Next Generation Molecular Assay Market By Test Type (HPV Testing, Virus Testing, STD Testing, Oncological Testing, Influenza Testing, HIV Testing, HCV Testing, Genetic Testing, Blood Testing, and Others), By Technology (Polymerase Chain Reaction (PCR), Microarrays, Gene Expression Profiling Assays, Enzyme-Linked Immuno-Sorbent Assay (ELISA), and Others), By End-user (Biopharmaceutical Companies, Hospitals, Academic & Research Centers, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 168081

- Number of Pages: 350

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

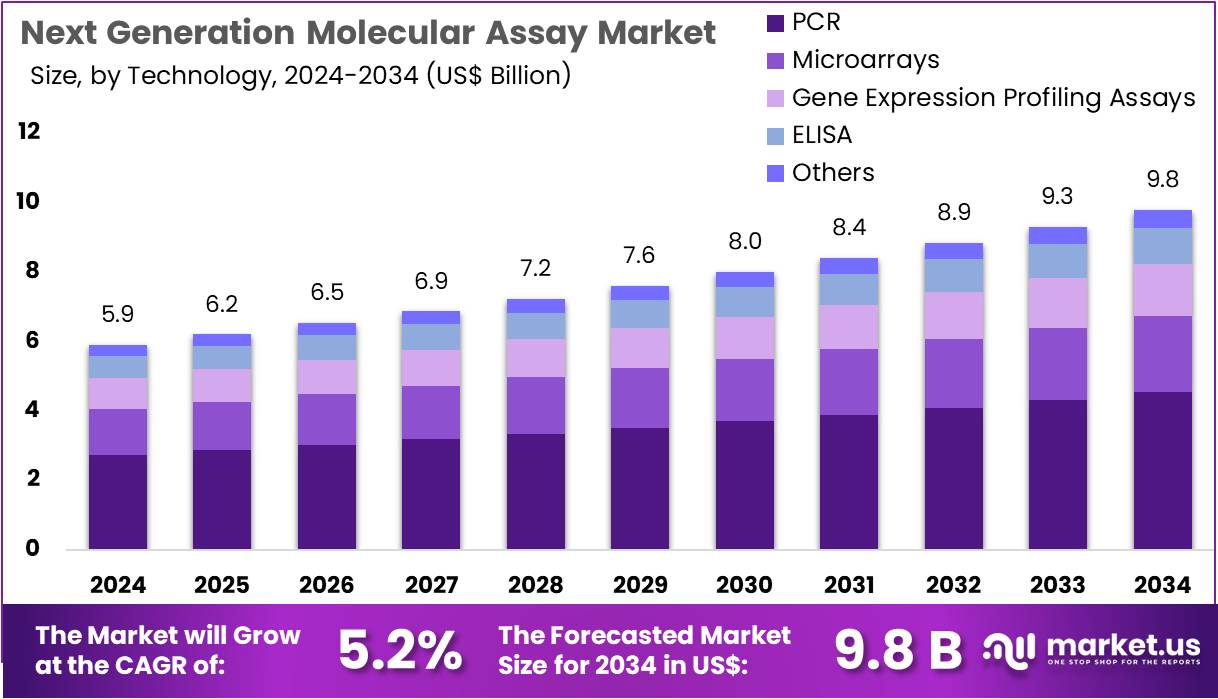

The Next Generation Molecular Assay Market Size is expected to be worth around US$ 9.8 billion by 2034 from US$ 5.9 billion in 2024, growing at a CAGR of 5.2% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 41.1% share and holds US$ 2.4 Billion market value for the year.

Increasing demand for ultrasensitive mutation detection propels the Next Generation Molecular Assay market, as oncologists require precise quantification of rare variants to guide targeted therapy selection and monitor disease progression. Diagnostic companies engineer digital PCR platforms that partition samples into thousands of reactions for absolute target enumeration without standard curves.

Laboratories deploy these assays for circulating tumor DNA monitoring in liquid biopsies, minimal residual disease assessment post-resection, fusion gene identification in sarcomas, and copy number variation analysis in hereditary cancer syndromes. Clinical-grade automation creates opportunities for standardized workflows in high-volume cancer centers.

QIAGEN advanced this precision on September 30, 2024, by introducing the QIAcuityDx Digital PCR System, enabling routine adoption of highly sensitive molecular quantification in oncology diagnostics. This launch accelerates the transition from conventional methods to next-generation assays for superior patient management.

