Mycoplasma Testing Market By Product (Instruments, Kits & Reagents, and Services), By Technique (PCR, Direct Assay, ELISA, Indirect Assay, Microbial Culture Techniques, DNA Staining, And Enzymatic Methods,), By Testing Type (Cell Line Testing, End of Production Cell Testing, Virus Testing), By End Users, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Nov 2024

- Report ID: 99656

- Number of Pages: 388

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

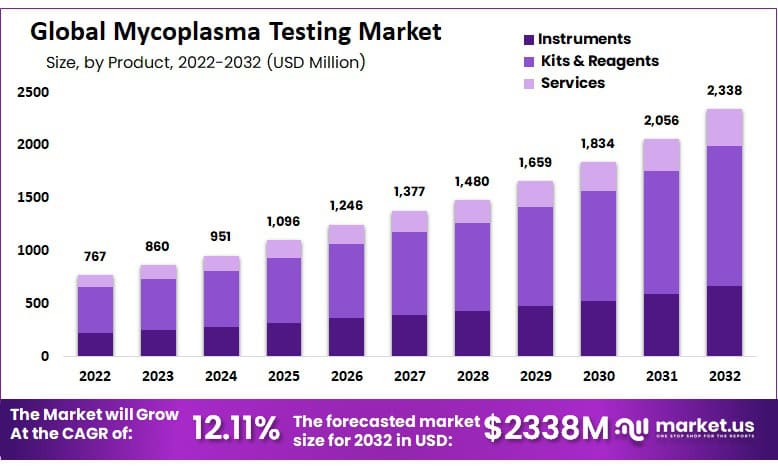

In 2022, the Global Mycoplasma Testing Market was valued at USD 766.63 Million and is expected to grow to USD 2338 Million in 2032. Between 2023 and 2032, this market is estimated to register a CAGR of 12.11%.

Mycoplasma is a type of bacteria that is characterized by its small size and lack of a cell wall. Mycoplasma species are known for their ability to cause various types of infections in animals and humans, including pneumonia, bronchitis, urinary tract infections, and sexually transmitted infections.

Because of their unique properties, they are sometimes referred to as “minimal bacteria” or “cell wall-deficient bacteria.” In addition, Due to the coronavirus pandemic and the detection of Mycoplasma pneumoniae in SARS-CoV-2 patients, mycoplasma testing services are in high demand.

*Actual Numbers Might Vary In The Final Report

Key Takeaways

- The Mycoplasma Testing Market is projected to grow at a CAGR of 12.11%.

- The Global Mycoplasma Testing market was valued at US$ 766.63 million in 2022.

- It is estimated to reach US$ 2338 million by 2032.

- The market is dominated by the kit & reagents segment in 2022 due to the availability of automated equipment.

- The PCR segment dominated the mycoplasma testing market in 2022.

- In 2022, North America held the highest revenue share of 40.7% in the Mycoplasma Testing Market.

- The kit and reagents sector had a market share of 55.6% in 2022.

- The PCR category in the mycoplasma testing market had a revenue share of 36.1% in 2022.

- The biotechnology and pharmaceutical sector had the largest revenue share among end-users at 36.8%.

Driving Factors

Increasing R&D Expenditures

The usage of extremely efficient mycoplasma testing technologies will undoubtedly increase as research costs rise and major firms invest more in R&D. Bristol-Myers Squibb, for instance, began investing resources in developing new drugs to aid clinical preliminary studies. Safety testing has become more crucial to make sure that a product satisfies the standards for efficacy, public health, and safety as a whole since the emergence of biosimilars and the profitable investment in R&D that followed.

In December 2020, Merck KGaA spent about USD 46.3 million (EUR 40 million) in manufacturing facilities in Massachusetts and New Hampshire to increase its manufacturing presence in the United States.

Innovative Approaches and Significant Investments

The market for mycoplasma testing is growing as a result of bright strategies and large expenditures made by market participants. By the middle of 2020, biologics, for example, account for seven of the top ten most prescribed medications. This depicts the growth of the biologics market globally.

Cell lines are required to synthesize numerous medical and therapeutic biological products like monoclonal antibodies, viral vaccinations, and cytokines. Mycoplasma strains significantly influence the metabolism, physiology, & gene expression of cell lines. As a result, the following are the specific market expansion considerations for mycoplasma testing.

