Global Nitrochlorobenzene Market Size, Share, And Business Benefits By Product (Para Nitrochlorobenzene, Ortho Nitrochlorobenzene, Meta Nitrochlorobenzen), By Application (Agrochemicals or Pesticides, Dyes, Pigments, Lumber Preservatives, Photographic Chemicals, Corrosion Inhibitors, Rubber Chemicals), By End user (Pharmaceutical Industry, Automobile Industry, Construction Industry, Agricultural Industry), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 164158

- Number of Pages: 357

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

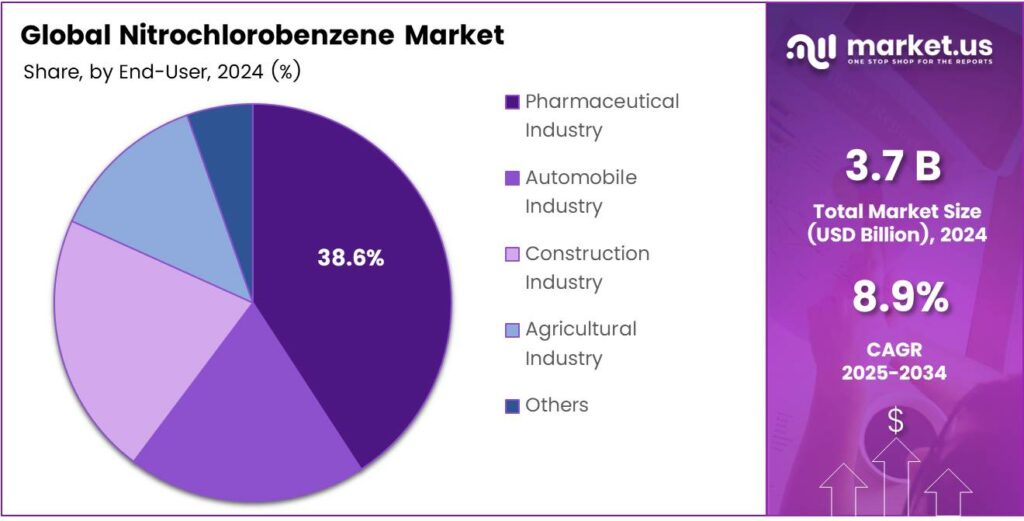

The Global Nitrochlorobenzene Market size is expected to be worth around USD 8.7 billion by 2034, from USD 3.7 billion in 2024, growing at a CAGR of 8.9% during the forecast period from 2025 to 2034.

Nitrochlorobenzene is a yellow crystalline solid organic compound primarily used as a precursor to other chemicals due to its two functional groups. It is combustible but poorly flammable, very slightly soluble in water (0.0441 g/100 mL), and poses acute or chronic health hazards as well as risks to the aquatic environment. Nitrochlorobenzene (NCB), including its three isomeric forms, serves primarily as a versatile intermediate for key downstream sectors such as dyes & pigments, agrochemicals, rubber chemicals, and pharmaceutical intermediates.

The compound is especially valuable because its reactive sites are ortho to each other, enabling the synthesis of diverse derivatives. Notably, 2-nitrochlorobenzene serves as an intermediate in producing o-aminophenol, while its derivatives are widely employed in manufacturing colorants and effect chemicals. It also functions as a raw material for rubber accelerators and stabilizers.

- Physically, nitrochlorobenzene appears as a yellow-green solid with an aromatic or characteristic odor and a pH of 6. It melts at 32.5 °C, boils at 246 °C (1000 hPa), has a flash point of 123 °C (closed cup, 1013 hPa), and a density of 1.368 g/mL at 22 °C. Health effects include acute toxicity via oral, inhalation, or dermal routes, toxic if swallowed, in contact with skin, or inhaled.

It may cause allergic skin reactions but does not irritate or corrode the skin, eyes, or respiratory tract, nor does it exhibit respiratory sensitization. Repeated exposure can damage organs, and it is suspected of causing cancer as well as damaging fertility or the unborn child, though it shows no genotoxicity or mutagenicity. Historically, industrial production has for decades moved from Western regions toward Asia-Pacific as a result of cost, regulatory, and feedstock advantage shifts.

Key Takeaways

- The Global Nitrochlorobenzene Market is projected to grow from USD 3.7 billion in 2024 to USD 8.7 billion by 2034 at 8.9% CAGR.

- Para Nitrochlorobenzene dominated the By Product segment in 2024 with 65.9% share, driven by its role in dyes and pesticides.

- Agrochemicals/Pesticides led by the Application segment in 2024 with 32.2% share, fueled by demand for crop protection solutions.

