over the printed substrate, providing various benefits, including improved gloss, protection against abrasion, moisture, and fading, and an overall professional finish.

The North American overprint varnish markets are experiencing significant growth driven by a range of factors. In North America, the demand for overprint varnishes is on the rise, particularly in commercial applications such as supermarkets, strip malls, hospitals, and other businesses. This increased demand can be attributed to the need to protect and enhance the appearance of products and attract customers through visually appealing labels.

Key Takeaways

- the North American overprint varnish market was valued at USD 267.0 million, and from 2024 and 2032, this market is estimated to register a CAGR of 9.6% in 2023.

- The North American overprint varnish market is projected to reach USD 669.3 Million by 2033.

- Among types, water-based held the majority of the revenue share of 50.2% in 2023.

- Among the finish segment, the Gloss varnishes accounted for the majority of the market share with 64.0%.

- Based on substrate, Paper and Paperboard accounted for the largest market share in 2023 with 63.7%.

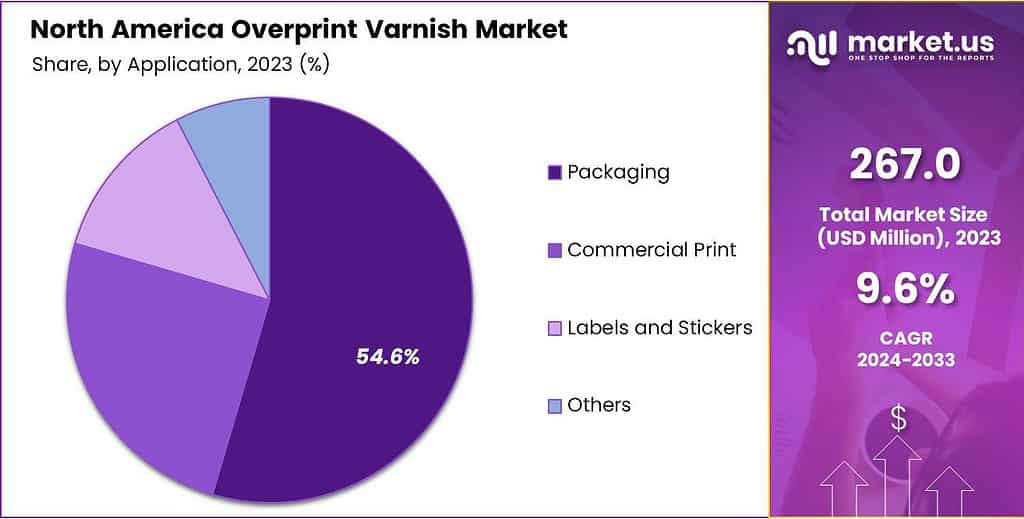

- By applications, the Packaging industry is anticipated to dominate the market in the coming years.

- Moreover, in 2023, it accounted for the majority of the share of 54.6%.

- The US is expected to hold the largest North American Overprint Varnish Market share with 87.3% of the market share.

Actual Numbers Might Vary in the Final Report

Type Analysis

Water-Based Varnishes Are Environmentally Friendly Which Makes It a Leading Segment In The Market

The overprint varnish market is segmented based on type into UV-curable, water-based, and solvent-based. Among these, water-based held the majority of revenue share of 50.2% in 2023. This dominance can be attributed to its environmental friendliness. Water-based overprint varnishes are more environmentally friendly compared to solvent-based varnishes.

They have lower levels of volatile organic compounds (VOCs), which are a major source of environmental pollution and health hazards. As global awareness and regulations around environmental protection have tightened, industries have increasingly favored eco-friendly options, leading to the popularity of water-based varnishes.

Finish Analysis

Owing to Their Printing and Graphics Clarity, Gloss Finishes Holds the Majority of Revenue Share.

Based on a finish, the market is segmented into gloss and matte. Among both, the gloss accounted for the majority of the market share with 64.0%. Owing to its visual appeal and vibrancy. Gloss finishes are known for their high shine and ability to make colors appear more vibrant and bright. This visual appeal is a significant factor in industries such as advertising, packaging, automotive, and consumer electronics, where attracting consumer attention is crucial.

Moreover, for printed materials, gloss finishes enhance the clarity and sharpness of graphics and text. This is crucial in advertising, publishing, and packaging, where the legibility and attractiveness of printed content can significantly impact its effectiveness.

The glossy surface reflects light, making products more eye-catching and aesthetically pleasing. While gloss finishes currently dominate, there is also a niche but growing demand for matte finishes, especially in areas where non-reflective surfaces are preferred for aesthetic or practical reasons.