Restraining Factors

Lack Of Awareness and Technological Limitations in the Market

There is still a lack of awareness about mycoplasma contamination in cell cultures and the importance of its testing. Many researchers are not aware of the need for regular testing and the consequences of not testing their samples, which can lead to false results and unreliable experiments. Mycoplasma testing can be expensive, especially for small research labs and academic institutions with limited budgets. The high cost of testing can deter researchers from conducting regular testing, leading to a higher risk of contamination.

Current mycoplasma testing methods can be time-consuming and have limitations in terms of sensitivity & specificity. This can result in false negative or false positive results, which can compromise the validity of the research. The regulatory landscape for mycoplasma testing can be complex and varies across various countries & regions. This can make challenges for companies that want to market their mycoplasma testing products globally.

Growth Opportunities

- Increasing Demand For Biologics: With the growing demand for biologics such as vaccines, monoclonal antibodies, and cell therapies, there is an increasing need for mycoplasma testing to ensure the safety and quality of these products.

- Advancements In Technology: The development of new technologies, such as digital PCR and CRISPR-based assays, has the potential to improve the sensitivity and specificity of mycoplasma testing, making it more reliable and accurate.

- Rising Adoption Of In-House Testing: More and more research labs are adopting in-house mycoplasma testing instead of outsourcing the testing to third-party labs. This presents an opportunity for companies to offer affordable and user-friendly testing kits for in-house testing.

- Growing Research In Regenerative Medicine: With the increasing research in regenerative medicine, there is a growing need for mycoplasma testing in stem cell research and tissue engineering. This presents an opportunity for companies to develop specialized mycoplasma testing kits for these applications.

- Increasing Regulatory Requirements: Regulatory agencies such as the FDA and EMA have strict requirements for mycoplasma testing in biologics manufacturing. This presents an opportunity for companies that offer mycoplasma testing services and products to expand their customer base and increase their market share.

Overall, the mycoplasma testing market presents several growth opportunities, especially with the increasing demand for biologics and technological advancements. Companies that can develop reliable, affordable, and user-friendly mycoplasma testing products are well-positioned to succeed in this market.

Trending Factors

- Increased Adoption Of PCR-Based Assays: PCR-based assays are becoming increasingly popular for mycoplasma testing due to their high sensitivity and specificity. These assays are faster and more accurate than traditional culture-based methods, which are time-consuming and less reliable.

- Rising Demand for Automated Testing: The demand for automated mycoplasma testing is increasing, especially in large biopharmaceutical companies and contract research organizations. Automated testing systems can reduce the turnaround time for testing and increase the efficiency of the testing process.

- Growing Use Of In-Line Testing: In-line testing is becoming more common in biologics manufacturing, where mycoplasma testing is integrated into the manufacturing process. This approach reduces the risk of contamination and improves the efficiency of the manufacturing process.

By Product Analysis

By product analysis, the market is further divided into Instruments, Kits and reagents, and Services. The kit & reagents segment dominated with a market share of 55.6 % and a projected CAGR of 12.11% in 2022.

Because of the developing accessibility of robotized hardware for the location of mycoplasma, instruments are anticipated to encounter significant development during the projected period.

