Global Next Generation Sweeteners Market Size, Share, And Industry Analysis Report By Source (Plant-Derived, Microbial and Fermentation-Derived, Synthetic), By Sweetener Type (Mogroside V, Brazzein, Thaumatin I and II, Monellin, Curculin, Pentadin, Peptide-based Sweeteners, Sweet Chrysanthemum Glycosides), By Formulation Type (Powder, Liquid, Tablets, Sachets), By Application (Beverages, Confectionery and Baked Goods, Nutraceuticals and Supplements, Pharmaceuticals, Tabletop Sweeteners), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 172742

- Number of Pages: 366

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

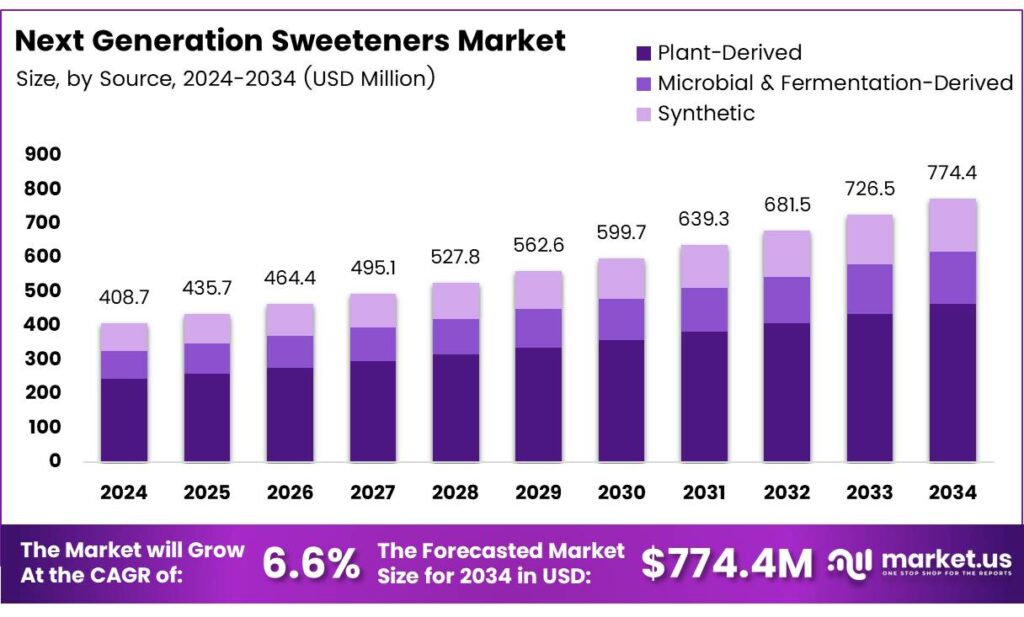

The Global Next Generation Sweeteners Market size is expected to be worth around USD 774.4 million by 2034, from USD 408.7 million in 2024, growing at a CAGR of 6.6% during the forecast period from 2025 to 2034.

The Next Generation Sweeteners Market refers to advanced low-calorie and non-caloric sweetening solutions designed to replace traditional sugar while maintaining taste performance. Increasingly, food and beverage manufacturers adopt these sweeteners to meet clean-label, diabetic-friendly, and reduced-calorie product demand, thereby supporting healthier consumption patterns and long-term dietary shifts.

Cyclamate continues to hold relevance in modern sweetener formulations because of its unique metabolic behavior. According to the World Health Organization, only 1% of ingested cyclamate is metabolized, while the rest is excreted, resulting in almost no energy contribution. This profile supports its regulated use in soft drinks, pastries, and fruit-processing applications.

- Protein-based high-intensity sweeteners are also strengthening product diversification. Alitame, made from L-aspartic acid and D-alanine, delivers sweetness about 2,000–3,000 times higher than sugar and remains stable under heat. Similarly, advantame provides an even stronger profile at roughly 20,000–37,000 times sucrose, clearly outperforming neotame at 8,000 times, making it attractive for processed foods.

Innovation in plant-derived sweeteners further expands market options. Optimization of the UGT76G1 enzyme has improved yields of Reb D and Reb M by limiting unwanted by-products. At the leaf level, Stevia rebaudiana typically contains stevioside at 5–10%, Reb A at 2–4%, and Reb C at 1–2% of dry weight, highlighting both the potential and ongoing challenges around bitterness management.

Next-generation sweeteners represent a structural growth opportunity across beverages, bakery, dairy, and nutraceutical formulations. As obesity and diabetes concerns intensify, manufacturers increasingly reformulate products using high-intensity sweeteners, sugar alternatives, and steviol-based compounds, thereby improving nutritional profiles without sacrificing sweetness, texture, or thermal stability during processing.