Substrate Analysis

The Dominance of Paper and Paperboard In The Market Is Due To Its Environmental Sustainability, Material Versatility And Cost-Effectiveness.

Based on substrate, the market is further divided into paper and paperboard, plastic, and metal. Among these substrates, paper, and paperboard accounted for the largest market share in 2023 with 59.8%. One of the primary reasons for the dominance of paper and paperboard in the market is the growing global concern for the environment and the increasing demand for sustainable products.

Paper and paperboard are considered eco-friendlier than plastics or metals as they are biodegradable, recyclable, and often sourced from renewable resources. The shift to environmental sustainability has led to a preference for paper-based packaging among both consumers and manufacturers.

Moreover, compared to plastics and metals, paper and paperboard are generally more cost-effective, especially for single-use or disposable packaging. Their lower cost also makes them a preferred choice for many businesses seeking to reduce packaging expenses.

Application Analysis

Owing to Increasing Consumer Demand Across Various Sectors, the Packaging Industry Dominates the Market in Terms of Application.

Based on applications, the market is further divided into packaging, commercial print, labels and stickers, and others. Among these applications, packaging accounted for the largest market share in 2023 with 54.6%. The packaging industry has seen substantial growth due to increasing consumer demand across various sectors such as food & beverages, pharmaceuticals, cosmetics, and consumer goods.

This growth is driven by rising global populations, urbanization, and changes in consumer lifestyles. Furthermore, there’s a growing consumer demand for packaging that is not only durable but also sustainable.

Overprint varnishes contribute to the durability of packaging by protecting against environmental factors like moisture, UV radiation, and wear and tear during handling and shipping. This longevity is increasingly important in the context of sustainable packaging practices.

Key Market Segments

By Type

- UV Curable

- Water-based

- Solvent-based

By Finish

- Gloss

- Matte

By Substrate

- Paper and Paperboard

- Plastic

- Metal

By Application

- Packaging

- Food & Beverages

- Pharmaceuticals

- Personal Care & Cosmetics

- Tobacco

- Others

- Commercial Print

- Labels and Stickers

- Others

Drivers

Rising Technological Advancement

The advent of the Industry 4.0 characterized by the seamless integration of physical and digital communication, has brought about significant technological advancements in the North American overprint varnish market.

This disruptive period has particularly transformed industries such as Print and Packaging, enhancing organizational efficiency through the digitization of processes. Traditionally, printing technologies were tailored for mass production with undifferentiated runs, but they are now evolving to cater to the increasing demand for personalized interactions between organizations and their customers.

In this evolving landscape, digital printing technologies have gained prominence and are reshaping the Overprint Varnish Market. Unlike traditional methods that rely on printing plates, digital printing processes artwork directly through a computer and applies it directly to the product surface. This approach offers several advantages, including time efficiency and cost-effectiveness for short to medium-production runs, allowing manufacturers to customize products without disrupting their printing operations.

Furthermore, the versatility of digital printing empowers companies to diversify their packaging offerings and employ more nuanced marketing strategies, such as micro-targeting and just-in-time customization.

In the past two decades, the North American label printing industry, spanning the United States, and Canada, has witnessed a substantial surge in the adoption of digital press and desktop printer installations. Brand owners and packaging buyers recognize digital label printing as a means to order smaller quantities, expedite product delivery, and reduce the volume of obsolete inventory.

Consequently, the overprint varnish market is experiencing a notable push as it adapts to the evolving demands of the digital printing era. As digitally printed label volumes continue to grow across various end-use categories, both in the prime and non-prime label sectors, the market for overprint varnish is poised for expansion, driven by the need to enhance and protect these digitally customized and personalized packaging solutions.

Increasing Demand for High-Quality Printing in Packaging

Advancements in technology are leading to the development of refrigeration systems with improved in North America, one of the key driving forces for the overprint varnish market is the increasing demand for high-quality printing in the packaging industry.

This region, particularly the United States, is home to a large and diverse consumer market where packaging plays a crucial role in marketing and brand differentiation. High-quality printing, which includes the use of overprint varnishes, is essential for creating attractive, durable, and visually appealing packaging.

Overprint varnishes not only enhance the aesthetic appeal of packaging but also provide functional benefits such as protection against moisture, UV radiation, and mechanical abrasion. As the retail sector continues to grow, with a significant shift towards online shopping, the demand for durable and attractive packaging is likely to increase. This trend is driving the growth of the overprint varnish market as manufacturers seek to improve the quality and longevity of their printed materials.

Restraints

Environmental Concerns and Regulations

A significant hindrance faced by the overprint varnish market in North America pertains to the increasingly stringent environmental regulations and growing sustainability concerns within these regions. Historically, solvent-based overprint varnishes have gained popularity due to their fast-drying characteristics and performance attributes.