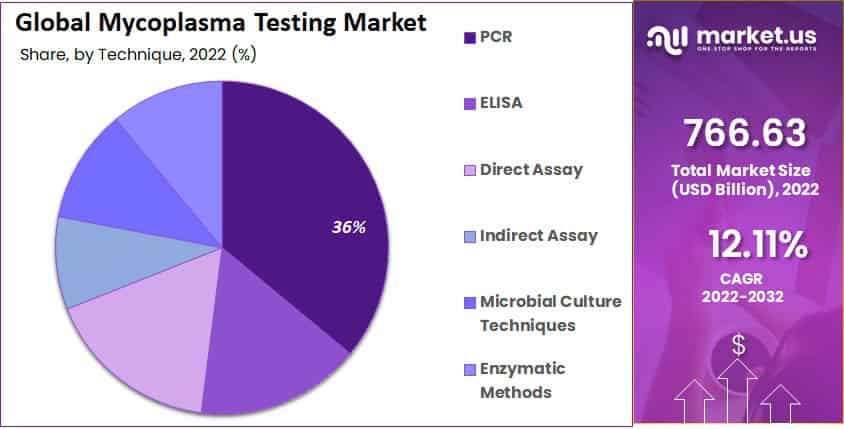

By Technique Analysis

Based on technique, the market is segmented into PCR, Direct Assay, Indirect Assay, ELISA, Enzymatic Methods, and microbial Culture Techniques. With a revenue share of 36.1% in 2022, The PCR segment dominated the mycoplasma testing market and is projected to grow fastest.

Various mycoplasma species can be identified, and other contaminating DNA can be separated using this method. ELISA technology is anticipated to see a rise in the market during the forecast period because it simplifies mycoplasma detection with labeled probes or antibodies.

By End-User Analysis

Based on end-user, the market is segmented into academic research institutes, cell banks, contract research organizations, pharmaceutical & biotechnology companies, hospitals and surgical centers, clinics, community healthcare, and others. Among these end-users, the pharmaceutical and biotechnology segment is estimated to be the most lucrative segment in the global mycoplasma testing market, with the largest revenue share of 36.8%.

Contract research organizations (CROs) are anticipated to profitably expand over the anticipated time frame as a result of the expanding range of research services provided by these businesses. They require the use of mycoplasma tests to guarantee the quality of the outsourced testing services and to guarantee the sterility of cultures utilized in biopharmaceutical development and preclinical research.

Key Market Segments

Based On Products

- Instruments

- Kits & Reagents

- Services

Based On Technique

- PCR

- ELISA

- Direct Assay

- Indirect Assay

- Microbial Culture Techniques

- Enzymatic Methods

- DNA Staining

Based On Testing Type

- By Testing Type

- Cell Line Testing

- Virus Testing

- End of Production Cells Testing

- Others

Based On End User

- Academic Research Institutes

- Cell Banks

- Contract Research Organizations

- Pharmaceutical & Biotechnology Companies

- Hospitals and surgical centers

- Clinics

- Community Healthcare

- Others

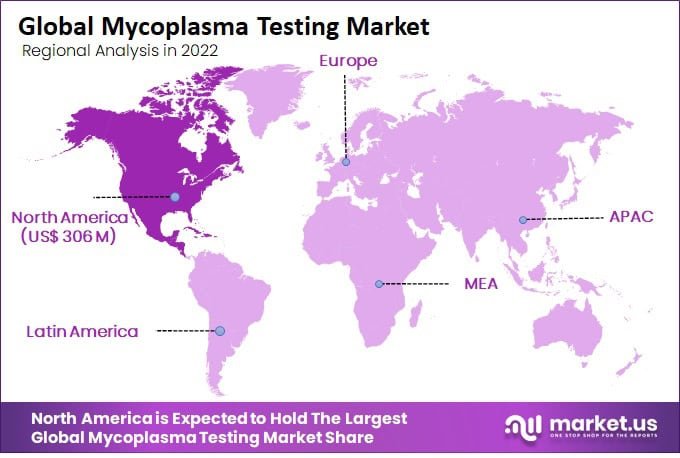

Regional Analysis

North America Generated Highest Revenue Globally and dominated the Mycoplasma Testing Market

The mycoplasma testing market is growing worldwide, with increasing demand for testing products and services in various regions. In 2022, North America held a 40.7% revenue share, dominating the market. Europe is the second-largest market for mycoplasma testing, driven by the growing biopharmaceutical industry in the region.

The Asia-Pacific region is the fastest-growing market for mycoplasma testing, driven by the increasing adoption of biologics, the growing biopharmaceutical industry, and the increasing outsourcing of biopharmaceutical manufacturing to countries such as China and India.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Thermo Fisher Scientific Inc. is a leading player in the mycoplasma testing market, offering a wide range of products and services for mycoplasma detection, including PCR-based assays, ELISA kits, and culture-based methods. Other key players in the mycoplasma testing market include Roche Diagnostics, Bio-Rad Laboratories, GenBio, and InvivoGen.