Key Takeaways

- The Global Next Generation Sweeteners Market is projected to grow from USD 408.7 million in 2024 to USD 774.4 million by 2034, registering a 6.6% CAGR during 2025–2034.

- Plant-derived sweeteners dominated the market by source in 2024, accounting for a leading share of 51.2% driven by clean-label and natural ingredient demand.

- Mogroside V emerged as the leading sweetener type, holding a market share of 24.8% due to its high sweetness intensity and formulation stability.

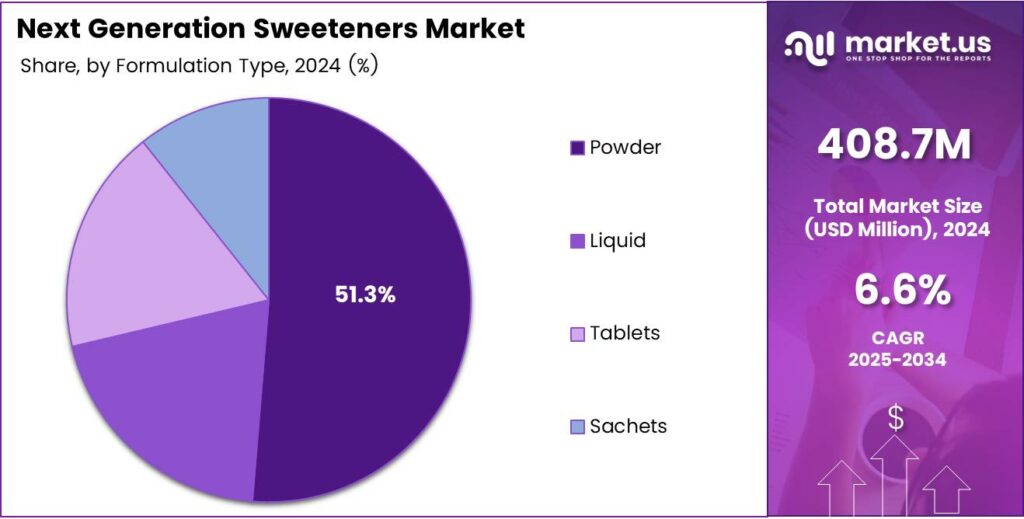

- Powder formulations led the market by formulation type with a share of 51.3%, supported by ease of handling, storage, and global transportation.

- Beverages represented the largest application segment, capturing 37.9% of the total market in 2024 as sugar reduction accelerates globally.

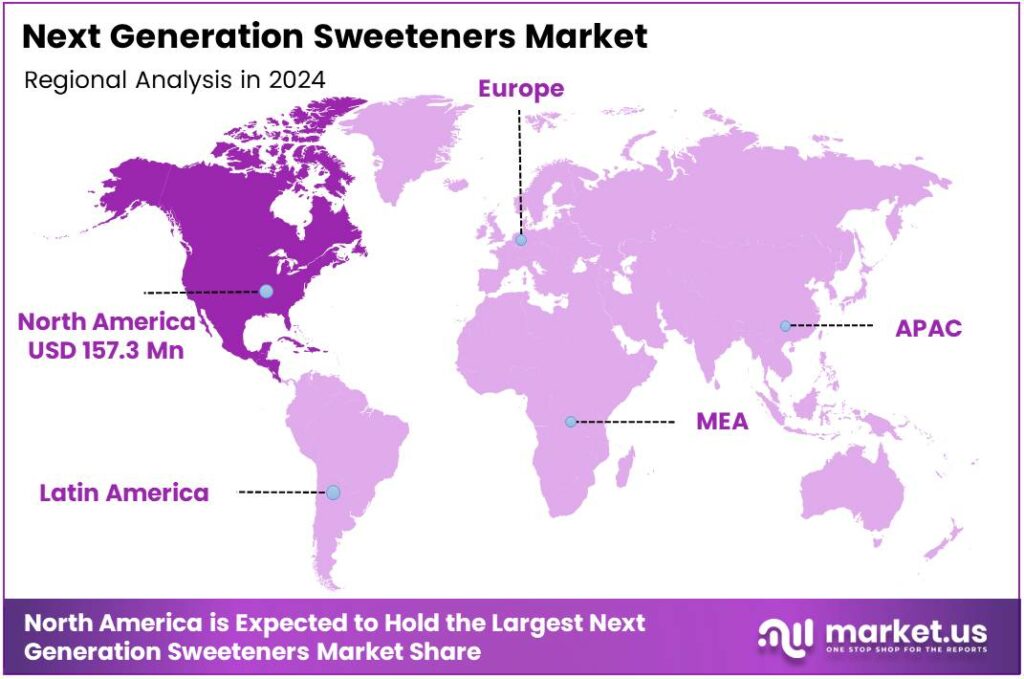

- North America dominated the regional landscape with a market share of 38.5%, generating revenue of USD 157.3 million in 2024.