- The Pharmaceutical Industry held the top position in the end-user segment in 2024 with a 38.6% share, due to its use in antibiotic synthesis.

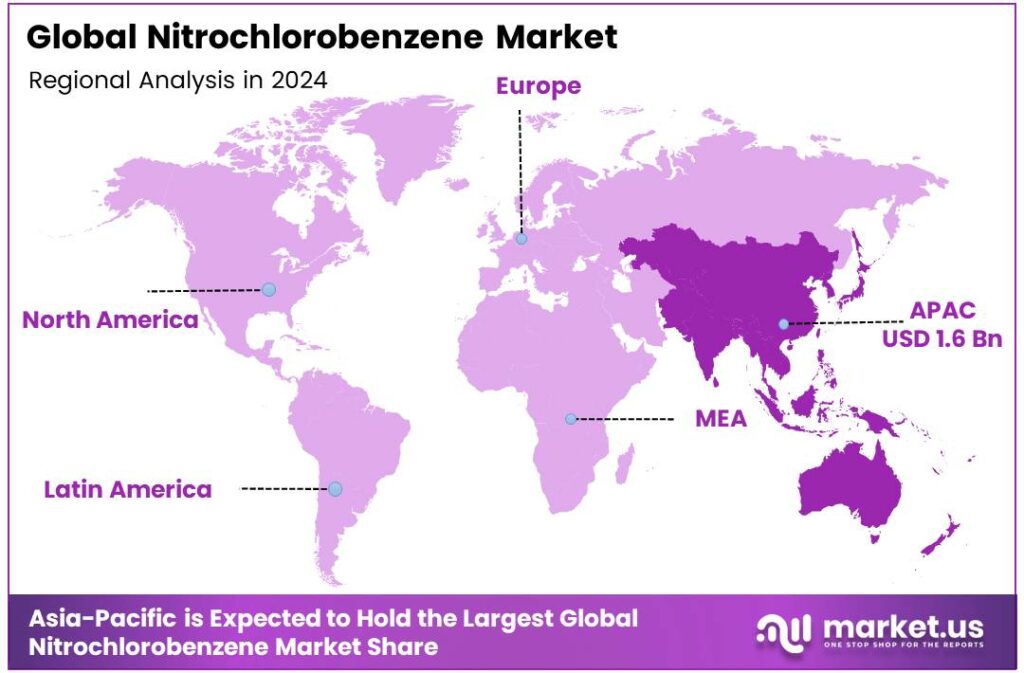

- Asia-Pacific commanded 43.9% market share (USD 1.6 billion) in 2024, led by chemical hubs in China, India, and Japan.

By Product

Para Nitrochlorobenzene dominates with 65.9% due to its key role in dyes and agrochemicals.

In 2024, Para Nitrochlorobenzene held a dominant market position in the By Product Analysis segment of the Nitrochlorobenzene Market, with a 65.9% share. This isomer leads because it serves as a vital intermediate in producing vibrant dyes and effective pesticides. Manufacturers favor it for its stability and versatility, driving high demand. As industries expand, this segment continues to surge, supporting sustainable chemical processes. Its widespread use ensures steady growth.

Ortho Nitrochlorobenzene follows as a crucial player, integrating seamlessly into rubber chemicals and corrosion inhibitors. It transitions smoothly into applications like automotive parts, enhancing durability. Producers rely on it for cost-effective solutions in manufacturing. This sub-segment grows steadily, fueled by rising needs in protective coatings. Its role in industrial innovations keeps it relevant.

Meta Nitrochlorobenzene emerges next, contributing through specialized pharmaceutical syntheses. It connects effectively to drug intermediates, aiding anti-inflammatory treatments. Researchers value its reactivity, boosting adoption in healthcare. This segment expands gradually, driven by R&D efforts. Its niche applications promise future potential.

By Application

Agrochemicals or Pesticides dominate with 32.2% due to rising agricultural demands.

In 2024, Agrochemicals or Pesticides held a dominant market position in the By Application Analysis segment of the Nitrochlorobenzene Market, with a 32.2% share. This application thrives as farmers seek potent herbicides and insecticides for higher yields. It integrates well into modern farming, promoting crop protection. Global food needs propel its growth, ensuring robust market presence.

Dyes advance prominently, linking nitrochlorobenzene to colorful textiles and pigments. This sub-segment flourishes with fashion trends, delivering stable colors. Industries adopt it for efficient production, reducing waste. Its vibrant output drives consistent demand. Expansion in the apparel sector sustains momentum.

Lumber Preservatives complete the trio, safeguarding wood against decay effectively. It bonds strongly in treatments, extending material life in construction. Users prefer it for eco-friendly options, minimizing rot. This area grows with building booms, offering reliable protection. Its practical benefits ensure ongoing relevance.