These players are investing in research and development activities, strategic partnerships, and acquisitions to strengthen their market position and expand their product portfolios.

Market Key Players

- Agilent Technologies

- American Type Culture Collection

- Asahi Kasei Medical Co. Ltd.

- Biological Industries

- Bionique Testing Laboratories Inc.

- Biotools B & M Labs.

- Charles River Laboratories International Inc.,

- Clongen Laboratories Inc

- Creative Bioarray

- Eurofins Scientific

- GenBio,GeneCopoeia Inc

- Lonza Group Ltd.

- Merck KGaA

- Meridian Bioscience Inc.

- Minerva Biolabs GmbH

- Mycoplasma Experience

- Nelson Laboratories Fairfield Inc.

- NorgenBiotek Corp.

- PromoCell GmbH

- Roche Diagnostics

- Sartorius AG

- Savyon Diagnostics

- ScienCell Research Laboratories Inc.

- Thermo Fisher Scientific Inc.

- Other Key Players

Recent Developments

- In June 2021: Merck announced the launch of its new mycoplasma detection kit, the Milliflex Quantum, which is a highly sensitive and automated test that detects and quantifies mycoplasma in biopharmaceutical products and raw materials.

- In July 2021: Lonza announced the expansion of its mycoplasma testing services for cell and gene therapies, with the introduction of a new MycoSEQ(R) Mycoplasma Detection Assay that is highly sensitive and specific and can provide rapid results.

- In August 2021: Sartorius Stedim Biotech announced the launch of its new Sartoclear Dynamics(R) Lab V centrifuge system for mycoplasma removal, which provides a high level of purity and yield for biopharmaceutical production.

- In September 2021: Bio-Rad Laboratories announced the launch of its new PCR-based mycoplasma detection kit, the ddPCR Mycoplasma Detection Kit, which offers improved sensitivity and specificity compared to traditional methods.

Report Scope

Report Features Description Market Value (2022) USD 766.33 Million Forecast Revenue (2032) USD 2338 Million CAGR (2023-2032) 12.11% Base Year for Estimation 2022 Historic Period 2016-2021 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product- Instruments, Kits & Reagents, and Services; By Technique- PCR, ELISA, Direct Assay, Indirect Assay, Microbial Culture Techniques, Enzymatic Methods, and DNA Staining; By Testing Type- Cell Line Testing, Virus Testing, End Of Production Cell Testing; End Users- Academic Research Institutes, Cell Banks, Contract Research Organizations, Pharmaceutical & Biotechnology Companies, Hospitals, and surgical centers, Clinics, Community Healthcare, Others End Users Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Agilent Technologies, American Type Culture Collection, Asahi Kasei Medical Co. Ltd., Biological Industries Israel Beit Haemek Ltd., Bionique Testing Laboratories Inc., Biotools B & M Labs, Charles River Laboratories International Inc., Clongen Laboratories Inc., Creative Bioarray, Eurofins Scientific, GenBio, GeneCopoeia Inc., InvivoGen, Lonza Group Ltd., Merck KGaA, Meridian Bioscience Inc., Minerva Biolabs GmbH, Mycoplasma Experience, Nelson Laboratories Fairfield Inc., NorgenBiotek Corp., PromoCell GmbH, Roche Diagnostics, Sartorius AG, Savyon Diagnostics, ScienCell Research Laboratories Inc.,Thermo Fisher Scientific Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Agilent Technologies

- American Type Culture Collection

- Asahi Kasei Medical Co. Ltd.

- Biological Industries

- Bionique Testing Laboratories Inc.

- Biotools B & M Labs.

- Charles River Laboratories International Inc.,

- Clongen Laboratories Inc

- Creative Bioarray

- Eurofins Scientific

- GenBio,GeneCopoeia Inc

- Lonza Group Ltd.

- Merck KGaA

- Meridian Bioscience Inc.

- Minerva Biolabs GmbH

- Mycoplasma Experience

- Nelson Laboratories Fairfield Inc.

- NorgenBiotek Corp.

- PromoCell GmbH

- Roche Diagnostics

- Sartorius AG

- Savyon Diagnostics

- ScienCell Research Laboratories Inc.

- Thermo Fisher Scientific Inc.

- Other Key Players