By Source Analysis

Plant-Derived dominates with 51.2% due to its natural origin and rising consumer preference for clean-label ingredients.

In 2024, Plant-Derived held a dominant market position in the By Source Analysis segment of the Next Generation Sweeteners Market, with a 51.2% share. This segment thrives because consumers increasingly seek natural alternatives to traditional sugar. Consequently, manufacturers are prioritizing extracts from stevia and monk fruit to meet this surging demand.

Microbial and Fermentation-Derived sources are gaining significant traction as sustainable production methods. These processes offer high purity and consistent quality without the land-use requirements of traditional farming. Thus, they represent a vital technological shift for companies focusing on scalable bio-based solutions.

Synthetic sweeteners continue to play a role in the market by offering cost-effective and highly stable options for mass production. Although natural trends are strong, these ingredients remain essential for specific industrial applications where high-intensity sweetness is required at a lower price point.

By Sweetener Type Analysis

Mogroside V dominates with 24.8% due to its intense sweetness profile and high stability in various food applications.

In 2024, Mogroside V held a dominant market position in the By Sweetener Type Analysis segment of the Next Generation Sweeteners Market, with a 24.8% share. This compound, primarily derived from monk fruit, is favored for its clean taste profile. Therefore, it has become a staple ingredient for premium health-focused brands.

Brazzein is emerging as a powerful protein-based alternative with a flavor profile very similar to sucrose. Because it is heat-stable, it is increasingly being explored for use in baked goods and heated beverages. This makes it a promising contender for future market expansion.

Transitioning to Thaumatin I and II, these proteins are valued not just for sweetness but also for their flavor-modifying properties. They effectively mask bitterness in pharmaceutical and nutritional products. Consequently, their utility extends beyond simple sweetening to complex flavor balancing.

Monellin offers an incredibly high sweetness intensity, though its sensitivity to heat presents some formulation challenges. Researchers are currently working on stabilized versions to enhance their commercial viability. As a result, it remains a high-interest niche sweetener.

By Formulation Type Analysis

Powder dominates with 51.3% due to its ease of transport, longer shelf life, and versatility in manufacturing.

In 2024, Powder held a dominant market position in the By Formulation Type Analysis segment of the Next Generation Sweeteners Market, with a 51.3% share. This format is highly preferred by industrial food processors because it mixes easily with dry ingredients. Additionally, its stability makes it ideal for global export and long-term storage.

Moving to Liquid formulations, these are increasingly popular in the beverage and dairy sectors. They allow for precise dosing and rapid integration during the mixing process. Consequently, many beverage manufacturers prefer liquids to reduce processing time and ensure a uniform flavor profile.

Tablets serve a specific niche in the tabletop sweetener market, offering convenience for coffee and tea drinkers. They are portable and provide a controlled serving size for health-conscious individuals. Thus, they remain a staple in the retail and food service sectors.

By Application Analysis

Beverages dominate with 37.9% due to the massive global shift toward low-calorie sodas, juices, and functional drinks.

In 2024, Beverages held a dominant market position in the By Application Analysis segment of the Next Generation Sweeteners Market, with a 37.9% share. The rapid growth of sugar taxes worldwide has forced beverage giants to reformulate their products. Therefore, next-generation sweeteners have become essential tools for maintaining taste while reducing sugar content.

In the Confectionery and Baked Goods segment, manufacturers are working to overcome the structural challenges of removing sugar. Next-gen sweeteners are being paired with bulking agents to replicate the mouthfeel of traditional treats. Consequently, this allows for the production of guilt-free snacks and desserts.

Dairy and Frozen Desserts utilize these sweeteners to cater to the growing demand for low-glycemic yogurts and ice creams. These applications require sweeteners that can withstand cold temperatures and maintain stability. Thus, specialized blends are frequently used to achieve the desired creamy texture.