However, these varnishes are often laden with volatile organic compounds (VOCs), posing potential risks to the environment and human well-being.

- For instance, The U.S. Environmental Protection Agency (EPA) published guidelines “Control of Volatile Organic Compound Emissions from Screen Printing and Digital Imaging”, in which according to the EPA, the permissible limit for the volatile organic compound (VOC) content in overprint varnish, when applied to any substrate, is set at a maximum of 6.03 pounds of VOC per gallon.

The escalating awareness surrounding environmental issues and sustainability considerations has propelled a movement aimed at minimizing the ecological impact of packaging materials and processes. Consequently, there is a heightened emphasis on stricter regulations governing the use of VOCs and other hazardous substances in coatings and varnishes.

Manufacturers in the overprint varnish industry encounter a formidable challenge in aligning their products with the evolving environmental standards. Shifting away from solvent-based varnishes towards eco-friendlier alternatives, such as water-based or UV-curable varnishes, presents a multifaceted problem.

Although these alternatives offer the advantage of reduced VOC emissions and a diminished environmental footprint, they necessitate intricate adjustments in production processes and often entail higher production costs. As a result, there is growing pressure on manufacturers to develop eco-friendly alternatives.

This shift is a challenge for the overprint varnish market as it requires significant research and development investment to create products that meet both environmental standards and the functional requirements of high-quality printing.

Opportunity

Emergence of Sustainable and Eco-Friendly Varnishes

An exciting opportunity in the North America Overprint Varnish Market is the emergence of sustainable and eco-friendly varnish solutions. With sustainability becoming a central focus in various industries, including packaging and printing, there is a growing demand for coatings and varnishes that align with eco-friendly practices and principles.

One prominent aspect of this opportunity is the development and promotion of varnishes with low volatile organic compound (VOC) content. Traditional solvent-based varnishes have been criticized for their contribution to air pollution and adverse health effects. In response, water-based varnishes and UV-curable varnishes have gained traction.

Water-based varnishes use water as a carrier instead of organic solvents, resulting in significantly lower VOC emissions. UV-curable varnishes, on the other hand, cure rapidly when exposed to ultraviolet light, eliminating the need for solvents. These alternatives offer environmental benefits and align with increasingly stringent regulations.

- For instance, BCM Inks headquartered in Ohio, United States has introduced the environmentally friendly overprint varnish DuaKure. It represents a compelling alternative to UV coatings, as it is a water-based Overprint Varnish (OPV) derived from a naturally secreted plant product. This innovative solution offers a range of advantages over both UV coatings and traditional water-based coatings and varnishes.

Additionally, eco-friendly varnishes can explore the use of renewable resources and sustainable manufacturing processes. By incorporating bio-based ingredients, such as plant-derived resins or binders, into varnish formulations, manufacturers can reduce their reliance on fossil-based resources and promote sustainability.

Trends

Technological Advancements and Innovation

A significant opportunity in the North America overprint varnish market is the ongoing technological advancements and innovation. These advancements are focused on improving the efficiency, quality, and environmental friendliness of overprint varnishes. Innovations in UV-curable and water-based overprint varnishes are particularly promising.

These products offer faster drying times, reduced VOC emissions, and improved print quality, aligning with the environmental concerns and the demand for high-quality printing. As technology continues to evolve, there’s an opportunity for market players to develop new products that meet these emerging needs, potentially leading to significant growth in the market.

Shift Towards Digital Printing

A major trend influencing the overprint varnish market in North America is the shift towards digital printing. Digital printing technology has been rapidly evolving, offering higher print quality, faster turnaround times, and greater flexibility in print runs.

This shift is significant for the overprint varnish market because it changes the type and nature of the varnishes needed. Digital printing often requires specialized overprint varnishes that are compatible with inkjet or laser printing technologies. These varnishes need to adhere properly to digitally printed surfaces and provide the necessary protection and finish.

As digital printing continues to grow in popularity, driven by its cost-effectiveness and flexibility, the demand for compatible overprint varnishes is also expected to rise, shaping the future of the market in North America.

Geopolitical Impact Analysis

Geopolitical Tensions Significantly Impact the Growth of the Overprint Varnish Market Owing to The Pause in Manufacture and Supply Chain Activities

Geopolitical conflicts, characterized by market volatility and economic uncertainty, can significantly influence the overprint varnish industry. Consumer confidence wavers in the face of geopolitical tensions, potentially reducing demand for printed materials and overprint varnish products. Moreover, disruptions in supply chains, export market challenges, and stock market fluctuations can create a complex landscape for manufacturers.