By End User

Pharmaceutical Industry dominates with 38.6% due to expanding drug developments.

In 2024, the Pharmaceutical Industry held a dominant market position in the By End User Analysis segment of the Nitrochlorobenzene Market, with a 38.6% share. This sector leads by using the compound in vital drug syntheses like antibiotics. It streamlines production, meeting healthcare demands swiftly. Innovations in medicine amplify its usage, fostering growth.

Automobile Industry progresses next, incorporating it via rubber chemicals for durable tires. This sub-segment accelerates with vehicle production rises, enhancing part longevity. Manufacturers integrate it to boost performance, cutting maintenance. Electric car trends further elevate needs. Its efficiency supports industry evolution.

Construction Industry rounds out, applying preservatives for sturdy buildings. It fortifies materials against wear, ensuring safety. Builders embrace it for cost savings, promoting long-term structures. Urbanization drives adoption, linking to infrastructure projects. This area builds steadily toward broader impacts.

Key Market Segments

By Product

- Para Nitrochlorobenzene

- Ortho Nitrochlorobenzene

- Meta Nitrochlorobenzene

By Application

- Agrochemicals or Pesticides

- Dyes

- Pigments

- Lumber Preservatives

- Photographic Chemicals

- Corrosion Inhibitors

- Rubber Chemicals

- Others

By End user

- Pharmaceutical Industry

- Automobile Industry

- Construction Industry

- Agricultural Industry

- Others

Emerging Trends

Shift to Continuous-Flow & Safer Nitration of Nitrochlorobenzene

A major emerging trend in the manufacture of nitrochlorobenzene (NCB) derivatives is the transition from traditional batch nitration methods toward continuous‐flow nitration technology, driven by improvements in safety, yield, and environmental impact.

- Nitration of Chlorobenzene with mixed acids has been highly exothermic and risk-prone; Recent studies reveal that continuous‐flow reactors can achieve yields of up to 99.2% under optimized conditions in a tubular stainless‐steel reactor. Studies have shown that approximately 83% of continuous-flow nitration systems utilize conventional HNO₃ or HNO₃/H₂SO₄ reagents under intensified conditions, signaling broad uptake of the continuous-flow approach.

From an environmental and regulatory perspective, this trend fits the global push for safer chemical processes and reduced hazardous waste. In India, for instance, the Central Pollution Control Board (CPCB) has updated its Hazardous Waste Management rules, reinforcing the need for processes that minimise spent-acid waste, reduce thermal runaway risk, and enhance the recoverability of reaction streams.

Drivers

Expanding Textile & Dye-Intermediate Usage

One of the major driving factors for the demand for nitrochlorobenzene (NCB) lies in its extensive role as an intermediate in dye and pigment manufacture. The textile, apparel, and home-textile sectors require vast quantities of coloured dyes, many of which depend on NCB derivatives for azo dyes, sulfur dyes, and specialty pigment intermediates. The upstream chemical intermediates used in dye manufacture also stand to benefit.

In this way, growth in textiles, combined with export ambitions and government support such as India’s PLI schemes for textiles, creates a ripple effect, boosting demand for intermediates like NCB. Official sources mark that monochlorobenzene, one of the precursors to nitrochlorobenzene, has been historically used in the manufacture of o and p-nitrochlorobenzenes dye and herbicide intermediates in the United States environmental assessment.

This underlines that NCB is firmly anchored in the dye-intermediates value chain. Governments are backing textile growth with incentives, export schemes, and infrastructure support—this creates a favourable environment for NCB usage. The health of the textile sector, therefore, becomes a major driver for NCB demand.

Restraints

Stringent Health & Environmental Regulations

One of the biggest constraints facing the production and use of Nitrochlorobenzene (NCB) is the growing regulatory burden tied to its health hazards and environmental impact. The National Institute for Occupational Safety and Health (NIOSH), together with (OSHA) in the U.S., the permissible exposure limit (PEL) for the isomer p-nitrochlorobenzene is 1 mg/m³ as an 8-hour time-weighted average, and it carries a skin-notation reflecting danger from dermal exposure.

Further, the substance is classified as suspected of causing cancer and organ damage upon prolonged exposure: the material safety data sheet (MSDS) notes that p-nitrochlorobenzene is Toxic if swallowed, in contact with skin, or if inhaled, and is suspected of causing genetic defects; suspected of causing cancer. From an environmental standpoint, NCB is Toxic to aquatic life with long-lasting effects and is not readily biodegradable in soil.