Key Market Segments

By Source

- Plant-Derived

- Microbial and Fermentation-Derived

- Synthetic

By Sweetener Type

- Mogroside V

- Brazzein

- Thaumatin I and II

- Monellin

- Curculin

- Pentadin

- Peptide-based Sweeteners

- Siraitiflavone-based Derivatives

- Licorice Root Glycyrrhizin Derivatives

- Sweet Chrysanthemum Glycosides

- Oubli Fruit Extract

- Others

By Formulation Type

- Powder

- Liquid

- Tablets

- Sachets

By Application

- Beverages

- Confectionery and Baked Goods

- Dairy and Frozen Desserts

- Nutraceuticals and Supplements

- Pharmaceuticals

- Tabletop Sweeteners

- Others

Emerging Trends

Shift Toward Natural and Fermentation-Based Sweeteners Gains Momentum

A major trending factor is the shift toward natural and fermentation-based sweeteners. Consumers are moving away from synthetic additives and prefer ingredients with simple origins. Sweeteners derived from plants or produced through fermentation fit well into this trend and support clean-label positioning.

- WHO has advised countries to reduce added sugar intake to improve health, recommending adults and children cut free sugars to less than 10% of their daily energy intake—and ideally below 5% for added benefits. This guideline is pushing consumers and manufacturers toward alternatives that offer sweetness with fewer calories.

The increased use of sweetener blends. Instead of relying on a single ingredient, manufacturers combine multiple sweeteners to balance sweetness, texture, and taste. This approach improves product quality and reduces aftertaste issues, making next-generation sweeteners more commercially viable.

Drivers

Rising Health Awareness and Sugar Reduction Drive Demand

Growing health awareness is a key driver for the Next Generation Sweeteners Market. Consumers are increasingly reducing sugar intake due to concerns about obesity, diabetes, and heart disease. Governments and health bodies continue to promote low-sugar diets, which supports demand for advanced sweetening solutions. Food and beverage brands are reformulating products to cut calories without losing taste.

Another strong driver is the rise in diabetes and lifestyle-related disorders across both developed and developing economies. Next-generation sweeteners help manufacturers offer sweetness with little or no impact on blood sugar levels. This makes them suitable for diabetic-friendly foods and beverages. As a result, demand is increasing across soft drinks, bakery, dairy, and nutraceutical products.

Clean-label and natural ingredient preferences also support market growth. Many next-generation sweeteners are plant-based or fermentation-derived, which aligns well with consumer trust in natural solutions. Manufacturers view these sweeteners as long-term replacements for artificial sweeteners. Together, health awareness, regulatory pressure on sugar, and product reformulation trends continue to push market expansion steadily.

Restraints

Regulatory Complexity and Taste Challenges Limit Adoption

Regulatory approval remains a major restraint in the Next Generation Sweeteners Market. Many new sweeteners face long and costly approval processes before they can be used in food and beverages. Regulations differ widely by country, making global product launches difficult for manufacturers. This slows innovation and delays commercialization.

- Some next-generation sweeteners have bitter or lingering aftertastes, which require blending with other ingredients. WHO strongly recommends that adults and children limit free sugars to <10% of total energy intake (roughly no more than 50 g or 10 teaspoons per day) and suggests an even lower target of <5% of energy for additional benefits like reduced dental caries and obesity risk.

Cost is another limiting factor. Compared to traditional sugar, many advanced sweeteners are more expensive to produce and source. This price gap restricts adoption in cost-sensitive markets and mass-consumption products. Until production scales up and costs decline, these restraints will continue to impact wider market penetration.

Growth Factors

Product Innovation and Functional Food Expansion Create Opportunities

Strong growth opportunities are emerging from product innovation and functional food development. Food and beverage companies are investing in research to improve taste profiles and stability of next-generation sweeteners. New blends are being designed to closely match sugar’s mouthfeel, opening doors to wider applications.

The rapid growth of functional foods and beverages creates another major opportunity. Products targeting weight management, sports nutrition, and digestive health increasingly use advanced sweeteners. These sweeteners support low-calorie positioning while maintaining product appeal. This trend is especially strong in beverages and nutraceuticals.

Emerging markets also offer long-term growth potential. Rising disposable income and urban lifestyles are increasing the demand for healthier packaged foods. As awareness improves, next-generation sweeteners can gain traction beyond premium segments. Improved production efficiency and local sourcing can further unlock these opportunities over time.

Regional Analysis

North America Dominates the Next Generation Sweeteners Market with a Market Share of 38.5%, Valued at USD 157.3 Million

North America leads the Next Generation Sweeteners Market, holding a dominant share of 38.5% and generating revenue of USD 157.3 million. This strong position is supported by high consumer awareness around sugar reduction, obesity management, and clean-label food products. Food and beverage manufacturers across the U.S. are increasingly adopting advanced sweeteners to meet regulatory sugar targets and shifting dietary preferences.

Europe represents a mature and regulation-driven market for next-generation sweeteners, supported by strict sugar reduction policies and labeling standards. Countries across Western and Northern Europe show rising demand for low-calorie and natural sweeteners in beverages, dairy, and bakery products. Growing health consciousness and government-backed nutrition programs continue to encourage reformulation efforts.