To thrive in this environment, overprint varnish companies must adopt proactive risk mitigation strategies, diversify their customer base, and remain adaptable in the face of geopolitical dynamics, all while keeping a long-term perspective on growth and resilience.

Changes in geopolitical dynamics can necessitate a comprehensive review of trade agreements and market access strategies for North American overprint varnish manufacturers. This entails assessing the impact of evolving international relations and trade policies on business operations. Manufacturers may need to diversify their export markets, customize market entry approaches, and bolster supply chain resilience.

Additionally, active engagement in advocacy efforts, thorough trade compliance due diligence, and strategic partnerships in target markets can be essential in adapting to geopolitical shifts. By staying proactive and flexible, manufacturers can effectively navigate the changing North American trade landscape while maintaining or expanding their international footprint.

Key Regions

- North America

- The US

- Canada

Key Players Analysis

In the Overprint Varnish Market, Key Players Are Evolving and Asserting Their Dominance Through A Combination Of Strategic Initiatives, Innovation, And Market Adaptation.

To expand their market presence and capabilities, major players are engaging in mergers and acquisitions. These strategic moves allow them to integrate vertically, access new technology, enter new markets, and enhance their product portfolios.

Leading companies are heavily investing in research and development to innovate and improve their product offerings. This includes developing new formulations of overprint varnishes that are more environmentally friendly, offer better performance, and cater to the specific needs of various applications such as digital printing and flexible packaging.

Market Key Players

North American key players are continuously expanding their geographic footprint to tap into emerging markets, particularly in Asia-Pacific and Latin America, where the packaging industry is experiencing rapid growth. Understanding customer needs and tailoring products to meet these demands is crucial.

The leading companies involved in this market are, BASF SE, DIC Corporation, Altana AG, Allnex GMBH, and Toyo Ink Mfg. Co., Ltd. These companies are offering customized solutions and technical support to maintain competitive advantage.

- BASF SE

- DIC Corporation

- Altana AG

- Allnex GMBH

- Toyo Ink Mfg. Co., Ltd.

- INX International Ink Co.

- Michelman, Inc.

- Van Son Ink Corporation

- Hubergroup

- Advancion Corporation

- Kor-Chem, Inc.

- Other Key Players

Recent Development

- In December 2022: Specialty chemicals group ALTANA acquired a stake in the technology startup SARALON, which specializes in the development of inks for printing electronics and offers prefabricated electronic components that enable printers to quickly build capacities for printing electronics. This strategic commitment by ALTANA opens up new markets for SARALON, and the innovation partnership is in the growth market of printed electronics.

- In December 2019, ALTANA acquired the Swiss overprint varnish specialist Schmid Rhyner AG and strategically expanded its ACTEGA division.

Report Scope

Report Features Description Market Value (2023) US$ 267.0 Mn Forecast Revenue (2033) US$ 669.3 Mn CAGR (2024-2033) 9.6% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (UV Curable, Water-based, and Solvent-based), By Finish (Gloss, and Matte), By Substrate (Paper and Paperboard, Plastic, and Metal) By Application (Packaging, Commercial Print, Labels and Stickers, and Others Regional Analysis North America – The US & Canada Competitive Landscape BASF SE, DIC Corporation, Altana AG, Allnex GMBH, Toyo Ink Mfg. Co., Ltd., INX International Ink Co., Michelman, Inc., Van Son Ink Corporation, Hubergroup, Advancion Corporation, Kor-Chem, Inc., and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is overprint varnish (OPV)?Overprint varnish is a clear coating applied to printed materials, such as packaging, labels, or publications, after the printing process. It enhances the appearance, durability, and sometimes the functionality of the printed surface.

What are the types of overprint varnishes available in the North American market?The market offers various types of overprint varnishes, including water-based, solvent-based, UV-curable, and oil-based varnishes. Each type has specific characteristics and applications.

What are the benefits of using overprint varnishes?OPVs provide multiple benefits, including protection against moisture, abrasion, and chemicals, enhancing the visual appeal by adding gloss or matte finishes, and improving the print's longevity.

North America Overprint Varnish MarketPublished date: Dec 2023add_shopping_cartBuy Now get_appDownload Sample

North America Overprint Varnish MarketPublished date: Dec 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- BASF SE

- DIC Corporation

- Altana AG

- Allnex GMBH

- Toyo Ink Mfg. Co., Ltd.

- INX International Ink Co.

- Michelman, Inc.

- Van Son Ink Corporation

- Hubergroup

- Advancion Corporation

- Kor-Chem, Inc.

- Other Key Players