Growing need for high-throughput genomic sequencing accelerates the Next Generation Molecular Assay market, as research and clinical facilities scale operations to process thousands of samples with minimal turnaround time. Innovators develop novel chemistries that expand nucleotides during sequencing cycles to achieve rapid, accurate base calling at massive parallel levels. These platforms support whole-exome sequencing for rare disease diagnostics, transcriptome profiling in immunotherapy response prediction, metagenomic pathogen identification in infectious outbreaks, and pharmacogenomic panel testing for personalized drug dosing.

Faster run times open avenues for population-scale screening programs and real-time epidemiological surveillance. Roche unveiled its groundbreaking Sequencing by Expansion (SBX) platform on February 20, 2025, dramatically reducing sequencing duration while accommodating extreme sample volumes. This architecture removes longstanding barriers and empowers broader implementation of comprehensive next-generation molecular testing.

Rising adoption of multi-omic integration invigorates the Next Generation Molecular Assay market, as investigators combine DNA and RNA insights from identical specimens to uncover complex biological mechanisms. Manufacturers streamline library preparation with kits that simultaneously capture genomic and transcriptomic signals through unified protocols. Laboratories leverage these tools for simultaneous mutation and expression analysis in tumor profiling, splice variant detection in neurological disorders, epigenetic-transcriptomic correlation in autoimmune diseases, and integrated biomarker discovery in drug development trials.

Single-sample dual-library workflows create opportunities for cost-effective, data-rich studies that enhance translational outcomes. QIAGEN launched the QIAseq Multimodal DNA/RNA Library Kit on May 29, 2024, eliminating separate preparation steps and markedly boosting throughput for multi-omic sequencing. This innovation establishes efficient, comprehensive next-generation assay designs as standard practice across research and clinical environments.

Key Takeaways

- In 2024, the market generated a revenue of US$ 5.9 billion, with a CAGR of 5.2%, and is expected to reach US$ 9.8 billion by the year 2034.

- The test type segment is divided into HPV testing, virus testing, STD testing, oncological testing, influenza testing, HIV testing, HCV testing, genetic testing, blood testing, and others, with HPV testing taking the lead in 2024 with a market share of 22.6%.

- Considering technology, the market is divided into PCR, microarrays, gene expression profiling assays, ELISA, and others. Among these, PCR held a significant share of 46.3%.

- Furthermore, concerning the end-user segment, the market is segregated into biopharmaceutical companies, hospitals, academic & research centers, and others. The biopharmaceutical companies sector stands out as the dominant player, holding the largest revenue share of 49.7% in the market.

- North America led the market by securing a market share of 41.1% in 2024.

Test Type Analysis

HPV testing, holding 22.6%, is expected to grow rapidly due to rising awareness of HPV-driven cervical, head and neck, and anal cancers. Screening programs expand across North America, Europe, and Asia as governments focus on early detection and prevention. Laboratories adopt molecular HPV assays that detect high-risk strains with improved accuracy, and this technological advancement strengthens demand. Vaccination drives encourage more screening participation, especially among younger populations.

HPV genotyping gains importance as clinicians differentiate high-risk variants for precision management. Biopharmaceutical companies intensify research into HPV-related oncology pathways, increasing the need for sensitive assay platforms. Women’s health organizations run large awareness campaigns, supporting early testing uptake. Self-sampling kits expand accessibility and boost participation rates. Low- and middle-income countries invest in HPV screening infrastructure, increasing assay consumption. Automation trends simplify lab workflows and support higher testing throughput.

Non-invasive molecular assays gain traction as they reduce patient discomfort and encourage routine screening. Expanded clinical guidelines encourage HPV testing as a primary screening method. Increasing incidence of HPV-associated cancers drives further adoption. Digital reporting platforms improve follow-up rates and strengthen clinical outcomes.

Expanding collaborations between diagnostic firms and public-health agencies enhance global penetration. Rapid innovation in molecular detection strengthens accuracy and reliability. Growing emphasis on preventive healthcare positions HPV testing projected to remain the leading test type in the next generation molecular assay market.