Asia Pacific is emerging as a high-growth region due to rapid urbanization, rising disposable incomes, and increasing awareness of lifestyle-related health issues. Food and beverage companies are actively introducing reduced-sugar products to cater to a large and diverse consumer base. Expanding middle-class populations and growing demand for functional foods accelerate adoption.

The U.S. plays a central role within North America, driven by strong demand for sugar substitutes in beverages, nutraceuticals, and tabletop sweeteners. Consumers actively seek products supporting weight management and blood sugar control. Regulatory support for sugar reduction and high innovation intensity among food manufacturers accelerate market penetration. The country remains a key revenue contributor and trendsetter for advanced sweetener adoption.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global Next Generation Sweeteners market continued to be shaped by major ingredient innovators, with a strong focus on scalability, consumer clean-label demand, and product diversification.

Tate and Lyle PLC maintained its leadership through strategic investments in high-intensity sweeteners and texturants, leveraging its global supply chain to support demand from beverage and bakery customers, while advancing sustainability across its product portfolio.

Cargill, Incorporated, strengthened its position by expanding its next-generation sweetener offerings, placing emphasis on stevia and other plant-derived sweeteners that align with shifting consumer preferences toward natural alternatives. Its deep customer relationships in North America and Europe helped accelerate innovation and adoption in reduced-sugar formulations.

Ingredion Incorporated used its ingredient science capabilities to tailor sweetener blends that balance performance with taste, particularly for functional foods and beverages. By enhancing formulation support services and leveraging its global R&D network, Ingredion addressed complex application challenges that many food manufacturers face when reducing sugar without compromising quality.

Ajinomoto Co., Inc. focused on expanding its portfolio of specialty sweeteners, including next-generation options with improved taste profiles and metabolic benefits. The company’s strong presence in Asia-Pacific provided a platform for scaling novel sweetener solutions, while collaborative efforts with food brands helped increase market penetration and accelerate product launches.

Top Key Players in the Market

- Tate and Lyle PLC

- Cargill, Incorporated

- Ingredion Incorporated

- Ajinomoto Co., Inc.

- DuPont Nutrition and Health

- Archer Daniels Midland Co. (ADM)

- PureCircle Ltd.

- JK Sucralose Inc.

- NutraSweet Company

- International Flavors and Fragrances Inc. (IFF)

Recent Developments

- In 2024, Tate & Lyle announced a strategic partnership with BioHarvest Sciences to develop next-generation botanical sweetening ingredients using plant-derived molecules, aiming to advance sugar reduction solutions. This collaboration focuses on pioneering plant-based sweeteners for broader food and beverage applications.

- In 2025, Cargill’s EverSweet stevia sweetener was named a finalist in the Global Good Awards for Game Changing Innovation of the Year, highlighting its role in sustainable sugar reduction. Cargill unveiled new sustainable innovations at Food Ingredients Europe, including advancements in sweeteners focused on improved flavor and environmental impact.

Report Scope

Report Features Description Market Value (2024) USD 408.7 Million Forecast Revenue (2034) USD 774.4 Million CAGR (2025-2034) 6.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Plant-Derived, Microbial and Fermentation-Derived, Synthetic), By Sweetener Type (Mogroside V, Brazzein, Thaumatin I and II, Monellin, Curculin, Pentadin, Peptide-based Sweeteners, Siraitiflavone-based Derivatives, Licorice Root Glycyrrhizin Derivatives, Sweet Chrysanthemum Glycosides, Oubli Fruit Extract, Others), By Formulation Type (Powder, Liquid, Tablets, Sachets), By Application (Beverages, Confectionery and Baked Goods, Dairy and Frozen Desserts, Nutraceuticals and Supplements, Pharmaceuticals, Tabletop Sweeteners, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Tate and Lyle PLC, Cargill, Incorporated, Ingredion Incorporated, Ajinomoto Co., Inc., DuPont Nutrition and Health, Archer Daniels Midland Co. (ADM), PureCircle Ltd., JK Sucralose Inc., NutraSweet Company, International Flavors and Fragrances Inc. (IFF) Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Next Generation Sweeteners MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Next Generation Sweeteners MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Tate and Lyle PLC

- Cargill, Incorporated

- Ingredion Incorporated

- Ajinomoto Co., Inc.

- DuPont Nutrition and Health

- Archer Daniels Midland Co. (ADM)

- PureCircle Ltd.

- JK Sucralose Inc.

- NutraSweet Company

- International Flavors and Fragrances Inc. (IFF)