Opportunity

Rising Agrochemical & Crop-Protection Demand

One of the most significant growth drivers for the Nitrochlorobenzene (NCB) market is the expanding demand for agrochemicals and crop-protection products worldwide. According to data from the Food and Agriculture Organization of the United Nations (FAO), the usage of pesticides increased by about 70%, clearly illustrating the accelerating need for intermediates that feed into herbicides, fungicides, and insecticides.

As NCB commonly serves as a starting point in the manufacture of such agrochemical compounds, especially in the production of certain herbicides and insecticides, this surge directly supports the chemical’s consumption. In India specifically, policy support further accentuates this growth dynamic.

- The government’s initiatives aimed at expanding domestic chemical manufacturing, including a vision to make the chemical sector a global powerhouse with a 5 – 6% share of the global value chain, will reinforce local production of intermediates such as NCB. This means that not only is global use of agrochemicals climbing, but domestic policy frameworks are also aligning to boost intermediate chemical manufacturing.

Regional Analysis

Asia-Pacific leads with a 43.9% share and a USD 1.6 Billion market value.

In 2024, Asia-Pacific held a dominant position in the Nitrochlorobenzene market, capturing 43.9% share valued at USD 1.6 billion. The region’s strong performance stems from the rapid expansion of chemical manufacturing hubs across China, India, and Japan, which collectively account for a substantial portion of global nitrochlorobenzene production and consumption.

Rising demand from downstream industries such as dyes, agrochemicals, and pharmaceuticals. China remains the largest contributor, leveraging its well-established chemical ecosystem and large-scale export infrastructure. India, meanwhile, is witnessing strong growth through government initiatives supporting domestic specialty chemical production under programs such as Make in India.

The Asia-Pacific region benefits from cost-effective raw materials, a robust supply chain, and favorable regulatory frameworks that promote industrial investments. Rapid urbanization and increased industrialization are also driving up demand for intermediates used in dyes and pesticides. Japan and South Korea contribute to the regional market through their strong electronics and chemical sectors.

Supported by the expansion of end-use industries and ongoing capacity additions by major manufacturers, Asia-Pacific is expected to maintain its leadership position in the coming years, reinforcing its role as the global hub for nitrochlorobenzene production and consumption.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

AkzoNobel is a dominant force in the nitrochlorobenzene market. Its strength lies in extensive production capabilities and a robust, integrated supply chain that serves various downstream industries. The company’s significant market share is reinforced by its strong technical expertise and global distribution network. AkzoNobel primarily uses its NCB production to manufacture essential derivatives for agrochemicals, dyes, and rubber processing.

Toray Industries is a key player, distinguished by its focus on high-purity nitrochlorobenzene and advanced chemical synthesis. The company leverages its NCB production primarily as a critical intermediate for including advanced polymers and pharmaceuticals. Toray’s strategy emphasizes rigorous quality control and technological innovation, catering to demanding sectors like electronics and specialty chemicals.

Aarti Industries is a prominent and fast-growing Indian manufacturer in the nitrochlorobenzene landscape. It has carved a significant niche through a cost-competitive and backward-integrated business model. Aarti’s strength is its large-scale, dedicated production facilities that serve a wide array of downstream segments, including dyes, pigments, and agrochemicals.

Top Key Players in the Market

- AkzoNobel

- Toray Industries

- Aarti

- Hemani

- Seya Industries Ltd.

- Others

Recent Developments

- In 2024, AkzoNobel, Pharmaceuticals, and coatings reported financial and operational progress, with implications for its chemical intermediates segment. The company completed the sale of its Indian paints, enabling further asset disposals to streamline operations, including potential optimizations in NCB-related facilities.

- In 2024, Aarti Industries, a major Indian producer of NCB isomers for pharmaceuticals and agrochemicals, reported targeted expansions. Directly boosting NCB production capacity for herbicides and insecticides. Preliminary EPA TRI data flagged minor releases from global supply chains involving Aarti-sourced NCB, prompting enhanced reporting.

Report Scope

Report Features Description Market Value (2024) USD 3.7 Billion Forecast Revenue (2034) USD 8.7 Billion CAGR (2025-2034) 8.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Para Nitrochlorobenzene, Ortho Nitrochlorobenzene, Meta Nitrochlorobenzene), By Application (Agrochemicals or Pesticides, Dyes, Pigments, Lumber Preservatives, Photographic Chemicals, Corrosion Inhibitors, Rubber Chemicals, Others), By End user (Pharmaceutical Industry, Automobile Industry, Construction Industry, Agricultural Industry, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape AkzoNobel, Toray Industries, Aarti, Hemani, Seya Industries Ltd., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Nitrochlorobenzene MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

Nitrochlorobenzene MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- AkzoNobel

- Toray Industries

- Aarti

- Hemani

- Seya Industries Ltd.

- Others