Technology Analysis

PCR, holding 46.3%, is anticipated to remain the dominant technology due to its unmatched sensitivity, rapid results, and versatility across infectious disease, oncology, and genetic testing applications. Laboratories depend on PCR for accurate pathogen quantification and mutation detection. Biopharmaceutical companies incorporate PCR across drug discovery, biomarker development, and clinical-trial analysis, driving high testing volumes.

Outbreak preparedness strategies across multiple countries strengthen investments in PCR-based platforms. Advances in multiplex PCR enable simultaneous detection of multiple targets, increasing testing efficiency. Point-of-care PCR devices gain traction for rapid clinical decision-making. High-throughput PCR systems support screening programs for HPV, influenza, HIV, and STDs. Digital PCR expands precision for oncology, cell-therapy monitoring, and rare mutation detection.

Academic researchers use PCR extensively for gene expression analysis and molecular pathway studies. PCR instrument manufacturers develop automated workflows and robotics integration to reduce manual workloads. Increased demand for personalized medicine strengthens usage of PCR-based companion diagnostics.

PCR also supports quality-control testing in bioprocessing, growing adoption within manufacturing environments. Its reliability and adaptability across clinical, research, and industrial settings keep PCR projected to remain the central technology in next generation molecular assays.

End-User Analysis

Biopharmaceutical companies, holding 49.7%, are expected to dominate due to their expanding use of next generation molecular assays across research, development, clinical validation, and biomanufacturing workflows. R&D teams use assays to study disease mechanisms, gene expression patterns, and viral or oncogenic targets. Drug-discovery programs depend on high-accuracy molecular testing to evaluate therapeutic impact at early stages.

Clinical-trial activities expand globally, and molecular assays support patient screening, biomarker analysis, and treatment-response evaluation. Cell and gene therapy pipelines grow rapidly, and these programs require next-generation assays for precision monitoring. Biopharmaceutical production facilities rely on molecular tests for contamination control, purity checks, and quality assurance. Companies adopt multiplex assays to increase throughput and accelerate development cycles.

Collaborations with diagnostic firms accelerate assay innovation tailored to therapeutic programs. Oncology-focused companies invest heavily in molecular profiling, increasing testing demand. Regulatory expectations for molecular analytics strengthen adoption across development phases. Biopharmaceutical companies also outsource large testing volumes to CROs, increasing overall consumption.

Advanced biologics and personalized-medicine programs require deeper molecular insights, driving demand for high-sensitivity assays. The rapid growth of RNA therapeutics, mRNA vaccines, and gene-editing platforms further expands molecular testing needs. Strong investment capacity and continuous innovation keep biopharmaceutical companies anticipated to remain the most influential end-user segment in this market.

Key Market Segments

By Test Type

- HPV testing

- Virus testing

- STD Testing

- Oncological Testing

- Influenza testing

- HIV testing

- HCV testing

- Genetic Testing

- Blood Testing

- Others

By Technology

- Polymerase chain reaction (PCR)

- Microarrays

- Gene expression profiling assays

- Enzyme-Linked Immuno-Sorbent Assay (ELISA)

- Others

By End-user

- Biopharmaceutical Companies

- Hospitals

- Academic & Research Centers

- Others

Drivers

Increasing Global Cancer Incidence is Driving the Market

The mounting global incidence of cancer has positioned it as a fundamental driver for the next generation molecular assay market, where these advanced sequencing technologies enable precise identification of actionable mutations for targeted therapies. This epidemiological escalation necessitates widespread deployment of next-generation sequencing panels in oncology workflows, from initial diagnosis to relapse monitoring.

Healthcare systems are integrating these assays into standard protocols to stratify patients for immunotherapies and kinase inhibitors, optimizing treatment selection. Diagnostic laboratories are expanding capacity to handle surging sample volumes, supported by automated library preparation kits for efficiency. Regulatory frameworks encourage the development of comprehensive genomic profiling assays, aligning with precision oncology initiatives.

Collaborative consortia among research institutions facilitate large-scale validations, ensuring robustness across tumor types. The financial rationale is compelling, as early molecular insights reduce ineffective treatments and associated expenditures. Professional guidelines from oncology societies endorse routine assay use, embedding them in multidisciplinary tumor boards. This driver stimulates investments in bioinformatics pipelines, essential for interpreting vast genomic datasets.

Patient advocacy groups champion access to these tools, influencing policy for equitable distribution. The World Health Organization reported an estimated 20 million new cancer cases worldwide in 2022. These figures illustrate the diagnostic imperative fueling market dynamics.

Restraints

High Cost of NGS Assays is Restraining the Market

The elevated expenses associated with next generation molecular assays continue to serve as a primary restraint, limiting their routine incorporation into clinical practice, especially in resource-constrained environments. Comprehensive sequencing panels often require specialized equipment and reagents, imposing substantial upfront investments for laboratories. Reimbursement inconsistencies across payers further complicate affordability, with many jurisdictions capping coverage for non-essential profiling. This financial barrier disproportionately affects community hospitals, favoring academic centers with grant funding.

Developers grapple with balancing assay comprehensiveness against cost reductions, delaying broader commercialization. Supply chain dependencies on imported consumables exacerbate pricing volatility in emerging regions. The restraint perpetuates diagnostic delays, as clinicians opt for cheaper, less informative alternatives like single-gene tests. Policy discussions highlight the need for tiered pricing models, yet implementation faces bureaucratic hurdles.

Educational efforts underscore long-term savings from personalized treatments, but immediate budget pressures dominate decisions. International aid programs aim to subsidize access, though coverage remains patchy. A 2025 study published via the National Institutes of Health indicated a mean per-patient cost of €2,102 for next-generation sequencing in advanced non-small cell lung cancer scenarios. This figure illustrates the economic challenges impeding equitable adoption.

Opportunities

Growth in Personalized Medicine Approvals is Creating Growth Opportunities

The proliferation of regulatory approvals for personalized medicine applications is forging expansive growth opportunities in the next generation molecular assay market, linking genomic insights directly to therapeutic decisions. These endorsements validate multi-analyte assays as companion diagnostics, streamlining patient matching to biomarker-driven interventions. Pharmaceutical collaborations with diagnostic firms accelerate co-development, enhancing assay portfolios for rare mutations. This synergy opens doors for liquid biopsy innovations, enabling non-invasive serial monitoring in metastatic settings.

Market entrants can leverage fast-track designations, expediting validations for oncology and beyond. Global harmonization of approval standards facilitates cross-border expansions, particularly in high-prevalence regions. Economic projections favor these opportunities, as precision approaches yield superior outcomes and cost efficiencies over empiric therapies. Training consortia equip pathologists with interpretation skills, bridging690 gaps in frontline deployment.

The resultant ecosystem diversifies revenue through service contracts and data analytics add-ons. Emerging applications in infectious diseases further broaden utility, adapting assays for pathogen resistance profiling. The US Food and Drug Administration approved 50 novel drugs in 2024, many incorporating next-generation molecular assays for personalized indications. This milestone exemplifies the catalytic potential for diagnostic advancements.

Impact of Macroeconomic / Geopolitical Factors

Fiscal uncertainties and climbing energy tariffs across major economies pinch R&D allocations, prompting diagnostic firms to shelve next-generation molecular assay rollouts in secondary markets. Pharma giants ramp up genomics budgets and secure milestone-based grants, however, which fast-track assay integrations for precision oncology pipelines. Border skirmishes in critical mineral zones like Africa disrupt rare earth deliveries for sequencer hardware, jacking up fabrication delays and premiums for equipment builders.

These geopolitical snags, though, rally industry players toward modular designs and intra-continental trades that trim vulnerabilities and boost throughput. US tariffs hitting 25% on Chinese biotech imports under Section 301 since late 2024 swell overheads for American labs chasing cutting-edge molecular tools. Savvy operators sidestep this via reshoring pilots and leveraging CPTPP exemptions that lock in cost savings and speed. Taken together, these ripples enforce leaner operations and bolder tech bets.

Latest Trends

FDA Approval of Advanced NGS Platforms is a Recent Trend

The US Food and Drug Administration’s clearance of sophisticated next-generation sequencing platforms has crystallized as a pivotal trend in 2025, emphasizing high-throughput, pan-cancer profiling for real-time clinical guidance. These systems integrate artificial intelligence for variant prioritization, reducing analysis times from days to hours in busy laboratories. The trend prioritizes decentralized testing, with benchtop sequencers enabling point-of-care decisions in oncology clinics.

Manufacturers are refining error-correction algorithms, enhancing accuracy for low-input samples like circulating tumor DNA. This development aligns with telepathology networks, facilitating remote expert consultations on assay outputs. Competitive launches underscore modularity, allowing upgrades without full system overhauls. Validation studies confirm equivalence to centralized labs, bolstering adoption in regional facilities.

The focus on inclusivity incorporates diverse genomic references, mitigating ancestry biases in variant calling. Broader ramifications extend to pharmacovigilance, using assays for post-treatment resistance surveillance. Regulatory dialogues evolve toward adaptive approvals, incorporating post-market data for label expansions. On July 3, 2025, the US Food and Drug Administration approved Thermo Fisher Scientific’s Oncomine Dx Express Test, a next-generation sequencing assay for comprehensive tumor profiling. This approval highlights the trend’s momentum toward integrated, actionable diagnostics.

Regional Analysis

North America is leading the Next Generation Molecular Assay Market

The percentage share of North America in the Next Generation Molecular Assay market stands at 41.1%, underscoring its preeminent role amid accelerated advancements in genomic sequencing and precision diagnostics throughout 2024. This expansion arises from intensified focus on companion diagnostics for targeted therapies, particularly in oncology, where next-generation sequencing panels enable rapid identification of actionable mutations to guide treatment decisions. Major pharmaceutical companies ramped up collaborations with sequencing providers to integrate these assays into phase III trials, enhancing efficacy assessments for immunotherapies and kinase inhibitors.

The Centers for Medicare & Medicaid Services broadened reimbursement policies for multi-gene panels, incentivizing widespread clinical adoption in community hospitals across the United States and Canada. Venture funding surged into startups developing droplet digital PCR-based assays for minimal residual disease monitoring, addressing unmet needs in hematologic malignancies. Academic medical centers in hubs like Houston and Toronto pioneered multiplexed assays combining RNA and DNA analysis, streamlining workflows for transplant compatibility testing.

Regulatory endorsements from the College of American Pathologists standardized validation protocols, reducing barriers to implementation in routine pathology labs. Heightened awareness of pharmacogenomics in cardiology drove demand for assays predicting adverse drug responses, integrating seamlessly into electronic health records.

Supply chain resilience, bolstered by domestic manufacturing of library preparation kits, ensured uninterrupted access amid global logistics challenges. In support of this momentum, the National Institutes of Health awarded US$27 million to establish a network of genomics-enabled learning health systems in 2024, advancing molecular diagnostic integration.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Biotech innovators project robust trajectory for the advanced molecular diagnostics sector in Asia Pacific over the forecast period, propelled by expansive genomic mapping initiatives and surging infectious disease surveillance in nations such as Japan and Australia. Health ministries channel investments into high-throughput platforms for viral variant detection, optimizing real-time PCR workflows to combat emerging pathogens like influenza strains.

Research alliances anticipate deeper penetration of CRISPR-based assays in agricultural biotech, evaluating gene edits for crop resilience against climate stressors. Policymakers estimate accelerated uptake through subsidized training programs for bioinformatics specialists, enhancing data interpretation from whole-exome sequencing in rare disease cohorts. International consortia likely foster cross-continental validations of liquid biopsy assays, refining sensitivity for early-stage lung cancer screening.

Manufacturing hubs in South Korea gear up to scale production of nanoparticle-enhanced probes, lowering costs for point-of-care applications in remote areas. Educational reforms in India equip universities with next-gen sequencers, spurring thesis projects on epigenetic markers for metabolic syndromes. Trade agreements facilitate technology imports, enabling seamless deployment of automated extraction systems in national reference labs.

Philanthropic foundations project gains in equity through portable assays for maternal health monitoring, targeting prenatal aneuploidy detection. Reinforcing this vision, China’s National Bureau of Statistics reported fiscal expenditures on science and technology reaching 1,199.58 billion yuan in 2023, underpinning biotechnology infrastructure development.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Pioneering entities in the Next Generation Molecular Assay market catalyze expansion by channeling substantial resources into high-throughput sequencing platforms that integrate AI-driven variant calling, enabling rapid biomarker discovery for oncology and rare disease cohorts while commanding premium integrations in precision medicine pipelines. They execute transformative joint ventures with pharmaceutical titans to co-engineer companion diagnostics tied to novel targeted agents, thereby embedding their assays within accelerated regulatory pathways and securing milestone-laden revenue streams.

Decision-makers aggressively acquire agile bioinformatics startups to fortify data analytics ecosystems, accelerating turnaround from raw genomic reads to actionable insights that differentiate offerings in competitive CRO tenders. Organizations prioritize localized innovation centers in Asia-Pacific hotspots, tailoring multiplex panels to regional pharmacogenomic profiles and navigating harmonized approvals to penetrate high-volume emerging diagnostics arenas.

Leaders cultivate clinician-led advisory councils to refine user interfaces on portable analyzers, fostering guideline endorsements that propel adoption in decentralized testing networks. These precision-engineered initiatives not only erect robust competitive moats but also harmonize with the escalating imperative for scalable, equitable genomic intelligence.

Illumina, Inc., a San Diego-headquartered genomics powerhouse founded in 1998, engineers end-to-end sequencing ecosystems that span research-grade instruments to clinical-grade consumables, empowering over 155 countries with tools for genetic variation analysis and biological function elucidation in molecular diagnostics and translational applications. The firm anchors its supremacy through the NovaSeq and NextSeq series, which deliver scalable throughput from benchtop to production-scale workflows, while its microarray reagents support focused genotyping in agricultural and consumer genomics domains.

Illumina amplifies its global mandate via strategic R&D collaborations with academic powerhouses like the Broad Institute, yielding breakthroughs in single-cell resolution and multi-omic integrations that redefine therapeutic development paradigms. Under CEO Jacob Thaysen, the enterprise navigates geopolitical headwinds with agile manufacturing pivots across Singapore, the UK, and India, ensuring uninterrupted supply amid evolving trade dynamics.

The company sustains its vanguard through relentless firmware evolutions and cloud-based informatics suites that transform petabyte-scale datasets into clinician-ready dashboards. This cohesive blueprint cements Illumina’s stature as the indispensable architect of genomic accessibility in an era of democratized discovery.

Top Key Players in the Next Generation Molecular Assay Market

- Thermo Fisher Scientific Inc.

- Siemens Healthineers AG

- QIAGEN N.V.

- Myriad Genetics, Inc.

- Luminex Corporation

- Illumina Inc.

- Hoffmann‑La Roche Ltd

- Danaher Corporation

- Bio‑Rad Laboratories Inc.

- Agilent Technologies Inc.

Recent Developments

- On October 29, 2025: Thermo Fisher Scientific moved to acquire Clario Holdings, Inc., significantly expanding its capabilities in digital data capture and advanced clinical trial analytics. This acquisition reinforces the ecosystem required to support next-generation molecular assays—particularly those used in biomarker-driven trials that generate large and complex genomic datasets. By strengthening data workflows, Thermo Fisher accelerates the transition toward molecular assays embedded in AI-supported clinical development.

- On January 10, 2025: QIAGEN upgraded the QIAcuity Digital PCR platform with enhanced high-order multiplexing, permitting far more genetic targets to be measured from a single sample. This advancement allows laboratories to consolidate multiple tests into one ultra-sensitive assay, improving efficiency and reducing per-sample costs. The capability directly stimulates adoption of next-generation molecular assays that depend on detecting multiple biomarkers simultaneously for disease profiling, monitoring, and precision therapy selection.

Report Scope

Report Features Description Market Value (2024) US$ 5.9 billion Forecast Revenue (2034) US$ 9.8 billion CAGR (2025-2034) 5.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Test Type (HPV Testing, Virus Testing, STD Testing, Oncological Testing, Influenza Testing, HIV Testing, HCV Testing, Genetic Testing, Blood Testing, and Others), By Technology (Polymerase Chain Reaction (PCR), Microarrays, Gene Expression Profiling Assays, Enzyme-Linked Immuno-Sorbent Assay (ELISA), and Others), By End-user (Biopharmaceutical Companies, Hospitals, Academic & Research Centers, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thermo Fisher Scientific Inc., Siemens Healthineers AG, QIAGEN N.V., Myriad Genetics, Inc., Luminex Corporation, Illumina, Inc., F. Hoffmann‑La Roche Ltd, Danaher Corporation, Bio‑Rad Laboratories, Inc., Agilent Technologies, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Next Generation Molecular Assay MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Next Generation Molecular Assay MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Thermo Fisher Scientific Inc.

- Siemens Healthineers AG

- QIAGEN N.V.

- Myriad Genetics, Inc.

- Luminex Corporation

- Illumina Inc.

- Hoffmann‑La Roche Ltd

- Danaher Corporation

- Bio‑Rad Laboratories Inc.

- Agilent Technologies Inc.